XAUUSDG trade ideas

Sell Analysis – 30M Smart Money Concept Sell Analysis – 30M Smart Money Concept

📊 Chart Context:

Timeframe: 30M

Market: Gold (XAUUSD)

Bias: Bearish – Scalp Sell

---

🔍 Key Observations:

Premium Zone Rejection:

Price tapped into a premium supply zone formed after a clear break of structure (BoS) to the downside. This confirms seller dominance at higher pricing levels.

FVG (Fair Value Gap) Fill:

The price filled a previous FVG imbalance and showed rejection without closing above the origin of the impulse. This shows liquidity grab behavior typical in smart money moves.

Bearish Order Block Confirmation:

A bearish OB was respected and reacted to. The latest candle shows strong rejection with a long upper wick and volume tapering — an early confirmation of potential entry trigger for scalp short.

---

🧨 Entry Strategy (Scalp Sell):

Entry Zone:

Inside the reaction to the OB and FVG (just below the premium zone)

✅ 3325 ~3330

Stop Loss:

Just above the last high or FVG origin

✅ 3340

Take Profit:

TP1: Towards the equilibrium of the recent impulse leg

✅ 3300

TP2: Below the discount zone, targeting liquidity under recent lows

✅ 3280

---

⚠️ Risk Note:

This is a scalping setup, not a swing trade. Higher timeframes still show mixed signals, so risk management is key. Avoid over-leveraging.

---

🏁 Summary:

> A high-probability scalp sell setup confirmed by smart money concepts: BOS → FVG Fill → OB Rejection → Liquidity Grab → Bearish Continuation.

Gold short-term bearish

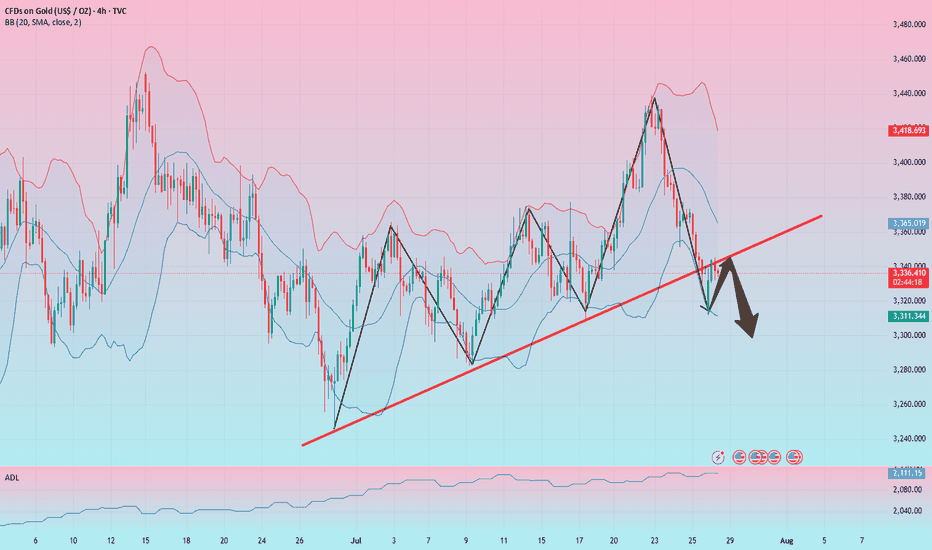

From the Bollinger daily line, as shown in the figure below, the gold price should still test the lower track of $3,280 in the future. The short-term upward trend line has also been broken, and this yellow line has now become a pressure.

From the moving average system, the daily line is chaotic, and the gold price goes up and down without order and rules to cross the moving average, so the daily moving average system has no reference significance. From the weekly line, the gold price has the need to step back on the 20-week moving average of $3,277 to $3,280.

So, if I look at the bearish, I can only see $3,277 to $3,280. No deeper decline can be seen, and no more signals appear. Therefore, shorting is relatively short. Or it is short within the daily Bollinger track, not structural short or trend short. Everything has a law, just oscillation.

So, I think that even if there is a short in the future, it is the end of the short. It is the right way to stop when you see good results. Even though the current gold price has fallen due to the short-term positive tariff negotiations between Trump, Japan and the European Union, the tariff level is still much higher than before, which will undoubtedly bring more uncertainty to future economic growth. Many other factors are not conducive to a sharp drop in gold prices. The overall situation is that the basic trend of gold price increases is intact.

Therefore, the high point of $3345.30 has become the watershed between long and short positions. You can use this as the dividing line for long and short operations. There is nothing wrong with setting a loss above $3345.30 to short in batches. There is nothing wrong with placing a long position at 3346. The market trend is very uncertain, so it all depends on what order you want to make.

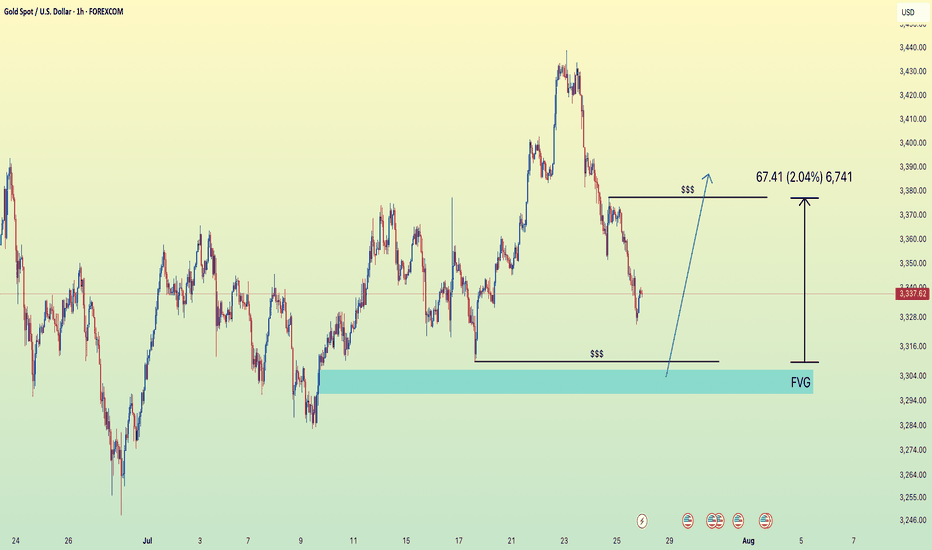

GOLD BUY TRADE IDEA • Price Action Context:

• Recent bearish leg shows a clear shift from premium to discount territory.

• Market is approaching a higher timeframe demand zone around $3,277 – $3,299 (highlighted red zone).

• Notable inducement below recent lows suggests engineered liquidity to fuel a potential reversal.

• Current Market Structure:

• After a deep retracement, price is expected to tap into the discount zone, where institutional buy orders may be resting.

• Anticipated bullish reaction following a liquidity sweep of the lows and demand mitigation.

• Smart Money Flow:

• Inducement ➝ Liquidity Grab ➝ Demand Tap ➝ Bullish Reaction setup in play.

• Internal structure likely to shift bullish after a sweep, potentially forming a higher low and aiming for a BOS (Break of Structure) on the upside.

• Upside Target:

• Short-term target area: $3,360 – $3,380.

• Possible continuation toward premium if internal structure confirms strength.

🧠 Smart Money Narrative:

1. Induced sell-off below structure for liquidity collection.

2. Approaching major POI (Point of Interest) in discount.

3. Anticipated entry point for institutions to buy gold at value.

4. Reversal expected toward premium imbalance areas.

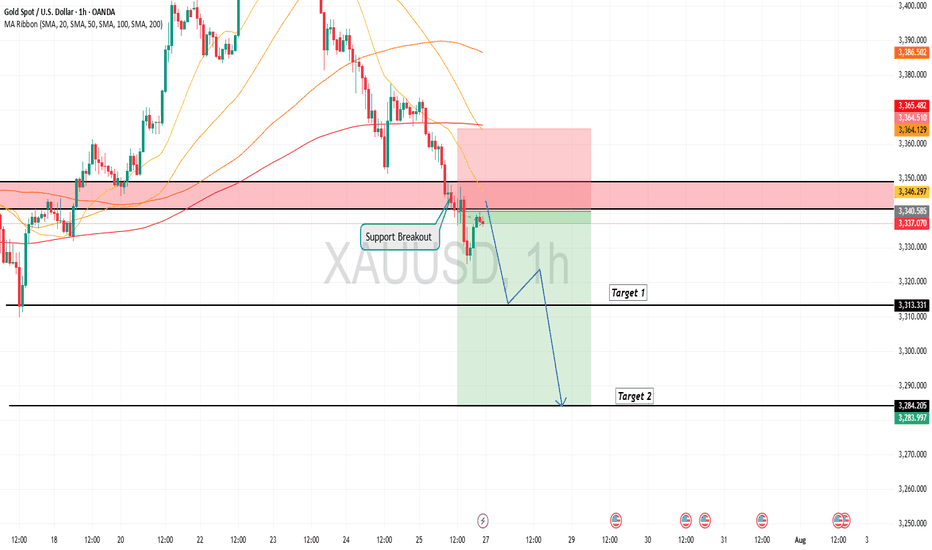

Gold is in the Bearish Direction after Breaking SupportHello Traders

In This Chart GOLD HOURLY Forex Forecast By FOREX PLANET

today Gold analysis 👆

🟢This Chart includes_ (GOLD market update)

🟢What is The Next Opportunity on GOLD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

XAUUSD – TCB Strategy Setup✅ TCB Strategy Analysis

Trend Phase

HTF Bias: Recently shifted from bearish to potential bullish — clear breakout from descending channel.

Current Structure: Price has broken above channel and retested former structure resistance (~3325) as support.

Bias: Bullish continuation forming.

🚨 XAUUSD – TCB Strategy Setup (EP1 Active, EP2 Pending) 💥

Price just broke out of the descending channel and is now forming a solid base above the 3325 zone.

✅ EP1 (Pullback Buy) already triggered after price retested support.

📍 EP2 will activate on clean breakout + retest of 3330 zone.

🎯 Targets:

• TP1: 3348

• TP2: 3356–3360

If price loses 3325 structure, we reassess. For now, I’m bullish while structure holds.

This setup aligns 100% with the TCB Strategy:

Trend Phase: Bullish structure forming

Countertrend: Liquidity sweep + reclaim

Breakout Phase: Incoming on 3330 retest

🧠 Flow with structure, not emotion.

💬 Drop your comment if you're trading Gold too.

#TCBFlow #XAUUSD #GoldAnalysis #SmartMoney #BreakoutTrading #FlowWithTCB

Daily gold analysisDaily gold analysis

Sell trade with target and stop loss as shown in the chart

The trend is down and we may see more drop in the coming period in the medium term

All the best, I hope for your participation in the analysis, and for any inquiries, please send in the comments.

He gave a signal from the strongest areas of entry, special recommendations, with a success rate of 95%, for any inquiry or request for analysis, contact me

GOLD Melted , 2 Best Places To Sell Clear , Don`t Miss 200 Pips Here is My 30 Mins Gold Chart , and here is my opinion , we Again Below 3377.00 and we have a 30 Mins Candle closure below this strong res , so i`m waiting the price to go back and retest this res and new support and give me a good bearish price action to can enter a sell trade and we can targeting 200 pips , and we have a good res @ 3365.00 we can sell from it also if the price didn`t reach 3377.00 and targeting from 100:200 pips , and if we have a Daily Closure below This res this will increase the reasons for us , just wait the price to back a little to retest it and then we can sell it . if we have a daily closure aboveit this idea will not be valid anymore .

Gold Market Outlook – 1H ChartGold (XAU/USD) continues to show bearish momentum with lower highs and consistent structural breakdowns. Price is currently consolidating just above a key support zone (~3315), forming a descending triangle pattern — often a bearish continuation signal.

If the support breaks, the next liquidity zones lie around 3270–3250, with a deeper target near 3225, as highlighted by the green demand areas. Fundamental catalysts ahead (as shown by US economic events) could act as triggers.

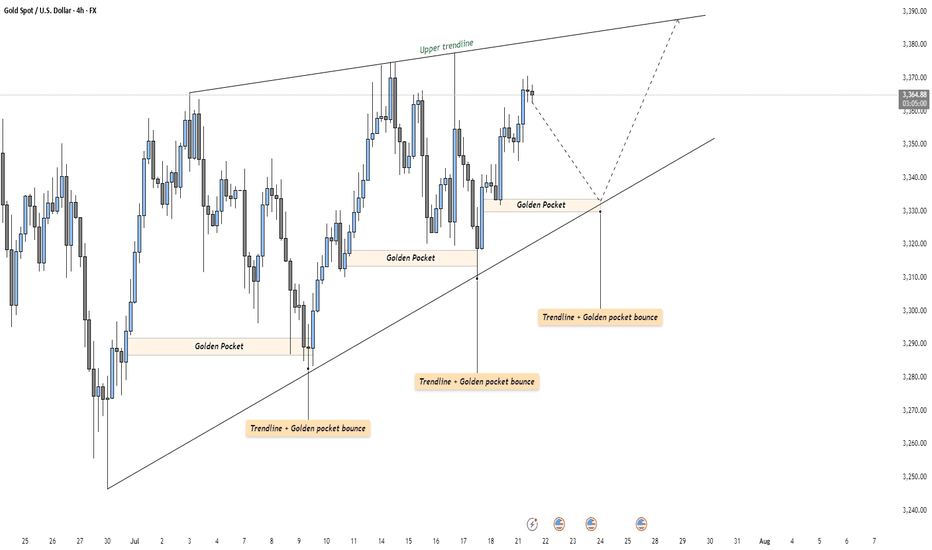

GOLD - Strong Trendline & Golden Pocket ContinuationMarket Context

Gold is currently trading within a rising wedge structure on the 4-hour timeframe. This formation typically represents a tightening market, where buyers continue to push higher — but with decreasing momentum. The confluence of both trendlines and repeated Golden Pocket bounces makes this setup technically rich and worth watching closely.

Golden Pocket & Trendline Confluence

Throughout the recent move up, price has consistently reacted to the 0.618–0.65 Fibonacci retracement zone — often referred to as the Golden Pocket. Each major retracement has found support not only at this zone but also at a rising trendline, showing strong alignment between horizontal and diagonal demand. This dual-layer support has repeatedly led to sharp rebounds, reinforcing the bullish structure.

What Comes Next?

Price is currently sitting just below the upper resistance of the wedge. If history repeats, a retracement toward the lower trendline could be the next logical step. A reaction in the same region — where the Golden Pocket once again overlaps the trendline — could offer a high-probability long opportunity for continuation toward the top of the wedge or even a breakout.

Alternatively, if price breaks below the trendline with conviction, it could signal exhaustion in the current structure, potentially flipping the bias toward a broader correction.

Final Thoughts

This is a textbook example of how technical confluence can guide trade planning — especially in clean, trending environments like this. Remember: patience is key. Let the market come to your levels.

If you enjoyed this breakdown, a like would go a long way — and feel free to share your thoughts or ideas in the comments below!

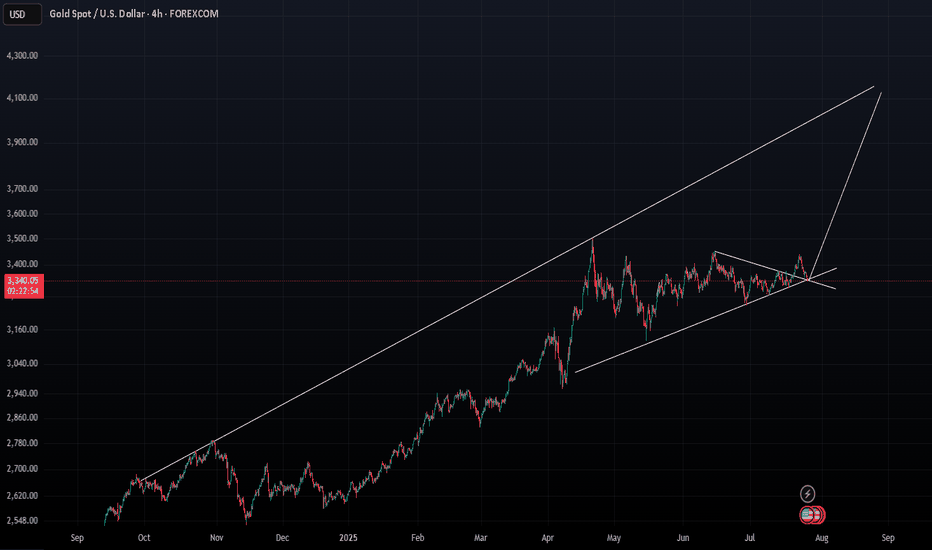

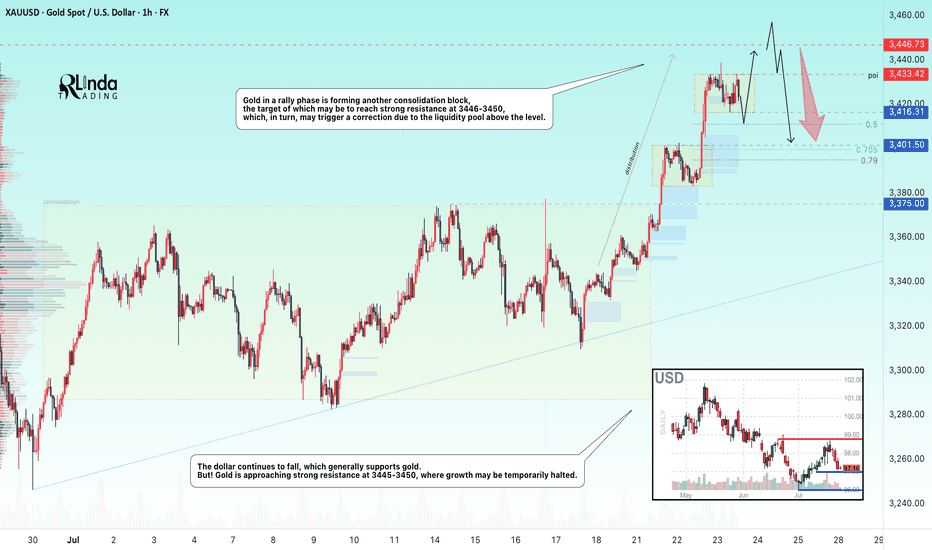

GOLD → Consolidation before the next jump to 3450?FX:XAUUSD continues to rally, with the price updating its local high to 3438 and moving into consolidation, possibly for another jump...

After hitting a five-week high of $3,438, traders are taking a break. Optimism is fuelled by Trump's statements about the largest deal with Japan and negotiations with Canada, but uncertainty about the details of the agreements and political instability in Japan are keeping caution in check. The market is waiting for further signals on trade and political issues, which remain key factors for gold.

Technically, the dollar continues to fall, which generally supports gold. But! Gold is approaching strong resistance at 3445-3450, where growth may be temporarily halted.

Resistance levels: 3433, 3446

Support levels: 3416, 3401, 3375

As part of a local correction, gold may test consolidation support or 0.5-0.7f before continuing to rise. There are quite a few orders in the 3433-3446 zone, and it will be difficult to break through this area to reach the target. Consolidation before this level may help the rise to continue.

Best regards, R. Linda!

It still looks like a Triangle on goldHi traders,

Last week gold made an impulsive wave up but after that it dropped very hard.

If gold is still in a Triangle we could see a correction up and one more move down for wave E. But if price closes below (orange) wave C then the pattern is changed.

Let's see what price does and react.

Trade idea: Wait for the pattern to finish. Then wait for an impulsive move up and a small correction down on a lower timeframe and a change in orderflow to bullish to trade longs.

NOTE: The next three weeks I'm on holiday so I will not post any outlooks publicly.

If you want to learn more about trading FVG's & liquidity sweeps with wave analysis, please make sure to follow me.

This shared post is only my point of view on what could be the next move in this pair based on my technical analysis.

Don't be emotional, just trade your plan!

Eduwave

Gold is in the Bearish Direction after Breaking SupportHello Traders

In This Chart GOLD HOURLY Forex Forecast By FOREX PLANET

today Gold analysis 👆

🟢This Chart includes_ (GOLD market update)

🟢What is The Next Opportunity on GOLD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

Bullish or Bear trapHello Traders 👋

What are your thoughts on XAUUSD

Looking at the daily timeframe I anticipate manipulation by market players on gold.

Is likely that market players will stop Hunt Traders who have their stop losses at the different lows which is indicated with a red circle.

For every buyer there must be a seller and for every seller there must be a buyer.Where they are no sellers in the market the institutions will want to trigger stop losses in order to buy,which is known as stop hunting.That is to takeout previous buyers in the market and generate liquidity to buy.

And this stop hunting usually happens in a ranging market.

Looking at the structure of gold we can see that gold is ranging,

We can see a low or support of the range which was previously resistance and turned support for the ranging market.

I see the market using sell liquidity to liquidate buyers and react at the support or low of the range and move up to the range of the resistance

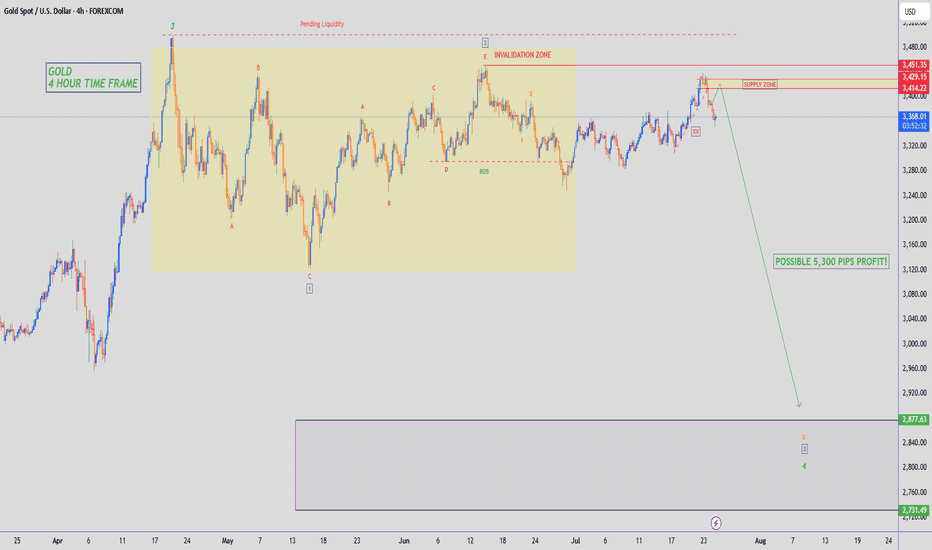

GOLD - SHORT TO $2,880 (UPDATE)Beautiful melt overnight, with Gold down close to 400 PIPS so far. Zoom in to the left & you'll see I've also added in a trendline which sellers have now start taking out. Another strong confluence of sellers taking control.

I warned you all last night not to sleep on Gold. My Gold Fund investors are in deep profits😉