XAUUSDK trade ideas

Gold Breakout or Pullback Ahead?Currently, price is in a correction phase within this rising channel after hitting the upper resistance near $3,438. The pullback is moving toward the mid and lower channel zones, which is healthy for a bullish continuation. Gold is in a healthy pullback phase inside a bigger bullish trend. If support at $3,358 – $3,373 holds, expect an upward push back to $3,438 → $3,487 → $3,517 in the coming sessions. Only a clean break below $3,309 would signal a deeper bearish move.

Gold is likely to consolidate or retest the lower channel support ($3,358 – $3,373). If buyers defend this zone, the price is expected to bounce back toward $3,400 – $3,420 and eventually retest $3,438.

Key Price Zones

- Main Resistance: $3,438 (if broken, potential rally toward $3,487 → $3,517)**

- Immediate Support: $3,373 (first reaction level)

- Major Support: $3,358 (key level to protect bullish structure)

- Potential Higher Low Zone: Around $3,342.44

Expected Price Behavior

- If gold holds above $3,373 – $3,358, it is likely to form a new higher low near $3,342 – $3,358 before attempting to push higher.

- A successful breakout above $3,438 would indicate continuation of the bullish momentum targeting $3,487 and $3,517 ).

- Failure to hold above $3,358 may open the door for a deeper correction toward $3,309, but the overall trend remains bullish unless that level is broken.

Trend Outlook

- Short-Term Trend: Consolidation / corrective pullback within a bullish channel

- Medium-Term Trend: Bullish (higher lows and breakout structure intact)

- Long-Term Trend: Bullish as long as the channel holds above $3,309

Gold is currently in a pullback phase after a strong bullish breakout. The market is likely forming a higher low and may resume upward momentum once the $3,373 – $3,358 zone is confirmed as support. A breakout above $3,438 would validate a bullish continuation toward $3,487 - $3,517.

Note

Please risk management in trading is a Key so use your money accordingly. If you like the idea then please like and boost. Thank you and Good Luck!

GOLD Long After Lower Dip - Catching PullbackOANDA:XAUUSD / TVC:GOLD Long Trade, with my back testing of this strategy, it hits multiple tp, here price will pullback up.

Price will bounce in this zone.

I kept SL slight big to be safe because TP levels are good so I don't want to get pushed out because of tight SL.

Note: Manage your risk yourself, its risky trade, see how much your can risk yourself on this trade.

Use proper risk management

Looks like good trade.

Lets monitor.

Use proper risk management.

Disclaimer: only idea, not advice

NFP Friday - XAUUSD Prediction - August 2025#NFP Friday + New Month 👇

- Still leaning bearish on TVC:GOLD

- New month = re-positioning flows

- Watching 3225–3250 zone (Fib 38/50 confluence)

- Clean pullback setup near Psy level & untested orders

News Prediction:

- Labor market still holding up, I’m thinking NFP prints closer to 130k–150k, not that 110k estimate

- Yes, tech & retail saw some layoffs, but not enough to tank the whole report

- Adapt if wrong, execute if right. No stress

#XAUUSD #Gold #NFP #Dollar #NFPFriday #XAUUSD #Gold #NFP #JobsReport #Dollar #Macro #Trading #MarketOutlook #NFPFriday

XAUUSD – Demand Zone Reaction & Potential Markup (VSA Analysis)💡 Idea:

Gold is testing a major 4H demand zone with early signs of smart money accumulation. VSA signals show supply exhaustion and potential for a bullish reversal toward upper resistance.

📍 Trade Setup:

Entry Zone: 3,265 – 3,285 (current demand zone)

Target 1: 3,380 – 3,400 (mid supply zone)

Target 2: 3,440 – 3,460 (major supply zone)

Stop Loss: Below 3,240 (to avoid false breakouts)

R:R Potential: ~3:1

📊 Technical Reasoning (VSA)

Stopping Volume Detected

On the recent drop into the demand zone, a wide spread down-bar on ultra-high volume appeared, followed by no further downside progress.

This is a classic stopping volume pattern where professional money absorbs selling pressure.

No Supply Confirmation

Subsequent candles inside the zone show narrow spreads on decreasing volume, indicating a lack of genuine selling interest.

Demand vs Supply Shift

Multiple attempts to break below 3,265 have failed, showing absorption of supply and positioning for markup.

If price rallies from here on increasing volume and wider spreads up, it would confirm demand dominance.

Structure Context

This demand zone has historically produced strong rallies.

Break above the minor resistance inside the zone could trigger a swift move toward Target 1, with momentum possibly extending to Target 2.

📌 Trading Plan:

Look for bullish confirmation bars with high volume before entry.

If price breaks below 3,240 on high volume, invalidate the long setup and watch for the next demand level around 3,140.

Partial profits can be taken at Target 1, and the remainder trailed toward Target 2.

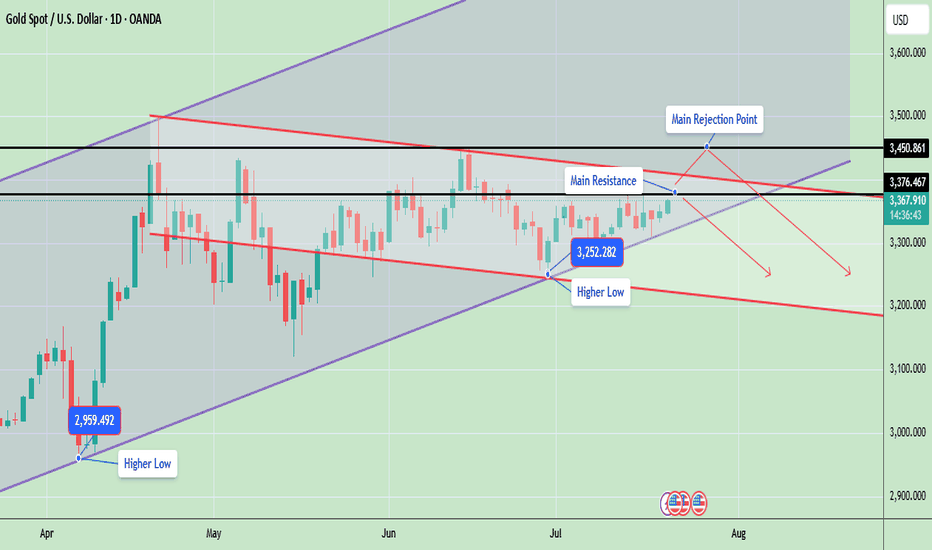

Gold Price Update – Testing Key ResistanceGold is currently trading around 3367, showing strong bullish momentum as it continues to form higher lows, which indicates an ongoing uptrend. The market structure is developing inside a rising wedge pattern, with the price consistently respecting both the ascending support and resistance lines.

Gold is now testing a key resistance zone between 3376 and 3450, an area that previously acted as a major supply zone and caused sharp rejections. A successful breakout and close above 3450 will likely confirm a bullish continuation and may open the door for a rally toward 3500 and possibly 3580. However, if gold fails to break this level, it could retrace back to the 3300 or 3250 support zones, especially if a rejection candle forms in the daily timeframe.

📊 Key Technical Highlights:

- Price has approached the upper resistance boundary of the wedge.

- Daily candle is bullish, indicating strong buying momentum.

- However, unless price closes above 3,376–3,450, there’s still a risk of rejection from the top channel and a pullback toward 3,300–3,250.

🔑 Key levels to watch:

- Gold is currently trading around $3,367, just below a crucial horizontal resistance at $3,376

- A strong breakout above $3,376, and especially above $3,450, could open the door for further bullish movement toward the $3,500–$3,600 range, following the upper trendline of the ascending channel.

- On the downside, if price fails to hold the higher low at $3,252, a drop toward $3,200 or even $3,100 is possible aligning with the downward red trendline.

- The structure remains bullish overall, as price is still making higher lows and staying within the rising channel

📊 Weekly Gold Chart Analysis

Gold is currently trading around $3,368, forming a symmetrical triangle pattern on the weekly timeframe. This pattern typically indicates a period of consolidation before a potential breakout in either direction. The price is getting squeezed between lower highs and higher lows, which is a sign of decreasing volatility and approaching breakout.

🔑 Key Technical Insights:

- ✅ Current Structure: Price has been consolidating within a triangle since April 2025 after a strong upward move. It is now near the apex of the triangle, suggesting a breakout is imminent—most likely in the next 1–2 weeks.

🔼 Bullish Breakout:

- If gold breaks above the triangle resistance (~$3,385–$3,393), it could trigger a sharp rally.

- Upside targets post-breakout: $3,450, $3,500, $3,600+ (if momentum continues)

🔽 Bearish Breakdown:

- A break below the triangle support (~$3,335–$3,325) may lead to a deeper correction.

- Downside targets post-breakdown: $3,285, $3,200

- Possibly $3,100–$3,050 if bearish sentiment intensifies

📉 Volume Drop:

As typical with triangles, volume has likely decreased, signaling indecision. Once volume returns, it will likely confirm the breakout direction.

Note

Please risk management in trading is a Key so use your money accordingly. If you like the idea then please like and boost. Thank you and Good Luck!

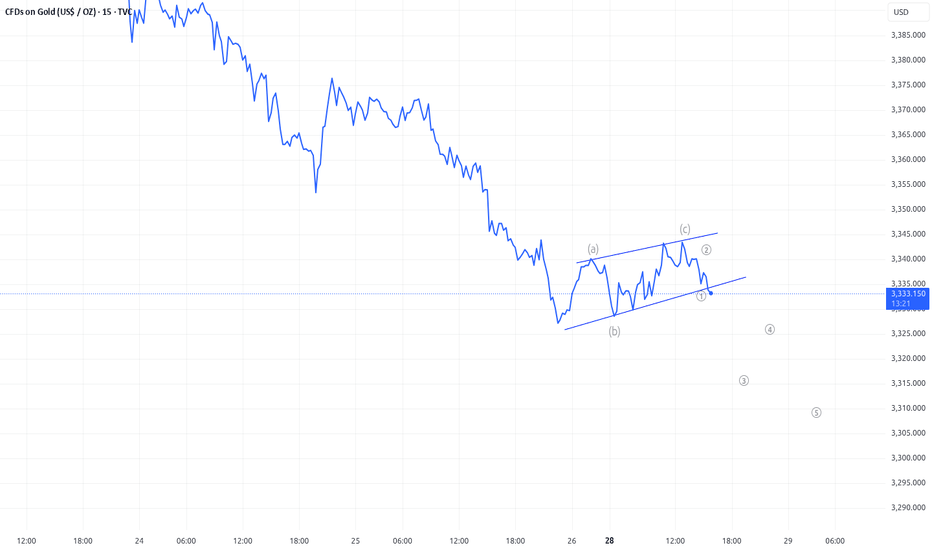

Gold 31 July – Bearish Bias Holds, Watching Supply ZonesGold (XAUUSD) Analysis – 31 July

Market structure is now aligned across both higher and lower timeframes:

H4: Bearish

M15: Bearish

This alignment strengthens the probability of trend-continuation setups in favor of the dominant downtrend.

🔄 Current Market Behavior:

The M15 chart is currently in a pullback phase, retracing toward its previous lower high and approaching a key supply zone.

📍 Key Supply Zones to Watch:

Zone 1 – Immediate Supply Zone (3299 – 3305)

• First area of interest where price may react.

• If respected and followed by M1 confirmation, a short setup could be initiated.

• Watch for signs of exhaustion or sharp rejection.

Zone 2 – Higher Supply Zone (3326 – 3332)

• If the first zone fails, this becomes the next high-probability area.

• Well-aligned with the broader bearish structure — expect stronger reaction potential.

• Suitable for cleaner high RR short trades if price reaches this level.

✅ Execution Plan:

• Observe how price behaves inside the marked zones.

• Only plan short entries after M1 confirmation — this adds precision and prevents premature entries.

• Stay patient. Let the market come to you and reveal intent before acting.

📌 Summary:

Bias: Bearish

Structure: H4 and M15 both support downside bias

Zones in Focus:

– Primary: 3299–3305

– Secondary: 3326–3332

Execution: Wait for confirmation before entering.

Risk-Reward: Maintain 1:3 RR minimum (e.g., 40 pip SL, 120 pip TP).

Let the structure guide your setups — not impulse.

📘 Shared by ChartIsMirror

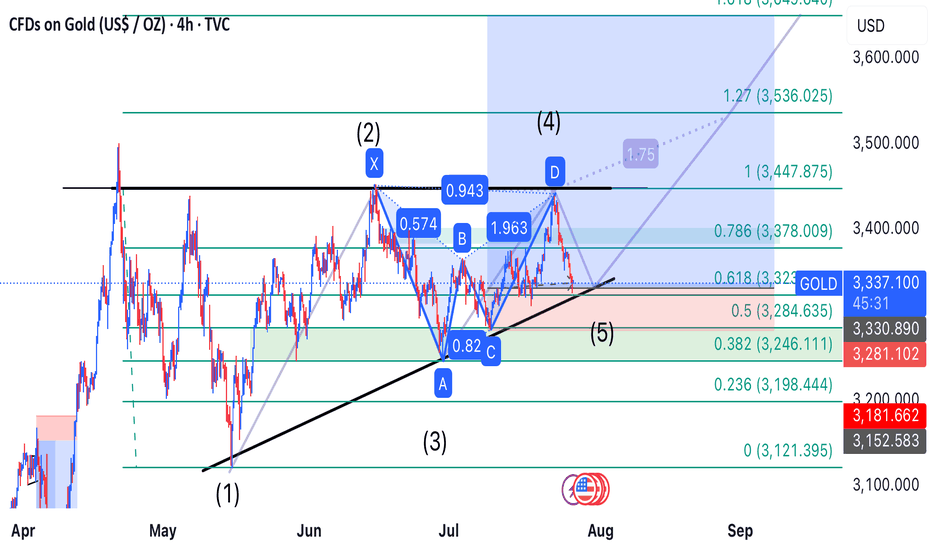

Gold’s Precision Drop: Wave 5 Ignites the Bullish Reversal

---

### 🚀 **Golden Opportunity Ahead: Wave 5 Bullish Breakout Incoming!**

After perfectly completing the **bearish Gartley pattern**, gold dropped precisely to the **target zone at 3,323**, just as predicted. This move confirmed the formation of **Wave 5**, signaling the end of the corrective phase.

Now, all signs point to a **strong bullish reversal**—and the next step is a powerful rally toward the predefined targets. This is a **prime buying opportunity** for traders looking to ride the wave!

### 🎯 **Buy Zone:**

- **Entry:** Around **3,323 USD**

### 📈 **Profit Targets:**

| Target | Fibonacci Level | Price (USD) |

|--------|------------------|-------------|

| TP1 | 1.0 | 13,447.875 |

| TP2 | 1.27 | 13,536.025 |

| TP3 | 1.618 | 13,649.640 |

The link of. The previous analysis is below in the comment

---

Gold deeper consolidation supported at 3266The Gold remains in a bullish trend, with recent price action showing signs of a continuation breakout within the broader uptrend.

Support Zone: 3266 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 3266 would confirm ongoing upside momentum, with potential targets at:

3335 – initial resistance

3351 – psychological and structural level

3366 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 3308 would weaken the bullish outlook and suggest deeper downside risk toward:

3250 – minor support

3230 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the Gold holds above 3266. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Gold Faces Strong Rejection Below $3,365 – Bearish Wave Ahead?Gold is currently trading around $3,359, showing signs of exhaustion after climbing from the $3,248 low. The chart illustrates a textbook scenario of channel rejection after testing the upper boundary of the descending wedge and failing to break above the $3,365–$3,392 resistance zone. Price is now hovering just below the diagonal black trendline, indicating a potential lower high formation and setting up for another bearish wave.

📌 Key Technical Highlights

Resistance Zone: $3,365–$3,392

This area marks the confluence of the black long-term trendline, the top of the descending purple channel, and the previous high at $3,392.

Price attempted a "Possible Retest" as annotated on the chart and is now starting to pull back—showing signs of bearish rejection.

Bearish Scenario (Blue Arrows):

Multiple downward arrows show likely bearish paths if the current resistance holds.

Key short-term targets:

$3,337, $3,320, $3,303, Strong support at $3,293–$3,248

Further downside may test extension levels toward $3,220–$3,200 by early August if momentum builds.

⚠️ Bearish Confirmation Criteria

Failure to close above $3,365 (black trendline)

Breakdown below $3,337 followed by $3,320

Strong selling pressure supported by fundamentals (e.g. USD strength, Fed hawkish stance)

✅ Invalidation / Bullish Outlook

A decisive breakout and close above $3,392.73 would invalidate the bearish structure.

In that case, targets would shift toward:

$3,412, $3,434, $3,490 (long-term trendline intersection)

However, today's U.S. CPI (Consumer Price Index) release adds a layer of volatility and potential trend disruption, making this a high-risk trading day.

📊 CPI News Impact – What to Watch

High CPI (Stronger than forecast):

- Increases expectations of further Fed tightening → strengthens USD → bearish for gold

- Likely scenario: sharp drop toward $3,337 → $3,320 → $3,293

Low CPI (Weaker than forecast):

- Signals disinflation → weakens USD → bullish for gold

- Possible breakout above $3,365 → retest of $3,392 → if broken, target $3,412 and $3,434

Neutral or as expected CPI:

- Likely leads to whipsaw — fakeout on both sides

- Caution advised — wait for candle close confirmations post-news

Note

Please risk management in trading is a Key so use your money accordingly. If you like the idea then please like and boost. Thank you and Good Luck!

[ TimeLine ] Gold 31 July 2025📆 Today’s Date: Wednesday, July 30, 2025

📌 Upcoming Signal Dates:

• July 31, 2025 (Thursday) — Single-candle setup

• July 31–August 1, 2025 (Thursday–Friday) — Two-candle combined range

🧠 Trading Outlook & Notes

✅ Gold has recently dropped sharply from 3439 to 3298, and current conditions suggest this bearish momentum may continue.

✅ I’ll be actively trading both the July 31 and July 31–August 1 setups as part of my ongoing strategy testing and live analysis.

✅ This method and timing structure can also be applied to other assets like BTC, the US Index, and various commodities.

⚠️ For those taking a more cautious approach, it’s absolutely okay to skip the single-candle setup on July 31 and wait for the more confirmed 2-day range setup (July 31–August 1).

📋 Execution Guidelines

🔹 Range Identification:

• Let the Hi-Lo range of the chosen candle(s) form completely.

• Purple lines will mark these ranges on the chart.

• After the daily close, charts will be updated to include a 60-pip buffer, Fibonacci zones, and relevant indicators.

🔹 Entry Conditions:

• Trades are triggered only if price breaks above/below the full range, including the buffer zone.

🔹 Risk Management – Recovery Logic:

• If the Stop Loss is triggered, the trade is exited or switched, and the next valid breakout setup will use a doubled lot size to attempt recovery.

📉📈 Chart Snapshot

🔗 Paste this in TradingView: TV/x/fykxBG6w/

📌 Stick to the plan, follow the system, and let the chart lead the way.

🛡️ Capital protection comes first — always manage your risk.

GOLD (XAUUSD) Analysis : Major Break + Bullish Setup + Target🟩 Today’s GOLD Analysis based on Volume Behavior, Smart Money Traps & Market Structure (MMC)

🔍 Chart Breakdown and MMC Concepts Explained:

1. Preceding Downtrend – Smart Money Trap Initiated

The chart begins with an extended downtrend, marking significant bearish pressure. However, deeper into the move, we notice price entering a Volume Absorption (VA) Zone — a key MMC signal where institutional orders quietly absorb aggressive retail selling.

This Volume Absorption Zone is highlighted on the left of the chart.

Smart money quietly positions longs here while inducing panic-selling from retail traders.

Wicks and indecision candles show early signs of sell exhaustion.

2. QFL Breakdown & Liquidity Sweep

The breakdown from the QFL (Quick Flip Level) is another hallmark of MMC behavior. The market intentionally breaks previous lows to trigger stop-loss clusters — known as a liquidity sweep or stop-hunt.

Price aggressively drops to a well-marked demand zone.

Massive bullish reaction from this zone confirms that smart money has completed accumulation.

The QFL move is not a true breakout, but a trap, designed to mislead retail into chasing shorts.

3. Demand Zone Reaction – Shift in Momentum

Price finds support at the demand zone (highlighted in green) and starts forming higher lows. This transition from lower lows to higher lows is a structural confirmation of market reversal.

Buyers have regained control.

Large bullish candles and wick rejections at key levels signal institutional entry.

4. SR Interchange Zone – Key MMC Confirmation

One of the most important zones on this chart is the SR Interchange area.

This level was previously resistance and is now acting as support — a concept known as support-resistance flip.

MMC teaches us that this is where smart money re-tests the breakout zone to trap late sellers and confirm the trend.

This zone is reinforced by:

Previous rejections

Retest with wicks

Alignment with ascending trendline support

5. Minor & Major Resistance Levels

Currently, price is attempting to break above a minor resistance at ~$3,330–3,332.

If it breaks, the next major target lies at the ~$3,340–3,345 level, marked on the chart.

This zone is crucial for short-term targets and may act as a profit-taking zone for early bulls.

Once this major resistance is cleared, the trendline projection suggests a continuation toward higher highs.

📐 Trendline Analysis

An ascending trendline is supporting price action. Each bounce off this line has led to higher lows — a clear sign of bullish intent.

Trendline + SR Interchange = Confluence zone

Traders should watch for bullish engulfing candles or strong wick rejections at this trendline area for re-entry or add-ons.

🧠 MMC Strategy Interpretation (Mirror Market Concepts)

This chart perfectly follows the MMC logic:

Trap retail sellers during the downtrend.

Absorb their volume at a key zone (Volume Absorp).

Sweep liquidity below QFL level.

Reverse structure with a shift to higher highs and higher lows.

Interchange SR zone to test buyers' strength.

Continue trend post-confirmation with breakout above resistance.

This is the classic "trap-to-trend" sequence smart money uses repeatedly in gold and other volatile markets.

✅ Trade Setup Summary:

Bias: Strongly Bullish (based on market structure shift)

Entry #1: Pullback into SR Interchange (ideal if price rejects 3,326–3,328)

Entry #2: Break and retest of Minor Resistance (3,332–3,334)

Targets:

TP1: 3,340 (Major Resistance)

TP2: 3,345–3,350 (Projection based on breakout path)

Invalidation: Clean break below trendline and demand zone (~3,318)

🧭 Final Words for Traders:

Gold is currently positioned at a critical junction where structure, volume, and institutional behavior all align. If you're following MMC strategies, this is a textbook scenario:

Trap ✅

Absorption ✅

Structure Shift ✅

Trendline Support ✅

SR Interchange ✅

Now, we wait for confirmation and execute with discipline.

Sell Analysis – 30M Smart Money Concept Sell Analysis – 30M Smart Money Concept

📊 Chart Context:

Timeframe: 30M

Market: Gold (XAUUSD)

Bias: Bearish – Scalp Sell

---

🔍 Key Observations:

Premium Zone Rejection:

Price tapped into a premium supply zone formed after a clear break of structure (BoS) to the downside. This confirms seller dominance at higher pricing levels.

FVG (Fair Value Gap) Fill:

The price filled a previous FVG imbalance and showed rejection without closing above the origin of the impulse. This shows liquidity grab behavior typical in smart money moves.

Bearish Order Block Confirmation:

A bearish OB was respected and reacted to. The latest candle shows strong rejection with a long upper wick and volume tapering — an early confirmation of potential entry trigger for scalp short.

---

🧨 Entry Strategy (Scalp Sell):

Entry Zone:

Inside the reaction to the OB and FVG (just below the premium zone)

✅ 3325 ~3330

Stop Loss:

Just above the last high or FVG origin

✅ 3340

Take Profit:

TP1: Towards the equilibrium of the recent impulse leg

✅ 3300

TP2: Below the discount zone, targeting liquidity under recent lows

✅ 3280

---

⚠️ Risk Note:

This is a scalping setup, not a swing trade. Higher timeframes still show mixed signals, so risk management is key. Avoid over-leveraging.

---

🏁 Summary:

> A high-probability scalp sell setup confirmed by smart money concepts: BOS → FVG Fill → OB Rejection → Liquidity Grab → Bearish Continuation.

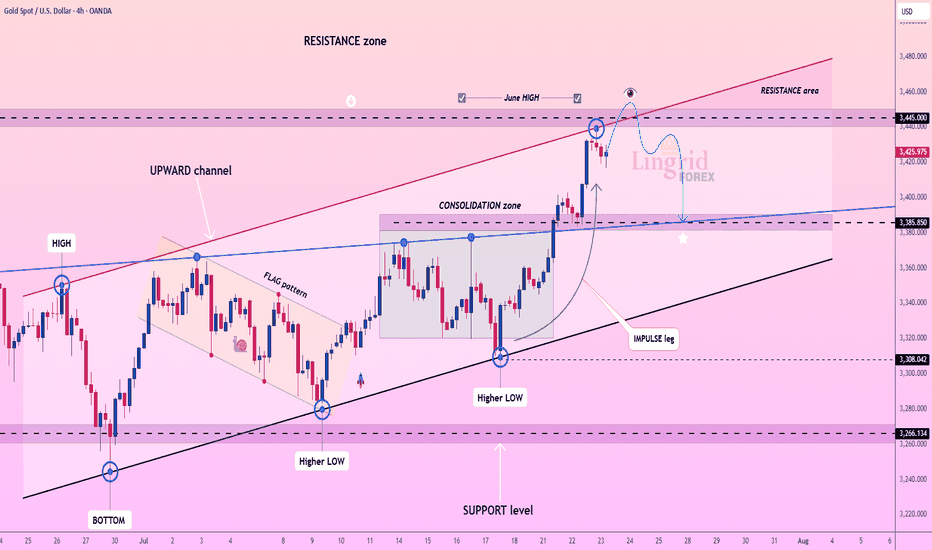

Lingrid | GOLD Key Resistance Zone. Possible Short-Term TradeThe price perfectly fulfilled my last idea . OANDA:XAUUSD has reached the upper boundary of the resistance zone around 3,445 after a strong impulse leg from the support trendline and the breakout of consolidation. Price action shows signs of exhaustion just below the June high, forming a potential reversal pattern near the channel top. If gold fails to hold above this resistance, a short-term pullback toward the 3,385 level becomes likely. The setup favors a short-term corrective decline unless bulls reclaim control with a breakout above the red trendline.

📉 Key Levels

Sell trigger: Rejection below 3,445

Sell zone: 3,430–3,445

Target: 3,385

Invalidation: Close above 3,480

💡 Risks

Breakout continuation toward 3,480

Sustained momentum from recent impulse leg

DXY weakness boosting gold's appeal

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

As the bull market continues, is gold poised to hit new highs?Judging from the current gold trend, the technical side opened high and closed low, releasing the demand for short-term adjustments. The intraday low hit 3344 and then rebounded, which is enough to reflect the resilience of the bulls. The hourly doji continued to rise, and the 3353 line was pulled up again. It is expected that it will be difficult to give an entry opportunity near 3340-3345 again. Since the new high has been refreshed again, the technical short-term adjustment may have ended. With the current strong bull structure, further testing the 3370-3380 area is a high probability event. If it unexpectedly falls below 3340 in the future, the bulls will no longer defend strongly, and the market may turn to volatility. Breaking below 3340 is also expected to open up short-term short space, but this is a later story. The current market structure is clear, and we continue to see a strong upward trend for the bulls. At least at the beginning of the week, I do not think the bull market is nearing its end.

Gold operation suggestion: go long around 3360-3355, target 3370-3380.Strictly set stop loss and control your position.

Gold rebound is weak, short below 3315

Gold remains weak, with multiple intraday rebounds failing to maintain momentum. The upper moving average continues to suppress the market, and the short-term market remains dominated by bears. Today, we are following the trend and taking a bearish stance. The key upside level is around 3315. If it reaches this level before the US market opens or if it peaks in the short term, we will short sell. The non-farm payroll data will be released today, and we will consider reversing our direction based on the situation after the data.

Gold prices have once again encountered resistance to their upward trend, and the volatile pattern continues. The gold price trend is trending lower highs, and today's low is expected to be lower than yesterday's. Therefore, our intraday short target could be 3268 or even lower, so it's crucial to seize the right entry point.

If you're new to the market, come to me. I'll teach you how to trade while you learn. If you're already in the market and struggling, come to me. I'll help you avoid repeating the same mistakes. If you've already experienced this market and are battered, come to me. I'm confident I can help you regain confidence. If you're stuck in a position, I'll develop a strategy tailored to your entry point. Because everyone's trapped positions are different, the solutions will vary, some suitable for conservative traders and others for aggressive ones. However, I can't offer a perfect answer to every situation. I suggest you bring your order with you. Once you contact me, I'll use the most appropriate method to resolve your situation and help you exit the market.

Specific Strategy

Short gold at 3315, stop loss at 3325, target at 3280

Gold (XAU/USD) on the 1‑hour timeframeGold (XAU/USD) on the 1‑hour timeframe

Chart Structure & Bias

* Price remains trapped in a **rising channel** (\~\$3,328–3,333), pressing against resistance near **\$3,340–3,345**.

* Short-term momentum is bearish: both EMA 7 and EMA 21 sit above current price, with declining volume signaling weakening buyer strength.

* Overall trend leans neutral‑to‑bearish until market clears key zones decisively.

Trade Scenarios

**Bearish Breakdown (Preferred)**

* **Trigger:** Break and close below channel support (\~\$3,326).

* **Targets:** Initial drop toward **\$3,320**, then **\$3,300**, and possibly lower if momentum intensifies.

* **Invalidation:** Price pushes back above **\$3,333–3,335**, negating bearish structure.

**Bullish Breakout (Conditional)**

* **Trigger:** Clean breakout and sustained close above **\$3,342–3,345**.

* **Targets:** Upward stretch toward **\$3,355–3,360**, and if strong, **\$3,367–3,375+**.

* **Invalidation:** Fails to hold structure—retesting from above back beneath **\~\$3,338**.

Macro Drivers & Market Conditions

* Caution prevails pre‑Fed decision and ADP / GDP releases—market awaits cues on interest rate direction.

* Safe‑haven demand has softened as global trade sentiment improves, while U.S. dollar strength continues to cap upside in gold.

* Analysts favor **sell‑on‑rise positioning**, bumping up potential for controlled pullbacks.

Verdict

Gold is consolidating in a tight upward channel, showing short-term bearish pressure. The **bearish breakdown scenario holds the edge** unless price convincingly clears above **\$3,345** on strong volume, which could flip bias. A confirmed break below **\$3,326** sets the stage for downward moves toward **\$3,300** or lower.

GOLD SETUP – BUY THE DIP OR SELL THE LIQUIDITY?Smart Money Playbook with Macroeconomic Context

📅 Date: July 31, 2025

🧠 Analyst: Clinton Scalper

🔍 Technical Breakdown (XAU/USD – H1/H4 Confluence)

Price is currently reacting within a key Fair Value Gap (FVG) zone and appears to be setting up a liquidity sweep on both sides before committing to a strong directional move.

🟢 BUY PLAN

Entry: 3,284

SL: 3,275

TP Targets:

▫️ TP1: 3,290

▫️ TP2: 3,300

▫️ TP3: 3,310

▫️ TP4: 3,320

▫️ TP5: 3,330

▫️ TP6: 3,340

▫️ TP7: 3,350

Key Support Zone: 3,276–3,284

→ Bullish OB + previous demand + potential BOS if price holds

🔴 SELL PLAN

Entry: 3,324

SL: 3,334

TP Targets:

▫️ TP1: 3,320

▫️ TP2: 3,310

▫️ TP3: 3,305

▫️ TP4: 3,300

Sell Zone: Inside FVG + liquidity inducement structure

→ Sell into imbalance after price fakes above recent swing highs

🔎 Smart Money Logic

Price is navigating a deep retracement inside a key FVG, targeting both sides of liquidity before trend continuation.

The BUY PLAN aligns with a classic "liquidity sweep → OB rejection → internal structure break".

The SELL PLAN is a short-term scalping idea inside the FVG liquidity zone, where institutional orders are often triggered before real bullish continuation.

🌍 Macroeconomic Context

US GDP data recently came in slightly below forecast → weaker USD outlook.

Gold demand remains supported due to:

Geopolitical risks (Ukraine, Taiwan tensions)

Market uncertainty over next Fed move (dovish bias increasing)

Real yields declining → bullish for precious metals

However, any hawkish Fed speak or sudden bond yield spikes can trigger intraday sell-offs into OB demand.

🎯 Trading Strategy Outlook

Buy if price sweeps below 3,284 and holds the demand zone. Target extended upside as macro supports gold.

Sell scalp at 3,324–3,330 zone if price shows rejection in FVG zone, but don’t overstay shorts.

⏳ Patience is key: Let price fill liquidity zones and follow smart money trail.

📌 Summary

🔸 Primary Bias: Bullish (Buy Plan favored due to macro + structure)

🔸 Secondary Bias: Bearish scalps from premium FVG

🔸 Watch for: USD volatility, yields, and institutional reaction in OB/FVG zones.

Gold Bulls Charging to 3305 But What’s Waiting There?Gold has recently taken support from the lower levels and has also shown a Break of Structure (BoS) to the downside. Currently, there is Imbalance and Internal Draw on Liquidity (IDM) resting around the 3305 level. The market appears to be moving upward to mitigate that imbalance. It's important to closely monitor this zone, as once the market reaches and fills this area, there is a high probability of a potential rejection or bearish move from that level