Can Gold Regain Its Recent Highs or Does a Shakeout Loom?Gold has seen its price volatility increase across the first three trading days of this week. The initial move was a 3% spike higher from opening levels at 3339 on Monday, to a one month high of 3439 early on Wednesday morning, as traders sought out Gold as a safe haven hedge against renewed political attacks on the independence of the Federal Reserve and more specifically its Chairman, Jerome Powell.

Then on Wednesday, the outlook for Gold changed again, almost instantaneously, and prices reversed their course, dropping 1.7% to touch a low of 3381 after President Trump announced a trade deal with Japan, which agreed tariffs of 15% on Japanese imports into the US, a number better than many traders and investors had anticipated. Taken alongside a Bloomberg report released on Wednesday afternoon suggesting a similar agreement could be reached with the EU using the Japan deal as a blueprint, and suddenly the need for Gold as a safe haven hedge didn’t seem quite so necessary.

However, while Gold has traded as low as 3374 this morning, prices remain around 1% higher on the week (around 3380 at time of writing 0700 BST), supported on dips by an on-going theme of dollar weakness, which has continued as risk sentiment has shifted to a more positive stance. The challenge for traders is to determine whether this will remain the case into the weekend.

Looking forward, President Trump still needs to agree any trade deal negotiated with the EU, which could be a stumbling block keeping Gold volatility elevated, as could updates on the strength of the US economy when the Preliminary PMI Surveys for July are released later today at 1445 BST. Any print below 50 = economic contraction, while any print above 50 = economic expansion, and the direction of service activity in the US economy may be what draws the most headlines, especially if it moves back to the downside.

The failure of Gold ahead of the June high at 3451 may also be potentially important from a technical perspective and this is discussed further below.

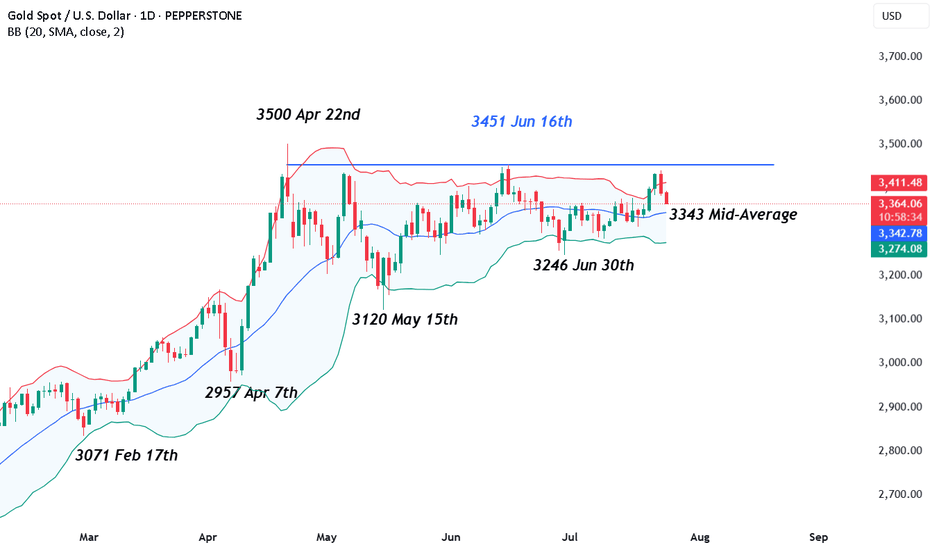

Technical Update: 3451 June Highs In Focus

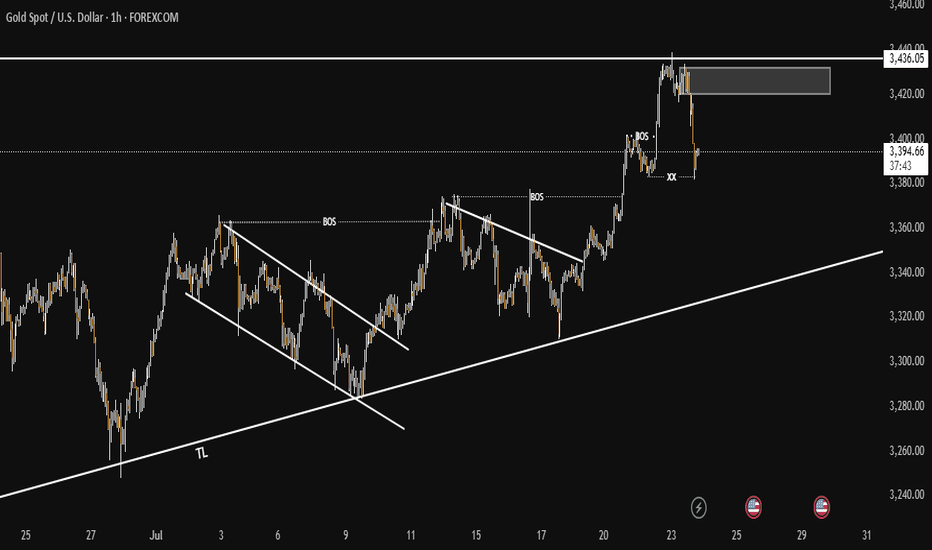

Having previously encountered selling pressure leading to price weakness after being capped at the June 16th high of 3451, this level remains a potential resistance focus for traders. These themes may also have been strengthened after Wednesday’s failure below this level (the session high was 3439), which has prompted the latest downside price activity, as the chart below shows.

This activity may see traders question the sustainability of the recent price strength, even looking for fresh price declines. With this in mind, let’s consider what support or resistance levels could be monitored to help establish the direction of the next possible price move.

Possible Support Levels:

The first support level if price declines are seen over the balance of the week may be marked by 3343, which is equal to the Bollinger mid-average.

Closing breaks under the 3343 support, while not a guarantee of a more extended phase of price weakness, might then open potential for a move towards 3246, the June 30th session low.

Possible Resistance Levels:

As we have suggested, it’s possible the 3451 June 16th session high represents the first resistance focus for traders, if attempts at price strength are again seen.

However, closing breaks above 3451 may be required to suggest the potential of a more extended phase of price strength to challenge the 3500 April 22nd all-time high and possibly further if this is broken on a closing basis.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

XAUUSDK trade ideas

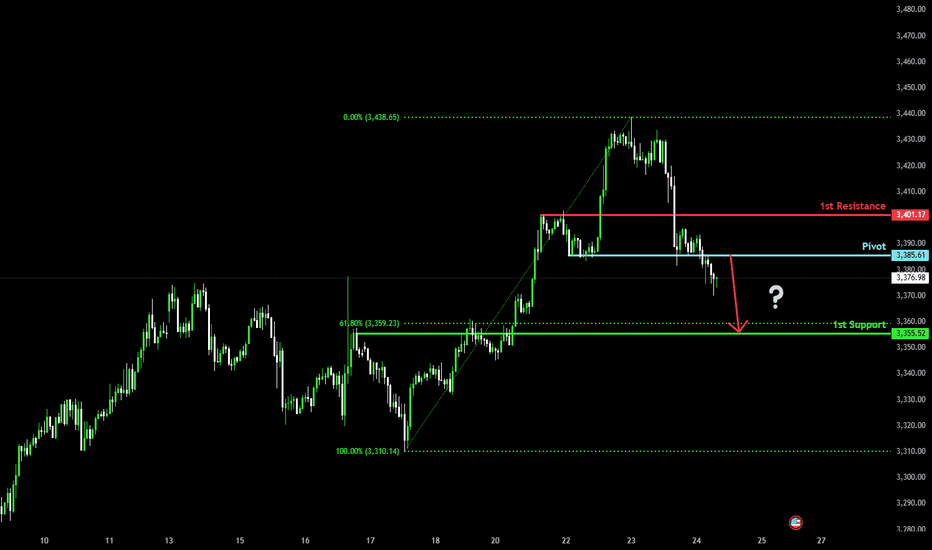

Bearish drop?The Gold (XAU/USD) has reacted off the pivot and could potentially drop to the 1st support, which is a pullback support that is slightly below the 61.8% Fibonacci retracement.

Pivot: 3,385.61

1st Support: 3,355.52

1st Resistance: 3,401.17

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

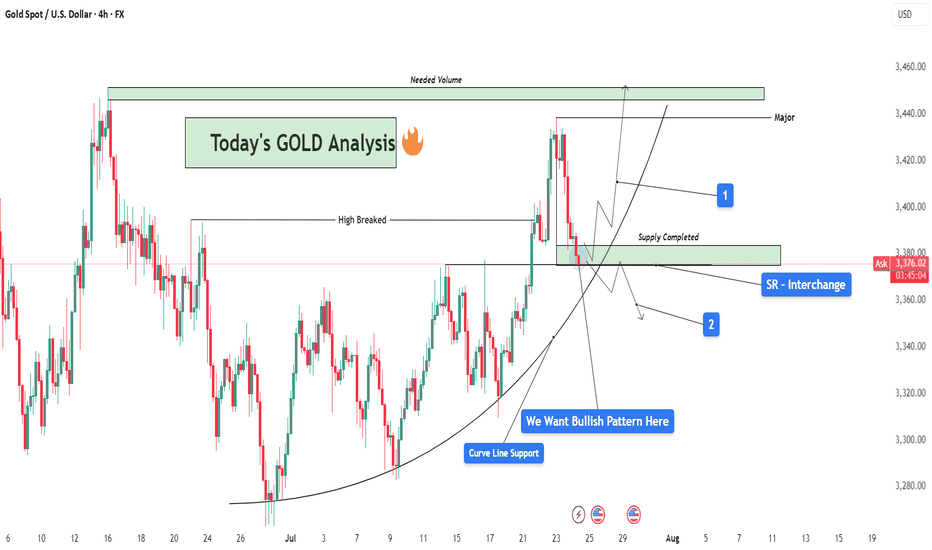

GOLD Analysis : SR Interchange , Reversal Zone + High Break🧠 Market Context & Structural Overview:

Gold has been trading within a clearly defined bullish structure after forming a rounded base pattern in early July, indicating accumulation by smart money. The market recently broke through a key horizontal resistance (previous swing high), marking a potential bullish continuation phase. However, we are now witnessing a pullback — a healthy corrective phase — that is currently testing multiple high-probability confluences.

🧱 Key Technical Zones Explained:

🔹 1. SR Interchange Zone – High Probability Reversal Area:

This area (roughly between $3,360 and $3,380) acted as previous resistance (supply) and has now flipped into support.

This is a textbook Support-Resistance Interchange (SR Flip) — a concept where prior resistance becomes new support.

Traders often look for entries here, especially when it aligns with other technical factors.

🔹 2. Curve Line Support – Dynamic Buyer Strength Indicator:

A curved trendline, often referred to as a parabolic support, has been respecting price structure for over two weeks.

Price is now sitting exactly on this support, signaling potential for another impulsive bullish leg if momentum builds.

🔹 3. Supply Zone Completed – Correction Phase Active:

The supply zone above (approx. $3,420–$3,440) has already been tapped and respected by the market.

This “completed” supply may now act as resistance unless broken with strong volume — we now watch how price reacts at the current pullback zone.

📊 What the Candles Are Telling Us:

The latest candles show some hesitation from sellers — wick rejections and smaller body candles hint at buyer interest at this level. However, confirmation is crucial. We want to see a bullish reversal pattern such as:

Bullish engulfing

Morning star

Pin bar (hammer)

Break and retest of minor resistance inside the SR zone

🔮 Scenarios to Watch:

✅ Scenario 1 – Bullish Continuation (Ideal Setup):

If a bullish reversal forms at this support zone:

Expect a potential rally back to the $3,420–$3,440 resistance area.

If this zone breaks with high volume, price could target the major supply zone near $3,465+, where we’ll need “Needed Volume” for a decisive break.

⚠️ Scenario 2 – Bearish Breakdown (Alternative View):

If the curve support and SR zone fail to hold:

Expect a drop towards $3,345 – $3,320 — where next structural support lies.

This would suggest a deeper retracement or range formation before bulls can regroup.

🧩 Strategy & Psychology:

“We want bullish pattern here.”

You’ve highlighted the importance of not entering impulsively. This is about trading with confirmation, not prediction. Waiting for a valid bullish pattern reduces risk and increases probability.

This is where smart traders win — waiting patiently for confirmation at a zone of confluence.

🧠 Learning Mindset – Why This Zone Matters:

Combines horizontal support, curved trendline, and broken structure retest.

This zone is the battleground between bulls and bears — whoever wins here will likely control short-term momentum.

Newer traders can study this as a classic example of multi-confluence trading, which combines price action, market structure, and dynamic trendlines.

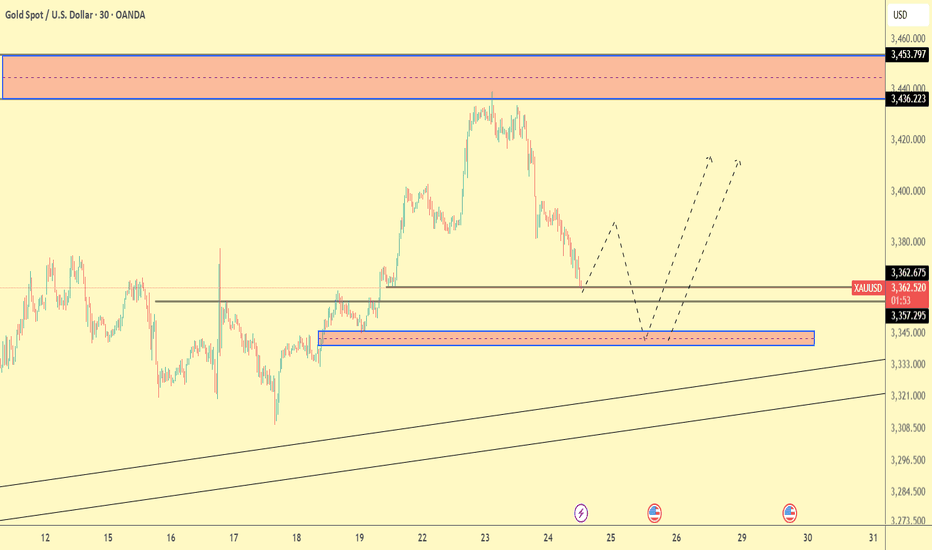

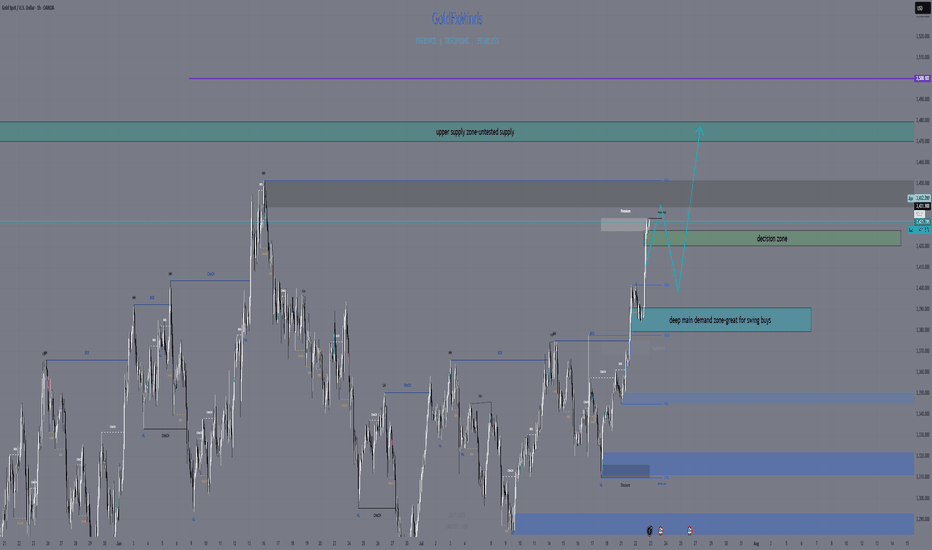

Gold Next Move According To My Analysis (READ DESCRIPTION).Hellow Traders, I'm here with new idea.

The Previous Major Highs and Lows

price (3125) Major Low

Price (3449) Major High

Price (3253) Major Low

Price (3432) Major High

The market rejects four times at the price (3436) according to D1 TF. when the market touches the area (3436) then falling again and again so it couldn't break.

Now the price respects the demand zone M30, It will give you few pips, after a little pump gold will drop if price respects the bearish engulfing H1 at 3420-3432. Now the trend is bullish it will change if price breaks the Trendline and 3253 area then our target will be 3129.

If price breaks the area 3432 then we will change our gear into buy because when the price breaks the supply zone it will be {BOS} and RBS.

STAY TUNE FOR UPDATE

KINDLY SHARE YOUR IDEAS HERE AND LEAVE POSSITIVE COMMENTS, THANKS EVERYBODY.

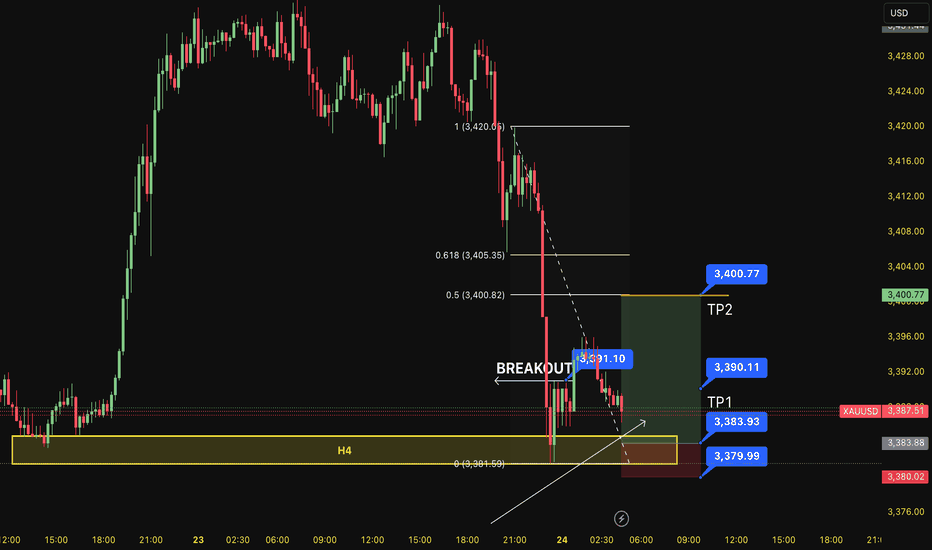

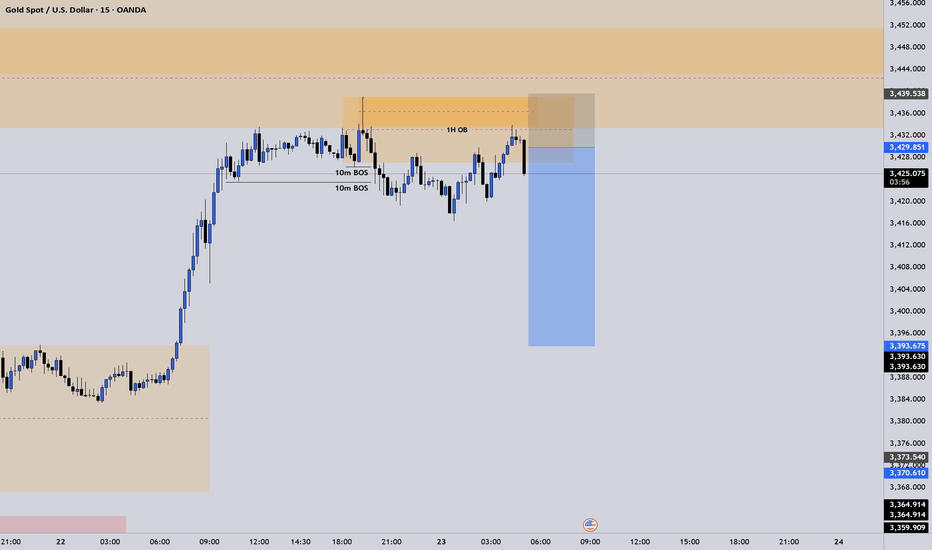

BUY XAUUSD 24.7.2025Counter-trend trade order: SELL at H4~H1~M15

Type of entry: Limit order

Reason:

- If the price breakout at 3,391 confirming the uptrend.

Note:

- Management of money carefully at the price of last top (3,390)

Set up entry:

- Entry sell at 3,383

- SL at 3,379

- TP1: 3,390

- TP2: 3,400

Trading Method: Price action (No indicator, only trend and candles)

XAUUSD I Potential Pullback and More GrowthWelcome back! Let me know your thoughts in the comments!

** XAUUSD Analysis - Listen to video!

We recommend that you keep this on your watchlist and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support!

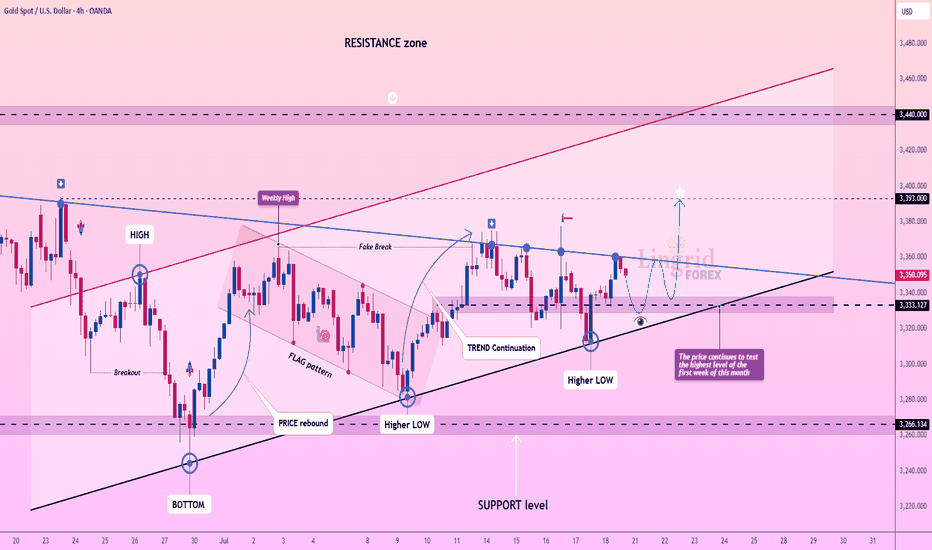

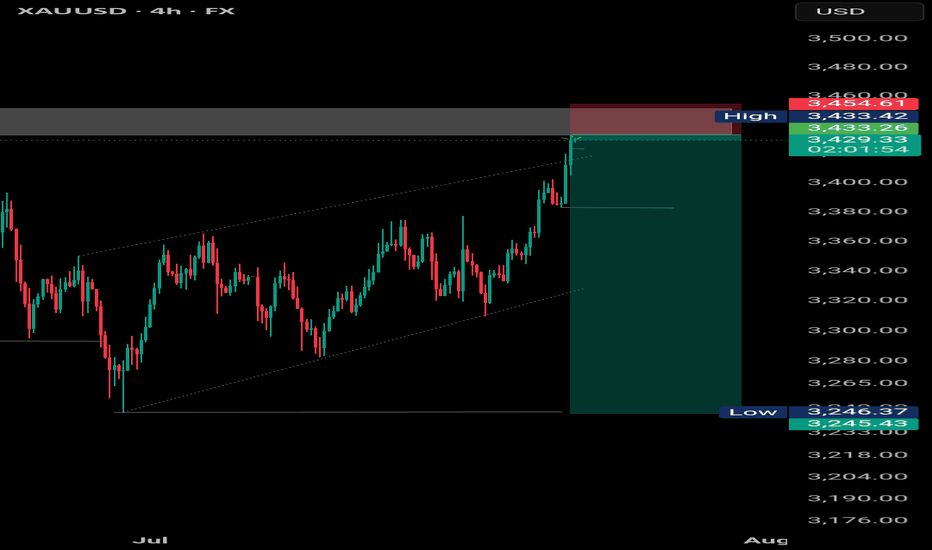

Lingrid | GOLD Weekly Analysis: Testing Resistance ZoneOANDA:XAUUSD markets are showing renewed strength as prices continue to test the highest levels reached in the first week of this month, demonstrating persistent bullish momentum despite ongoing consolidation. The precious metal is approaching a decisive technical juncture that could determine the next major directional move.

The chart reveals a compelling technical setup with gold forming higher lows while maintaining the upward trend continuation. After the previous fake breakout and flag pattern completion, the market has established a solid foundation above the $3,330 support level. The current structure shows a series of higher lows, confirming the underlying bullish bias.

The weekly high retest presents a crucial inflection point. A successful break above this level could trigger the next major leg higher toward the $3,400+ target zone, particularly given the ascending triangle formation and persistent institutional interest. The convergence of multiple technical indicators, including the trend continuation pattern and higher low formation, suggests accumulation at current levels.

Key levels to monitor include the immediate resistance at $3,393 and the critical $3,450 level. A decisive break above these levels would likely accelerate momentum toward $3,500-$3,600, while failure to maintain the higher low structure could see a pullback toward $3,285 support. The overall technical picture remains constructively bullish within the broader uptrend.

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

Gold 1H - Retest of channel & support zone at 3340After breaking out of the falling channel, gold is currently retesting its upper boundary — now acting as support. The 3340 zone is particularly important as it aligns with the 0.618 Fibonacci level and high volume node on the visible range volume profile. The price action suggests a potential bullish rejection from this area. With both the 50 and 200 EMA below price on the 1H, the short-term trend remains bullish. The 4H trendline further supports this setup. RSI is cooling off near the neutral zone, leaving room for another leg higher toward the 3377 resistance zone. If 3340 fails, 3324 (0.786 Fibo) becomes the next line of defense. Until then, the structure remains bullish following the successful breakout and retest of the channel.

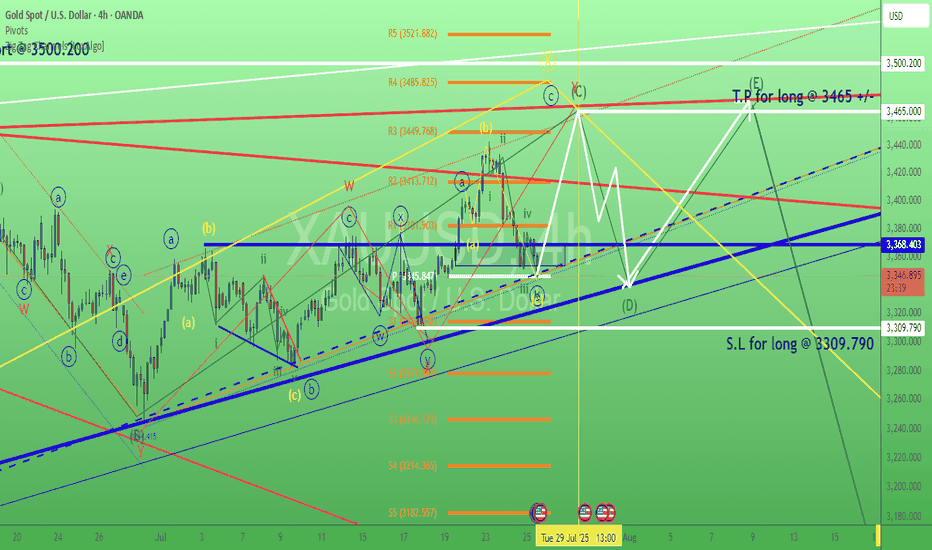

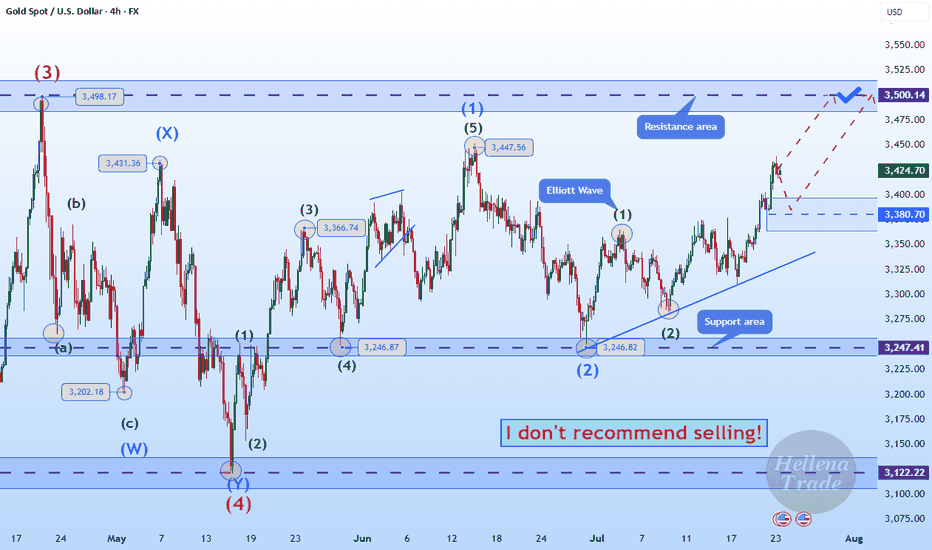

Hellena | GOLD (4H): LONG to resistance area of 3498 (Wave 3).The price continues to move in a bullish direction, and I believe that now is the time to pay attention to the medium-term wave “3.” It is actively developing, and I believe that the target should be set at the maximum area of the higher-order wave “3” — the resistance area of 3498.

This is the nearest target, which carries significant weight.

Overall, the upward five-wave movement is developing according to the old scenario.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

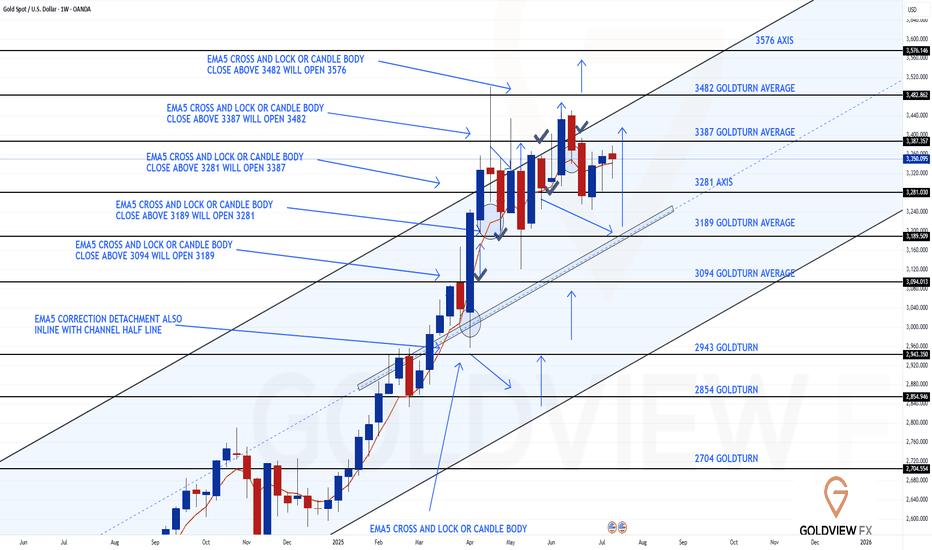

GOLD WEEKLY CHART MID/LONG TERM ROUTE MAPHey Everyone,

Please see update on our Weekly Chart idea.

As of now, nothing has changed structurally, the framework remains fully intact, and price continues to trade cleanly within the defined range.

After delivering a rejection at the channel top, price pulled back into 3281 support, where buyers once again stepped in decisively. That level held firm on a weekly closing basis, validating it as a reliable pivot and launching price back into bounce mode.

Despite the progress, we’ve yet to test the 3387 gap, which continues to act as a short term magnet. The longer range gap at 3482 also remains open and in focus as the larger objective.

Key takeaways from the current structure:

🔹 Structure unchanged:

The rising channel remains orderly. EMA5 still hasn’t locked bearishly, and the mid-line continues to climb beneath price, maintaining a constructive bias.

🔹 Support confirmed – 3281:

Held for a second time, reaffirming its significance in the broader structure.

🔹 3387 gap still in play:

While price is gravitating toward this zone, it has not yet been tested. Expect a reaction on first contact.

Updated Levels to Watch:

📉 Immediate Support – 3281

Held again, reinforcing its status as the key structural axis.

📈 Resistance 1 – 3387

Still untested. Remains the active near term target.

📈 Resistance 2 – 3482

Unfilled weekly gap and broader objective.

Plan:

As long as 3281 continues to hold, the bias remains for a measured grind higher toward 3387 and, eventually, 3482. If 3281 fails, we’ll reassess at the rising mid line for the next structured long opportunity.

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

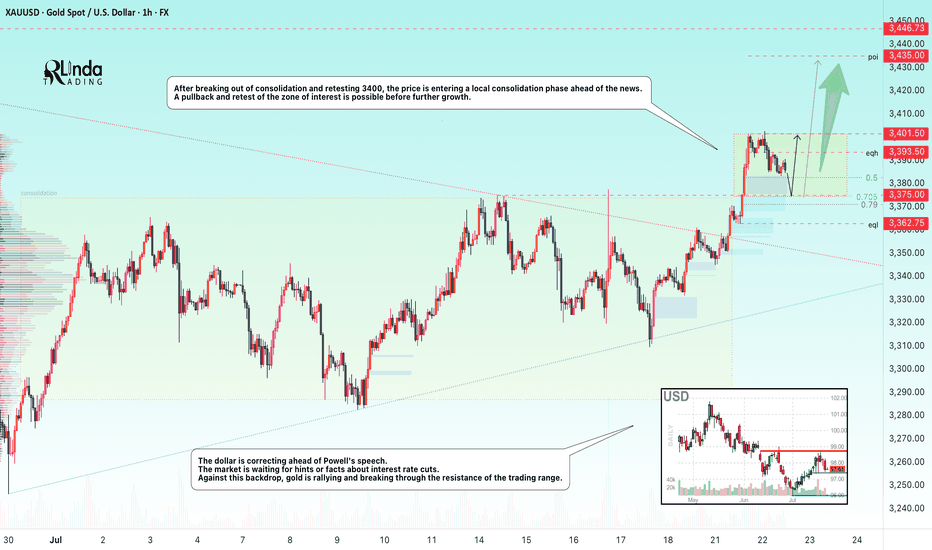

GOLD → Correction before continuing the rally to 3450FX:XAUUSD updates its local maximum to 3401.5 and enters a consolidation phase ahead of news. The dollar correction gives speculators a chance...

The price of gold is correcting from 3400. The reason is profit-taking ahead of Powell's speech at 12:30 GMT and waiting for clarity on US trade negotiations with the EU and Japan before August 1.

Gold remains sensitive to the progress of negotiations and the dynamics of the dollar, which is weakening amid political uncertainty, declining yields, and pressure on the Fed from Trump.

Technically, after exiting consolidation and retesting 3400, the price is entering a local consolidation phase.

Focus on key levels: 3401, 3382, 3375. A false breakdown of support could trigger a recovery phase.

Resistance levels: 3402, 3393

Support levels: 3382, 3375, 3362.75

The distribution phase has been halted by resistance, and the price has moved into a countertrend correction due to uncertainty. Markets are waiting for positive signals from the Fed. Local and global trends are bullish, which may support the price overall...

Best regards, R. Linda!

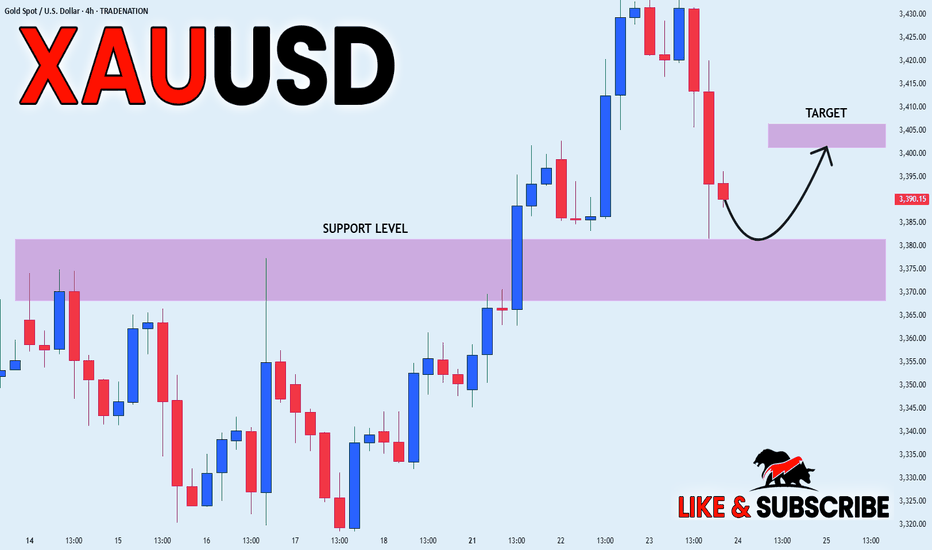

GOLD LOCAL LONG|

✅GOLD went down from

The resistance just as I predicted

But a strong support level is ahead at 3380$

Thus I am expecting a rebound

And a move up towards the target of 3400$

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

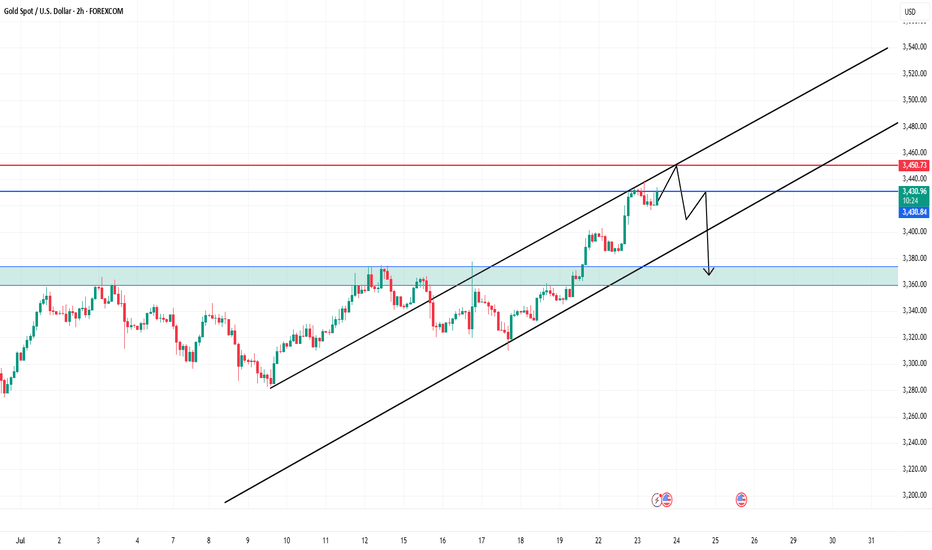

Gold at Key Resistance – Bearish Pullback Ahead?Technical Analysis (2H Chart)

1. Trend Structure:

Price is moving in a clear ascending channel (black trend lines).

Currently testing the upper boundary of the channel, which may act as resistance.

2. Resistance Zones:

$3,431–$3,450: Strong resistance zone.

Horizontal resistance at $3,450.73 (marked in red).

Price may form a lower high before reversal, as the black arrow suggests.

3. Support Zones:

$3,374 – $3,360: Previous structure and demand zone (highlighted green).

Strong potential bounce zone if price drops.

4. Price Action Expectation:

Possible fakeout or retest near $3,450 → followed by a rejection and drop toward the $3,360 area.

Bearish bias indicated by the projected path.

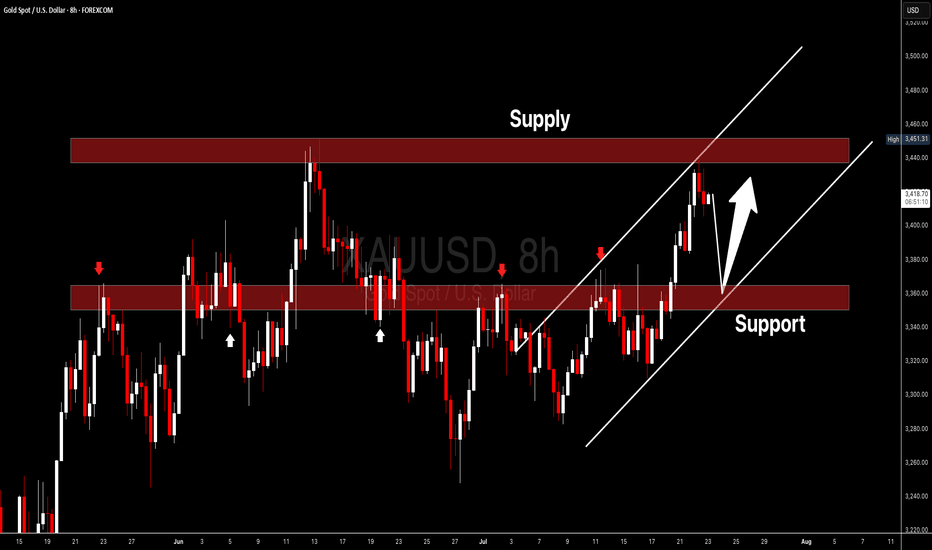

XAU/USD Chart Analysis: Bulls Break Important ResistanceXAU/USD Chart Analysis: Bulls Break Important Resistance

When analysing the XAU/USD chart last week, we:

→ noted that the ADX indicator had reached its lowest level since the beginning of 2025 – a clear sign of declining gold price volatility;

→ highlighted the formation of a large-scale triangle with its axis around the $3,333 level, bounded by a resistance line (marked in red) and the lower boundary of the ascending channel.

Since then, the price has climbed above $3,400 – reaching its highest level since mid-June. According to media reports, the uptick in demand may be driven by escalating geopolitical risks, renewed optimism regarding potential monetary policy easing in the US, and consistent gold buying from central banks.

This suggests that the balance has shifted in favour of the bulls, who have made an attempt to break through the resistance line – an attempt that, so far, appears promising and points towards a potential resumption of the upward trend.

However, today's XAU/USD chart shows that the bulls are now facing a key resistance level at $3,440 – a level that has reversed gold prices downward both in May and June. What will happen in July?

It is possible that, following a prolonged consolidation near the lower boundary of the channel, the bulls have built up sufficient momentum to finally break through this critical level and push gold prices towards line Q, which divides the lower half of the long-term channel into two quarters.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Gold Trade Plan 24/07/2025Dear Traders,

The price is currently near the demand zone in the range of 3358-3362. If the price holds above the support line, it could rise towards the 3388-3390 zone and then enter a correction again. However, if the 3362-3358 zone is broken, I expect a drop towards around 3350, followed by a potential rise towards the 3400 zone.

regards,

Alireza!

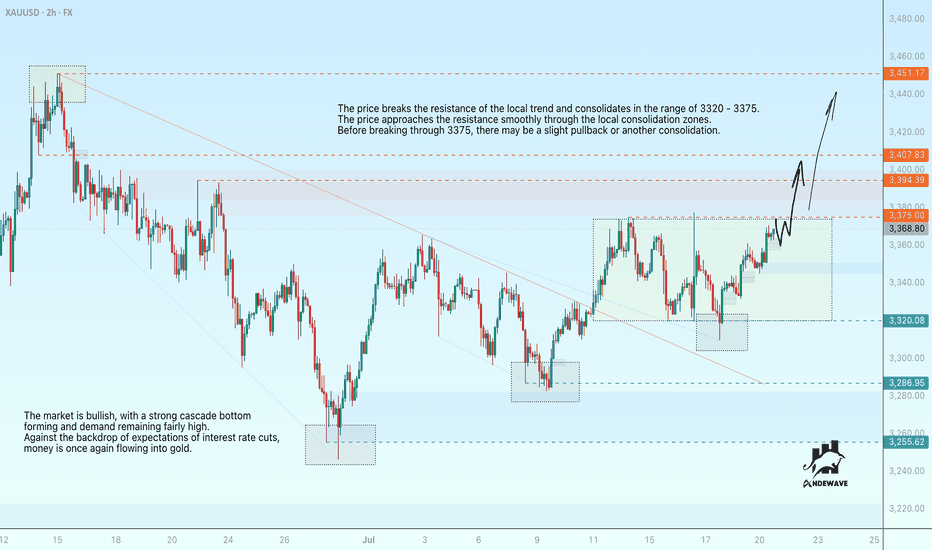

Gold tests resistance for a rally to 3450The price breaks through the resistance of the local trend and consolidates in the range of 3320-3375. The price approaches the resistance smoothly through local consolidation zones. Before breaking through 3375, there may be a slight pullback or another consolidation.

The market is bullish, with a strong cascade bottom forming and demand remaining fairly high. Against the backdrop of expectations of interest rate cuts, money is once again flowing into gold.

XAU/USD – Elliott Wave Update | Wave (2) in Progress)OANDA:XAUUSD

🔍 Wave Structure Overview

We’re currently in a

Prior impulse (likely 1-2-3-4-5) completed, forming (Circle) wave ①

Current correction unfolding as (A)-(B)-(C) in yellow

↳ Presently in wave (A) or transitioning into (B)

↳ Within (B), structure is forming as A-B-C

↳ Currently tracking 5-wave move from 4 to 5

📐 Fibonacci & Key Levels

Watching 61.8% retracement as a critical support zone ✅

This level also marks a high-probability TP area for short positions

Strong confluence:

🔹 Fibonacci retracement

🔹 Extension alignment (e.g. yellow fib extension to ~4403)

🔹 Trendline reaction expected

🧠 Trade Setup (Scenario-Based)

🔸 Scenario A – Early Entry:

Enter small long near 61.8% Fib zone

SL: Below last swing low

TP: To be refined once C-wave completes

🔸 Scenario B – Confirmation Entry:

Wait for break above red trendline

Add position

SL below Fib zone low

TP around Fibonacci extension / structure resistance (~4403)

⚠️ Key Considerations

Many positions will close in this zone → increase in selling pressure

Possible reversal zone → watch for confirmation (impulse or ABC)

Once wave (C) completes, we’ll likely see entry into a larger bearish move

📎 Conclusion

This is a high-probability reversal zone, supported by Elliott structure and Fib levels. I’m planning to scale in based on price action and confirmation.

📈 Stay flexible, manage risk, and watch the structure evolve.

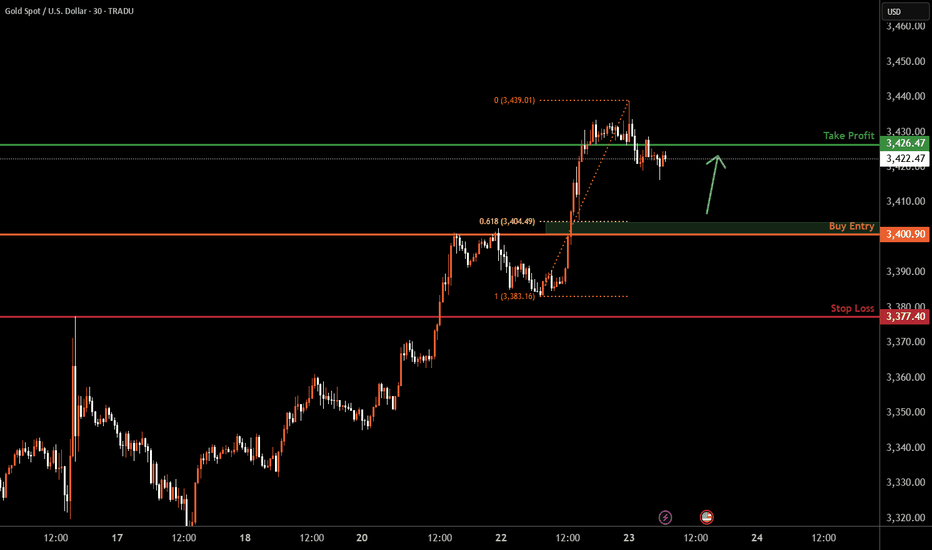

XAUUSD M30 I Bullish Bounce Off the 61.8% Fib Based on the M30 chart analysis, the price is falling toward our buy entry level at 3400.90, a pullback support that aligns closely with the 61.8% Fib retracement.

Our take profit is set at 3426.47, an overlap resistance.

The stop loss is placed at 3377.40, a pullback support.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

Gold Market Update – Key Zones for the Next MoveHey gold lovers! As the NY session wraps up, the chart is a painting of tension: gold boxed tight between major structure — and the real action is only about to start.

Bias:

At this stage, gold remains in a short-term bullish structure as long as price holds above the 3421–3428 decision area. A break and hold below this zone would shift the bias to neutral or bearish for the next sessions.

🎨 What’s drawn on the chart?

🟥 3472–3478 Supply Zone:

The ceiling, still untouched — this is where every failed breakout has left a “scar” on the chart. If we finally reach this zone, watch for wicks, rejections, or that rare, clean breakout candle. Sellers and patient bulls are both watching for “the drawing” to be complete.

🟩 3383–3390 Demand Zone:

The real floor. On your chart, it’s the base built by strong bounces and those long wicks buyers left behind. If price falls here, it’s not just a line: it’s a zone where new rallies are born and the market might “paint” a major reversal.

🟦 The Middle is Just Noise

Price is coiling, painting confusion in the center — but the edge zones are where structure and opportunity live.

Don’t be the trader who gets erased in the chop. Let price draw the story at supply or demand before making your move.

💡 Plan for Tonight

Wait for price to reach 🟥 supply or 🟩 demand.

Watch the “drawing” — will you see a wick, a rejection, or a true breakout?

Only trade once the story is clear at the edges.

Drop your best chart art or scenario below!

like🚀🚀🚀and 🔔 Follow for real structure updates & daily market stories — let’s turn trading into a masterpiece, together.

GoldFxMinds

Will we be SHOWERED with GOLDen gainz?!IS IT PAMPIN TIME?!?!?! Looks like it's tryna break out, but beware of the fakeout. WIll it pop or double top!?

To those holding the golden treasure, may the lawd of pamp bless thee with gainz forever.

Gold miners went ham today too... probably nothing. LETS PAMP IT!

THANK YOU FOR YOUR ATTENTION ON THIS MATTER.