GOLG H4 Analysis - BULLISH ELLIOT WAVE SETUP UNFOLDING ! After completing a deep WXY corrective structure ending with wave (E), the market confirmed a Break of Structure (BoS) followed by a clear Change of Character (ChoCH) – signaling a bullish shift with the launch of a wave 1 impulse. 📈

Price is currently forming an ascending wedge (ending diagonal) pattern, with internal subwaves (1)-(2)-(3)-(4)-(5), preparing for a full bullish 5-wave structure targeting the $3,480–$3,510 zone.

🎯 Buy Signal Parameters:

Potential entry zone (on retest): $3,319–$3,357 💎

Take Profit (final wave 5 target): $3,510 🎯

Stop Loss: $3,257 🛡️

Buy Confidence Level: 92% ✅

XAUUSD trade ideas

GOLD A Fall Expected! SELL!

My dear subscribers,

My technical analysis for GOLD is below:

The price is coiling around a solid key level - 3358.0

Bias - Bearish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 3350.7

My Stop Loss - 3362.4

About Used Indicators:

By the very nature of the supertrend indicator, it offers firm support and resistance levels for traders to enter and exit trades. Additionally, it also provides signals for setting stop losses

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

BUY XAU 4.8.2025Confluence order: BUY at M15

Type of order: Limit order

Reason:

- The current top is not touching anything, expected to rise to the H4~H1 above.

Note:

- Management of money carefully at the last bottom (3,347)

Set up entry:

- Entry buy at 3,342

- SL at 3,338

- TP1: 3,347 (~1R)

- TP2: 3,355 (~3R)

- TP3: 3,361 (~4,5R)

Trading Method: Price action (No indicator, only trend and candles)

Report - 4 August, 2025OPEC+ Ends Output Restraint, Glut Risk Emerges

OPEC+ announced a production increase of 547,000 barrels/day starting in September, marking the end of its nearly two-year output restraint policy. The move comes after coordinated cuts of 2.2 million b/d by core members like Saudi Arabia and the UAE failed to stabilize prices amid weak Chinese demand and rising EV adoption. With U.S., Canada, and Brazil gaining market share, internal cohesion within the cartel has weakened.

Implication: Bearish short-term crude oil outlook. A Q4 glut risk rises. Watch for downside toward $65/barrel. Inflationary pressures may abate, reducing urgency for central bank hawkishness.

U.S. Wage Inequality Deepens, Data Integrity in Question

New Atlanta Fed data shows low-income workers (<$806/week) saw wage growth fall to 3.7% YoY — nearly half its 2022 peak — while the top 25% still enjoy 4.7% gains. This uneven recovery is amplifying scrutiny of Trump’s economic policies. The president’s firing of the Labor Statistics chief post-weak jobs report has alarmed economists and investors, raising fears of political interference in vital data.

Implication: Undermines institutional trust in U.S. economic data. Increases political risk premium. Weighs on confidence in Treasury markets and complicates Fed response amid wage stagnation for key consumer segments.

Swiss Trade Shock – Tariffs Spike to 39%

Switzerland faces a 39% U.S. tariff after being blindsided by Trump’s administration, which rejected a presumed 10% baseline deal. Despite pledging $150B in U.S. investments, the Swiss were penalized over a $39B trade deficit, most of which stems from gold and pharma — sectors already exempt. President Keller-Sutter is under political fire, with comparisons drawn to historic national embarrassments.

Implication: Undermines smaller neutral economies' negotiating leverage. Risks spillover into Swiss equities (e.g., watchmakers, pharma). FX safe-haven status of CHF could weaken if investor confidence wavers.

European Bank Stocks Surge to 2008 Highs

Europe’s banks are outperforming globally, with shares in HSBC, Santander, Barclays, and UniCredit reaching decade highs. The rally is driven by sharply rising long-term yields (30Y–2Y spread at 1.3%+), boosting net interest margins. Though Trump’s latest tariff shock pulled back gains slightly, the sector is still up 34% YTD — outpacing U.S. peers.

Implication: Positive for European financials. But sustainability is tied to rate curve steepness — a flattening or ECB dovish pivot could halt momentum. Sector rotation trades favor EU banks over U.S. for now.

Dollar Rallies, Then Retreats on Weak Jobs Print

The U.S. dollar rallied 1.5% during the week — its strongest since Trump’s re-election — but Friday’s dismal jobs data triggered a 1.3% drop. Downward revisions and signs of broader labor market weakness are raising bets on Fed rate cuts. Trump’s abrupt removal of the BLS head has added institutional risk to dollar sentiment.

Implication: Dollar strength narrative interrupted. Expect near-term softness as markets price deeper cuts. Watch for EURUSD support around 1.08 and DXY pullback toward 101. Tech and gold likely to benefit from a weaker USD outlook.

Trade War Creates Uneven U.S. Corporate Profit Map

Big Tech and banks (Apple, Meta, JPMorgan) are defying tariffs with strong Q2 earnings, while consumer staples and materials suffer margin erosion despite rising sales. Over half of S&P 500 companies report lower margins YoY. The top 10 stocks now account for one-third of total index profits, underlining concentration risk.

Implication: Fragile breadth in equity markets. Overweight tech/financials remains dominant strategy, but under-the-surface weakness in consumer cyclicals may pressure indices on earnings misses. Trade war effects are being absorbed by the bottom end of the corporate and household spectrum.

GOLD | Bullish Mitigation + Inducement Lining Up For Execution(Refined & Structured):

• Pair: XAUUSD (Gold)

• Bias: Bullish

• 4H Overview: Gold broke last week’s previous high, then pulled back and mitigated this week’s order block within the same range. A significant internal high (turnover HH) has now been broken, and price retraced to sweep liquidity and tap into the OB zone.

• 30M Structure: Now watching for a clean pullback into a refined OB after taking out sell-side liquidity/inducement. Structure is aligning perfectly for the next leg up.

• Entry Zone: Once price enters the OB zone, I’ll be watching the 5M for church-level confirmation. Execution follows once LTF speaks clearly.

• Targets: 5M to 30M structural highs depending on delivery.

• Mindset Note: I’m not rushing. Just following structure and reading price. Analysis mode right now—execution comes once price gives the sermon.

August 4, 2025 - XAUUSD GOLD Analysis and Potential OpportunitySummary:

Gold is currently in a sideways-to-bullish structure. Strong resistance remains around 3440–3450; if this level fails to break, it offers a high-probability shorting opportunity. Near-term focus is on the 3350 support level — if it breaks, bearish momentum may pick up and selling the pullback becomes ideal. If 3350 holds, consider buying the dip and targeting a test of 3375. Stay flexible and responsive to price action at key levels. Manage risk accordingly.

📍 Key Levels to Watch:

• 3400 – Resistance

• 3384 – Resistance

• 3375 – Key resistance

• 3365 – Resistance

• 3350 – Psychological level

• 3345 – Support

• 3334 – Key support

• 3323 – Support

• 3310 – Support

📈 Intraday Strategy

SELL if price breaks below 3350 → target 3340, then 3334, 3323, 3315

BUY if price holds above 3365 → target 3370, then 3375, 3384, 3394

👉 If you find this helpful or traded using this plan, a like would mean a lot and keep me motivated. Thanks for the support!

Disclaimer: This is my personal view, not financial advice. Always use proper risk control.

GOLD LONG TRENDAfter price correction and a downward movement that touched the 600 and 300 moving averages on the 4H chart, with a subsequent strong bullish candlestick reversal and a breakout above the MA200, we can expect the bullish trend to continue respecting the Fibonacci levels. In the coming week, upon the first touch of the 3350 price level, we may enter a long position. The price could potentially extend even beyond the specified level, reaching the 1.618 Fibonacci extension. The first target at 3396 seems the most probable scenario...

XAUUSD (GOLD): Bullish Impulsive Move Up Friday! Wait For Buys!In this Weekly Market Forecast, we will analyze the Gold (XAUUSD) for the week of Aug 4 - 8th.

Gold is bullish on the Monthly, Neutral on the Weekly, Bullish on the Daily.

The aggressive move higher after bad job numbers caused a shift in the market from bearish to bullish on the D1 time frame.

Be wary of the pullback, as that move is likely to be corrected, but that would set up a great long opportunity!

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

XAUUSDUpdate:

Gold Price Trend: As per our previous analysis on July 28, 2025, the price has now tested the support at 3,269. We expect that if the gold price can hold above 3,249, the gold price trend will remain bullish. We recommend considering buying in the red zone.

🔥Trading futures, forex, CFDs and stocks carries a risk of loss.

Please consider carefully whether such trading is suitable for you.

>>GooD Luck 😊

❤️ Like and subscribe to never miss a new idea!

DeGRAM | GOLD fixed below the triangle📊 Technical Analysis

● XAUUSD is forming a bearish descending wedge within a broader symmetrical triangle, facing rejection at 3,310 near prior support-turned-resistance.

● Repeated failure to hold above trendlines and continued lower highs favor a drop toward the 3,246.56 level, with possible overshoot if support breaks.

💡 Fundamental Analysis

● Rising real yields and hawkish Fed tone continue to pressure gold; ISM Manufacturing Prices and NFP loom as next volatility catalysts.

● Reduced ETF inflows and strong dollar on resilient US macro data weigh on demand for non-yielding assets.

✨ Summary

Short bias below 3,310. Breakdown eyes 3,246 → 3,200 zone. Resistance holds while trendline caps recovery.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

Gold Technical Analysis - Bullish Momentum or Pullback Ahead?Gold (XAU/USD) is trading around $3,371, showing a bullish bias within an ascending channel. Price is consolidating below key resistance at $3,384, and a breakout above this level could lead to a rally toward $3,400–$3,429. On the downside, support lies at $3,340 and $3,312; a break below these could trigger a deeper pullback toward $3,268. The trend remains bullish above $3,340, with buy interest expected on dips, while a confirmed breakdown below $3,268 would shift momentum in favor of bears.

🔑 Key Levels to Watch:

- Resistance: $3,384 → $3,396 → $3,429

- Support: $3,360 → $3,340 → $3,320

📈 Potential Scenarios:

- Bullish: If gold holds above $3,340 and breaks above $3,384, it may rally toward $3,400–$3,429, with potential to reach $3,450+. This keeps the uptrend intact.

- Bearish: If rejected from $3,384, gold could dip to $3,340–$3,312 for a healthy correction before possibly bouncing again. Trend remains bullish unless lower supports break.

📊 Trend Outlook:

- Short-Term Trend: Bullish while inside or above the rising channel

- Medium-Term Trend: Neutral to Bullish; watch for breakout confirmation above $3,384

- Momentum: Consolidating, with potential for a breakout after current sideways structure

Note

Please risk management in trading is a Key so use your money accordingly. If you like the idea then please like and boost. Thank you and Good Luck!

Gold establishes bullish wave. Wait for recovery point to BUY✏️ OANDA:XAUUSD Nonfarm announcement has shaped a new trend for gold price. completely broke the previous bearish wave structures and formed a new bullish trend with the break of wave 1 peak around 3315. Trading strategy next week only focuses on BUY signals. Maybe this bullish wave can make gold reach the all-time high.

📉 Key Levels

Support 3333-3315

Resistance 3373-3416

BUY zone: 3333 ; 3315 ( Strong support zone)

BUY DCA trigger Break resistance 3373

Target 3416

Leave your comments on the idea. I am happy to read your views.

After data shock, GOLD has bullish conditions againOANDA:XAUUSD rose more than 2% on Friday, hitting a one-week high, as weaker-than-expected U.S. non-farm payrolls data boosted hopes of a Federal Reserve rate cut and the announcement of new tariffs boosted safe-haven demand.

On the economic data front

Gold prices rose more than 2% in U.S. trading on Friday (Aug. 1), hitting a one-week high, as weaker-than-expected U.S. non-farm payrolls data fueled hopes of a Federal Reserve rate cut and safe-haven demand was boosted by the announcement of new tariffs.

The U.S. Department of Labor's Bureau of Labor Statistics reported that nonfarm payrolls increased by just 73,000 jobs in July, well below market expectations of 110,000. June's data was revised down to just 14,000, indicating a significant slowdown in job growth. The unemployment rate rose to 4.2%, indicating a cooling labor market.

The jobs data was weaker than expected, but slightly higher than the market's lowest forecast. This increases the likelihood of a rate cut by the Fed later this year. As a non-yielding asset, gold typically performs better in a low-interest-rate environment.

According to CME Group's FedWatch tool, market participants now expect the Federal Reserve to cut rates twice before the end of the year, starting in September. Earlier this week, the Fed held rates steady at 4.25%-4.50%. Chairman Powell said it was too early to determine whether a rate cut would be forthcoming in September, citing inflation and employment data.

On the trade front

Trump has imposed a new round of tariffs on exports from dozens of trading partners, including Canada, Brazil, India and Taiwan, causing a global market crash.

Countries are scrambling to negotiate a better deal. In times of economic and geopolitical uncertainty, safe-haven gold is in high demand.

So far in 2025, gold prices have risen more than $400, hitting a record high of $3,167.57/oz on April 3, driven by safe-haven demand and central bank buying.

Weak jobs data also sent the dollar lower against major currencies, further supporting gold prices as a weaker greenback makes gold more attractive to investors holding other currencies.

Investors' Attention Turns to September FOMC Meeting

Markets are now focused on the September Federal Open Market Committee (FOMC) meeting. Facing the dual pressures of volatile inflation, slowing employment and escalating global trade tensions, the Fed will have to balance its inflation target with economic growth.

Markets are betting on the Fed to begin a new round of easing, and gold, as a hedge against currency devaluation and economic uncertainty, is expected to continue to benefit.

Gold prices have risen more than 30% year-to-date, reflecting the market’s preference for safe-haven assets. If weak U.S. economic data continues in the coming weeks, or if new geopolitical conflicts emerge, gold prices are expected to continue their upward trend, challenging new highs for the year.

Summary, Commentary

Weak employment, new tariffs and a slumping stock market have all contributed to a strong recovery in gold prices. With the possibility of the US Federal Reserve cutting interest rates in September increasing significantly, gold market sentiment has warmed and risk aversion has returned.

Investors will need to keep a close eye on inflation data, Fed officials’ speeches, and whether Trump continues to stoke trade tensions, which could lead to greater volatility in the gold market.

Against the backdrop of the unexpected non-farm payrolls report and moderate inflation, the market has essentially “locked in” the possibility of a rate cut in September, but whether the cut will be 25 or 50 basis points, and whether there will be further rate cuts in the future, will depend on the interaction between the Fed members’ verbal guidance and market expectations.

Technical Outlook Analysis OANDA:XAUUSD

On the daily chart, affected by the sudden weak data that shocked the market, gold broke most of the technical structure that was leaning towards the downside. Price action was pushed above the EMA21, while the short-term downtrend channel was also broken above and the Relative Strength Index crossed above 50.

These are the initial conditions for a short-term uptrend. But to confirm an uptrend and a new uptrend in the near term, gold needs to continue to break above the 0.236% Fibonacci retracement level (3,371 USD) first, then the target will be around 3,400 USD in the short term.

If gold breaks above $3,400 again, traders should set a new target of $3,430 in the short term, rather than $3,450 which is the all-time high.

Motivationally, the RSI has not reached oversold territory to provide pure reversal support, but it has been pushed by the market shock after the NFP data release, so this rally may not be sustainable in a purely motivational way either.

Overall, gold is now more bullish after a rally on Friday, opening up initial conditions for expectations of a new uptrend. And the notable points will be listed as follows.

Support: 3,323 – 3,310 – 3,300 USD

Resistance: 3,371 – 3,400 – 3,430 USD

SELL XAUUSD PRICE 3376 - 3374⚡️

↠↠ Stop Loss 3380

→Take Profit 1 3368

↨

→Take Profit 2 3362

BUY XAUUSD PRICE 3327 - 3329⚡️

↠↠ Stop Loss 3323

→Take Profit 1 3335

↨

→Take Profit 2 3341

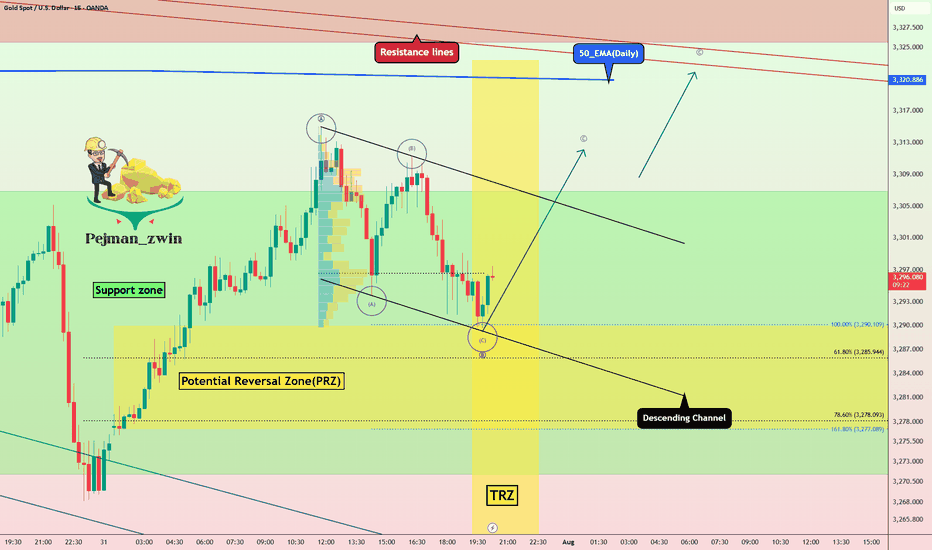

Gold in PRZ + TRZ: Is a Bullish Reversal Brewing(Short-term)?Gold , as I expected in yesterday's idea , fell to the Potential Reversal Zone(PRZ) and started to rise again .

Today's Gold analysis is on the 15-minute time frame and is considered short-term , so please pay attention .

Gold is currently trading in the Support zone($3,307-$3,275) and near the Potential Reversal Zone(PRZ) and Time Reversal Zone(TRZ) .

In terms of Elliott Wave theory , it seems that Gold can complete the microwave C of wave B at the lower line of the descending channel.

I expect Gold to trend higher in the coming hours and rise to at least $3,311 .

Note: Stop Loss (SL) = $3,267

Gold Analyze (XAUUSD), 15-minute time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅ ' like ' ✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Gold 30Min Engaged ( Bullish Reversal Entry Detected )Time Frame: 30-Minute Warfare

Entry Protocol: Only after volume-verified breakout

🩸Bullish Reversal - 3318

➗ Hanzo Protocol: Volume-Tiered Entry Authority

➕ Zone Activated: Dynamic market pressure detected.

The level isn’t just price — it’s a memory of where they moved size.

Volume is rising beneath the surface — not noise, but preparation.

🔥 Tactical Note:

We wait for the energy signature — when volume betrays intention.

The trap gets set. The weak follow. We execute.

Today's GOLD Analysis : MMC Structural Analysis + Reversal ZoneThis analysis is rooted in MMC – Mirror Market Concepts, a framework designed to track institutional behavior through liquidity patterns, QFL (Quick Flip Levels), trendline shifts, and volume bursts. The current 4H Gold chart demonstrates a smart money footprint that provides actionable insight for intraday and swing traders.

🔍 Detailed Technical Breakdown:

🟦 1. Previous Supply Completed | Demand Zone Reversal

At the lower end of the chart, price entered a key blue zone around $3,250–$3,280, previously a supply zone now flipped into demand. This zone represents where institutional buyers absorbed liquidity, forming the base for a bullish impulse.

The strong reaction from this zone, marked by long-wick candles and immediate reversal, indicates exhaustion of selling pressure.

This reversal is confirmed by a QFL structure, meaning price created a fast liquidity sweep before flipping direction.

MMC recognizes this as a high-probability area of reversal, a point where smart money typically enters.

📈 2. Trendline Breakout & Structure Shift

A descending trendline, representing bearish market control, was decisively broken to the upside. This shift marks:

End of the corrective phase

Beginning of a bullish structural change

Buyers now control the short-term narrative

The breakout was not only clean but also supported by a volume burst, which is a classic MMC indicator that institutional traders are entering the market.

🔶 3. Volume Burst Confirmation

Volume behavior plays a critical role in MMC. We see a clear volume spike post-breakout. This suggests that:

The breakout is not false

Buyers were aggressively positioned

A sustainable move is in development

This supports the validity of the trendline breakout and confirms the idea that price is ready to test higher liquidity zones.

🟢 4. Current Price Structure: Bullish Channel

After the breakout, the market formed a bullish channel, where price is steadily climbing while respecting parallel boundaries.

The channel support line acts as a dynamic entry point for retracement buys

MMC strategy uses this structure to identify scaling entries at channel lows or after successful pullbacks into key reversal zones

🟩 5. Mini Reversal Area (Short-Term Resistance Zone)

Price is currently testing a minor supply zone or what MMC defines as a "Mini Reversal Area". This is a reaction zone before continuing toward the major target above.

There are two possible reactions:

Short-term rejection, leading to a pullback into the lower channel support zone

Minor consolidation, forming a base for a breakthrough toward major resistance

🟦 6. Major & Minor Supply Zones Above

Marked in light blue and green, these zones represent areas where previous selling volume and distribution occurred.

The major supply zone (approx. $3,440–$3,470) is the next institutional target

The minor zone sits between $3,400–$3,420 and may cause initial resistance or a base for another impulse

These levels are prime for partial profit-taking or scouting short-term reversal trades.

📊 Trade Management Insights:

🛒 Buy Opportunities (Long Bias):

On pullback into channel support near $3,340–$3,350

On bullish confirmation from mini reversal area

On break and retest above minor resistance at $3,420

🛑 Stop-Loss Suggestion:

Below the channel support or below the blue demand zone (approx. $3,245)

🎯 Profit Targets:

TP1: $3,400 (first resistance)

TP2: $3,420 (minor supply)

TP3: $3,450–$3,470 (major institutional level)

🧠 Mirror Market Concepts (MMC) Highlights:

QFL Structures = Institutional Reversal Points

Volume Burst = Confirmation of Breakout Validity

Trendline Breakout = Momentum Shift

Channel Structure = Controlled Climb Pattern

Mini Reversal Zone = Key Decision Point Before Continuation

🧭 TradingView Summary for Minds Community:

This GOLD chart beautifully aligns with the MMC method — spotting smart money involvement early and aligning with their flow. After confirming structural reversal via trendline and QFL, the setup now looks poised for continuation toward the $3,440–$3,470 zone, making it a perfect chart to watch for buy-the-dip setups.

10 POWERFUL INVESTING & TRADING QUOTES OF ALL TIME

Here are powerful quotes of professional traders, investors and experts in financial markets.

Let their words inspire you and help you in your trading journey.

"To succeed in the market, you must learn to think like everyone else and do the opposite." - Sir John Templeton 📈💭💡

"The four most dangerous words in investing are: 'This time it's different.'" - Sir John Templeton ⏳📉🛑

"The more you learn, the more you earn." - Warren Buffett 📚💰📈

"The key to trading success is emotional discipline. If intelligence were the key, there would be a lot more people making money." - Victor Sperandeo. 💪💰🚫🧠

"Investing is not about making predictions, it's about having a plan and sticking to it." - Tony Robbins 📊🔄📌

"The best time to buy a stock is when the blood is running in the streets." - Baron Rothschild 💀🔪💰

"The best investment you can make is in yourself." - Warren Buffett 💼💡💰

"The stock market is not a casino; it's a crooked casino." - Charlie Munger 🎰🎲🏛️

"Losses are part of the game. You can't win every trade." - Martin Schwartz. 📉😔💔

"The fundamental law of investing is the uncertainty of the future." - Peter Bernstein. ⚖️❓🔮

The More I trade, the more I realize how precise and meaningful are these phrases. Take them seriously, and they will help you achieve the financial success.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

XAUUSD Live Trade Last Night (Killed it with 11,641 USD Profits)I managed to ride the momentum last night on XAUUSD and made over 11,641 usd profit on a live trading account. Gold usually create a range. It will create a top and a bottom then it will spend most of its time inside that range. That is pretty much how XAUUSD moves. If you can identify the top and the bottom then you can short it from the top and do a long trade on the bottom. The price will just travel from bottom to top and top to bottom. You can scalp your way to profits on this move if you can time it properly. Once in a while, a break from the top or the bottom happens. This is where you switch from trading the range to trading breakouts.

End of GOLD correction#GOLD #XAUUSD

UPDATE

As I mentioned earlier, gold was forming a contracting triangle.

The wave-(e) of the triangle has formed a double pattern diametric-X-triangle and has moved beyond my expectations (the post-pattern movement has passed ), breaking the trendline of (a)-(c). However, since it did not exceed the end of wave-(c), the contracting triangle has not been invalidated.

We expect gold to gradually rise from this range and surpass $3,500.

Good luck

NEoWave Chart

GOLD CONTINUATION PATTERNHello folks, here we go again, This idea stuck in my head only today and its friday. rather shared it or none, but see the charts for stops and target. this might be your lucky day on my page.

Here is my idea, take it if you love to swing or watch it fade. Congrats were on 800 community or I got more followers because of this. and Previous idea we made a lot thats 1200 pips good for a month trade. lets see this August. my target is labeled this chart first at 3500 zone. next target will be posted on my notes or updated the idea. no charts until it breaks that labeled on chart. until it goes higher again.

You will never see this kind of idea for a month again. So follow on my page, I have some for you if you have small accounts.d m here

My goal is to target the highest TP will be above this new highs.