XAUUSD.P trade ideas

XAUUSD Outlook: Bull or Bear Move Ahead? Manage Risk📊 XAUUSD Market Insight 🌍

Gold is heating up once again, currently testing a tight range between 3080 and 3095. A breakout in either direction could set the tone for the next big move.

🔻 If price breaks below, we may see a slide toward 3060 and 3050—potential areas to watch for bearish momentum.

🔺 However, a strong push above 3095 could spark bullish energy, aiming for short-term targets at 3115 and 3127.

💡 Trade Smart

The market is full of opportunity, but don’t forget: risk management is key. Use proper position sizing, set clear stop-losses, and never overexpose your capital. Stay sharp, trade safe, and let the market come to you. 🧠💼

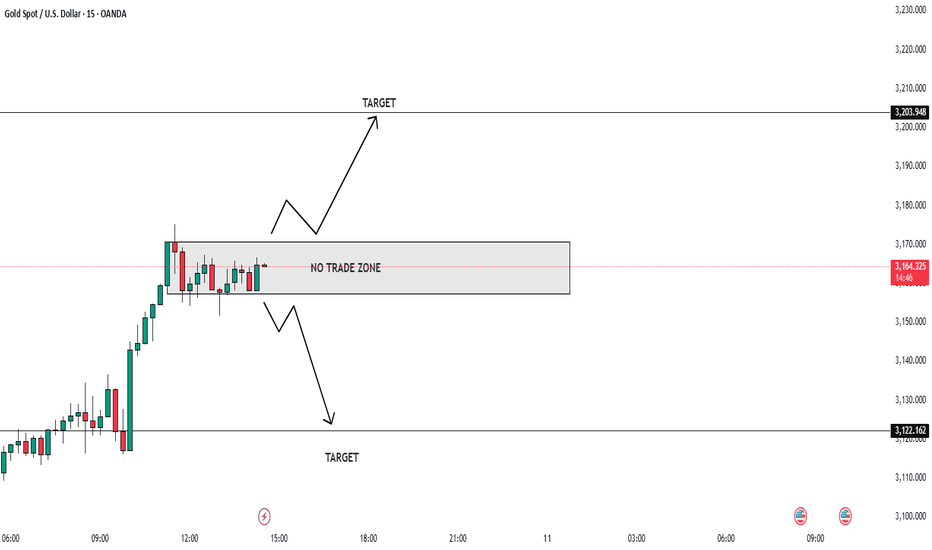

XAUUSD Alert: Critical Zones in Play — Trade Smart, Trade Safe!📊 XAUUSD Market Insight 🌍

Gold is heating up once again, currently testing a tight range between 3160 and 3174. A breakout in either direction could set the tone for the next big move.

🔻 If price breaks below, we may see a slide toward 3150 and 3130—potential areas to watch for bearish momentum.

🔺 However, a strong push above 3174 could spark bullish energy, aiming for short-term targets at 3200 and 3227.

💡 Trade Smart

The market is full of opportunity, but don’t forget: risk management is key. Use proper position sizing, set clear stop-losses, and never overexpose your capital. Stay sharp, trade safe, and let the market come to you. 🧠💼

BEARS ARE TRAPPED 〉3300 SOONAs illustrated, I'm trying to visualize a brief pull back next week making the low of the week early into Monday.

Potentially ASIA making the week's low on Monday's open.

I was able to visualize the path to 3200, and showed in a past idea how 3200 COULD HOLD as support ... so I wouldn't be surprised if price doesn't even get to 3100, although it could very well find a support there as it is a strong psychological + institutional price at which many central banks, brokers, hedge funds, etc could be dealing gold.

In other words, institutions willing to add long positions or even position themselves for the week, they'll do it a these key round numbers easy to deal big orders with... (3,200; 3150, 3100, etc).

That being said, we can't ignore or take out the fundamental aspect of gold which, as a matter of fact, it is its main driver until this day. That is: tariff war escalating, stock market on the edge of a cliff, geopolitical conflict very uncertain, ... and much more.

Not only investors are protecting their assets with gold, but CENTRAL BANKS keep purchasing gold... for a reason...

I've said it multiple times before: any dip is a buying opportunity. Every correction is a bear trap... to traders that think gold is like any other FOREX pair that responds to "divergence" or "stochastic crossovers" or some random indicator.

As these retail traders pile in with short trades, the trend continues to take them out and all of that liquidity is actually serving as more gas and power for gold to expand higher and higher... since for every buyer there must be a seller ...

"But it's so expensive". .. well... define "expensive". There is no historical point that defines today's price as "expensive" ... it's simply the new and actual price of gold.

THE TREND IS YOUR FRIEND.

--

GOOD LUCK!

XAUUSD - Preparing for Healthy Pullback?Gold has exhibited remarkable strength in recent days, surging from around $2,960 to establish new all-time highs above $3,230. After this vertical move and having reached overbought conditions, the 4-hour chart indicates a likely correction phase is imminent, with price projected to retrace toward the highlighted support zone around $3,160-3,170, which previously acted as resistance. This pullback represents a natural technical rebalancing after such an explosive upward movement and would provide an opportunity to test the market's conviction about the current bull trend. The highlighted lower support zone near $2,960 should contain any deeper corrections, though the immediate focus is on the upper support level as a probable target for this corrective wave before potentially resuming the larger uptrend. Traders should monitor price action around these key levels for signs of stabilization and renewed buying interest.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GOLD Explosive Bull Run or Setup for a Historic Short?📌 XAU/USD Outlook: Explosive Bull Run or Setup for a Historic Short? 💥📈

✨ Market Overview:

Gold (XAU/USD) has entered an exceptionally volatile phase, with price swings exceeding $100 per day. After dropping from 3,280 to 3,080, gold has roared back to a new all-time high at 3,200 in just two sessions — raising the critical question: Is this a true recovery wave, or merely a bull trap ahead of a potential historic short?

A surge of capital has flooded into financial markets, aggressively buying the dip across multiple asset classes. Investor psychology is now at the forefront, driving gold into extreme territory.

🌍 Fundamental Outlook:

Recent U.S. economic data came in weaker than expected, supporting the bullish momentum in gold. If history repeats itself, we could witness similar outcomes with the upcoming CPI and PPI releases — both of which are forecast to remain soft, potentially weakening the USD and further lifting gold.

Short-term: U.S. consumer demand appears weaker, pressuring USD.

Medium-to-long term: These weak data points may be laying the groundwork for a massive short on gold once the Fed initiates its expected rate cuts — potentially as early as June.

📊 Technical Outlook:

Gold’s price action is becoming increasingly difficult to predict. It took a full week for gold to fall $200 — but only two days to fully reclaim that ground and establish a new ATH.

Today, the market may continue this bullish surge, particularly if the PPI data surprises to the downside.

Key Support Levels:

3,200

3,188

3,174

3,157

3,130

3,120

Key Resistance Levels:

3,265

3,302

🧭 Trading Plan:

BUY Zone (High Probability):

Entry: 3,175 – 3,173

Stop Loss: 3,168

Take Profit: 3,180 | 3,184 | 3,188 | 3,192 | 3,196 | 3,200 | Open

SELL Zone (Aggressive Counter-Play)

Entry: 3,301 – 3,303

Stop Loss: 3,308

Take Profit: 3,296 | 3,292 | 3,288 | 3,284 | 3,280 | 3,270 | Open

⚠️ Risk Management Advisory:

Price action is extremely volatile — trade setups should be chosen carefully. Ensure proper stop-loss and take-profit are in place for every trade. Avoid emotional entries and respect risk-to-reward principles to protect your capital.

💡 Conclusion:

Gold is in a critical zone. With macro sentiment, news flow, and technicals all aligned, traders must stay alert. In the short term, the FOMO-driven rally looks likely to continue — but remain vigilant for signs of a reversal that could usher in a massive short wave.

🗨️ Share Your View:

Do you see gold continuing this bullish run — or is this the calm before a historic dump? Share your thoughts and strategies below! 💬👇

Learning Not to TradeThe ability to wait for your setup is the most important skill a trader can have.

Strangely enough, in trading, you absolutely must learn not to trade. Patience is key. We’re like predators lying in ambush: no sudden moves, no panic, just waiting for the right moment.

No setup — no trade.

Sometimes it's a day or two without trades, sometimes a week or even more.

Hard? Very. It feels like you have to participate in every move, squeeze the maximum out of every market, trade daily, nonstop — hands itching, mind racing, gotta make money. Some traders even set financial goals — I’m totally against that. You’ve got a "monthly target"? Great — now you're forced to find trades where there are none.

But there’s an awesome fix for that: create trading-related activities for yourself during downtimes:

1. Analyze your past trades.

In detail: average gain, average loss, win rate, risk/reward ratio, and more. Where are your strengths? Which markets and instruments work best for you? Where do you tend to screw up — late stops, premature exits, re-entries? How can you minimize losses?

2. Study price action after you close a trade.

Maybe you’re exiting too early and missing the rest of the move. Tons of traders scalp and make money, sure — but if they didn’t scalp, they could’ve made twice as much. Data from successful traders shows a clear edge in holding positions for at least a few days. Also — let’s not forget commissions: fewer trades means lower costs.

3. Test new setups.

Use TradingView's replay function to go back in time and trade historical data as if it were live. It’ll sharpen your eye for candle and chart patterns, help validate new strategies, and overall — it’s just super useful.

4. Read books.

All good traders read — a lot, constantly, forever. Sit down with a highlighter, mark up important ideas, and better yet — take notes. Learning never stops.

And now — plot twist: this is your actual job.

Not sitting and hypnotizing charts all day. Not entering a trade and staring at every pip like a madman — one second you're thrilled, the next you’re sweating bullets.

Yes, we look at charts and order books — all useful tools — but we analyze smartly, not emotionally.

Trading is everything that happens before the trade.

Waiting for your moment. Knowing exactly where your stop loss and take profit should be.

I was analyzing my trading and realized that my main recurring mistakes right now is exiting too early , then re-entering with a tight stop, getting stopped out, and then entering again.

Overtrading.

And the worst part — this isn’t the first time. But I know how to fix it!

In my next educational post, I’ll write about the most common trading mistakes and how I personally worked through them.

Because honestly — I’ve made every mistake you can possibly make, even the ones you’re not supposed to be able to make. I’ve been in all kinds of psychological states, and I’ve tried a ton of different ways to deal with each issue.

See you in the next one.

GoldvsUSD on the 1-hour timeframe, likely illustrating bearish T

Harmonic Pattern (XABCD):

X to A: Initial impulse down.

A to B: Retracement.

B to C: Another downward move.

C to D: Strong bullish leg forming the completion point (D), which signals a potential reversal zone.

Entry Zone:

Highlighted in red around the 3,240 area, suggesting the analyst expects price rejection or reversal here.

Target Zones:

Three horizontal levels marked as “target” align with liquidity zones, indicating areas where price might move towards after reversal due to stop-loss clusters or previous consolidation.

Support and Resistance:

Prior resistance at around 3,045 is now acting as a potential support zone.

Intermediate support and liquidity areas are layered as possible price action reaction zones.

Red Arrow:

Indicates the bearish bias or expected price drop after touching the entry zone.

Analysis Summary:

The chart suggests a short/sell setup at the current highs (around 3,240), with multiple downside targets down to 3,045.17. The harmonic pattern and the marked liquidity zones reinforce this bearish outlook, aiming to capture a retracement or reversal move.

GOLD - Price can bounce down from resistance line of triangleHi guys, this is my overview for XAUUSD, feel free to check it and write your feedback in comments👊

Some time ago, the price moved inside a rising channel, steadily growing and forming higher highs on the chart.

Then Gold touched the upper boundary, made a reversal, and exited from the channel with a sharp impulse.

After that, the price reached $2970 support level and bounced, forming a triangle pattern with a narrowing range.

Recently, it made a breakout above $3095 zone but quickly faced resistance at the upper line of triangle.

Now, Gold trades inside triangle structure and shows weakness near resistance area without strong breakout.

In my opinion, Gold can decline and reach $3015 support line of triangle during the next corrective wave.

If this post is useful to you, you can support me with like/boost and advice in comments❤️

Lingrid | GOLD key LEVELS for Potential BULLISH ContinuationThe price perfectly fulfilled my last idea . It hit the take profit level. OANDA:XAUUSD market bounced off the 3000 support level, potentially signaling the end of the corrective move. However, examining the 1H timeframe reveals the price still remains within the consolidation zone. If the price breaks and closes above the 3050 resistance zone, we can anticipate a continuation of the bullish move. I expect the price may continue moving sideways until the next trading day. However, if the price retests the psychological level below, we can look for buying opportunities. My goal is resistance zone around 3100

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

XAUUSD Entry on break of structure ?Hello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

Gold/XAUUSD Intraday Move 10.04.2025📊 Market Context

After a sharp selloff from the $3,160 region to sub-$2,980 levels, the market is now in recovery/consolidation mode.

Market currently hovers around $3120 after bouncing from below $2,980, indicating buyer interest.

📏 Fibonacci + Support Confluence Zones

✅ Buy Zone 1 – $3095–3100

Reason: Retest of strong horizontal support.

Signal to Enter Long: Bullish engulfing / hammer on M5/M15 + RSI divergence.

Target: $3,110 (first), $3,120+ (extended).

✅ Buy Zone 2 – 3070-3075

Reason: Previous bottom, possible double bottom scenario forming.

Signal to Enter Long: Strong rejection wick / double bottom + volume surge.

Target: $3085 first, then trail till $3,100.

🔁 Retest Logic

Wait for price to retest any of these zones on low volume → watch for bullish candle close.

Ideal scalping trade: Enter on confirmation, small SL, tight TP.

⚠️ Important Notes

Avoid entering mid-range trades without pullback confirmation.

Aggressive buys can be scalped on momentum only if volume supports.

Always monitor for news or sudden volume spikes which can invalidate pullback zones.

Please follow, like, comment and share to get more analysis daily.

Gold Potential Bullish Continuation (Potential HH formation)With with continued global tariff war between USA and China, Gold price still seems to exhibit signs of overall Bullish momentum as the price action may form a prominent Higher High with multiple confluences through key Fibonacci and Support levels which presents us with a potential long opportunity.

Trade Plan:

Entry : 3178

Stop Loss : 2946

TP 0.9 - 1 : 3399 - 3408

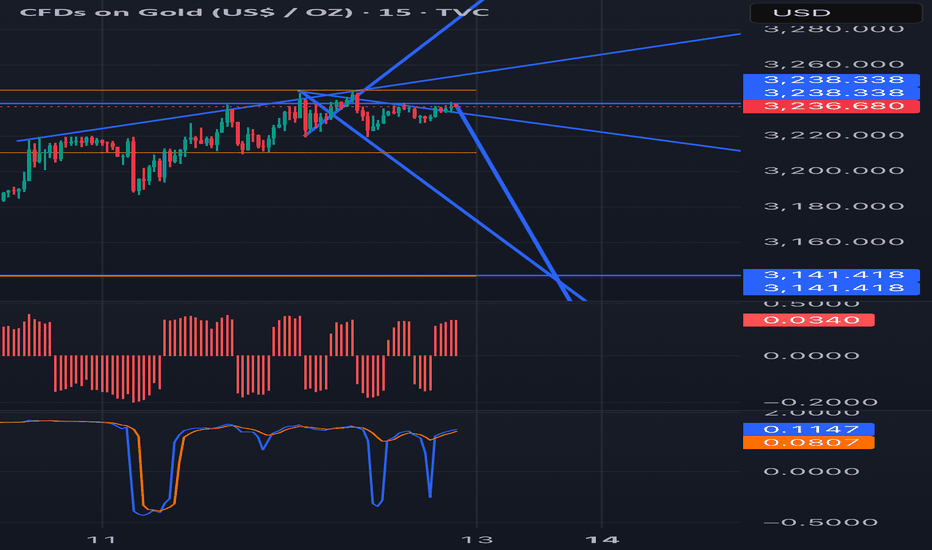

Gold Bearish ReversalPattern: Bearish Harmonic Butterfly

Entry: ~$3,238

Stop Loss: Above $3,330

Take Profit Target: $3,020 (next major support level)

• Price action is stalling near the PRZ of the pattern.

• The next logical support level is around $3,020, making it a compelling downside target.

Caveats:

• Strong macro tailwinds or news shocks could push price through the stop zone.

• Keep an eye on USD strength, real yields, and the tariff news.

XAU 1M Gold price formation history and future expectationsGold , or as denote the main trading pair XAUUSD , has been gaining a lot of attention around itself in recent years.

As soon as major analysts or hedge fund top-managers begin to say that the next crisis is near, investors immediately start buying gold as a defensive asset, and its price, accordingly, goes up.

Let's walk a little through the history of the Gold price.

We finished drawing the graph, to what exists on tradingview.com, based on the data that is freely available.

1) In 1933, to overcome the crisis after the "Great Depression", US President Roosevelt issued a decree on the confiscation of gold from the population. The price for an ounce of gold is set at $20.66.

2) In 1971, a real rise in the value of gold begins. After decoupling the US dollar rate from the "gold standard", which regulated the cost of 1 troy ounce of gold at $35 for a long period from 1934 to August 1971.

3) 1973 - "The First Oil Crisis" and the rise in the value of gold from $35 to $180 - as the main anti-crisis instrument, a means of hedging investment risks.

4) 1979-1980 Islamic Revolution in Iran (Second Energy Crisis). The cost of gold, as the main protective asset, in a short period of time grows more than 8 times and sets a maximum at around $850

5) During 1998-2000, the world swept through: the "Asian economic crisis", defaults in a number of countries, and the cherry on the cake - the "Dotcom Bubble". During this period, the price of gold was twice aggressively bought out by investors, from the level of $250. It was a clear signal - there will be no lower, next, only growth!

6) And so it happened, from 2001 to 2011 there was an increase in the value of gold from $250 to $1921 . Even the mortgage crisis of 2008 could not break the growth trend, but only acted as a trigger for a 30% price correction.

Looking at the XAUUSD chart now, one can assume that large investors were actively buying gold in the $1050-1350 range during 2013-2019.

It is hard to believe that investors who have been gaining long positions for 6 years will be satisfied with such a small period of growth in 2019-2020.

For ourselves, we establish a Gold purchase zone in the range of $1527-1600 per troy ounce, from where we expect the growth trend to continue to the $3180-3350 region

What are your views on the future price of gold? Share them in the comments!

XAUUSDXAUUSD is currently at a high point, with many expecting a declining in the near future. The market is showing signs that the recent strength in gold might not be sustainable, and a pullback could be on the horizon. Traders are anticipating potential shifts in sentiment that could lead to a downward movement, especially as attention turns to upcoming economic events and data.

Gold Spot - Max Caution Zone! Gold is approaching the 3.618 Fibonacci extension at $3,270.93.

This level is often seen as a final stage of a strong bullish wave especially in a parabolic move.

The next level up is 4.236 ($3,553), which is extreme and only likely in euphoric conditions.

We are likely in or near a topping zone.

Watch for confirmation via candlestick patterns or momentum slowing.

The 3,270–3,550 range is high risk/reward zone for reversal or consolidation.