Gold Looks Bullish: technical and fundamentalHi Guys!

Gold is starting to flash major bullish signals, and this time, it’s not just about the chart. The technical setup is clean, but we’re also seeing fundamental tailwinds that could fuel a bigger move.

Let’s break it down

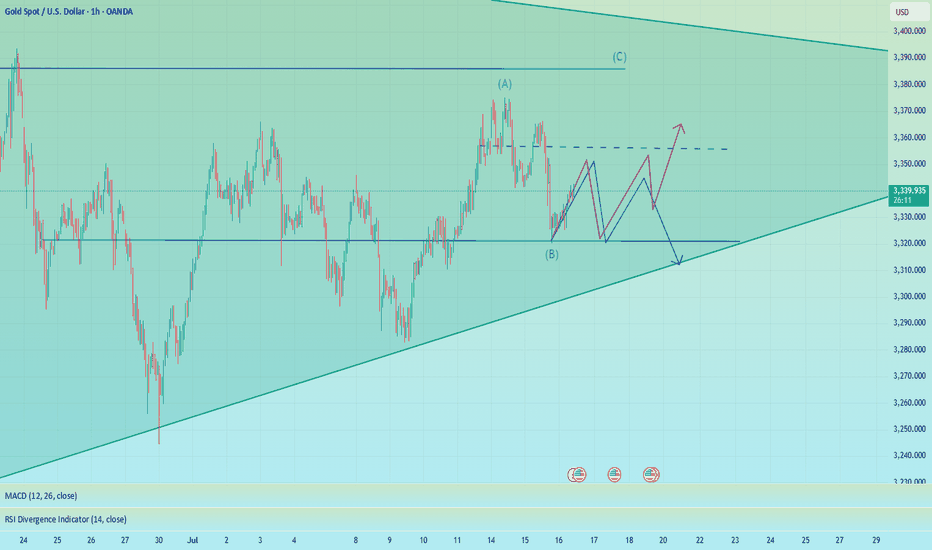

1. Technical Setup: The QML Reversal Is In Play

On the 1H chart, Gold is showing a textbook Quasimodo (QML) reversal pattern. Price made a lower low, then reversed up to break structure, and now it’s pulling back and respecting the key QML zone around $3,296.

This zone has turned into strong support. As long as we stay above it, the structure suggests a continuation toward $3,367 — a clean upside liquidity target and the previous high.

Strategy: Look for pullbacks into $3,296 for potential long entries with targets around $3,367 or higher.

2. Fundamental Tailwinds: Why Gold Is Gaining Strength

The fundamentals are stacking up in Gold’s favor right now. Here’s what’s fueling the move:

- Weakening USD & Rate Cut Expectations

With the Fed increasingly signaling rate cuts by late 2025, the US dollar is losing steam. Lower interest rates reduce the opportunity cost of holding non-yielding assets like Gold, making it more attractive to investors. Traders are already pricing this in.

- Softening Economic Data

Recent U.S. data, including weaker-than-expected job growth and declining manufacturing numbers, points to a slowing economy. That puts more pressure on the Fed to pivot dovish, which historically sends Gold higher.

- Central Bank Demand

Global central banks (especially in Asia) continue to accumulate physical Gold as part of their long-term reserve strategy. That institutional demand provides strong support at lower levels.

Technical + Fundamental = Strong Bullish Bias

We’re seeing a solid confluence here:

Chart says long (QML + bullish structure)

Macro says long (dovish Fed + weaker dollar + safe haven demand)

Drop your thought here!

XAUUSD trade ideas

GOLD MARKET ANALYSIS AND COMMENTARY - [Jul 14 - Jul 18]This week, OANDA:XAUUSD opened at $3,342/oz, dropped to $3,282/oz, but then rebounded sharply to close at $3,355/oz. The recovery was mainly driven by former President Trump's announcement of new tariffs ranging from 20% to 50% on imports from 22 countries, effective August 1st. Particularly, a 35% tariff on Canadian goods — a key U.S. trading partner — raised concerns about global trade stability and supply chains.

Trump also proposed 15–20% tariffs on most other trading partners, reigniting fears of global trade disruptions. At the same time, ongoing conflict between Israel and Hamas continued to weigh on sentiment, despite U.S. diplomatic efforts showing little progress.

However, analysts note that gold still lacks strong momentum for a breakout. Trump's tariff threats may be more about negotiation leverage than triggering a full-blown trade war. Meanwhile, with the labor market recovering and inflation rising, the Fed is expected to maintain its neutral monetary policy, limiting short-term gold price movements.

Although geopolitical tensions remain (e.g., Russia-Ukraine, Israel-Hamas), the ceasefire between Israel and Iran has reduced gold’s geopolitical risk premium.

Looking ahead, key U.S. economic data next week — including CPI, PPI, and retail sales — will be closely watched. A strong June core CPI (0.4% or higher) could reduce the likelihood of a Fed rate cut in September, strengthening the USD and pushing gold lower. Conversely, weaker inflation data could boost expectations of a rate cut, supporting gold prices.

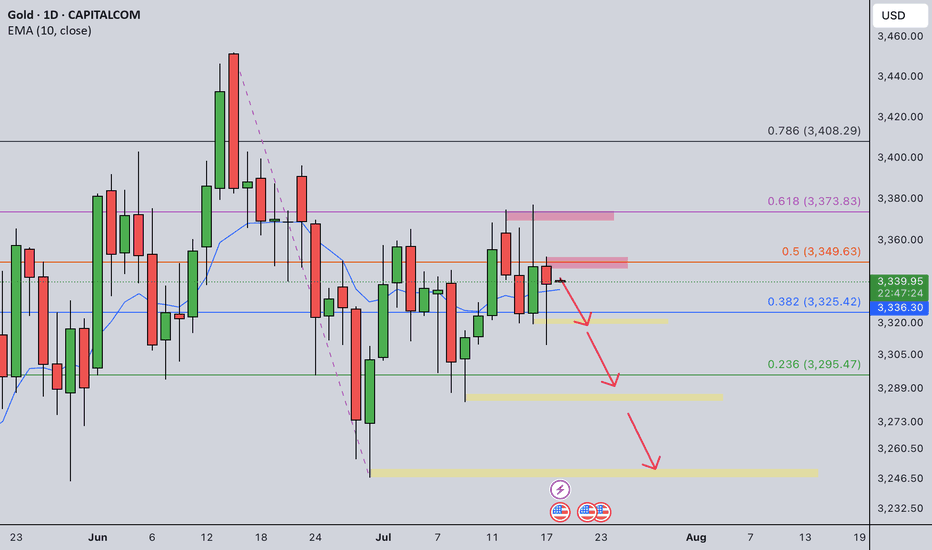

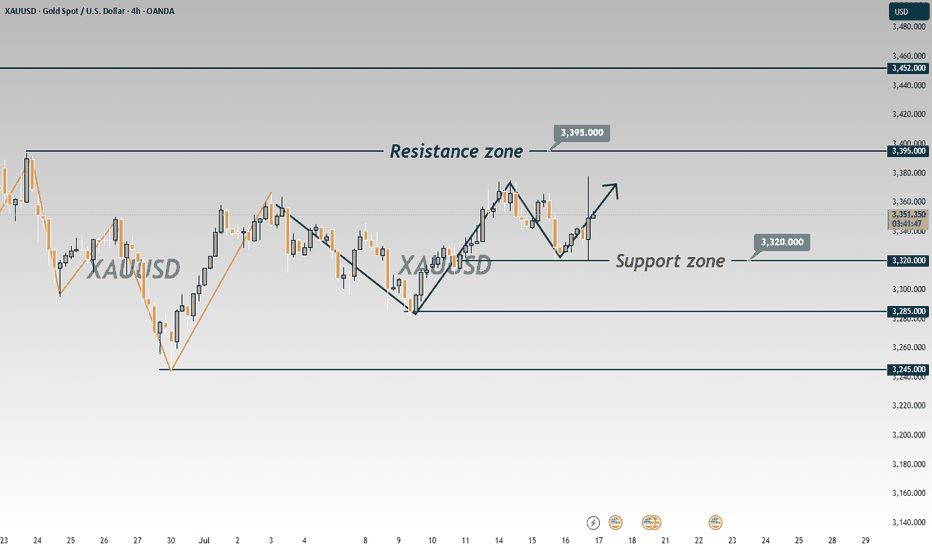

📌In terms of technical analysis, gold prices next week may continue to adjust and accumulate. Accordingly, if they surpass the 3,370 USD/oz mark, gold prices next week will challenge the 3,400-3,450 USD/oz range. On the contrary, gold prices next week will adjust down to 3,285 USD/oz, or even 3,245 USD/oz.

Notable technical levels are listed below.

Support: 3,350 – 3,310 – 3,300USD

Resistance: 3,371 – 3,400 – 3,430USD

SELL XAUUSD PRICE 3435 - 3433⚡️

↠↠ Stop Loss 3439

BUY XAUUSD PRICE 3329 - 3331⚡️

↠↠ Stop Loss 3326

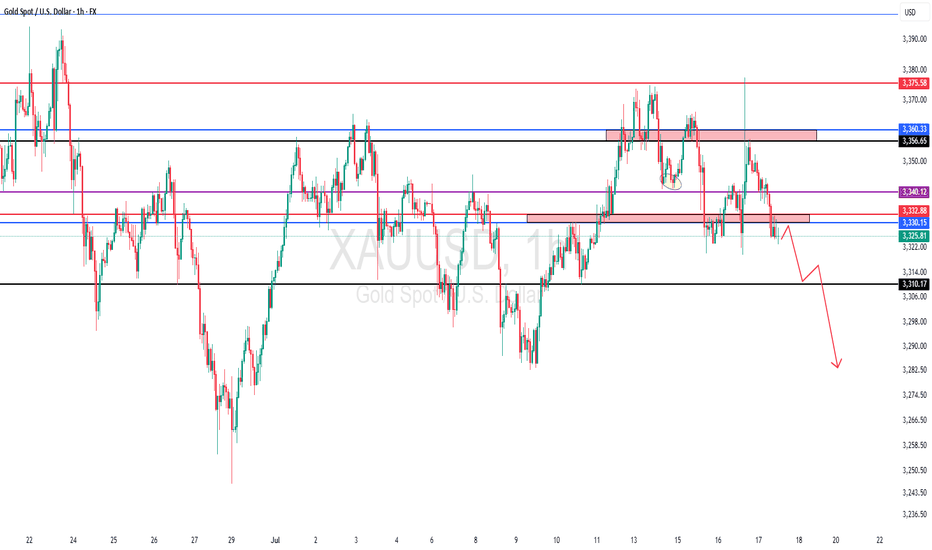

GOLD Outlook – Bearish Confirmed Post-CPIWith the CPI data released at 2.7%, gold’s bearish momentum is confirmed below the Pivot Line of 3,357.953 USD.

The market reaction suggests no immediate Fed rate cuts, supporting downward pressure. Expect a move toward Support at 3,307.665 USD and the Support Zone around 3,264.120 USD. A close above 3,357.953 USD on a 1H or 4H candle could indicate a bullish reversal toward Resistance at 3,390.028 USD.

Trade Setup:

Short Entry: Near 3,357.953 USD with bearish confirmation, Stop Loss above 3,390.028 USD.

Take Profit: Initial target at 3,307.665 USD, with a second target at 3,264.120 USD.

Long Entry: Only if price breaks and holds above 3,357.953 USD, with a Stop Loss below 3,250 USD, targeting 3,390.028 USD.

Pivot Line: 3,357.953 USD

Support: 3,307.685 USD – 3,264.120 USD (Support Zone)

Resistance: 3,390.028 USD – ~3,400 USD (Key Resistance)

1h, 2h Supply Zone: Between 3,357.953 USD and 3,390.028 USD

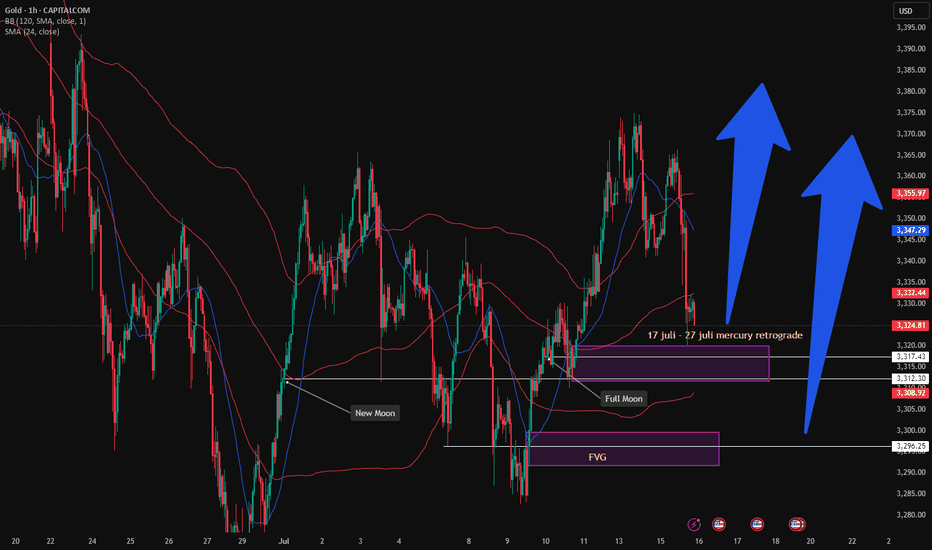

short recovery, trend line✍️ NOVA hello everyone, Let's comment on gold price next week from 07/14/2025 - 07/18/2025

⭐️GOLDEN INFORMATION:

Gold prices surged nearly 1% on Friday as market sentiment soured in response to US President Donald Trump’s controversial trade policies targeting Canada, while hinting at broader tariffs on other nations and copper. At the time of writing, XAU/USD is trading at $3,354, rebounding from intraday lows of $3,322.

On Thursday, Trump announced a 35% tariff on Canadian imports, though goods complying with the 2020 USMCA trade agreement remain exempt. He also signaled intentions to expand tariffs across most trading partners, proposing blanket rates ranging from 15% to 20%.

With a light US economic calendar, attention turned to Fed commentary. Chicago Fed President Austan Goolsbee pushed back on calls for rate cuts aimed at reducing government borrowing costs, stressing the central bank’s focus remains firmly on employment and price stability.

⭐️Personal comments NOVA:

growth according to the trend, maintaining the accumulation price zone above 3300

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $3392, $3447

Support: $3330, $3308, $3246

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

Gold Intraday Trading Plan 7/18/2025I should follow through my trading plan on weekly trend. Instead of rising up, gold fell through early yesterday and rose back above 3340 in late US session.

I will trust my weekly analysis and based on the red daily candle, I expect gold continue to fall and it should break 2320 today. After that, we could see 2280 or even 2250 today.

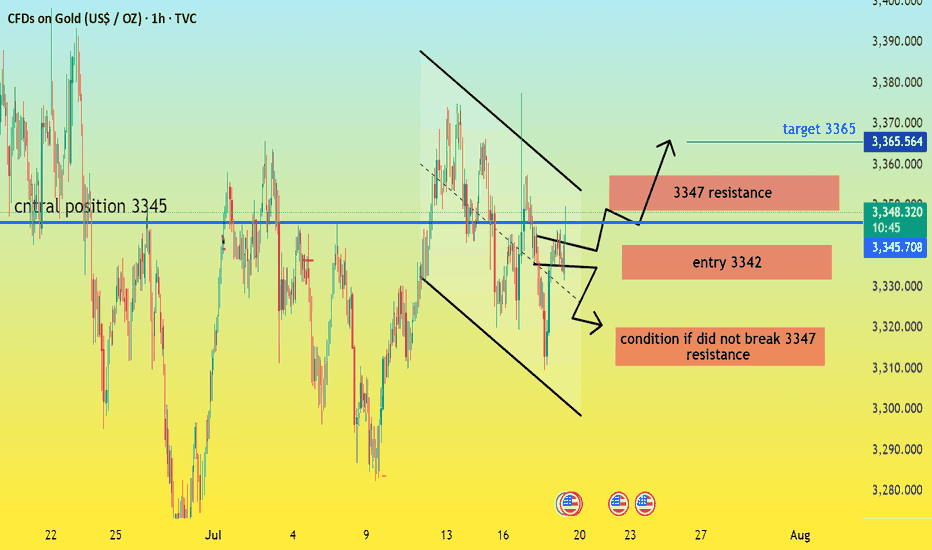

How to find solid trading opportunities amid gold volatility?Gold opened at around 3338, and then fluctuated and fell after reaching the highest point of 3344. The 3313 long orders that were publicly deployed yesterday reached the target range of 3327-3330 as expected and stopped profit smoothly. Although the overall trend is weak, it has never effectively left the range, and the typical bottoming rebound structure is still an important basis for the low-multiple thinking. The market rose to around 3340 in the short term and then fell again. The overall operation fluctuated and consolidated below 3340, and failed to reach the expected short order entry position, and maintained fluctuations until the close.

At present, gold is still in the range of fluctuations. Although the hourly line has some fluctuations, there is no obvious directional breakthrough, and it is more of a consolidation and accumulation state. The upper short-term suppression focuses on the 3345-3355 line, which is the current primary resistance area; the lower support focuses on the 3325-3315 area, and the judgment of the long and short key nodes is maintained. The daily structure shows a yin-yang staggered pattern. The market sentiment is cautious and the long and short forces are relatively balanced. Before an effective breakthrough is formed, the operation should be based on support and pressure points to avoid chasing ups and downs and do a good job of risk control.

Operation suggestions are as follows:

1. Go long near 3325-3315, with a target of 3340-3345.

2. Go short near 3345-3355, with a target of 3325-3320.

Today is Friday, and it is recommended to respond steadily, focusing on the competition for key support and resistance areas. I will prompt more real-time strategies and entry points at the bottom, remember to pay attention to it as soon as possible.

The rebound is not a reversal, continue to shortGold showed a trend of rising and falling back and closing low on Tuesday. The highest intraday rise was 3366, and the lowest fell to 3320. The daily line recorded a medium-sized Yin line with a long upper shadow. The K-line was negative, and the closing line broke the resonance support of the middle track and the short-term moving average, suggesting that the bullish momentum has slowed down and the bears are ready to move. Today, we need to pay attention to the further downward performance of gold. From the 4H level, the price stood firm at the four-hour resistance position last Thursday, and then rebounded upward in the short term. Yesterday, the price fell below the daily support level. Currently, the short-term market is bearish, and attention is paid to the resistance in the 3340-3345 range above. In the one-hour period, the price is in short-term shock adjustment. On the whole, it will be treated as a shock decline before breaking yesterday's low, and the lower side pays attention to the 3225-3320 area support. In the short term, you can consider shorting at 3340-3350 in the European session, and look towards 3330-3320

OANDA:XAUUSD

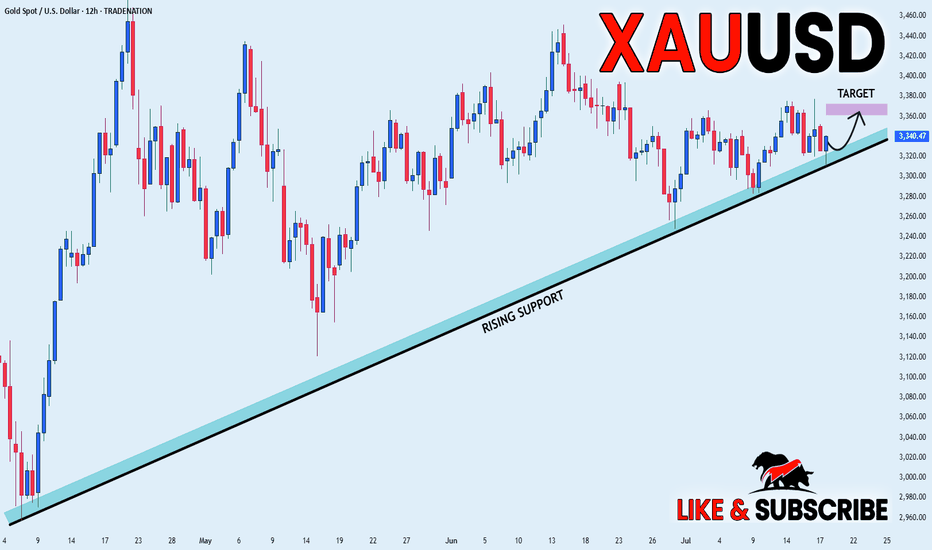

GOLD LONG FROM RISING SUPPORT|

✅GOLD is trading in an uptrend

And the bullish bias is confirmed

By the rebound we are seeing

After the price retested the support

So I think the growth will continue

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

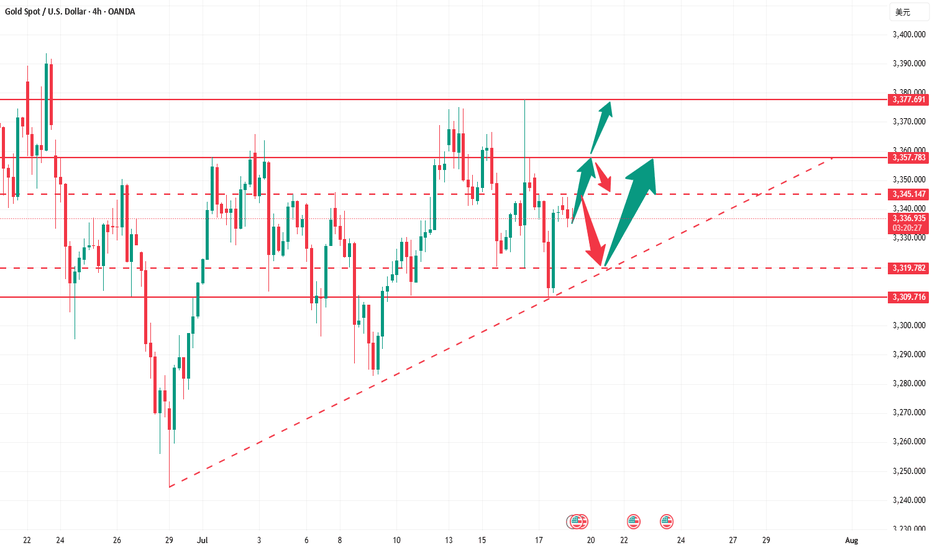

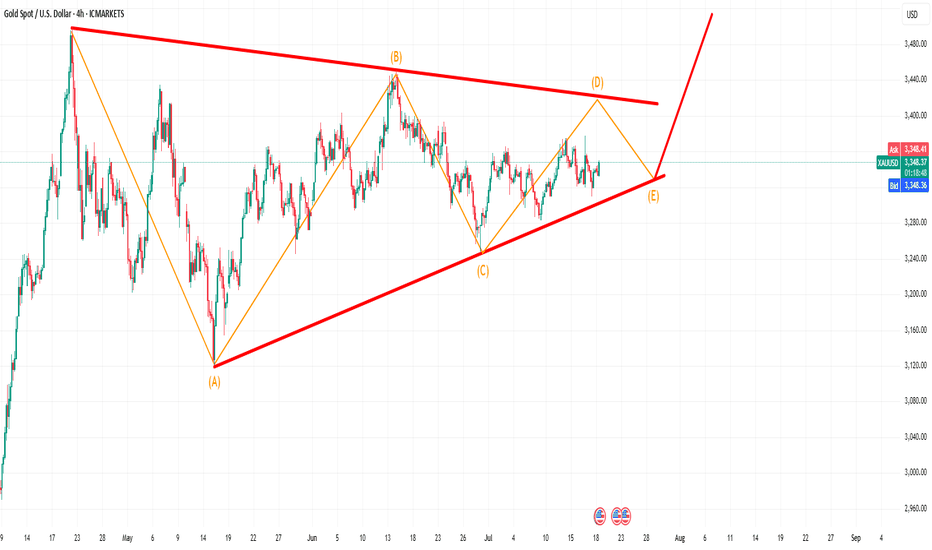

XAUUSD – Summer Triangle ConsolidationGold (XAUUSD) is unfolding a textbook contracting triangle on the 4H chart, currently developing leg D of the pattern. This structure has been forming over the past few months and reflects classic market behavior during the summer — slow, sideways consolidation as many participants are away for the season.

Given the current structure, I expect one more leg down to form wave E, completing the triangle. Once this leg is in place and the support trendline holds, we could see a significant breakout to the upside in line with the broader bullish outlook on higher timeframes.

This setup remains valid as long as price continues respecting the triangle boundaries. I’m watching for a clean rejection at the lower trendline near point E to validate the bullish breakout scenario.

📌 Seasonality, structure, and market tempo suggest patience as the consolidation plays out. The breakout opportunity may follow shortly after leg E concludes.

Gold: Bull-Bear Swings & Today's Trade Tips + AnalysisAnalysis of Gold News Drivers:

During the U.S. session on Wednesday (July 16th), spot gold surged sharply and is currently trading around 3,370 🚀. Trump stated that tariff letters will soon be sent to small countries, with rates likely slightly above 10%, providing safe-haven support for gold prices 🛡️.

Gold prices fell 0.5% on Tuesday, closing at 3,324.68, barely holding above the 55-day moving average of 3,222 📉. Earlier, the U.S. June CPI increase hit its highest level since January, pushing the U.S. dollar index to a nearly three-week high, while U.S. Treasury yields also climbed to a six-week peak, pressuring gold prices ⚖️. The dollar index has risen for four consecutive trading days, hitting a high of 98.70 on Tuesday, the highest since June 23rd 🆙. A stronger dollar makes dollar-denominated gold more expensive for investors holding other currencies, thereby weighing on gold prices 💸.

However, the market largely interprets the dollar's recent rally as a technical adjustment rather than a reversal of the long-term trend 🔄. Despite short-term pullbacks in gold prices, market sentiment has not fully turned pessimistic 😐. While gold is currently in a consolidation range since mid-May, uncertainties surrounding tariff policies may offer support 🔀. Overall, the long-term outlook for gold remains optimistic, with sustained market focus on tariff issues expected to drive a rebound in gold prices in the future 📈

Accurate signals are updated every day 📈 If you encounter any problems during trading, these signals can serve as your reliable guide 🧭 Feel free to refer to them! I sincerely hope they'll be of great help to you 🌟 👇

Gold Aiming Higher: Bullish Momentum Toward Key S&D ZoneHello guys!

The main bullish trend remains intact on Gold. After forming a solid base near the QML level, price has been respecting the ascending channel structure and is now pushing toward the upper boundary of that channel.

The current price action shows strength and momentum, and with the recent breakout above the midline of the channel, it signals that buyers are likely to push price toward the next key area of interest.

The target is clearly defined: the supply zone around 3409–3423, which has previously acted as a major resistance area.

Core idea:

Main trend: Bullish

Structure: Ascending channel

Support confirmed: QML zone bounce

Current behavior: Price moving along the top of the channel

Target: 3409–3423 supply zone

1507 a bull trend back to Gold Hello traders,

Gold has returned back above EMAs on daily chart.

On 4h chart, there is a chance for it to break through last top level to make a new high up to 3438 .

Take a good use liquidity of CPI of US today.

You could get a great result of that.

GOOD LUCK!

LESS IS MORE!

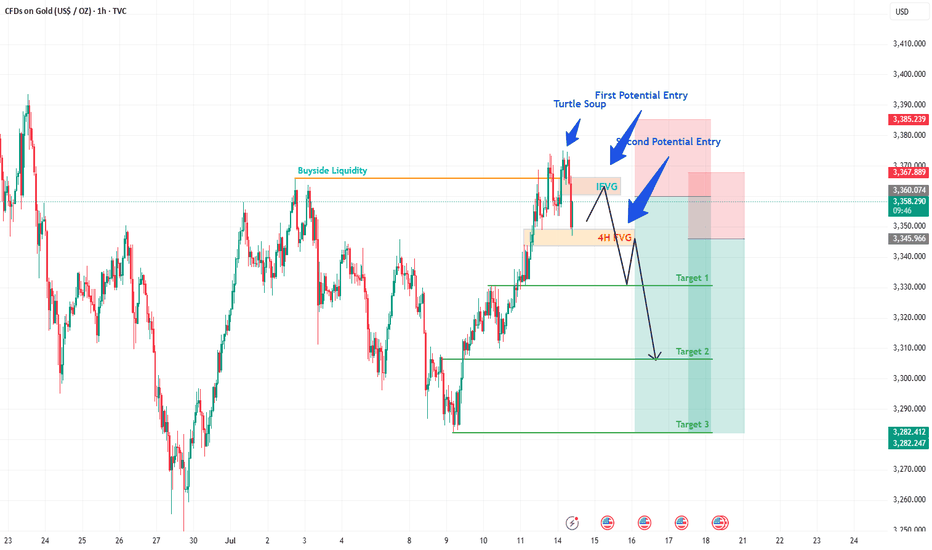

XAUUSD (GOLD) POTENTIAL SELL IDEAGold after hitting 3500 level, has kind of been ranging between 3200 and 3450 level. As we can say that Monday as start of the week has taken a Buyside Liquidity maybe making it high of the week which we will know as the market unfolds itself.

A FVG was formed on 1H before the Buyside was taken and after taking BSL, price sliced through FVG making it IFVG, we can expect Gold to give us a sell trade as it enters this IFVG which will be our first potential entry, placing SL slightly above Buyside Liquidity level.

If our first entry is successful, we can see a second entry when the price slices through the 4h FVG as marked, making it again an IFVG targeting the levels as highlighted on the chart.

FIRST POTENTIAL ENTRY:

Sell @ 3360-3365

Stop loss = 3385

Take Profit = 3335 (Target 1), 3310 (Target 2), 3390 (Target 3)

SECOND POTENTIAL ENTRY:

Sell @ 3340-3345

Stop loss = 3367

Take Profit = 3335 (Target 1), 3310 (Target 2), 3390 (Target 3)

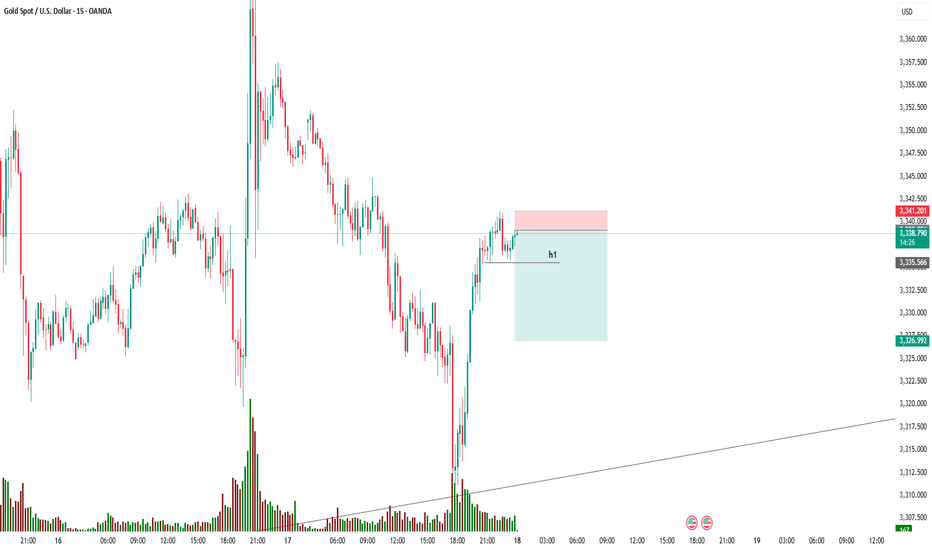

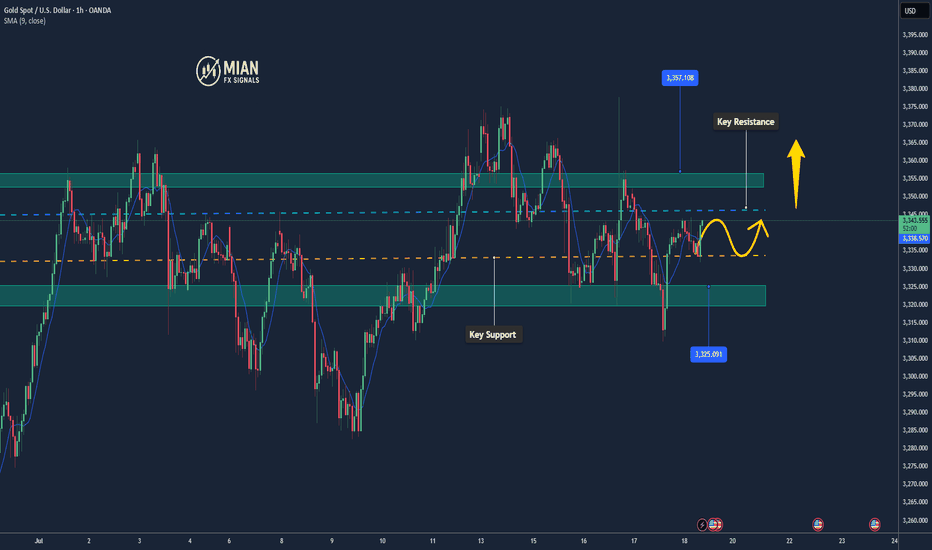

Gold Maintains Bullish Tone – Eyes on $3,350 Breakout📊 Market Overview

• Gold is trading around $3,339 – $3,340, after rebounding from the session low at $3,332.

• The USD is temporarily weakening, and safe-haven flows remain steady — key factors supporting gold.

• Markets are awaiting fresh U.S. economic data for clearer directional cues.

📉 Technical Analysis

• Key Resistance Levels:

– Near-term: $3,344 – $3,345

– Extended: $3,352 – $3,356 (weekly highs)

• Key Support Levels:

– Near-term: $3,332 – $3,335

– Extended: $3,320 – $3,325 (MA confluence + technical base)

• EMA: Price remains above EMA 09, confirming a short-term uptrend.

• Candle Pattern / Volume / Momentum: RSI is around 54–56; momentum remains positive but has cooled — suggesting potential consolidation.

📌 Outlook

Gold is maintaining a bullish technical structure — if it breaks above $3,345, a move toward $3,352 – $3,356 is likely. On the downside, a drop below $3,332 could trigger a retest of $3,325 – $3,320.

💡 Suggested Trading Strategy

🔺 BUY XAU/USD: $3,324 – $3,327

• 🎯 TP: 40/80/100 pips

• ❌ SL: $3,320

🔻 SELL XAU/USD :$3,352 – $3,355

• 🎯 TP: 40/80/100 pips

• ❌ SL: $3,359

Gold Price Analysis July 18XAUUSD Analysis

Gold has just had a deep sweep to 3310 before bouncing back within the trading range. Currently, the price is reacting at the Trendline area around 3344. This is an important level - if broken, gold can return to the uptrend, with the nearest target at 3373.

🔹 Key Levels

Support: 3332 - 3312

Resistance: 3344 - 3357 - 3373 - 3389

🔹 Trading Strategy

BUY trigger: when price breaks 3344

BUY DCA: when price surpasses 3353

SL: below 3332

Target: 3373

💡 Note:

The 3332 area plays an important role in the bullish wave structure, suitable for placing Stop Loss for BUY orders.

Report - 17 jully, 2025Executive Notes – Summary

Tariffs Bring In $50bn+ for U.S.: Global partners mostly restrained; only China and Canada retaliated. EU delays action until Aug 1. → Bullish short-term for USD revenue and equities tied to U.S. industrial base; long-term inflation risk rising.

Trump vs Powell (Fed Chair): Trump floated firing Powell; market volatility followed. Odds hit 40%, fell after walk-back. → Bearish for DXY, bullish for XAUUSD and risk hedges.

China-Japan Espionage Flashpoint: Japanese executive jailed. U.S. and Japanese corporates face higher operational risk. → Negative FDI outlook for China, positive momentum for India, Vietnam.

EU–Mercosur Trade Deal at Risk: France demands safeguards on beef, sugar, poultry. Deal approval hinges on political concessions. → Watch agri-commodities (softs), BRL, and EU agri-lobby impacts.

ASML Profit Warning: Trump tariff fears cloud 2026 chip industry outlook; shares drop 11%. → Bearish on EU semis, capital goods.

Nvidia China Deal Revival: U.S. set to grant export licenses for AI GPUs; H20 shipments may resume. → Bullish for China AI adoption and semis; BABA, BIDU, NVDA in rebound territory.

Goldman & JPM Rally on IB Recovery: M&A/IPO flows return; +26% YoY IB fees. → Signals CEO confidence; bullish for dealmakers and sector ETFs (KCE, XLF).

Subsea Cable Ban on China: FCC to block Chinese tech in U.S.-linked subsea networks. → Signals rising digital Cold War; tech supply chains shifting westward.

Germany’s Allianz CEO Sounds Alarm: Warns of fiscal collapse by 2035 if welfare spending not reformed. → Supports hard-asset thesis; bearish EU fiscal stability perception.

Crypto Week & Stablecoin Push: Cantor-led SPAC to buy $4B BTC; U.S. fast-tracking stablecoin rules. → Bullish BTC, USDT dominance, and crypto-native banking platforms.

Full Strategic Macro & Market Analysis

President Trump’s aggressive tariff policy is achieving both economic and political outcomes ahead of the election: $64 billion in Q2 customs revenues and symbolic victory over hesitant global peers. According to Treasury data, tariffs have surged income by over $47 billion YoY. This influx comes with asymmetric retaliation: only China and Canada have meaningfully responded. The EU, under pressure from France’s agricultural bloc, has paused countermeasures, awaiting August 1 negotiations.

The market's muted reaction reflects the novelty of tariffs being treated as quasi-fiscal tools. Yet, the Yale Budget Lab’s finding of a 20.6% effective average tariff — the highest since 1910 — is an inflationary wildcard. UBS projects that core goods prices may push CPI above 2.3% until 2027 without policy reversal, eroding real incomes and squeezing margins across consumer sectors. As noted by Fed officials like John Williams, tariffs alone are lifting inflation by a full percentage point over the next 12 months.

At the same time, Trump’s remarks about firing Fed Chair Powell jolted Treasury and currency markets. The DXY fell nearly 0.9% intraday, while 2-year U.S. yields dropped to 3.90%, pricing in a potentially more dovish successor. This political volatility amplified market preference for inflation hedges and high-quality equity earnings.

Assets:

XAUUSD (Gold):

Trump’s Fed confrontation, rising CPI prints, and global legal-institutional instability support continued gold upside. Technical momentum remains bullish. If DXY dips below 103 and Powell uncertainty rises, gold could retest $2,450.

S&P 500 & Dow Jones:

Rotation continues. Industrials and financials (e.g., Goldman Sachs, JPMorgan) gain from tariff-driven reshoring and M&A revival. However, semis and global tech face drag from ASML warnings and U.S.–China tech decoupling. Dow holds better given dividend strength, but risk spikes if Powell is removed or tariffs push inflation past 3%.

USDJPY:

USD weakening bias persists on Fed risk, though yen gains are capped by geopolitical risk in Asia (e.g., Chinese jet near Japan, espionage cases) and Japan’s sluggish growth. A move toward 152 is possible if Powell exits or the Fed pivots dovishly.

DXY (Dollar Index):

Trump’s instability narrative, threats to Fed credibility, and rising CPI are weighing on the dollar. Watch for a decisive breakdown below 103, especially if ECB/BoE turn hawkish or U.S. deficit headlines worsen.

Crude Oil (WTI):

Supported by strong commodity complex (steel, copper, aluminum all up), tariffs on inputs, and stable OPEC+. Bullish bias into Q3, with demand steady and risk premia rising from China tensions and Middle East unrest.

Macro Risks

Fed Politicization: Powell’s premature dismissal could unravel market confidence in the U.S. rate regime. Bonds and USD would sell off; capital flight risk rises.

Persistent Inflation: Tariffs risk pushing CPI above 3% in 2025. Long-end yields will respond faster than the Fed.

Tech War Escalation: Subsea cable bans, Huawei exclusion, and AI chip controls could trigger further retaliation from China.

EU-Mercosur Breakdown: French farming veto could stall EU diversification efforts and strengthen protectionist politics in Europe.

Emerging Opportunities

U.S. Banks and Dealmakers: Goldman Sachs and JPMorgan gains point to a rebound in capital markets activity. KCE ETF, GS, and MS are prime exposure vehicles.

AI-Semiconductor Complex (Selective): Nvidia’s China deal reversal allows for a tactical rebound in NVDA, BIDU, BABA, despite broader export controls.

Bitcoin Accumulation Wave: Trump-aligned SPACs (Cantor Equity Partners 1, BSTR Holdings) are spearheading institutional BTC acquisition. Stablecoin legislation expected to favor U.S. dollar dominance.

Dividend-Centric Strategies: Payout increases from industrials (Costamare, ILPT) outnumber dividend cuts. Defensive dividend plays are outperforming growth narratives in volatile macro backdrops.

Possibilities:

XAUUSD (Gold)

Short-Term (1–4 weeks): Likely to stay elevated or push higher amid Fed independence concerns and strong CPI tailwinds. A sustained move above $2,400 opens a path to $2,450–2,480, especially if Powell’s status deteriorates or the DXY breaks 103.

Medium-Term (3–6 months): Remains supported by structural inflation and global de-dollarization themes (e.g., stablecoins, geopolitical risk in Asia, digital infrastructure war). Positioning may increase if the Fed turns more political.

S&P 500

Short-Term: High volatility. Earnings remain solid, especially in financials and industrials, but valuation compression risk persists if long-end rates stay above 5%. Potential 1–2% pullbacks on Powell uncertainty.

Medium-Term: Rotation-led upside possible if Fed stability is restored. But if tariffs worsen CPI and margins compress, we could see a multi-month consolidation. AI and industrial resilience may cap downside.

USDJPY

Short-Term: Expected to test downside near 152. Japanese yen gaining haven demand, and dovish Fed risk undermines USD strength. If risk sentiment worsens (China, Powell), JPY outperforms.

Medium-Term: Neutral-to-bearish. If the Fed resumes cuts or dollar confidence erodes, USDJPY could move sub-150. BOJ remains dovish, limiting gains beyond that.

DXY (US Dollar Index)

Short-Term: Under pressure. If Powell's removal gains traction or more tariffs fuel CPI, DXY may decisively lose 103 support. Temporary rebounds on safe-haven flows possible.

Medium-Term: Bearish bias forming. Stablecoin growth, Trump-led policy volatility, and global diversification efforts (e.g., EU trade deals) weigh on demand for USD assets.

Crude Oil (WTI)

Short-Term: Bullish tone holds. Supply-side support from OPEC+, tariffs lifting input costs, and solid U.S. industrial activity. Potential retest of $85/bbl.

Medium-Term: Risk of higher volatility. If global growth slows (China contraction or Fed missteps), oil could retreat to mid-$70s. But inflationary pressure remains net supportive.

Dow Jones Industrial Average

Short-Term: Outperforming due to resilient bank earnings, dividend momentum, and defensive bias. Likely to remain range-bound with modest upward drift unless Powell is ousted.

Medium-Term: Cautiously bullish. Dividend themes remain strong, and industrials benefit from tariff protection. But inflation and long-duration debt concerns could cap gains.