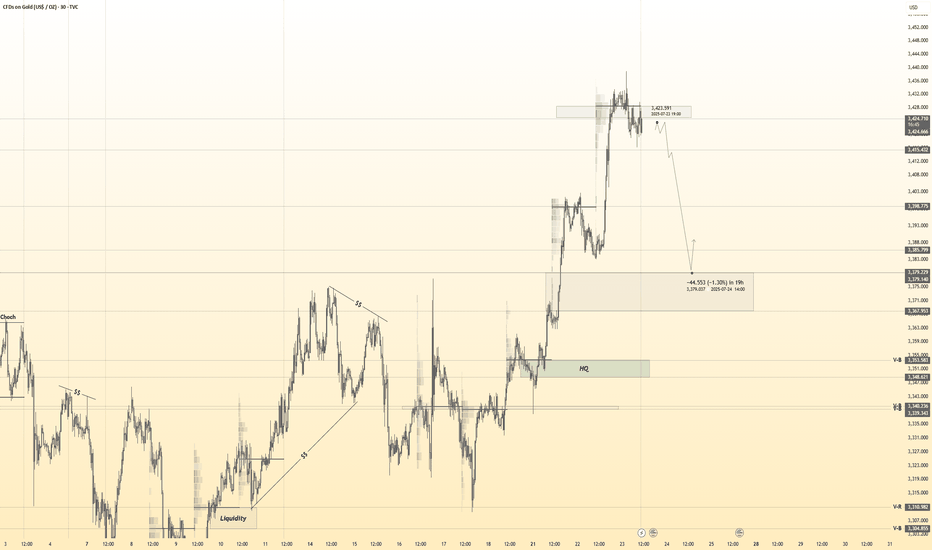

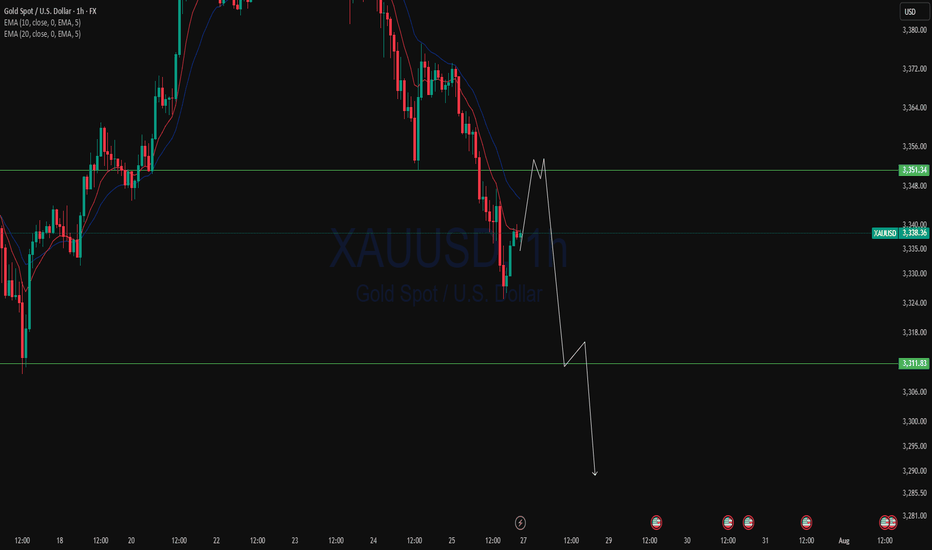

Gold 30Min Engaged ( Bearish Entry Detected )————-

➕ Objective: Precision Volume Execution

Time Frame: 30-Minute Warfare

Entry Protocol: Only after volume-verified breakout

🩸 Bearish From now Price : 3423

➗ Hanzo Protocol: Volume-Tiered Entry Authority

➕ Zone Activated: Dynamic market pressure detected.

The level isn’t just price — it’s a memory of where they moved size.

Volume is rising beneath the surface — not noise, but preparation.

🔥 Tactical Note:

We wait for the energy signature — when volume betrays intention.

The trap gets set. The weak follow. We execute.

XAUUSDK trade ideas

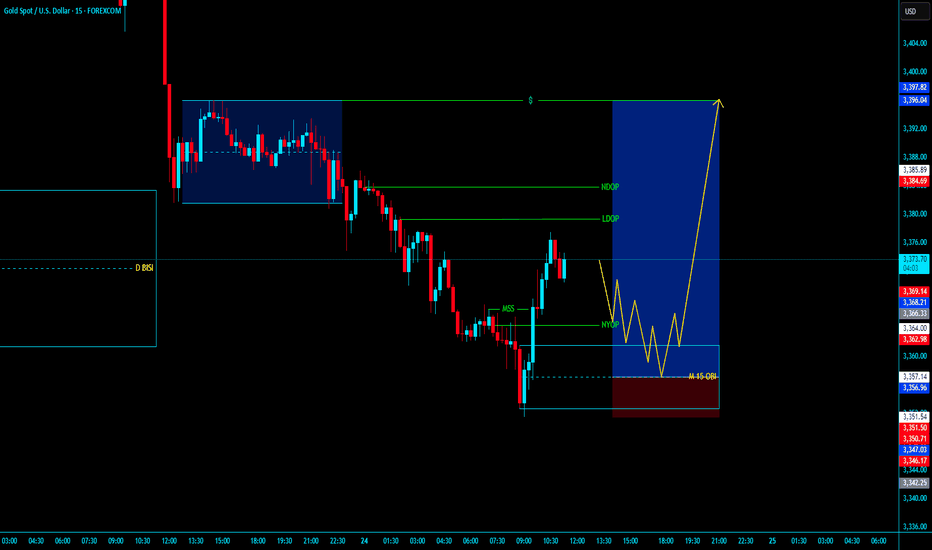

XAUUSD BUY LONG XAUUSD BUY LONG FROM BULLESH OBI

- In Daily TF Market will bullesh

- In H1 TF market is stell fully bullesh

- Market is in Daliy , H4 , H1 , M15 BISI

- In H1 & M15 MSS then our entry in OBI in LTF Valid MSS then our Entry target H1 Nearest Liquidity with Tight SL

tradE anD enjoY ......................................................

~~ KGB Priyabrat Behera ~~

~ ICT Trader & Advance Mapping SMC Trader ~

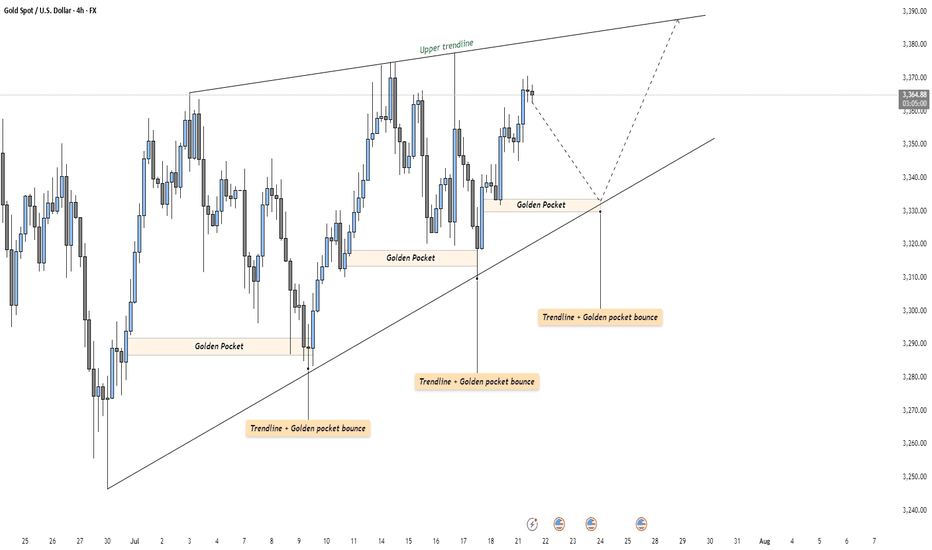

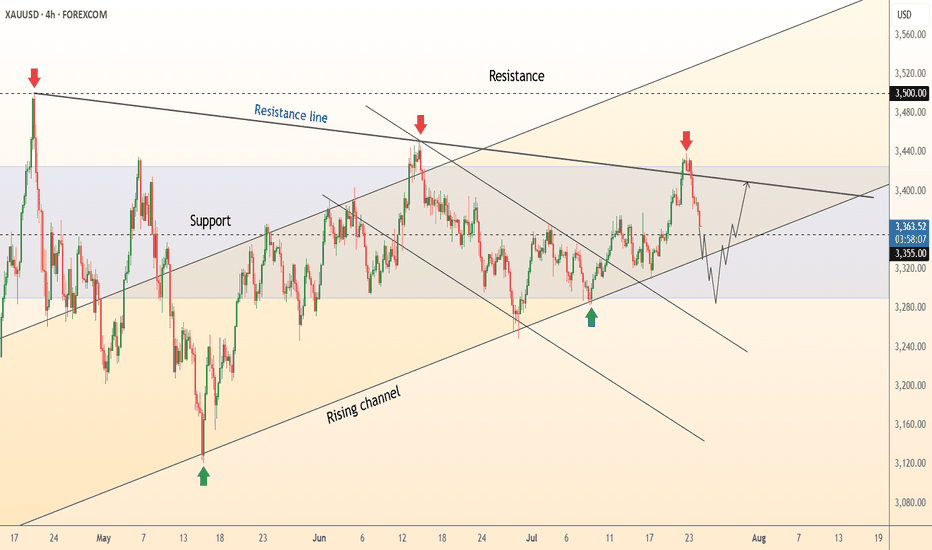

GOLD - Strong Trendline & Golden Pocket ContinuationMarket Context

Gold is currently trading within a rising wedge structure on the 4-hour timeframe. This formation typically represents a tightening market, where buyers continue to push higher — but with decreasing momentum. The confluence of both trendlines and repeated Golden Pocket bounces makes this setup technically rich and worth watching closely.

Golden Pocket & Trendline Confluence

Throughout the recent move up, price has consistently reacted to the 0.618–0.65 Fibonacci retracement zone — often referred to as the Golden Pocket. Each major retracement has found support not only at this zone but also at a rising trendline, showing strong alignment between horizontal and diagonal demand. This dual-layer support has repeatedly led to sharp rebounds, reinforcing the bullish structure.

What Comes Next?

Price is currently sitting just below the upper resistance of the wedge. If history repeats, a retracement toward the lower trendline could be the next logical step. A reaction in the same region — where the Golden Pocket once again overlaps the trendline — could offer a high-probability long opportunity for continuation toward the top of the wedge or even a breakout.

Alternatively, if price breaks below the trendline with conviction, it could signal exhaustion in the current structure, potentially flipping the bias toward a broader correction.

Final Thoughts

This is a textbook example of how technical confluence can guide trade planning — especially in clean, trending environments like this. Remember: patience is key. Let the market come to your levels.

If you enjoyed this breakdown, a like would go a long way — and feel free to share your thoughts or ideas in the comments below!

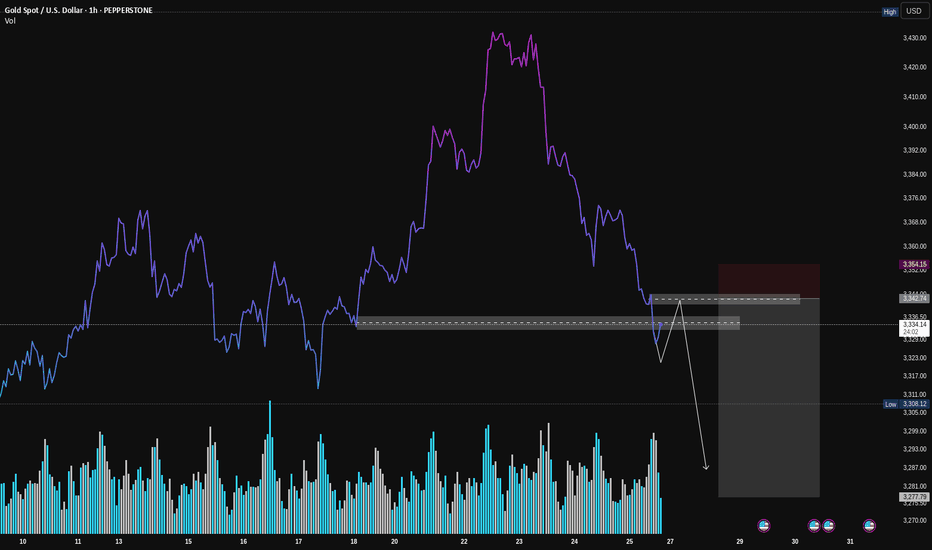

Gold (XAU/USD): A Classic VSA Short Setup in PlayHey Traders,

Following up on the general weakness we discussed in Gold, here's a closer look at a specific trade setup that's unfolding right now. This is a textbook example of a high-probability short setup according to Volume Spread Analysis (VSA).

Let's break down the story the volume is telling us.

1. The Breakdown: Sellers Show Their Hand

First, look at how the price broke down hard through that support level (the grey box). Notice the volume on that sharp drop? It was high. This is our clue that sellers are strong and in control. They had enough power to smash right through a level that was previously holding the price up.

2. The Retest: Buyers Don't Show Up

Now, the price is creeping back up to that same exact level. But here's the most important clue: look at the volume on this rally. It's much lower than the volume on the breakdown.

This is what VSA calls a "No Demand" rally. It’s like the market is trying to push a car uphill without any gas. It tells us that strong buyers (the "smart money") have no interest in buying at these prices.

3. The Setup: Selling into Weakness

This combination creates a classic short setup:

Logic: We are looking to sell at a level where old support has flipped into new resistance.

Confirmation: The low volume on the retest confirms the rally is weak and likely to fail.

How to Potentially Trade It

The grey box represents a high-probability entry zone. To time an entry, you could watch for a clear rejection signal right inside this zone. For example:

A "rejection candle" (like a pin bar) that pushes into the zone but gets slammed back down.

An up-bar with a tiny body and very low volume, showing buyers are completely exhausted.

Seeing one of these signs would be the final confirmation that sellers are about to take back control.

Conclusion:

This is a powerful setup because all the pieces line up: the background is weak, sellers have shown their strength, and buyers are now showing no interest at a key resistance level.

Disclaimer: This is my personal analysis using VSA and is for educational purposes only. It is not financial advice. Always do your own research and manage your risk. Good luck, traders!

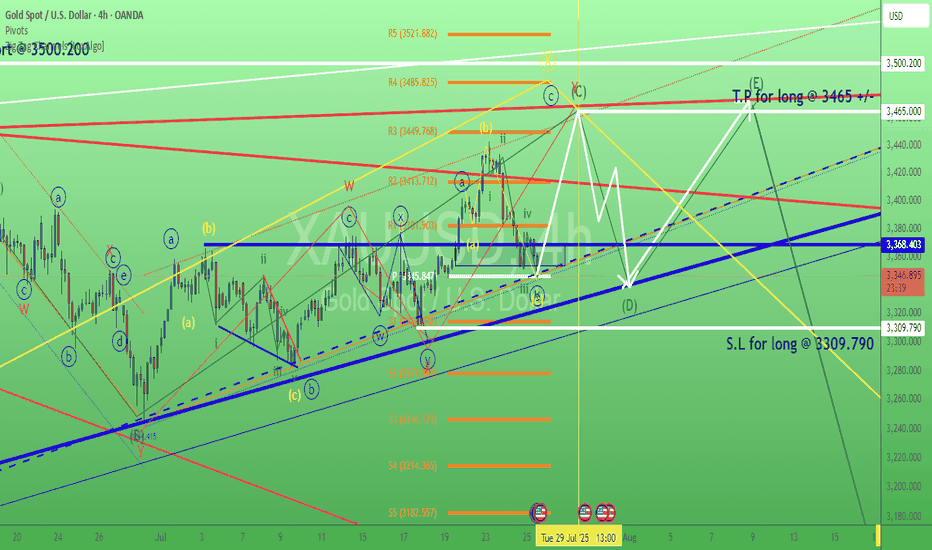

XAU/USD – Elliott Wave Update | Wave (2) in Progress)OANDA:XAUUSD

🔍 Wave Structure Overview

We’re currently in a

Prior impulse (likely 1-2-3-4-5) completed, forming (Circle) wave ①

Current correction unfolding as (A)-(B)-(C) in yellow

↳ Presently in wave (A) or transitioning into (B)

↳ Within (B), structure is forming as A-B-C

↳ Currently tracking 5-wave move from 4 to 5

📐 Fibonacci & Key Levels

Watching 61.8% retracement as a critical support zone ✅

This level also marks a high-probability TP area for short positions

Strong confluence:

🔹 Fibonacci retracement

🔹 Extension alignment (e.g. yellow fib extension to ~4403)

🔹 Trendline reaction expected

🧠 Trade Setup (Scenario-Based)

🔸 Scenario A – Early Entry:

Enter small long near 61.8% Fib zone

SL: Below last swing low

TP: To be refined once C-wave completes

🔸 Scenario B – Confirmation Entry:

Wait for break above red trendline

Add position

SL below Fib zone low

TP around Fibonacci extension / structure resistance (~4403)

⚠️ Key Considerations

Many positions will close in this zone → increase in selling pressure

Possible reversal zone → watch for confirmation (impulse or ABC)

Once wave (C) completes, we’ll likely see entry into a larger bearish move

📎 Conclusion

This is a high-probability reversal zone, supported by Elliott structure and Fib levels. I’m planning to scale in based on price action and confirmation.

📈 Stay flexible, manage risk, and watch the structure evolve.

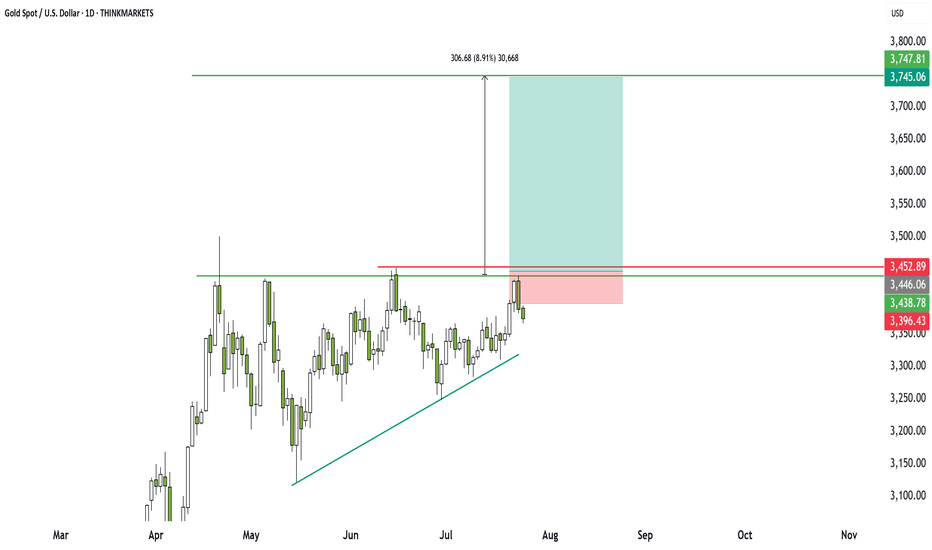

Gold: ascending triangle sets up big opportunityGold has traded sideways for 93 days, but breakout traders should take note. A clear ascending triangle is forming, offering a high reward-to-risk setup. I walk through the key levels, breakout zone, and why this could lead to a 6x return. Bulls may be frustrated, but momentum is building. Are you ready?

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

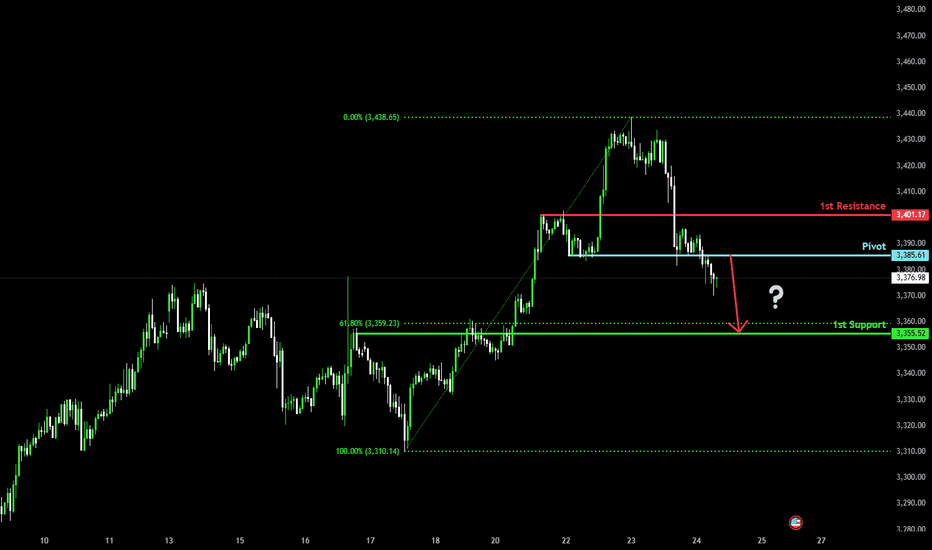

Bearish drop?The Gold (XAU/USD) has reacted off the pivot and could potentially drop to the 1st support, which is a pullback support that is slightly below the 61.8% Fibonacci retracement.

Pivot: 3,385.61

1st Support: 3,355.52

1st Resistance: 3,401.17

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

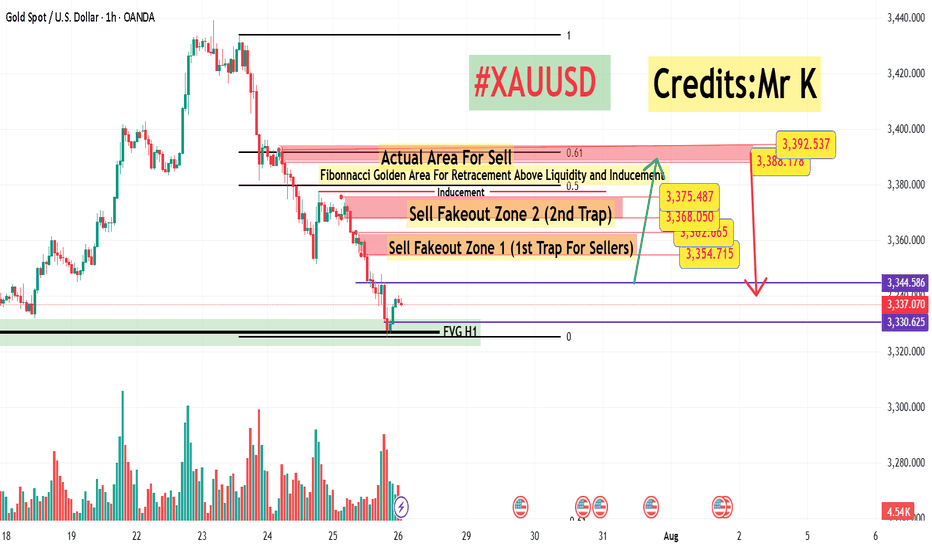

#XAUUSD H1 Setup – Smart Money Outlook📊 **#XAUUSD H1 Setup – Smart Money Outlook**

What we've been observing over the **last 3 sessions** is consistent **selling pressure** with **no meaningful pullback** yet — something that’s usually inevitable, even in strong downtrends.

🔁 A **retracement** is likely, and to identify key levels, we use the **Fibonacci Retracement Tool**.

---

### 🔍 **Market Sentiment Right Now**:

* Many traders are expecting a pullback into the **3348–3360 H1 Order Block**,

* Others are targeting **3368–3375** as a sell zone.

But here’s the twist:

⚠️ **Both these zones** could be potential **sell trap areas** (Fakeout Zone 1 & 2).

Why? Because **massive liquidity sits just above these levels**.

---

### 💡 **Smart Money Logic**:

Above the second fakeout zone lies an **inducement area** (liquidity pool).

And beyond that sits our **true institutional sell zone** at **3388–3393**, which aligns perfectly with the **Golden Fibo Zone (0.50–0.618)**.

📌 This is where we may see the **real bearish reaction**.

---

### 🟢 **Buy Setup Plan (Short-Term Opportunity)**:

If we get a **fully bullish H1 candle close above 3345**, we’ll look to **buy** with:

* **Entry:** Above **3345**

* **Stoploss:** Around **3332**

* **Target 1:** **3355**

* **Target 2:** **3368**

*(Potential final move into the trap zone)*

📢 **Important Note**: No buy will be considered without a strong **bullish H1 candle close** for confirmation. ✅

---

Let the market come to us — stay smart, not emotional. 🧠💰

\#SmartMoneyConcepts #XAUUSD #H1Analysis #LiquidityHunt #OrderBlock #GoldenFiboZone

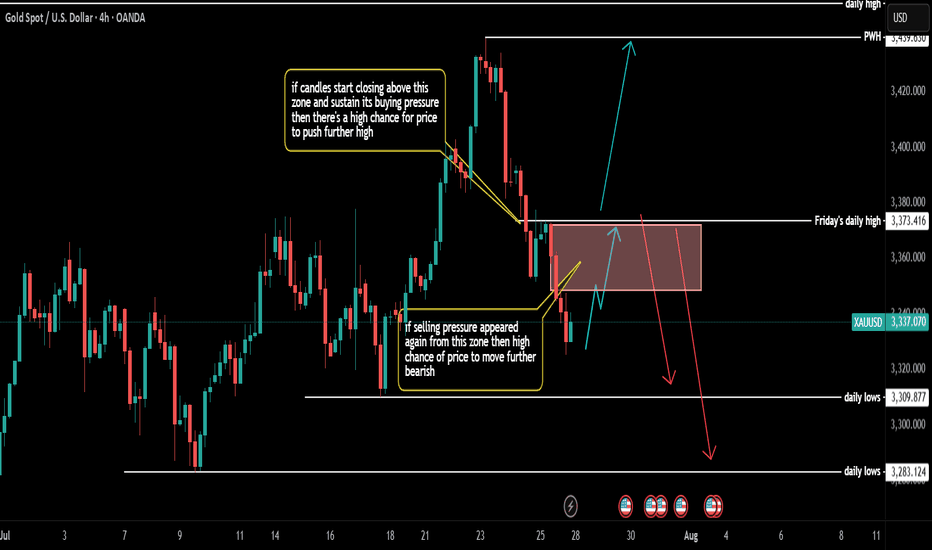

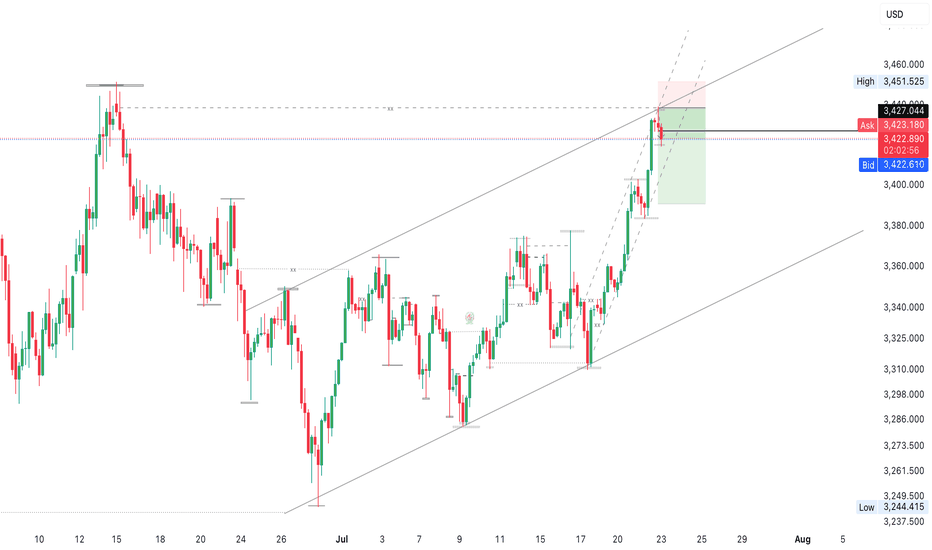

Gold Market Completes Bullish Wedge at 3439Gold market lures to 3439, completing the bullish wedge formation as anticipated.

A retracement is now setting in, with price action expected to sweep through 3391—a key zone that may determine the next leg of the trend.

Watch closely for confirmation at this level for a potential bullish continuation or deeper correction. follow for more insight , comment and boost idea

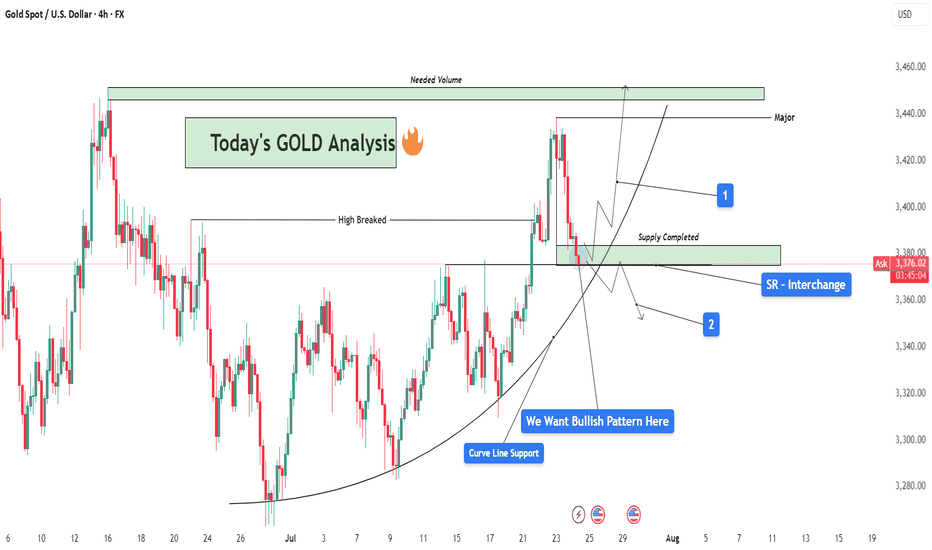

GOLD Analysis : SR Interchange , Reversal Zone + High Break🧠 Market Context & Structural Overview:

Gold has been trading within a clearly defined bullish structure after forming a rounded base pattern in early July, indicating accumulation by smart money. The market recently broke through a key horizontal resistance (previous swing high), marking a potential bullish continuation phase. However, we are now witnessing a pullback — a healthy corrective phase — that is currently testing multiple high-probability confluences.

🧱 Key Technical Zones Explained:

🔹 1. SR Interchange Zone – High Probability Reversal Area:

This area (roughly between $3,360 and $3,380) acted as previous resistance (supply) and has now flipped into support.

This is a textbook Support-Resistance Interchange (SR Flip) — a concept where prior resistance becomes new support.

Traders often look for entries here, especially when it aligns with other technical factors.

🔹 2. Curve Line Support – Dynamic Buyer Strength Indicator:

A curved trendline, often referred to as a parabolic support, has been respecting price structure for over two weeks.

Price is now sitting exactly on this support, signaling potential for another impulsive bullish leg if momentum builds.

🔹 3. Supply Zone Completed – Correction Phase Active:

The supply zone above (approx. $3,420–$3,440) has already been tapped and respected by the market.

This “completed” supply may now act as resistance unless broken with strong volume — we now watch how price reacts at the current pullback zone.

📊 What the Candles Are Telling Us:

The latest candles show some hesitation from sellers — wick rejections and smaller body candles hint at buyer interest at this level. However, confirmation is crucial. We want to see a bullish reversal pattern such as:

Bullish engulfing

Morning star

Pin bar (hammer)

Break and retest of minor resistance inside the SR zone

🔮 Scenarios to Watch:

✅ Scenario 1 – Bullish Continuation (Ideal Setup):

If a bullish reversal forms at this support zone:

Expect a potential rally back to the $3,420–$3,440 resistance area.

If this zone breaks with high volume, price could target the major supply zone near $3,465+, where we’ll need “Needed Volume” for a decisive break.

⚠️ Scenario 2 – Bearish Breakdown (Alternative View):

If the curve support and SR zone fail to hold:

Expect a drop towards $3,345 – $3,320 — where next structural support lies.

This would suggest a deeper retracement or range formation before bulls can regroup.

🧩 Strategy & Psychology:

“We want bullish pattern here.”

You’ve highlighted the importance of not entering impulsively. This is about trading with confirmation, not prediction. Waiting for a valid bullish pattern reduces risk and increases probability.

This is where smart traders win — waiting patiently for confirmation at a zone of confluence.

🧠 Learning Mindset – Why This Zone Matters:

Combines horizontal support, curved trendline, and broken structure retest.

This zone is the battleground between bulls and bears — whoever wins here will likely control short-term momentum.

Newer traders can study this as a classic example of multi-confluence trading, which combines price action, market structure, and dynamic trendlines.

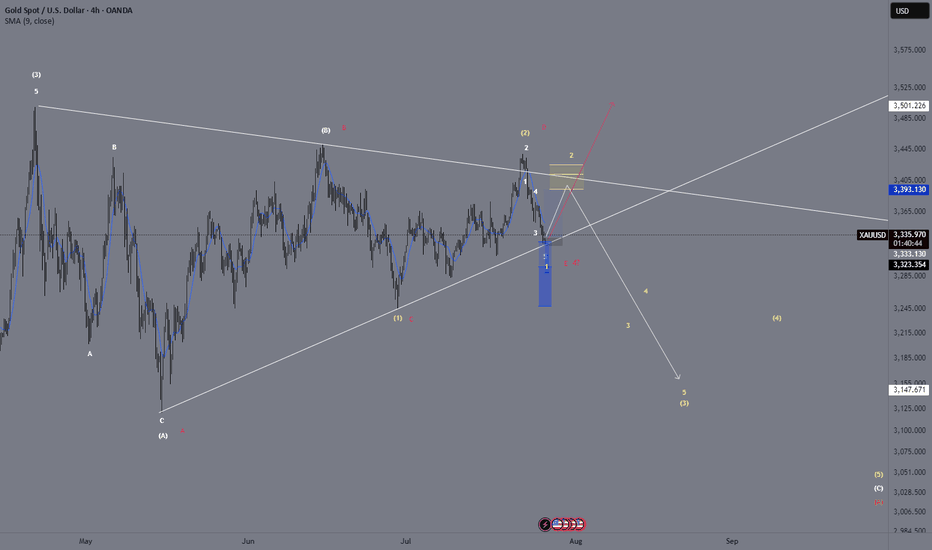

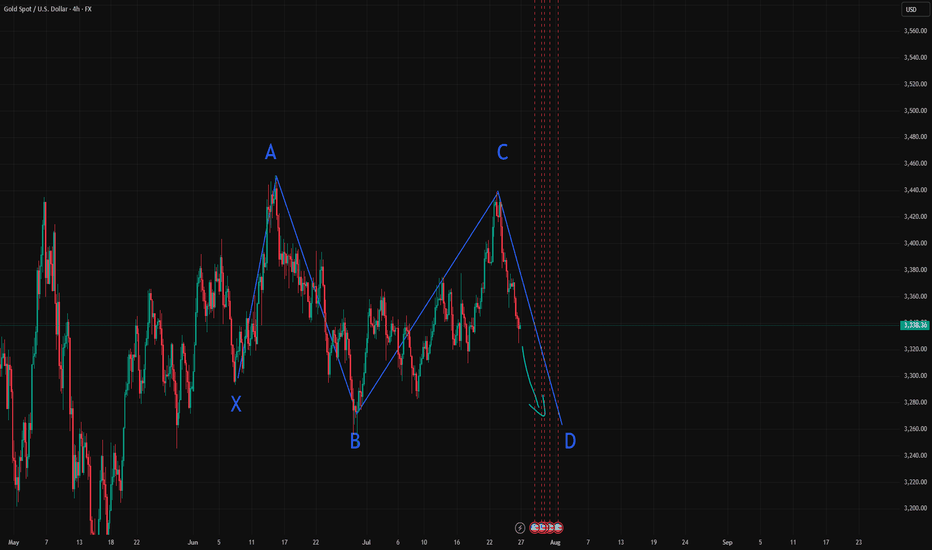

XAU/USD – Current Wave Count & Potential ScenariosOANDA:XAUUSD

We are currently moving from (white) wave 3 to (white) wave 4.

So far, I am leaning towards the white count where the waves labeled (A), (B), (C) form a larger corrective wave A, which leads to wave B, and then to (white) wave 4.

Up to now, we have only completed (A) and (B).

Now, in the yellow bracket, we can interpret a 1-2-3-4-5 structure leading to (white) wave C 🟡.

Alternatively, one could interpret a triangle pattern (pink count):

Waves A, B, C, D, E, which would then form our wave 4.

In that case, we would expect bullish targets afterwards 🚀.

We need to watch closely if the price reverses or breaks through our yellow Fibonacci zone 🟡.

For now, we are primarily looking for upside potential 🔼.

From our yellow wave 2, we saw a downward push, which could theoretically be our yellow wave 1 leading into yellow wave 2 and the yellow Fibonacci zone — essentially a five-wave move from wave 2 to wave 3.

XAUUSD Analysis TodayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis

DeGRAM | GOLD will retest the channel boundary📊 Technical Analysis

● Fresh rejection at the blue resistance line (~3 435) pushed XAU back to the 3 355 mid-band, yet successive higher-lows (green arrows) keep price inside the May-origin rising channel.

● The pullback is probing 3 328-3 355 — confluence of the former flag roof and triangle top; holding this zone should launch another test of 3 400/3 435, with the channel crest targeting 3 500.

💡 Fundamental Analysis

● U-S S&P-Global PMIs softened, nudging 2-yr real yields to three-week lows, while cautious ECB rhetoric limits dollar gains — both supportive for gold.

✨ Summary

Long 3 328-3 355; above that aims 3 400 ➜ 3 435, stretch 3 500. Invalidate on an H4 close below 3 293.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

GOLD Weekly Idea💡Why Gold Pulled Back

- Gold pulled back today after hitting $3439.04, just below resistance at $3451.53. Traders took profits ahead of key Fed and trade headlines. Right now, it’s trading around $3414.48, down 0.50%.

- The dip came after the U.S.-Japan trade deal eased geopolitical tension, cutting safe-haven demand. Plus, U.S. bond yields are climbing (10-year at 4.384%), which adds pressure on gold.

Support is building at $3374.42, with stronger buying interest expected around $3347.97 and the 50-day moving average at $3336.40 — a key level bulls want to defend.

Short-term looks a bit weak, but as long as gold holds above the 50-day MA, the bullish trend remains intact. Longer-term, weakness in the dollar, central bank gold buying, and concerns about Fed independence could push prices higher.

🔍Watching the Fed’s July 29–30 meeting next