XAUUSD trade ideas

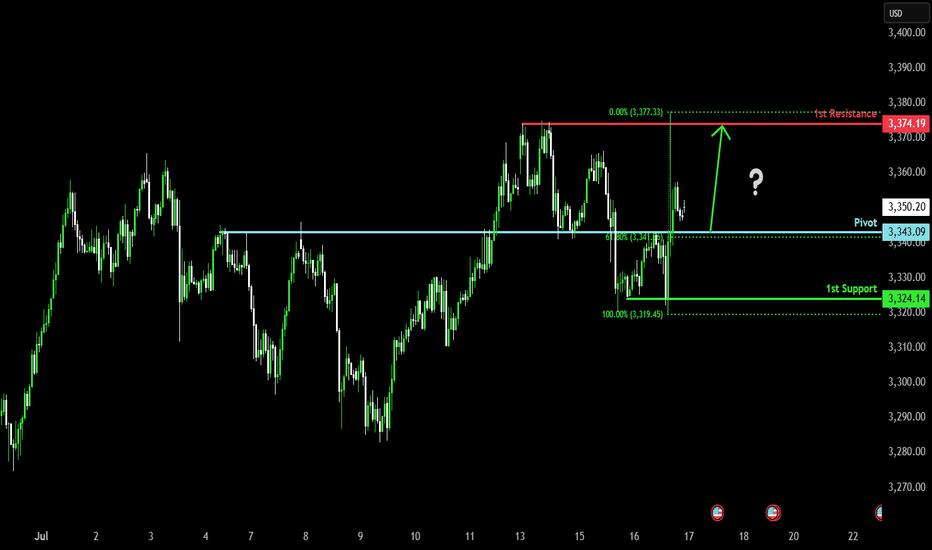

Bullish bounce off overlap support?The Gold (XAU/USD) is falling towards the pivot which has been identified as an overlap support and could bounce to the pullback resistance.

Pivot: 3,343.09

1st Support: 3,324.14

1st Resistance: 3,374.19

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

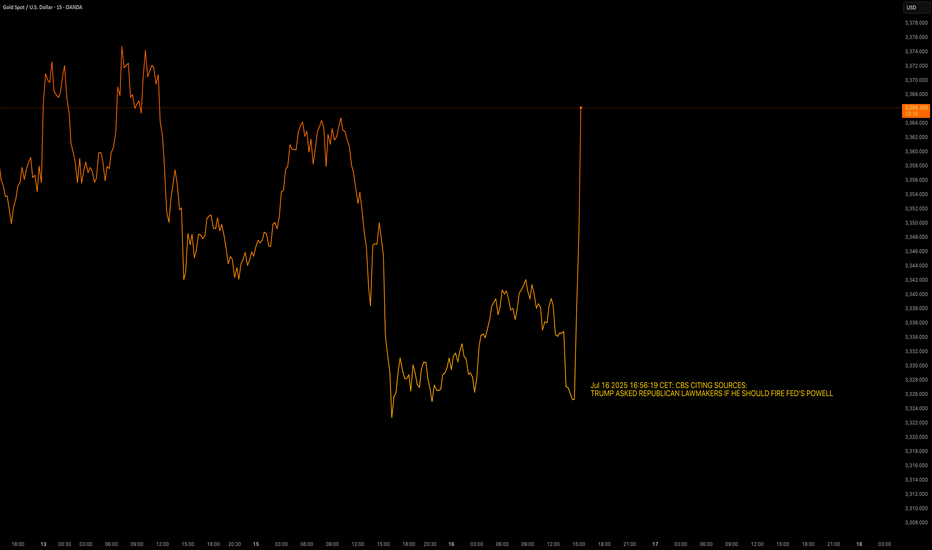

Breaking News - Trump vs. PowellJul 16 2025 16:56:19 CET: CBS CITING SOURCES:

TRUMP ASKED REPUBLICAN LAWMAKERS IF HE SHOULD FIRE FED'S POWELL

OANDA:XAUUSD sees upside +35$/oz after Trump has asked the republican lawmakers if he should fire Powell.

TVC:DXY weakens against TVC:EXY and TVC:JXY after Trumps question.

Volatility is increased.

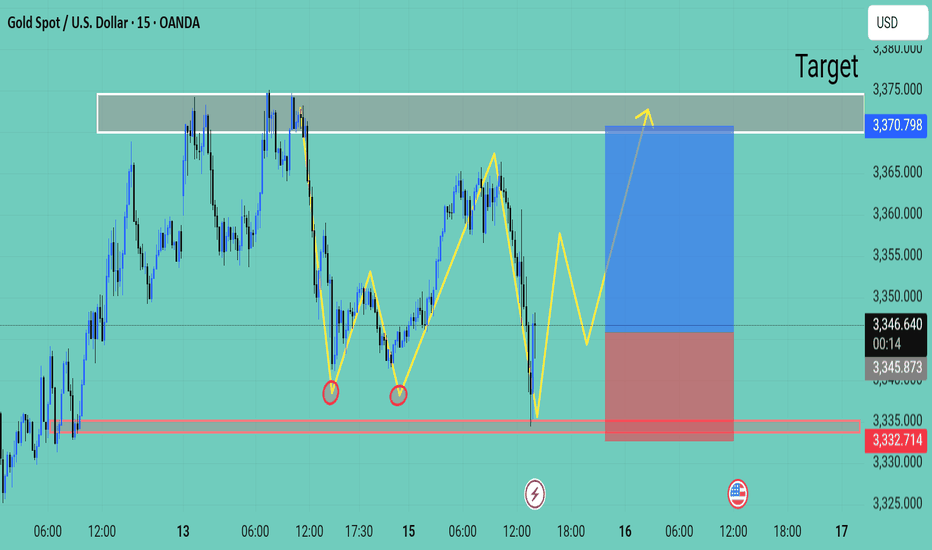

Expecting Gold bullish Movement Gold (XAU/USD) on the 15-minute chart is showing signs of a bullish reversal after forming a potential double bottom pattern around the 3332 support zoneThis area has been tested multiple times indicating strong buying interest and a solid demand zone

The price action suggests a possible continuation of the bullish momentum, supported by the higher lows and projected upside trajectory. A breakout above the minor consolidation and neckline zone near 3346 could push price toward the identified target zone around 3370 which also aligns with a previous resistance level

Key Levels

Support 3332

Resistance Target Zone 3370

Entry Zone Current pullback near 3345 3346

Bullish Structure: Double bottom with higher low confirmation

If bullish momentum holds this setup offers a favorable risk to reward scenario aiming for a breakout toward the upper resistance zone

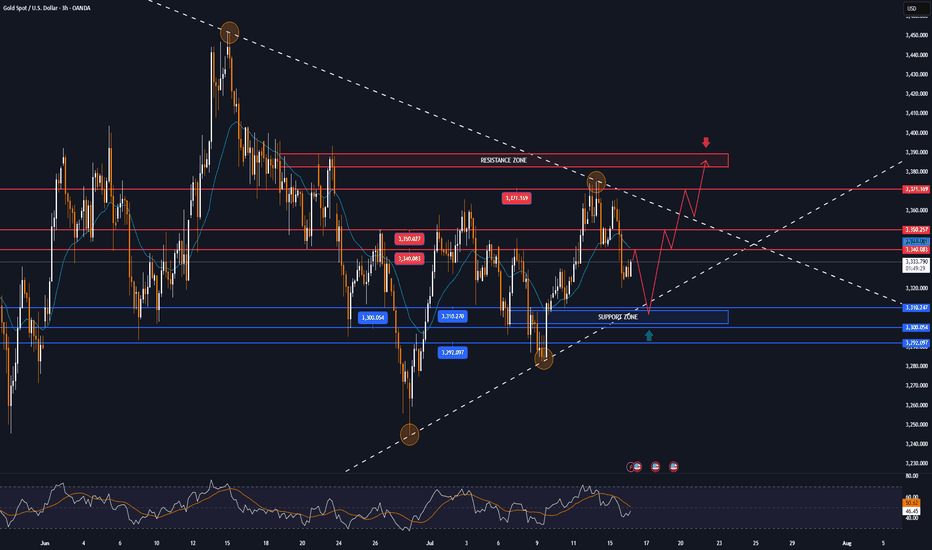

XAUUSD CHART PATTERN 2\HTrade Setup (Buy Position):

Entry Point: 3330

Target 1: 3380

Target 2: 3420

Stop Loss: 3290

Strategy Insight

You’re targeting a +50 pip move to Target 1 and +90 pip move to Target 2.

Risk is -40 pips from the entry (3330 → 3290).

Risk-Reward Ratio:

To Target 1: 1.25 : 1

To Target 2: 2.25 : 1

This is a moderately aggressive setup with a good reward potential.

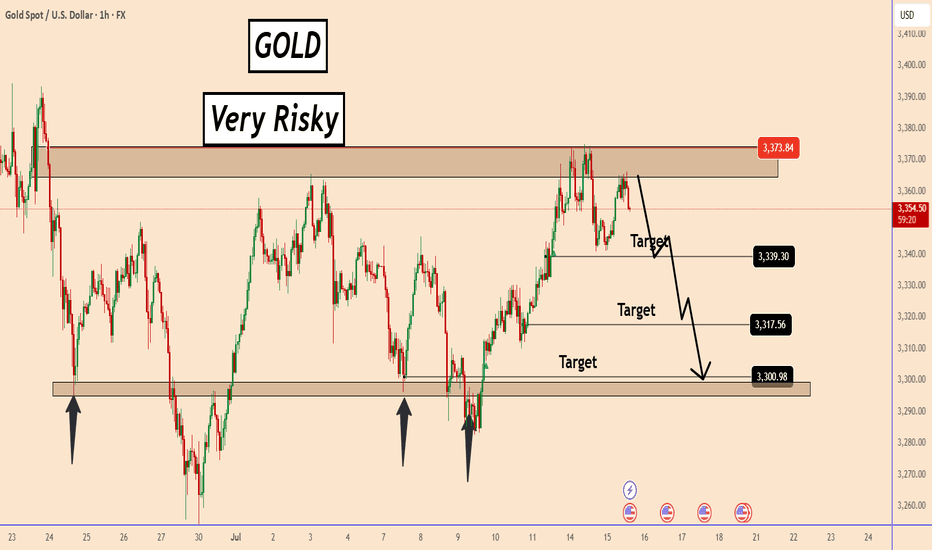

GOLD: A Short-Term Trading Setup - High RiskGOLD: A Short-Term Trading Setup - High Risk

Since July 9, GOLD has been in an uptrend, rising to 3375 as its current high.

The market focus is solely on the Fed’s interest rate cut and when it might happen. Today we have the US CPI data in about 30 minutes. The market expects the CPI to be 2.7% vs. 2.4%.

The market is expecting a bullish data, which increases the odds that the Fed will not cut rates anytime soon and should reduce the odds of an interest rate cut at the July meeting.

From a technical perspective, the price is already facing a strong zone and the chances of a decline are high. However, this trade carries a higher than normal risk, as we can never know how the market may interpret inflation data and its impact on future interest rate cuts.

You may find more details in the chart!

Thank you and Good Luck!

PS: Please support with a like or comment if you find this analysis useful for your trading day

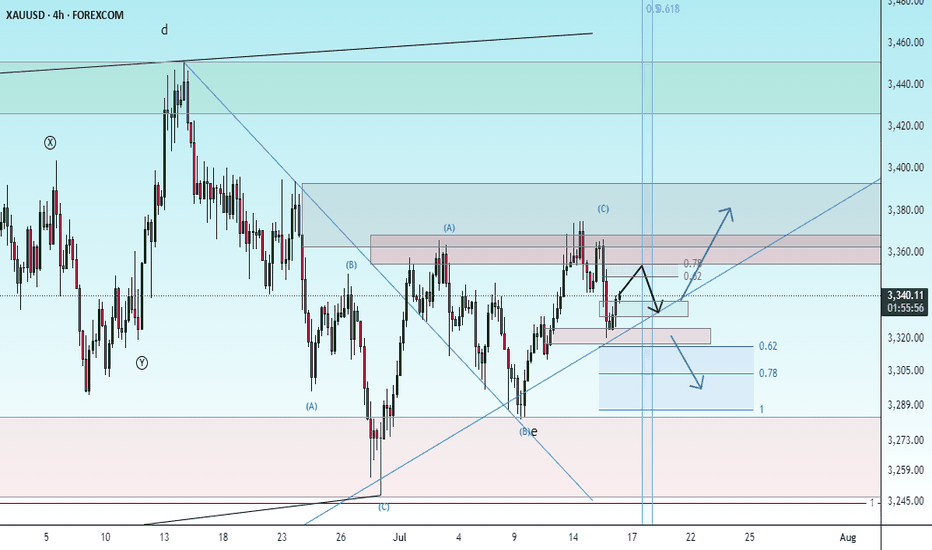

Gold is set to rise, which is an opportunity to buy!Last week gold made another correction down for Wave E but after that it broke the low again. This could be wave 2 of the next impulsive wave up and gold will continue to rise next week.

Or price makes one more move down for wave E and then start the next impulsive wave up.

Let's see what price does and react.

Trade idea: Wait for a small correction down on a lower timeframe and a change in orderflow to bullish to trade longs.

Don't be emotional, just trade your plan!

GOLD in narrow range, after sharp drop on US CPI dataOANDA:XAUUSD fell sharply on Tuesday (July 15) as the US Dollar TVC:DXY gained significantly after the US CPI report was released. As of now (July 16), gold is trading at 3,326 USD/oz, equivalent to an increase of only 2 USD in the day.

The US Consumer Price Index (CPI) in June was in line with expectations but higher than the previous value. The surge in the Dollar after the US released the June CPI is the main reason for the pressure on gold prices so far.

• Data released by the US on Tuesday showed that the US CPI increased by 2.7% compared to the same period last year in June, in line with expectations, but higher than the 2.4% in May.

• The US CPI rose 0.3% month-on-month in June, in line with market expectations but up from a 0.1% increase, the largest increase since January this year.

• In addition, the US core CPI rose 2.9% year-on-year in June, up from 2.8% in May, while the core CPI in June rose 0.2% month-on-month.

The market generally believes that US President Trump's tariff policies have increased price pressures, prompting the Federal Reserve to wait and see what further action to take. Federal Reserve Chairman Powell previously said he expected prices to rise in the summer.

The market is still expecting the first rate cut in September. Investors are looking ahead to Wednesday's U.S. producer price index data for more information on the Federal Reserve's move.

Since gold does not yield interest, it typically performs well in low-interest-rate environments, whereas high-interest-rate environments or expectations of future rate hikes put pressure on gold prices.

Technical Outlook Analysis OANDA:XAUUSD

On the daily chart, gold is trading in a fairly narrow range after 2 sessions of downward adjustment, but the specific trend is still unclear, as sent to readers throughout last week, the technical conditions mainly show a sideways accumulation movement. After testing the 0.236% Fibonacci retracement level, gold was unable to overcome this resistance, and the decline from this position brought the gold price close to the support of 3,310 USD and then the area of the original price point of 3,300 USD with the 0.382% Fibonacci retracement.

With the technical conditions not giving a specific trend as they are now, for gold to be able to have a new bullish cycle it needs to move the price action above the 0.236% Fibonacci retracement level, then the target would be around $3,400 in the short term, more than $3,430. On the other hand, if gold falls below the 0.382% Fibonacci retracement level again, it could be a good signal for an expectation of a bullish cycle, then the target would be around $3,246 in the short term, more than the 0.50% Fibonacci retracement level.

The relative strength index is hovering around 50, indicating that the market is hesitant in terms of momentum and is not leaning towards a specific trend.

During the day, with the current sideways accumulation, gold will be noticed by the following technical levels.

Support: 3,310 – 3,300 – 3,292 USD

Resistance: 3,240 – 3,250 – 3,371 USD

SELL XAUUSD PRICE 3383 - 3381⚡️

↠↠ Stop Loss 3387

→Take Profit 1 3375

↨

→Take Profit 2 3369

BUY XAUUSD PRICE 3304 - 3306⚡️

↠↠ Stop Loss 3300

→Take Profit 1 3312

↨

→Take Profit 2 3318

GOLD NEXT MOVE (expecting a bullish move)(15-07-2025)Go through the analysis carefully and do trade accordingly.

Anup 'BIAS for the day (15-07-2025)

Current price- 3358

"if Price stays above 3340, then next target is 3372, 3390 and 3410 and below that 3325 and 3315 ".

-POSSIBILITY-1

Wait (as geopolitical situation are worsening )

-POSSIBILITY-2

Wait (as geopolitical situation are worsening)

Best of luck

Never risk more than 1% of principal to follow any position.

Support us by liking and sharing the post.

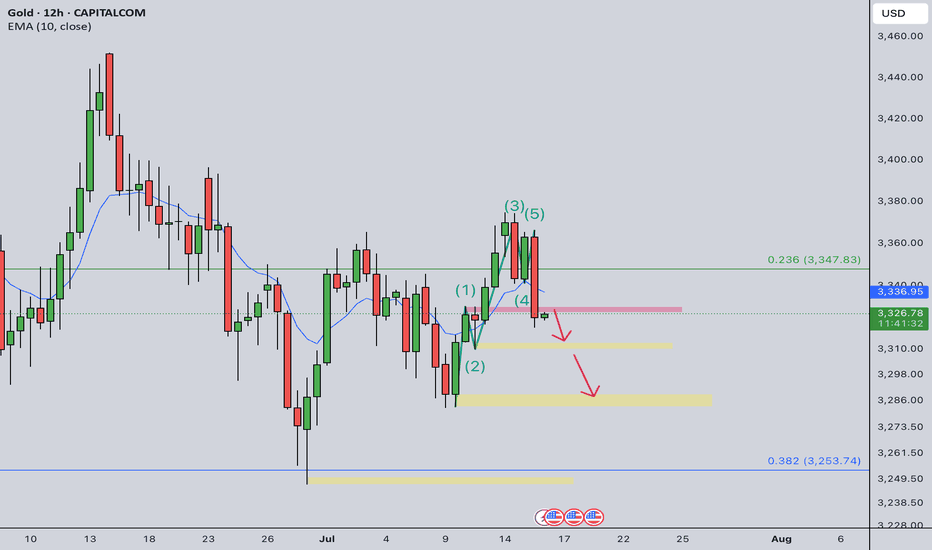

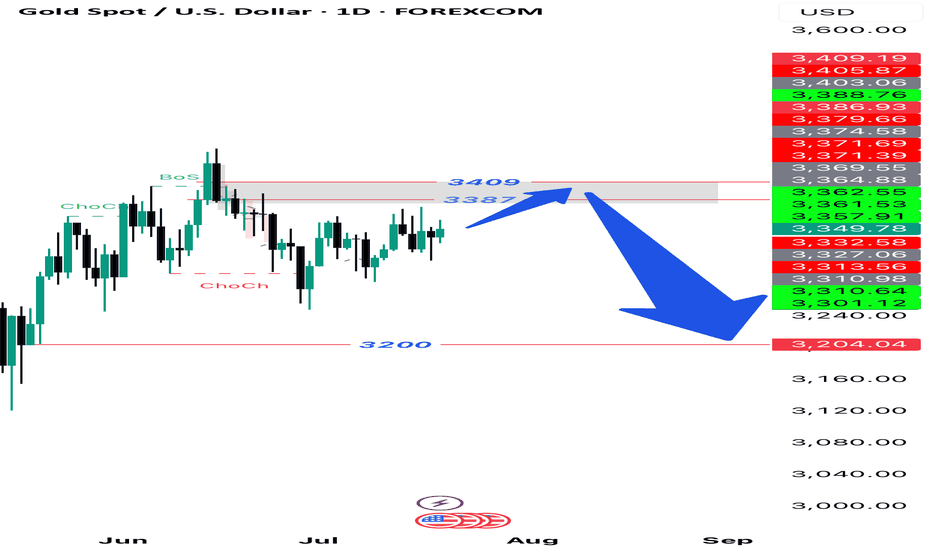

GOLD (XAUUSD): Mid-Term Outlook

Analysing a price action on Gold since March,

I see a couple of reliable bullish signals to consider.

As you can see, for the last 4 month, the market is respecting

a rising trend line as a support.

The last 4 Higher Lows are based on that vertical support.

The last test of a trend line triggered a strong bullish reaction.

The price successfully violated a resistance line of a bullish flag pattern,

where the market was correcting for almost a month.

A strong reaction to a trend line and a breakout of a resistance of the flag

provide 2 strong bullish signals.

I think that the market may grow more soon and reach at least 3430 resistance.

An underlined blue area will be a demand zone where buying orders will most likely accumulate.

❤️Please, support my work with like, thank you!❤️

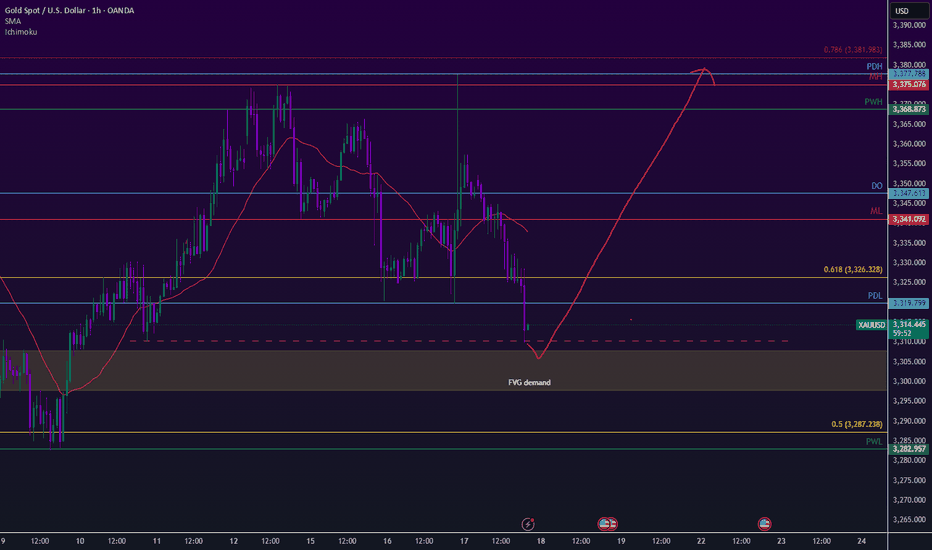

THE KOG REPORT THE KOG REPORT:

In last week’s KOG Report we said we would be looking for the price to spike down into potentially the extension level 3310 and then give us the tap and bounce we wanted to be able to capture the long trade in to the 3345-50 region initially. It was those higher resistance levels that we said we would stick with and the bias was bearish below. This move resulted in a decent long trade upside into the region we wanted, and then the decline we witnessed mid-week completing all of our bearish target levels which were shared with everyone.

On top of that, we got the bounce we wanted for the long trade but only back up into the 3335 level which was an Excalibur active target. The rest, we just sat and watched on Friday as unless we were already in the move, the only thing we could have done is get in with the volume, which isn’t a great idea with the limited pull backs.

All in all, a great week in Camelot not only on Gold, but also the other pairs we trade with the DAX swing trade being a point to point swing move executed with precision by the team.

So, what can we expect in the week ahead?

We’ll keep it simple again this week but will say this, there seems we may see a curveball on the way this week. With tariff news over the weekend we may see price open across the markets with gaps, one thing we will say is if you see these gaps, don’t gap chase until you see a clean reversal!

We have the higher level here of 3375-85 resistance and lower support here 3350-45. If support holds on open we may see that push upside into the red box which is the one that needs to be monitored. Failure to breach can result in a correction all the way back down into the 3335 level initially. Again, this lower support level is the key level for this week and needs to be monitored for a breach which should then result in a completed correction of the move.

Our volume indicators are suggesting a higher high can take place here and if we do get a clean reversal we should see this pull back deeply. As usual we will follow the strategy that has been taught and let Excalibur guide the way.

KOG’s bias for the week:

Bullish above 3350 with targets above 3360, 3373, 3375 and 3383 for now

Bearish below 3350 with targets below 3340, 3335, 3329, 3320 and 3310 for now

RED BOX TARGETS:

Break above 3365 for 3372, 3375, 3382, 3390 and 3406 in extension of the move

Break below 3350 for 3340, 3335, 3329, 3322 and 3310 in extension of the move

It’s a HUGE RANGE this week so play caution, wait for the right set ups, don’t treat it like it’s your every day market condition. News from Tuesday so expect Monday to be choppy!

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

Expecting Gold bullish Movement The chart illustrates a potential bullish reversal setup for Gold XAU/USD on the 15-minute timeframe Price action has recently tested and respected a key demand zone marked as the Kee point around the 32853 level This area acted as strong support with multiple rejections suggesting buyer interest

Following this, the price has started forming higher lows and higher highs indicating the beginning of a bullish structure The large blue arrow suggests bullish momentum is expected to continue, aiming for upside targets

Key Levels

Kee Point Support Zone 3285 Crucial area where the reversal initiated

Target 1: 3316 First resistance level and a potential take-profit zone

Target 2: 3330 Final bullish target if momentum sustains

Outlook

As long as the price holds above the Kee Point, bullish continuation is favored

Breaking and closing above Target 1 could lead to further gains toward Target 2

A break below the Kee Point would invalidate this bullish scenario

This setup presents a potential buying opportunity with defined upside targets contingent on sustained bullish pressure

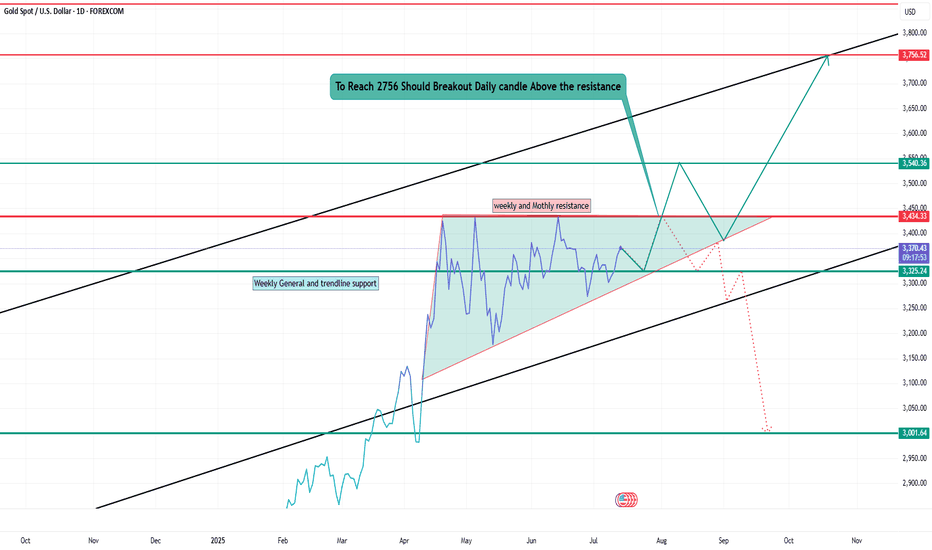

Gold Price Update: Key Breakout Level in Sight – Watch $3,434! Technical Analysis – XAU/USD

Current Price: $3,371

Gold is trading inside a rising wedge pattern with strong resistance at $3,434.

A daily candle close above $3,434 could trigger a breakout toward:

🎯 Target 1: $3,540

🎯 Target 2: $3,756

If rejected at resistance, price may drop to:

⚠️ Support 1: $3,325

⚠️ Support 2: $3,001 (major weekly support)

🌍 Fundamental Outlook

CPI Data Impact:

Higher CPI → Gold bearish (rate hikes expected)

Lower CPI → Gold bullish (rate cuts or pause likely)

Federal Reserve Policy:

Hawkish = Negative for gold

Dovish = Positive for gold

Other Drivers:

USD Strength

Geopolitical risks

Central bank gold buying

GOLD → Consolidation. Long squeeze before growth to 3400FX:XAUUSD has broken through resistance at 3353-3357 since the session opened, and bulls are currently trying to keep the market in the buying zone. Should we expect a long squeeze before growth?

Gold is in local consolidation after breaking through a key level. The price is still in the consolidation phase formed during a week-and-a-half correction. The price reached a three-week high of $3,374 on Monday but fell after the EU's conciliatory statements. Investors are awaiting US inflation data and Chinese GDP figures as they assess the prospects for a Fed rate cut. Heightened geopolitical and trade tensions are keeping demand for safe-haven assets high.

Technically, gold has entered a local buying zone, but there is a fairly complex resistance zone above it, and consolidation is needed to break through it. Such patterns could include a retest of support and a liquidity grab before growth.

Resistance levels: 3373, 3394

Support levels: 3357, 3353, 3345

There is a possibility of a retest of eql 3353 in a long squeeze format and a return to resistance at 3373 for a breakout. I also do not rule out a retest of the key level of 3345. The global trend is bullish, with the price locally in a fairly wide range, with an emphasis on the support zone of 3345-3355. If the bulls can hold this zone overall, the market will have a good chance of rising to 3400-3450

Best regards, R. Linda!

GOLD again targets $3,371, new bullish cycle conditionToday (Tuesday, July 15), in the Asian market, the spot OANDA:XAUUSD maintained a slight recovery trend, currently at around 3,360 USD/ounce.

The spot OANDA:XAUUSD rose to a 3-week high on Monday, but quickly fell back and finally closed lower. Trump's open attitude towards trade negotiations has improved the market's risk-on sentiment and negatively impacted gold, a safe-haven asset. But gold still has a lot of potential risks for price increases, and personally, the fundamental trend for gold has not changed.

The US Bureau of Labor Statistics will release its June Consumer Price Index (CPI) report today (Tuesday).

According to a Reuters survey, economists expect the US CPI to increase year-on-year in June to 2.7% from 2.4% the previous month, while the core CPI is expected to increase year-on-year to 3% from 2.8%.

The survey also showed that the US CPI is expected to increase 0.3% month-on-month in June, and the core CPI is also expected to increase 0.3% month-on-month.

According to the Chicago Mercantile Exchange's "FedWatch Tool", the market believes that the Fed is unlikely to cut interest rates in July and the probability of keeping interest rates unchanged in September is about 30%.

If the US core CPI rises by 0.4% or more in June, this could prompt market participants to reassess the possibility of a rate cut in September. In this case, the US Dollar could hold steady and push gold prices lower. On the other hand, if the data is lower than expected, gold will become more attractive while a weaker Dollar will be positive for gold prices.

Technical Outlook Analysis OANDA:XAUUSD

After gold reached the resistance target of attention to readers in the weekly publication at 3,371 USD, which is the location of the 0.236% Fibonacci retracement, it fell slightly but is now recovering positively.

Currently, gold is trading in the range of 3,360 USD, the price action above the lower edge of the long-term rising price channel with support from the EMA21, gold is now likely to continue to retest the 0.236% Fibonacci retracement level.

If gold breaks above $3,371 it will be eligible for a new bullish cycle, with the target then being around $3,400 in the short term, more so than $3,430.

On the other hand, the RSI is pointing up, maintaining activity above 50, and this should be considered a positive signal in terms of momentum. It shows that there is still a lot of room for growth ahead.

However, as of now, gold is still neutral in terms of trend, with conditions gradually tilting towards the possibility of price increase.

Along with that, the notable positions will be listed as follows.

Support: $3,350 – $3,340 – $3,310

Resistance: $3,371 – $3,400 – $3,430

SELL XAUUSD PRICE 3390 - 3388⚡️

↠↠ Stop Loss 3394

→Take Profit 1 3382

↨

→Take Profit 2 3376

BUY XAUUSD PRICE 3304 - 3306⚡️

↠↠ Stop Loss 3300

→Take Profit 1 3312

↨

→Take Profit 2 3318

Back above $3,300, GOLD may remain neutral, tax focusOANDA:XAUUSD reclaimed the psychologically important level of $3,300/ounce last week, but while gold is still receiving some support as a safe haven amid economic and geopolitical risks, its upside momentum may be limited as the market shifts its attention to other commodities.

Gold prices ended last week on a generally bullish note, rising back above $3,300 an ounce after US President Trump unexpectedly announced a series of new trade policies. Spot gold prices rose about 0.5% last week on Friday.

Although the market initially doubted Trump’s self-imposed July 9 deadline, the overall market reaction remained steady and the renewed risk appetite helped the S&P 500 hit a new record high, somewhat undermining gold’s safe-haven appeal. The July deadline has been pushed back to August 1, but the global trade conflict is far from over. Gold has regained support after initial pressure after Trump announced a new trade policy on copper imports, along with a series of news stories about the relationship between Trump and the FED sent to readers throughout the past week.

A sharp rise in copper prices will also add to inflationary pressures, exacerbate economic uncertainty and raise concerns about recession and stagflation. In this context, gold is expected to continue to receive support from potential risks.

In addition to fierce competition in the commodity market, gold may remain fundamentally neutral in the short term, as economic data will support the Fed's neutral monetary policy. The key market focus next week will be the June Consumer Price Index (CPI). The Fed has made it clear that it is in no rush to raise interest rates while inflation risks remain high.

However, traders still need to be cautious and closely monitor the situation surrounding the tariff war initiated by Trump, which will directly affect the price of gold. In case of negative news, the gold price will receive support and vice versa if positive news appears in the market.

Over the weekend, US President Trump once again used the tariff tactic, announcing that he would impose a 30% tax on imports from the EU and Mexico, causing a strong reaction from the international community. This move not only casts a shadow over the relationship between Europe and the United States, as well as between the United States and Mexico, but also adds further uncertainty to the global trade model. EU politicians, businesses and academics were quick to respond, calling for unity to protect their interests, while Mexico stressed the need to maintain national sovereignty and pledged to respond calmly.

Technical Outlook Analysis OANDA:XAUUSD

On the daily chart, gold has a 3-day rally, and the upside momentum has reached the important target resistance at the 0.236% Fibonacci retracement level. Gold's upside momentum is also limited by this Fibonacci retracement level, specifically it has slightly dropped to $3,355/oz.

But overall, gold is still not in a position to form a specific trend, and the indicators and positions are mainly showing the possibility of continuing to accumulate sideways.

For gold to have the conditions for a new bullish cycle, it needs to bring price activity above the 0.236% Fibonacci retracement level, then the target will be around $3,400 in the short term, more than $3,430.

Meanwhile, a pullback, which sees gold sell below the 0.382% Fibonacci retracement, would open the door to a bearish cycle, with a target of around $3,246 in the short term, rather than the 0.50% Fibonacci retracement.

RSI hovering around 50 also suggests a hesitant market sentiment, so the short-term bias for gold is neutral.

Along with that, notable positions will also be listed as follows.

Support: $3,350 – $3,310 – $3,300

Resistance: $3,371 – $3,400 – $3,430

SELL XAUUSD PRICE 3406 - 3404⚡️

↠↠ Stop Loss 3410

→Take Profit 1 3398

↨

→Take Profit 2 3392

BUY XAUUSD PRICE 3340 - 3342⚡️

↠↠ Stop Loss 3336

→Take Profit 1 3348

↨

→Take Profit 2 3354

check the trendIt is expected that a trend change will form within the current support area and we will witness the beginning of the upward trend.

If the price breaks through the support zone, the continuation of the correction is likely.

If the price breaks through the support levels, the continuation of the downtrend is likely.