Gold 4H Swing Trade Setup!Currently watching price action as it approaches the 4H Fair Value Gap and descending trendline resistance. Price has not tapped this zone yet, and a move higher into this area could set up a potential reversal.

Setup Highlights:

4H FVG: 3,397–3,400 – Main area of interest.

Trendline Resistance: Confluence zone to watch for rejection.

Plan: Waiting for price to fill the imbalance and test the resistance before considering short entries.

Targets if Rejection Occurs:

TP1: 3,344 – First partial target.

TP2: 3,268 – 4H OB retest.

Invalidation:

A clear breakout and hold above 3,440 would invalidate the bearish scenario.

XAUUSDG trade ideas

GOLD REMAINS UNDER PRESSURE AFTER U.S. INFLATION DATA📊 Market Overview:

Gold is trading around $3294, down from $3311 earlier after U.S. Core PCE and Employment Cost Index came in as expected — reinforcing the Fed's hawkish stance. A stronger dollar and rising Treasury yields continue to weigh on gold.

📉 Technical Analysis:

• Key resistance: $3302 – $3305

• Nearest support: $3285 – $3275

• EMA09 (H1): Price is below the 9-period EMA → short-term trend remains bearish

• Candlestick / volume / momentum: After the sharp drop, price is consolidating between $3293–$3298 with low volume. Failure to break above $3302 may trigger further downside. RSI near 45 suggests room for more selling.

📌 Outlook:

Gold may continue to decline in the short term if it fails to reclaim $3302 and the dollar remains strong through the Asian and European sessions.

💡 Suggested Trade Setup:

🔻 SELL XAU/USD: $3296 – $3298

🎯 TP: $3280 / $3275

❌ SL: $3305

🔺 BUY XAU/USD: $3275 – $3278 (if reversal candle appears)

🎯 TP: $3295

❌ SL: $3270

GOLD PLAN – LIQUIDITY HUNT BEFORE THE REAL MOVE? SCALPING PLAN – LIQUIDITY HUNT BEFORE THE REAL MOVE? 🔍

🔹 Timeframe: 30M

🔹 Bias: Intraday Bullish to Bearish Reversal

🔹 Posted by: Clinton Scalper | Smart Money Focus

🔹 Date: July 30, 2025

🔍 MACRO CONTEXT – WHY GOLD REMAINS HIGHLY REACTIVE

The macro backdrop continues to favor volatility in gold:

🟢 Dovish Fed tone ahead of FOMC

– Fed speakers hint at a pause or rate cut timeline.

– Inflation pressures are easing → lowers interest rate expectations.

📉 USD weakening + falling yields

– 10Y U.S. bonds retreating → dollar under pressure → gold gains ground.

🌐 Geopolitical risks remain elevated

– Tensions from Middle East and global recession risks continue to drive flows into safe-haven assets like gold.

🧭 Conclusion: Short-term upside still viable – but be cautious of liquidity traps and OB rejection.

📈 TECHNICAL + SMC INSIGHTS – THE CHART TELLS THE STORY

🔹 Structure Overview:

Market broke out of a descending channel and formed a bullish ascending wedge.

However, price is now approaching multiple OB SELL zones, aligning with smart money exhaustion levels.

🔹 Key Zones:

🔺 OB SELL Zones:

3,334 → 3,342

3,354 → 3,369 (Fibonacci 1.618 extension)

🔻 OB BUY Zones:

3,302 → 3,291 (confluence with previous liquidity sweep)

📍 Current Price: 3,330 – approaching first supply zone.

🔹 Smart Money Flow:

Liquidity above 3,334 has likely been targeted.

If price reaches 3,354–3,369 and shows exhaustion, expect distribution + reversal.

Key confirmation will be a break back below the ascending structure with momentum.

🎯 TRADE PLAN – TWO POSSIBLE SCALPING SCENARIOS

✅ SCENARIO 1: SHORT FROM PREMIUM OB SELL ZONE

Looking to fade bullish liquidity grab near top of range.

Entry: 3,354–3,369

SL: 3,375

TP1: 3,334

TP2: 3,302

TP3: 3,291

Ideal for reversal scalpers catching the distribution move.

✅ SCENARIO 2: LONG FROM DISCOUNT OB BUY ZONE

If price rejects OB SELL and dumps into unfilled demand.

Entry: 3,291–3,302

SL: 3,275

TP1: 3,322

TP2: 3,343

TP3: 3,354

Smart money often reloads after hunting liquidity beneath discount OBs.

⚠️ EXECUTION REMINDERS

✅ Wait for confirmation candles: engulfing / wick rejection / breaker structure

⛔ No market orders without OB reaction

📊 Risk max 1–1.5% per position

📉 Use volume to confirm absorption / exhaustion in OB zones

📢 FINAL THOUGHT – TRAPS COME FIRST, THEN MOVES

Smart Money doesn't chase price — it hunts stops first.

We’re watching closely to see if price completes its liquidity sweep at 3,354–3,369 before a potential reversal. Alternatively, we wait for price to return to the OB BUY zone around 3,291 for a high-RR long play.

🔥 If this helped you:

👍 Like this idea

💬 Comment your thoughts below

🔔 Follow Clinton Scalper for weekly institutional-grade setups

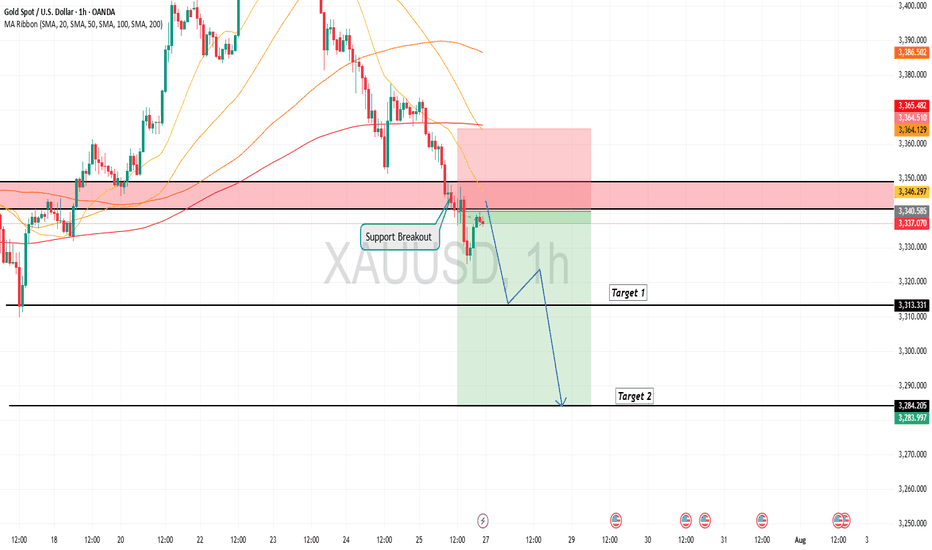

Gold is in the Bearish Direction after Breaking SupportHello Traders

In This Chart GOLD HOURLY Forex Forecast By FOREX PLANET

today Gold analysis 👆

🟢This Chart includes_ (GOLD market update)

🟢What is The Next Opportunity on GOLD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

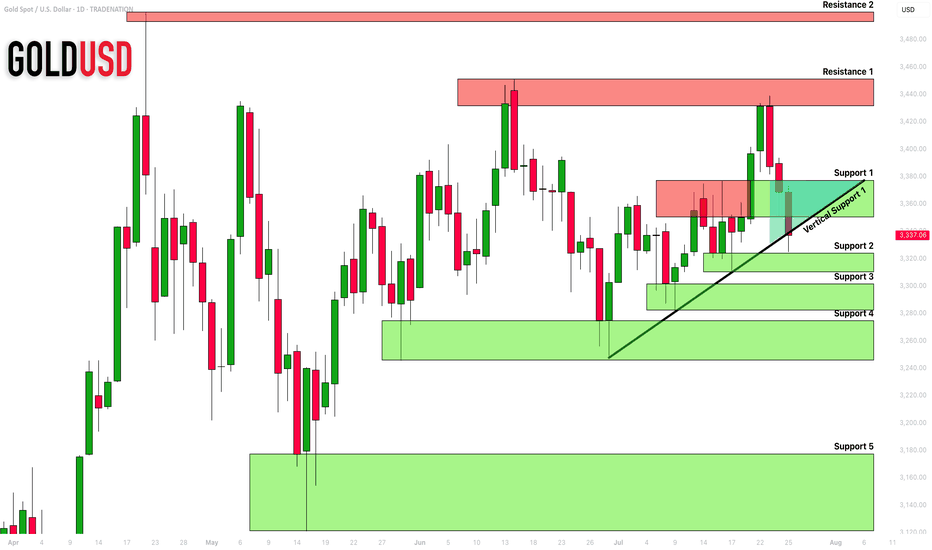

GOLD (XAUUSD): Support & Resistance Analysis for Next Week

Here is my latest structure analysis and important

supports and resistances for Gold for next week.

Consider these structures for pullback/breakout trading.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Big money coming? Here, NFP data XAUUSD Technical Analysis PredDXY forecast today

XAU USD forecast today

EURUSD forecast today

NFP Data Forecast: Xauusd buys SELV sales for mass profit! Your latest gold trade guide confidently during the production of this most important wages is not related to the farm. In this video you will receive technical analysis from XaUUSD experts and proven adjustments for XaUUSD sales. It breaks down how you interpret forecasts for NFP data, how it affects gold prices, and where the best opportunities are. Whether you're a day trader or swing, this video gives you real information to plan your trade and plan your risk management as an expert. Don't miss this opportunity to turn your data into profits ahead of the market. Now look, trade more intelligently and go ahead with the crowd!

#NFPDATAFORECAST

#xauusd

#GoldTrading

#technicalalyasis

#forexsignals

#GoldPrice

#daytrading

#swingtrading

Bullish Break of Structure on 4H XAUUSD – Targeting 3451.525 Price broke structure to the upside on the 4H chart, showing bullish intent. I expect price to continue higher toward the 3451.525 level, which looks like a key liquidity area. As long as price holds above the break, the bias remains bullish.

Elliott Wave Analysis Points to Gold (XAUUSD) Support Near 3320Gold (XAUUSD) appears poised for a double correction from its 16 June 2025 high. A double three consists of two corrective patterns, typically zigzags. From the June peak, wave (W) concluded at 3246.55, and wave (X) rallied to 3438.58, as shown on the 1-hour chart. Wave (Y) is now unfolding lower with internal subdivision as a zigzag. From wave (X), wave ((i)) ended at 3351.17, and wave ((ii)) peaked at 3377.45. Wave ((iii)) declined to 3324.80, followed by a wave ((iv)) rally to 3340.34. The final wave ((v)) completed at 3311.62, forming wave A in a higher degree. A corrective wave B rally reached 3345.35 before gold resumed its downward move.

Within wave C, wave ((i)) finished at 3301.47, and wave ((ii)) rallied to 3334.08. Wave ((iii)) dropped to 3267.94, with wave ((iv)) ending at 3314.85. Gold should continue lower in wave ((v)) to complete wave C. The potential target lies within the 100%–161.8% Fibonacci extension from the 16 June high. This projects a support zone between 3104 and 3230, where a three-wave rally is anticipated. Traders should monitor this area for potential reversal signals, as it may offer support for a corrective bounce.

The trend is clear, why do I choose to be firmly bullish on goldGold Trend Analysis: Yesterday, the gold market demonstrated strong upward momentum, opening near 3290 before falling slightly to a low of 3281 before fluctuating upward. Boosted by the non-farm payroll data, the gold market surged during the US trading session, reaching a single-day gain of 2.02%, reaching a high of 3363 and closing there. The daily chart formed a long bullish candlestick with a long lower shadow, forming a Morning Star pattern, reinforcing the bullish trend. From the perspective of the cycle structure, the daily level is clearly in the 5-wave upward stage, and the upward trend of the large cycle has not changed. At the indicator level, the daily MACD momentum column (the column below the zero axis) represents the short-selling momentum. Its "gradual shortening" means that the short-selling force is weakening and the downward momentum is gradually fading. It is a potential signal of stopping the decline or rebounding. KDJ is about to form a golden cross between 20-50, which is a signal that short-term bullish power is beginning to increase, and the overall trend is bullish.

The 4-hour level shows typical bullish characteristics: the moving average system is arranged in a bullish pattern, but there is a certain deviation between the short-term price and the moving average. The technical side needs to correct the deviation rate through a callback before continuing to rise. The short-term support below is focused on the line near 3330-3335. This position is both the relay support level in the previous rise and the intersection of the 4-hour moving averages MA10 and MA20, which has strong support strength; the short-term resistance above is focused on the line near 3370-3383. This area is a pressure-intensive area near the previous high point. If it can be effectively broken through, it will further open up upward space. A successful breakout would open up further upside potential. A breakout would further open up the 3400 mark.

For gold trading, the short-term strategy is to buy on dips. If the price pulls back to the 3330-3335 support level, consider entering a long position with a target of 3355-3365. If it reaches 3370-3380, consider a short-term short position with a target of 3350-3340.

GOLD Analysis – Bullish Recovery Setup After Trendline Breakout ⚙️ Technical Structure Overview

This 4-hour chart of Gold (XAUUSD) illustrates a classic reversal setup developing after a significant correction. Price previously faced strong selling pressure from the 3,470+ zone and declined sharply. However, the recent price action suggests a shift in control from sellers to buyers, signaling a likely medium-term trend reversal or a bullish wave formation.

The key to this setup lies in three confluences:

Completion of a previous supply zone, which no longer holds influence.

Aggressive buyer activity from a major support zone.

A clean break above the descending trendline, which is a common signal that bearish momentum is losing strength.

🔑 Key Levels & Concepts Explained

🟢 1. Major Support Zone (3,260–3,280)

This zone has been tested multiple times and each time, buyers stepped in and prevented further downside. The most recent rejection from this area shows long wicks and bullish engulfing candles, indicating accumulation by institutional players. This is the foundational support that has held the entire corrective structure.

📉 2. Trendline Breakout

The descending trendline connecting swing highs has now been broken to the upside. This is a critical technical signal, especially on the 4H timeframe, as it suggests a potential trend reversal or at least a deep retracement in the opposite direction.

Trendline breakouts typically result in a retest of the trendline or a nearby support-turned-resistance zone (as is the case here with the Mini SR level).

It also implies that supply is weakening, and buyers are ready to push.

🧱 3. Mini Support/Resistance Interchange (~3,300–3,320)

This zone now plays the role of an interchange level—a previous minor resistance that could act as a support after the breakout. This level is crucial for intraday and swing traders because it can offer a low-risk long entry if price retests and confirms it with bullish momentum.

The chart projection suggests a bounce off this mini S/R, followed by successive higher highs and higher lows, forming a new bullish structure.

📈 Forecast Path & Trade Scenario

✅ Bullish Path (Preferred MMC Scenario)

Stage 1: Price retests the 3,300–3,320 zone (Mini S/R).

Stage 2: Buyers step in, leading to a bullish continuation.

Stage 3: Price targets the Minor Resistance (~3,440).

Stage 4: If momentum is sustained, it aims for Major Resistance (~3,470–3,480), completing a clean reversal formation.

This path reflects perfect bullish market structure—a breakout, followed by a retest and rally.

❌ Bearish Invalidation

If the price closes strongly below 3,260, the structure would be invalidated.

This would suggest that the support zone failed, possibly triggering deeper downside toward 3,220–3,200.

🧠 MMC Trader Mindset & Risk Considerations

Don’t Chase: Wait for a confirmed retest of the Mini S/R zone. Let the market come to your entry.

Entry Confirmation: Use candlestick signals like bullish engulfing, pin bars, or inside bars near the Mini S/R.

Volume Consideration: Volume should ideally rise on breakout legs and decline on pullbacks—this confirms healthy bullish structure.

Risk-Reward: With a stop below 3,260 and targets toward 3,470, the RR ratio favors long entries, especially after confirmation.

🔁 Summary Plan for Execution

Entry Zone: 3,300–3,320 (after bullish confirmation)

Stop Loss: Below 3,260 (structure break)

Take Profit 1: 3,440

Take Profit 2: 3,470–3,480

Risk-to-Reward: 1:2+ if planned carefully

Gold Slipping Lower — 3250 and 3200 in Sight!✅ Gold & DXY Update – Post-FOMC Price Action

Earlier today, before the U.S. interest rate decision, I released my outlook on both the Dollar Index and gold.

In that analysis, I highlighted the DXY’s readiness to move toward the key level of 100 — and as of now, price is actively testing that exact zone, just as expected.

As for gold, I repeatedly emphasized the visible weakness on the buy side. It was clear that there were very few remaining buy orders strong enough to hold price up in this region — and that’s exactly what played out. Price has started pushing lower, in line with our expectations.

Looking ahead, I believe the first target is 3250, followed by a deeper move toward the liquidity zone and the marked box around 3200, which could act as a key target area in the coming days.

🔁 This analysis will be updated whenever necessary.

Disclaimer: This is not financial advice. Just my personal opinion.

XAU/USD Approaches Resistance – Watch 3374 CloselyGOLD Overview

Gold is currently approaching the 3374 resistance level. A 1H candle close above 3374 could trigger further upside toward the next resistance zones at 3401 and 3402.

However, if the price fails to hold above 3365 and starts to decline, this would indicate a potential bearish reversal toward the support levels at 3350 and 3333.

The next short-term move will depend on how price reacts around the 3374 zone — watch for either a confirmed breakout or rejection.

🔹 Key Technical Levels:

Pivot Line: 3365

Resistance: 3374 • 3388 • 3402

Support: 3350 • 3333

Scenarios:

🔺 Bullish: 1H close above 3374 → Targets: 3388 / 3402

🔻 Bearish: Failure to hold above 3365 → Downside toward 3350 / 3333

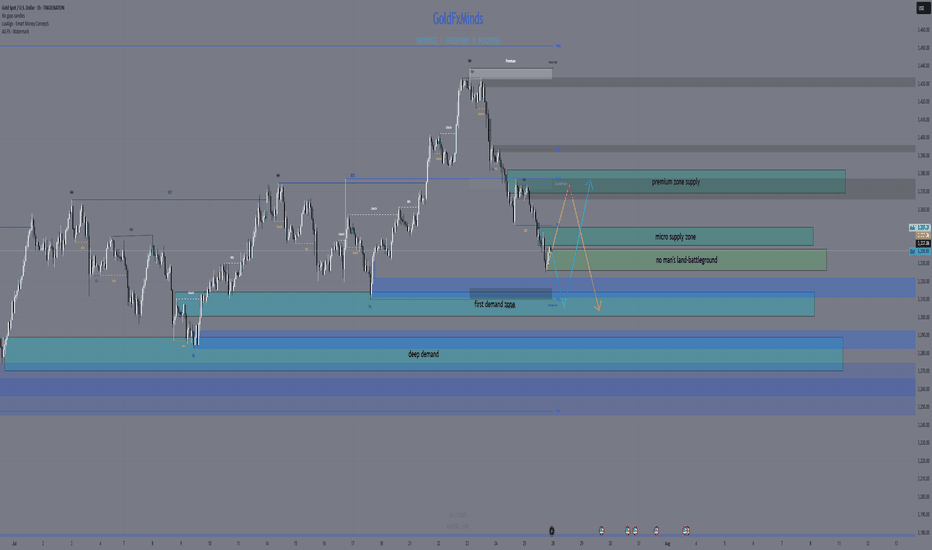

XAUUSD SNIPER OUTLOOK – JULY 28, 2025🔥 Macro & Sentiment

The dollar remains dominant — DXY holding above 105 keeps gold under pressure. No fundamental support for bullish continuation unless major macro shifts. Risk flows are defensive, not aggressive. FOMC and US GDP data remain key drivers for direction this week.

BIAS:

• Short-term bearish under 3350

• Market still in distribution mode — every bounce gets sold

• Real buy interest only deep below 3315

🔻 INTRADAY SUPPLY ZONES (Short Only With Rejection)

1. 3382–3370 (H1/M30 Premium Supply)

🔹 H1 order block, FVG alignment, EMA21/50/100 convergence

🔹 Liquidity inducement above → then rejection

📍 Short only if rejection shows via engulf / upper wick.

2. 3355–3340 (Decision Zone / Micro Supply)

🔹 EMA100/200 alignment, former support flipped resistance

🔹 M30 FVG fully filled, structure flip from mid-July

📍 Short bias below. Long only if reclaimed with H1 close above 3355.

🔵 NEUTRAL / PIVOT ZONE

3. 3338–3326 (Decision Band – M30/M15)

🔹 Consolidation area post-BOS, internal liquidity sweeps

🔹 EMA21 base on M15, no clear dominance

📍 Wait for clean reaction. Bullish engulf = scalp long to 3355. Failure = slide to demand.

🟢 DEMAND ZONES (Buy Only On Strong Reversal Confirmation)

4. 3314–3302 (M30/M15 Deep Demand)

🔹 H1 OB + hidden FVG + fib 38.2%

🔹 First real demand zone where buyers may engage

📍 Long only if strong M15 confirmation: engulf + RSI cross + EMA5/21 angle change.

5. 3289–3272 (True Reversal Demand – H1/M30)

🔹 Full NY reversal origin (July 18), major FVG left unfilled

🔹 Institutional volume + liquidity grab zone

📍 Buy only on full flush + fast snapback with BOS on M15/H1.

🧭 BIAS & EXECUTION BY TIMEFRAME

H4 Bias:

Bearish while below 3350. No valid supply above until 3370+. Avoid longs unless price sweeps 3314 or 3272 and confirms.

H1 Bias:

Sell clean rejection at 3355 or 3370–3382. Only flip long above 3355 with full-bodied close.

M30 Bias:

Watch decision zone 3338–3326 for direction. No-man’s land in between — don’t force trades.

M15 Bias:

Scalp long from 3314 or 3272 only on full confluence (OB + RSI + EMA realignment). Short only confirmed rejections above.

📊 FULL INTRADAY KEY LEVELS (Top → Bottom)

Level Context

3405 Fib ext. 127% (HTF sweep target only)

3385 OB

3375–3350 Valid Premium Supply (H1 shelf)

3350–3340 Micro Supply / Flip Zone

3338–3326 Decision Zone – watch reaction

3314–3302 Deep Demand (H1/M30 confluence)

3289–3272 Extreme Demand Base

3260 Fib 61.8% + HTF support

3250 Minor volume node

3240 Final structural floor

✅ EXECUTION NOTES

⛔ Avoid entering inside 3340–3326 → fakeout zone

✅ Play only clean sniper triggers with structure

⚠️ Wait for macro — FOMC / GDP releases may fake both sides

💡 Patience wins. Pick your zone, wait for setup, strike.

Which zone are you watching to strike? Drop your bias below.

📍 Like, comment & follow GoldFxMinds for the most precise sniper maps on TradingView.

Disclosure: This plan is based on the Trade Nation chart feed. I am part of their Influencer Program.

XAUUSD (GOLD): Wait For The BOS! FOMC and NFP Looms!In this Weekly Market Forecast, we will analyze the Gold (XAUUSD) for the week of July 28 - June 1st.

Gold is in the middle of a consolidation. Bas time to look for new entries!

FOMC on Wednesday and NFP on Friday. Potential news drivers to move price in a decisive direction!

Wait for a break of structure (BOS) either direction before entering a new trade.

Be mindful that the Monthly is bullish, and the Weekly is neutral.

The Daily is bearish, with 3 days of data indicating so. I am leaning towards this bias, as the draws on liquidity are near and obvious.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

GOLD A Fall Expected! SELL!

My dear subscribers,

My technical analysis for GOLD is below:

The price is coiling around a solid key level - 3358.0

Bias - Bearish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 3350.7

My Stop Loss - 3362.4

About Used Indicators:

By the very nature of the supertrend indicator, it offers firm support and resistance levels for traders to enter and exit trades. Additionally, it also provides signals for setting stop losses

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

From Execution to Adaptation: Enter Dynamic ProbabilitiesIn the previous article , we looked at a real trade on Gold where I shifted from a clean mechanical short setup to an anticipatory long — not because of a hunch, but because the market behavior demanded it.

That decision wasn’t random. It was based on new information. On structure. On price action.

It was based on something deeper than just “rules” — it was about recognizing when the probability of success had changed.

That brings us to a powerful but rarely discussed concept in trading:

👉 Dynamic probabilities.

________________________________________

📉 Static Thinking in a Dynamic Market

Most traders operate with static probabilities — whether they realize it or not.

They assign a probability to a trade idea (let’s say, “this breakout has a 70% chance”) and treat that number as if it’s written in stone.

But markets don’t care about your numbers.

The moment new candles print, volatility shifts, or structure morphs — the probability landscape changes. What once looked like a clean setup can begin to deteriorate. Conversely, something that looked uncertain can start aligning into high-probability territory.

Yet many traders fail to adapt because they’re emotionally invested in the original plan.

They’ve already “decided” what the market should do, so they stop listening to what the market is actually doing.

________________________________________

🧠 Dynamic Probabilities Require Dynamic Thinking

To trade dynamically, you must be able to update your internal odds in real time.

This doesn’t mean constantly second-guessing or overanalyzing — it means refining your bias based on evolving context:

• A strong breakout followed by weak continuation? → probability drops.

• Price holding above broken resistance with clean structure? → probability increases.

• Choppy pullback into support with fading volume? → potential reversal builds.

It’s like playing poker: you might start with a good hand, but if the flop goes against you, your odds change.

If you ignore that and keep betting like you’ve got the nuts, you’re not being bold — you’re being blind.

________________________________________

📍 Back to the Gold Trade

In the Gold trade, the initial short was based on structure: broken support turned resistance.

The entry was mechanical, the reaction was clean. All good.

But then:

• Price came back fast into the same zone.

• Sellers failed to defend it decisively.

• The second leg down was sluggish, overlapping, and lacked momentum.

• Compression began to form.

That’s when the probability of continued downside collapsed — and the probability of a reversal increased.

The market had changed. So did my bias.

That’s dynamic probability in action — not because of a feeling, but because of evolving evidence.

________________________________________

🧘♂️ The Psychological Trap

Many traders intellectually accept the idea of being flexible — but emotionally, they cling to certainty.

They fear being “inconsistent” more than they fear being wrong.

But in a dynamic environment, consistency of thinking is not about repeating the same action — it’s about consistently reacting to what’s real.

True consistency is not mechanical repetition. It’s mental adaptability grounded in logic.

________________________________________

🧠 Takeaway

If you want to trade professionally, you must upgrade your mindset from fixed-probability execution to fluid-probability reasoning.

That doesn’t mean chaos. It means structured flexibility.

Your edge isn’t just in spotting patterns — it’s in knowing when those patterns are breaking down.

And acting accordingly, before your PnL does it for you.

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.