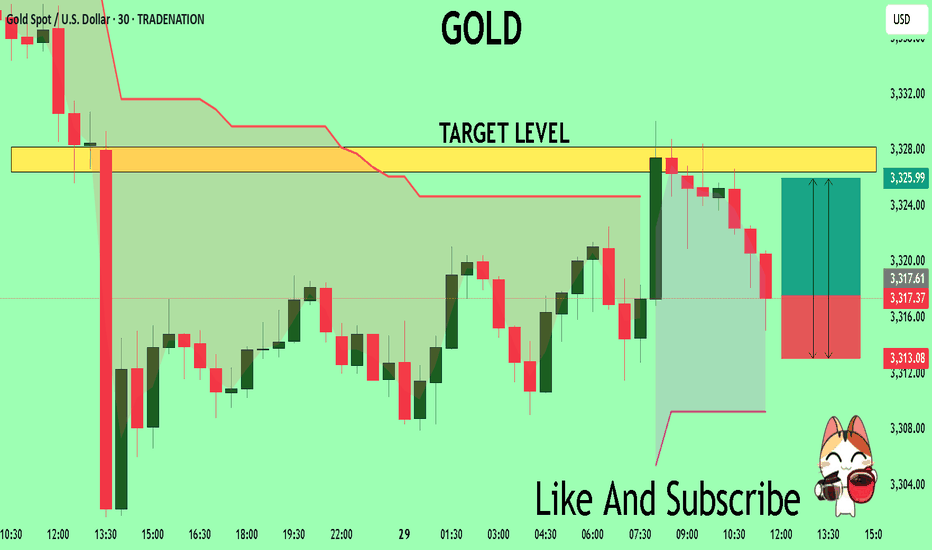

GOLD The Target Is UP! BUY!

My dear subscribers,

This is my opinion on the GOLD next move:

The instrument tests an important psychological level 3317.7

Bias - Bullish

Technical Indicators: Supper Trend gives a precise Bullish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 3326.4

My Stop Loss - 3313.0

About Used Indicators:

On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

XAUUSDG trade ideas

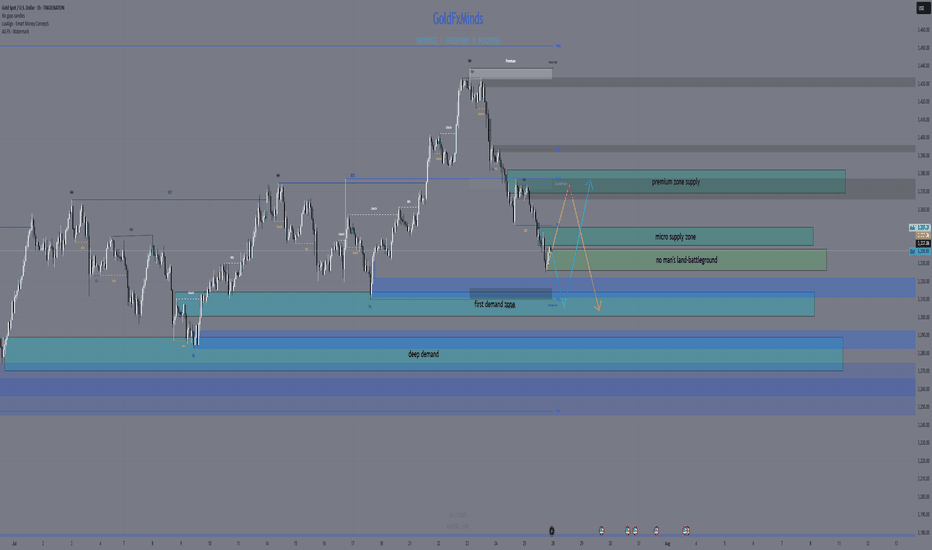

GOLD ROUTE MAP UPDATEHey Everyone,

What a PIPTASTIC finish to the week! 🚀. We tracked the move down with precision durung the week and then rode the momentum right back up.

Yesterday, we confirmed the swing range activation and bounce, and that bullish follow through carried beautifully into today, completing our Bullish Target at 3348. Just perfect execution all around.

BULLISH TARGET

3348 - DONE

BEARISH TARGETS

3328 - DONE

EMA5 CROSS AND LOCK BELOW 3328 WILL OPEN THE FOLLOWING BEARISH TARGET

3305 - DONE

EMA5 CROSS AND LOCK BELOW 3305 WILL OPEN THE SWING RANGE

3289 - DONE

3267 - DONE

We will now come back Sunday with a full multi timeframe analysis to prepare for next week’s setups, including updated views on the higher timeframes, EMA alignments, and structure expectations going forward.

Thanks again for all your likes, comments, and follows.

Wishing you all a fantastic weekend!!

Mr Gold

GoldViewFX

Gold Drops After Failing to Hold Above $3322📊 Market Overview:

Gold initially surged above the $3322 resistance, hitting $3329 amid Fed pause expectations. However, a rebound in the US dollar and profit-taking triggered a sharp drop back to $3315, signaling weakening bullish momentum.

📉 Technical Analysis:

• Key resistance: $3322 – $3330

• Nearest support: $3308 – $3300

• EMA09 (H1): Price has fallen below EMA09 → turning short-term trend bearish

• Candlestick / Volume / Momentum:

• Failed breakout above $3322 with strong bearish H1 reversal

• Increasing volume during the drop → rising selling pressure

📌 Outlook:

Gold may continue declining in the short term if it fails to hold above $3312. Bears have taken control after the failed breakout attempt. Risk increases for a move toward $3300–$3295.

💡 Suggested Trade Setup:

🔻 SELL XAU/USD : $3318 – $3321

🎯 TP: 40/80/200 pips

❌ SL: $3325

🔺 BUY XAU/USD: $3295 – $3292 (only with clear bullish signal)

🎯 TP: 40/80/200 pips

❌ SL: $3288

XAUUSD Market Update – July 30 Late NY Recap🔸Macro Context

Markets are still digesting Powell’s ongoing speech with no clear pivot signals. While FOMC tone remained cautious, no dovish surprise emerged. Trump’s upcoming comments keep geopolitical risks elevated. USD remains firm. Gold is reacting within key HTF demand as intraday volatility cools off.

🔸Bias Overview

Weekly Bias:

• Bearish rejection from the major supply wick 3439–3350

• Structure still below 3345, maintaining downside pressure

• Weekly RSI cooling off — no bullish divergence yet

Daily Bias:

• Lower high locked below 3345

• Price reentered the imbalance toward 3272

• Clean structure remains bearish unless we reclaim 3302

H4 Bias:

• Lower high formed at 3314

• Current price testing HTF Extreme Demand Base (3289–3272)

• Still bearish unless we see a confirmed M15 or H1 BOS from demand

🔸Key Structural Zones

🔺Above Price (3272):

• 3289–3294

Decision Block – M30 OB + FVG. First sign of momentum shift if reclaimed.

• 3302–3314

Supply Reversal – H1 OB + previous BOS zone. EMA alignment adds pressure.

• 3345–3350

Major Rejection Zone – H4 origin of last leg down. Strong resistance area.

🔻Below Price (3272):

• 3254–3264

Imbalance + OB – H4 FVG + clean demand zone. Buy setup only on deep flush + reversal PA.

• 3227–3214

HTF Demand Base – Daily OB + historical volume shelf. Final structural floor before deeper downside opens.

🔸Battle Plan

▶ Scenario 1 – Bearish Breakout

If 3272 fails with momentum and no reversal signs, expect continuation into 3254–3264.

No long trades unless BOS confirms.

▶ Scenario 2 – Reactive Long from Demand

If price gives a strong reaction from 3272 with BOS on M15 or H1 and clears 3294, then a recovery into 3302 is possible. Only valid with confirmed PA + EMA shift.

▶ Scenario 3 – Choppy Rejection from 3294

If price tests 3294 but fails, watch for rejections back toward 3272. Scalpers can fade reactions if no bullish structure forms.

🔸Final Thoughts

Price is once again testing our Extreme Demand Base from July 28 (3289–3272). The zone remains valid — but execution depends entirely on confirmation. Bears still in control unless we reclaim 3302 cleanly.

No need to rush. Best RR setups are found at clean structural edges.

Patience = profits.

—💬 Drop your thoughts in the comments.

❤️ Like if you appreciate the precision.

🔔 Follow GoldFxMinds for more sniper-level updates.

With you all the way,

— GoldFxMinds

📊 Analysis based on Trade Nation TradingView charts.

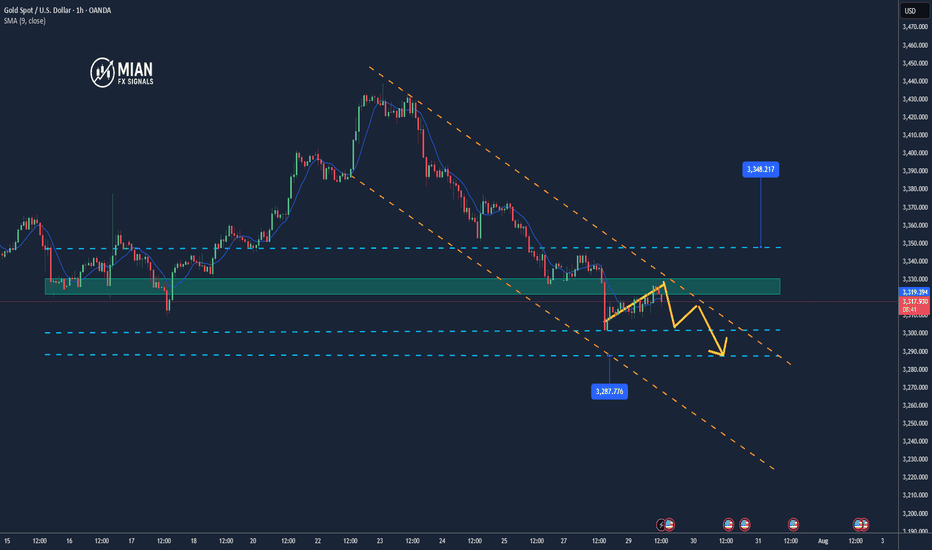

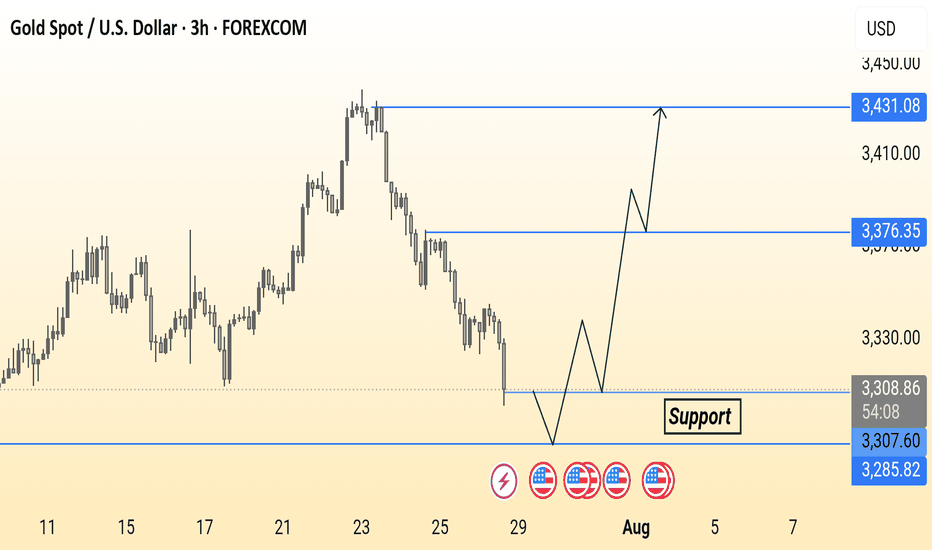

GOLD → Countertrend correction, retest of 3345 before growthFX:XAUUSD , undergoing a deep correction after a false breakout of local resistance at 3433, has reached the support of the upward trend. Will the bulls be able to maintain the trend?

Gold held below $3,400 on Friday, rebounding from $3,350, and is poised to end the week higher. Investors are watching the conflict between Thailand and Cambodia, which is boosting demand for safe-haven assets, and are also awaiting decisions from the Fed and the Bank of Japan next week. The markets received additional support from US trade deals with Asian countries and progress in negotiations with the EU, easing fears of a tariff war.

As part of the correction, gold is testing trend support and the 3345-3337 zone of interest. A false breakdown, lack of downward momentum, and bulls holding prices above 3345 could trigger growth and a continuation of the main upward trend.

Resistance levels: 3375, 3383

Support levels: 3345, 3337, 3330

Technically, the support level of 3345 plays a fairly important role in the market. If, during the correction, the bulls manage to hold their ground above this zone, the prospects for recovery will be high, especially against the backdrop of geopolitical problems.

Best regards, R. Linda!

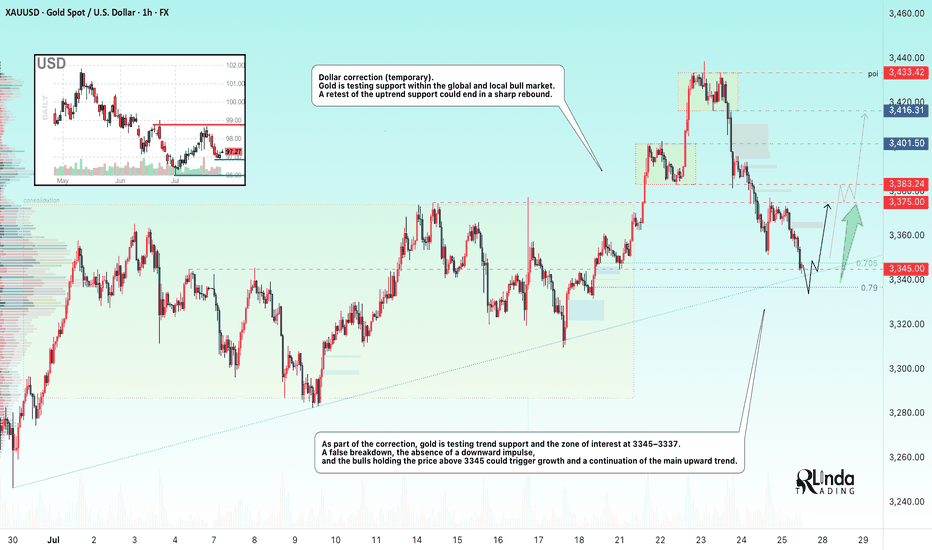

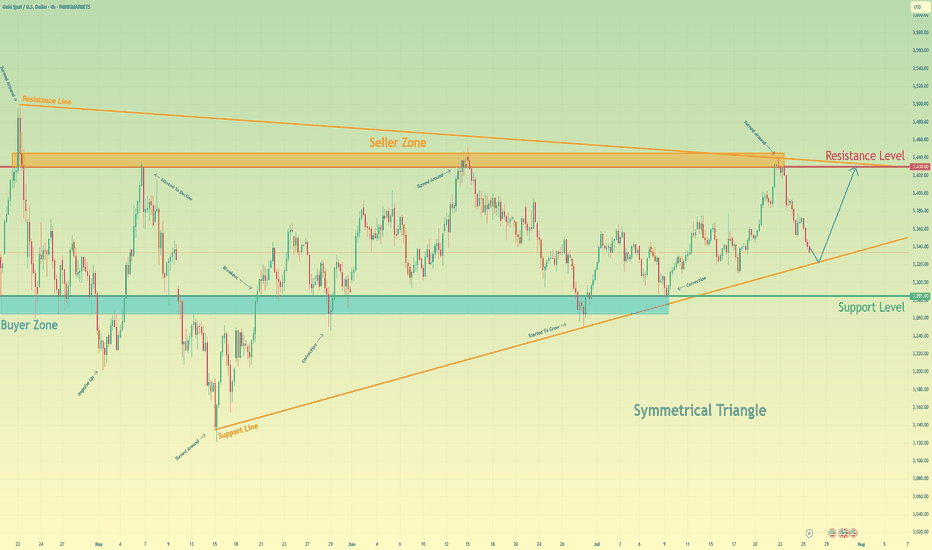

Gold can reach resistance area and then continue to fallHello traders, I want share with you my opinion about Gold. Over an extended period, the price action of Gold has been contained within a large descending triangle, a pattern characterized by a series of lower highs testing a descending resistance line and a relatively flat support base. The major seller zone around the 3415 resistance level has consistently capped upward rebounds, establishing a clear downward pressure on the asset. The most critical recent development has been a decisive breakdown, where the price broke below a key ascending trend line and, more importantly, below the horizontal support at 3310. This structural break has shifted the immediate market dynamics, turning the former support area of 3310 - 3320 into a new ceiling of resistance. The primary working hypothesis is a short scenario based on the principle of a breakdown and retest. It is anticipated that the price will attempt a corrective rally back towards this new resistance area around 3310. A failure to reclaim this level, confirmed by a strong rejection, would validate the breakdown and signal the continuation of the larger downward trend. Therefore, the tp for this next bearish leg is logically placed at the 3240 level. This target represents a significant area of potential support and a measured objective following the resolution of the recent consolidation. Please share this idea with your friends and click Boost 🚀

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

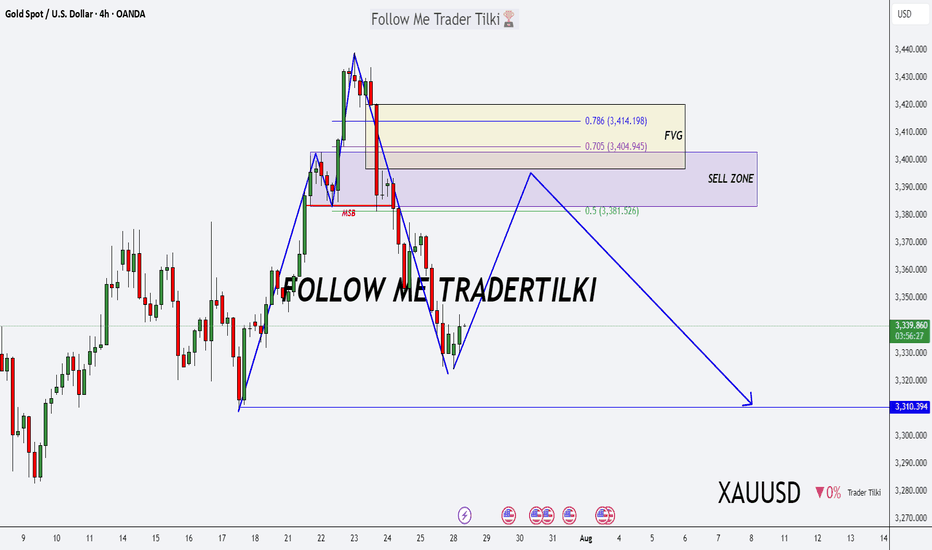

Gold Alert: Key Levels for Potential Sell Setup!Good morning, my friends 🌞

Here’s today’s gold analysis. I'm expecting a decline in gold prices, specifically from the 3,383–3,420 level.

Once a correction starts around that zone, my target will be 3,310. Gold has been riding a strong uptrend, and if we reach those levels, I’ll be expecting a pullback and opening a sell position accordingly.

Please set your stop loss based on your personal margin preferences.

Your likes and support are my biggest motivation for continuing to share these analyses. Thank you to everyone showing appreciation 🙏

GOLD falls on USD and trade talks, big data weekSpot OANDA:XAUUSD ended its rally this week on Friday (July 25) and closed down nearly 1%, mainly affected by the recovery of the US Dollar TVC:DXY and progress in trade negotiations that weakened safe-haven demand.

DXY recovered 0.27% on Friday to close at 97.642, ending a two-week low, making gold less attractive than its direct correlation.

Earlier, news of a US-Japan trade deal and a breakthrough in US-EU talks weakened the market's demand for safe-haven assets.

For the content of the US-Japan trade deal, readers can review it in the daily publications during the past trading week.

Data and Fed Expectations

The latest US jobless claims fell to a three-month low, suggesting the job market remains solid. This gives the Federal Reserve reason to maintain interest rates at 4.25%-4.50%, despite President Trump once again pressuring Powell to cut rates.

However, in the short term, the fundamental direction of gold may need to wait for the Federal Reserve to announce more policy signals at its meeting next week.

Speculative Longs Hit High Near April Peak

Data from the U.S. Commodity Futures Trading Commission (CFTC) showed that as of the week of July 22, the speculative net long position in COMEX gold rose by 27,211 lots to 170,868 lots, the highest level since April. This shows that as gold prices fall again, buyers are still actively deploying, waiting for more guidance from policy and data.

Last Week Review and This Week’s Fundamental Outlook

Last week, gold prices initially rose and then fell. Due to risk aversion and volatility in the US dollar, gold prices surpassed the $3,400/ounce mark at the start of the week, but as trade optimism increased and profit-taking emerged, gold prices fell back, trying to stay above $3,300/ounce.

Investors will face several major events this week:

Federal Reserve policy meeting (Wednesday): Markets expect interest rates to remain unchanged, but Powell’s speech could influence market expectations for a rate cut this year.

Macro data will be released in batches: including ADP employment data on Wednesday, PCE price index on Thursday and non-farm payrolls report on Friday. These data will determine the next move of gold.

Global central bank trends: The Bank of Canada and the Bank of Japan also hold policy meetings next week. Investors will be watching to see if their policy signals cause volatility in the US dollar and gold prices.

Technical Outlook Analysis OANDA:XAUUSD

On the daily chart, gold is in a rather important position after 3 consecutive corrective declines. However, the bearish momentum still keeps gold above the base price, which is an important psychological point for the bullish expectation of 3,300 USD.

In terms of position and indicators, gold has not completely lost the ability for a bullish outlook. Specifically, gold is still in a short-term rising channel and supported by the EMA21. On the other hand, it is still supported by the horizontal support level of 3,310 USD, followed by the psychological level of 3,300 USD and the 0.382% Fibonacci retracement.

Gold will only qualify for a bearish cycle if it sells below the 0.382% Fibonacci retracement level, then the target will be around 3,246 USD in the short term, more than the 0.50% Fibonacci level.

RSI is sloping down, but has not yet crossed the 50 level, and in the current case, the 50 level acts as a momentum support for the RSI. It shows that there is still room for an increase in price, and if RSI sloping up from 50, it will provide a bullish signal with relatively wide room.

If gold rises above the 0.236% Fibonacci retracement level (3,371 USD), it will be eligible for a new bullish cycle with a target of around 3,400 USD in the short term, more than 3,430 – 3,450 USD then the all-time high.

In the coming time, in terms of position and indicators, gold still has a technical outlook leaning more towards the upside and the notable points will be listed as follows.

Support: 3,310 – 3,300 – 3,292 USD

Resistance: 3,350 – 3,371 – 3,400 – 3,430 USD

SELL XAUUSD PRICE 3371 - 3369⚡️

↠↠ Stop Loss 3375

→Take Profit 1 3363

↨

→Take Profit 2 3357

BUY XAUUSD PRICE 3303 - 3305⚡️

↠↠ Stop Loss 3299

→Take Profit 1 3311

↨

→Take Profit 2 3317

GOLD Breakdown Setup | Clean Sell Targets Ahead!XAU/USD (Gold) Analysis – 2H Timeframe

After a clear rejection from higher levels, Gold has pulled back to retest the broken support zone around 3340–3350, which now acts as a resistance.

If the price sustains below this zone, we can expect a smooth move down toward clean liquidity areas below.

This is a textbook bearish continuation setup. 💥

🔻 Trade Idea – Short Setup:

• Sell Below: 3,340

• Target 1: 3,300

• Target 2: 3,280

• Stop Loss: 3,355 (above resistance zone)

🧠 Confluences:

• Bearish market structure

• Support zone retest

• Trend continuation

• High-impact USD news ahead (watch for volatility)

📅 Key Dates: July 30 – Aug 1

⚡ NY session could trigger the move!

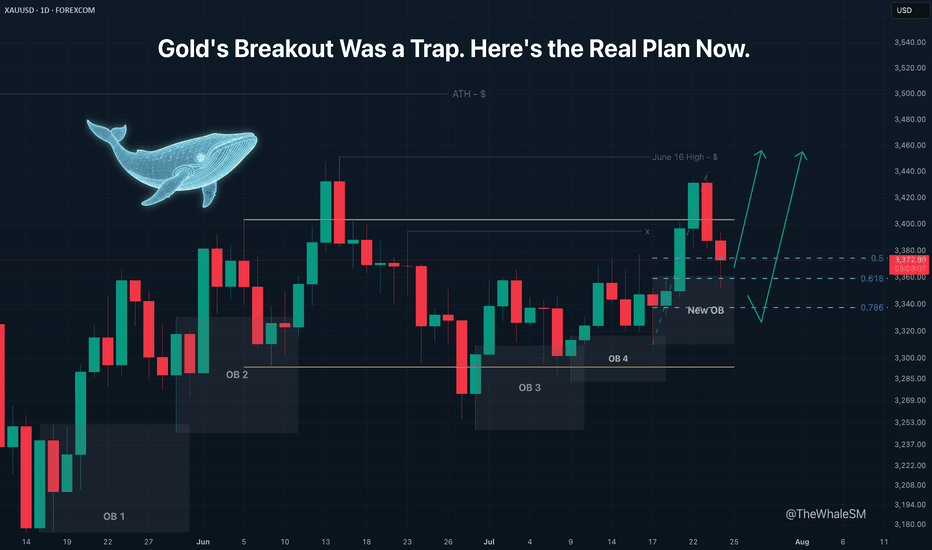

Gold's Breakout Was a Trap. Here's the Real Plan Now.Gold has made its next move, and it was quite sharp. I was expecting a smoother correction with a return to the manipulation zone, but Gold followed a different scenario, which I described at the end of my last gold analysis:

Gold has practically confirmed its breakout from the global range it has been in since the beginning of June. The only thing that could prevent this is a complete engulfing of the bullish daily candle that broke the upper boundary of the range by a bearish candle, but I consider this an unlikely scenario.

The closed red daily candle, which completely engulfed the preceding bullish one, showed that the move was, in fact, an internal liquidity sweep . The price has not yet managed to break out of the range. Therefore, when I wrote "Gold has practically confirmed its breakout from the global range" , the daily candle had not yet closed, and the price had not secured its position above the range's upper boundary.

Essentially, it's not important how the price arrives at a Point of Interest (POI) . What matters is what we have now: the price has mitigated a manipulation in the form of a new daily order block that was formed inside the range.

Although the middle of a range is a highly unpredictable area for price movement, and I almost never consider it for entries, in this case, there is a strong exception that allows us to consider longs from this order block. The reason for this exception is the bullish order flow on the daily structure, which I have mentioned several times, and the ascending daily structure within the range. This structure allows us to identify the start of the last impulse and draw Fibonacci retracement levels, which will serve as an additional condition for our potential long setup. We can now see that the price has reached the 61.8% Fib level and has shown a reversal reaction to it. To see more precisely if there is a potential entry point, let's switch to the 4H timeframe.

On the 4H chart, we see that the 61.8% level has held, and we can look for entry confirmation on a lower timeframe. The 4H timeframe also shows that the liquidity sweep created a supply zone , which will act as resistance on the path of the next attempt to break out of the range. Due to this zone, considering a long from the current position is not optimal because the risk-to-reward ratio is too small. Furthermore, the price could reject from this supply zone and continue its correction to the next level, the 78.6% Fib level . To find an entry with a more acceptable R:R, let's move to the lower timeframes.

Two Potential Long Scenarios

SCENARIO 1: Entry from the 15M Demand Zone or 15M OB

The 15M timeframe shows a break of the 15M structure and the formation of manipulations in the form of a demand zone and a 15M order block within it.

► Setup Condition: I will consider a long position upon the mitigation of one of these manipulation zones and a clear reversal reaction from it. If the price continues to move up from the current levels, I will not enter due to the large stop loss required and the suboptimal R:R to the nearest resistance.

► Invalidation: A break below these support zones on the lower timeframe will invalidate this scenario.

SCENARIO 2: Entry from the 78.6% Fib Level

This scenario becomes active if the first one fails.

► Setup Condition: If the price breaks the 15M supports, I will watch for its interaction with the 78.6% Fib level . For a potential entry, this level must hold, show a reversal reaction, and be followed by confirmation on a lower timeframe.

► Invalidation: A decisive close below the 78.6% Fib level.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

The principles and conditions for forming the manipulation zones I show in this trade idea are detailed in my educational publication, which was chosen by TradingView for the "Editor's Picks" category and received a huge amount of positive feedback from this wonderful, advanced TV community. To better understand the logic I've used here and the general principles of price movement in most markets from the perspective of institutional capital, I highly recommend checking out this guide if you haven't already. 👇

P.S. This is not a prediction of the exact price direction. It is a description of high-probability setups that become valid only if specific conditions are met when the price reaches the marked POI. If the conditions are not met, the setups are invalid. No setup has a 100% success rate, so if you decide to use this trade idea, always use a stop-loss and proper risk management. Trade smart.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

If you found this analysis helpful, support it with a Boost! 🚀

Have a question or your own view on this idea? Share it in the comments. 💬

► Follow me on TradingView to get real-time updates on THIS idea (entry, targets & live trade management) and not to miss my next detailed breakdown.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Mechanical vs. Anticipation Trades: The Fine LineWhen traders talk about discipline, they often refer to following rules — sticking to a plan, being methodical, and avoiding emotional decisions. But there's a subtle and powerful difference between being rule-based and being blindly mechanical. And even more, there's a moment in every trader’s process where discipline demands adaptation.

Let’s look at a recent trade on Gold to understand this better.

On Thursday, I published an analysis on Gold stating that the recent breakdown of support had turned that zone into resistance. A short entry from that level made sense.

It was mechanical, clean, and aligned with what the chart was showing at the time.

And, at first, it worked. Price rose into the resistance area and dropped. Perfect reaction. Textbook setup. Confirmation. The kind of trade you want to see when following a rule-based system.

But then something changed.

Price came back. Quickly.(I'm talking about initial 3315-3293 drop and the quick recover)

So, the very next rally pushed straight back into the same resistance area, hmmm...too simple, is the market giving us a second chance to sell?

That was the first sign that the market might not respect the previous structure anymore.

It dipped again after, but the second drop was different: slower, weaker, choppier.

That told me one thing: the selling pressure was fading.

So I shifted. From mechanical execution to anticipatory mindset.

This is where many traders struggle — not because they don’t have a system, but because they don’t know when to let go of it. Or worse: they abandon it too quickly without cause.

In this case, the evidence was building. The failed follow-through. The loss of momentum. The compression in structure. All signs that a reversal was brewing.

Rather than continuing to blindly short, referring to a zone that no longer held the same weight, I started looking for the opposite: an upside breakout and momentum acceleration.

That transition wasn’t based on emotion. It was based on market behavior.

________________________________________

Mechanical vs. Anticipation: What’s the Real Difference?

A mechanical trade is rule-based:

• If X happens, and Y confirms, then enter.

• No need for interpretation, no second guessing.

• It can (in theory) be automated.

An anticipatory trade is different:

• It’s about reading intent in price action before confirmation.

• Higher risk usually, but higher reward if you’re right.

• Can’t be automated. It requires presence, experience, and context.

And the tricky part? Often, we lie to ourselves. We say we’re "mechanical" while actually guessing. Or we think we’re being smart and intuitive, when in fact, we’re being impulsive.

The key is awareness.

In my Gold ideas, the initial short was mechanical. But the invalidation came quickly — and I was alert enough to switch gears. That shift is not a betrayal of discipline. It’s an upgrade of it.

________________________________________

Final Thoughts:

Discipline is not doing the same thing no matter what. Discipline is doing what the market requires you to do, without emotional distortion.

And that, often, means walking the fine line between the setup you planned for, and the reality that just showed up.

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

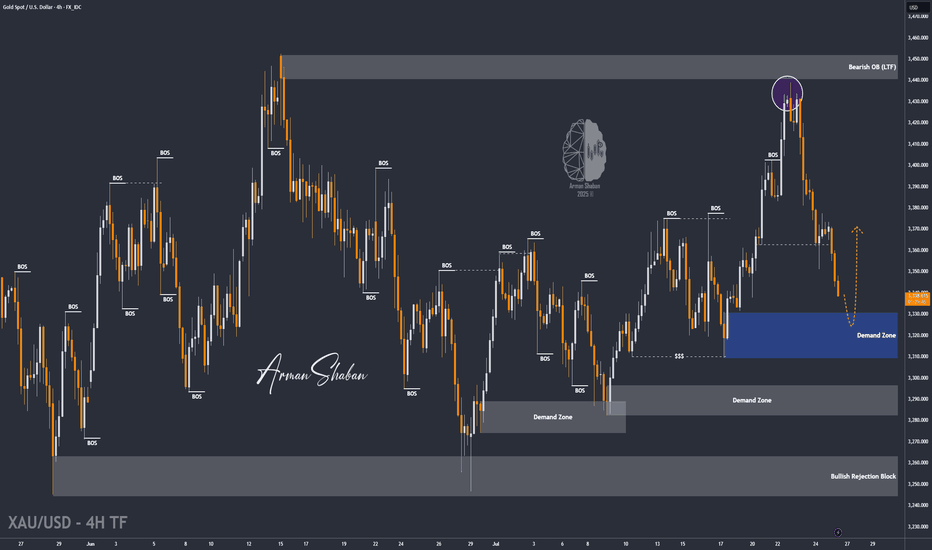

XAU/USD | Gold Holding Strong – Watching for Next Bullish Move!By analyzing the gold chart on the 4-hour timeframe, we can see that yesterday, as expected, when the price dropped to around $3357, it faced strong buying pressure and rallied up to $3377. After that, it corrected again, pulling back to $3338 so far, and is currently trading around $3341. If gold manages to hold above $3337, we can expect another bullish move, with potential targets at $3347, $3354, $3364, and $3374.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

GOLD (XAUUSD): Bearish Continuation Ahead?!

Gold retested a recently broken significant liquidity cluster.

I see a clear sign of strength of the sellers after its test

with multiple intraday confirmation.

I think that the price will retrace to day to 3276 level.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Follow master candle for today's SELL strategy✏️ OANDA:XAUUSD has continued a strong downtrend. Yesterday's D1 candle closed with a 60-price decrease, forming a master candle that determines the market trend. With the market having a master candle, pay attention to the 25% or 50% candle zones to trade in the direction of the trend. Today's main trading strategy will be to SELL according to the master candle. The BUY strategy will only be implemented when the 3313 zone is broken.

📉 Key Levels

Support: 3285-3270-3250

Resistance: 3301-3312-3333

SELL Trigger. Rejection 3301, 3312

Target 3250

Leave your comments on the idea. I am happy to read your views.

XAUUSD-3336.40 — a key level bulls want to defend.Why Gold Pulled Back

- Gold pulled back today after hitting $3439.04, just below resistance at $3451.53. Traders took profits ahead of key Fed and trade headlines. Right now, it’s trading around $3414.48, down 0.50%.

- The dip came after the U.S.-Japan trade deal eased geopolitical tension, cutting safe-haven demand. Plus, U.S. bond yields are climbing (10-year at 4.384%), which adds pressure on gold.

Support is building at $3374.42, with stronger buying interest expected around $3347.97 and the 50-day moving average at $3336.40 — a key level bulls want to defend.

Short-term looks a bit weak, but as long as gold holds above the 50-day MA, the bullish trend remains intact. Longer-term, weakness in the dollar, central bank gold buying, and concerns about Fed independence could push prices higher.

Watching the Fed’s July 29–30 meeting next

Gold keeps falling – is there more to come?Hello everyone, great to see you again!

Today, gold remains under pressure following a series of strong U.S. economic data releases, which have reinforced expectations that the Federal Reserve will keep interest rates elevated for longer. As a result, the U.S. dollar has strengthened, Treasury yields have climbed, and gold has lost its footing.

On the H1 chart, XAUUSD is clearly trading within a descending price channel. Both the EMA 34 and EMA 89 are acting as dynamic resistance zones. Recent attempts to rally have consistently failed at these levels, mirroring the bearish setup seen before July 29.

Currently, price is retesting a minor resistance area. If this retest fails, the next downside targets lie near 3,270 – and potentially down to 3,230 USD, which aligns with the lower boundary of the price channel.

From my perspective, the bearish momentum is likely to continue.

What about you? How do you think gold will close the day?

My first take on XAUUSDI see this last fall as a very clear sweep of liquidity (the recent lows. After that i see an impulsive push away from this zone giving me a change of character. Left behind is an FVG on hopurly chart that aligns within the kill zone on my Fibonacci tool. and that is where i would enter. I would expect price to mitigate this FVG. Another confluence is that we created many IFVG's on the way up showing balanced price action. Only one more confluence i would have liked is a HTF order block from the liquidity sweep but only have one on the 5 minute. i will monitor. First tp is that internal liquidity from the move, second tp is the external liquidity where we have had consolidation and a few failed attempts to break above this opening gap fvg. thanks for looking. any comments welcome,

Gold will rebound from support line of triangle and rise to 3430Hello traders, I want share with you my opinion about Gold. Following a sequence of significant upward trends and the subsequent downward corrections that defined its range, gold has entered a broad market zone of consolidation. This battleground is clearly anchored by the historically significant buyer zone around 3285 and a formidable seller zone near 3430. Currently, the asset's price action is coiling and contracting within the confines of a large symmetrical triangle, a classic pattern that signifies a period of equilibrium and energy build-up before a potential high-volatility breakout. After a recent upward rebound was decisively rejected by the upper resistance line, the price is now in a corrective descent, heading towards the crucial ascending support line of the triangle. The primary working hypothesis is a long scenario, which is based on the expectation that this downward move will find strong buying interest on this key trendline, respecting the pattern's integrity. A confirmed and strong bounce from this level would signal another complete upward rotation within the triangle is underway. Therefore, the tp is logically and strategically set at the 3430 resistance level, as it not only aligns with the formation's upper boundary but also represents the major seller zone, a natural magnet for price on such a rebound. Please share this idea with your friends and click Boost 🚀

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

XAUUSD SNIPER OUTLOOK – JULY 28, 2025🔥 Macro & Sentiment

The dollar remains dominant — DXY holding above 105 keeps gold under pressure. No fundamental support for bullish continuation unless major macro shifts. Risk flows are defensive, not aggressive. FOMC and US GDP data remain key drivers for direction this week.

BIAS:

• Short-term bearish under 3350

• Market still in distribution mode — every bounce gets sold

• Real buy interest only deep below 3315

🔻 INTRADAY SUPPLY ZONES (Short Only With Rejection)

1. 3382–3370 (H1/M30 Premium Supply)

🔹 H1 order block, FVG alignment, EMA21/50/100 convergence

🔹 Liquidity inducement above → then rejection

📍 Short only if rejection shows via engulf / upper wick.

2. 3355–3340 (Decision Zone / Micro Supply)

🔹 EMA100/200 alignment, former support flipped resistance

🔹 M30 FVG fully filled, structure flip from mid-July

📍 Short bias below. Long only if reclaimed with H1 close above 3355.

🔵 NEUTRAL / PIVOT ZONE

3. 3338–3326 (Decision Band – M30/M15)

🔹 Consolidation area post-BOS, internal liquidity sweeps

🔹 EMA21 base on M15, no clear dominance

📍 Wait for clean reaction. Bullish engulf = scalp long to 3355. Failure = slide to demand.

🟢 DEMAND ZONES (Buy Only On Strong Reversal Confirmation)

4. 3314–3302 (M30/M15 Deep Demand)

🔹 H1 OB + hidden FVG + fib 38.2%

🔹 First real demand zone where buyers may engage

📍 Long only if strong M15 confirmation: engulf + RSI cross + EMA5/21 angle change.

5. 3289–3272 (True Reversal Demand – H1/M30)

🔹 Full NY reversal origin (July 18), major FVG left unfilled

🔹 Institutional volume + liquidity grab zone

📍 Buy only on full flush + fast snapback with BOS on M15/H1.

🧭 BIAS & EXECUTION BY TIMEFRAME

H4 Bias:

Bearish while below 3350. No valid supply above until 3370+. Avoid longs unless price sweeps 3314 or 3272 and confirms.

H1 Bias:

Sell clean rejection at 3355 or 3370–3382. Only flip long above 3355 with full-bodied close.

M30 Bias:

Watch decision zone 3338–3326 for direction. No-man’s land in between — don’t force trades.

M15 Bias:

Scalp long from 3314 or 3272 only on full confluence (OB + RSI + EMA realignment). Short only confirmed rejections above.

📊 FULL INTRADAY KEY LEVELS (Top → Bottom)

Level Context

3405 Fib ext. 127% (HTF sweep target only)

3385 OB

3375–3350 Valid Premium Supply (H1 shelf)

3350–3340 Micro Supply / Flip Zone

3338–3326 Decision Zone – watch reaction

3314–3302 Deep Demand (H1/M30 confluence)

3289–3272 Extreme Demand Base

3260 Fib 61.8% + HTF support

3250 Minor volume node

3240 Final structural floor

✅ EXECUTION NOTES

⛔ Avoid entering inside 3340–3326 → fakeout zone

✅ Play only clean sniper triggers with structure

⚠️ Wait for macro — FOMC / GDP releases may fake both sides

💡 Patience wins. Pick your zone, wait for setup, strike.

Which zone are you watching to strike? Drop your bias below.

📍 Like, comment & follow GoldFxMinds for the most precise sniper maps on TradingView.

Disclosure: This plan is based on the Trade Nation chart feed. I am part of their Influencer Program.