GOLD: Move Up Expected! Long!

My dear friends,

Today we will analyse GOLD together☺️

The in-trend continuation seems likely as the current long-term trend appears to be strong, and price is holding above a key level of 3,393.33 So a bullish continuation seems plausible, targeting the next high. We should enter on confirmation, and place a stop-loss beyond the recent swing level.

❤️Sending you lots of Love and Hugs❤️

XAUUSDG trade ideas

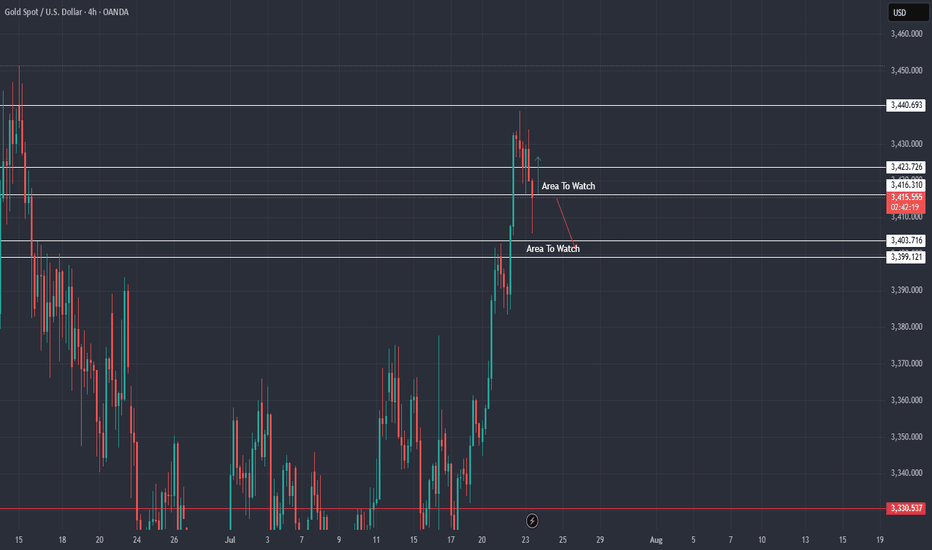

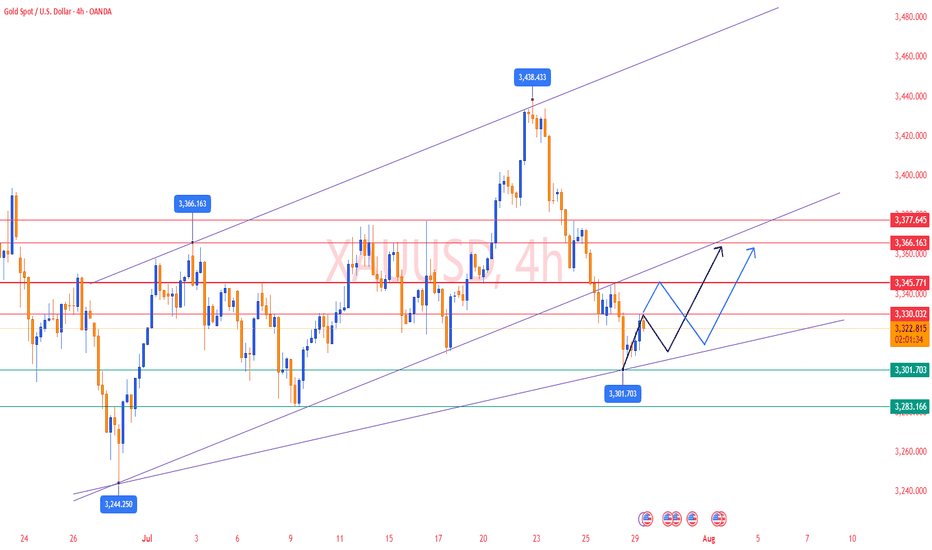

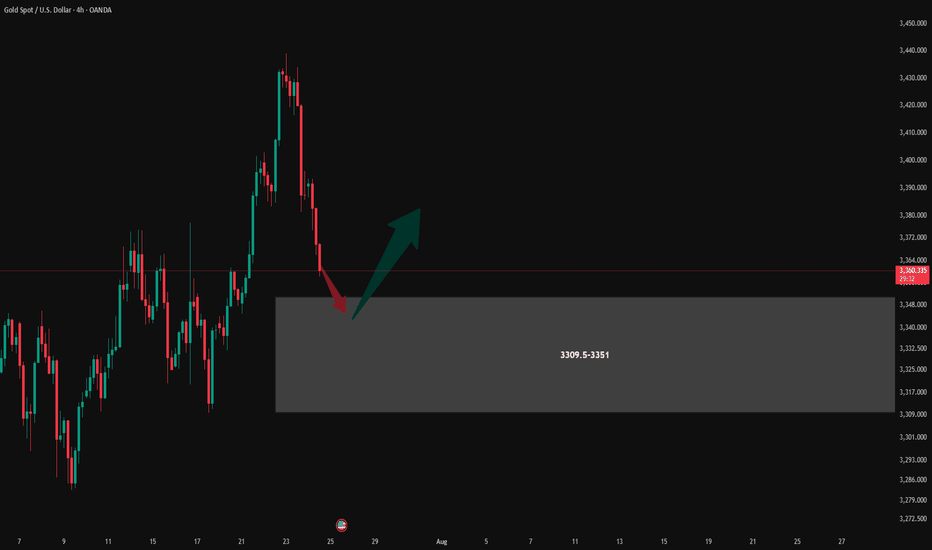

XAU / USD 4 Hour ChartHello traders. Well although I didn't take the trade, we pushed down as per my last analysis. I have currently marked my areas of interest for scalp buy / sell trades. Big G gets a shout out. Lower time frame confirmation is always a must. Be well and trade the trend. Let's see how the current 4 hour candle closes.

Gold Trading on my predicted valuesTechnical analysis: As discussed, as long as #3,400.80 mark (Xau-Usd numbers) holds, Gold is more likely to push towards #3,442.80 strong Resistance and #3,452.80 benchmark in extension for a Higher High’s Upper zone test invalidating the Hourly 4 chart’s Neutral Rectangle. This Trading week is packed with the U.S. reports, so Fundamentally the real trend will be revealed after those, since today’s E.U. session delivered indecision movements only (Spinning Top’s formation) however Bullish bias is here to stay. The Short-term Price-action has turned Bullish just over the Hourly 4 chart’s former Support at #3,363.80, while Technically, Gold is critically Bearish. It is interesting to mention that even the Daily chart is to a certain extent is Bearish however Technical rules do not apply on Fundamentally driven sessions. Everything depends upon the DX (and to a lesser extent Bond Yields), so I can't make any Short-term recommendation other than the Bullish break-out points that I am already Trading on. See also how Xau-Usd (spot price) and GC (Futures price) are finally closing the gap and getting into tight range again. Regarding today’s session - two straight red Hourly 1 candles (after Bullish rejection) so far which indicate (unless broken) that #3,427.80 is a Double Top. Most likely Gold is going towards #3,416.80 - #3,420.80 to test the Support zone and then if Price-action gets rejected (most likely it will), then Hourly 4 chart’s Resistance zone test should be next - and potentially stay Neutral for a few sessions in a symmetrical manner as April #14 - 16.

My position: I spotted that many Traders Sold Gold throughout yesterday's session which was a mistake personally as Gold will remain strong on each next session due global Fundamentals. Firstly I have Bought #3,385.80 Bottom with #4 orders. First one I have closed near #3,400.80 benchmark, second two I have closed at #3,407.80 since Profit was already great and left final runner which I closed on #3,424.80 / expecting #3,434.80 final destination which was delivered. I will keep Buying every dip on Gold as long as #3,400.80 benchmark holds as an Support from my key re-Buy points.

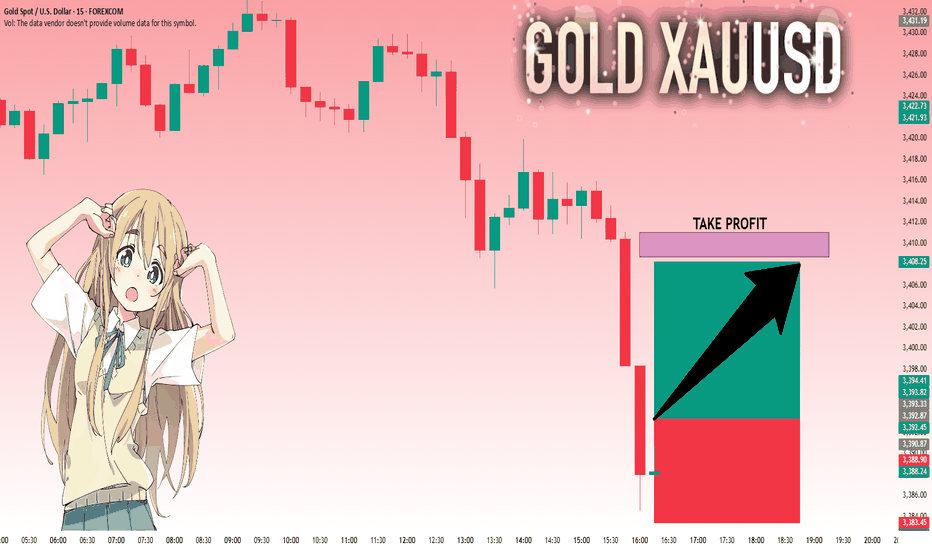

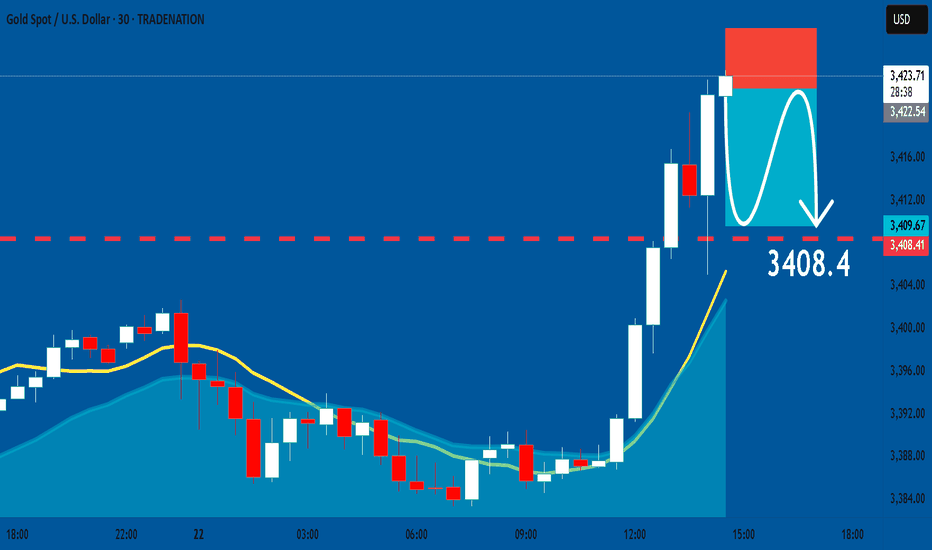

GOLD: Bearish Continuation & Short Trade

GOLD

- Classic bearish formation

- Our team expects fall

SUGGESTED TRADE:

Swing Trade

Sell GOLD

Entry Level -3422.5

Sl - 3428.1

Tp - 3408.4

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

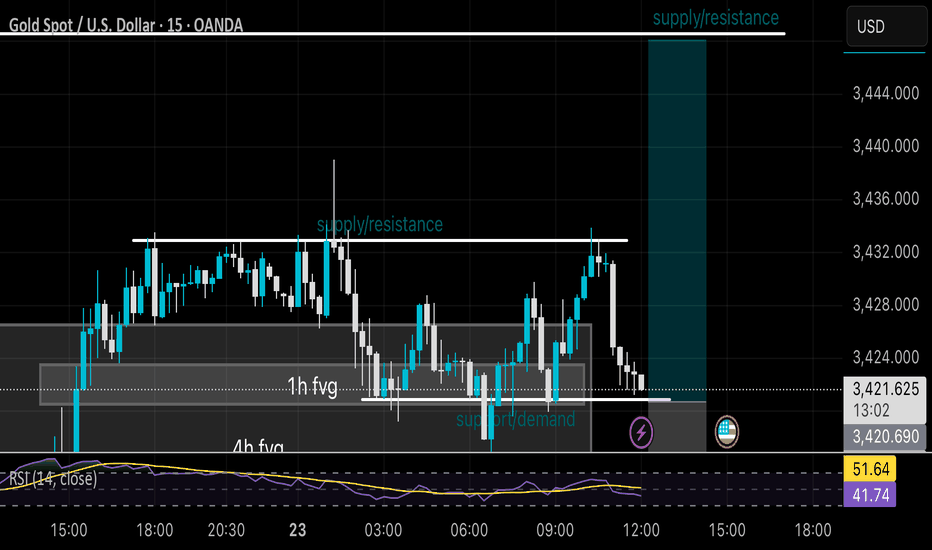

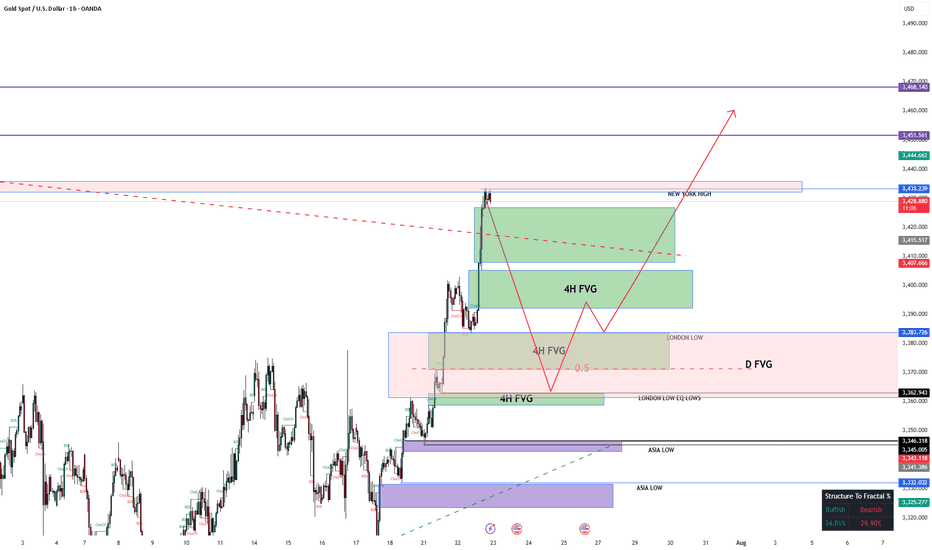

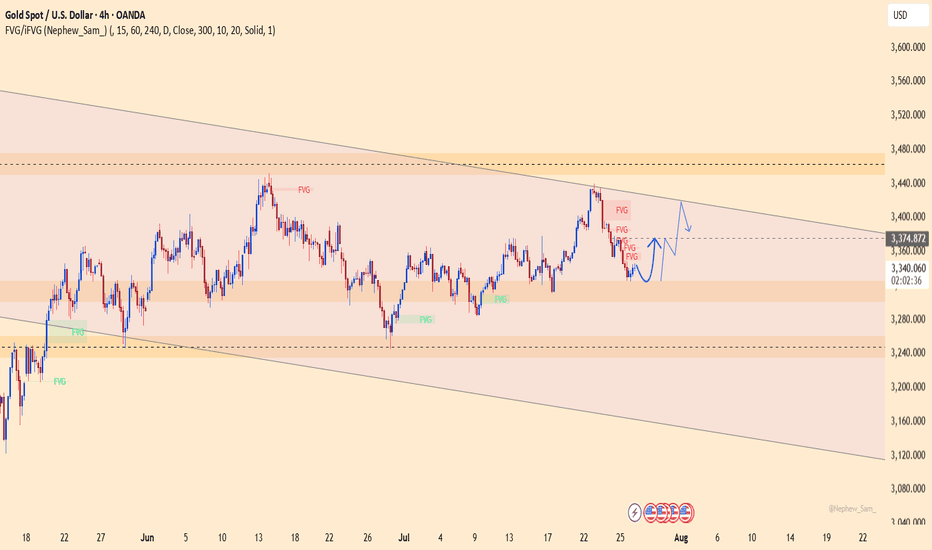

XAU/USD /IDEAGold continues its second consecutive aggressive bullish move, but the structure is beginning to show signs of a potential correction.

During this rally, highs and liquidity were taken,

and previously unfilled FVG zones from about a month ago have now been filled.

I'm watching for a possible correction toward the discount zone around 3360, where the following are located:

– A daily FVG

– A 4H FVG

– 1H Equal Lows, with clear liquidity resting below

If price sweeps the liquidity below these equal lows and reacts around 3360, I will anticipate a continuation of the bullish trend.

However, if a solid setup forms before that, I may enter a short position targeting 3360, where I’ll be looking to close the trade and potentially position for a reversal.

No entry yet – watching closely and waiting for price confirmation.

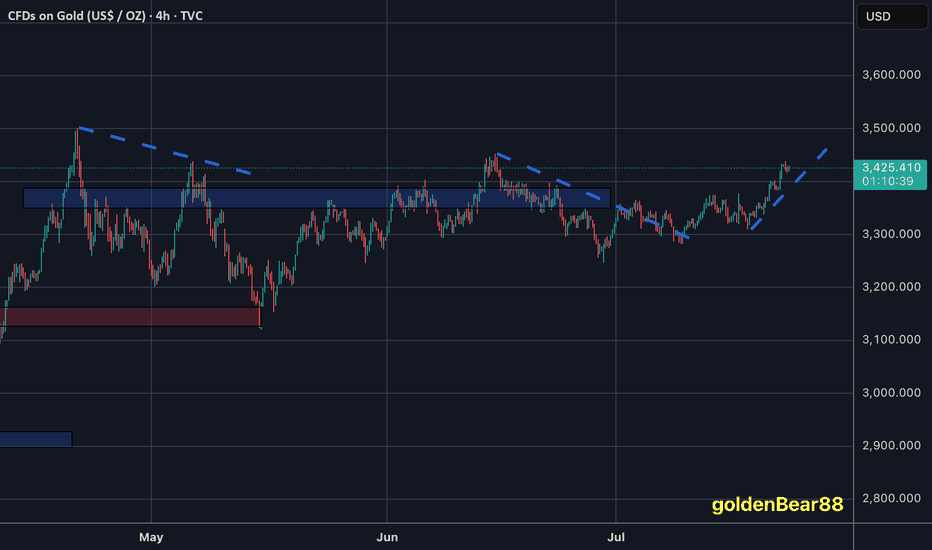

XAUUSD Outlook – July 29, 2025

Gold enters a high-risk environment starting today.

All eyes are on Jerome Powell's speech, which will signal whether the Fed remains firm on its hawkish stance or adopts a more dovish tone.

📈 That said, a broader look at the chart suggests the market has already aligned itself with the dominant trend.

🗓️ In addition to today’s speech, tariff-related news expected on Friday doesn’t seem likely to disrupt the ongoing bullish momentum in gold — or in crypto markets, for that matter.

🧠 That’s the general market read I'm sensing right now, but we’ll have to see how it unfolds.

🎯 Personally, I still view the $3290 level as a solid buy zone, with the potential to become one of gold’s historical bottoms.

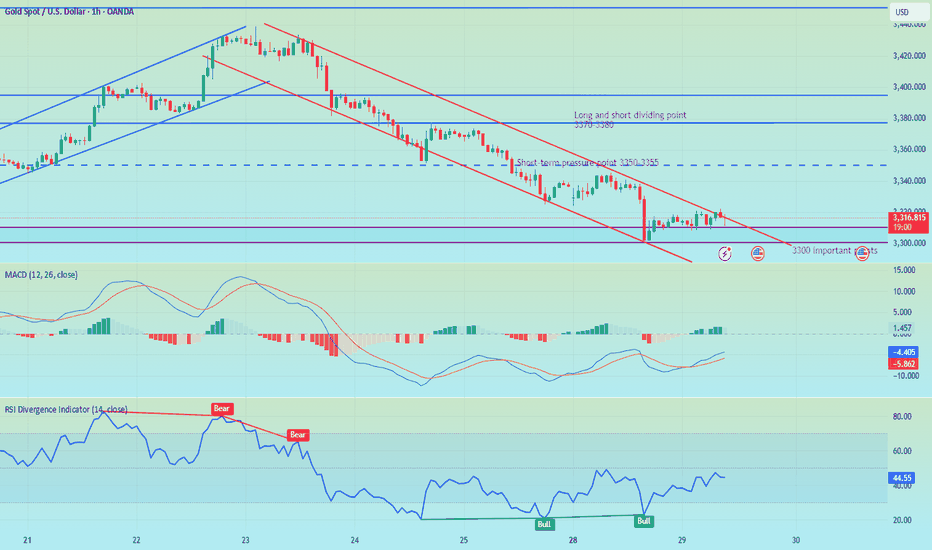

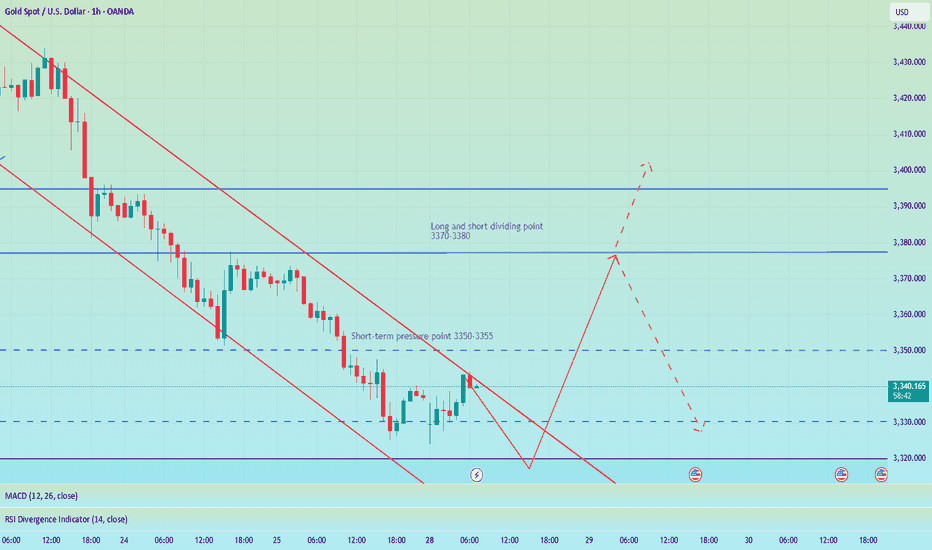

Gold short-term fluctuations downward, first short and then longGold showed a trend of rising and falling. After touching the central axis pressure level, gold fell downward. After breaking the 3320 support level, it accelerated to around 3302. It rebounded at the end of the trading day and reached the highest level of 3318.8 before falling again. The daily line finally closed with a cross Yin line with upper and lower shadows. From the current market, the short-selling trend at the daily level has not changed, and the moving average system is arranged in a short position and diverges downward. After the rebound, it is observed that the price of the hourly chart is still running in the downward channel, so the operation is still mainly based on rebound shorting. Since the daily level is to complete the bottoming or reversal, the short-term moving average must follow up downward, and the current upper pressure level is around 3337 on the daily line, which coincides with the upper pressure level of the hourly chart. In addition, the lower pressure level of 3330 on the four-hour chart also formed suppression here yesterday. The specific operation suggestions are as follows: the support level focuses on the 3285-3280 area, and the pressure level focuses on the 3340-3345 area. Operation strategy: If gold rebounds to 3335-3340, you can enter the market conservatively to short, and set the stop loss at 3347; if it touches 3285-3280, you can go long with a light position, and the rest of the points can be handled flexibly according to the intraday trend.

Operation strategy:

1. If gold rebounds to 3335-3340, you can go short, with a stop loss at 3347 and a target at 3320-3300. If it breaks, continue to hold;

2. If gold pulls back to 3285-3280, you can go long, with a stop loss at 3272 and a target at 3310-3330. If it breaks, continue to hold.

Please check how to trade later.Since the release of the trading strategy, I have been able to accurately predict market trends. I am also grateful to so many brothers for following me. My premium privileges are about to expire. I will put the subsequent trading content in the group. If any brothers are interested, they can find me through 🌐. As for how to deal with the future market, I have stated the extraordinary situation and will patiently wait for the rebound of gold. At the same time, I will pay attention to the impact of the Sino-US trade talks.

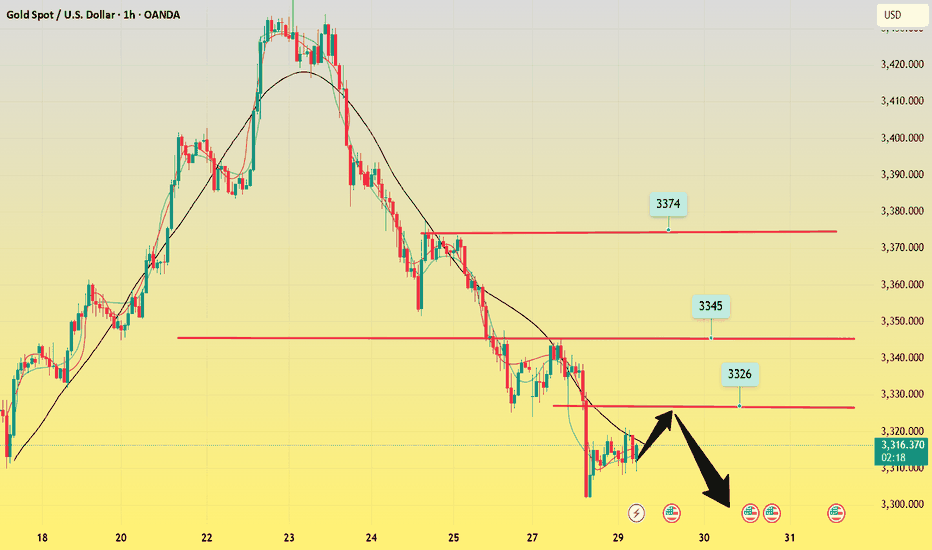

European session under pressure 3321 continue to shortI reminded everyone last night that if gold holds the 3300 mark, it will consolidate in the 3300-3345 range in the short term. The current gold price basically fluctuates narrowly between 3320-3310. Judging from the daily chart, the short-term upper pressure is at 3330. Only if the daily line stands firmly above 3330, there is a possibility of a rebound upward in the short term. Judging from the hourly chart, gold is still in a downward trend, and the hourly line is blocked near 3321. In the short term, if it cannot break through 3320-3330, gold will continue to fall. You can consider shorting, with the target at 3310-3300. If the European session is still volatile, maintain high shorts and low longs to participate in the cycle.

My premium privileges are about to expire, and subsequent trading strategies and analysis will be published in the group.

Gold Analysis and Trading Strategy | July 29✅ Fundamental Analysis

🔹 U.S. Dollar Index Surges Strongly: On Monday, the U.S. Dollar Index jumped over 1%, closing at 98.6, marking a new short-term high. This rally was primarily driven by the U.S.-EU trade agreement, which reduced tariffs to 15%, easing concerns of a trade war escalation. As a result, risk assets gained appeal, while gold's safe-haven demand was suppressed.

🔹 U.S.-China Talks Resume with Limited Expectations: The U.S. and China resumed trade negotiations in Stockholm, aiming to extend the 90-day tariff truce. However, the U.S. side made it clear that "no major breakthroughs are expected," leaving room for uncertainty, which provides some support for gold.

🔹 Geopolitical Risks Remain Elevated: President Trump has set a 10–12 day deadline regarding the Russia-Ukraine issue, warning of stronger measures if no progress is made. Meanwhile, tensions in the Middle East continue. Any escalation in conflicts could trigger renewed safe-haven buying in gold.

✅ Technical Analysis

🔸 Gold closed lower again on Monday, marking the fourth consecutive daily loss. The price rebounded to the 3345 level during the day but encountered strong resistance. During the European session, gold broke down swiftly, reaching a low of around 3301, showing a typical one-sided sell-off with strong bearish momentum.

🔸 On the 4-hour chart, gold broke below the key support level at 3320 and continued trading below the MA system. If the price fails to reclaim the 3330–3340 zone, the outlook remains bearish. However, if the European or U.S. session can push the price firmly above 3330, a potential bottom formation could be underway.

🔴 Resistance Levels: 3330 / 3345–3350

🟢 Support Levels: 3300 / 3285–3280

✅ Trading Strategy Reference:

🔻 Short Position Strategy:

🔰Consider entering short positions in batches if gold rebounds to the 3340-3345 area. Target: 3320-3310;If support breaks, the move may extend to 3300.

🔺 Long Position Strategy:

🔰Consider entering long positions in batches if gold pulls back to the 3300-3305 area. Target: 3325-3335;If resistance breaks, the move may extend to 3345.

🔥Trading Reminder: Trading strategies are time-sensitive, and market conditions can change rapidly. Please adjust your trading plan based on real-time market conditions. If you have any questions or need one-on-one guidance, feel free to contact me🤝

SHORT | Gold | 4H Chart Direction: Bearish

Moving Average: Blue < Red

Pattern Impulse: Impulse correction

Fib Retracement: 38.2

MACD > 0

1st Target = 3302

2nd Target = 3290

Lots: 0.02

RISK: Economic instability still begs the question around whether commodities continue higher over the coming months.

Trade 1/20

Gold----Sell near 3326, target 3300-3280Gold market analysis:

The recent gold daily line is still weak. It rebounded yesterday and fell again. It has touched the strong support of the weekly line. Today's idea is still bearish. Consider continuing to sell it if it rebounds. It is estimated that it will be repaired if there is support at 3300. The daily line was a cross star yesterday, and the upper shadow line was very long. The daily moving average suppression position was also around 3345, and the suppression position of the pattern was also around 3350. Today, the price is below 3345. We insist on being bearish. This week is a data week. The subsequent trend depends on the release of data. If the data is not strong and the weekly selling signal is added, it is very likely that gold will enter the 3200 era. After the weekly line breaks 3280, it basically opens up the weekly line's downward space, and will start a deep decline in the later period. In the Asian session of gold, we pay attention to the suppression of 3326. This position is the indicator suppression and the small suppression of the pattern. Consider selling it near this position. If it stands above 3326, don't sell it. The repair range will be 3345. Consider selling it at 3345. If the US market cannot break 3300, we should consider whether it will rebound. On the contrary, if it breaks 3300 directly in the Asian market, we should consider selling it directly.

Support 3300 and 3280, suppress 3326 and 3345, and the watershed of strength and weakness in the market is 3326.

Fundamental analysis:

This Monday and Tuesday are relatively quiet, and the big data will be released one by one starting from Wednesday.

Operation suggestion:

Gold----Sell near 3326, target 3300-3280

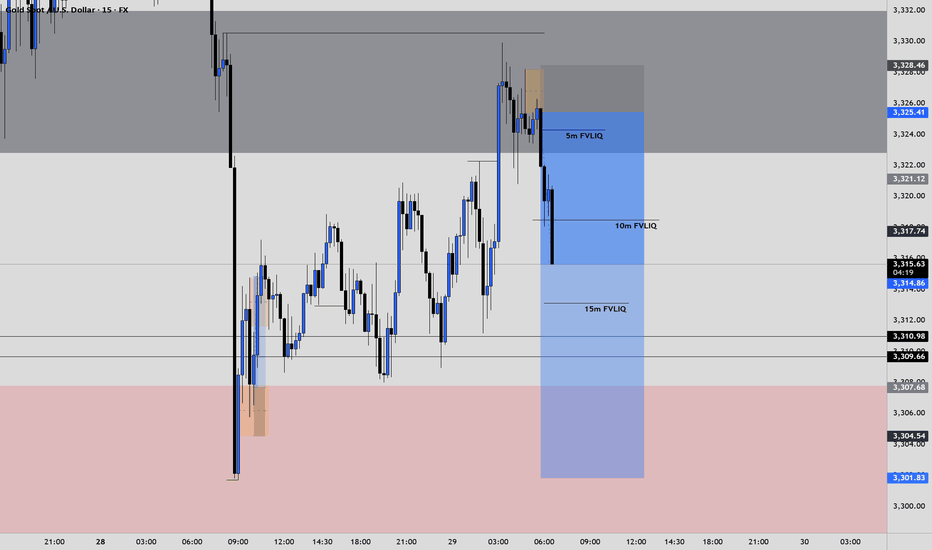

XAUUSD – Technical rebound, but downside risks remainOn the H4 chart, gold is bouncing slightly from the 3,323 support zone after a sharp drop. However, price remains within a large descending channel and is approaching a dense cluster of bearish FVGs around 3,360–3,374.

News context:

– US GDP and ADP data beat expectations, boosting the USD and adding pressure on gold.

– JOLTS dipped but remains above 7 million → limited support for gold.

– Thailand–Cambodia conflict provides only short-term impact.

Strategy: Favor SELL if price retests 3,360–3,374 and gets rejected. Downside targets: 3,323 or lower.

Main trend remains bearish, unless gold breaks above the descending channel.

Analysis and strategy of gold market on July 28:

Core influencing factors

Risk aversion cools down: Despite frequent geopolitical risk events, market panic has not significantly increased, weakening gold safe-haven buying.

US dollar strengthens: US economic data supports the continuous rise of the US dollar, and funds flow back to US dollar assets, suppressing the attractiveness of gold.

ETF holdings outflow: Short-term risk appetite has rebounded, and gold ETFs have seen a slight outflow of funds, reflecting the cautious attitude of the market.

Key events focus:

US-EU and US-China trade negotiations: If progress is optimistic, gold prices may fall to the $3,300/ounce mark.

Federal Reserve resolution: Pay attention to policy independence (affected by Trump's pressure) and interest rate guidance.

Non-farm data: Released on Friday, if the employment data is strong, it may strengthen the US dollar to further suppress gold.

Key technical points

Weekly level:

Watershed $3,325: If it is held, it will maintain high-level fluctuations, and if it is lost, it will open up downward space.

Support area: If the daily support is broken, the weekly support may be tested (reference 3300-3310).

Daily level:

Key support: The current daily support is facing the risk of breaking down, and we need to be alert to the acceleration of short positions.

4-hour level:

Resistance 3388 US dollars (middle track): Before the rebound is not broken, the short-term is short.

Weak signal: The price continues to run below 3363, and the rebound is weak.

Hourly chart:

Strong and weak boundary 3363 US dollars: Maintain weakness before breaking, and avoid bottom-fishing against the trend in the negative market.

Operation strategy suggestions

Short-term direction: Short-selling on rebound is the main, supplemented by light-weight buying at key support levels.

Short-term selling opportunities:

Ideal entry: 3370-3375 area (below the 4-hour middle track), stop loss above 3380.

Target: 3320-3310, if it breaks down, look at 3300.

Opportunities to buy long orders in the short term:

Participate cautiously: If the support of 3320-3310 stabilizes, combine the K-line signal to hold a light long position, and stop loss below 3300.

Quick in and out: You can exit the market when it rebounds to 3340-3350.

Risk warning:

Before the Fed’s decision: Avoid heavy positions, and be wary of unexpected hawkish policies that cause volatility.

Non-agricultural data: If the data exceeds expectations, it will be bearish for gold.

Summary: Gold is short-term technically bearish, but be wary of event-driven reversals. Trading requires strict stop losses and flexible response to data and policy risks.

Pay attention to 3350 gains and lossesGood morning, bros. This morning gold again tested last week's low near 3325. From the chart, gold may continue to rise this week, with tariffs approaching, the Fed's interest rate cut, and NFP data imminent. The current strength and weakness are at 3350-3355. If it can effectively break through and stand above, it is expected to continue to test the previous high point, which is also the long-short dividing point of 3370-3380.

From the daily chart, there is not much change in the operational range of gold in the short term, and the change in the 4H chart is more obvious. After the decline in the early trading, it is now rebounding. There is a possibility of closing positive at the low. If it is directly positive on Monday, then it will bottom out directly at the beginning of the week. If it refreshes the low on Monday, the low point of 3285 will be seen below. Therefore, today's market focuses on the continuity of long and short. Of course, according to the current changes, the biggest possibility is to continue to rebound at the low point, pay attention to the support of 3310-3300 below, and pay attention to the gains and losses of the high point of 3355 above.

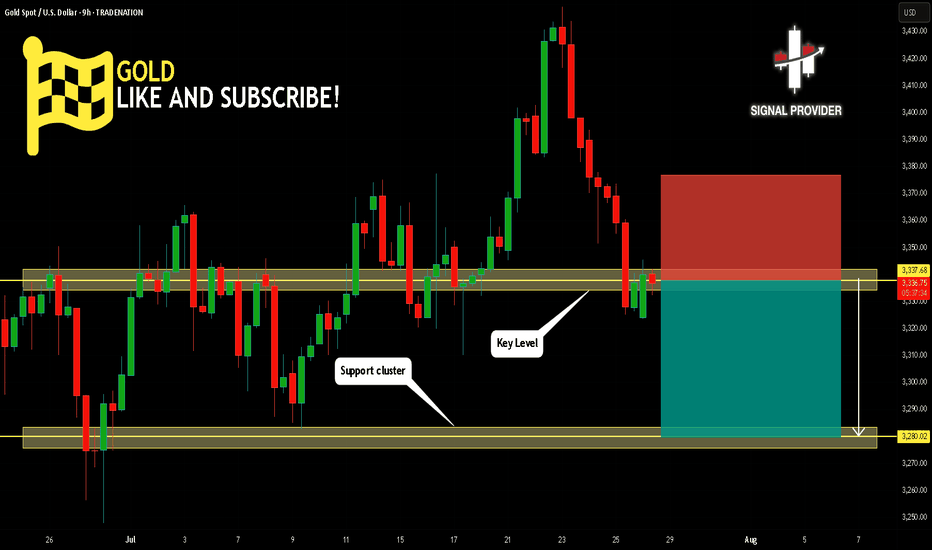

GOLD Will Move Lower! Sell!

Here is our detailed technical review for GOLD.

Time Frame: 9h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is testing a major horizontal structure 3,337.68.

Taking into consideration the structure & trend analysis, I believe that the market will reach 3,280.02 level soon.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!