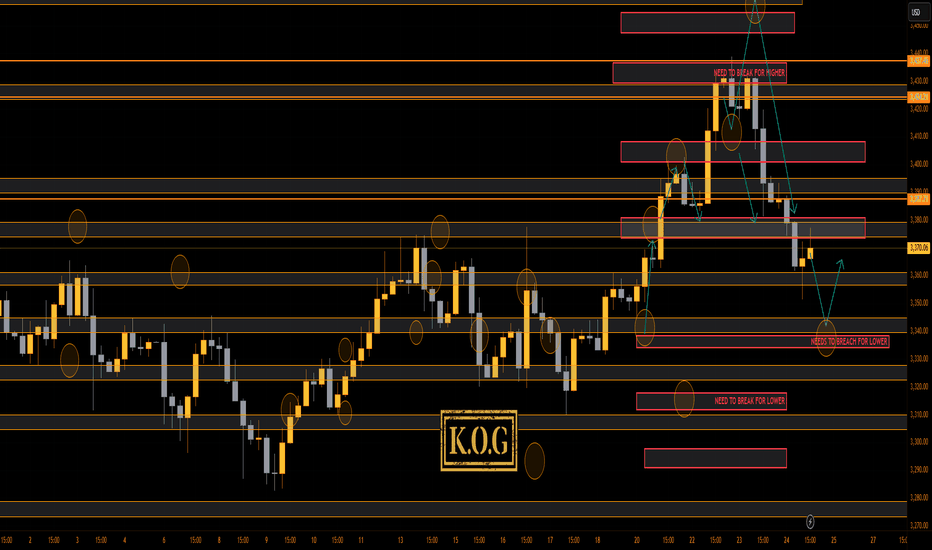

THE KOG REPORT - UpdateEnd of day update from us here at KOG:

Not bad play at all with the red boxes working well, KOG's bias of the day and the red box targets working well and of course the indicators and our trusted algo Excalibur guiding the way completing the move that we wanted downside. We then got a fantastic long from the bias level and red box activation up into where we are now.

So, what now?

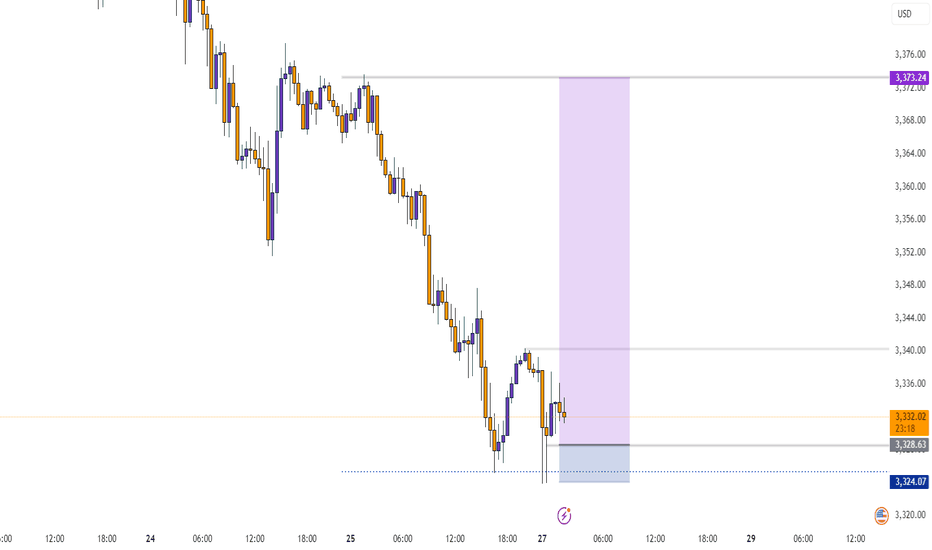

We have resistance and a red box above which is broken suggesting we may see some more movement downside in the coming sessions. This would also align with the hunt and undercut low that can take place at this key level. We're a bit too low to short, so we'll either look for the break above 3375 to go higher, or, we'll wait lower for a potential long trade from the red box region.

Immediate support here is 3360-5 and resistance 3375.

Price: 3364

KOG’s Bias of the day:

Bullish above 3350 with targets above 3358✅, 3365✅ and above that 3379✅

Bearish on break of 3350 with target below 3337 and below that 3330

RED BOXES:

Break above 3365 for 3372✅, 3375✅, 3388 and 3406 in extension of the move

Break below 3350 for 3335, 3330, 3326 and 3307 in extension of the move

As always, trade safe.

KOG

XAUUSDG trade ideas

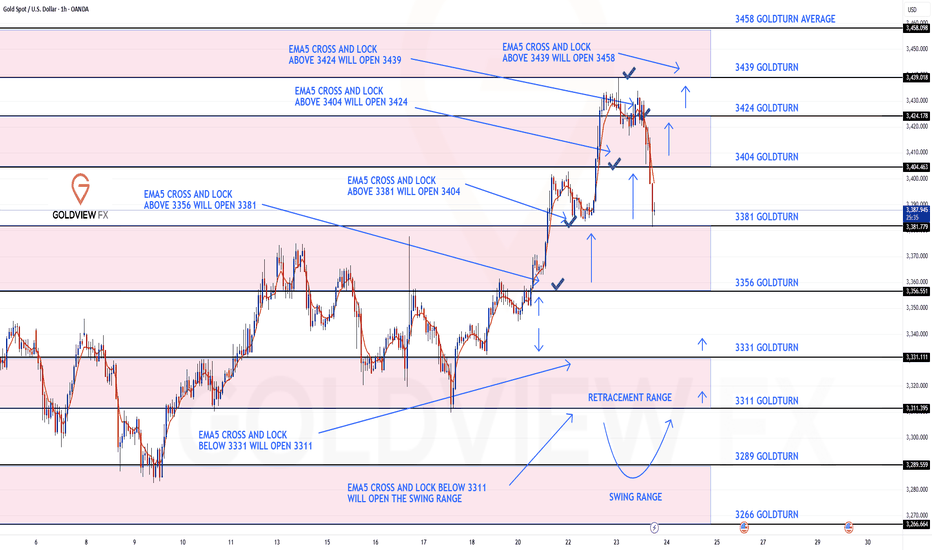

GOLD ROUTE MAP UPDATEHey Everyone,

Another PIPTASTIC day on the charts with our analysis once again hitting gold!!!

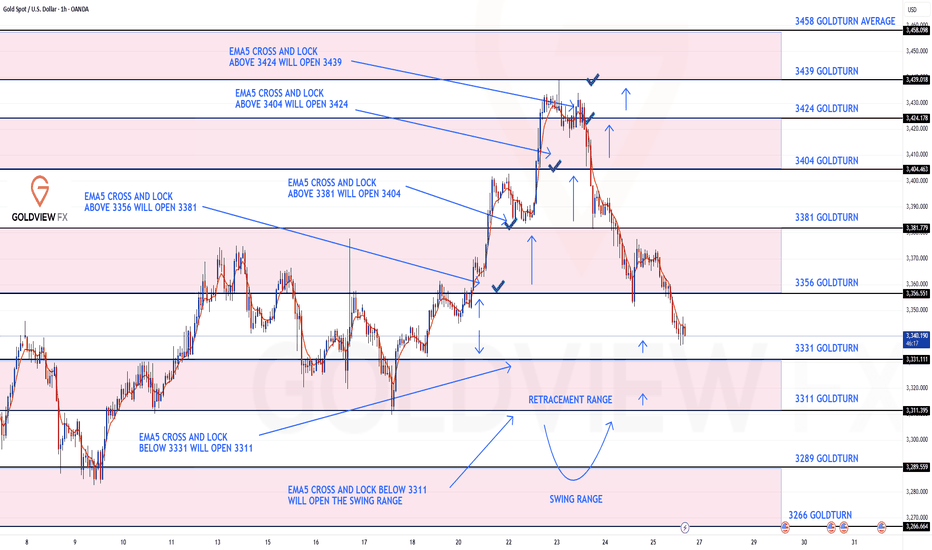

After completing all our bullish targets yesterday we stated that we will now look for EMA5 lock above 3424 to open the next bullish level at 3439.

- This played out perfectly completing 3439 to perfection!!

We are now seeing no further lock above 3439 confirming the rejection, which we are seeing now. We will now look for lower Goldturns to be tested for support and bounce inline with our plans to buy dips.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels, taking 20 to 40 pips. As stated before, each of our level structures gives 20 to 40 pip bounces, which is enough for a nice entry and exit. If you backtest the levels we’ve shared every week for the past 24 months, you’ll see how effectively they were used to trade with or against short/mid-term swings and trends.

The swing ranges give bigger bounces than our weighted levels, that’s the difference between the two.

BULLISH TARGET

3356 - DONE

EMA5 CROSS AND LOCK ABOVE 3356 WILL OPEN THE FOLLOWING BULLISH TARGETS

3381 - DONE

EMA5 CROSS AND LOCK ABOVE 3381 WILL OPEN THE FOLLOWING BULLISH TARGET

3404 - DONE

EMA5 CROSS AND LOCK ABOVE 3404 WILL OPEN THE FOLLOWING BULLISH TARGET

3424 - DONE

EMA5 CROSS AND LOCK ABOVE 3424 WILL OPEN THE FOLLOWING BULLISH TARGET

3439 - DONE

EMA5 CROSS AND LOCK ABOVE 3439 WILL OPEN THE FOLLOWING BULLISH TARGET

3458

BEARISH TARGETS

3331

EMA5 CROSS AND LOCK BELOW 3331 WILL OPEN THE FOLLOWING BEARISH TARGET

3311

EMA5 CROSS AND LOCK BELOW 3311 WILL OPEN THE SWING RANGE

3289

3266

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

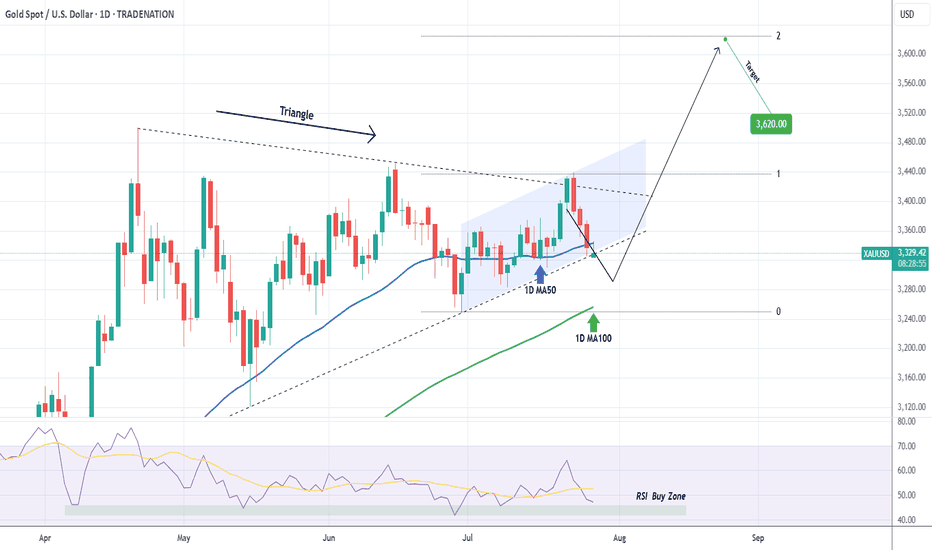

HelenP. I Gold may reach resistance zone and then dropHi folks today I'm prepared for you Gold analytics. From a structural perspective, the XAU chart indicates a recent shift to a bearish bias, following a clear breakdown from a large broadening wedge pattern. This development suggests that sellers have gained a significant advantage in the market. The price is now staging a corrective rally back towards the point of the breakdown, creating a critical test at the confluence of the broken trend line and the major horizontal resistance zone at 3375 - 3385. My analysis for a short position is based on a potential 'bull trap' scenario within this area. I believe the price may briefly push above the trend line to trap buyers, but the key condition is a swift and forceful rejection from within the resistance zone. If the price fails to hold its gains and reverses back below the trend line, it would be a strong confirmation of the underlying bearish pressure. This would likely trigger the next impulsive move downwards, and therefore, the primary goal for this scenario is set at the 3320 level, a logical objective following such a powerful rejection. If you like my analytics you may support me with your like/comment ❤️

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

The US and Europe reached an agreement. Gold rebounded.At the current node, the EU and the US reached a tariff cooperation, 15% tariff + 600 billion US dollars for investment in the United States. The additional tariffs are considered a big deal, and the US has become the winner again this time.

Of course, this is a small negative for the current gold market.

From a multi-period analysis, the monthly chart price is still in a reverse K state. For the current situation, we need to pay attention to the gains and losses of the monthly highs and lows. The weekly chart shows that the price has continued to fluctuate at a high level recently. As time goes by, the weekly watershed is temporarily at 3320. After last week's high and fall, there is currently a further downward performance.

The four-hour chart shows that the price has continued to be suppressed after breaking through the four-hour support last Wednesday. The four-hour level resistance is currently around 3355, and the resistance level has moved up compared with the early Asian market. Therefore, we will pay attention to the pressure at this position in the future. If it fails to break through for a long time, it is likely to fall directly under pressure; pay attention to the support range of 3320-3310 below.

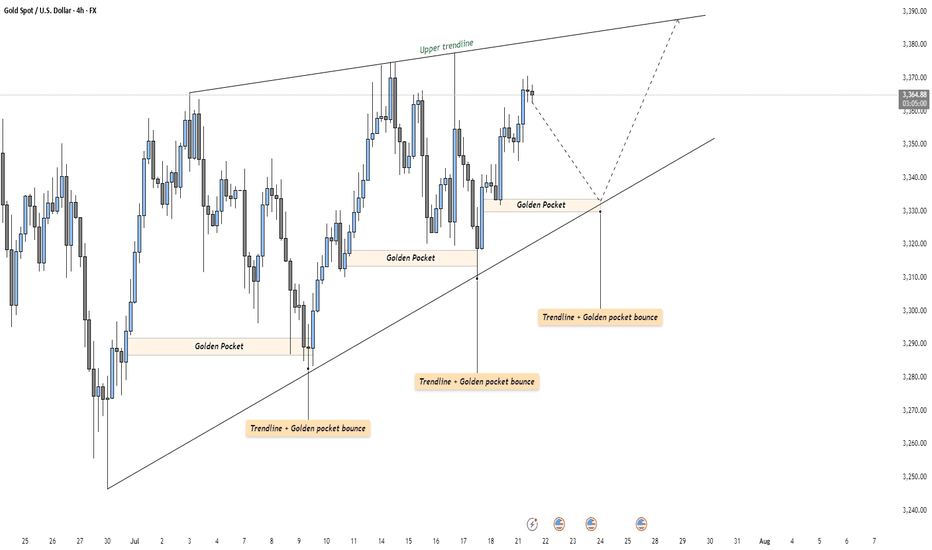

GOLD - Strong Trendline & Golden Pocket ContinuationMarket Context

Gold is currently trading within a rising wedge structure on the 4-hour timeframe. This formation typically represents a tightening market, where buyers continue to push higher — but with decreasing momentum. The confluence of both trendlines and repeated Golden Pocket bounces makes this setup technically rich and worth watching closely.

Golden Pocket & Trendline Confluence

Throughout the recent move up, price has consistently reacted to the 0.618–0.65 Fibonacci retracement zone — often referred to as the Golden Pocket. Each major retracement has found support not only at this zone but also at a rising trendline, showing strong alignment between horizontal and diagonal demand. This dual-layer support has repeatedly led to sharp rebounds, reinforcing the bullish structure.

What Comes Next?

Price is currently sitting just below the upper resistance of the wedge. If history repeats, a retracement toward the lower trendline could be the next logical step. A reaction in the same region — where the Golden Pocket once again overlaps the trendline — could offer a high-probability long opportunity for continuation toward the top of the wedge or even a breakout.

Alternatively, if price breaks below the trendline with conviction, it could signal exhaustion in the current structure, potentially flipping the bias toward a broader correction.

Final Thoughts

This is a textbook example of how technical confluence can guide trade planning — especially in clean, trending environments like this. Remember: patience is key. Let the market come to your levels.

If you enjoyed this breakdown, a like would go a long way — and feel free to share your thoughts or ideas in the comments below!

GOLD NEXT MOVE (expecting a mild bullish(24-07-2025)Go through the analysis carefully and do trade accordingly.

Anup 'BIAS for the day (24-07-2025)

Current price- 3357

"if Price stays above 3345, then next target is 3370, 3320 and 3400 and below that 3330 and 3310 ".

-POSSIBILITY-1

Wait (as geopolitical situation are worsening )

-POSSIBILITY-2

Wait (as geopolitical situation are worsening)

Best of luck

Never risk more than 1% of principal to follow any position.

Support us by liking and sharing the post.

GOLD Slips as Dollar Gains on Trade Deal – Bearish Below 3349

Gold Pares Gains as USD Strengthens on Trade Deal Ahead of Fed

Gold gave up early gains, pressured by a stronger U.S. dollar after the announcement of the US–EU trade agreement.

Meanwhile, attention shifts to upcoming U.S.–China negotiations later today, as both sides aim to extend the current trade truce and avoid new tariffs.

Investors are also closely watching the Federal Reserve’s policy decision on Wednesday, seeking signals on future interest rate moves.

TECHNICAL OUTLOOK:

Gold maintains a bearish trend while trading below 3349, with potential downside toward 3320.

A 1H candle close below 3320 – 3312 would confirm extended bearish pressure targeting 3285, driven in part by ongoing geopolitical risks.

⚠️ To shift back to a bullish structure, the price must stabilize above 3349.

Key Levels:

• Support: 3320 – 3285 – 3256

• Resistance: 3365 – 3375

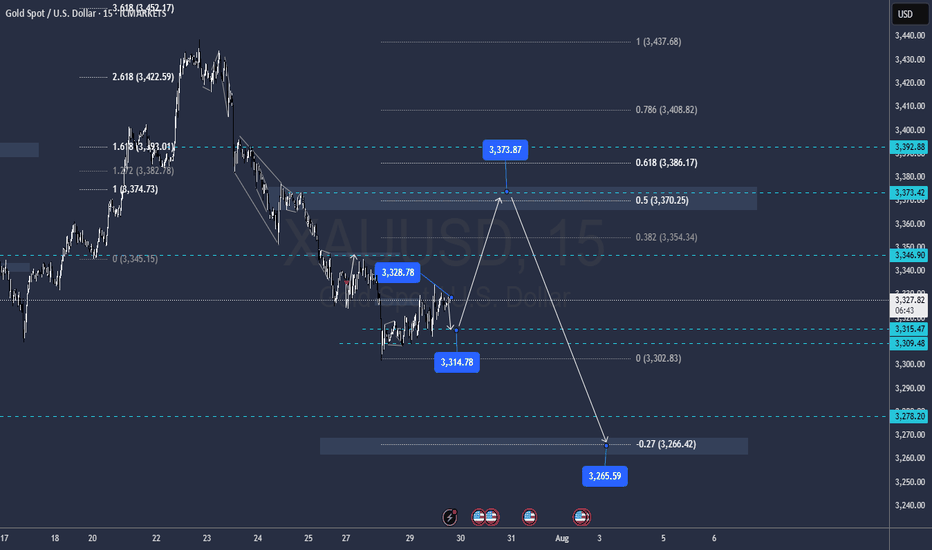

GOLD BUY TRADE IDEA🟡 XAU/USD Smart Money Setup – July 31, 2025

🔍 Key Technical Highlights:

• Demand Zone Entry:

• Price has tapped into a clear demand zone (gray box) around 3,274 – 3,290, signaling potential institutional accumulation.

• The previous inducement low has been swept, aligning with Smart Money Concepts (SMC).

• Liquidity Engineering:

• Equal highs (liquidity pool) visible from late June remain uncollected — a prime upside target.

• Price structure shows internal BOS, suggesting a shift in market sentiment.

• Expected Path:

• A potential multi-leg bullish move is mapped out, targeting the 3,440+ premium zone, completing imbalance fill and stop-run above highs.

• Risk-Reward:

• Stop loss sits just below the demand zone (~3,274), maintaining a favorable risk-to-reward ratio.

⸻

🧠 Smart Money Flow Narrative:

1. Sweep of inducement lows triggers institutional entries.

2. Demand zone holds with bullish reaction — confirmation of intent.

3. Expect higher highs and a rally toward uncollected liquidity above 3,440.

4. Low-risk buy opportunity for both swing and intraday traders.

Gold Next Move (Read description). Hello, Traders.

As you saw we have achieved our target at last ideas.

This week gold is running in down trend, today it has touched the price 3268 and then gold pumped.

As you see guys, gold has breakout the last support area and its support became resistance.

Gold has changed the character according to H1 and there is break of structure (BOS).

The trend is bearish, so gold needs to fall, it can fall till 3351.

Comment positive feedbacks, Thanks.

Gold Eliot analysis My predictions about gold in previous years have been quite accurate and calculated. Currently, I think a wave 4 correction, which is a micro-wave, is taking place. As we can see, this micro-wave will probably decrease between $2,700 and $3,000 and then advance to targets above $4,000. Majid Babaei Tehran August 1404

GOLD awaiting confirmation of a bullish zone formation.Gold has confirmed support at 3310, with the price rebounding and returning to the buying side. We are now awaiting confirmation of a bullish zone formation.

Gold remains under pressure ahead of key market-moving events, including the US GDP data release and the Federal Reserve’s interest rate decision. However, the pause in Dollar strength is offering some support to the gold price. As long as the price holds above this level, the bullish scenario remains valid. A sustained move above this zone may open the path toward the next resistances: 3360 / 3385 we can expect Growth more.

You May find more Details in the Chart.

Trade wisely best of Luck Buddies.

Ps: Support with like and comments for more insights Thanks for Supporting.

Will Upcoming Data Determine the Next Gold's Direction?Macro approach:

- Gold retreated this week, reversing early gains to trade near four-week lows amid renewed US dollar strength and caution ahead of the Fed's policy decision.

- The retreat was mainly pressured by stronger-than-expected US economic data and a tentative revival in risk appetite, offsetting pockets of safe-haven demand.

- Key drivers included robust US GDP growth for 2Q, a bounce in consumer confidence, and the Fed's steady rates with a more hawkish tone, suggesting cuts may be further out.

- Meanwhile, recent US-EU and US-China trade deals eased some global uncertainty, damping gold's appeal as a hedge.

- Market participants also eyed the labor market's continued cooling, but resilient consumer spending further buoyed the dollar.

- Gold may remain volatile, with potential upside if upcoming US PCE inflation and NFP reports disappoint expectations. Any escalation in trade tensions or signals of Fed policy easing could renew support for gold prices.

Technical approach:

- XAUUSD fluctuated within the range of 3285-3560, which is below the broken ascending trendline. The price between the two EMAs awaits an apparent breakout to determine the next trend.

- If XAUUSD breaks below the support at 3273, confluence with EMA78, the price may plunge to retest the following support at 3167.

- On the contrary, remaining above the support at 3273 may lead XAUUSD to retest the resistance at around 3560.

Analysis by: Dat Tong, Senior Financial Markets Strategist at Exness

GOLD (XAUUSD) -Monthly Analysis & Trading Plan (Aug 2025)GOLD (XAUUSD) -Monthly Analysis & Trading Plan (Aug 2025)

Title: XAUUSD: Correction in Progress, Patience is Key for the Next Move

Chart: XAUUSD Monthly (1M)

Analysis Type: ICT/SMC, Price Action, & Moving Average

Summary:

After a historic and powerful bull run that saw Gold (XAUUSD) breach all-time highs in the first half of 2025, the market has entered a significant corrective phase. The massive red candle in June signaled a strong reversal of momentum, and the current July candle confirms that sellers remain in control, albeit with less intensity. This is a critical juncture for long-term traders, and a strategic approach is required.

Key Observations & Analysis

1. **Price Action & Market Structure:**

The move from late 2024 through May 2025 was a textbook "impulsive leg." The sharp reversal in June 2025, with a powerful bearish candle, likely acted as a **liquidity grab** or a **high-volume distribution event**, trapping late buyers. The market is now in a clear **break in market structure (BOS)** to the downside on this long-term timeframe, suggesting the correction is not over.

2. **ICT/SMC Concepts:**

* **Imbalance/Fair Value Gap (FVG):** The rapid bullish move created significant imbalances on the monthly chart. Price often returns to fill these gaps. The current correction is likely heading to fill or test these inefficiencies.

* **Order Block (OB):** The massive bullish move in late 2024/early 2025 likely created a strong bullish order block. The current sell-off is heading toward this potential institutional demand zone.

* **Liquidity:** The lows from late 2024 and early 2025 will be key liquidity pools. Smart money will likely be targeting these areas for a potential reversal or accumulation.

3. **Moving Average Analysis (MMA):**

* The price is currently trading above both the purple and yellow moving averages, which are still pointing upward. This confirms the long-term trend remains bullish, and the current move is a correction within that trend.

* The **purple moving average** is a key support level to watch. A test of this level would be a high-probability event, and its reaction will be crucial for the next major move.

Suggested Entry & Exit Levels

1. Aggressive Entry (Short)

Rationale

The bearish momentum, though slowing, is still the dominant force. An aggressive trader could look for a continuation of the short-term bearish trend.

Entry/b]

A short entry could be considered on a pullback to the recent highs around **$3,400 - $3,500** if a strong bearish candlestick pattern forms on a lower timeframe (e.g., weekly or daily).

Stop Loss

A tight stop-loss placed just above the recent high, for example, **$3,600**. This is a high-risk entry, so position sizing should be small.

Target

The first major target would be the **moving average support level**, roughly in the **$3,000 - $3,100** zone. The ultimate target for a full correction would be the order block from late 2024, around **$2,800**.

2. Conservative Entry (Long)

Rationale

The long-term trend is still bullish. The current move is a correction. The most prudent approach is to wait for a high-probability long entry at a key support level.

Entry/b]

Wait for price to reach the **purple moving average support zone (around $3,000 - $3,100)**. Look for a clear reversal signal on this level, such as a large bullish "pin bar" or "engulfing candle" on the monthly or weekly chart. This would be a high-probability demand zone for a reversal.

Stop Loss

A stop-loss should be placed below this key support level, perhaps around **$2,850 - $2,900**, giving the trade room to breathe.

Target

The first target for a new bullish leg would be the New swing high around **$3,800**. The ultimate long-term target would be a new all-time high above **$4,000**.

Conclusion

The Gold market is in a crucial phase. The bullish party from earlier in 2025 is over for now, and a healthy correction is underway. **The most logical and safe approach is to wait for the market to complete its corrective move.** Do not attempt to catch a falling knife. Instead, be patient and wait for price to reach a key institutional demand zone (our moving average support or the late 2024 order block) and show a clear sign of reversal. This will present a high-probability, low-risk long entry for the next impulsive move up.

Disclaimer

This is not financial advice. Please perform your own due diligence and risk management. Trading involves a significant risk of loss.

XAUUSDGold (XAUUSD) has been undeniably one of the most rewarding instruments to trade this year. Whether that be longs or shorts.

Well, after the latest drop let’s be clear on one thing…. There is another big one to come.

There is a 4 year cycle of behaviour to not be ignored. Question, what happened this time in the Gold charts 4 years ago?

If you know the answer then you need to be setting up for sells.

Of course there have been many highs made this year and some are anticipating a new ATH before the drop. It is possible based on price action in 2025.

If history is to repeat itself, the open of Asian Session tonight (030825) could see a continuation up of the explosion up of Friday (010825). This should result in the sweeping out of stop losses of any sells that have been held over the weekend.

The closure of the sells will create buying pressure sending price further up to retest at least the most significant swing high. At and from this level and a few more above, we can look out for sustained selling to break below 3300 and beyond.

It is just theory at this point but should be taken into account.

Potential sell areas:

3368-3370

3378-3380

3400-3405

3412-3416

3428-3430

3433-3438

3444-3450

Of course risk management is key. But from the highest point that price reaches early next week could be the start of a very good sell.

All entry zone me should have an initial 1:2RR while holding partial sells with extended TPs as far as 3233,3217,3198,3159,3099.

Good luck 🤞

This is not financial advice and should be taken with a pinch of salt.

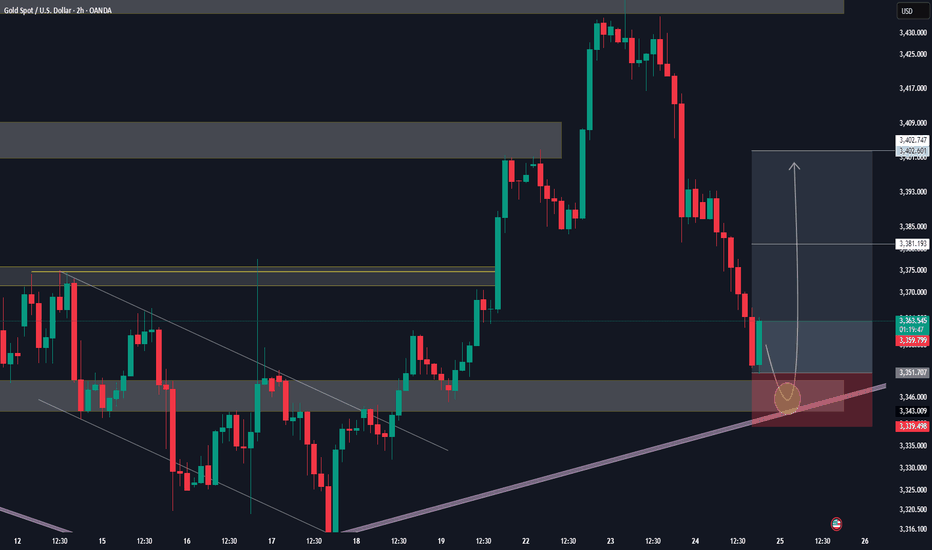

XAUUSD Does it need to test the 1D MA100 first?Gold (XAUUSD) is attempting to break below its Triangle formation just 4 days after marginally breaking above it. This has invalidated that pattern so after breaking also below its 1D MA50 (blue trend-line), it could technically go for a 1D MA100 (green trend-line) test for the first time since January 06 2025.

If it does, there will be more probabilities for a stronger than before rebound to make a new High. Our Targe is the 2.0 Fibonacci extension at $3620.

Keep also an eye on the 1D RSI Buy Zone, which has been giving the most optimal buy signals since April 07 2025.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

GOLD 1H CHART ROUTE MAP UPDATEHey Everyone,

Great finish to the week with our chart ideas playing out, as analysed.

We completed all our Bullish targets on this chart with ema5 cross and lock confirmation. We were also able to step away today after the final target with no further ema5 cross and lock, confirming the rejection that we are seeing now.

BULLISH TARGET

3356 - DONE

EMA5 CROSS AND LOCK ABOVE 3356 WILL OPEN THE FOLLOWING BULLISH TARGETS

3381 - DONE

EMA5 CROSS AND LOCK ABOVE 3381 WILL OPEN THE FOLLOWING BULLISH TARGET

3404 - DONE

EMA5 CROSS AND LOCK ABOVE 3404 WILL OPEN THE FOLLOWING BULLISH TARGET

3424 - DONE

EMA5 CROSS AND LOCK ABOVE 3424 WILL OPEN THE FOLLOWING BULLISH TARGET

3439 - DONE

We will now come back Sunday with a full multi timeframe analysis to prepare for next week’s setups, including updated views on the higher timeframes, EMA alignments, and structure expectations going forward.

Thanks again for all your likes, comments, and follows.

Wishing you all a fantastic weekend!!

Mr Gold

GoldViewFX

XAUUSD H4 Update – The Battle Has Moved to 3350

“From deep demand to key supply. The next move is decisive.”

🔸 Sunday Plan Recap

Price was falling aggressively into the HTF demand zone (3265–3240).

The plan anticipated a bounce only if that deep zone held.

Above price, major zones included:

3314 – mid-structure

3330–3345 – supply zone

3368–3380 – final retracement targets

🔸 What Changed?

✅ The deep demand zone worked — H4 CHoCH bullish was confirmed.

✅ Price climbed through 3285 and 3314, confirming a retracement leg.

🔥 Now, price sits at 3349.57, testing the same supply zone marked in Sunday’s plan (3330–3345).

🔸 Current H4 Structure

🔼 Short-term bias = bullish retracement

📍 Price = inside HTF premium zone

📈 EMAs aligned bullish (5/21/50), confirming short-term momentum

💡 RSI = approaching overbought

⚔️ Liquidity above 3355, trapped shorts below 3314

🧠 Today’s Battle Plan (August 1)

🔴 Sell Zone (live) – 3345 to 3355

Price just entered the key H4 supply zone. Watch for rejection signs:

Bearish confirmation needed (e.g. M15/M30 CHoCH or engulfing)

If confirmed → downside targets: 3314 → 3285 → 3265

High RR short only if structure confirms

🔵 Breakout Bullish Case

If 3355 breaks with a clean body + HL at 3340 → bullish continuation active

Next upside target: 3368 → 3380

🧭 Final Thoughts

We’ve reached the exact decision zone from Sunday’s plan.

The market will now reveal: retracement over... or breakout coming?

Patience is key — this is a high RR zone, but only if structure reacts.

💬 Did you catch the move from deep demand? Or waiting for confirmation here at supply?

📈 Share your thoughts in the comments and let’s break it down together.

🔔 Follow for real-time market insights, sniper plans, and structured trading logic you can trust.

❤️ Like if you enjoy clean, actionable updates🚀🚀🚀

🔁 Share with traders who love structure over noise

📉 Price data from Trade Nation feed