XAUUSDG trade ideas

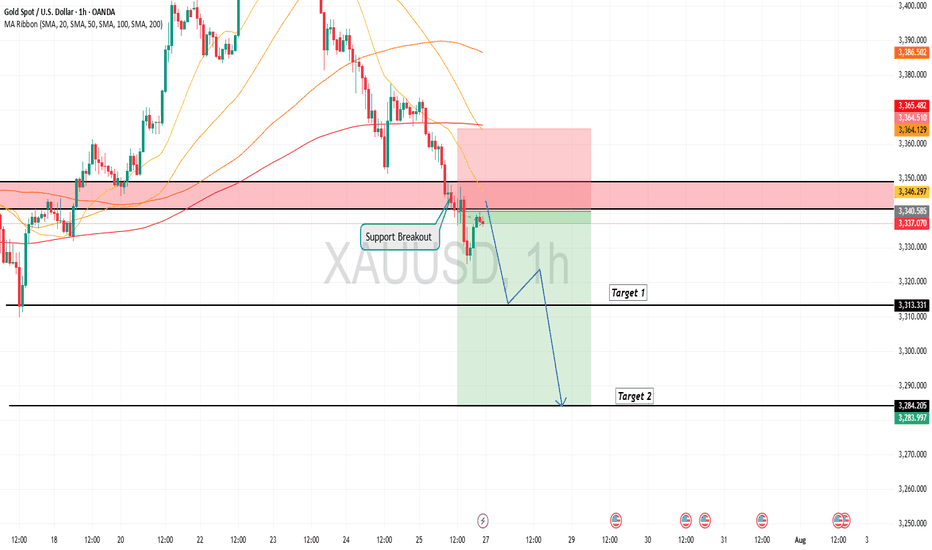

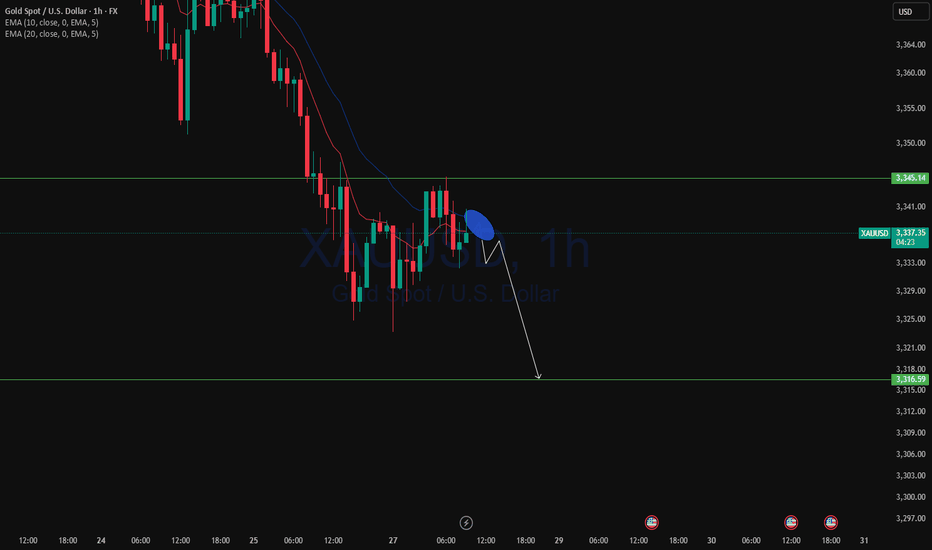

Gold is in the Bearish Direction after Breaking SupportHello Traders

In This Chart GOLD HOURLY Forex Forecast By FOREX PLANET

today Gold analysis 👆

🟢This Chart includes_ (GOLD market update)

🟢What is The Next Opportunity on GOLD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

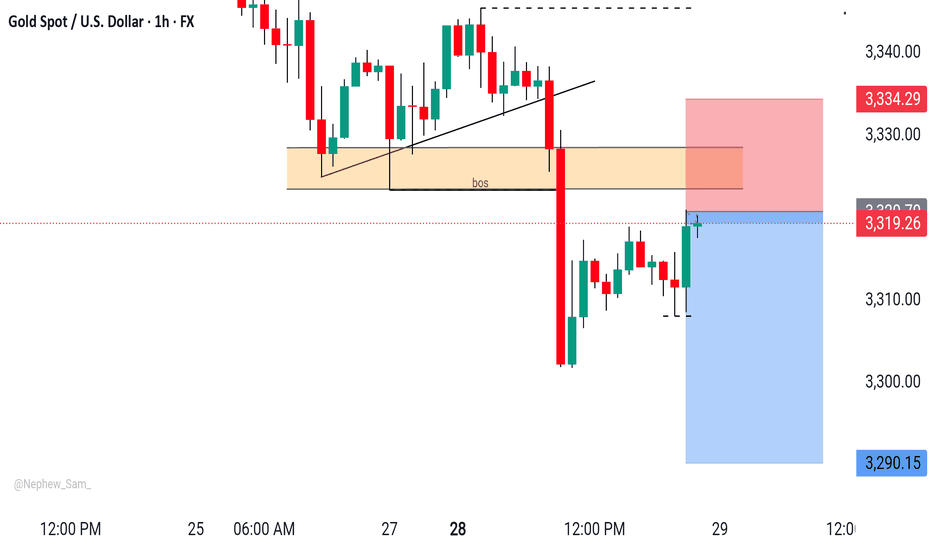

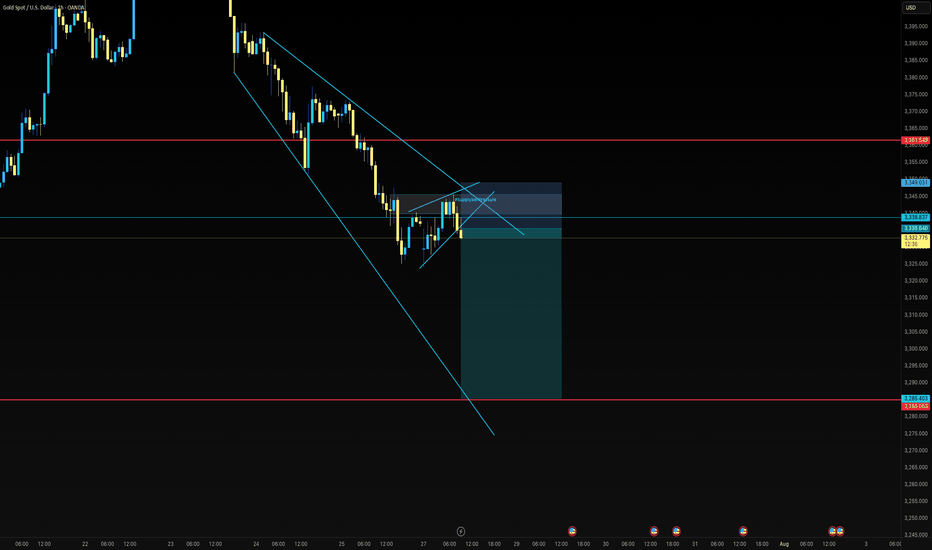

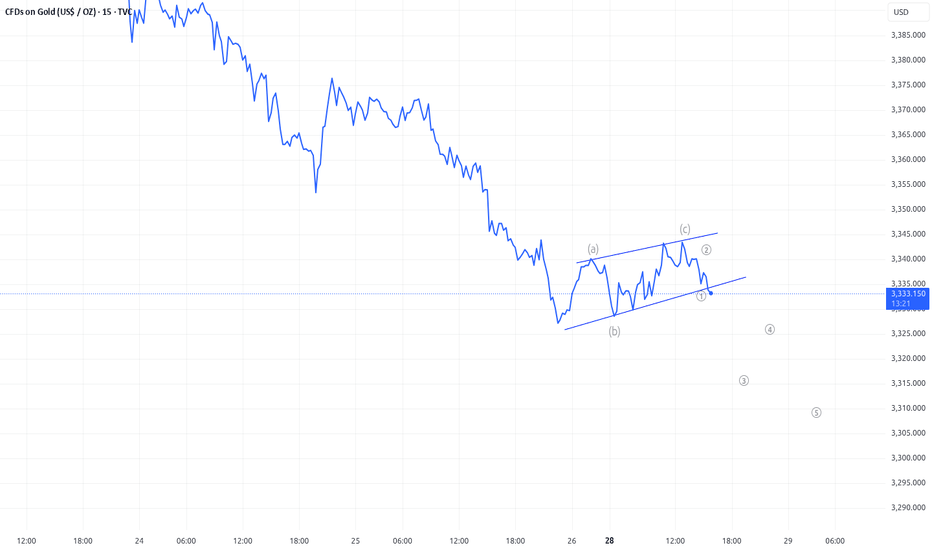

Elliott Wave Analysis – XAUUSD – July 28, 2025📊

________________________________________

🔍 Momentum Analysis:

• D1 Timeframe: Momentum has entered the oversold zone. This strongly suggests a potential bullish reversal today, which could lead to a rally or sideways movement lasting around 4–5 days.

• H4 Timeframe: Momentum is reversing upward. This indicates a likely bullish or sideways move in the short term, at least until momentum reaches the overbought zone (estimated within the next 2 H4 candles).

• H1 Timeframe: Momentum is currently overbought, so we may first see a pullback or sideways movement until a clearer reversal signal appears.

________________________________________

🌀 Wave Structure Analysis:

• On the H4 chart, as noted in previous plans, the assumption that price is forming a contracting triangle (abcde) is still valid. Price is currently in the final leg (wave e) of this triangle.

• On the H1 chart, we can observe a channel structure, within which an abc corrective pattern is unfolding.

• The lower boundary of the triangle (marked by the green trendline) combined with support zones will be critical areas to monitor for the end of wave e.

🔺 Note: Wave e does not necessarily end precisely at the triangle boundary – it can slightly overshoot. Hence, we’ll rely on smaller wave structures to identify potential reversal zones.

________________________________________

🎯 Key Price Zones to Watch:

• Target 1: 3329

• Target 2: 3309

• Target 3: 3290

________________________________________

🔎 Lower Timeframe Structure (M10):

From the current price action (as shown in the chart), we can see a leading diagonal triangle structure forming. This is a pattern commonly seen in wave 1. If this pattern is confirmed, a sharp and steep decline toward the 3329 zone is likely.

________________________________________

⚖️ Combining Momentum & Wave Structure:

• D1: Signals a potential reversal → favors Buy setups.

• H4: Momentum is rising, but price hasn’t confirmed a new bullish trend → need to stay alert and tighten Stop Loss.

• H1: Overbought + possible leading diagonal → Expecting a pullback for wave 2 toward 3329 → this would be the optimal Buy zone.

________________________________________

🧭 Trade Plan:

• For experienced traders:

→ Wait for price to reach key levels and watch for reversal signals before entering.

• For beginners:

→ Use the following Limit Buy setup:

✅ Setup 1:

• Buy zone: 3330 – 3328

• Stop Loss: 3320

• TP1: 3351

• TP2: 3370

• TP3: 3385

✅ Setup 2:

• Buy zone: 3310 – 3308

• Stop Loss: 3300

• TP1: 3328

• TP2: 3351

• TP3: 3370

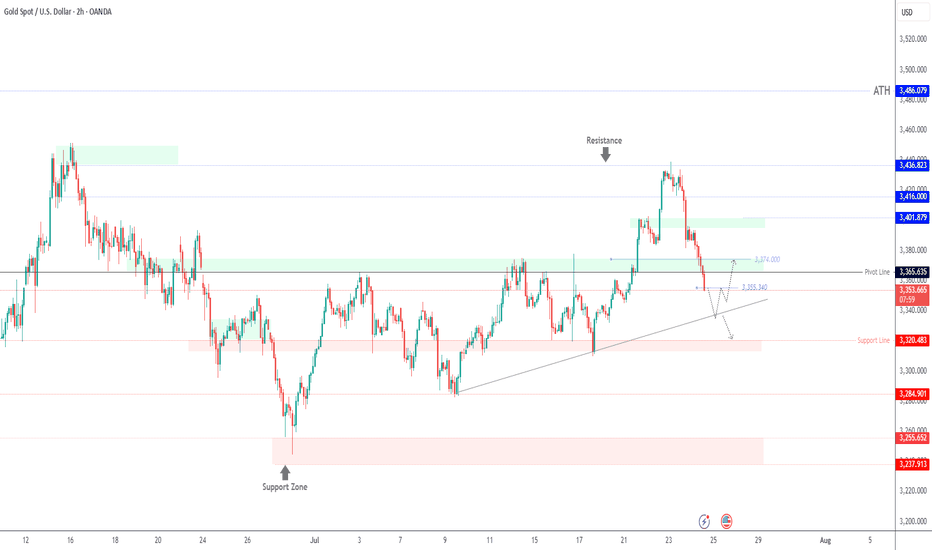

GOLD Analysis : XAUUSD Major Bullish Demand Zone🧠 Market Structure Context (MMC Framework)

Gold has recently shown a clean structural decline from its local highs within a well-defined ascending channel. This analysis highlights a reaction zone-based playbook, focusing on high-probability reversal scenarios guided by institutional footprints, volume reaction points, and MMC logic.

We’re currently trading near a previous reversal zone, where history tells us the market tends to shift behavior. Let’s dissect the key components.

📊 Key Technical Components

🔸 1. Ascending Channel Breakdown

The entire uptrend was respecting a well-established bullish channel until the recent drop violated the midline structure. This breakdown confirms a temporary bearish phase, with price breaking cleanly below a QFL base (Quick Flip Level)—a level where price reversed sharply before, which now acts as a major supply zone.

Psychological Insight: Channels give clues about momentum. Breaking below the lower band shows the market is preparing for a retest or a deeper liquidity hunt.

QFL Breakdown: Once broken, previous buyer confidence is shaken—inviting sellers to test demand zones.

🔸 2. Previous Reversal Zone (PRZ) Reaction

Currently, price is hovering inside the blue shaded Previous Reversal Zone, where bullish pressure previously kicked in. It’s a minor demand zone, but critical due to historical reaction. The projected structure shows a bounce from this area before deciding next direction.

MMC Insight: The first test of PRZ often leads to an initial reaction. But deeper liquidity lies just below in the major green demand zone.

🔸 3. Major Demand Zone + Volume Burst Area (The Real Magnet)

Below the PRZ lies the major reversal block—highlighted in green. This zone is significant because:

It aligns with a high-volume burst in the past, confirming institutional orders.

It's a cleaner structure level for smart money re-entry.

It also provides room for the “liquidity sweep” (stop hunt), collecting sell stops before a proper reversal.

💡 Expected Play: Price may fake out below PRZ, enter the major demand, and then initiate a multiple-leg bullish rally. Patience is key here.

🛠️ Trade Structure Outlook

✅ Scenario 1 – Aggressive Buyers (Marked "1"):

Buy from the current PRZ zone around $3,305–$3,315

Target: $3,340 (Minor Resistance)

Risk: Slippage into deeper demand zone

Stop-loss: Below $3,295

✅ Scenario 2 – Safer Entry from Major Demand (Marked "2"):

Let price dip into $3,270–$3,280 zone (green box)

Look for reversal candles or liquidity sweeps on lower timeframes

TP1: $3,330

TP2: $3,365 (Major Resistance)

📈 Resistance Levels to Watch:

Minor Resistance: $3,340 – Expect short-term pullbacks or hesitation.

Major Resistance: $3,365 – Key target for swing traders and potential reversal zone.

🔍 MMC Concepts in Action

✅ Channel Logic: Breakdown implies momentum shift—watch for retests.

✅ QFL: Previous bounce zone broken = supply now overhead.

✅ Volume Burst Zone: Strong historical reaction = institutional interest.

✅ Zone-to-Zone Trading: Instead of random entries, focus on logical zone interactions.

🧭 Conclusion – Path of Probability

Gold is currently in a transitional phase—shifting from bearish correction to potential bullish revival. Patience will reward those who wait for PRZ rejections or deeper liquidity taps. The MMC framework helps frame this market not as chaos, but a map of strategic reaction points.

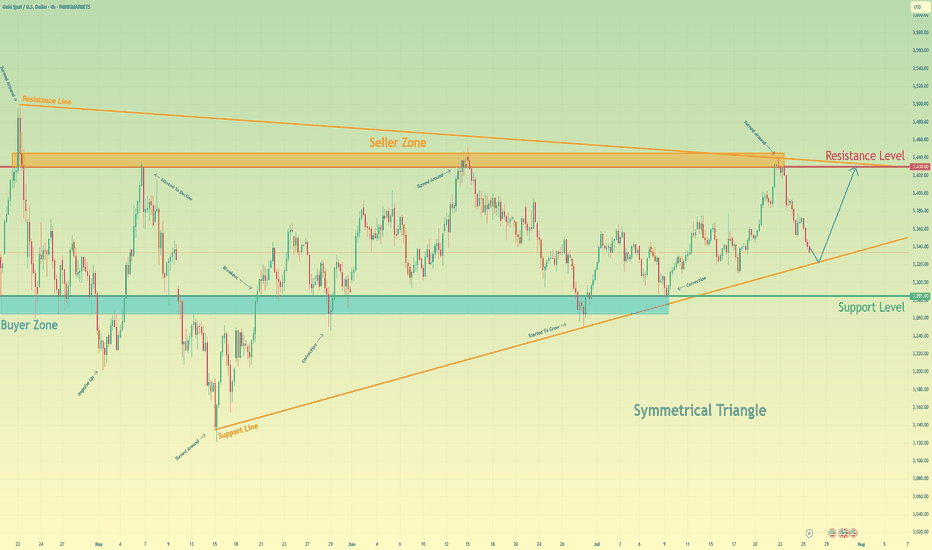

Gold will rebound from support line of triangle and rise to 3430Hello traders, I want share with you my opinion about Gold. Following a sequence of significant upward trends and the subsequent downward corrections that defined its range, gold has entered a broad market zone of consolidation. This battleground is clearly anchored by the historically significant buyer zone around 3285 and a formidable seller zone near 3430. Currently, the asset's price action is coiling and contracting within the confines of a large symmetrical triangle, a classic pattern that signifies a period of equilibrium and energy build-up before a potential high-volatility breakout. After a recent upward rebound was decisively rejected by the upper resistance line, the price is now in a corrective descent, heading towards the crucial ascending support line of the triangle. The primary working hypothesis is a long scenario, which is based on the expectation that this downward move will find strong buying interest on this key trendline, respecting the pattern's integrity. A confirmed and strong bounce from this level would signal another complete upward rotation within the triangle is underway. Therefore, the tp is logically and strategically set at the 3430 resistance level, as it not only aligns with the formation's upper boundary but also represents the major seller zone, a natural magnet for price on such a rebound. Please share this idea with your friends and click Boost 🚀

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

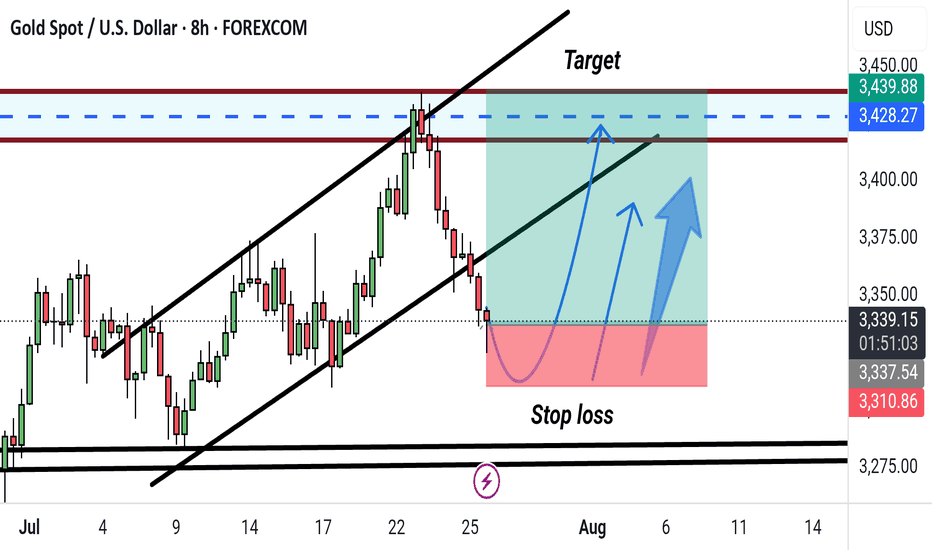

Gold 8H Bullish Reversal Setup After Channel Break. Gold/USD 8H Chart Analysis:

Price has broken below an ascending channel, indicating potential short-term weakness. However, a bullish reversal setup is marked, with a suggested buy zone near current levels (~3339), targeting the 3428–3459 USD range. Stop loss placed below 3310 for risk management.

Gold: This Week's Analysis & StrategyThis week, the fluctuations have clearly moderated📉. Focus on a strategy of buying at lows and selling at highs as much as possible📈. Currently, the resistance around 3350 is prominent🚧, and 3300 acts as support below🛡️. If the decline continues, it may reach around 3285👇

We successfully took short positions last week 📉, and this week I recommend going long at lower levels 📈. Over the long term, gold remains in a bull market 🐂, but it will not repeat the frenzy seen in April; instead, it will maintain a steady upward pace ⬆️.

Market expectations for Fed rate cuts have been volatile so far this year 📊. At the start of the year, as Trump-related developments unfolded, market optimism faded 😐. Meanwhile, the de-dollarization trend fueled growing expectations of Fed rate cuts 💹. By early April, Trump’s reciprocal tariff measures—far more aggressive than expected—roiled global financial markets 🌍, triggering a surge in concerns about a U.S. recession ⚠️. Markets thus anticipated that the Fed would cut rates quickly to shore up the economy, with expectations for rate cuts within the year once exceeding 100 basis points 📉. However, shortly after, Trump announced a 90-day extension of the reciprocal tariffs, easing market pessimism 😌 and driving a strong rebound in U.S. stocks 📈. At this point, markets began worrying that his tariff policies could spark an inflation rebound 🔥, leading to a steady decline in rate cut expectations—currently, expectations for rate cuts this year have dropped to fewer than two 🔄.

Risk Warning ⚠️

Event Sensitivity: Outcomes of China-U.S. trade talks 🤝, the Fed’s statements , and nonfarm payroll data 📊 may trigger one-sided volatility. Positions should be adjusted promptly to avoid risks 🛡️

⚡️⚡️⚡️ XAUUSD ⚡️⚡️⚡️

🚀 Buy@ 3300 -3310

🚀 TP 3320 - 3330 - 3340

🚀 Sell@ 3350 -3340

🚀 TP 3330 - 3320 - 3310

Daily updates bring you precise trading signals 📊 When you hit a snag in trading, these signals stand as your trustworthy compass 🧭 Don’t hesitate to take a look—sincerely hoping they’ll be a huge help to you 🌟 👇

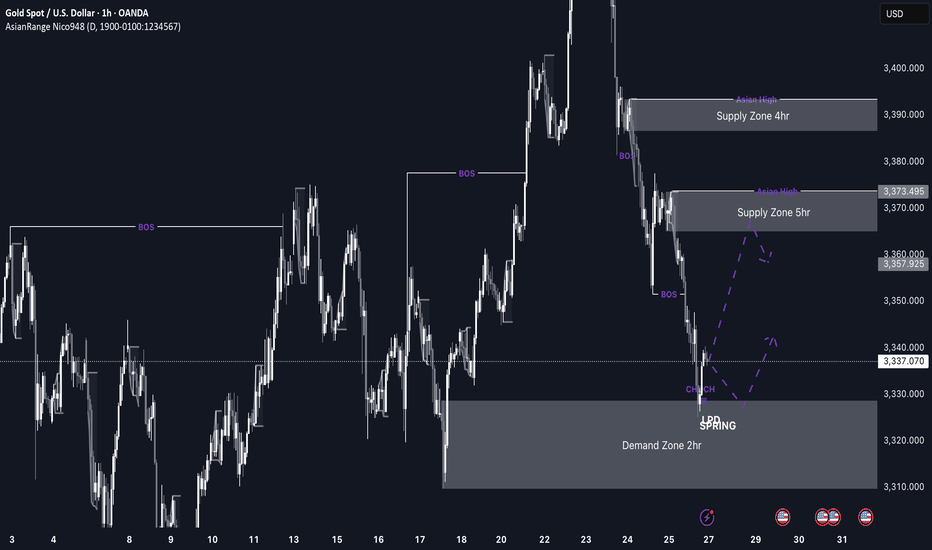

GOLD imminent possible buys up to 3,370 This week’s price action on GOLD is shaping up to be very interesting. After weeks of sustained bearish pressure, price has now entered a discounted 2hr demand zone sitting at a swing low, which makes it a high-probability area for a bullish reaction, especially as markets open.

If we do get the expected bullish reaction from this level, I’ll be watching the 3,370 region, where there’s a clean 5hr supply zone. If price reaches that level, I’ll be looking out for distribution and a potential short setup from there.

Confluences for GOLD Longs:

Price has been very bearish recently, so a retracement is expected

Currently sitting in a discounted 2hr demand zone

The overall long-term trend is still bullish

Early signs of accumulation and bullish reaction from this zone

P.S. If price fails to hold this current demand zone and breaks lower, then bearish momentum may continue. In that case, I’ll look for new long opportunities around 3,290 where a deeper demand zone exists.

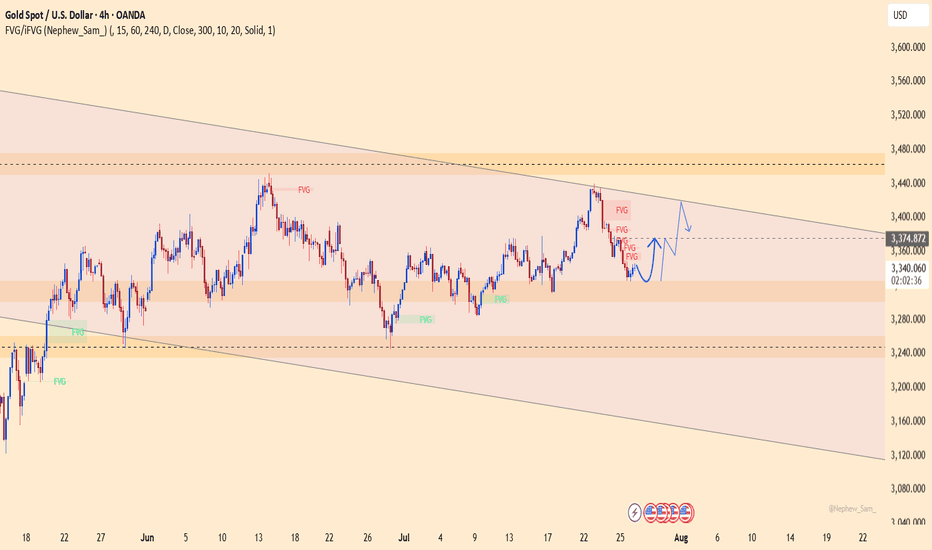

XAUUSD – Technical rebound, but downside risks remainOn the H4 chart, gold is bouncing slightly from the 3,323 support zone after a sharp drop. However, price remains within a large descending channel and is approaching a dense cluster of bearish FVGs around 3,360–3,374.

News context:

– US GDP and ADP data beat expectations, boosting the USD and adding pressure on gold.

– JOLTS dipped but remains above 7 million → limited support for gold.

– Thailand–Cambodia conflict provides only short-term impact.

Strategy: Favor SELL if price retests 3,360–3,374 and gets rejected. Downside targets: 3,323 or lower.

Main trend remains bearish, unless gold breaks above the descending channel.

XAUUSD approaches a strong buy zoneGold is approaching a strong buy area. Aggressive traders set pending orders whereas cautious ones wait for some confirmation signals in the range of such zones. I expect buyers to push price back up for atleast half day today Follow risk management to enjoy your trading journey.

Target1 3374

Analysis and strategy of gold market on July 28:

Core influencing factors

Risk aversion cools down: Despite frequent geopolitical risk events, market panic has not significantly increased, weakening gold safe-haven buying.

US dollar strengthens: US economic data supports the continuous rise of the US dollar, and funds flow back to US dollar assets, suppressing the attractiveness of gold.

ETF holdings outflow: Short-term risk appetite has rebounded, and gold ETFs have seen a slight outflow of funds, reflecting the cautious attitude of the market.

Key events focus:

US-EU and US-China trade negotiations: If progress is optimistic, gold prices may fall to the $3,300/ounce mark.

Federal Reserve resolution: Pay attention to policy independence (affected by Trump's pressure) and interest rate guidance.

Non-farm data: Released on Friday, if the employment data is strong, it may strengthen the US dollar to further suppress gold.

Key technical points

Weekly level:

Watershed $3,325: If it is held, it will maintain high-level fluctuations, and if it is lost, it will open up downward space.

Support area: If the daily support is broken, the weekly support may be tested (reference 3300-3310).

Daily level:

Key support: The current daily support is facing the risk of breaking down, and we need to be alert to the acceleration of short positions.

4-hour level:

Resistance 3388 US dollars (middle track): Before the rebound is not broken, the short-term is short.

Weak signal: The price continues to run below 3363, and the rebound is weak.

Hourly chart:

Strong and weak boundary 3363 US dollars: Maintain weakness before breaking, and avoid bottom-fishing against the trend in the negative market.

Operation strategy suggestions

Short-term direction: Short-selling on rebound is the main, supplemented by light-weight buying at key support levels.

Short-term selling opportunities:

Ideal entry: 3370-3375 area (below the 4-hour middle track), stop loss above 3380.

Target: 3320-3310, if it breaks down, look at 3300.

Opportunities to buy long orders in the short term:

Participate cautiously: If the support of 3320-3310 stabilizes, combine the K-line signal to hold a light long position, and stop loss below 3300.

Quick in and out: You can exit the market when it rebounds to 3340-3350.

Risk warning:

Before the Fed’s decision: Avoid heavy positions, and be wary of unexpected hawkish policies that cause volatility.

Non-agricultural data: If the data exceeds expectations, it will be bearish for gold.

Summary: Gold is short-term technically bearish, but be wary of event-driven reversals. Trading requires strict stop losses and flexible response to data and policy risks.

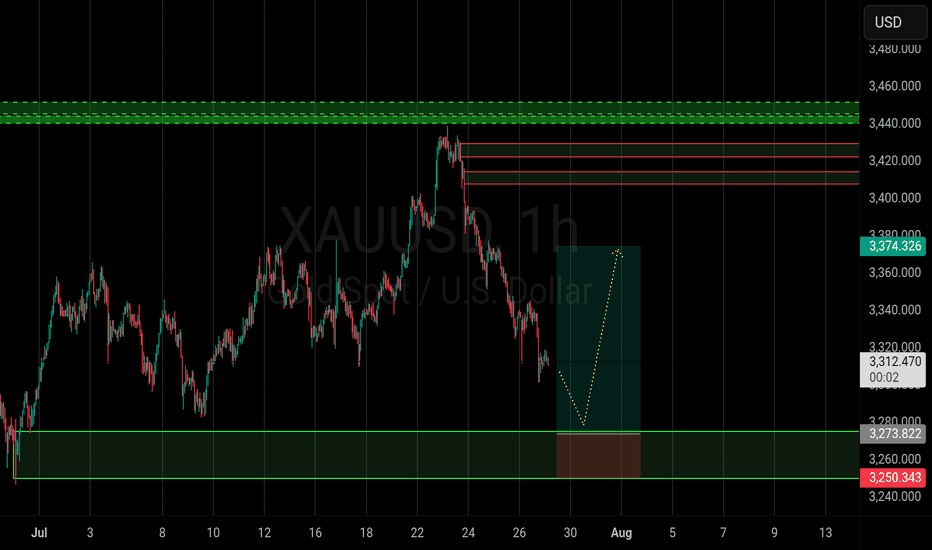

GOLD Drops $60 – Bearish Bias Holds Below 3365GOLD | OVERVIEW

As expected, gold continued its bearish momentum, dropping from the 3430 level and delivering a move of approximately $60.

For today, the bearish bias remains valid as long as the price stays below 3365, with potential targets at 3337 and 3320.

However, if the price reverses and stabilizes above 3365, it could signal a shift to bullish momentum.

Key Levels:

Support: 3355 · 3337 · 3320

Resistance: 3374 · 3388

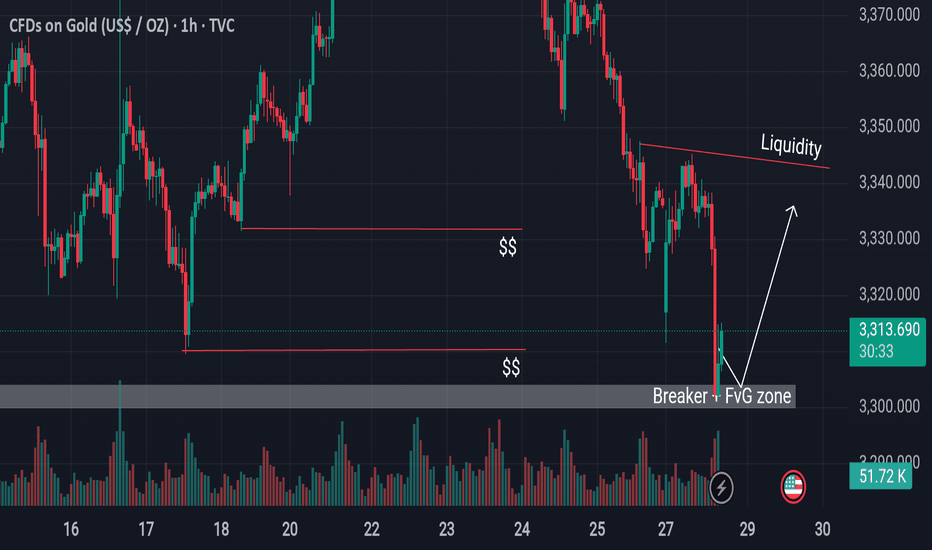

Institutional Footprint Detected Gold Hits FVG + Breaker Block.GOLD has now entered a significant confluence zone, aligning with both a bullish Fair Value Gap (FVG) and a breaker block areas commonly respected by institutional algorithms. In the process, it has also swept sell-side liquidity resting below recent lows, which often serves as fuel for a reversal. This combination of technical factors suggests a high-probability scenario for a bullish bounce from this region.

Traders should closely monitor price behavior around the marked Equal Relative Liquidity (ERL) zone for additional confirmation before executing any trades.

Always conduct your own analysis (DYOR) and manage risk accordingly.

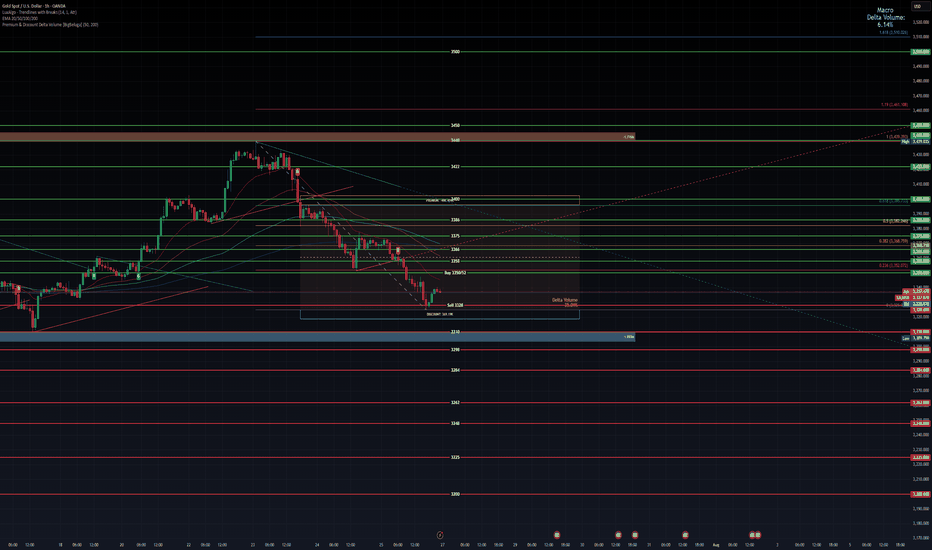

Gold weekly chart with both buy and sell entriesAnalysis of the Buy Entry: 2350/52

This level has been chosen as a potential long entry point due to a confluence of several technical factors.

Smart Money Concepts (SMC) - Discount Zone: The chart has a "Premium - Discount" range drawn over the recent downward price leg. The equilibrium (EQ) level is marked in the middle. According to SMC principles, traders look to buy assets at a "discount" (below the 50% EQ level) and sell at a "premium" (above the EQ level). Your buy entry at 2350/52 is located deep within the discount zone, making it an attractive price from this perspective.

Key Horizontal Support Level: The 2350 price is a significant psychological and technical level. Looking to the left of the chart, this area has previously acted as both support and resistance. By placing a buy order here, you are anticipating that this historical support level will hold again and cause price to bounce.

Potential Mean Reversion: At the point of entry, the price is significantly extended below the moving averages (the thin red, orange, and green lines). This can sometimes indicate an "oversold" condition in the short term, increasing the probability of a corrective bounce back up towards the moving averages (the "mean").

In summary, the buy entry is a calculated risk, betting on a bounce from a confluence of a deep discount price, a strong historical support level, and an oversold condition.

Analysis of the Sell Level: 2328

This level is critically important and likely serves two potential purposes: as a stop-loss for the buy trade, or as a trigger for a new short (sell) position.

Breakdown of Major Support: The chart highlights a significant support zone (the thick blue/grey box) roughly between 2330 and 2334. Your sell level at 2328 is placed just below this entire support structure and also below the most recent swing low. A price break below 2328 would signify a failure of this support, confirming that sellers are still in firm control.

Confirmation of Bearish Trend Continuation: In a downtrend, the price makes a series of lower highs and lower lows. A move down to 2328 would create a new lower low, reinforcing the bearish market structure and suggesting that the price is likely to continue much lower. This makes it an ideal place to exit a long position (cut losses) or to initiate a new short position to follow the dominant trend.

Order Flow and Volume Clues:

The note "Delta Volume?" next to this level suggests you are looking for confirmation from order flow data. A strong negative delta (more aggressive sellers than buyers) as the price breaks 2328 would provide strong confirmation for a short trade.

The label "LVN 2334.86" indicates a Low-Volume Node from a volume profile analysis. Price tends to move very quickly through these areas of low liquidity. By placing the sell level below the LVN and the support zone, you are anticipating an acceleration or a "flush" downwards once these key levels are breached.

In summary, the 2328 level is the invalidation point for the bullish "bounce" idea. If the price reaches this level, the reasons for buying are no longer valid, and the evidence strongly points towards a continuation of the downtrend.

Overall Strategy

The plan is to:

Enter a counter-trend long at 2350/52, anticipating a bounce from a strong support and discount zone.

Define risk by placing a stop-loss just below the key support structure at 2328.

Potentially use the 2328 level as a trigger to close the long and open a new short position to trade with the dominant bearish trend if the support level fails.

Gold short-term rise waiting for breakthrough

💡Message Strategy

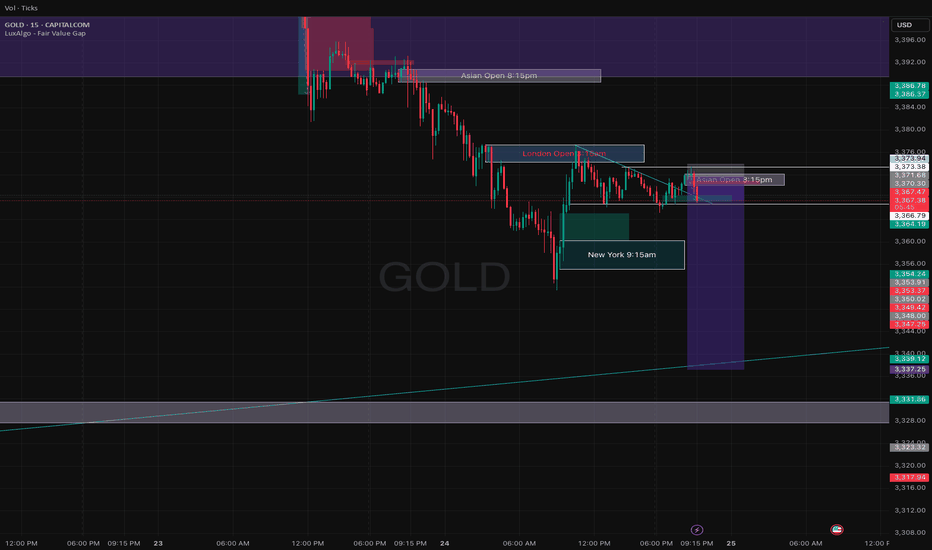

During the Asian trading session, gold prices rebounded slightly from $3,320, filling the short gap at the start of the new week. As investors chose to stay on the sidelines before the Fed's two-day monetary policy meeting, the bullish force of the US dollar temporarily weakened, providing support for gold, an interest-free asset.

However, with the 15% tariff agreement between the United States and Europe and the positive progress of trade easing between the United States, Japan and the United States, market risk appetite has rebounded, weakening the appeal of gold as a safe-haven asset.

According to market surveys, "The current optimistic atmosphere of trade has weakened the safe-haven demand for gold, while the weakening of the US dollar has provided support for gold prices. The two forces offset each other, causing gold to fluctuate."

Investors are focusing on the FOMC meeting to be held on Tuesday. Although Trump continues to pressure the Fed to cut interest rates, the market generally expects that the interest rate will remain unchanged at this meeting because the US labor market remains strong.

In addition to the interest rate decision, this week will also usher in the US second quarter GDP estimate, PCE price index and non-farm payrolls report, all of which may have a significant impact on gold.

📊Technical aspects

From the technical trend, gold triggered a rapid correction after breaking below the lower edge of the short-term rising channel and the 50% Fibonacci retracement level last week. The current gold price stabilized in the $3,320 area and received some buying at the 61.8% Fibonacci support.

However, it is worth noting that the 200-period moving average on the 4-hour chart is at $3,350, which constitutes an important technical resistance for a short-term rebound. On the contrary, if gold breaks through the $3,350 level, gold will continue to develop a bullish pattern.

From the technical trend, gold triggered a rapid correction after falling below the lower edge of the short-term rising channel and the 50% Fibonacci retracement level last week. The current gold price stabilized in the $3,320 area and received some buying at the 61.8% Fibonacci support.

However, it is worth noting that the 200-period moving average on the 4-hour chart is at $3,350, which constitutes an important technical resistance for a short-term rebound.

On the contrary, if gold breaks through the $3,350 line, it will be expected to attack the $3,371-3,373 area in the short term, and further look to the key pressure levels of $3,400 and $3,440.

💰Strategy Package

Long Position:3320-3325,SL:3300,Target: 3350

XAUUSD and AUDUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

XAUUSD REBOUNDED FROM CURRENT TRENDLINE. WHAT'S NEXT?XAUUSD REBOUNDED FROM CURRENT TRENDLINE. WHAT'S NEXT?

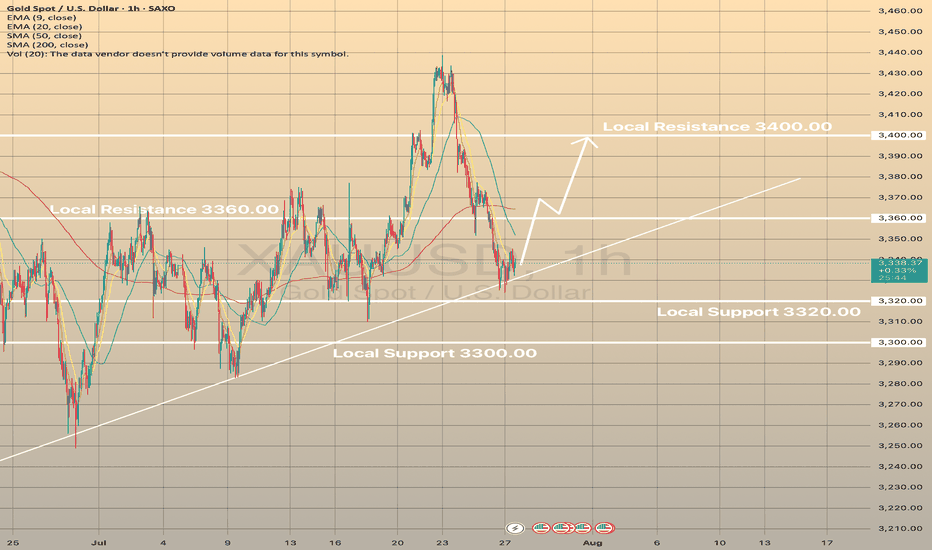

Gold had successfully rebounded from the trendline, still showing mid-term bullish trend despite recent news on U.S. - E.U. and U.S. - Japan trade deals. Currently price is attempting to hold above the EMA20 on 1-h chart timeframe.

If this occurs and the asset develops another short-term bullish impulse, we may expect the price to reach 3,360.00 resistance level with further possible impulse towards 3,400.00 level.

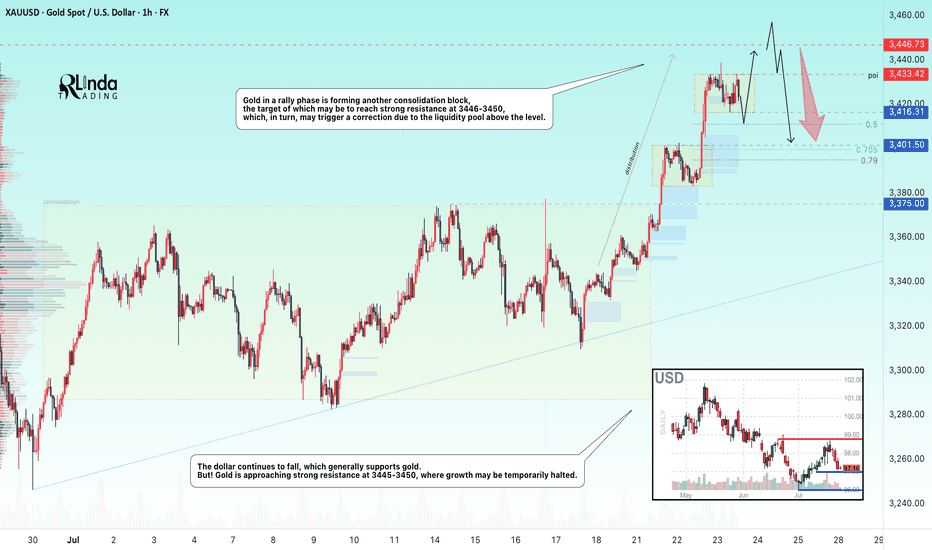

GOLD → Consolidation before the next jump to 3450?FX:XAUUSD continues to rally, with the price updating its local high to 3438 and moving into consolidation, possibly for another jump...

After hitting a five-week high of $3,438, traders are taking a break. Optimism is fuelled by Trump's statements about the largest deal with Japan and negotiations with Canada, but uncertainty about the details of the agreements and political instability in Japan are keeping caution in check. The market is waiting for further signals on trade and political issues, which remain key factors for gold.

Technically, the dollar continues to fall, which generally supports gold. But! Gold is approaching strong resistance at 3445-3450, where growth may be temporarily halted.

Resistance levels: 3433, 3446

Support levels: 3416, 3401, 3375

As part of a local correction, gold may test consolidation support or 0.5-0.7f before continuing to rise. There are quite a few orders in the 3433-3446 zone, and it will be difficult to break through this area to reach the target. Consolidation before this level may help the rise to continue.

Best regards, R. Linda!