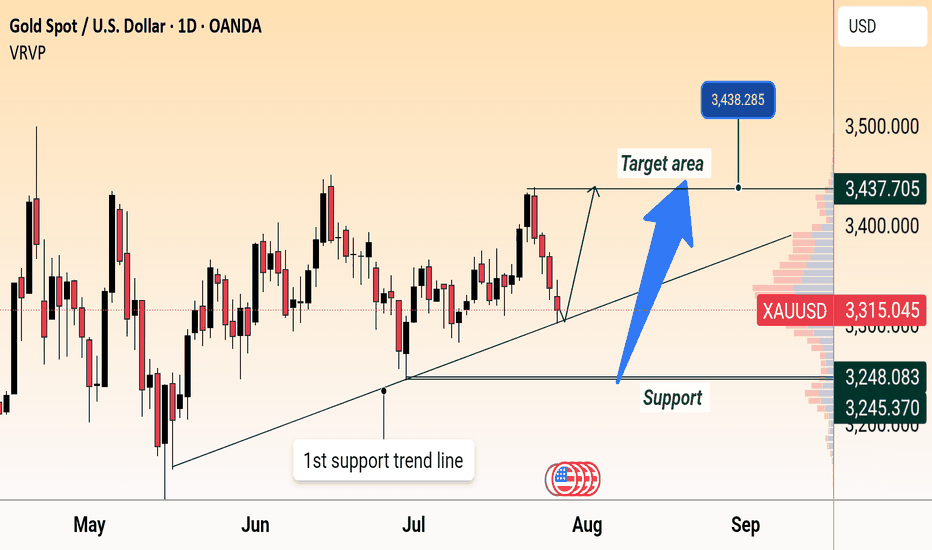

HelenP. I After correction to support level, Gold start to growHi folks today I'm prepared for you Gold analytics. An examination of the chart highlights a well-established long-term uptrend, with the bullish structure being clearly defined by a major ascending trend line that has consistently provided dynamic support. Currently, the price is undergoing a healthy correction after being rejected from the major resistance zone around 3430. This pullback is now guiding the price towards a critical confluence of support, where the aforementioned ascending trend line intersects with a strong horizontal support zone at 3305 - 3285. My analysis for a long position is based on the high probability of a bullish reaction from this key area. I believe that as the price enters this support confluence, it will be met with strong buying pressure, as it represents a logical point for buyers to defend the trend. A confirmed bounce from this zone, demonstrated by a rejection of lower prices, would be the main condition to validate the continuation of the uptrend. Therefore, the primary goal for the subsequent rally is set at the 3430 resistance level, as a retest of the recent high is the most logical objective following a successful defense of the trend. If you like my analytics you may support me with your like/comment ❤️

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

XAUUSDG trade ideas

DeGRAM | GOLD reached the $3300 level📊 Technical Analysis

● XAUUSD remains capped below a broken trendline retest near 3,355, while price forms a lower-high inside a descending channel.

● The repeated rejection of the 3,357.83 resistance level, coupled with failed bullish continuation, points to renewed downside toward 3,300 and 3,262.

💡 Fundamental Analysis

● A rebound in the DXY after strong US consumer sentiment and pending home sales adds pressure to gold, reaffirming real-yield strength.

● Traders are reducing long exposure ahead of upcoming NFP data and Powell’s next statement, shifting bias away from risk hedges.

✨ Summary

Short bias below 3,355. Break under 3,320 eyes 3,300 → 3,262. Key breakdown risk if lower trendline fails.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

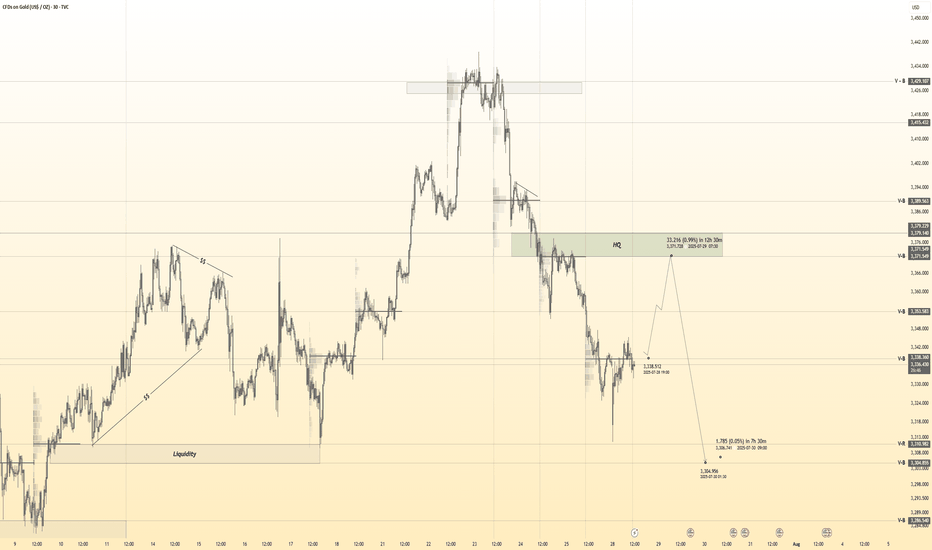

XAU/USD (Gold) - Triangle Breakout (1.08.2025)The XAU/USD Pair on the M30 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Triangle Breakout Pattern. This suggests a shift in momentum towards the downside in the coming hours.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Pattern.

Target Levels:

1st Support – 3249

2nd Support – 3225

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

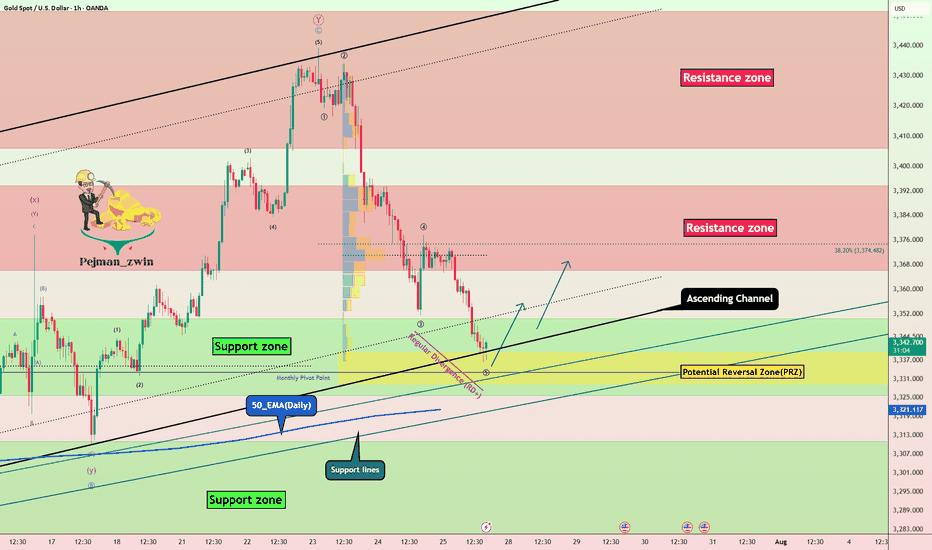

Gold Recovery Setup = Divergence + Support ClusterGold ( OANDA:XAUUSD ) fell to the lower line of the ascending channel and the Support zone($3,350-$3,326) , as I expected in my previous idea .

Gold is currently near a set of Supports .

Supports:

Support zone: $3,350-$3,326

Monthly Pivot Point: $3,333

Potential Reversal Zone(PRZ): $3,339-$3,329

Lower line of the ascending Channel

50_EMA(Daily)

Support lines

In terms of Elliott Wave theory , Gold appears to be completing a bearish wave 5 .

Also, we can see the Regular Divergence(RD+) between Consecutive Valleys .

I expect Gold to rise to at least $3,359 .

Second target: $3,367

Note: Stop Loss (SL) = $3,319

Do you think Gold can break the Support cluster by the end of trading hours?

Gold Analyze (XAUUSD), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅ ' like ' ✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

GOLD → The market is waiting for NFP. What could happen?FX:XAUUSD is bouncing off resistance at 3310, confirming the upper limit of the new trading range. The dollar continues to rally, but the market as a whole is stagnating ahead of upcoming news—NFP is coming up!

Gold is consolidating at monthly lows around $3268, awaiting key US labor market data (NFP). Trump's new tariffs (10% globally, 35% for Canada, 39% for Switzerland) have boosted demand for the dollar, putting pressure on gold. Markets are waiting for NFP: forecast +110K jobs, unemployment 4.2%. Weak data (<100K) → gold may rise to $3400. Strong (>150K) → the dollar will strengthen, gold will continue to fall. The probability of a Fed rate cut in September is <50%.

Based on yesterday's data, I would cautiously suggest that NFP will be in the range of 125K–145K, slightly above the consensus (110K). This will play into Trump's hands (I think you understand what I mean...).

Resistance levels: 3300, 3310, 3320

Support levels: 3287, 3268, 3255

The news has a negative nuance — unpredictability. Be careful.

Technically, based on the data we have at the moment, I would assume that the market may test resistance at 3300-3310 before a possible pullback to the specified support. BUT! Unpredictable data could turn the game around, and in that case, if the dollar falls, gold could start to rise.

Best regards, R. Linda!

Gold Crashing After Hot U.S. Data – More Pain Ahead?Minutes ago, important indices were released from the US , which catalyzed the continuation of gold's downward trend .

Key U.S. Economic Data Just Dropped!

ADP Employment: 104K

GDP q/q: 3.0%

Both came in stronger than expected , signaling that the U.S. economy is holding up better than many thought!

Strong job growth

Solid economic expansion

The result? A stronger U.S. dollar ( TVC:DXY ) and potential downward pressure on Gold .

All eyes are now on FOMC meeting .

Will the Fed still hint at future rate cuts despite the solid data? Or is the easing cycle officially on hold? What is your idea!?

----------------------

Gold ( OANDA:XAUUSD ) has already managed to break the Support zone($3,350-$3,326) , Monthly Pivot Point , 50_EMA(Daily) , Support lines , and the lower line of the ascending channel . Also, Gold trading below $3,333 plays an important role for me, which can increase the possibility of a continuation of the downtrend .

I expect Gold to drop to at least the Potential Reversal Zone(PRZ) before the FOMO meeting and if the Support zone($3,307-$3,272) is broken, we can expect further declines to $3,253(Second Target) .

--------------------------------

Information we need to know:

How should the Federal Funds Rate be announced to cause a deeper drop in Gold ?

The Fed needs to take a hawkish stance — meaning:

They keep rates unchanged, but make it clear they intend to keep them elevated for a prolonged period.

They emphasize strong economic data like today's solid ADP and GDP numbers .

They express concern that inflationary risks remain, and cutting rates isn’t on the table anytime soon.

In this case, markets get disappointed, rate cut hopes fade, and gold drops as real yields( TVC:US10Y ) rise and the U.S. dollar strengthens.

--------------------------------

Note: Stop Loss (SL) = $3,340

Gold Analyze (XAUUSD), 4-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅ ' like ' ✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

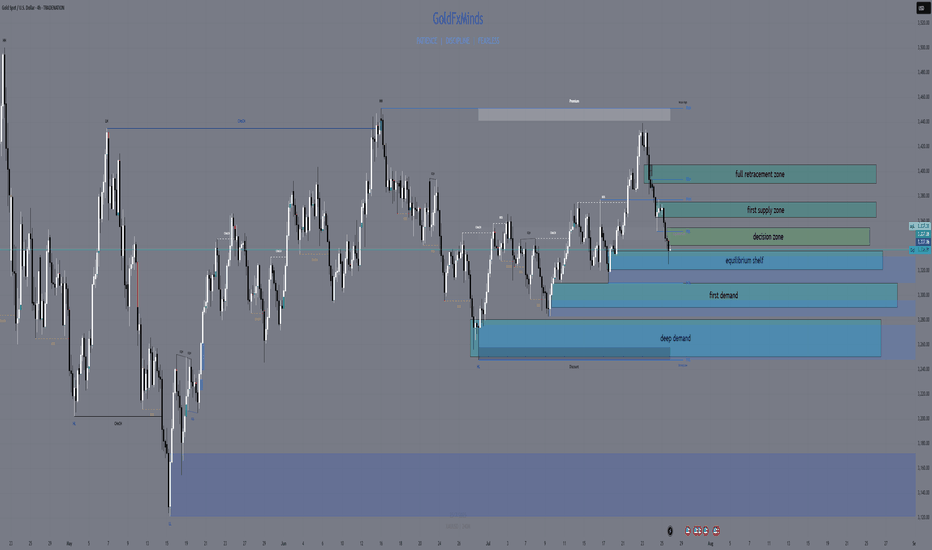

XAUUSD H4 Outlook – “Fed Week: Only the Real Zones”Hello, gold traders!

FOMC week is here, the dollar’s flexing, and gold is stuck under a fortress of supply. No fantasy, no overlaps, just your real, actionable H4 map—zones spaced, logic tight, and all fluff deleted.

⬜Bias:

Neutral to bearish while price is capped under 3,355 and the EMA cluster.

Only flip bullish if price closes and holds above 3,375 with strong confirmation after news.

Current Price: 3,336.81

Summary for your audience:

Neutral–bearish: All the EMAs (21/50/100/200) are overhead, and the primary supply and decision zones are blocking any upside.

No reason to flip bullish unless gold breaks out and holds above both the decision zone and the full supply ceiling after major news.

All bounces into supply are likely to get faded, unless the structure changes dramatically post-FOMC.

🟥 ULTRA SUPPLY ZONE: 3,390 – 3,405

127–161.8% Fib extension—liquidity grab and stop-hunt target for news-driven spikes

Only short if you see a monster upper wick and hard rejection

🟥 PRIMARY SUPPLY: 3,365 – 3,375

All EMAs (21/50/100/200) are stacked overhead; unfilled FVG at 3,370–3,375

Short on a clear rally rejection or bearish engulfing candle—this is where most breakouts get trapped

🔶 DECISION ZONE: 3,340 – 3,355

EMA100/200 straddle this level; small FVG at 3,350–3,352

Market “decides” here—fade unless price closes decisively above 3,355

🔵 EQUILIBRIUM SHELF: 3,320 – 3,335

50% Fib at 3,327; filled FVG at 3,325–3,330; SMA50 just below

Bounce/fake-break zone—wait for a clean H4 reversal, not a guess

🟢 FIRST DEMAND BASE: 3,290 – 3,310

H4 Order Block, hidden FVG (3,300–3,305), Fib 38.2% around 3,295

Longs only with strong pin-bar/engulf and quick EMA50 reclaim

🔵 DEEP PULLBACK BAY: 3,250 – 3,280

Weekly EMA21 and 61.8% Fib (~3,260), strong volume

Only consider a long on a panic flush and a powerful reversal wick

⚡️ MACRO CONTEXT

USD: On fire into ADP and FOMC; gold moves will be explosive, not logical

Events:

Tue: ADP

Wed: FOMC + Powell

Thu: Core PCE

Fri: NFP, ISM

Bias: Neutral-bearish under 3,355; only bullish if we close and hold above 3,375

EMAs: Clustered tightly overhead—bulls get no respect until this ceiling is crushed

🎯 TRADE LOGIC

Shorts:

3,390–3,405 (big wicks and clear rejection only)

3,365–3,375 (news spike or failed breakout with bearish candle)

Longs:

3,340–3,355 (only on a confirmed close above)

3,320–3,335 (strong reversal only—don’t front run)

3,290–3,310 (classic H4 pin-bar/engulf + EMA50 reclaim)

3,250–3,280 (deep panic flush and major reversal only)

NO TRADE: In the gaps—let the gamblers get chewed up, not you.

💬 Which zone will you snipe? Drop a comment and show you’re here for structure, not noise!

👍 Like & Follow for high-value, real-time sniper maps every day.

Disclosure: Chart via Trade Nation’s TradingView feed. Influencer Program participant.

GoldFxMinds 💛

Gold 30Min Engaged ( Bullish After Break Out Entry Detected )———

Time Frame: 30-Minute Warfare

Entry Protocol: Only after volume-verified breakout

🩸Bullish Break - 3339

➗ Hanzo Protocol: Volume-Tiered Entry Authority

➕ Zone Activated: Dynamic market pressure detected.

The level isn’t just price — it’s a memory of where they moved size.

Volume is rising beneath the surface — not noise, but preparation.

🔥 Tactical Note:

We wait for the energy signature — when volume betrays intention.

The trap gets set. The weak follow. We execute.

Gold price continues to decrease, keep the rate unchanged✍️ NOVA hello everyone, Let's comment on gold price next week from 07/28/2025 - 08/1/2025

⭐️GOLDEN INFORMATION:

Gold (XAU/USD) looks set to close the week lower, pressured by upbeat U.S. economic data and progress in trade negotiations, which have reduced demand for safe-haven assets. Despite declining U.S. Treasury yields, the U.S. Dollar regained some ground. At the time of writing, XAU/USD is trading around $3,336, down nearly 1%.

Looking ahead, the Federal Reserve is widely expected to keep interest rates steady at 4.25%–4.50% for the fifth time this year. Recent data supports this stance, with Initial Jobless Claims falling for the fourth straight week—signaling a resilient labor market—while Friday’s sharp drop in Durable Goods Orders, driven by weaker aircraft demand, adds a mixed tone to the outlook.

⭐️Personal comments NOVA:

Gold prices continue to fall as interest rates remain unchanged almost this week. Along with the H4 time frame, prices continue to break important support and continue to follow a downward trend.

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $3350, $3428

Support: $3312, $3280, $3246

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

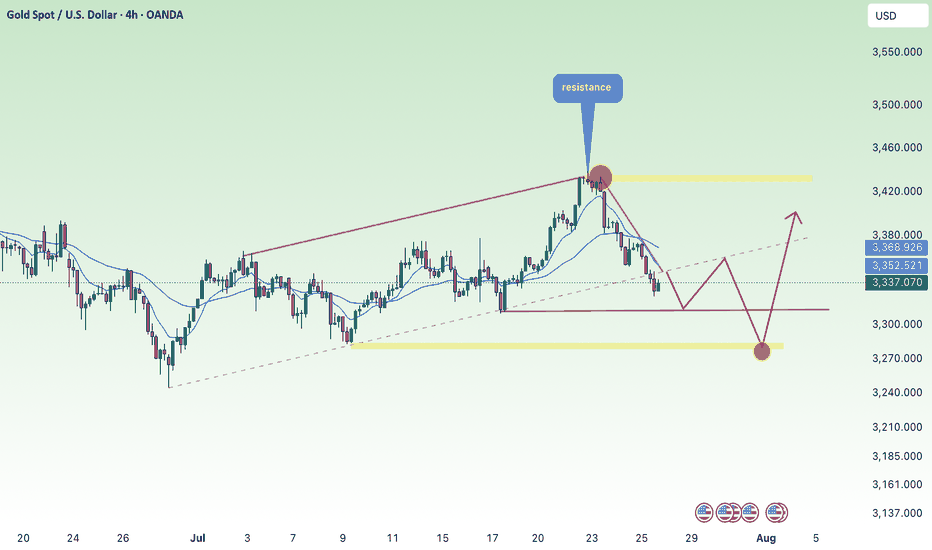

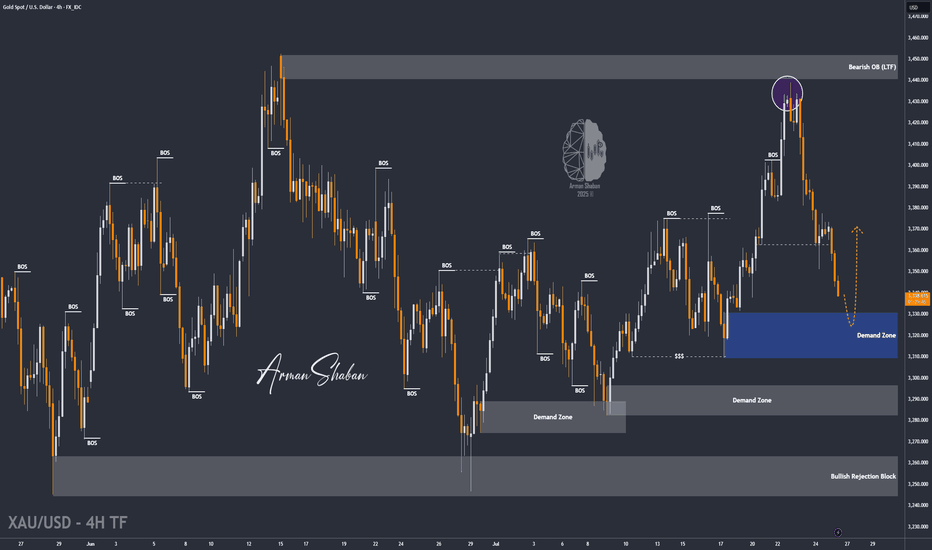

XAU/USD | Gold Holding Strong – Watching for Next Bullish Move!By analyzing the gold chart on the 4-hour timeframe, we can see that yesterday, as expected, when the price dropped to around $3357, it faced strong buying pressure and rallied up to $3377. After that, it corrected again, pulling back to $3338 so far, and is currently trading around $3341. If gold manages to hold above $3337, we can expect another bullish move, with potential targets at $3347, $3354, $3364, and $3374.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

Bullish Sentiment Returns to Gold?Hello everyone, what are your thoughts on XAUUSD?

From a technical perspective, XAUUSD has just retested its long-term ascending trendline and formed a bullish reaction candle, suggesting that buying pressure may be returning.

Recently, a survey of 206 investors revealed that market sentiment remains optimistic, with 66% expecting gold prices to continue rising, 19% predicting a decline, and 15% anticipating a sideways market.

What do you think? Share your opinion in the comments!

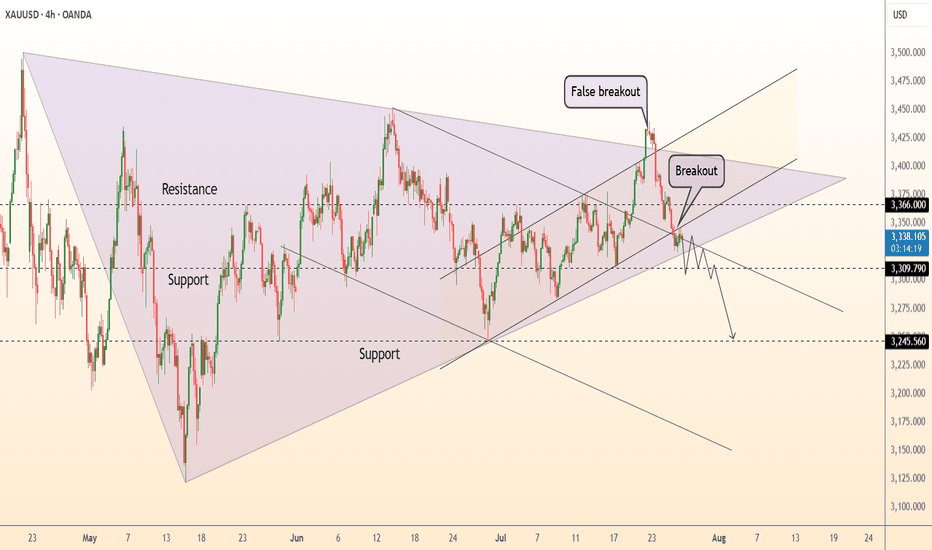

DeGRAM | GOLD fixed below the triangle📊 Technical Analysis

● XAUUSD is forming a bearish descending wedge within a broader symmetrical triangle, facing rejection at 3,310 near prior support-turned-resistance.

● Repeated failure to hold above trendlines and continued lower highs favor a drop toward the 3,246.56 level, with possible overshoot if support breaks.

💡 Fundamental Analysis

● Rising real yields and hawkish Fed tone continue to pressure gold; ISM Manufacturing Prices and NFP loom as next volatility catalysts.

● Reduced ETF inflows and strong dollar on resilient US macro data weigh on demand for non-yielding assets.

✨ Summary

Short bias below 3,310. Breakdown eyes 3,246 → 3,200 zone. Resistance holds while trendline caps recovery.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

GOLD could test 3375 before falling furtherGOLD could test 3375 before falling further

In our previous analysis, we were looking for gold to fall from the top and, as we can see, it has already reached 3341 from the 3430 area.

From the top down, the price depreciated by 2.85% in less than 3 days, so a possible correction is expected near the area of the structure coming from the left side around 3375.

Given that gold is only moving down, it may be possible for the downward movement to continue slowly. Both scenarios are possible at this point.

You may find more details in the chart!

Thank you and Good Luck!

PS: Please support with a like or comment if you find this analysis useful for your trading day

Gold Rejected at 3315 – But Bulls Might Not Be Done Yet📌 What happened yesterday?

During the Asian session, Gold printed a fresh local low at 3268, continuing the downtrend that already dropped over 1700 pips in just one week. However, that move quickly reversed, and we saw a natural corrective bounce.

📈 Resistance holds firm

The correction took price back up into the 3310 zone, which acted as confluence resistance. After two taps into that area, price failed to sustain above 3300, indicating sellers are still active there.

❓ Is the upside correction over?

I don't think so. The recent drop has been choppy, lacking the strong momentum of previous legs. This type of price action often signals that we are still within a correction, not in a clean continuation.

📊 What am I watching?

I’m actively monitoring for:

• Exhaustion signs on the downside

• Upside reversal signals

My plan is to open long trades only when I see confirmation, aiming for a move back toward the 3330 zone, which could act as resistance.

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

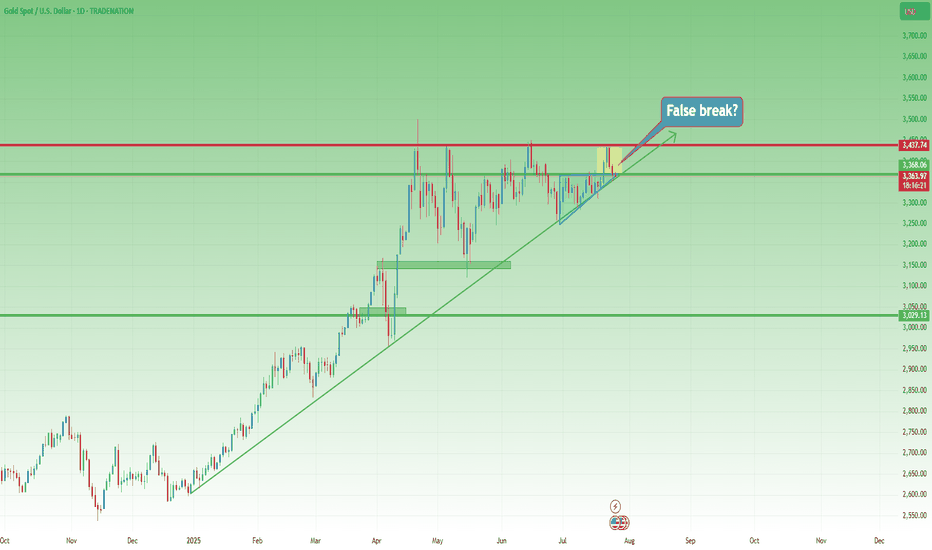

DeGRAM | GOLD broke the rising channel📊 Technical Analysis

● XAU printed a false break above the 3 400 wedge roof, then sliced back through the rising mid-channel, closing under the wedge base at 3 309 - a classic bull-trap that flips that band into resistance.

● Momentum has rolled over, and the break of July’s micro up-trend opens room to the broad triangle floor/May trend-pivot near 3 246; successive lower-highs since 24 Jul confirm bearish control.

💡 Fundamental Analysis

● Hot US Q2-GDP and sticky core-PCE lifted 2-yr yields to one-month highs, reviving the dollar bid, while cautious ECB guidance tempers euro gold demand.

✨ Summary

Sell 3 309-3 335; hold below 3 309 targets 3 246 ▶ 3 200. Invalidate on an H4 close above 3 366.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

XAUUSD – Downtrend Continues as USD StrengthensGold remains under significant pressure as the U.S. dollar continues to gain strength following a series of positive economic data from the U.S. Specifically, GDP grew by 2.5%, beating expectations, while ADP Non-Farm Employment data also came in strong. This suggests the U.S. economy remains resilient, supporting the Fed's hawkish stance and keeping the dollar strong.

On the 4H chart, XAUUSD has broken below the previous ascending price channel and is now trading under the 3,340.400 resistance zone – an area packed with unfilled FVGs. The current price structure leans bearish, with any rebounds likely to be temporary pullbacks.

If USD strength continues, gold could drop further toward the support zone at 3,279.200 or even lower near 3,240.

Trading Strategy: Focus on SELL

Entry: Around 3,325 – 3,340.400 upon price rejection signals.

Target: 3,279.200 or lower.

Stop-loss: Above 3,342.459

THE KOG REPORT - NFPTHE KOG REPORT – NFP

This is our view for NFP, please do your own research and analysis to make an informed decision on the markets. It is not recommended you try to trade the event if you have less than 6 months trading experience and have a trusted risk strategy in place. The markets are extremely volatile, and these events can cause aggressive swings in price.

Following on from the FOMC KOG Report which worked quite well, we’ll stick with the same chart and for today suggest caution. It’s the first day of the month and the last day of the weekly candle. The close here for gold is important and will give us further clues to the next few months.

We’ve shared the red boxes and the red box targets are below. There is a key level above 3306-10 which will need to be breached to correct the move back up to the 3330-34 region for the weekly close. However, we now have an undercut low which is potential if there is more aggressive downside to come and that level is sitting around the 3240-50 region which for us may represent an opportunity for a swing low. We’re a bit low and stretched here to short and as we’ve already hit our target for the day so we’ll wait for the extreme levels and if hit and our indicators line up, we may take some scalps. Otherwise, as usual on these events, the ideal trade will come next week.

RED BOXES:

Break above 3290 for 3295, 3306, 3310 and 3320 in extension of the move

Break below 3275 for 3267, 3260, 3255 and 3250 in extension of the move

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

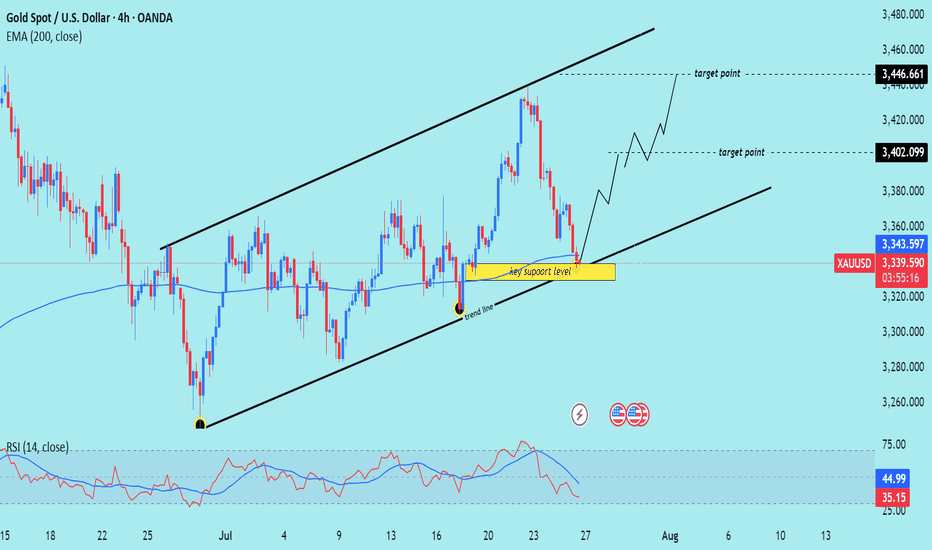

XAU/USD) bullish the support Read The captionSMC Trading point update

Technical analysis of (XAU/USD) on the 4-hour timeframe, indicating a potential bounce from a key trendline support within a rising channel.

---

Analysis Summary

Pair: XAU/USD (Gold Spot vs. USD)

Timeframe: 4H

Current Price: 3,338.715

Bias: Bullish rebound within ascending channel

---

Key Technical Elements

1. Ascending Channel:

Price has been respecting a well-defined rising channel, bouncing between support and resistance levels.

2. Key Support Zone:

The yellow highlighted area marks a critical support level and lower boundary of the channel.

Also intersects with the trendline, strengthening the potential for a bounce.

3. 200 EMA (Dynamic Support):

The 200 EMA at 3,343.616 lies just below current price, acting as a dynamic support level.

4. RSI (14):

RSI is around 34.93, nearing the oversold zone, suggesting a buying opportunity may be near.

---

Target Points

First Target: 3,402.099

Second Target: 3,446.661

---

Trade Idea

Direction Entry Zone Stop-Loss Target Zones

Buy 3,330–3,345 Below 3,320 3,402 / 3,446

Mr SMC Trading point

---

Summary

Gold is currently testing a key support level and ascending trendline. If price holds above this area, we can expect a bullish rebound toward 3,400–3,446 levels, aligning with the upper channel resistance.

Please support boost 🚀 this analysis)

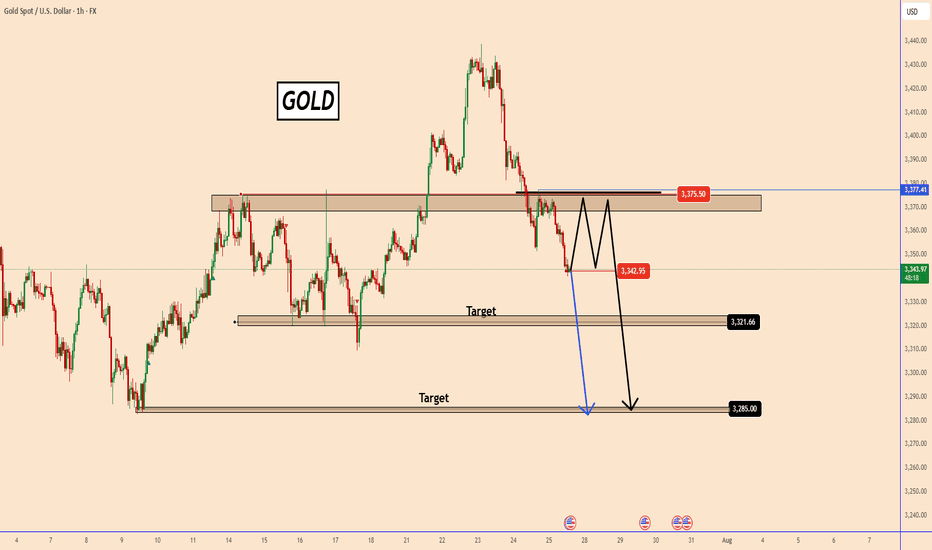

XUA/USD) Bearish Trend Read The captionSMC Trading point update

Technical analysis of (XAU/USD) on the 1-hour timeframe, targeting a move toward the $3,310–$3,315 support zone. Here's the full breakdown:

---

Technical Analysis – Gold (1H)

1. Fair Value Gap (FVG) Supply Zones

Two FVG supply zones are marked where price previously dropped sharply:

Upper FVG zone near $3,385.49 (with red arrow: expected rejection point)

Lower FVG zone near $3,352.47

Price is expected to reject from either zone, resuming the bearish move.

2. Market Structure: Lower Highs, Lower Lows

The chart shows a clear bearish structure, with consistent lower highs and lower lows.

The current price action suggests a potential pullback into FVG, followed by another leg down.

3. Key Support Zone (Target Area)

The yellow box between $3,315.22–$3,310.99 represents a strong demand/support zone and is marked as the target point.

This level has acted as a prior accumulation zone and is likely to attract buying interest again.

4. EMA 200 Resistance

Price is trading below the 200 EMA (currently at $3,365.87) — indicating a bearish bias.

EMA also aligns near the lower FVG zone, reinforcing the area as a potential reversal point.

5. RSI Indicator

RSI at 35.38 is nearing oversold territory but still shows downward pressure.

No divergence or reversal signal yet — supports the continuation view.

Mr SMC Trading point

---

Summary

Bias: Bearish

Current Price: $3,337.02

Supply Zones (FVG):

$3,385.49 (stronger supply)

$3,352.47 (minor supply)

Support Target: $3,315.22–$3,310.99

Structure: Bearish (LL-LH formation)

EMA: 200 EMA acting as dynamic resistance

RSI: 35.38 – still bearish momentum

---

Please support boost 🚀 this analysis)

GOLD - Price can fall to support level and then start to riseHi guys, this is my overview for XAUUSD, feel free to check it and write your feedback in comments👊

The price was consolidating for an extended period inside a wide, horizontal range.

A strong bullish impulse eventually broke the price out above the resistance of that flat channel.

This breakout move created a new significant high before sellers forcefully rejected the price downwards.

This rejection marked the beginning of the current falling wedge pattern, which has guided the price lower since.

The decline within the wedge has now brought the asset down to a critical historical support zone at $3285.

I expect that this key support will hold, causing a reversal and a new rally that targets the $3345

If this post is useful to you, you can support me with like/boost and advice in comments❤️

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

XAUUSD – The Structure Is Still Bullish... But Barely Holding 📌 In yesterday’s analysis, I mentioned that although Gold corrected deeper than expected, dropping below 3400, the bullish structure remained intact — and I stayed true to that view by buying dips.

🎯 The trade didn’t go as planned. Fortunately, the New York rebound from 3350 helped me exit at breakeven.

🧭 So now the big question is:

Is Gold reversing to the downside?

The answer: Not confirmed yet.

The structure is technically still bullish, but the chart is far from pretty.

🧨 What’s going wrong?

❌ Bearish engulfing candle on Wednesday – I chose to ignore it yesterday, but it’s still there.

❌ The breakout above 3375 (ascending triangle resistance) is failing – and could now turn into a false breakout trap.

❌ The ascending trendline from January 2025 is under pressure.

❌ And if today we close near 3350, the weekly chart will show a bearish Pin Bar – not exactly a sign of strength.

📉 My current plan:

- If price rallies back above 3380 → I’m looking to sell into strength, not buy.

- If we break below 3350 → I’ll also look to sell the breakdown.

Right now, for Gold to regain bullish momentum, it needs to reclaim 3400. No compromise.

⚠️ Summary:

Yes, the bigger structure is still bullish.

But momentum is fading, and price action is starting to turn against the bulls.

We need confirmation, not hope.

If 3350 breaks cleanly – things could accelerate to the downside.

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.