Schabacker's Gold Trap Inside the Trap: Schabacker Congestion, VWAP Warfare & The Silent Distribution on XAU/USD

1. The Congestion Area – Schabacker Style

🔍 What We Saw:

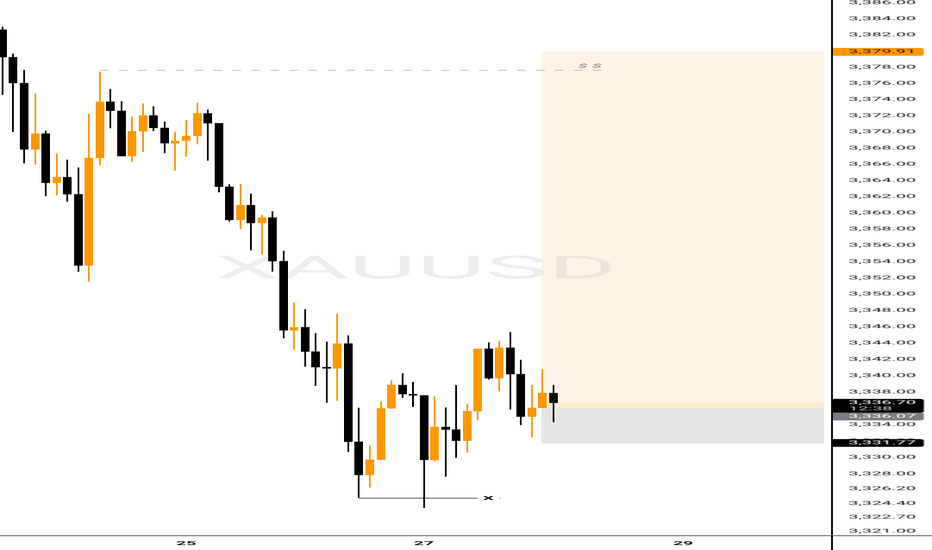

Price action rotated in a tight range: 3,324.5 - 3,329.5.

This is not random. This is Schabacker’s classic Congestion Zone:

Duration: 12+ hours

Width: ~5 points

Volume: tapering near edges

Failed breakouts on both sides = classic neutral wedge compression.

🎯 Schabacker Teaching Applied:

"Congestion areas are places of rest and preparation — they are the breeding grounds of significant breakouts or breakdowns."

From his bible “Technical Analysis and Stock Market Profits”:

Congestion after a trend → likely a continuation (but confirm via breakout volume).

Multiple failed breakouts = deceptive strength/weakness → traps.

Range becomes psychological equilibrium → breakout from this zone is explosive.

📘 Lesson:

Watch for breakout confirmation only AFTER price escapes the congestion and retests the range (confirm with volume and delta). If volume weakens and price returns inside = fakeout, fade that sh*t.

🔥 How Schabacker Explains July 29 Price Action

"This was a classic congestion scenario with symmetrical compression, rejecting value high and value low over and over — a balanced market ripe for an imbalanced expansion."

Price coiled with lower highs + higher lows inside the value zone = triangle-like congestion.

Breakout attempts both sides failed = energy stored.

Delta flipped negative toward the close + volume dried = distribution inside the congestion.

✅ Congestion was not random chop. It was the Smart Money disguising their exit before slamming price.

⚔️ ENHANCED STRATEGIC OUTLOOK FOR TODAY (JULY 30, 2025)

🎯 Bias: Short bias unless proven wrong by breakout + acceptance above 3,329.50

Schabacker’s congestion broken to the downside = high probability short trigger.

First target = edge of congestion zone @ 3,316.80 (previous VAL).

Second target (extension) = swing low anchor near 3,310.

📘 Volatility Note:

After tight range like this (Schabacker Box), volatility expansion is imminent. Don’t get caught trading inside — trade the break and retest.

💣 HYPOTHETICAL TRADE PLAN: SCHABACKER STRATEGY IN PLAY

Order Type: 🔻 Sell Stop Below Congestion Break

Entry: 3,322.00

Stop Loss: 3,330.00 (above congestion top + failed breakout zone)

Take Profit 1: 3,316.80 (edge of range, VAL)

Take Profit 2: 3,310.00 (target from congestion width projection)

Confidence: 78%

🧠 Justification:

Factor Explanation

VWAP Flatlined = balanced market

FVRP Price camped near POC = equilibrium

Footprint Absorption at highs, silent selling = distribution confirmed

Delta Early buyer strength flipped = trap

Schabacker Congestion Classic box breakout setup = timing the expansion

🧠 EDUCATIONAL SUMMARY — WHAT YOU JUST LEARNED

✅ Schabacker’s Congestion Area Tactics

Congestion after a move Leads to continuation (trend resumes after pause)

Multiple failed breakouts Traps traders = setup for fakeout fade

Volume dries inside box = Explosive breakout likely

Use congestion width To project breakout targets

You don't fade chop — you exploit it after the breakout.

Don't waste your bullets inside the box. Wait for the beast to break loose — then you unload.

XAUUSDK trade ideas

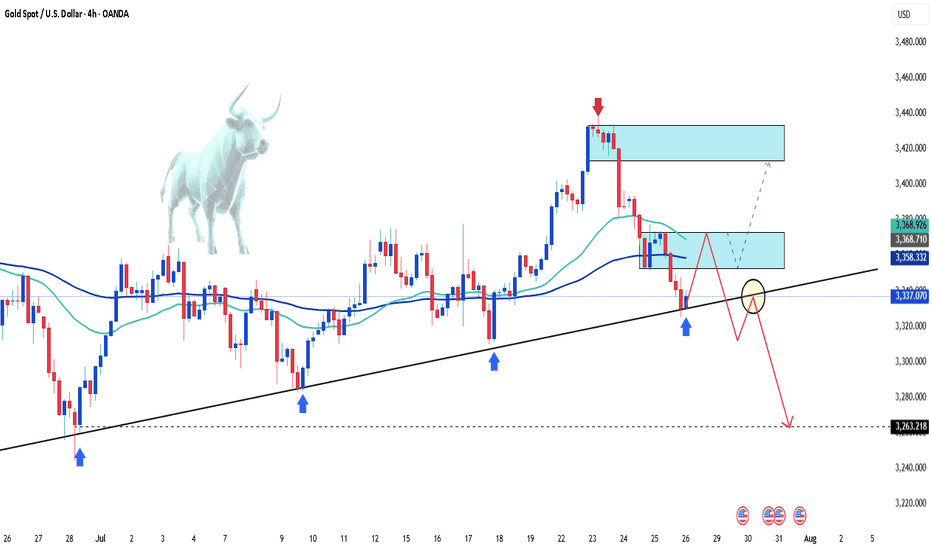

Gold Bear Flag Forming After Trendline Break – Short Setup BelowGold (XAUUSD) recently broke a major ascending trendline that had held since late June, leading to an aggressive sell-off from the $3,440s down to the $3,270 zone.

Following that, price is now consolidating just beneath the previous support trendline, forming what appears to be a bear flag or rising channel inside a corrective structure.

The $3,330–$3,340 zone is now acting as resistance, and price is struggling to close above this level.

The current structure suggests continuation to the downside, with clean space to revisit the $3,271 liquidity pool and potentially even sweep that low.

Watch for bearish confirmation below the current flag – especially if price prints a rejection wick or engulfing candle at the upper edge of the box.

⸻

Key Levels:

• Resistance: $3,330 – $3,340 (flag top + previous support turned resistance)

• Support: $3,271 zone, followed by $3,248 sweep potential

⸻

Trigger Criteria:

• Bearish rejection inside the flag (e.g. pin bar or engulfing)

• Break and retest of the flag bottom or horizontal support

⸻

Risk Note:

A clean break back above $3,350 and reclaim of the previous trendline would invalidate this idea short term and shift bias back to neutral/bullish.

GOLD: Strong Growth Ahead! Long!

My dear friends,

Today we will analyse GOLD together☺️

The market is at an inflection zone and price has now reached an area around 3,321.22 where previous reversals or breakouts have occurred.And a price reaction that we are seeing on multiple timeframes here could signal the next move up so we can enter on confirmation, and target the next key level of 3,329.97.Stop-loss is recommended beyond the inflection zone.

❤️Sending you lots of Love and Hugs❤️

[XAUUSD] Reversal Signals from Key Support As of the July 28–29 trading sessions, the XAUUSD 15-minute chart is showing early signs of a bullish reversal, with price reacting strongly at a key Fibonacci support zone and breaking through a descending trendline.

1. Price Action and Technical Structure

After a prolonged downtrend from the 3,430 zone, gold found support at the 0.618 Fibonacci retracement (3,327.85), aligning closely with the horizontal support at 3,324 – 3,327.

A descending trendline has been breached, signaling a potential breakout setup.

A potential ZigZag corrective wave structure is forming, hinting at the beginning of a new bullish swing.

2. Fibonacci Extension & Upside Targets

The Fibonacci extension tool suggests a possible rally toward the 3.618 extension at 3,425.

This level marks the next major upside target if the breakout holds.

3. Key Price Levels

Price Zone

Technical Significance: 3,327 – 3,324 Major support zone (Fib 0.618 + horizontal support)

3,350 – 3,355 First reaction zone / interim resistance

3,380 – 3,400 Strong resistance zone

3,425 Final target – 3.618 Fib extension

4. Suggested Trading Strategy

Long Setup – Breakout & Reversal Confirmation

Entry: 3,328 – 3,332 (after bullish confirmation above trendline and support)

Stop Loss: Below 3,320 (beneath local swing low)

Take Profit: 3,355 → 3,380 → 3,425 (scaling out by zone)

Bearish Continuation Scenario

If price drops below 3,320 and breaks 3,307 support, the bullish outlook is invalidated, and a retest of deeper levels is likely.

5. Volume and Confirmation Cues

Volume has started to pick up as price tests the breakout zone – indicating that buying pressure may be returning.

Wait for a strong bullish candle with volume above average before committing to the trade.

Gold is approaching a critical inflection point, and bulls may regain control from this confluence support zone. Stay alert for a breakout confirmation. Save this idea if you find it helpful and follow for more high-probability strategies!

Daily Analysis- XAUUSD (Monday, 28th July 2024)Bias: Bullish

USD News(Red Folder):

-None

Notes:

- Price gap down and filled up the gap

- Looking for price to tap 0.618 fib level

- Potential BUY if there's

confirmation on lower timeframe

- Pivot point: 3300

Disclaimer:

This analysis is from a personal point of view, always conduct on your own research before making any trading decisions as the analysis do not guarantee complete accuracy.

Gold under pressure as USD strengthensGold is facing significant selling pressure as the US dollar regains momentum. Currently, XAU/USD is trading near $3,337, down over $31 from the session high, and pressing directly against the ascending trendline.

The stronger USD is making gold—an asset that yields no interest—less attractive to investors. If this dollar strength continues, the likelihood of a trendline break and further downside is very high.

On the economic front, U.S. jobless claims have fallen to their lowest level in three months, signaling a resilient labor market despite sluggish hiring. This stable jobs data is expected to support the Fed’s decision to hold interest rates steady at 4.25–4.50% in the upcoming policy meeting, even amid rising inflation pressure driven by President Donald Trump’s tariff policies.

At this moment, sellers are in control. Traders should closely watch upcoming support zones and trading volume to spot reasonable entry points.

Good luck!

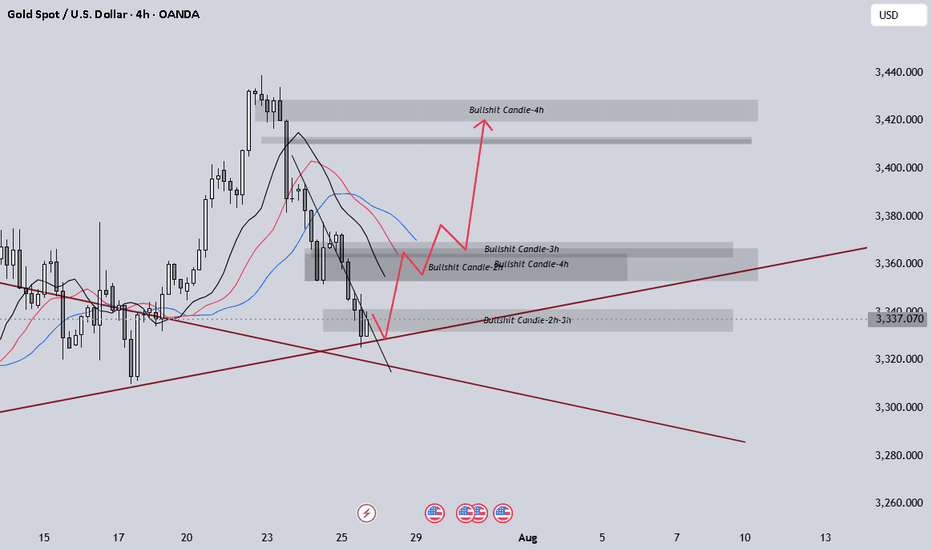

XAUUSD idea for upcoming weekThe chart presents a bearish outlook for gold based on a retracement and continuation pattern. Here's a detailed analysis:

🔍 Chart Summary:

Current Price: Around 3336

Bias: Bearish (after retracement)

Resistance Zone: 3370 – 3380

Sell Confirmation Area: Upon rejection from the 3370–3380 resistance zone

Target 1 (TP1): 3300

Target 2 (TP2): 3280

📈 Technical Structure:

Recent Trend:

The price has dropped sharply from its recent peak.

Now it's attempting a pullback to previous support, which has turned into a resistance zone (3370–3380).

Price Action Expectation:

A retracement is expected toward 3370–3380.

If the price gets rejected from this resistance block, the chart suggests the formation of a lower high.

After rejection, a bearish continuation is expected.

Projected Move:

Short entry around the resistance zone.

Targets:

TP1: 3300 (intermediate support)

TP2: 3280 (major support)

🧠 Trade Idea Logic:

The chart follows a classic bearish price action setup: impulse → retracement → continuation.

The consolidation and break area has flipped from support to resistance.

The retracement zone is clearly defined, making it a high-probability area for reversal if bearish signals (e.g., rejection candles) form.

⚠️ Key Considerations:

Wait for confirmation: Do not enter blindly at 3370–3380. Look for rejection patterns (like a bearish engulfing or pin bar).

Volume and fundamentals: Watch for economic data or geopolitical news that might invalidate the technical setup.

SL Suggestion: Above 3385 or 3390 to allow some room for wick spikes.

Gold Price Update – Bearish Flag Signals Possible Drop AheadGold is currently trading around $3,324, showing consolidation after a recent decline from the $3,345 region. The chart shows a bearish flag pattern forming after the sharp drop, indicating potential continuation of the downtrend. If gold fails to break above this region, sellers may push the price lower towards $3,301 and possibly $3,275.

The descending trend line adds further bearish pressure, limiting upside momentum unless gold decisively breaks and holds above $3,345. Overall, gold remains under short-term bearish sentiment, with the focus on support retests. Any bullish momentum will only be confirmed if the price closes above the flag and trendline resistance.

Key Points

Resistance Zones: $3,328 (0.618 Fib), $3,345 (flag top).

Support Zones: $3,301 (Fib base), $3,284, and $3,275 (bearish extension).

Trend Outlook: Short-term bearish unless price breaks above $3,345 with volume.

Bearish Targets: $3,301 → $3,284 → $3,275.

Bullish Invalidations: Break and close above $3,345 may shift bias to bullish.

Note

Please risk management in trading is a Key so use your money accordingly. If you like the idea then please like and boost. Thank you and Good Luck!

XAUUSD Gold Trading Plan – Monday, 4th August 2025 (M30 TF)Strategy Type: Intraday Trend Trading (Buy-the-Dip)

Timeframe: 30-Minute (M30)

Market Bias: Bullish

Execution Style: Step-Ladder Scaling into Strength

🧠 Market Outlook

Gold remains in a bullish trend structure, supported by geopolitical risk, moderate inflation sentiment, and the weakening US Dollar. While Friday showed signs of short-term exhaustion, price is still forming higher lows on the 30-minute chart, suggesting intraday momentum remains to the upside.

Based on current price action and Fibonacci retracement levels, I expect a healthy pullback early Monday before a push towards new short-term highs. I will be trading in phases — buying on dips and scaling out at each resistance zone.

✅ Phase 1: Buy on Dip at 3352 (Key Support Zone)

Entry Zone: 3352

Reasoning:

3352 lines up with M30 demand zone (previous accumulation area)

61.8% Fibonacci retracement of the last M30 bullish swing

Likely to act as intraday support if price retraces from current levels

Confirmation:

Strong bullish candlestick reversal (e.g. bullish engulfing, hammer, or rejection wick) on M30

Volume uptick or bullish divergence on RSI preferred

Stop Loss:

Just below 3346 (below the last valid swing low to protect the trade)

🎯 Target 1: 3361

Why: This is the first intraday resistance and previous minor high on M30

Action:

Secure partial profits (~50%)

Move SL to breakeven or +5 pips to protect capital

Wait for next retracement

✅ Phase 2: Wait for Pullback After 3361

Retracement Zone: Expected dip to 3356–3358 area (new higher low)

Re-Entry Condition:

Retest of breakout level with strong bullish candle on M30

Maintain bullish market structure

🎯 Target 2: 3370

Why: This is the next resistance zone and price magnet based on Friday's volume profile

Action:

Secure additional 30% profit

Trail SL below structure (~3362)

✅ Phase 3: Wait for Final Dip Before Final Push

Retracement Zone: Around 3364–3366 (support flip area)

Re-Entry Condition:

Rejection of this zone with continuation pattern (bullish flag, ascending triangle)

🎯 Target 3: 3379

Why: 3379 is near the top of current intraday channel and strong resistance on 4H/M30

Action:

Close all remaining positions

Assess for potential breakout above 3380 only if momentum is strong

⚠️ Risk Management Plan

Max Risk: 1.5% account risk split across 3 phases (0.5% per entry)

All SLs defined before entry — no averaging down

Trades invalidated if price breaks and closes below 3346 on M30

🔁 Summary Table

Entry Level Target Action

Buy @ 3352 TP1 = 3361 Secure partial profit, trail SL

Re-buy ~3356–3358 TP2 = 3370 Secure partial profit, trail SL

Re-buy ~3364–3366 TP3 = 3379 Close full position

🧭 Other Key Watch Points

DXY: Watching for rejection below 104.60 – bullish for Gold

News Events: Low-impact day; watch for any unscheduled Fed speakers

RSI + Volume: Using RSI (14) and OBV to confirm entry strength on M30

GOLD H2 Intraday Chart Update For 29 July 2025Hello Traders, Welcome to new day

we have US JOLTS high impact news today, for market sustains above 3300 psychological level

if market successfully break 3280 level then it will move towards 3280 or even 3270

if market crosses 3330 level successfully then it will move towards 3345 or even 3360

All eyes on FOMC & NFP news for the week

Disclaimer: Forex is Risky

Only by understanding the trend can you be firmly bullish.The market is changing rapidly, and going with the flow is the best way to go. When the trend comes, just go for it. Don't buy at the bottom against the trend, so as not to suffer. Remember not to act on impulse when trading. The market is good at dealing with all kinds of dissatisfaction, so you must not hold on to orders. I believe many people have experienced this. The more you resist, the more panic you will feel, and the floating losses will continue to magnify. You will not be able to eat or sleep well, and you will miss many opportunities in vain. If you also have these troubles, then you might as well follow Tian Haoyang's rhythm and try to see if it can make you suddenly enlightened. If you need help, I will always be here, but if you don't even extend your hand, how can I help you?

Gold rose unilaterally after the positive non-farm payrolls on Friday, hitting a new high this week. This week's K-line closed in a hammer shape, and the gold hourly line has a double bottom structure. However, gold should not have such a big retracement for the time being. The 3335-3330 line below is also an important support. So gold will mainly be bought on dips above 3335-3330 next week. Technically, there is still room for growth next week. The bulls continued to attack at the end of Friday and closed at 3363. Next week, we will continue to pay attention to the short-term suppression at the 3370-3375 line above. In terms of operations, we will continue to maintain retracement and buy. If your current operation is not ideal, I hope I can help you avoid detours in your investment. Welcome to communicate and exchange. Judging from the current gold trend, the short-term resistance above next week will be around 3370-3375, with a focus on the important pressure line of 3395-3400. Keep buying on pullbacks, and try to maintain a stable wait-and-see position in the middle. I will prompt the specific operation strategy at the bottom, so please pay attention in time.

Gold operation strategy: Go long on gold when it retraces to around 3340-3330, target 3370-3375, and continue to hold if it breaks through.

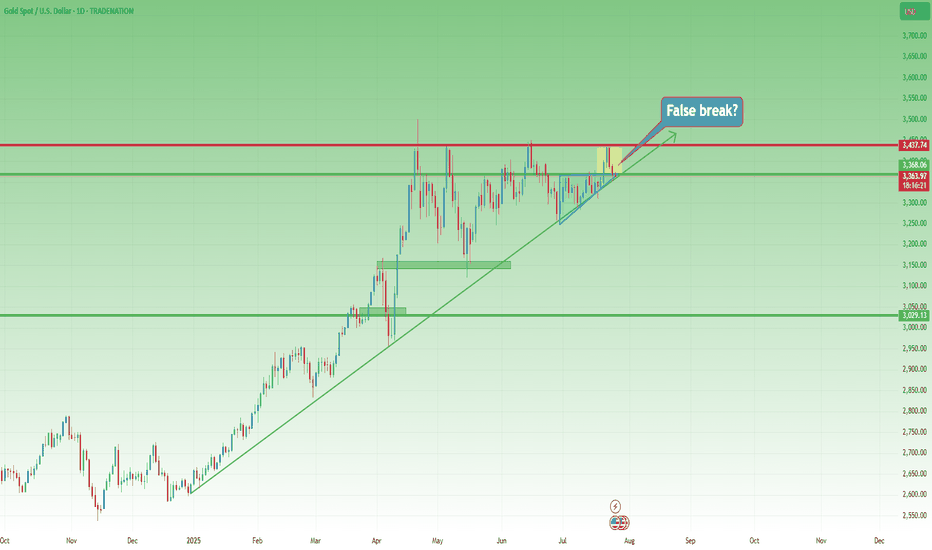

XAUUSD – The Structure Is Still Bullish... But Barely Holding 📌 In yesterday’s analysis, I mentioned that although Gold corrected deeper than expected, dropping below 3400, the bullish structure remained intact — and I stayed true to that view by buying dips.

🎯 The trade didn’t go as planned. Fortunately, the New York rebound from 3350 helped me exit at breakeven.

🧭 So now the big question is:

Is Gold reversing to the downside?

The answer: Not confirmed yet.

The structure is technically still bullish, but the chart is far from pretty.

🧨 What’s going wrong?

❌ Bearish engulfing candle on Wednesday – I chose to ignore it yesterday, but it’s still there.

❌ The breakout above 3375 (ascending triangle resistance) is failing – and could now turn into a false breakout trap.

❌ The ascending trendline from January 2025 is under pressure.

❌ And if today we close near 3350, the weekly chart will show a bearish Pin Bar – not exactly a sign of strength.

📉 My current plan:

- If price rallies back above 3380 → I’m looking to sell into strength, not buy.

- If we break below 3350 → I’ll also look to sell the breakdown.

Right now, for Gold to regain bullish momentum, it needs to reclaim 3400. No compromise.

⚠️ Summary:

Yes, the bigger structure is still bullish.

But momentum is fading, and price action is starting to turn against the bulls.

We need confirmation, not hope.

If 3350 breaks cleanly – things could accelerate to the downside.

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

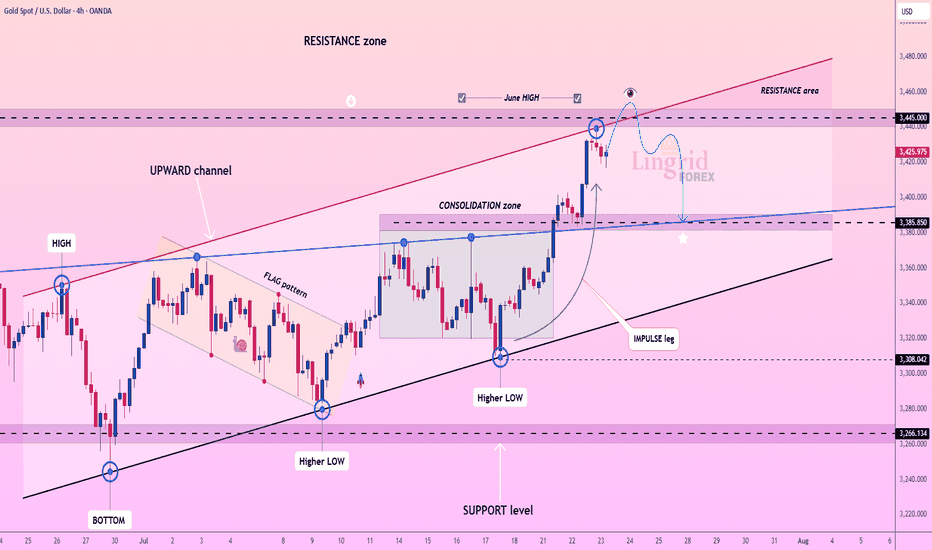

Lingrid | GOLD Key Resistance Zone. Possible Short-Term TradeThe price perfectly fulfilled my last idea . OANDA:XAUUSD has reached the upper boundary of the resistance zone around 3,445 after a strong impulse leg from the support trendline and the breakout of consolidation. Price action shows signs of exhaustion just below the June high, forming a potential reversal pattern near the channel top. If gold fails to hold above this resistance, a short-term pullback toward the 3,385 level becomes likely. The setup favors a short-term corrective decline unless bulls reclaim control with a breakout above the red trendline.

📉 Key Levels

Sell trigger: Rejection below 3,445

Sell zone: 3,430–3,445

Target: 3,385

Invalidation: Close above 3,480

💡 Risks

Breakout continuation toward 3,480

Sustained momentum from recent impulse leg

DXY weakness boosting gold's appeal

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!