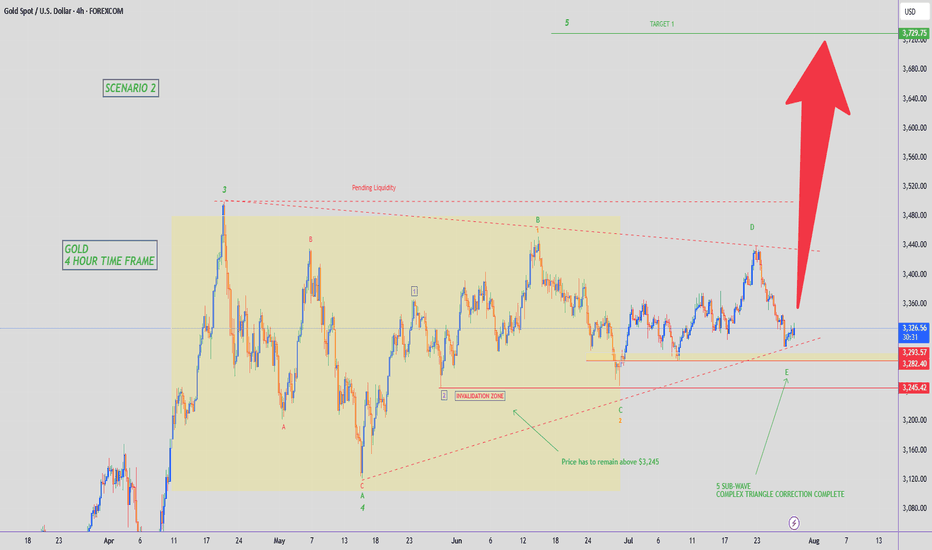

Analysis of gold market operation strategies and ideas next week

Gold rallied unilaterally on Friday following positive non-farm payroll data, reaching a new high for the week. This week's candlestick formed a hammer pattern, suggesting further upside potential next week. Bulls continued their push late Friday, closing at 3363. Next week, we will continue to monitor short-term resistance around 3370-3375. We will continue to buy on pullbacks. If your current trading is not satisfactory, I hope I can help you avoid investment setbacks. Welcome to discuss your options!

Based on a 4-hour analysis, short-term resistance will be seen around 3370-3375 next week, with a key resistance around 3395-3400. We will continue to buy on pullbacks. In the intermediate range, we recommend maintaining a cautious wait-and-see approach. I will provide detailed trading strategies during the trading session, so please stay tuned.

Gold Trading Strategy:

Go long on gold pullbacks to 3330-335, with a stop-loss at 3318 and a target at 3370-3375. Hold on if it breaks above this level.

XAUUSDG trade ideas

Gold Intraday Trading Plan 8/1/2025Although yesterday's retracement is a bit too deep, I am still bearish in gold in medium term as long as 3333 resistance is not broken. Therefore, I will still look for selling opportunities today.

Currently daily is in green bar while smaller timeframe shows bearish signs. If there is a double top formed near 3300, I will sell toward my weekly target at 3255.

Analysis For The Next WeekHello Traders,

I hope you had joyful weekend, the market is going to open tonight so we are back with new idea for next week.

As you know gold was dropping for last two weeks and suddenly pumped almost 650 pips after the impact of NFP News. We saw the high pressure in the market on Friday due to news impact.

Gold has broken the buy trend line D1,H4. According to D1,H4 gold still wants to drop till 3251.

If price respects area 3372-3393, then gold will drop. If price breaks the area 3400 then it will pump and it can make another All Time High. As you know 3501 is the All Time High (ATH). Price can break if there will be a breakout for bullish moment.

Keep in touch and drop positive comments here, Thanks.

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

Gold Trend Reversal: MSS Completed Eyes on OB and Breaker Block!The gold market has executed a Market Structure Shift (MSS) in the New York session, indicating a trend reversal. Initially, the market made a Break of Structure (BoS) to the upside, but later dropped sharply and closed below the MSS level, confirming a bearish shift. Currently, the market is likely entering a retracement phase and may look to fill its Pending Demand (PD) arrays.

There are two critical levels from which the market could potentially drop again:

1. The first is an Order Block (OB).

2. The second is a Breaker Block (BB).

Keep a close watch on these two levels. If the market returns to either and presents bearish confirmation signals, it could resume the downward move towards swing lows.

Do Your Own Research (DYOR).

Gold: final pullback or bull trap?On the 1H chart, gold (GOLD) is forming a bullish flag after a sharp decline, which may just be a corrective move within a broader downtrend. The price is now approaching the key resistance zone around $3313–$3317 - this area holds the POC, broken trendline, and the 0.705–0.79 Fibonacci retracement from the last drop. This is the decision-making zone.

If bulls fail to push above it, we expect a move down toward $3268 - the next strong support and potential buy zone, also confirmed by Fibonacci and local demand. Stochastic divergence and slowing volume suggest a possible rebound from that level. However, if the price breaks and holds above $3317, this would indicate a local trend reversal, with targets at $3333 and $3374.

Watch the $3317 zone closely - bulls have yet to prove this is more than just a bounce.

XAUUSD Long Setup – 1HGold (XAUUSD) has shown strong bullish rejection from the lower volatility band after a sharp selloff. The appearance of a Heikin Ashi reversal candle, suggests a short-term reversal is forming. Price has reclaimed key structure and is now targeting a reversion back to the mean, supported by Fibonacci retracement levels.

Entry: 3293.55

Target Zone: 3308.91 → 3333.76 (Fib 38.2% – 100%)

Stop Loss: 3253.35

Confluences:

✅ Bullish engulfing + Heikin Ashi trend shift

✅ Oversold bounce from lower channel extremity

✅ Fib retracement aligns with key structural resistance zones

✅ Custom signal confirmation (green dot)

✅ Clean R:R toward upper band and previous POI

Short-term counter-trend long targeting liquidity grab and mean reversion toward the 3308–3333 zone. Risk tightly managed with SL below local swing low.

XAU/USD – Bullish Breakout Toward 3,440 Target🔹 Trend & Structure:

Market formed a Higher High (HH) followed by a Lower Low (LL), indicating bearish correction within a falling channel.

Price then created a Higher Low (HL) suggesting a potential trend reversal.

🔹 Channel Breakout:

Price broke above the descending channel, confirming bullish momentum.

A strong bullish candle closed above the 70 EMA, showing further strength.

🔹 Support Zone:

A support level between 3,314.485 – 3,335.703 is now established, which was previous resistance turned support.

🔹 Target Projection:

Using measured move strategy, the projected bullish target is around 3,439.802, a 3.09% move from the breakout zone.

🔹 Volume & Momentum:

Sharp bullish impulse indicates increased buying interest, supported by possible retest before continuation.

📈 Conclusion:

Bullish breakout confirmed. Ideal strategy:

🔹 Entry: On retest of the support zone (3,335 area)

🔹 Stop-loss: Below 3,314

🔹 Take-profit: Near 3,439

✅ Strategies used:

Trendline & Channel Analysis

Support/Resistance.

EMA (70) confirmation.

Price Action (HH, LL, HL)

Measured Move Target.

GOLD possible ScenarioCurrently gold has broken a major trendline and currently trading in bearish momentum, currently consolidating or pullback from support and may get rejected from 0.5 or 0.618 if bearish ahs to continue 3240-3250, if breaks the fib level along with trendline resistance can easily price can reach 3340 major resistance level. let us see.

Market Analysis: Gold Prices Ease – Market Awaits Fresh CatalystMarket Analysis: Gold Prices Ease – Market Awaits Fresh Catalyst

Gold price started a fresh decline below $3,380.

Important Takeaways for Gold Price Analysis Today

- Gold price climbed higher toward the $3,430 zone before there was a sharp decline against the US Dollar.

- A key bearish trend line is forming with resistance near $3,350 on the hourly chart of gold at FXOpen.

Gold Price Technical Analysis

On the hourly chart of gold at FXOpen, the price climbed above the $3,380 resistance. The price even spiked above $3,400 before the bears appeared.

A high was formed near $3,432 before there was a fresh decline. There was a move below the $3,380 support level. The bears even pushed the price below the $3,350 support and the 50-hour simple moving average.

It tested the $3,325 zone. A low was formed near $3,325 and the price is now showing bearish signs. There was a minor recovery wave towards the 23.6% Fib retracement level of the downward move from the $3,433 swing high to the $3,325 low.

However, the bears are active below $3,342. Immediate resistance is near $3,350. There is also a key bearish trend line forming with resistance near $3,350.

The next major resistance is near the $3,380 zone. It is close to the 50% Fib retracement level of the downward move from the $3,433 swing high to the $3,325 low. The main resistance could be $3,410, above which the price could test $3,432. The next major resistance is $3,450.

An upside break above $3,450 could send the gold price towards $3,465. Any more gains may perhaps set the pace for an increase toward the $3,480 level.

Initial support on the downside is near the $3,325 level. The first major support is near the $3,310 level. If there is a downside break below it, the price might decline further. In the stated case, the price might drop towards the $3,265 support.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

XAUUSD - Short XAUUSD Short Trade Idea – 4H Chart

Price has made a strong move up, but it's now entering an area where sellers were in control before.

Why I'm looking to short:

Price is retesting a supply zone where the last big drop started

It’s also near a resistance level and rejected from there

The downtrend is still valid with lower highs

There's a good chance price could drop to grab liquidity below

*** Target areas:

First target: around 3288

Final target: around 3250, where we have a demand zone

*** Invalidation:

If price breaks and closes above 3385, this short idea is no longer valid.

**"Gold Price Rebounding from Support:Potential Move Toward 3436This chart shows the **price movement of Gold (XAU/USD)** on a **daily timeframe**.

### Key Points:

* **Support Zone** : Around **\$3,266**, this is the area where price has bounced up multiple times, meaning buyers step in here.

* **Resistance Line**: Around **\$3,436**, this is the level where price has been rejected before, meaning sellers are strong here.

* **Current Price**: Around **\$3,293**.

### What the Chart Suggests:

* Price is near the **support** zone again.

* If the support holds, the green arrow shows a possible move **upward**.

* Price may first move up slightly, pull back, and then try to **break above resistance** at \$3,436.

Gold is in a sideways range. It's near a strong support level and might go up from here toward the resistance level, as shown by the green line.

How to accurately capture golden trading opportunities?Bullish trend is still the main trend of gold at present. After rising to 3368 at the opening today, it fell under pressure and fluctuated. Technically, it has tested the pressure level and needs to be adjusted. The overall high-level carrying capacity has also declined, so it is not advisable to chase the rise too much. In terms of operation, it is recommended to wait for the price to stabilize before buying more. Judging from the current gold trend, the upper short-term resistance is in the 3380-3385 area, and the key pressure is at the 3395-3400 line; the lower short-term support is in the 3365-3355 area, and the key support is in the 3350-3345 range. The overall suggestion is to arrange long orders on dips around the support area, and try to maintain a stable wait-and-see attitude in the middle position. I will prompt the specific operation strategy at the bottom, please pay attention in time.

Gold Trading Strategy: Buy in batches as gold retreats to the 3365-3350 area, targeting the 3380-3385 area. If this resistance zone is broken, hold and look for upward movement.

How to accurately grasp the gold trading opportunitiesGold was greatly affected by the positive non-farm payroll data, and it rose strongly, with the increase completely covering all the losses this week. The current gold trend has completely reversed the previous bull-short balance. After breaking through the 3300 level and rising to around 3355, it maintains strong upward momentum, and the possibility of further testing the 3360-3375 area cannot be ruled out. Due to the strong positive data, if everyone fails to chase the long position or set a breakout long position in time in the first wave of the market, the subsequent pullback opportunities may be relatively limited, so it is necessary to maintain an active strategy in operation. It is recommended to continue to be bullish when it retreats to the 3335-3320 area, and the upper target is the 3360-3375 pressure range.

XAUUSD Update CONSOLIDATIONAfter bullish rejection, Gold make a new lower and break 3283 support level.

Now it seemslike bounce to make a correction and retest 3305 resistance.

If 3305 reject, price will continue moving downside and retest 3245 support.

If it break 3245...it will continue to find it support, near 3205 support zone.

Have a blessing day !

Gold Price Analysis July 30Gold (XAUUSD) Consolidating in a Triangle Pattern – Preparing for a Big Breakout

Currently, gold is moving within a triangle consolidation pattern, reflecting the market’s indecision as investors await a series of important economic data from the US this week. This hesitation suggests that a breakout from the triangle pattern could trigger a strong FOMO effect, creating a significant price movement in either direction.

The current price action is similar to a “bull flag” or “pennant” pattern, where a breakout could lead to a clearer and more decisive trend. If the support zone in the pattern fails to hold, the possibility of a sell-off is high.

Trading scenario:

🔻 Activate SELL order:

When price breaks the triangle bottom around 3324

Downside target: 3285, further is the strong support zone at 3250

🔺 Activate BUY order:

When price breaks and holds above the resistance zone 3333

Or: when there is a bearish rejection signal and candle confirmation at the area 3385

XAUUSD Live Trade Last Night (Killed it with 11,641 USD Profits)I managed to ride the momentum last night on XAUUSD and made over 11,641 usd profit on a live trading account. Gold usually create a range. It will create a top and a bottom then it will spend most of its time inside that range. That is pretty much how XAUUSD moves. If you can identify the top and the bottom then you can short it from the top and do a long trade on the bottom. The price will just travel from bottom to top and top to bottom. You can scalp your way to profits on this move if you can time it properly. Once in a while, a break from the top or the bottom happens. This is where you switch from trading the range to trading breakouts.

xauusdxauusd Focus on red line

From the price level of 3368 and above, gold is expected to pull back at least until the Stochastic on the M30–H1 timeframes reaches oversold levels.

After that, a bullish continuation is likely, pushing the price up to around 3400.

This area will be a critical decision point — determining whether the market will continue its uptrend or reverse into a downtrend.

If the H4 chart prints a reversal candlestick pattern, it would indicate the beginning of a bearish trend, which could potentially lead to a downward movement of up to 20,000 points.

GOLD CONTINUATION PATTERNHello folks, here we go again, This idea stuck in my head only today and its friday. rather shared it or none, but see the charts for stops and target. this might be your lucky day on my page.

Here is my idea, take it if you love to swing or watch it fade. Congrats were on 800 community or I got more followers because of this. and Previous idea we made a lot thats 1200 pips good for a month trade. lets see this August. my target is labeled this chart first at 3500 zone. next target will be posted on my notes or updated the idea. no charts until it breaks that labeled on chart. until it goes higher again.

You will never see this kind of idea for a month again. So follow on my page, I have some for you if you have small accounts.d m here

My goal is to target the highest TP will be above this new highs.

Today's GOLD Analysis : MMC Structural Analysis + Reversal ZoneThis analysis is rooted in MMC – Mirror Market Concepts, a framework designed to track institutional behavior through liquidity patterns, QFL (Quick Flip Levels), trendline shifts, and volume bursts. The current 4H Gold chart demonstrates a smart money footprint that provides actionable insight for intraday and swing traders.

🔍 Detailed Technical Breakdown:

🟦 1. Previous Supply Completed | Demand Zone Reversal

At the lower end of the chart, price entered a key blue zone around $3,250–$3,280, previously a supply zone now flipped into demand. This zone represents where institutional buyers absorbed liquidity, forming the base for a bullish impulse.

The strong reaction from this zone, marked by long-wick candles and immediate reversal, indicates exhaustion of selling pressure.

This reversal is confirmed by a QFL structure, meaning price created a fast liquidity sweep before flipping direction.

MMC recognizes this as a high-probability area of reversal, a point where smart money typically enters.

📈 2. Trendline Breakout & Structure Shift

A descending trendline, representing bearish market control, was decisively broken to the upside. This shift marks:

End of the corrective phase

Beginning of a bullish structural change

Buyers now control the short-term narrative

The breakout was not only clean but also supported by a volume burst, which is a classic MMC indicator that institutional traders are entering the market.

🔶 3. Volume Burst Confirmation

Volume behavior plays a critical role in MMC. We see a clear volume spike post-breakout. This suggests that:

The breakout is not false

Buyers were aggressively positioned

A sustainable move is in development

This supports the validity of the trendline breakout and confirms the idea that price is ready to test higher liquidity zones.

🟢 4. Current Price Structure: Bullish Channel

After the breakout, the market formed a bullish channel, where price is steadily climbing while respecting parallel boundaries.

The channel support line acts as a dynamic entry point for retracement buys

MMC strategy uses this structure to identify scaling entries at channel lows or after successful pullbacks into key reversal zones

🟩 5. Mini Reversal Area (Short-Term Resistance Zone)

Price is currently testing a minor supply zone or what MMC defines as a "Mini Reversal Area". This is a reaction zone before continuing toward the major target above.

There are two possible reactions:

Short-term rejection, leading to a pullback into the lower channel support zone

Minor consolidation, forming a base for a breakthrough toward major resistance

🟦 6. Major & Minor Supply Zones Above

Marked in light blue and green, these zones represent areas where previous selling volume and distribution occurred.

The major supply zone (approx. $3,440–$3,470) is the next institutional target

The minor zone sits between $3,400–$3,420 and may cause initial resistance or a base for another impulse

These levels are prime for partial profit-taking or scouting short-term reversal trades.

📊 Trade Management Insights:

🛒 Buy Opportunities (Long Bias):

On pullback into channel support near $3,340–$3,350

On bullish confirmation from mini reversal area

On break and retest above minor resistance at $3,420

🛑 Stop-Loss Suggestion:

Below the channel support or below the blue demand zone (approx. $3,245)

🎯 Profit Targets:

TP1: $3,400 (first resistance)

TP2: $3,420 (minor supply)

TP3: $3,450–$3,470 (major institutional level)

🧠 Mirror Market Concepts (MMC) Highlights:

QFL Structures = Institutional Reversal Points

Volume Burst = Confirmation of Breakout Validity

Trendline Breakout = Momentum Shift

Channel Structure = Controlled Climb Pattern

Mini Reversal Zone = Key Decision Point Before Continuation

🧭 TradingView Summary for Minds Community:

This GOLD chart beautifully aligns with the MMC method — spotting smart money involvement early and aligning with their flow. After confirming structural reversal via trendline and QFL, the setup now looks poised for continuation toward the $3,440–$3,470 zone, making it a perfect chart to watch for buy-the-dip setups.