Gold Price Rebound Towards 3325 Target After Support TestGold (30-min chart) shows a recovery from the support zone (3288–3298) with potential bullish movement. Key resistance levels are 3305 and 3316, with a target zone around 3325.510. Price is expected to follow a corrective structure before possibly reaching the target.

XAUUSDK trade ideas

Gold Trade plan 30/07/2025Dear Traders,

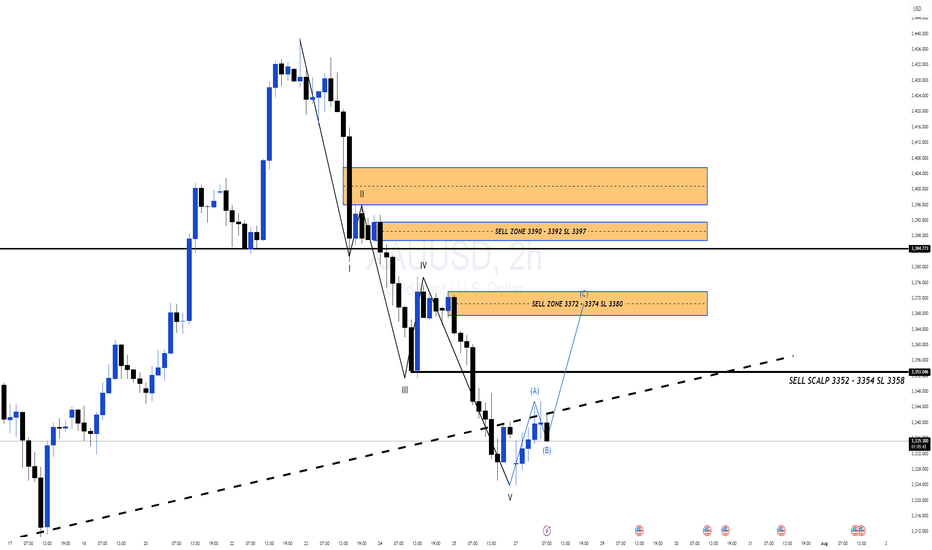

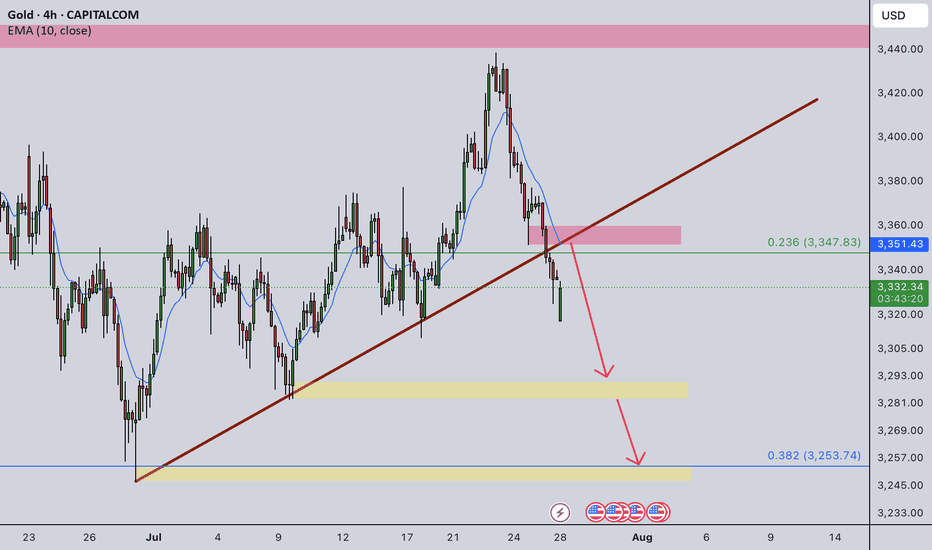

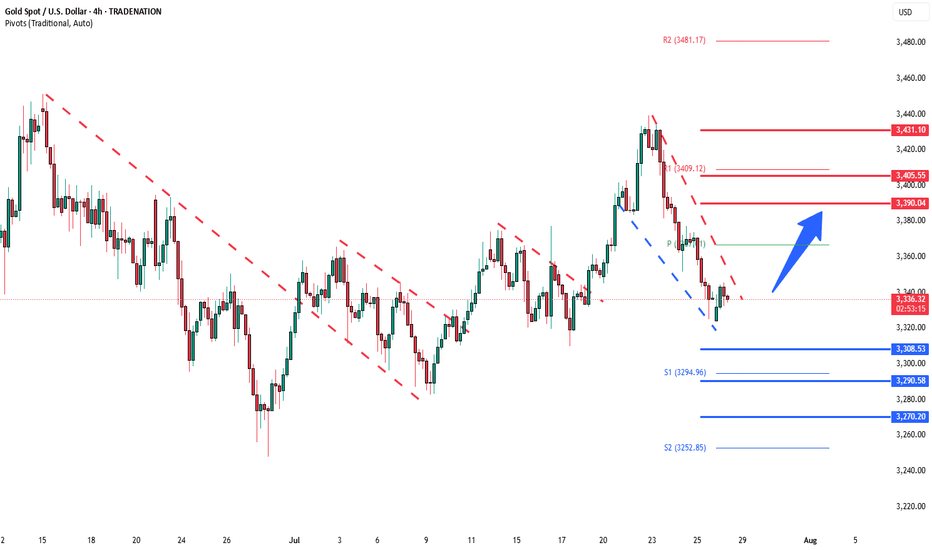

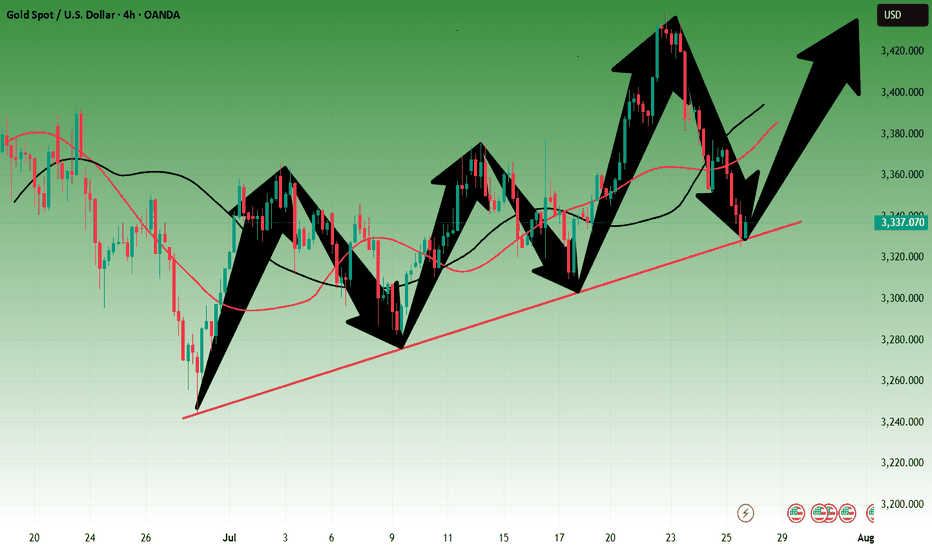

This chart represents the XAU/USD (Gold / U.S. Dollar) pair on a 4-hour timeframe. The market is showing a series of Fibonacci retracements and key levels, with potential price action zones marked for future movements.

Key Levels:

Resistance Zones: At 3,422.105 (near the green line), followed by the 3,386.171 level (Fibonacci 0.618).

Support Zones: Major support is visible near 3,282.131 (bottom of the chart), with additional minor support levels at 3,305.000 and 3,293.000.

Mid-range Support: Around 3,369.987.

Potential Price Action:

The price recently dropped from higher levels, breaking below the previous support levels. The market seems to be testing lower support zones.

A potential move down towards 3,284.116 or 3,282.131 is likely if the current support levels do not hold.

Conversely, if price action holds the current support zone (3,329.040), a retest of the higher resistance at 3,350.163 could occur.

Fibonacci Levels:

Retracement Levels: The Fibonacci retracement is drawn with key levels, particularly around 3,372-3,378 and 3,349-3,357, acting as strong support or resistance.

Extensions: There is potential for the price to move towards the 3,420 region if resistance levels break.

Strategy Suggestion:

Short Position: Targeting lower levels near 3,282.131 or 3,284.116.

Long Position: If price holds above 3,329.040, target resistance at 3,350.163 and beyond.

Regards,

Alireza!

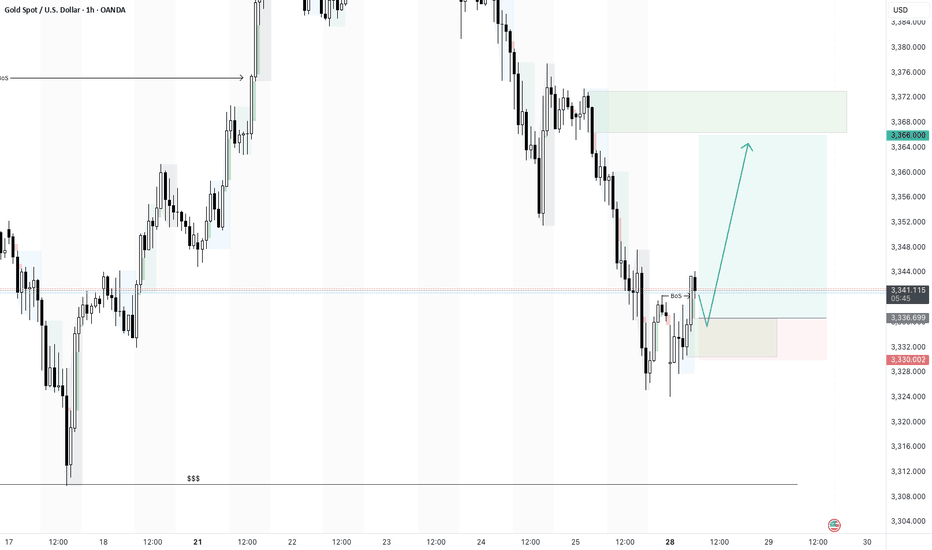

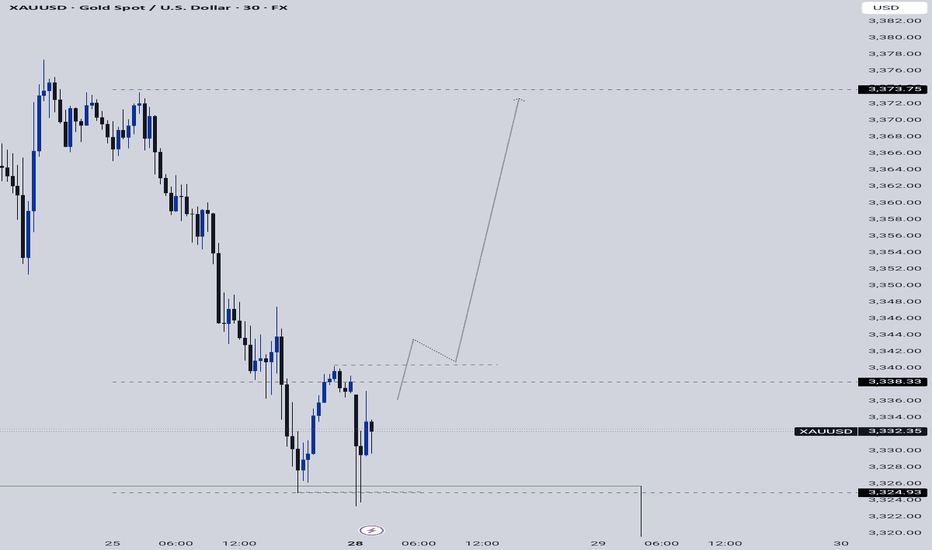

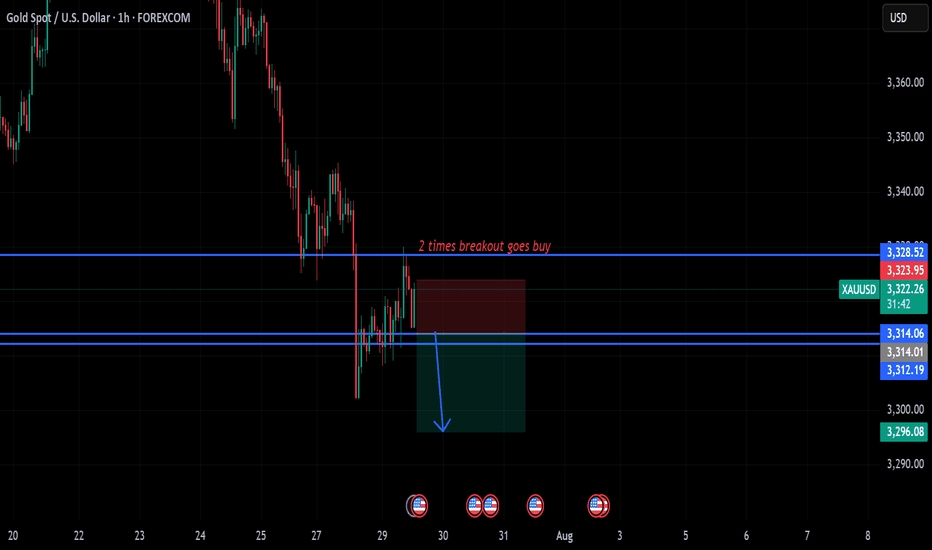

XAUUSD 28/2/25 - Morning bullish pushBased on the 1hr- there is a break of structure and i am looking for a bullish move this morning.

There is a chance that this trade fails as there is a 4hr equal low liquidity below which could draw the price to.

Im still going to take this trade and let price do its thing today.

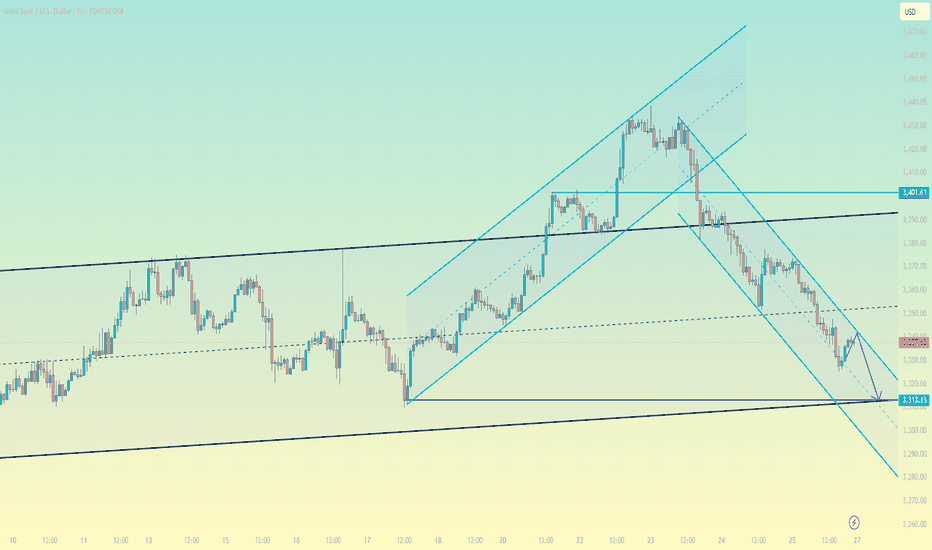

Gold (XAU/USD) Daily Trading Plan - 28th July 2025🔺 Technical Analysis

Gold opened the Asian session this week with a slight retracement, testing the 0.382 Fibonacci Retracement level before bouncing back strongly to last week's closing price around 3339. This move further solidifies the price action from a technical perspective.

Notably, gold has broken through a minor resistance on the M15 timeframe, invalidating the bearish structure and forming a full-bodied H1 candle. This sets the stage for a potential corrective uptrend to unfold.

On the Daily timeframe, the initial session's decline retested the bullish trendline and bounced back within the boundaries of the flag pattern. It's likely that this week, the price will continue towards the end of this pattern, providing a clearer confirmation of the medium-term trend.

🔺 Key Macroeconomic News

This week promises to be volatile with several crucial economic announcements, particularly as it marks both the end of the month and the start of a new one. Two key events that traders should pay close attention to are:

FOMC Interest Rate Decision: Always a focal point for the market, with significant impact on safe-haven assets like gold.

Non-Farm Payroll (NFP) Report: Vital US labour market data, capable of triggering substantial movements in both the USD and gold.

Therefore, be prepared for potential market shocks and exercise careful risk management.

📈 Trading Strategy & Considerations

Given the technical setup and upcoming macroeconomic events, consider the following:

Potential Corrective Uptrend: The invalidated bearish structure on M15 and the strong H1 candle suggest a short-term bullish bias for a corrective move.

Daily Flag Pattern: Monitor price action as it approaches the end of the flag pattern on the Daily timeframe for medium-term trend confirmation.

High Volatility Ahead: Exercise extreme caution around the FOMC and NFP announcements. These events can lead to significant and rapid price swings.

Risk Management: Prioritise strict risk management. Consider reducing position sizes or employing wider stop-losses during high-impact news events.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Trading involves significant risk, and you should only trade with capital you can afford to lose.

Gold prices are under pressure, focusing on the Fed stormGold prices are under pressure, focusing on the Fed storm

Weekly gold price report: The rebound of the US dollar suppresses precious metals, and the market focuses on the Fed's policies and trade negotiations

Market review

On Friday (July 26), the international gold price was under pressure to fall, with spot gold falling 0.9% to $3,336.01/ounce, and COMEX gold futures closing down 1.1% to $3,335.6/ounce. The US dollar index rebounded from a low of more than two weeks, and the progress in US-EU trade negotiations weakened the demand for safe havens, which jointly suppressed the performance of precious metals.

Analysis of core influencing factors

The US dollar and trade situation

The US-EU trade agreement negotiations have entered a critical stage. The EU said that "the agreement is just around the corner", but member states still approved the potential counter-tariff plan. US President Trump said that he will negotiate with the EU on Sunday, with a probability of 50%. If the agreement is implemented, it may further suppress the safe-haven properties of gold.

The recent trade agreement between Japan and the United States also boosted market risk appetite, and funds flowed to risky assets.

Fed policy expectations

Despite the resilience of the US labor market (initial jobless claims fell to 217,000 last week, the sixth consecutive week of decline), the market generally expects the Fed to keep interest rates unchanged at its July meeting.

Trump has recently pressured the Fed to cut interest rates and even made a rare visit to the Fed headquarters, sparking discussions on policy independence. Some analysts believe that if inflationary pressures ease, the Fed may release dovish signals in the second half of the year.

Fund positions and central bank demand

As of the week of July 22, hedge funds' net long positions in gold increased to 170,868 contracts, the highest level since April, reflecting the market's long-term concerns about trade tensions.

Central bank gold purchase demand still provides structural support for gold prices.

Geopolitical dynamics

Israeli-Palestinian conflict: Hamas said that the ceasefire negotiations have made progress, but the US statement caused a surprise, and the progress of subsequent negotiations may affect market sentiment.

Russia-Ukraine situation: Turkey coordinates all parties to hold a leaders' summit in Turkey. Russia and Ukraine have agreed in principle to meet, and potential peace plans may reduce the safe-haven premium.

Outlook for the future

Key short-term events:

US/EU/China trade negotiations: If progress is optimistic, gold prices may fall to the support level of $3,300/ounce.

Federal Reserve July resolution: Pay attention to the policy statement's hints on the path of interest rate cuts and the Fed's response to political pressure.

US non-farm data: If the employment data is strong, it may strengthen the expectation of "higher for longer" interest rates.

Technical aspect: Near $3,300/ounce may attract buying, but breaking through the previous high requires clearer signals of monetary policy shift.

Risk warning: Repeated trade negotiations, escalating geopolitical conflicts or unexpectedly dovish Fed may reverse the decline in gold prices.

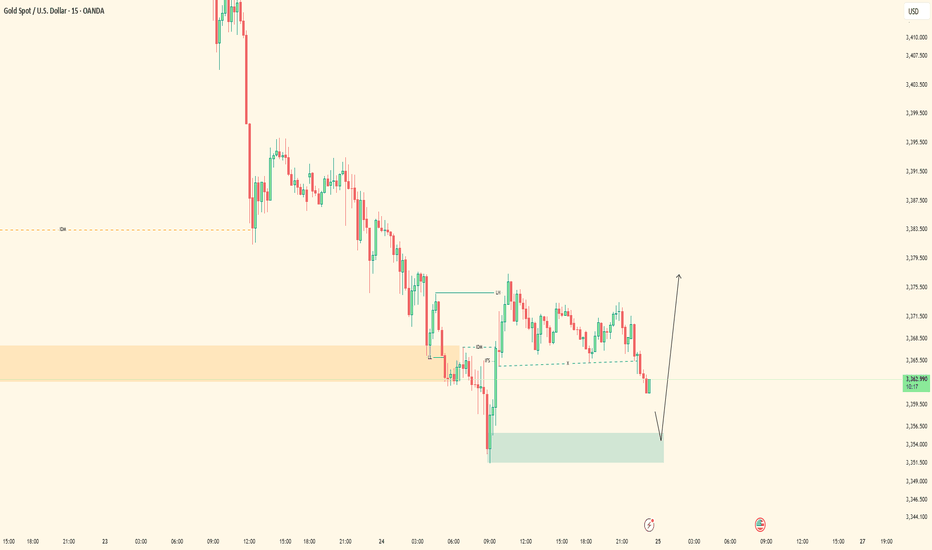

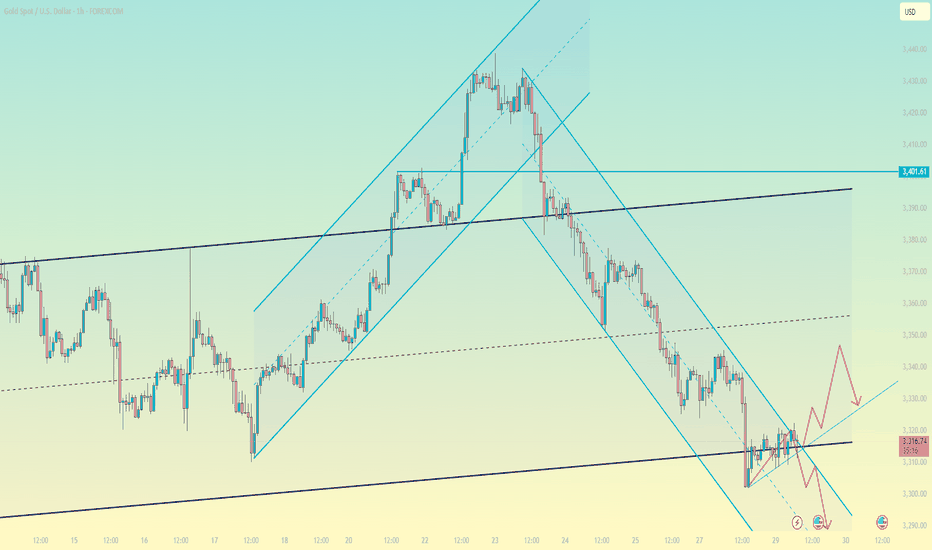

XAUUSD Locked In| Waiting for 5M OB SparkPair: XAUUSD (Gold)

Bias: Bullish

Timeframes: 30M / 5M

Gold has followed structure beautifully — top-down alignment from 30M into 5M is clear. Price respected the 30M OB and showed intent, but now we’re approaching the moment of truth.

I’m watching the 5M OB for entry — this is where execution mode activates. No rush. I’m in analysis mode right now, but the shift is coming.

Entry zone is mapped, structure’s in place, order flow is aligned — all I need now is price to do what it always does: respect the blueprint.

Entry Zone: 5M OB

Target: 5M highs

Mindset Note: Patience before the spark. I don’t force entries — I wait for the market to hand me the move it already hinted at. ⚡️

Gold big data is here! Gold prices are igniting the market!Market News:

Spot gold fluctuated narrowly in early Asian trading on Wednesday (July 30), currently trading around $3,325 per ounce. London gold prices recovered some of their losses on Tuesday after falling for the fourth consecutive day, as the US dollar gave up some of its earlier gains, boosting international demand for gold. Declining US Treasury yields and a weak US labor market report also prompted investors to buy gold. The gold market is currently at a critical turning point. Fundamental buying and selling factors are in fierce competition: on the one hand, easing global trade tensions are suppressing safe-haven demand; on the other hand, falling US Treasury yields and expectations of a possible Federal Reserve shift are providing support. Meanwhile, progress in US-China trade negotiations, Trump's tough stance on Russia and the Middle East, and ongoing geopolitical tensions continue to add further uncertainty to the future of the gold market. Furthermore, attention will be paid to the Bank of Japan and Bank of Canada's interest rate decisions, the US second-quarter GDP data and the July ADP employment data. Second-quarter GDP data from Germany and the Eurozone also warrant attention.

Technical Review:

Gold bottomed out and rebounded, stopping at the 3310 level before rising sharply above the 30 mark. The daily chart closed with a small positive candlestick pattern. The 10/7-day moving averages remain converging, suppressing the 57 level above. The RSI stopped below the 50-day moving average and adjusted downward, with the price trading below the middle Bollinger Band at 40. A four-hour chart golden cross formed and pointed upward. The hourly MACD momentum bar is above zero, while the RSI is flattening, indicating a neutral trend. Gold technically remains in a wide range of fluctuations. The trading strategy is to sell high and buy low. Plan to buy low at 3318/06 and sell high at 3346/58. The release of important data today will affect the original technical trend of gold and silver, increasing volatility. Be aware of market risks.

Today's Analysis:

Although gold rebounded yesterday, the momentum wasn't particularly strong, with the upward trend remaining erratic. Bullish volume remains insufficient. Today's key events will be the non-farm payroll report and the Federal Reserve's interest rate decision. Pre-market activity is unlikely to see a significant upturn, so we'll have to wait for the data to provide direction. Expect volatility before the release! The slope of gold's 1-hour rebound doesn't necessarily indicate a deep V-shaped pattern. Gold hasn't yet reversed, and a second bottom is possible. Only if gold doesn't break a new low during this second bottoming out could a double bottom form. Gold is still expected to decline in the Asian session. If gold rebounds and comes under pressure, continue selling. A deep V-shaped reversal is only possible if gold breaks through and stabilizes at the 3345 level. Until then, continue selling at high prices.

Trading strategy:

Short-term gold: Buy at 3310-3313, stop loss at 3300, target at 3340-3360;

Short-term gold: Sell at 3343-3346, stop loss at 3355, target at 3310-3300;

Key points:

First support level: 3310, Second support level: 3292, Third support level: 3284

First resistance level: 3338, Second resistance level: 3346, Third resistance level: 3358

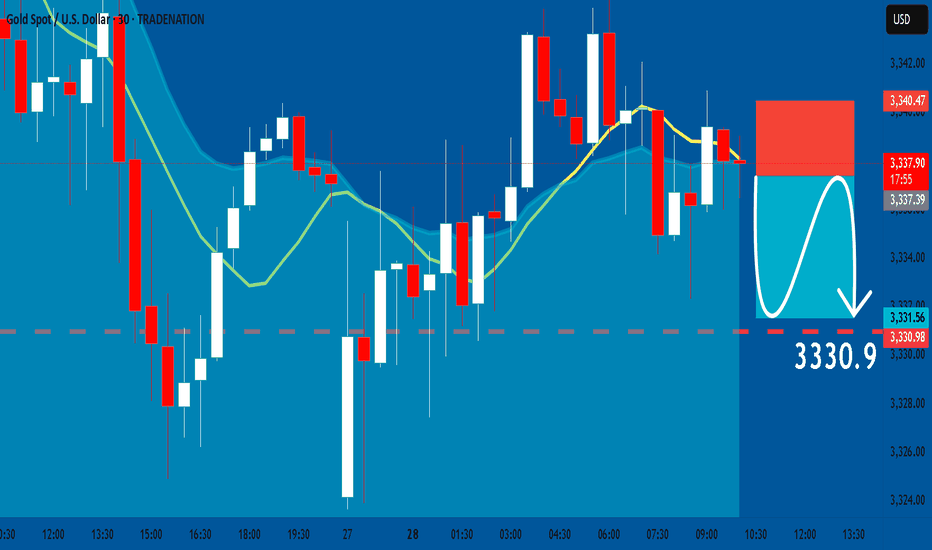

GOLD: Short Trade with Entry/SL/TP

GOLD

- Classic bearish setup

- Our team expects bearish continuation

SUGGESTED TRADE:

Swing Trade

Short GOLD

Entry Point - 3337.3

Stop Loss - 3340.4

Take Profit - 3330.9

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

GOLD BUY TRADE IDEA • Price Action Context:

• Recent bearish leg shows a clear shift from premium to discount territory.

• Market is approaching a higher timeframe demand zone around $3,277 – $3,299 (highlighted red zone).

• Notable inducement below recent lows suggests engineered liquidity to fuel a potential reversal.

• Current Market Structure:

• After a deep retracement, price is expected to tap into the discount zone, where institutional buy orders may be resting.

• Anticipated bullish reaction following a liquidity sweep of the lows and demand mitigation.

• Smart Money Flow:

• Inducement ➝ Liquidity Grab ➝ Demand Tap ➝ Bullish Reaction setup in play.

• Internal structure likely to shift bullish after a sweep, potentially forming a higher low and aiming for a BOS (Break of Structure) on the upside.

• Upside Target:

• Short-term target area: $3,360 – $3,380.

• Possible continuation toward premium if internal structure confirms strength.

🧠 Smart Money Narrative:

1. Induced sell-off below structure for liquidity collection.

2. Approaching major POI (Point of Interest) in discount.

3. Anticipated entry point for institutions to buy gold at value.

4. Reversal expected toward premium imbalance areas.

Gold Intraday Trading Plan 7/28/2025As explained in my weekly post, I am bearish on gold in short and medium term right now. Moreover, in smaller timeframe, the trendline has been broken. I am looking for selling opportunity from the retesting of the trendline, which is around 3352. My target for today is 3300, ultimate target for this week is 3252.

The Myth of Gold Reversals – Why Traders Keep Catching the KnifeGold is a master of deception.

It shows a clean wick into a zone, but reacts just enough to pull in early buyers or sellers — then rips straight through their stops like they weren’t even there.

The reversal looked real and the candles seemed perfect.

But the move? It was never meant for them.

This isn’t bad luck, but traders who survive aren’t trying to guess, they are the ones reading the reaction after the trap.

Let’s break down how these traps happen — and how Smart Money actually operates when XAUUSD is loading a real move.

🟥 Sell Trap – The "Instant Short" Mistake

Price pushes up into a clear reaction zone — maybe an OB, maybe an imbalance, a FVG, or a gap.

Structure looks stretched. Traders recognize a premium zone and decide it’s time to short.

The trap? Jumping in immediately on the touch, with no confirmation.

This is where Gold loves to trap sellers.

No M15 CHoCH/ BOS on M5 or real liquidity swept. Just a blind move and hope.

Price often pulls slightly higher — sweeping internal liquidity, triggering SLs — then shows a real rejection.

📌 Here’s what needs to happen before selling:

• First: look for a liquidity sweep (equal highs or engineered inducement)

• Then: price must shift — CHoCH or BOS on M15 or M5

• Finally: confirmation via bearish engulf, imbalance fill, or break + retest

• For experts: M1 can offer refined sniper triggers with minimal drawdown

💡 If none of this appears, it’s not a setup — it’s a trap.

🟩 Buy Trap – The "Wick Bounce" Illusion

Price taps a demand zone — again, a refined OB or imbalance, liquidity zone.

A long bullish wick forms. Some candles pause. It looks like a reversal.

But there’s no shift.Just hovering.

Many jump in long the second they see the wick. And then price breaks straight through.

📌 Here’s how to flip this trap into a real buy:

• Let price sweep liquidity below the zone — signs of a purge - true wick bounce

• Watch for a CHoCH or BOS on M15, M5, or even M1

• Look for a strong bullish engulf from the reactive level

• Confirm via imbalance fill or price reclaiming broken structure

📍 If all that happens — the trap becomes your entry.

If not? Stand down.

📊 What Smart Traders Actually Do Differently

They don’t chase wicks.

And never enter just because price tapped a line.

IT IS ALL ABOUT READING STRUCTURE AND PRICE ACTION.

Here’s how:

• Mark the highest probability reaction zones — above and below current price;

• Set alerts, not blind entries;

• Wait for price to come into their zone and then watch what it does there;

• Look for confirmation: CHoCHs, BOS, engulfing candles, FVG fills, clean rejections;

• And always keep one eye on the news — because Gold reacts fast and violently when volatility hits.

• Repeat this work daily until they learn how to recognize signs faster and more secure.

That’s the difference between chasing the reversal… and trading the move after the trap.

Because in this game, patience isn’t just a virtue — it’s survival.

And Gold? Well, XAUUSD has no mercy for those in a hurry and not studying its moves day by day, month after month and so on. Learn structure and price action even if you join any channel for help if you are serious about trading this amazing metal.

If this lesson helped you today and brought you more clarity:

Drop a 🚀 and follow us✅ for more trading ideas and trading psychology.

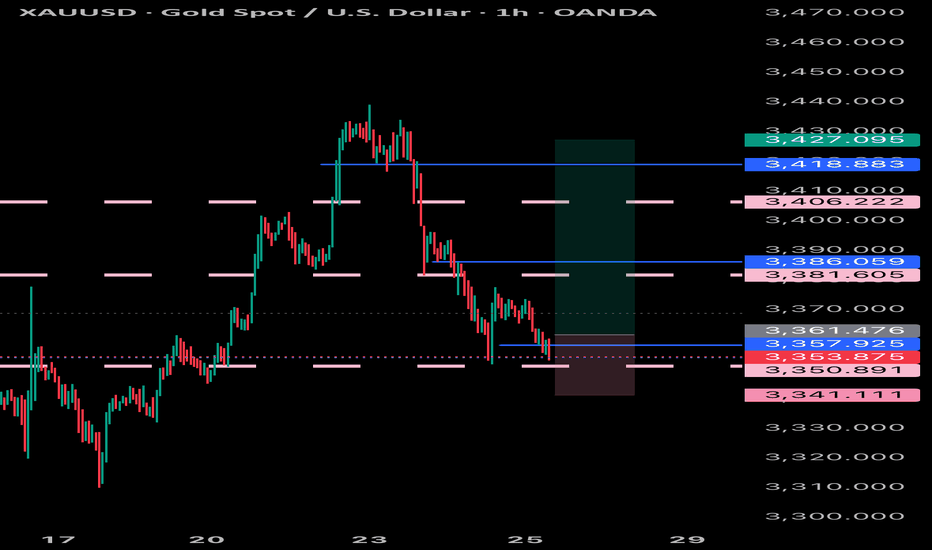

July 30, 2025 - XAUUSD GOLD Analysis and Potential Opportunity🔍 Key Levels to Watch:

• 3384 – Resistance

• 3375 – Key resistance

• 3365 – Resistance

• 3345 – Resistance

• 3336 – Resistance

• 3325 – Key support

• 3310 – Support

• 3300 – Psychological level

• 3283 – Major support

• 3275 – Support

• 3265 – Support

📈 Intraday Strategy:

• SELL if price breaks below 3325 → target 3320, then 3315, 3310, 3300

• BUY if price holds above 3330 → target 3336, then 3345, 3350, 3356

👉 If you find this helpful or traded using this plan, a like would mean a lot and keep me motivated. Thanks for the support!

Disclaimer: This is my personal view, not financial advice. Always use proper risk control.

Gold Market Technical Analysis and Trading StrategiesGold Market Technical Analysis and Trading Strategies

Current Trend Analysis

Gold prices entered a technical rebound after testing key support at $3,300 and are currently trading in a narrow range between $3,315 and $3,320. This area constitutes a key bull-bear dividing line, acting as both upper resistance at the hourly chart's descending channel and technical resistance from a previous low. Since retreating from the April high of $3,500, gold prices have fallen 5.7%, primarily due to the Federal Reserve's hawkish stance and a stronger dollar.

Key Price Analysis

Resistance Zone: 3,320-3,325 (upper channel edge + Fibonacci 23.6% retracement level)

Support Level: 3,300, a psychological barrier; a break below could see prices fall to 3,280-3,260.

Bull-Bear Divide: A break above 3,320 could see prices rise to 3,340-3,353; a break below 3,310 would signal a continuation of the trend.

Market Sentiment and Momentum

COMEX net long positions have fallen to a year-to-date low, reflecting subdued market sentiment. The MACD hourly chart shows a bottoming divergence, indicating weakening short-term downward momentum, but shrinking trading volume raises doubts about the sustainability of the rebound. A doji candlestick appears after consecutive negative closes on the daily chart, reflecting a temporary equilibrium between bulls and bears.

Trading Strategy Recommendations

Primary Strategy: Set up short positions on dips under pressure between 3320-3325, with a stop-loss above 3332. Targets are 3310-3305. A break below targets 3280.

Secondary Strategy: Try a small buy position if the price stabilizes at 3315, with a strict stop-loss below 3310 and a target of 3330-3340.

Position Management: Limit risk per trade to 1-2%, with a stop-loss of $6-8.

Risk Warning: Focus on a breakout above the 3315-3320 area. Performance in the European session may indicate the direction of the US market. Be wary of volatility risks arising from changes in US economic data and Fed policy expectations. The medium- to long-term downward trend remains unchanged; strict stop-loss orders are recommended for short-term trading.

XAU / USD 4 Hour ChartHello traders. Looking at the 4 hour chart, I have not changed a thing from my last post on Friday of last week. Saying that, we are my area of interest to see if we hold support or keep moving down. It's only Monday, so I am in not trying to force or rush a trade. Big G gets a shout out. Pre NY volume starts as of this writing here in the US. Let's see how things play out, be well and trade the trend. Happy Monday :)

Gold protracted consolidation The Gold remains in a bullish trend, with recent price action showing signs of a continuation breakout within the broader uptrend.

Support Zone: 3308 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 3308 would confirm ongoing upside momentum, with potential targets at:

3387 – initial resistance

3400 – psychological and structural level

3435 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 3308 would weaken the bullish outlook and suggest deeper downside risk toward:

3290 – minor support

3268 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the Gold holds above 3308. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Analysis of gold price trend next week!Market news:

This week, international gold recorded its biggest weekly decline in a month. Spot gold turned sharply lower after a sharp rise and finally closed lower. Signs of progress in US-EU trade negotiations hit the safe-haven demand for London gold prices. Geopolitical situation is also a factor in the downward trend of gold prices. On the 25th local time, Tahir Noonu, a senior Hamas official, said that Hamas was absolutely positive about the efforts of the relevant mediators, but was surprised by the US statement. Before the United States and the European Union made progress in trade negotiations, fund managers raised their bullish bets on gold to the highest level since April this year. The trade war has pushed gold prices up 27% this year. Although the easing of trade tensions will weaken safe-haven demand, gold has also been supported by strong buying from central banks.Next week, international gold prices will focus on US-EU and US-China trade negotiations. If the negotiations are optimistic, gold prices may continue to test the $3,300/ounce mark; in addition, focus on the Federal Reserve's resolution. After Trump's visit to the Federal Reserve headquarters, whether the Federal Reserve will maintain its independence will be highlighted in this resolution. Non-agricultural data will also be released on Friday, which needs attention.

Technical Review:

From the weekly gold level, gold is still in a wide range of 3500-3120. It has been fluctuating for ten weeks. The Bollinger Bands are gradually shrinking. MA5 and MA10 are running horizontally, indicating that gold fluctuations will continue. This time, gold stabilized and rose from 3247 to 3438 and then fell back. The current short-term range is 3247-3438! Next week, pay attention to the range of fluctuations and choose a new direction after the narrowing. The daily level is currently in the 4th wave adjustment. There is a high probability that there will be a 5th wave rise after the adjustment, and then a large-scale ABC adjustment will be started. At present, there are two changes in the structure of the 4th wave, one is the triangle contraction and the other is the ABC structure. No matter how it runs, the market outlook is to wait for low-level long positions to see the 5th wave rise. In the short term, gold is still oscillating and selling.

Next week's analysis:

Gold is still adjusting, but it has basically adjusted in place. The current daily price has also adjusted to the key support level of 3300. Similarly, the four-hour chart just stepped back to the upward trend line support, which is the short-term long order entry. Buy above the 3300 mark next week! Next week, gold is expected to further test the 3310-3280 support level. Gold at the 4-hour level peaked at 3438 and then fell back. It has now formed a unilateral trend. The K-line is under pressure from the 5-day moving average and continues to set new lows, and breaks the short-term upward trend line. The Bollinger band opens downward and diverges, and the MACD water cross diverges downward to underwater, indicating that the current gold trend is in an absolute weak position! Next, gold will continue to test the support near the previous low of 3300. If 3300 is not broken, gold buying will continue to have momentum. If 3300 is broken, the short-term rise will end, and the subsequent rebound will basically be just a correction. However, the current 4-hour green column shows signs of shrinking volume, so it is not easy to sell at a low level. Try to sell after the rebound correction, or buy at a low level!

Operation ideas:

Short-term gold 3305-3308 buy, stop loss 3297, target 3350-3370;

Short-term gold 3350-3353 sell, stop loss 3362, target 3320-3300;

Key points:

First support level: 3320, second support level: 3309, third support level: 3300

First resistance level: 3346, second resistance level: 3360, third resistance level: 3375