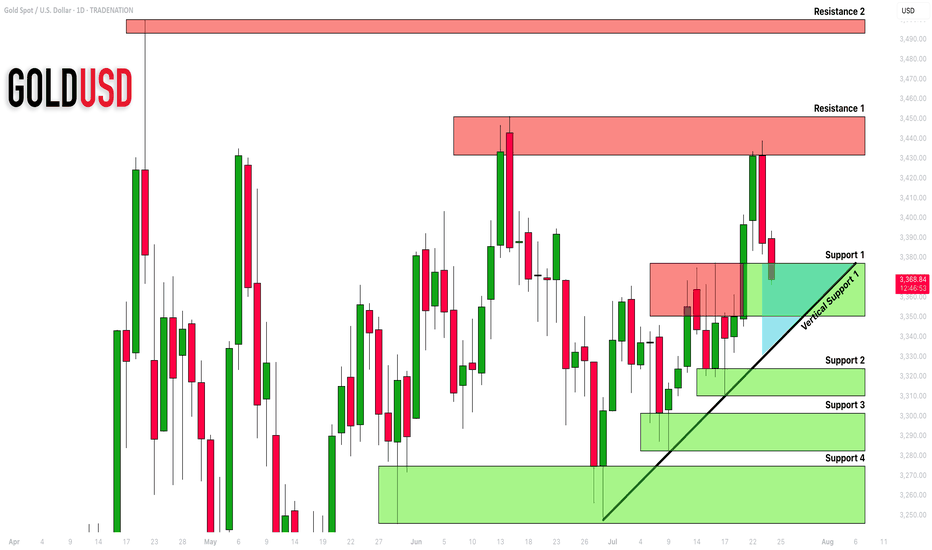

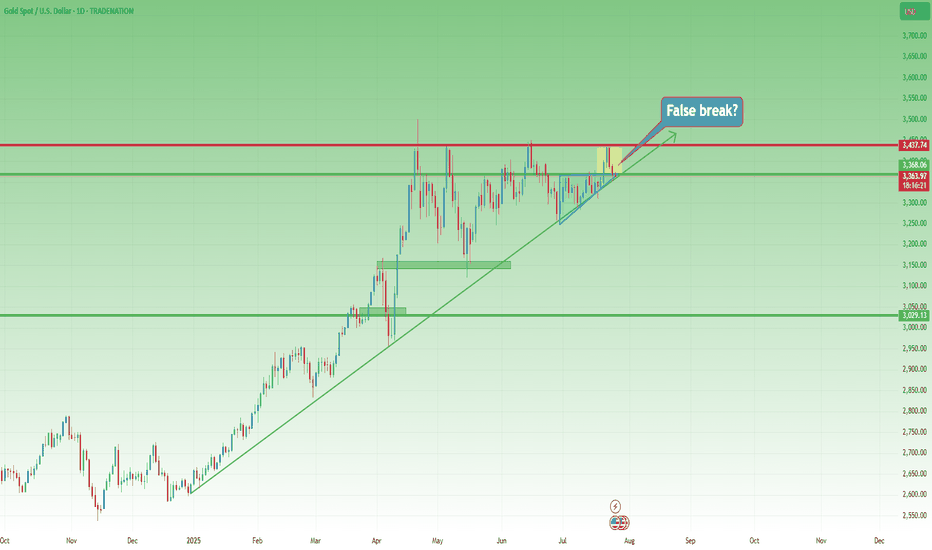

GOLD (XAUUSD): Important Demand Zone Ahead

Gold is currently retracing from a key daily horizontal resistance.

Here are important structures to watch.

Horizontal Structures

Support 1: 3350 - 3377 area

Support 2: 3310 - 3324 area

Support 3: 3282 - 3301 area

Support 4: 3245 - 3374 area

Resistance 1: 3431 - 3451 area

Resistance 2: 3493 - 3500 area

Vertical Structures

Vertical Support 1: rising trend line

Vertical and Horizontal Supports 1 compose a contracting demand zone.

Probabilities are high the price will pull back from that.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

XAUUSDK trade ideas

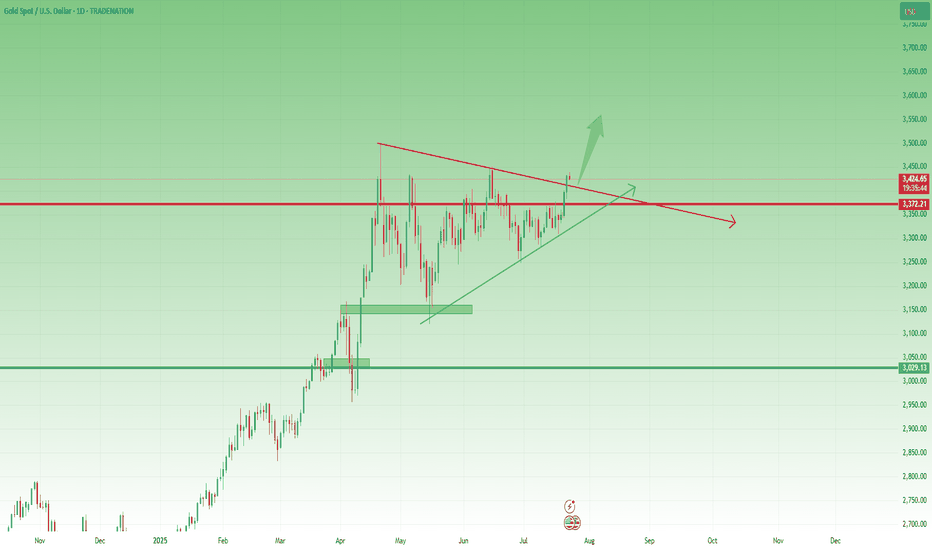

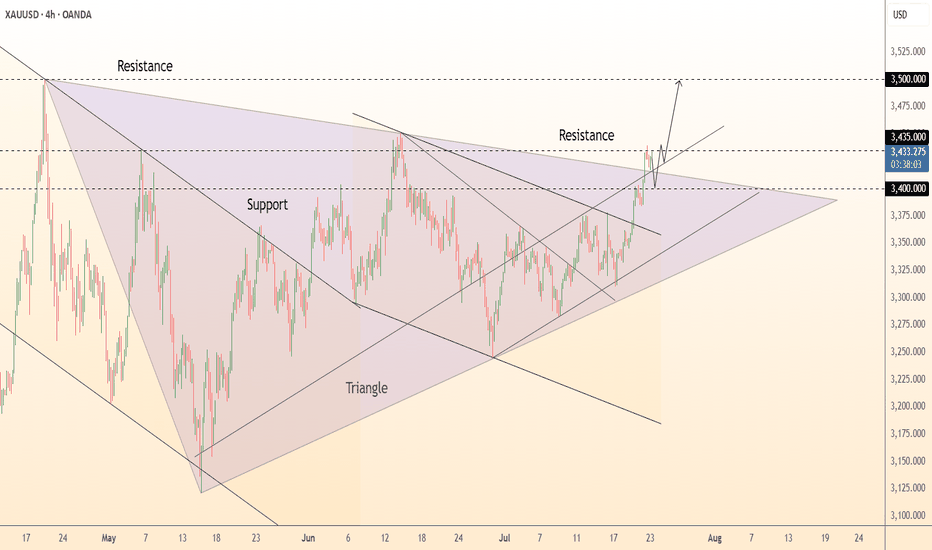

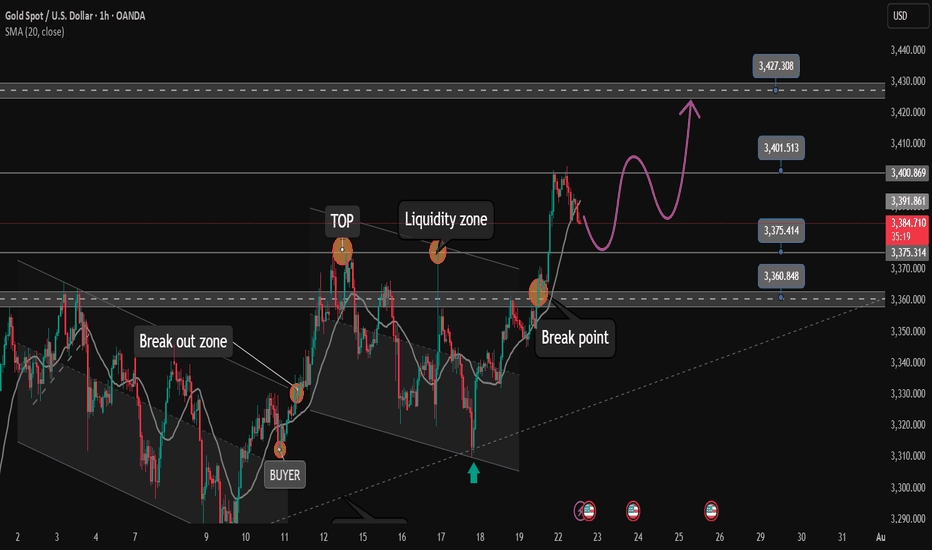

Gold Update – Strong Breaks, Strong BullsYesterday, after the break of the key 3370 resistance, Gold corrected slightly toward 3383, then consolidated briefly in that area. From there, it launched into a strong new leg up, closing the day once more near the highs, around 3430.

📌 What’s important here is that the price did not even come back to retest the broken resistance — now turned support. Combined with the strong daily close near the high of the range, this gives us a clear message:

➡️ Bulls are in full control.

________________________________________

🔍 This Week – Three Key Breaks

So far this week, Gold has delivered three major breakouts:

• ✅ A clean breakout from the box consolidation that kept price stuck and indecisive last week

• ✅ A decisive break above the 3400 psychological figure

• ✅ A breakout above the symmetrical triangle resistance, which had been forming since late April

Each of these is significant on its own. Together, they suggest a shift toward a more aggressive bullish scenario.

________________________________________

🔮 What’s Next?

All these breakouts point to the potential for more gains ahead.

In fact, the next logical step could be an attempt to mark a new All-Time High.

My view remains the same:

Buying dips remains the strategy of choice, with a focus on the 3400 zone as a key support area, and a swing target around 3500.

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

GOLD REVERSALHello folks, most traders stop out on this idea right? lets get back to previous month opening price, for short idea stoploss above. 3440.

But If you can wait for LONG below. maybe in the next 2 days.

Goodluck. I prefer LONG? I will update once I see volumes on downtrend today or the next day.

I only see short today. the volume is declining/exhausted. I predict reversal atm.

ciao.. see the chart above.

this is not a financial advice.

trade it like its your own business.

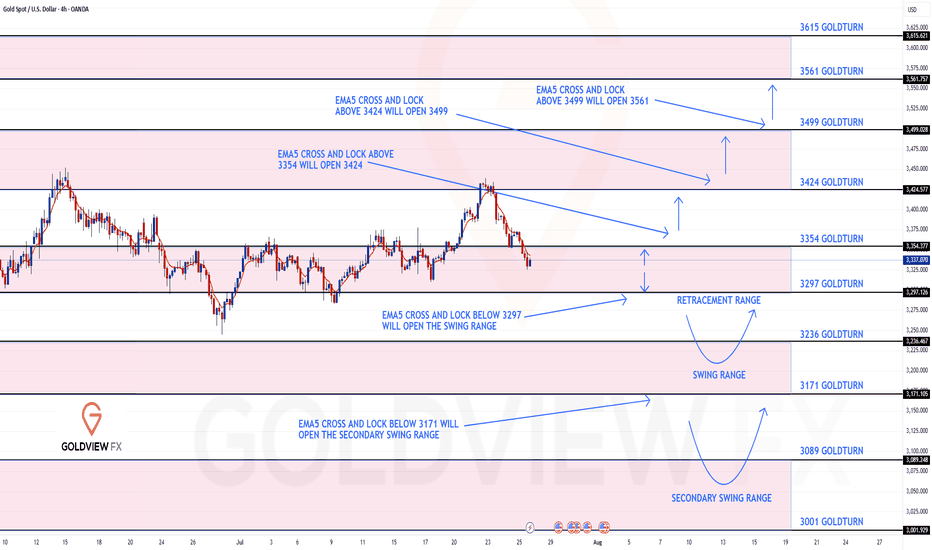

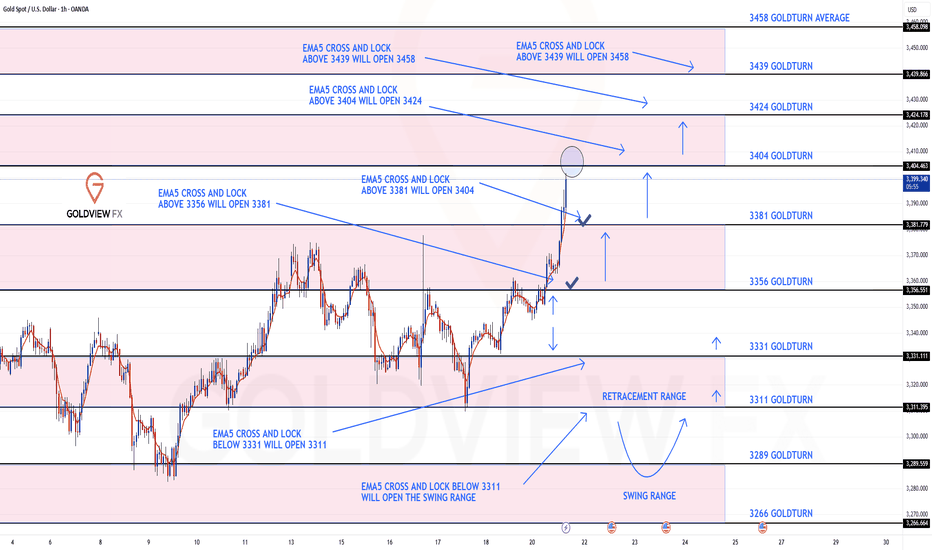

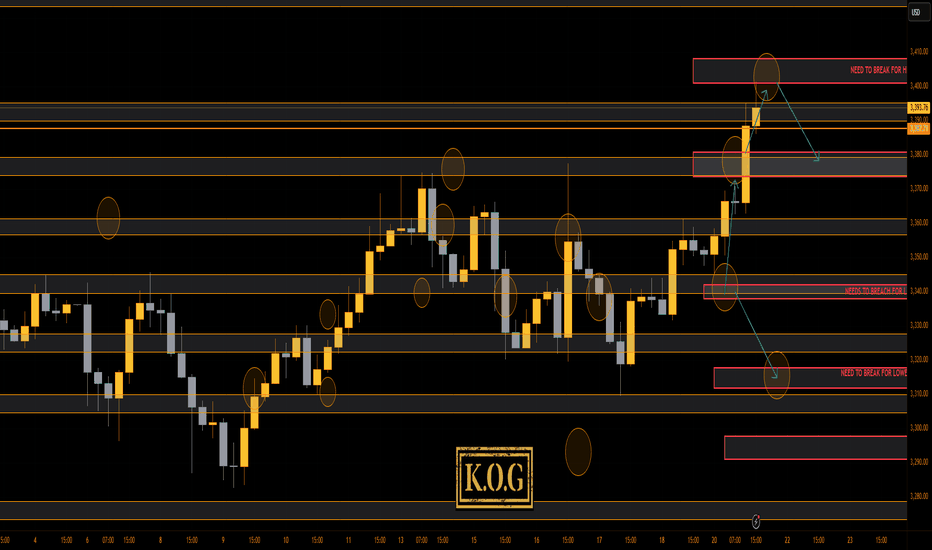

GOLD 4H CHART ROUTE MAP UPDATE & TRADING PLAN FOR THE WEEKHey Everyone,

Please see our updated 4h chart levels and targets for the coming week.

We are seeing price play between two weighted levels with a gap above at 3354 and a gap below at 3297. We will need to see ema5 cross and lock on either weighted level to determine the next range.

We will see levels tested side by side until one of the weighted levels break and lock to confirm direction for the next range.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 20 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

The swing range give bigger bounces then our weighted levels that's the difference between weighted levels and swing ranges.

BULLISH TARGET

3354

EMA5 CROSS AND LOCK ABOVE 3354 WILL OPEN THE FOLLOWING BULLISH TARGETS

3424

EMA5 CROSS AND LOCK ABOVE 3424 WILL OPEN THE FOLLOWING BULLISH TARGET

3499

EMA5 CROSS AND LOCK ABOVE 3499 WILL OPEN THE FOLLOWING BULLISH TARGET

3561

BEARISH TARGETS

3297

EMA5 CROSS AND LOCK BELOW 3297 WILL OPEN THE SWING RANGE

3236

3171

EMA5 CROSS AND LOCK BELOW 3171 WILL OPEN THE SECONDARY SWING RANGE

3089

3001

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

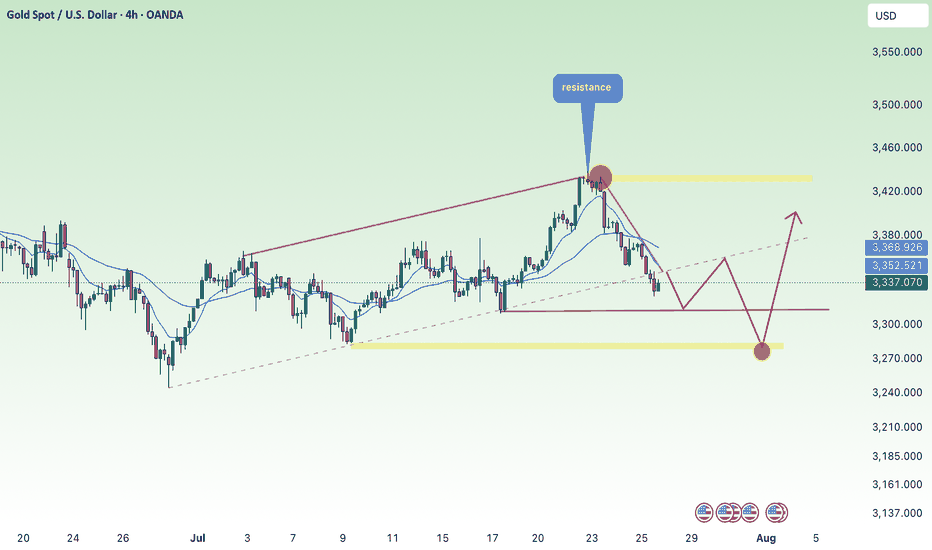

Gold price continues to decrease, keep the rate unchanged✍️ NOVA hello everyone, Let's comment on gold price next week from 07/28/2025 - 08/1/2025

⭐️GOLDEN INFORMATION:

Gold (XAU/USD) looks set to close the week lower, pressured by upbeat U.S. economic data and progress in trade negotiations, which have reduced demand for safe-haven assets. Despite declining U.S. Treasury yields, the U.S. Dollar regained some ground. At the time of writing, XAU/USD is trading around $3,336, down nearly 1%.

Looking ahead, the Federal Reserve is widely expected to keep interest rates steady at 4.25%–4.50% for the fifth time this year. Recent data supports this stance, with Initial Jobless Claims falling for the fourth straight week—signaling a resilient labor market—while Friday’s sharp drop in Durable Goods Orders, driven by weaker aircraft demand, adds a mixed tone to the outlook.

⭐️Personal comments NOVA:

Gold prices continue to fall as interest rates remain unchanged almost this week. Along with the H4 time frame, prices continue to break important support and continue to follow a downward trend.

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $3350, $3428

Support: $3312, $3280, $3246

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

GOLD ROUTE MAP UPDATEHey Everyone,

Great start to the week with our chart idea playing out, as analysed.

We started with our Bullish target 3356 hit, followed with ema5 cross and lock above 3356 opening 3381. This was also hit perfectly completing this target. We now have a further ema5 cross and lock above 3381 leaving 3404 open with already a nice push up, just short of the full gap.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 20 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

The swing range give bigger bounces then our weighted levels that's the difference between weighted levels and swing ranges.

BULLISH TARGET

3356 - DONE

EMA5 CROSS AND LOCK ABOVE 3356 WILL OPEN THE FOLLOWING BULLISH TARGETS

3381 - DONE

EMA5 CROSS AND LOCK ABOVE 3381 WILL OPEN THE FOLLOWING BULLISH TARGET

3404

EMA5 CROSS AND LOCK ABOVE 3404 WILL OPEN THE FOLLOWING BULLISH TARGET

3424

EMA5 CROSS AND LOCK ABOVE 3424 WILL OPEN THE FOLLOWING BULLISH TARGET

3458

BEARISH TARGETS

3331

EMA5 CROSS AND LOCK BELOW 3331 WILL OPEN THE FOLLOWING BEARISH TARGET

3311

EMA5 CROSS AND LOCK BELOW 3311 WILL OPEN THE SWING RANGE

3289

3266

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

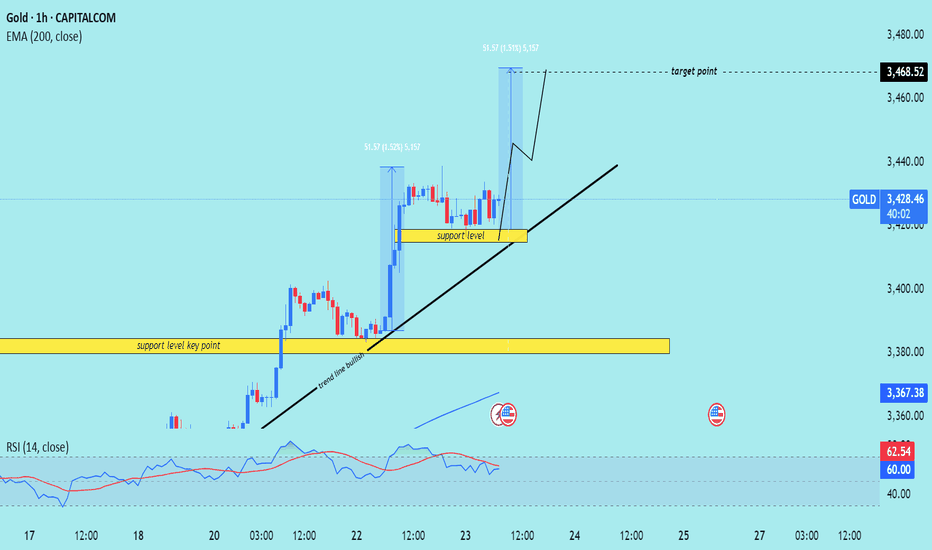

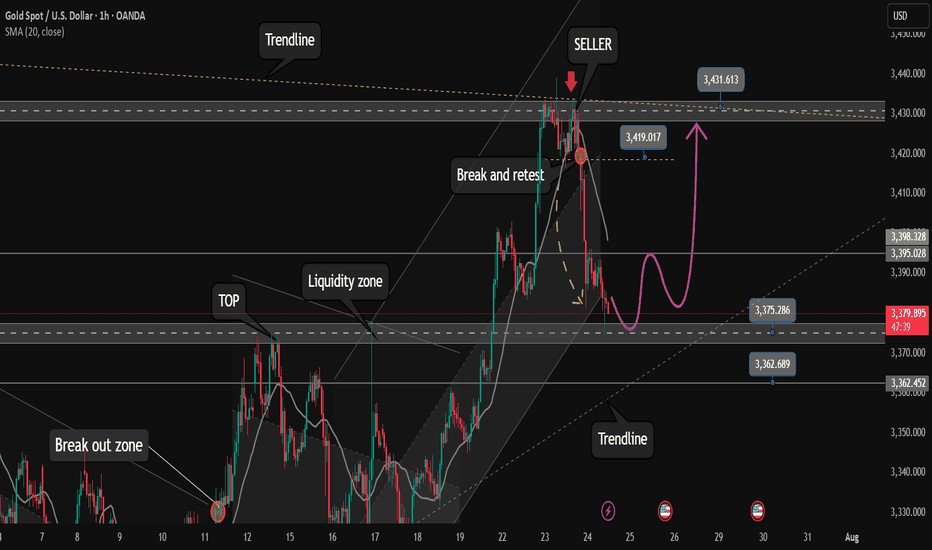

XAU/USD) Bullish trend analysis Read The captionSMC Trading point update

Technical analysis of Gold (XAU/USD) on the 1-hour timeframe. Here's a breakdown of the key trading

---

Technical Overview

Price: $3,428.71 (currently near the upper consolidation)

EMA 200: Around $3,367.38 (well below price, indicating strong uptrend)

Target Point: $3,468.52

Indicators:

RSI (14): 60.19–62.55 → shows moderate bullish momentum, not yet overbought.

---

Key Technical Elements

1. Bullish Breakout Structure:

Price has broken out of a previous range, and is forming a bullish flag or rectangle, which typically leads to continuation higher.

Measured move projection from previous leg (approx. $51.57 gain) targets the $3,468.52 level.

2. Strong Support Zones:

Two yellow zones highlighted:

Upper support level (around $3,415): acting as immediate structure support.

Lower key support (around $3,380): crucial structure level from where the trend initiated.

3. Trend Line Support:

A clearly marked ascending trend line supporting higher lows—indicating bulls are in control.

Expect price to stay above this trend line to maintain bullish bias.

4. Volume & RSI Confirmation:

RSI remains in a bullish zone but isn’t overbought → leaves room for upside.

Volume remains steady, confirming healthy consolidation.

Mr SMC Trading point

---

Conclusion & Trade Idea

Bias: Bullish

Entry Zone: On breakout or retest of minor support ($3,415–$3,420)

Stop Loss: Below trendline or below $3,415

Target: $3,468.52

Confirmation: Hold above trendline + RSI staying above 50

This is a classic bullish continuation setup supported by structure, RSI, and trend momentum. Traders could look for buying opportunities on minor dips or trendline retests.

---

Please support boost 🚀 this analysis)

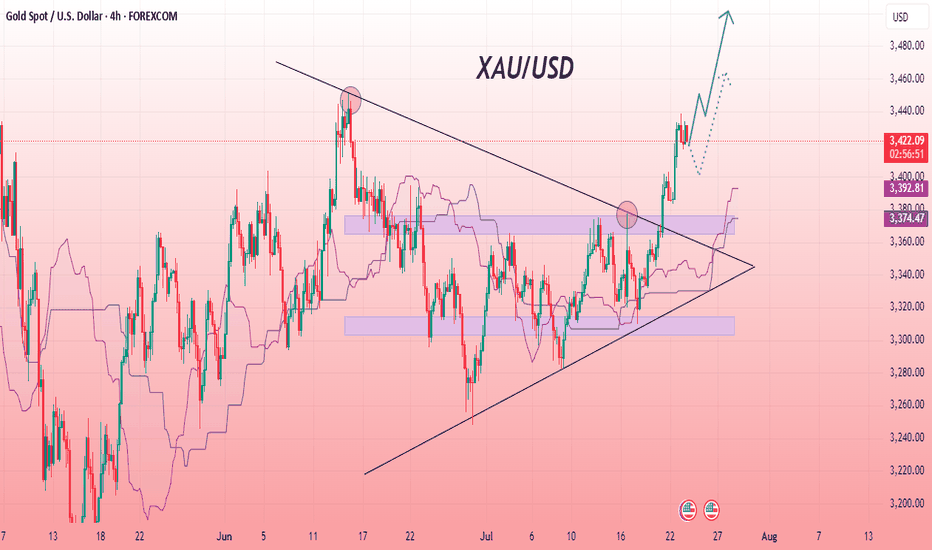

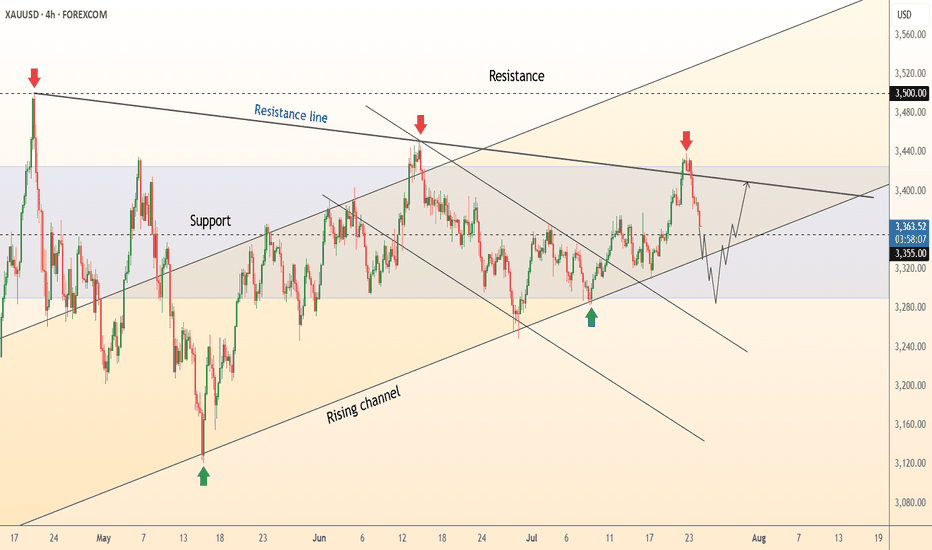

XAU/USD Powerful Bullish Rally AheadThe XAU/USD 4-hour chart shows a decisive breakout from a symmetrical triangle pattern, signaling a shift towards bullish momentum. Price action has moved strongly above the upper trendline, indicating that buyers are in control. The Ichimoku cloud provides additional confirmation of the uptrend, with price holding well above the cloud zone. Previous resistance areas have been converted into support, and the upward projection suggests potential continuation of the rally. The chart structure reveals consistent higher highs and higher lows, which further supports bullish sentiment. As long as the price remains above the breakout zone and maintains strong volume, the trend is expected to extend upward, reflecting strong market confidence in gold’s short-term growth.

Entry Buy : 3420

First Target :3450

Second Target :3500

If you found this analysis helpful, don’t forget to drop a like and comment . Your support keeps quality ideas flowing—let’s grow and win together! 💪📈

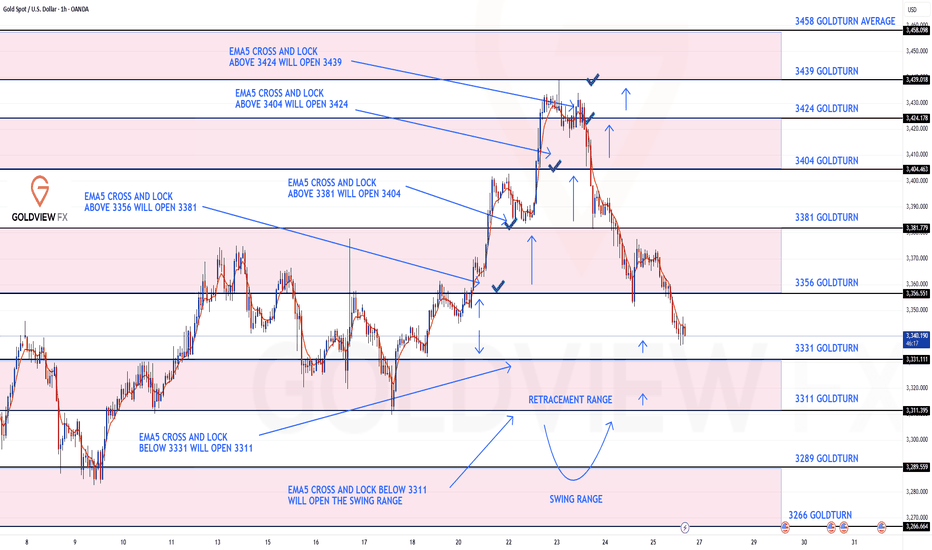

GOLD 1H CHART ROUTE MAP UPDATEHey Everyone,

Great finish to the week with our chart ideas playing out, as analysed.

We completed all our Bullish targets on this chart with ema5 cross and lock confirmation. We were also able to step away today after the final target with no further ema5 cross and lock, confirming the rejection that we are seeing now.

BULLISH TARGET

3356 - DONE

EMA5 CROSS AND LOCK ABOVE 3356 WILL OPEN THE FOLLOWING BULLISH TARGETS

3381 - DONE

EMA5 CROSS AND LOCK ABOVE 3381 WILL OPEN THE FOLLOWING BULLISH TARGET

3404 - DONE

EMA5 CROSS AND LOCK ABOVE 3404 WILL OPEN THE FOLLOWING BULLISH TARGET

3424 - DONE

EMA5 CROSS AND LOCK ABOVE 3424 WILL OPEN THE FOLLOWING BULLISH TARGET

3439 - DONE

We will now come back Sunday with a full multi timeframe analysis to prepare for next week’s setups, including updated views on the higher timeframes, EMA alignments, and structure expectations going forward.

Thanks again for all your likes, comments, and follows.

Wishing you all a fantastic weekend!!

Mr Gold

GoldViewFX

The correction is quite surprise. What direction for GOLD price?✏️Quite surprised with the adjustment of gold at the end of the previous trading week. The rising price channel is still holding around the lower border of the price channel around 3316. A liquidity sweep and candle wick removal in this area is considered a good buying opportunity.

If h1 closes below this border, limit trading BUY signals until the bottom support of 3286. When the price can close the candle below 3316, gold will trade in a wide range and there is no main trend dominating the market.

📉 Key Levels

Support: 3316-3286

Resistance: 3372-3400-3418

Buy trigger: Reject and Trading above 3316

BUY DCA Break 3372

Target: 3400

SELL Trigger: Break bellow and Retest 3416

Leave your comments on the idea. I am happy to read your views.

XAUUSD – The Structure Is Still Bullish... But Barely Holding 📌 In yesterday’s analysis, I mentioned that although Gold corrected deeper than expected, dropping below 3400, the bullish structure remained intact — and I stayed true to that view by buying dips.

🎯 The trade didn’t go as planned. Fortunately, the New York rebound from 3350 helped me exit at breakeven.

🧭 So now the big question is:

Is Gold reversing to the downside?

The answer: Not confirmed yet.

The structure is technically still bullish, but the chart is far from pretty.

🧨 What’s going wrong?

❌ Bearish engulfing candle on Wednesday – I chose to ignore it yesterday, but it’s still there.

❌ The breakout above 3375 (ascending triangle resistance) is failing – and could now turn into a false breakout trap.

❌ The ascending trendline from January 2025 is under pressure.

❌ And if today we close near 3350, the weekly chart will show a bearish Pin Bar – not exactly a sign of strength.

📉 My current plan:

- If price rallies back above 3380 → I’m looking to sell into strength, not buy.

- If we break below 3350 → I’ll also look to sell the breakdown.

Right now, for Gold to regain bullish momentum, it needs to reclaim 3400. No compromise.

⚠️ Summary:

Yes, the bigger structure is still bullish.

But momentum is fading, and price action is starting to turn against the bulls.

We need confirmation, not hope.

If 3350 breaks cleanly – things could accelerate to the downside.

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

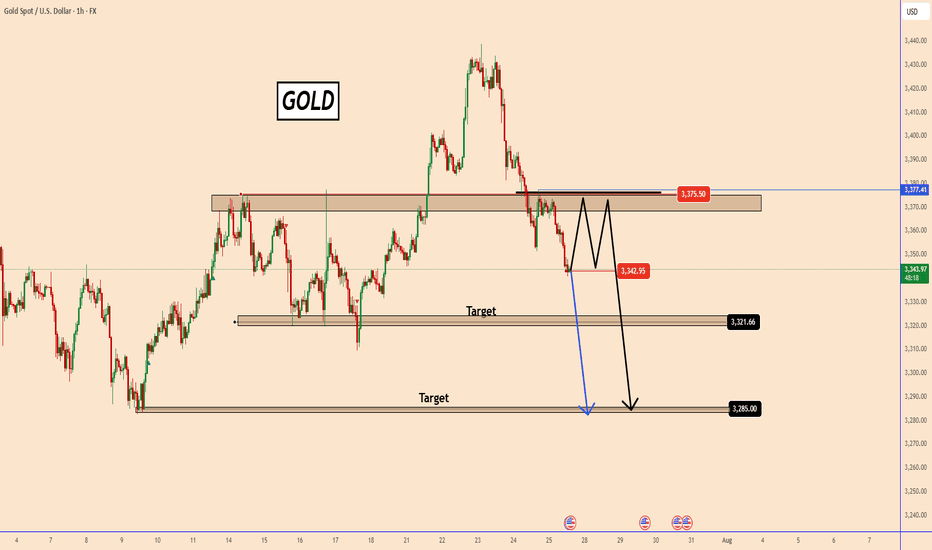

GOLD could test 3375 before falling furtherGOLD could test 3375 before falling further

In our previous analysis, we were looking for gold to fall from the top and, as we can see, it has already reached 3341 from the 3430 area.

From the top down, the price depreciated by 2.85% in less than 3 days, so a possible correction is expected near the area of the structure coming from the left side around 3375.

Given that gold is only moving down, it may be possible for the downward movement to continue slowly. Both scenarios are possible at this point.

You may find more details in the chart!

Thank you and Good Luck!

PS: Please support with a like or comment if you find this analysis useful for your trading day

DeGRAM | GOLD exited from the triangle📊 Technical Analysis

● Price has burst above the five-month symmetrical-triangle ceiling at 3 400, converting that line into support; the breakout’s measured move targets the June peak 3 435 and aligns with the rising-channel top near 3 500.

● A tight bull flag is forming on higher-lows inside the new micro up-trend; repeated bids on pull-backs to 3 400-3 405 confirm fresh demand and favour continuation.

💡 Fundamental Analysis

● Gold is buoyed by a softer USD and safe-haven demand as trade frictions grow and Fed guidance turns less certain, keeping XAU/USD firm above $3 400.

✨ Summary

Buy 3 400-3 410; sustained trade over 3 435 eyes 3 500. Bull view void on an H4 close below 3 360.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

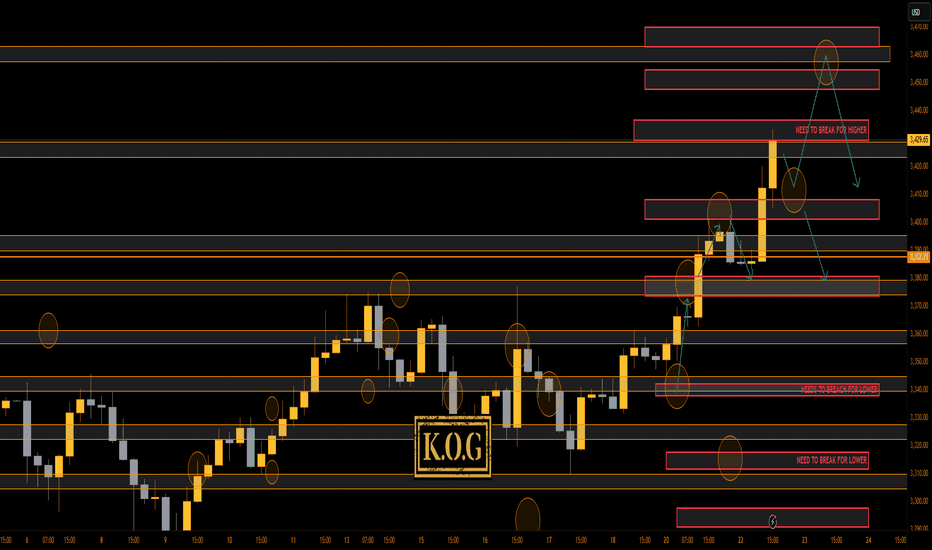

THE KOG REPORT - UpdateA rare day for us today even though we got the level for the short from above, we activated again, and due to everything lining up confirming the short into the lower order region where we wanted to bounce, we took it. Gold, had other plans, engulfing upside resulting in us having to SL the trade. It then went on to break above and complete our daily targets.

You win some, you lose some!

Now, we have support below at the 3410 region which will need to break to change short-term structure, while there is the order region above 3430-35 which could hold price and accumulate. All our bullish targets for the day are completed, we just wanted lower to then go higher.

If lower support can be targeted and held, we could see a move higher into the 3345-50 region before then a reaction in price. I'm still not happy with this move, something doesn't quite look right, so let's play it day by day.

RED BOXES:

Break above 3395 for 3404✅, 3410✅ and 3420✅ in extension of the move

Break below 3375 for 3368 and 3355 in extension of the move

As always, trade safe.

KOG

After reaching FULL TP. Relax and wait for strong support zone✏️Continuing yesterday's bullish wave structure, Gold has reached the Target level of 3400. In the European session, there is a possibility of a correction to some important support zones. And the US session will continue to aim for a level higher than 3400. Today's strategy is still quite similar to yesterday's strategy when waiting for the areas where buyers confirm to enter the market to FOMO according to the main trend.

📉 Key Levels

Support: 3375 - 3363

Resistance: 3400-3427

Buy Trigger: Rejects the support zone 3375 and reacts to the upside

Buy Trigger: Rebound from 3363

BUY DCA: Break and trading above 3400

Target 3427

Leave your comments on the idea. I am happy to read your views.

XAU/USD) Bullish trend analysis Read The captionSMC Trading point update

Technical analysis of XAU/USD (Gold) on the 1-hour timeframe. Here’s a breakdown

---

Technical Analysis Summary

Descending Channel Breakout

Price action previously formed a descending wedge/channel, shown by the two black trendlines.

A bullish breakout occurred above the trendline, signaling a shift in momentum from bearish to bullish.

Key Support Zone

The yellow highlighted zone (around $3,338–$3,340) is marked as the “new key support level”.

Price is expected to retest this area (confluence with 200 EMA), which aligns with standard bullish breakout behavior.

The green arrow indicates potential bounce confirmation.

Bullish Projection

After the retest, price is projected to climb steadily toward the target point at $3,394.52.

The setup anticipates around 56.27 points upside, or roughly +1.69% gain from the support zone.

---

Target

$3,394.52 – defined using the previous range breakout height and horizontal resistance.

---

Trade Idea

Entry: On bullish confirmation near $3,338 support zone.

Stop Loss: Just below the yellow zone (e.g., under $3,330).

Take Profit: Near $3,394.

Mr SMC Trading point

---

Conclusion

This is a classic breakout-retest-play, supported by trendline structure, a key horizontal support zone, and RSI strength. As long as price respects the highlighted support, the bullish outlook remains valid.

Please support boost 🚀 this analysis)

Hellena | GOLD (4H): LONG to resistance area of 3440 (Wave V).As you can see, everything turned out to be more complicated than I had previously thought. We are dealing with a complex correction and a diagonal. I believe that the “ABCDE” waves, which make up the corrective wave “4”, are completing their levels, and I continue to expect the upward movement to continue.

The first area I expect is the resistance area of 3440. This will be the beginning of the large upward wave “V.”

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

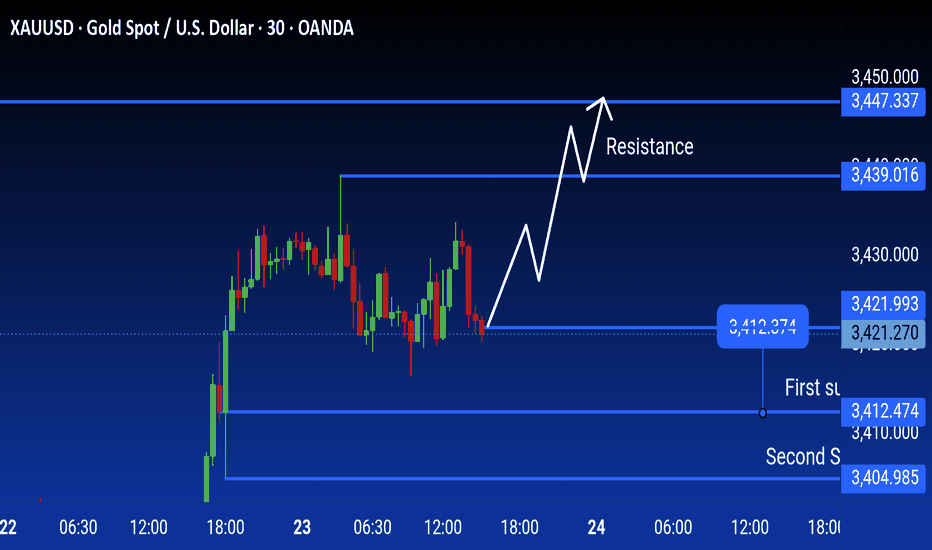

XAUUSD 30-Min Chart Analysis: Bullish Move Toward Resistance This 30-minute chart of XAUUSD (Gold vs. USD) shows key support and resistance levels. The price is currently around 3,422.615. Resistance is marked at 3,447.337, while the first and second support levels are at 3,412.474 and 3,404.985, respectively. The chart suggests a potential bullish move toward resistance.

DeGRAM | GOLD will retest the channel boundary📊 Technical Analysis

● Fresh rejection at the blue resistance line (~3 435) pushed XAU back to the 3 355 mid-band, yet successive higher-lows (green arrows) keep price inside the May-origin rising channel.

● The pullback is probing 3 328-3 355 — confluence of the former flag roof and triangle top; holding this zone should launch another test of 3 400/3 435, with the channel crest targeting 3 500.

💡 Fundamental Analysis

● U-S S&P-Global PMIs softened, nudging 2-yr real yields to three-week lows, while cautious ECB rhetoric limits dollar gains — both supportive for gold.

✨ Summary

Long 3 328-3 355; above that aims 3 400 ➜ 3 435, stretch 3 500. Invalidate on an H4 close below 3 293.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

Some investors take profits. Opportunity to buy gold to 3500?✏️ OANDA:XAUUSD price correction of 50 appeared yesterday. This is obvious to happen in a sustainable uptrend. Today's strategy will look for liquidity sweeps to support to BUY to ATH 3500. Gold's current border zone is limited by the upper and lower trendlines. Be careful not to trade against the trend when breaking the trend zone.

📉 Key Levels

Support: 3375 -3363

Resistance: 3418-3431-3490

Buy trigger: Buyers react at 3375

Buy zone: 3363

Target: 3430; level higher at 3490

Leave your comments on the idea. I am happy to read your views.

THE KOG REPORT - UpdateEnd of day update from us here at KOG:

Interesting open for the week, not just on gold but across the markets! Our plan yesterday in the KOG Report was to look for that lower support level to hold and then not only to target Excalibur which confirmed the move, but also the red box and bias level targets. This worked well and yet again, within a day, we've completed the week's targets upside!

We couldn't short from the first red box as it was broken. Now we have the red box above which is holding and giving a slight move downside and with the indicators flashing red, we'll stick with the move so far initially looking for 3390-85. We're not discounting a retest of the level, but as long as it holds, we'll go with it.

KOG’s Bias for the week:

Bullish above 3340 with targets above 3355✅, 3361✅, 3368✅, 3372✅ and above that 3385✅

Bearish below 3340 with targets below 3335, 3330, 3322, 3316, 3310 and below that 3304

RED BOX TARGETS:

Break above 3350 for 3355✅, 3361✅, 3367✅, 3375✅ and 3390✅ in extension of the move

Break below 3340 for 3335, 3330, 3320, 3310 and 3306 in extension of the move

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

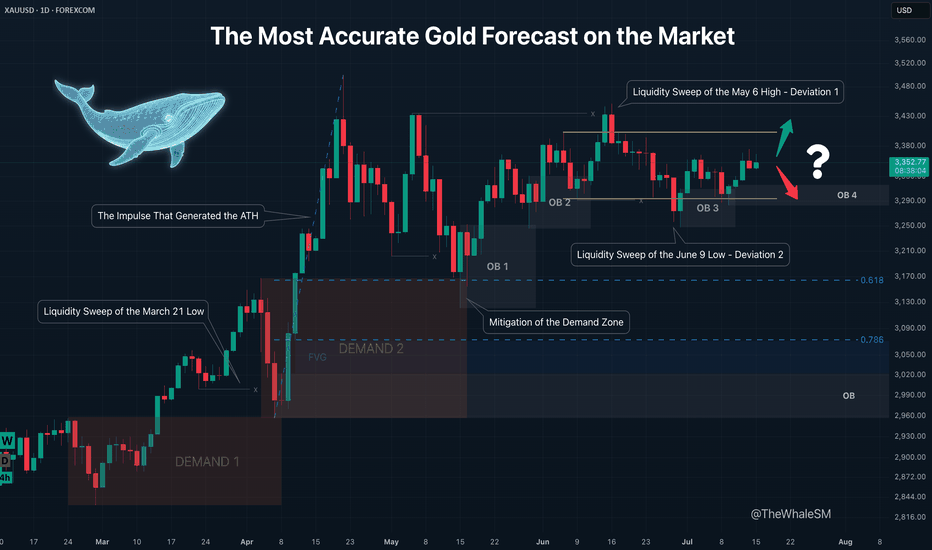

The Most Accurate Gold Forecast on the MarketThis is a continuation of sorts of my educational article that received an "Editor's Pick" from TradingView and a large number of positive reactions from this amazing trading community. However, unlike that post, this is a trade idea that outlines clear entry conditions for when the price reaches a relevant manipulation zone and shows a reversal reaction. If you don't want to get into the details and trace the entire chain of events through which large capital brought the price to its current levels, feel free to skip the intro and go straight to the 4H chart with the long setup conditions.

To better understand the logic of "smart money," let's revisit the Gold daily timeframe from my educational article:

We will approach this analysis like detectives, following the facts and footprints in the style of Sherlock Holmes and Hercule Poirot.

So, let's begin our investigation. On the daily structure, we see a clear order flow confirming the intention of large capital to lead the price in continuation of the uptrend. After the latest impulse that began on February 28th and ended on April 3rd, the price corrected and mitigated the DEMAND1 manipulation zone. The "Whale" refueled with liquidity, eliminated some competitors, closed its losing short positions used for the manipulation, and gained energy for the next impulse that set a new ATH. The correction that mitigated the DEMAND1 zone was nothing other than the next manipulation, also in the form of a DEMAND zone, within which there is a still-valid daily order block. How can we assert that DEMAND 2 is a manipulation and not just a correction?

Firstly, the sharp nature of the move swept liquidity from the March 21st low. Secondly, the sharp upward impulse accompanied by a series of FVGs showed the Whale's true intention. And thirdly, the reversal from this DEMAND 2 zone, combined with the 61.8% Fib retracement level, resulted in the formation of the next manipulation in the form of the OB 1 order block. Further, we see the continuation of the order flow on this daily structure; the price reacts to OB1, forming another order block, OB2 . The impulse from OB2 sweeps liquidity from the May 6th high. Many might have expected a continuation of the impulse and a new ATH instead of a sweep of this high, but as often happens when too many participants pile into one direction, the price sharply reverses and liquidates their positions. This intense decline after sweeping the high looked something like a local trend change from bullish to bearish, but the sharp recovery after sweeping the liquidity from the June 9th low and forming a new order block, OB 3 , finally revealed what was really happening: it turned out to be a range . It's impossible to identify a range until it is fully formed. A range is another type of manipulation where internal and external liquidity is swept from both sides. In our case, there was first a deviation above (Deviation 1 on the chart), then a deviation below (Deviation 2), after which the price swept some internal liquidity and got stuck exactly in the middle of the range.

And finally, after all our investigations and deductions, we can say with absolute certainty, practically with 100% confidence divided by two, that ABSOLUTELY NO ONE KNOWS where the price will go from the current levels. Because the center of a range is a state of complete uncertainty. Moreover, I dare to suggest that even the Whales don't know where the price will go right now. They certainly have enormous funds to sharply move prices at the right moments to capture liquidity and conduct manipulations. At other times, they can nudge the market to create a trend and direct it like a chain reaction of falling dominoes. But the entire market is much larger, and if its sentiment changes drastically due to external factors, smart money won't waste its resources fighting it. Their goal is to make more money, nothing personal. Why else is the price stuck in the middle right now? Inflation data is coming out soon, which could push the price in an unpredictable direction. The Whales will wait to use this news-driven impulse to their advantage.

So, what have we concluded from this investigation? Was it all in vain since we can't even say with 51% probability where the price will go next? Of course not. We simply need to wait for the price to reach an area where the probability of it moving in a certain direction is significantly higher than 50% — that's all you need to be profitable in the long run. This probability will never be close to 100% because we don't know what's really happening in the depths of the market. Are the Whales accumulating positions in this range now, or are they selling off at high prices after the ATH? Unless you are one of the few direct participants in large capital, you can't know this. Moreover, you don't need to know it to make a consistent profit in the market. It is enough for us to predict the next move of smart money with high probability at certain moments, join their movement, and take our profit. It's like a weather forecast: the further from the current date, the lower the probability of it being accurate. It's the same with the market; a completely unpredictable combination of factors, news, and hidden internal processes can lead the price on a unique path, but always accompanied by smart money. It doesn't matter where the gold market goes next, whether to a new ATH or down to the next correction level. When the Whale reveals itself again by leaving a trail in the form of a manipulation, we can lie in wait near it and join its next move. Why is it generally a good idea to enter from manipulation zones? You are essentially stepping onto a field where the Whale has already cleared the liquidity, and it has returned to that place for other business — to close its losing positions. That is, a mitigated manipulation zone is a safer place to enter the market; there's a much lower chance the Whale will absorb your position. Right now, we have such a manipulation in the form of the OB 4 order block, and we can switch to the 4H timeframe to look at a potential entry zone in more detail.

4H CHART - SETUP CONDITIONS

So, we already know the general context: the price is inside a range. After the second deviation, it has already reacted to the order block formed after it, and we are waiting for the mitigation of the next one, OB 4 , which will serve as a pivot point for a potential setup. A reversal from this order block will confirm the order flow for the price to move at least to the upper boundary of the range. The presence of a manipulation zone alone is not enough to open a position; additional confirming conditions are always needed. As one such condition here, we can take the combination of mitigation with one of the Fibonacci retracement levels — 61.8% or 78.6%. Upon reaching each level, the price must hold (not be broken by the bodies of 1-4H candles) and show a reversal reaction. The final confirmation for entry will be an LTF confirm in the form of a break of structure (BOS) or the beginning of order flow on a lower timeframe. An important part of the context is that important US inflation news is coming out soon, and positions should not be opened right before it or for some time after (at least an hour).

Invalidation of the long scenario would be a break below the 78.6% level and OB 4.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

If you found this analysis helpful, support it with a Boost! 🚀

Have a question or your own view on this idea? Share it in the comments! I read every single one. 💬

► Follow me on TradingView for more educational content like this and to not miss my next detailed trade idea .

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~