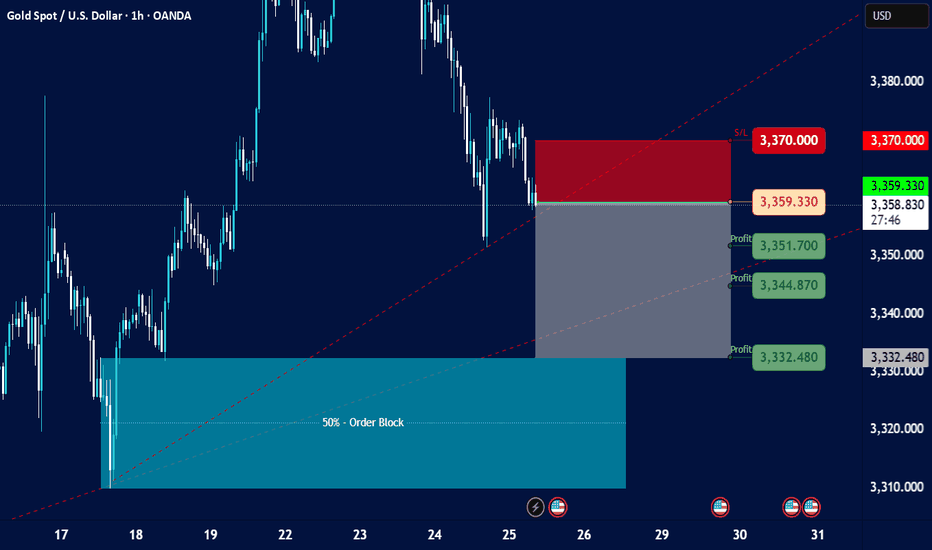

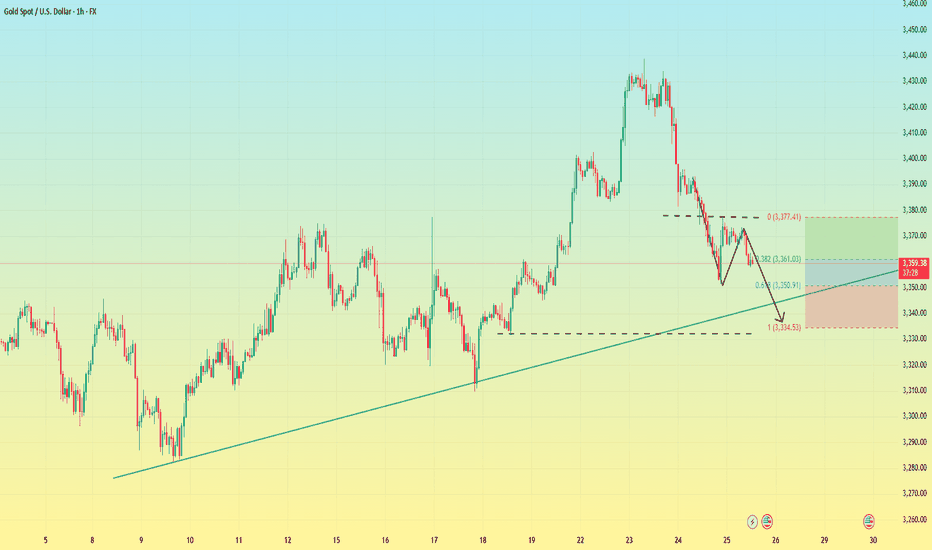

Gold Spot / U.S. Dollar - 1h on TradingView, dated July 25, 202Current Price and Trend:

The current price is shown as 3,359.330, and the last traded price is 3,359.005.

The chart indicates a downtrend in recent sessions, with the price having fallen significantly from higher levels around 3,380.000 to 3,390.000 down to the current levels.

There's a dashed red line (possibly a trendline or resistance) indicating a downward slope.

Key Zones and Levels Identified:

Resistance/Stop Loss Zone (Red Rectangle):

This zone is marked from approximately 3,365.000 up to 3,370.000.

A "S/L" (Stop Loss) level is explicitly marked at 3,370.000. This suggests that a short position (selling) is being considered, with a stop loss placed above this resistance.

Entry Point (Grey Line):

An entry point for a trade is indicated by a grey horizontal line at 3,359.330. This is very close to the current price, suggesting a potential entry for a short trade.

Profit Target Zones (Grey Rectangle with Green Labels):

Three "Profit" levels are identified below the entry point:

3,351.700

3,344.870

3,332.480

These levels suggest potential targets for taking profit on a short position. The grey shaded rectangle represents the area where these profit targets lie, extending downwards from the entry point.

50% - Order Block (Teal Rectangle):

At the bottom left of the chart, there's a large teal-colored rectangle labeled "50% - Order Block."

This typically represents an area where significant institutional buying interest (or an accumulation of orders) is expected, potentially acting as strong support. The price has previously bounced off this area.

Possible Trading Strategy Implied:

The setup suggests a potential short-selling strategy for Gold Spot / USD, likely based on a continuation of the downtrend or a retest of previous resistance levels.

Entry: Around 3,359.330 (current price level).

Stop Loss: At or above 3,370.000, to limit potential losses if the price moves against the short position.

Take Profit: Phased profit-taking at 3,351.700, 3,344.870, and 3,332.480.

Target Support: The ultimate target appears to be within the "50% - Order Block" zone, suggesting the expectation of the price reaching or testing this strong support area.

Considerations and Further Analysis Needed:

Confirmation: The chart doesn't show any specific indicators (e.g., RSI, MACD) that might confirm the downtrend or potential entry.

Volume: Volume analysis would be beneficial to assess the strength of price movements.

News/Fundamentals: Any upcoming economic data or geopolitical events could significantly impact gold prices.

Risk-Reward Ratio: A calculation of the risk-reward for each profit target would be useful to determine the attractiveness of the trade.

Market Structure: A deeper analysis of the market structure (higher highs/lows, lower highs/lows) could provide more context.

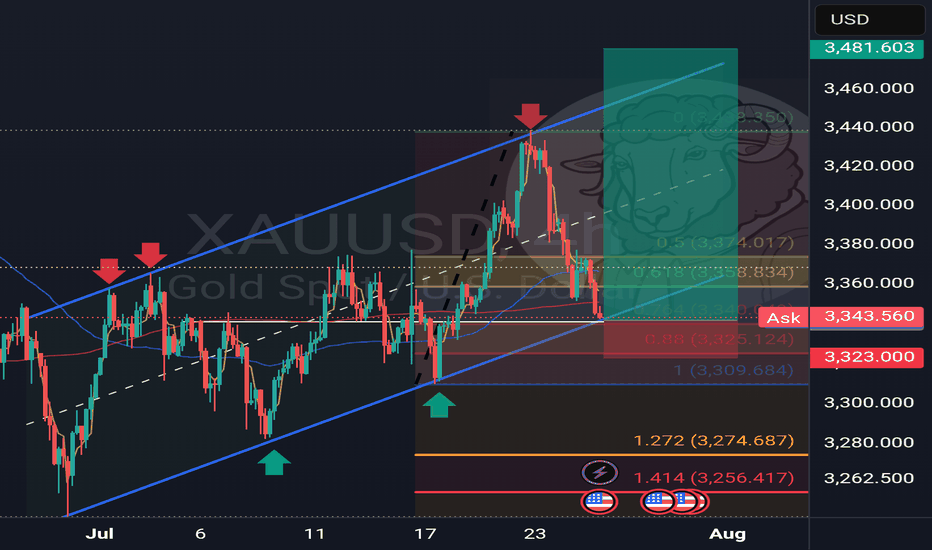

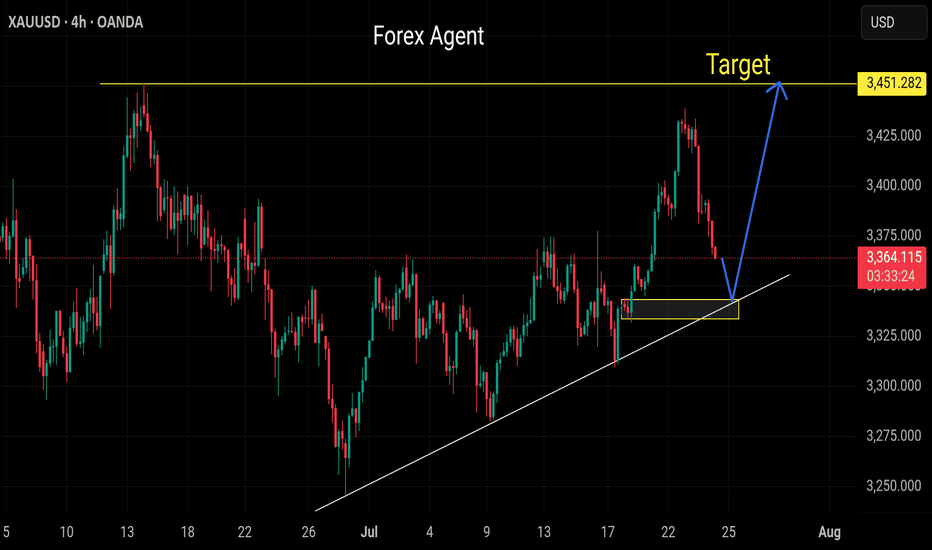

XAUUSDK trade ideas

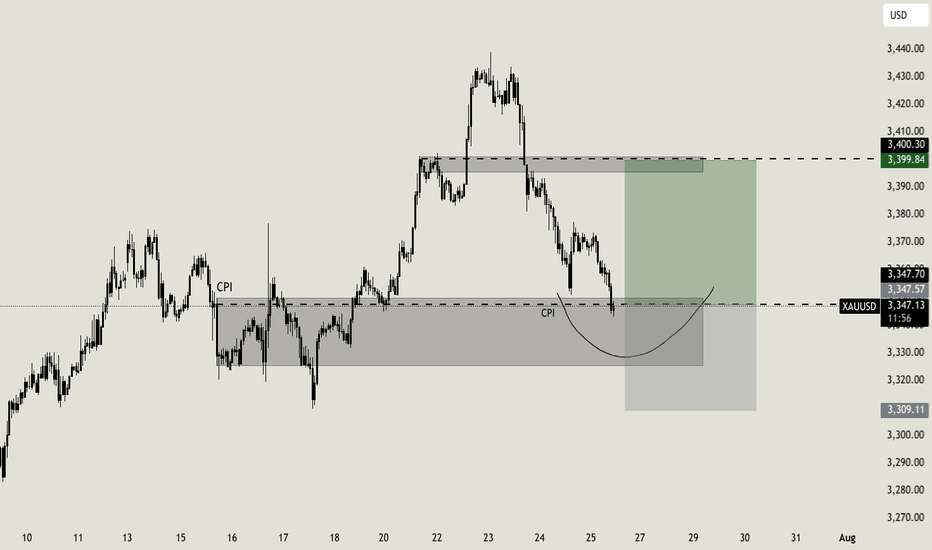

Accurate prediction, continue to buy after retracement to 3353📰 News information:

1. The Trump administration puts pressure on the Federal Reserve to cut interest rates

2. The continued impact of tariffs and the responses of various countries

📈 Technical Analysis:

Gold is currently rising rapidly, reaching a high near 3368, and the overall bullish trend has not changed yet. It is not recommended to continue chasing the highs at present. Those who are long at 3345 can consider exiting the market with profits. The technical indicators are close to the overbought area and there is a certain risk of a correction. Be patient and wait for the pullback to provide an opportunity. At the same time, 3353 has become the position with relatively large trading volume at present, and the top and bottom conversion in the short term provides certain support for gold longs. If it retreats to 3355-3345, you can consider going long again, with the target at 3375-3385. If it falls below 3345, look to 3333, a second trading opportunity within the day. If it falls below again, it means that the market has changed, and you can no longer easily chase long positions.

🎯 Trading Points:

BUY 3355-3345

TP 3375-3385

In addition to investment, life also includes poetry, distant places, and Allen. Facing the market is actually facing yourself, correcting your shortcomings, facing your mistakes, and exercising strict self-discipline. I share free trading strategies and analysis ideas every day for reference by brothers. I hope my analysis can help you.

FXOPEN:XAUUSD OANDA:XAUUSD FX:XAUUSD FOREXCOM:XAUUSD PEPPERSTONE:XAUUSD TVC:GOLD

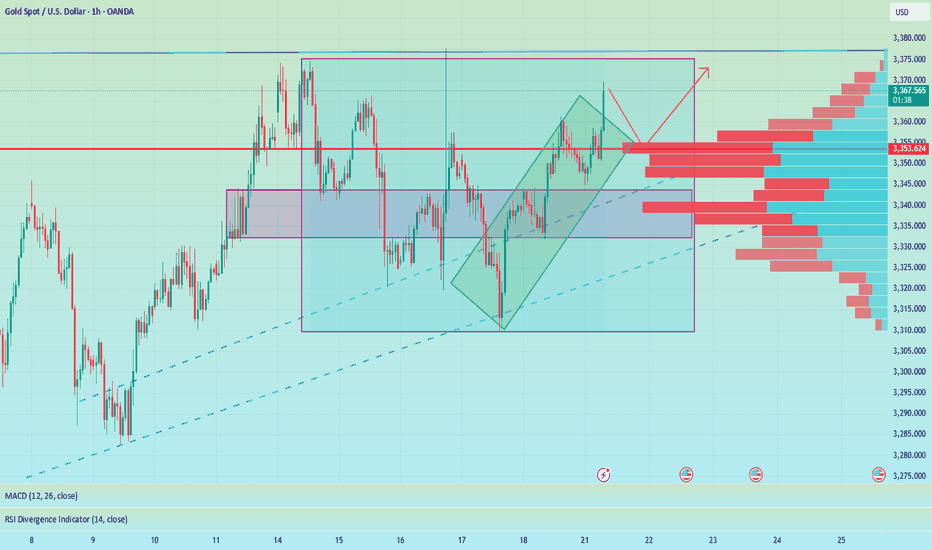

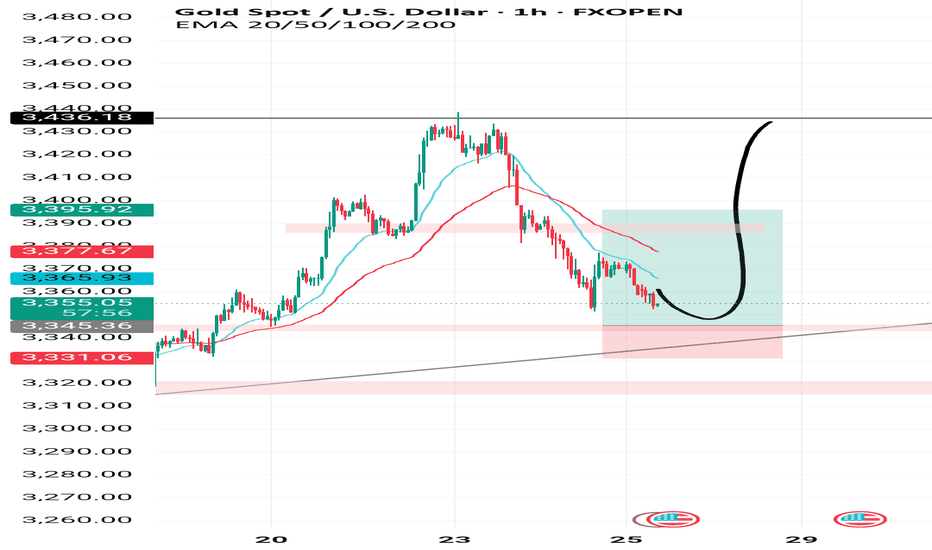

Gold on the magic level, pullback?Gold reached a key level i was waiting for more than a week. The area from 3325 till 3350 is the real support zone that could lead the price to pullback. In H1 and M15 timeframe i can see a reversal pattern, that let me join this trade with a small risk (due to the RR ratio). I will increase my size if NY will give us a better scalp opportunity

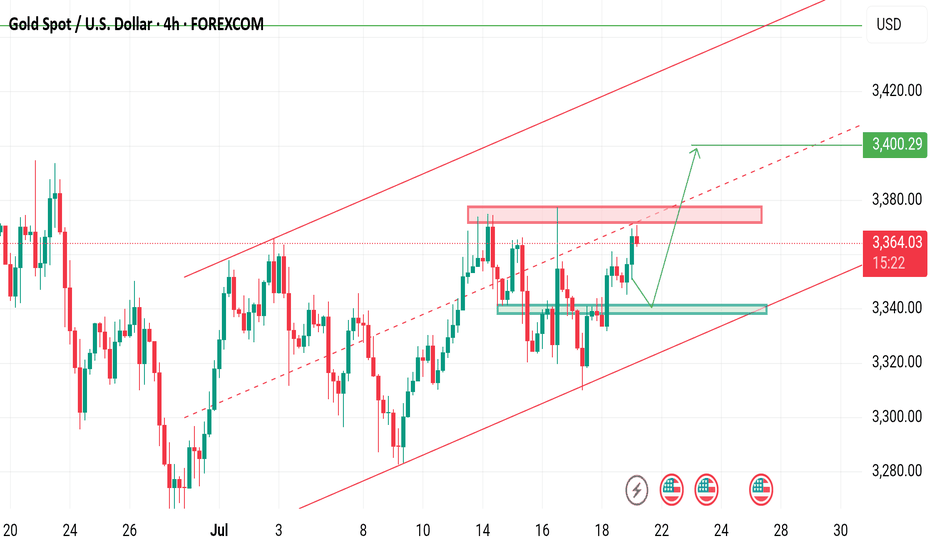

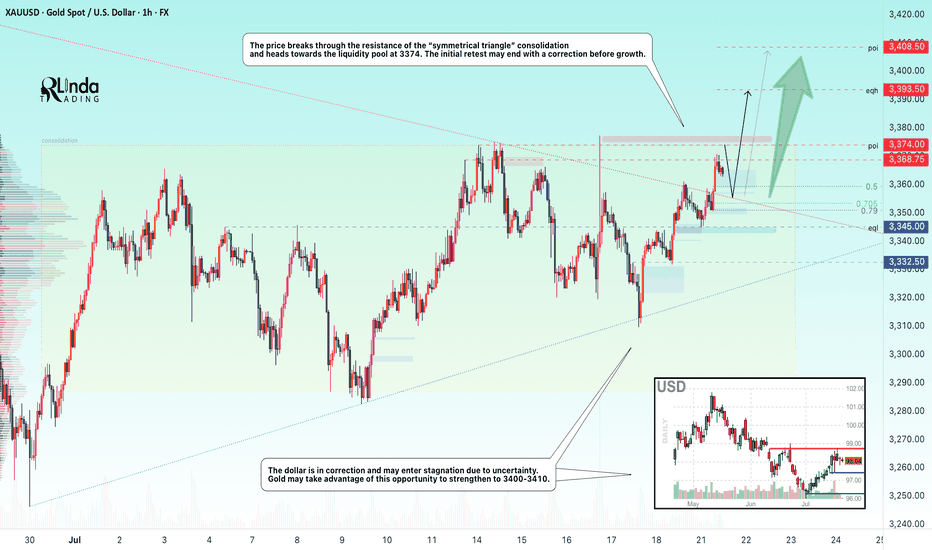

XAUUSD Technical Analysis – Triangle Breakout Ahead?Gold is currently consolidating in a symmetrical triangle pattern around $3,389. If it breaks above $3,402, we can expect a bullish continuation toward $3,420 and beyond. Key support lies at $3,367; a breakdown below this level would turn the trend bearish. The overall trend is still bullish, but a breakout is needed for confirmation.

📈 Potential Scenarios:

✅ Bullish Breakout Scenario:

- Break above $3,392–$3,402 zone.

- Targets: $3,420 > $3,450 > $3,480

- Supported by strong upward BOS (Break of Structure) and higher lows.

❌ Bearish Breakdown Scenario:

- Breakdown below $3,373–$3,367 zone.

- Targets: $3,355 > $3,345

- Would invalidate current bullish structure and form a lower low.

🔮 Trend Bias:

Bullish Bias remains intact as long as price stays above $3,367 and maintains higher lows. However, consolidation suggests waiting for breakout confirmation from the triangle before entering new trades.

🧭 Trend Outlook:

Gold is currently consolidating in a symmetrical triangle pattern, which typically precedes a breakout — either upward or downward. The price is holding above the key Fibonacci support levels and the overall market structure is bullish, suggesting an upward continuation is more likely if buyers maintain momentum.

Note

Please risk management in trading is a Key so use your money accordingly. If you like the idea then please like and boost. Thank you and Good Luck!

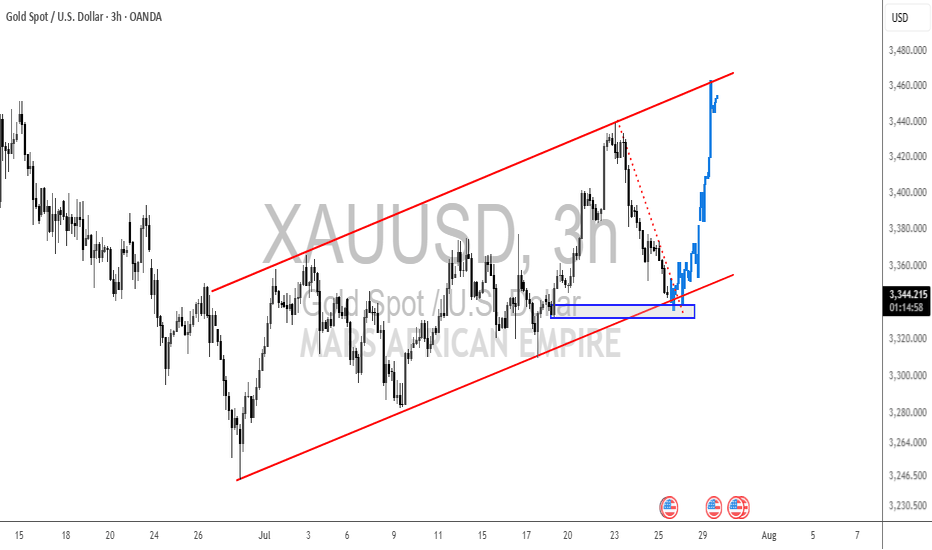

XAUUSD on swing Gold is currently holding rising channel along with the Range of 3340-3375

What's possible scanarios we have?

▪️I'm looking for Buying trade 1st we have 3342-3345 support area for potential buying spot.

Other then we have pending liquidity below 3340-3335 which I'm expecting the perfect buyying opportunity keep buy set targets at 3370 then 3400.

•Also we have buyying option If h4 closed above 3380 I will buy and target will be 3400.

▪️ keep in mind below 3330 we have sellers gap and our targets will 3305 then 3290

#XAUUSD

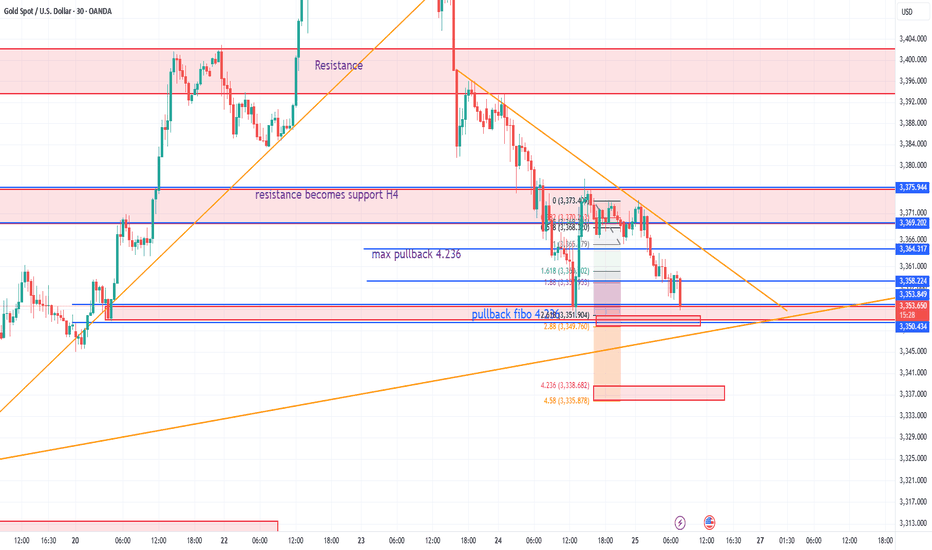

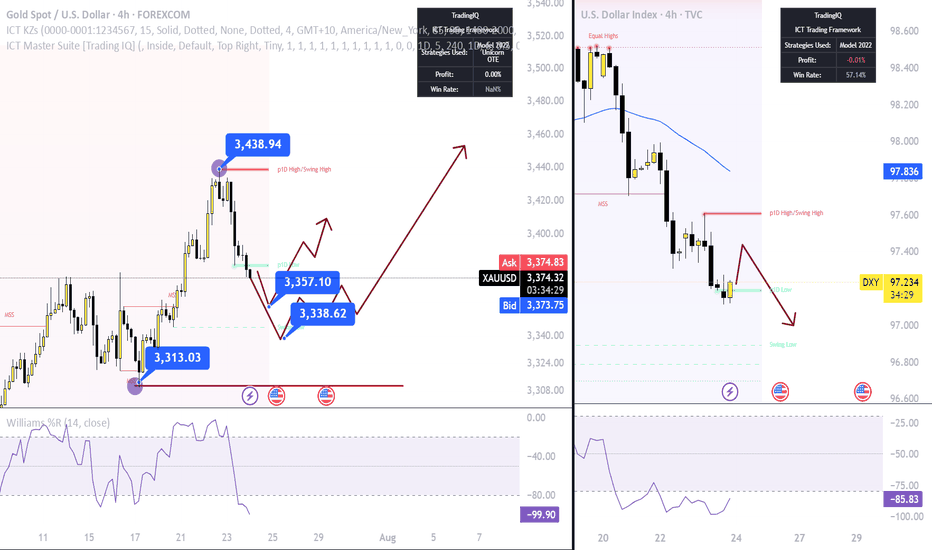

Gold is weak. Beware of lows.On Thursday, the dollar index ended a four-day losing streak thanks to the progress of the fund between the United States and its trading partners.

As signs of easing global trade tensions curbed demand for safe-haven assets, gold fell for the second consecutive trading day, and yesterday it hit the 3350 bottom support level.

From the 4-hour chart

although it rebounded to the 3370-3380 range after hitting 3350. But it can be found that the current rebound is actually weak, and it is still maintained at 3360-70 for rectification. At present, the bottom of the 4-hour bottom is absolutely supported at 3340-3335. The rebound high is around 3375. As of now, gold has not rebounded above 3375, and gold is actually in a weak position.

Secondly, from the hourly chart, the weakness is even more obvious. The high point on Thursday was around 3395. Today's current high point is around 3375. It can be seen that if the bottom falls below the 618 position 3350 again, it will directly touch around 3335. It coincides with the target position of 3340-3335 in the previous 4-hour chart.

Therefore, it is not possible to buy the bottom and go long today. Be alert to the possibility of further touching 3340-3335.

XAU/USD(20250725) Today's AnalysisMarket news:

The European Central Bank announced that it would maintain the three key interest rates unchanged, reiterated data dependence, warned that the external environment is highly uncertain, and President Lagarde did not rule out the possibility of future rate hikes. Traders reduced their bets on ECB rate cuts.

Technical analysis:

Today's buying and selling boundaries:

3370

Support and resistance levels

3412

3397

3386

3355

3344

3329

Trading strategy:

If the price breaks through 3370, consider buying in, with the first target price of 3386

If the price breaks through 3355, consider selling in, with the first target price of 3344

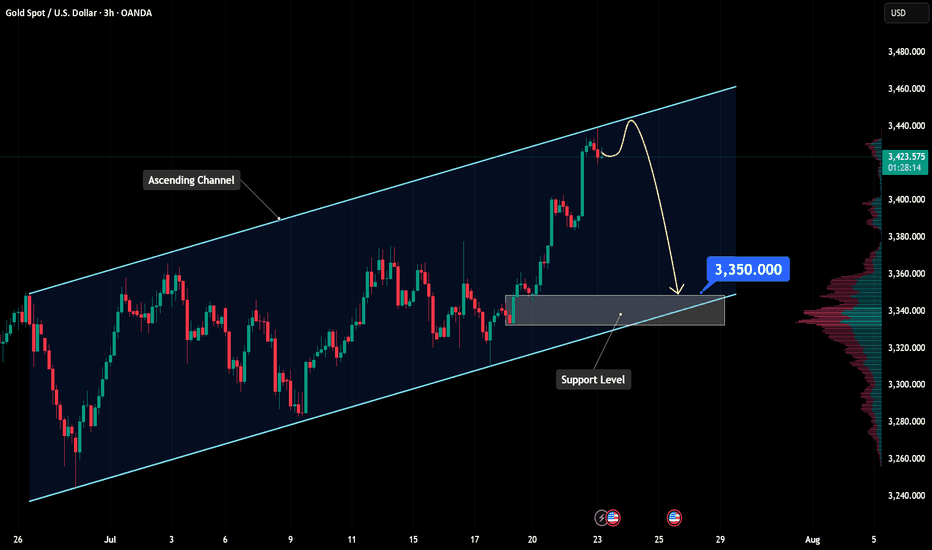

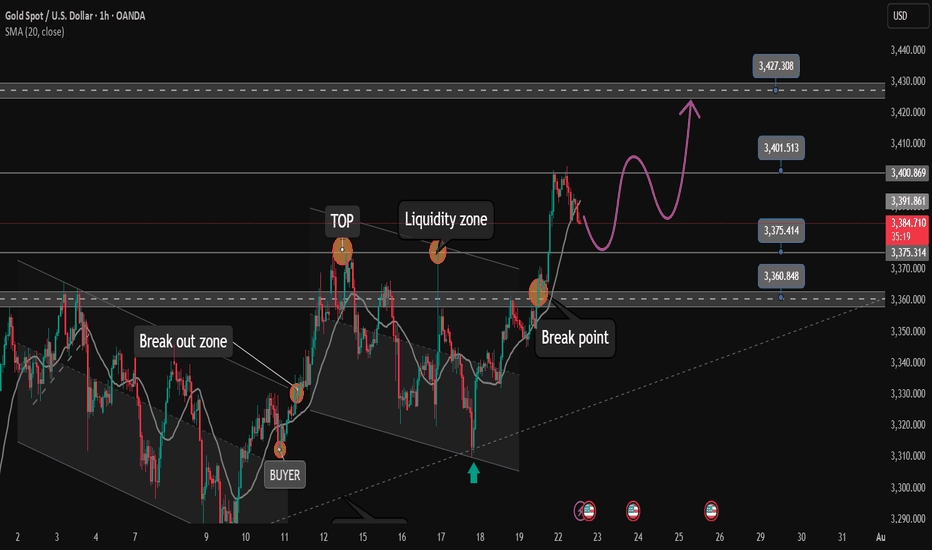

Gold technical outlook – Signs of exhaustion at channel topOANDA:XAUUSD is climbing within a well-defined ascending channel, and price is now brushing up against the upper boundary, a dynamic resistance zone that has historically triggered pullbacks. If price gets rejected here, we may see a healthy correction toward the key support at 3,350, offering a potential reload point for bulls.

Should buyers step in and defend this level, the bullish structure remains intact, setting the stage for a renewed push higher. On the other hand, a clean break below 3,350 could open the door for a deeper retracement toward the lower edge of the channel, where more significant demand may lie.

All eyes should be on price action and volume in this regio, watch for reversal patterns like bullish pin bars or engulfing candles to confirm entries. As always, risk management comes first. Don't trade assumptions, trade confirmations.

What’s your take on this setup? Drop your thoughts below and let’s discuss!

XAUUSD MULTI TIME FRAME ANALYSISHello traders , here is the full multi time frame analysis for this pair, let me know in the comment section below if you have any questions , the entry will be taken only if all rules of the strategies will be satisfied. wait for more price action to develop before taking any position. I suggest you keep this pair on your watchlist and see if the rules of your strategy are satisfied.

🧠💡 Share your unique analysis, thoughts, and ideas in the comments section below. I'm excited to hear your perspective on this pair .

💭🔍 Don't hesitate to comment if you have any questions or queries regarding this analysis.

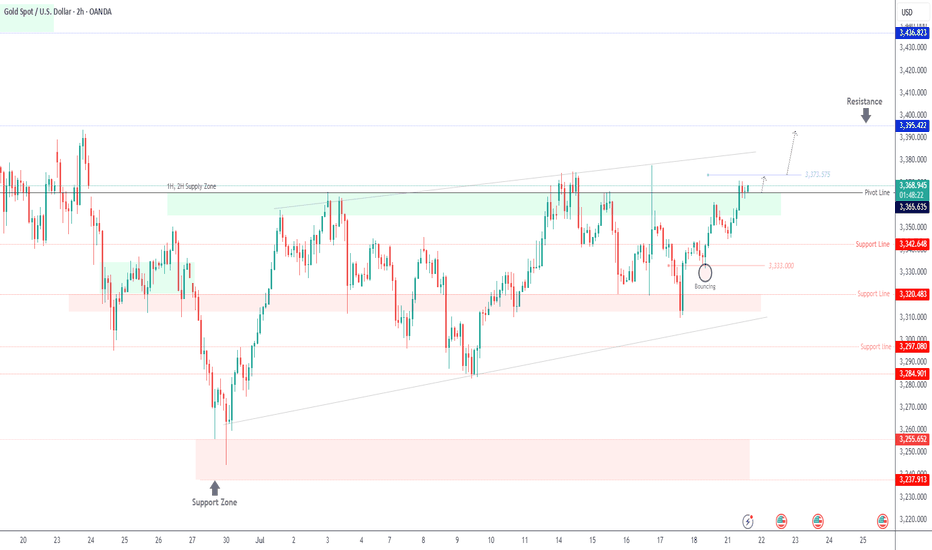

GOLD | Bullish Bias Amid Fed & Trade Policy UncertaintyGOLD | Bullish Bias Amid Fed & Trade Policy Uncertainty

Gold prices edge higher as markets weigh conflicting signals from the Federal Reserve and renewed trade policy uncertainty. Diverging opinions among Fed officials regarding the inflationary impact of President Trump's proposed tariffs have fueled demand for safe-haven assets.

While some members like Waller and Bowman appear open to rate cuts, others remain cautious about lingering inflation risks, adding to market volatility.

Technical Outlook:

Gold maintains bullish momentum above 3365. A break and hold above this pivot supports continuation toward 3375, and if momentum builds, toward 3385 and 3395.

However, any sustained move below 3365 may trigger a bearish correction toward the support zone between 3355 and 3342.

Pivot Line: 3365

Resistance Levels: 3375 · 3385 · 3395

Support Levels: 3355 · 3342

Bias: Bullish above 3365

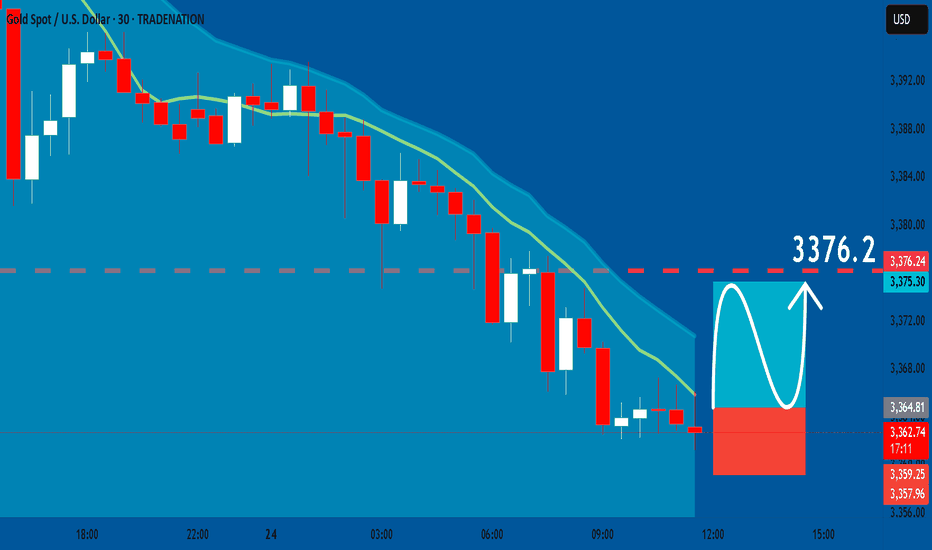

GOLD: Bullish Continuation & Long Signal

GOLD

- Classic bullish formation

- Our team expects growth

SUGGESTED TRADE:

Swing Trade

Buy GOLD

Entry Level - 3364.8

Sl - 3359.2

Tp - 3376.2

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

Gold at a Critical Reversal Zone – Waiting for Structural Break 📉 Gold Outlook – Corrective Dollar Strength & Potential Reversal Zones

🧭 Market Structure-Based Outlook with Multi-Timeframe Confluence

Gold is currently experiencing a controlled decline, primarily driven by a short-term corrective appreciation in the U.S. dollar.

This dollar strength is likely temporary and is expected to reverse toward the 3370–3354 zone — a technically significant area marked by previous liquidity sweeps and imbalance fills.

🔍 Technical Setup:

Bias (HTF): Bullish

Current Move (LTF): Corrective

Key Observation: No shift in long-term market structure on higher timeframes; price action remains within a bullish regime.

✅ Strategic Trade Plan:

We will not engage prematurely.

The optimal entry will only be considered upon a confirmed bullish market structure shift on the 15-minute timeframe — ideally a BOS (Break of Structure) followed by mitigation.

🛒 Entry Zone:

Around 3370 – 3354, contingent upon a clean bullish break in structure.

⛔ Invalidation Level (SL):

Below 3308 (structure invalidation + liquidity trap zone)

🎯 Profit Targets (Scaled):

TP1: 3400

TP2: 3430

TP3: 3500 – 3560

TP4 (Extended): 3600 – 3720

(Use partials & scale accordingly based on trade management plan)

🧠 Fundamental Confluence:

The macro picture remains supportive of higher gold prices.

Anticipated dovish shifts from the Federal Reserve, particularly in the form of rate cuts or forward guidance softening, may act as the macro catalyst for continuation toward new highs.

🛎 Conclusion:

While the current correction appears sharp, it lacks HTF structural reversal characteristics.

Patience and precision are essential — no entry should be considered without a 15m bullish break in structure.

After reaching FULL TP. Relax and wait for strong support zone✏️Continuing yesterday's bullish wave structure, Gold has reached the Target level of 3400. In the European session, there is a possibility of a correction to some important support zones. And the US session will continue to aim for a level higher than 3400. Today's strategy is still quite similar to yesterday's strategy when waiting for the areas where buyers confirm to enter the market to FOMO according to the main trend.

📉 Key Levels

Support: 3375 - 3363

Resistance: 3400-3427

Buy Trigger: Rejects the support zone 3375 and reacts to the upside

Buy Trigger: Rebound from 3363

BUY DCA: Break and trading above 3400

Target 3427

Leave your comments on the idea. I am happy to read your views.

GOLD → Breakthrough accumulation. Correction before growthFX:XAUUSD has been strengthening since the session opened and is heading towards the 3374 zone of interest. The price has previously broken through the consolidation resistance and may test this boundary before moving further.

Gold is rising amid trade risks and dollar weakness. After falling to $3310, gold resumed its growth, seeking to break through the $3368 level. Support for prices was provided by uncertainty surrounding Trump's tariff policy and expectations for Fed Chairman Powell's speech. The US dollar weakened temporarily as investors sought refuge in gold amid trade disputes with the EU, political instability in Japan, and criticism of the Fed from the White House.

Technically, the price is in a realization phase after breaking out of consolidation, but it has encountered resistance at 3368, which could lead to a correction. The focus is on the 3350-3355 zone. If the bulls hold their ground above this zone, the market may return to the realization phase.

Resistance levels: 3368, 3374

Support levels: 3345, 3332

The market is bullish and feels support, especially against the backdrop of a weak dollar. Traders are watching Trump and Powell. If the latter decides to cut rates, for example tomorrow at 12:30 GMT, gold could rally...

Technically, gold could test 3350 before rising.

Best regards, R. Linda!

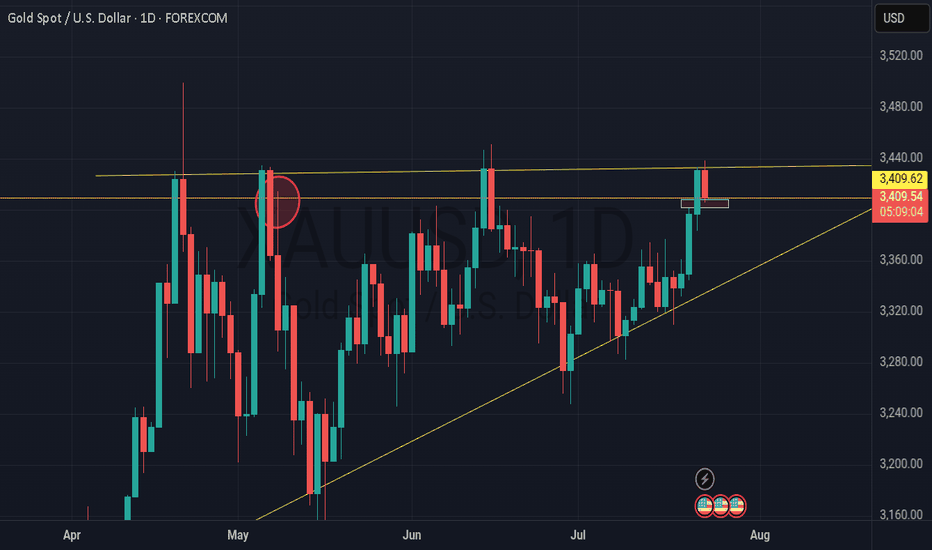

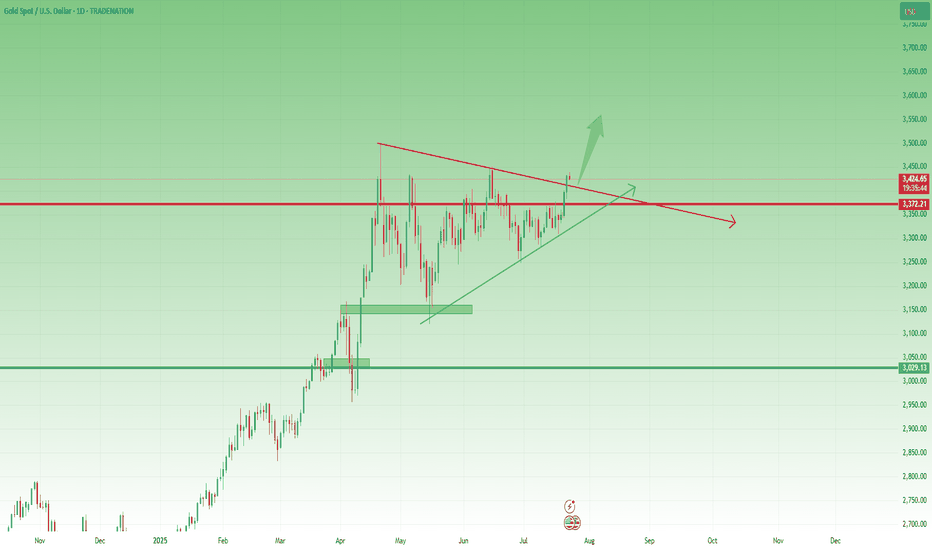

Gold Update – Strong Breaks, Strong BullsYesterday, after the break of the key 3370 resistance, Gold corrected slightly toward 3383, then consolidated briefly in that area. From there, it launched into a strong new leg up, closing the day once more near the highs, around 3430.

📌 What’s important here is that the price did not even come back to retest the broken resistance — now turned support. Combined with the strong daily close near the high of the range, this gives us a clear message:

➡️ Bulls are in full control.

________________________________________

🔍 This Week – Three Key Breaks

So far this week, Gold has delivered three major breakouts:

• ✅ A clean breakout from the box consolidation that kept price stuck and indecisive last week

• ✅ A decisive break above the 3400 psychological figure

• ✅ A breakout above the symmetrical triangle resistance, which had been forming since late April

Each of these is significant on its own. Together, they suggest a shift toward a more aggressive bullish scenario.

________________________________________

🔮 What’s Next?

All these breakouts point to the potential for more gains ahead.

In fact, the next logical step could be an attempt to mark a new All-Time High.

My view remains the same:

Buying dips remains the strategy of choice, with a focus on the 3400 zone as a key support area, and a swing target around 3500.

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

GOLD (XAU/USD) MA Breakout – High-Probability Long Setup!💰🚨 GOLD HEIST ALERT! XAU/USD MASTER PLAN (Thief Trading Style) 🎯

🔥 Steal Pips Like a Pro – High-Probability Gold Breakout Strategy! 🔥

🎯 Thief Trading’s GOLD Heist Strategy (Swing/Day Trade) �💸

👋 Hey there, Market Pirates & Profit Snatchers! 🌍✨

Based on our 🔥Thief Trading Style🔥 analysis, we’re plotting a major heist on XAU/USD (GOLD). The plan? Buy the breakout, escape before the cops (resistance) arrive! 🚔💨

📈 ENTRY ZONE: The Heist Begins!

🚀 "Wait for the MA Breakout (3400) – Then Strike!"

Bullish Confirmation: Enter on a 15M/30M pullback after MA breakout.

Thief’s Trick: Use Buy Stop above MA or Buy Limit near swing lows for best risk-reward.

DCA/Layering Strategy: Deploy multiple limit orders to maximize gains.

🔔 Set an ALERT! Don’t miss the breakout – thieves move fast! ⏳

🛑 STOP LOSS: Protect Your Loot!

📍 Thief’s SL Placement: 3330.00 (4H Swing Low) – Adjust based on your risk & lot size.

⚠️ WARNING: If using Buy Stop, DO NOT set SL until after breakout – unless you love unnecessary losses! 🔥

🎯 TARGET: Escape with the Gold!

🏴☠️ Take Profit Zone: 3460.00 (or Exit Early if Bears Show Up!)

Scalpers: Only trade LONG side – use trailing SL to lock in profits.

Swing Traders: Ride the wave but watch for resistance traps!

📰 MARKET CONTEXT: Why This Heist?

Neutral Trend (But Bullish Potential! 🐂)

Key Factors: Geopolitics, COT Data, Macro Trends, Sentiment Shift

🚨 News Alert: Avoid new trades during high-impact news – trailing SL saves profits!

💥 BOOST THIS HEIST! (Like & Share for More Pips!)

💖 Hit the 👍 Boost Button to strengthen our Thief Trading Crew!

🚀 More Heist Plans Coming Soon – Stay Tuned!

⚠️ DISCLAIMER (Stay Safe, Thieves!)

This is NOT financial advice. Do your own analysis & manage risk.

Markets change fast! Adapt or get caught.

🎯 Happy Trading, Pirates! Let’s Steal Some Gold! 🏴☠️💛