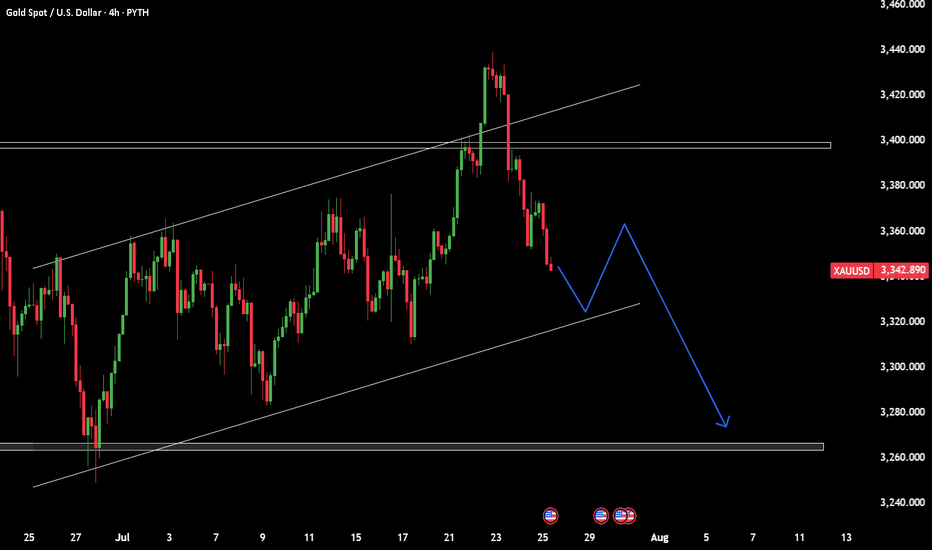

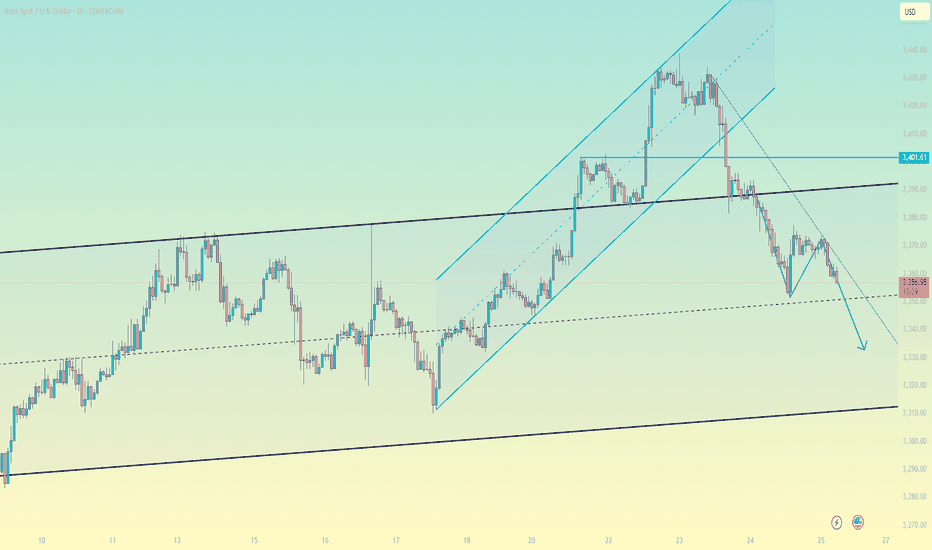

Daily Analysis- XAUUSD (Thursday, 24th July 2024)Bias: Bearish

USD News(Red Folder):

-Flash Manufacturing PMI

Notes:

- Strong bearish closure, tariffs ease

- Looking for retracement to the downside

- Potential SELL if there's

confirmation on lower timeframe

- Pivot point: 3430

Disclaimer:

This analysis is from a personal point of view, always conduct on your own research before making any trading decisions as the analysis do not guarantee complete accuracy.

XAUUSDK trade ideas

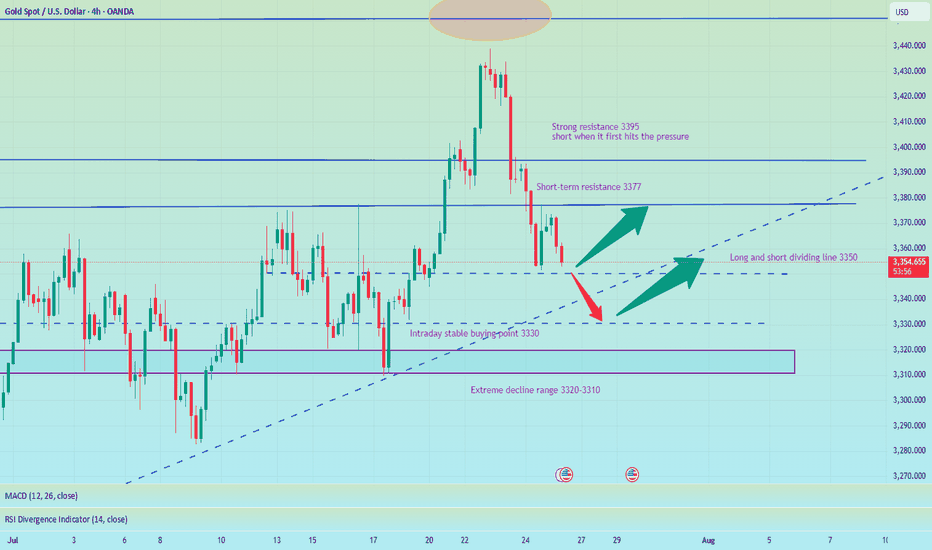

Be alert to new lows, pay attention to 3350 and go long at 3330📰 News information:

1. Tariff issues

2. Next week's NFP data

📈 Technical Analysis:

Last night, gold rebounded to only around 3377 before starting to fall back. Our judgment that the current rebound is weak is completely correct. 3350 is the support point of the bottoming out and rebounding to nearly $20 last night. Whether the European session can go down to 3350 will determine the trend of gold.

From the daily chart, the daily line has fallen for two consecutive days, suggesting that the price may continue to fall today. At present, we need to pay attention to this week's starting point of 3344-3345, and then the 3330 line below. The extreme decline is 3320-3310. At the same time, the narrowing of the daily Bollinger Bands is also paving the way for next week's NFP data.

From the 4H chart, the current MACD indicator crosses and increases in volume, and the middle track of the Bollinger Bands and SMA30 basically overlap near 3388. As for the hourly chart, the upper pressure is mainly concentrated near 3375-3377, which is also the high point of the rebound last night. If gold rebounds directly upward and encounters pressure and resistance at 3375-3385 for the first time, you can consider shorting and strictly implement stop loss.

Overall, if the current market falls to 3350-3345 for the first time and gets effective support, you can consider going long with a light position, defend 3340, and look to 3356-3362; if the decline is strong and continues to fall below 3350, the best stable long point for the day is 3330-3320, defend 3310, and earn $10-20 to leave the market.

🎯 Trading Points:

BUY 3350-3345

TP 3356-3362

BUY 3330-3320

TP 3345-3360

In addition to investment, life also includes poetry, distant places, and Allen. Facing the market is actually facing yourself, correcting your shortcomings, facing your mistakes, and exercising strict self-discipline. I share free trading strategies and analysis ideas every day for reference by brothers. I hope my analysis can help you.

TVC:GOLD PEPPERSTONE:XAUUSD FOREXCOM:XAUUSD FX:XAUUSD OANDA:XAUUSD FXOPEN:XAUUSD

Will gold continue to fall on July 25?

1. Brief analysis of gold fundamentals

The current gold price is fluctuating downward, and the core driving factors are:

Risk aversion has cooled down:

The United States and Japan reached an agreement on automobile tariffs and promoted an agreement with the European Union, easing previous global trade tensions;

The overall risk appetite of the market has increased, and safe-haven funds have withdrawn from gold.

The US dollar rebounded in stages:

The US dollar index rebounded after the previous decline, which partially offset the safe-haven appeal of gold;

Although there are expectations of interest rate cuts within the Federal Reserve, there are large differences, and the overall trend is still "wait-and-see", which has increased the volatility of the US dollar trend.

2. Technical analysis of gold

Trend characteristics:

Gold has fallen from the high of 3438 and has been under pressure for two consecutive days;

It is currently testing the 0.618 retracement support (about 3360) of the 3310-3438 increase;

The European session continued to fall. If there is a rebound before the US session, there may be a risk of "false breakthrough and real decline";

If the US session still does not rise in the early session, it is necessary to pay attention to the possible V-shaped reversal in the future.

Technical indicators:

The short-term MACD bottom divergence gradually emerges, and the probability of oversold rebound correction increases;

Important support: 3350-3340 range (once lost, it may test the lower track of the 3337 daily triangle);

Key pressure: 3393-3403 range (initial rebound resistance), stronger resistance is around 3416-3418.

III. Short-term operation strategy suggestions

✅ Main idea: shorting on rebound is the main, and long on callback is the auxiliary

Short order layout reference:

If the 3393-3403 area encounters resistance, you can try to short with a light position;

Stop loss is set above 3410, and the target is 3360-3350;

If the market breaks through 3403 strongly and stabilizes, the short order strategy needs to be suspended.

Long position layout reference:

If it drops to 3350-3340 and stabilizes, you can try short-term long with a light position;

Stop loss is set below 3335, and the target is 3375-3385;

If the market quickly breaks below 3337, wait for the lower support to stabilize before intervening.

IV. Trend warning points

If the price does not rebound significantly before the early US market, it is necessary to guard against a sudden V-shaped pull after the US market;

If it directly falls below 3340, the space below opens, it is recommended to stop loss in time and wait for new support points.

✅ Conclusion:

In the short term, gold is still in the downward correction stage, but as the technical oversold signs appear, short-term sharp pull rebound should be guarded against. It is recommended to respond flexibly in operation, pay attention to the response of key support and resistance levels, and avoid chasing up and selling down.

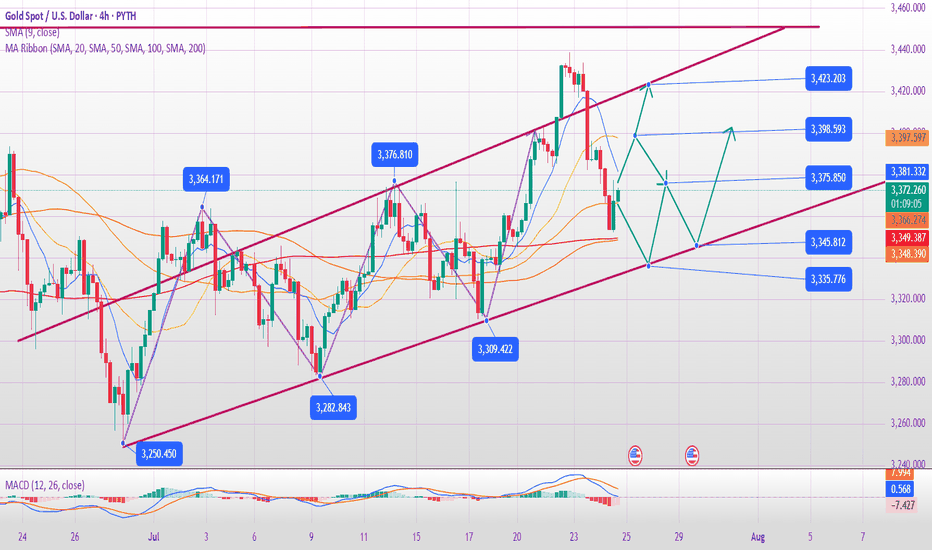

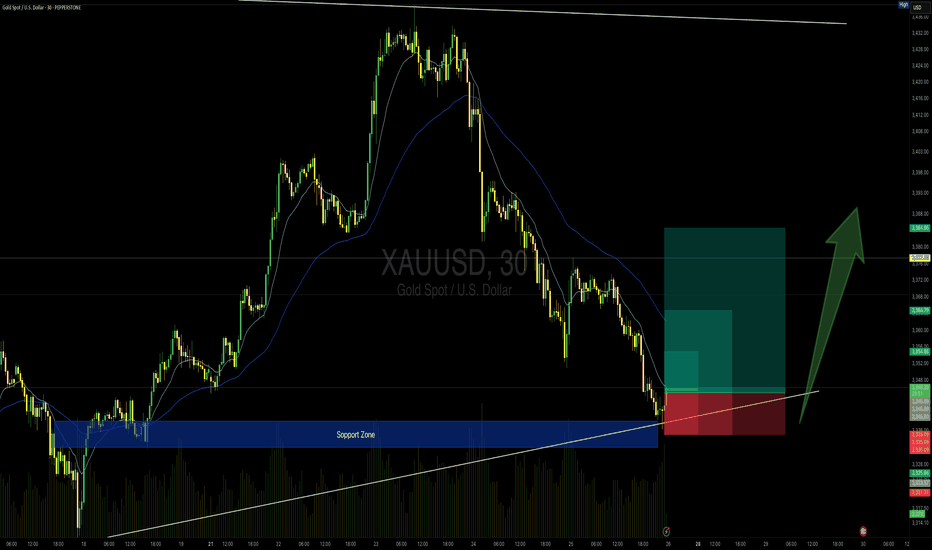

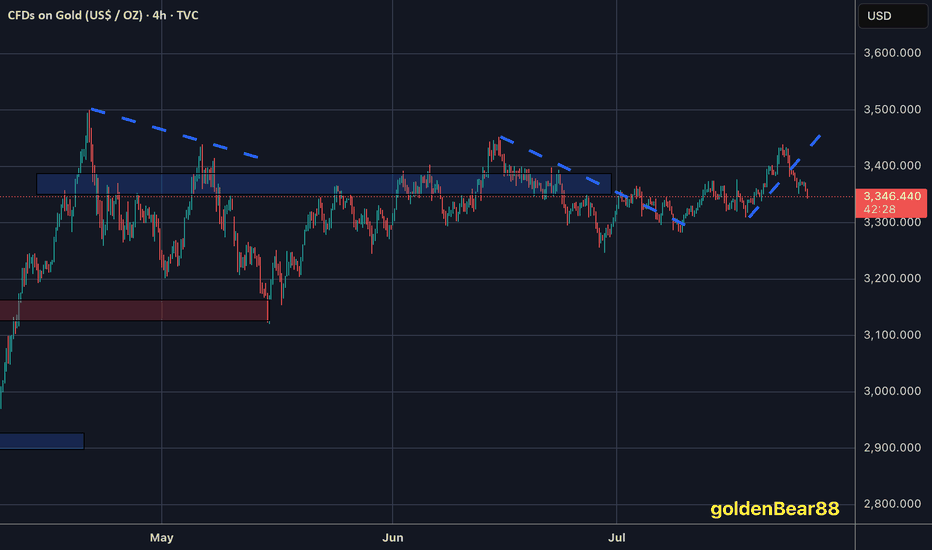

XAUUSD continuation of larger bullish move - 25/7/25Gold did touch the higher timeframe supply zone and pull back. It is now at a point where i am looking for a pivot to form to continue bullish.

I did place a buy limit trade at the extreme zone that started the break of structures.

i will wait a see if it drops and triggers or forms a pivot at the 4H zone that broke structure.

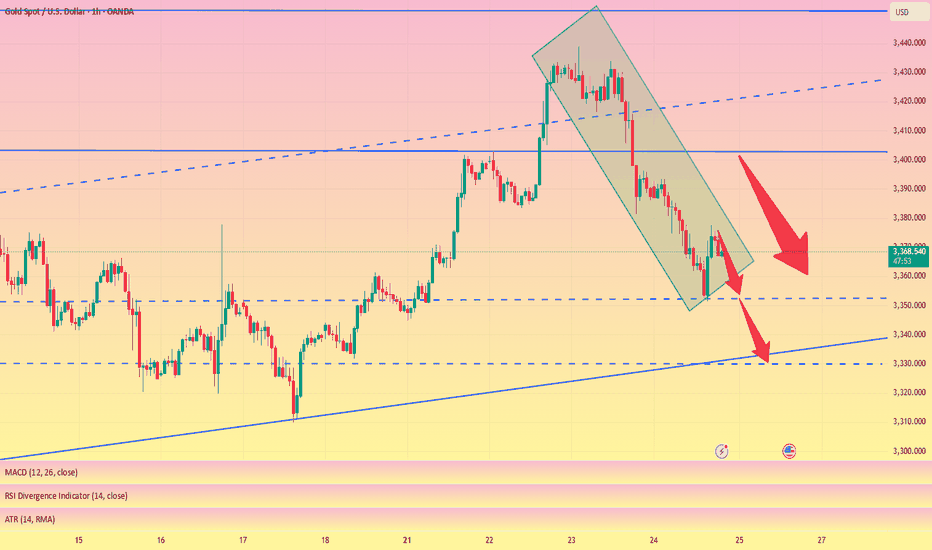

Gold approaches wedge resistance -Breakout or Fakeout incoming?Gold is trading within a rising wedge pattern, showing consistent higher lows and repeated rejections near the 3400 resistance zone.

Price is now approaching the upper trendline, an area of prior wick rejections and potential liquidity grab.

A confirmed breakout could signal continuation, while failure to sustain above this level may indicate bearish divergence or a reversal setup.👀📉

NordKern - XAUUSD InsightNordKern | Simplified Insight OANDA:XAUUSD possible scenarios

Gold saw some upside today, primarily driven by softer TVC:DXY and trade deadlines ahead. To be specific:

1. Softer U.S. Dollar (DXY)

The U.S. Dollar Index fell ~0.1–0.2% today, making gold more attractive for international buyers

Kitco confirms the decline in USDX, paired with weaker Treasury yields, is fueling bullion demand.

2. Cautious Market Ahead of Trade Deadlines

Markets are bracing for the August 1 U.S. tariff deadline, especially involving the EU. Investors are positioning defensively, increasing safe-haven interest in gold.

Heightened trade tensions and uncertainty including possible Trump-Xi talks boost demand for safe assets.

3. Falling Treasury Yields & Fed Policy Expectations

The U.S. 10‑year Treasury yield has slipped (~4.37%), reducing gold’s opportunity cost and supporting its attractiveness.

Market pricing shows increasing odds of a Fed rate cut at next week’s FOMC meeting, something analysts like Christopher Waller suggested.

4. Geopolitical & Trade Risk Premiums

Escalating trade risk (tariffs looming) and geopolitical uncertainty are prompting safe-haven inflows into gold.

India’s MCX mirror those sentiments: gold rose ~0.5% on local contracts amid global trade nerviness.

To sum it up:

Gold is rallying today primarily because of the softer dollar, lower yields, and elevated trade risks ahead of the August 1 tariff deadline all of which reinforce its safe-haven allure.

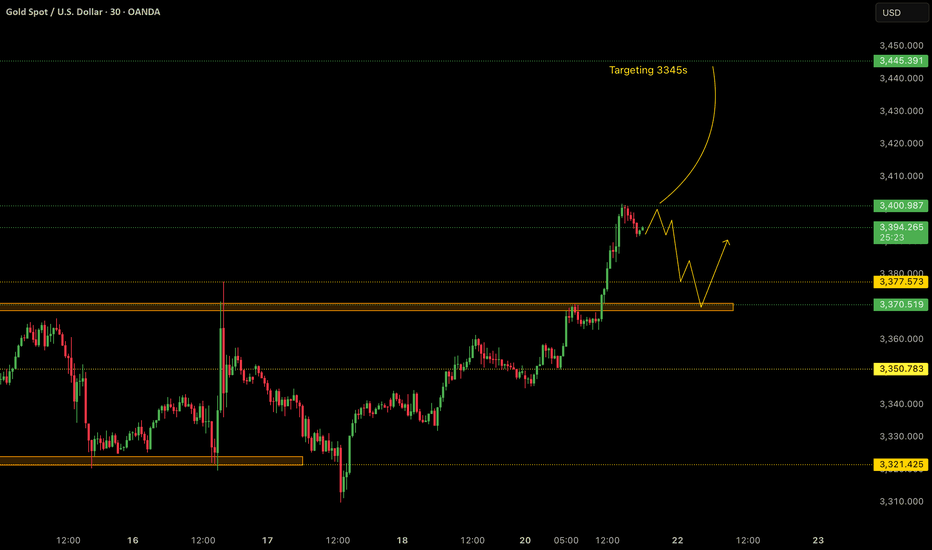

Trade Setup - Shorts; if we retest 3370s

- We would primarily look to enter into lower risk buys on gold at more preferable levels such as 3370. After breaking to the upside from the consolidation area, a pullback and a retest to that area would not be out of the ordinary.

Trade Setup - Buys; if we break above 3400

- In case of the dollar remaining soft, we can expect gold to continue its upside rally without any major pullbacks. In this case, we would be looking for the breaks of 3400 and continue to hold until around 3345s.

Key Notes:

- Softer Dollar

- Possible retest of 3370s

- Watch for potential breaks of 3400

This remains a tactically driven setup. Manage risk appropriately and stay alert for any renewed political developments.

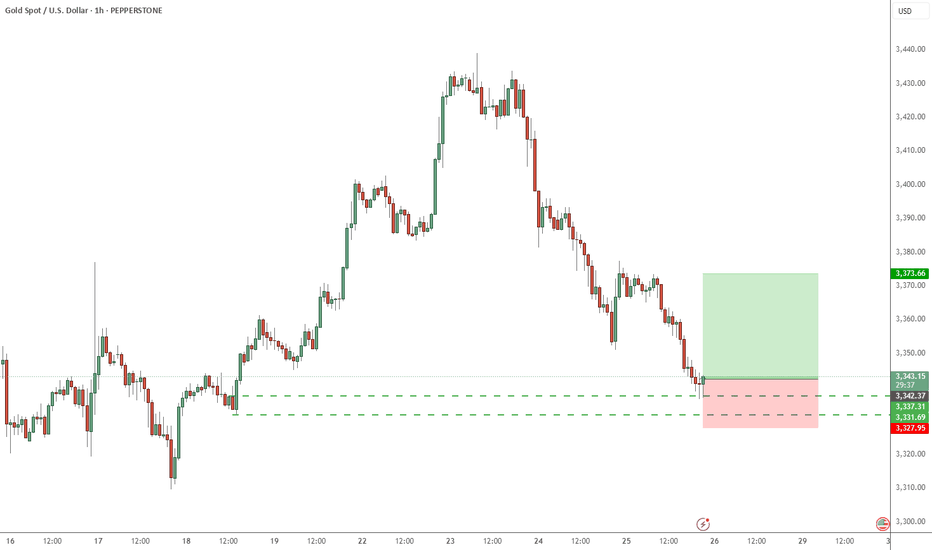

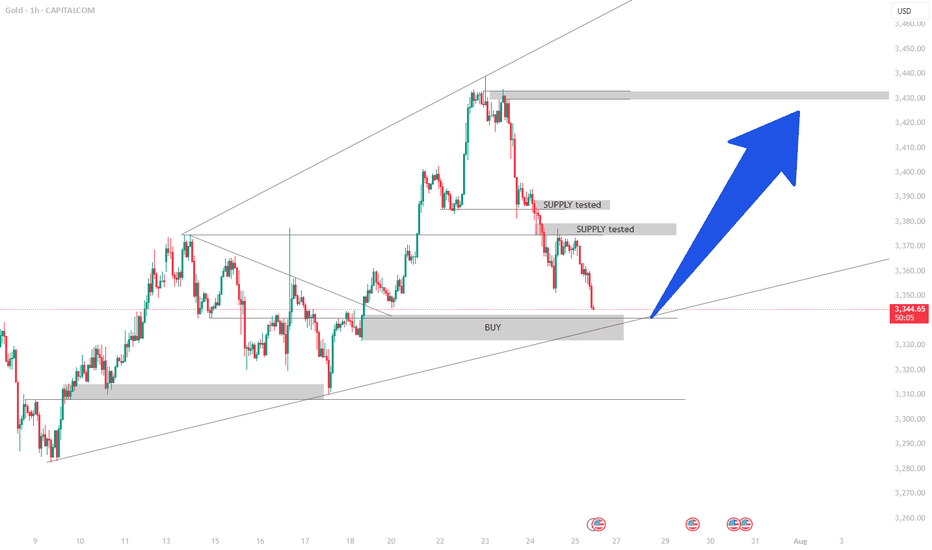

GOLD 30min Buy Setup (High Risk - High Reward)📍 TVC:GOLD 30min Buy Setup – MJTrading View

After an extended bearish leg, price has tapped into a strong support zone that previously acted as a launchpad. Also touching the main Uptrend...

We now see initial signs of absorption with potential reversal setup forming just above the ascending trendline.

🔹 Entry Zone: 3344–3346

🔹 SL: Below 3335 (under structure & wick base)

🔹 TP1: 3355

🔹 TP2: 3365

🔹 TP4: 3385+ (if momentum sustains)

🔸 RR: Up to 1:4 depending on target selected

🧠 Context:

– Still inside broader bullish structure (macro HL)

– Support zone coincides with rising trendline

– Potential for bullish reaccumulation after sharp drop

– Volume spike near zone suggests active buyers

Stay sharp and manage your risk please...

See the below Idea for full concept:

"Support isn't just a level — it’s a battlefield. If buyers win, they don’t look back."

#MJTrading #Gold #BuySetup #PriceAction #SmartMoney #ChartDesigner #ReversalSetup #MarketStructure

Psychology Always Matters:

Chart Analysis Gold (XAU/USD)Chart Analysis Gold (XAU/USD)

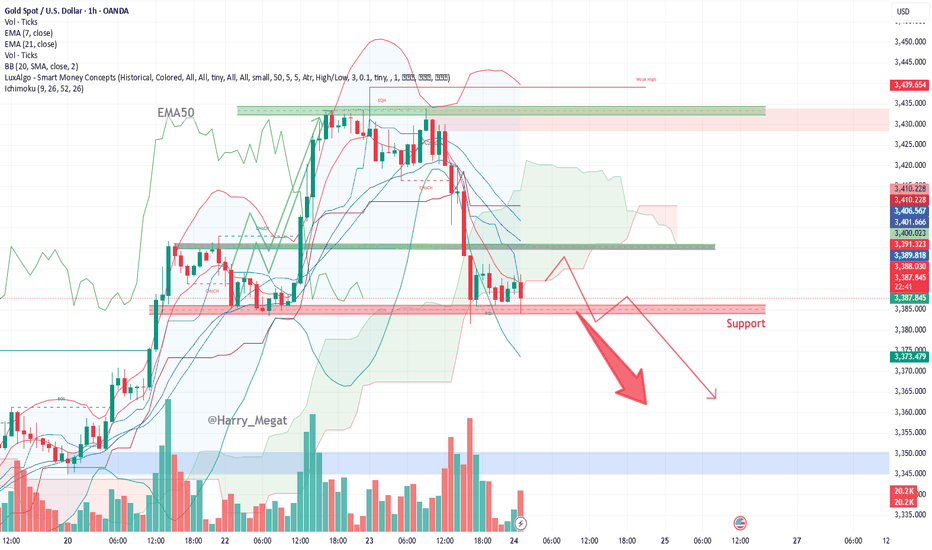

**Bearish Outlook (Short-Term)**

* **Price is below EMA 7 and EMA 21**, showing short-term bearish momentum.

* Strong **resistance zone** around **\$3,430–\$3,440** was rejected sharply.

* Price has broken below **\$3,405–\$3,395** support and is now **consolidating above \$3,385–\$3,380**, a critical support area.

* Volume is rising on red candles, supporting **selling pressure**.

**Key Support Zone:**

\$3,380 – If broken, next downside targets:

→ **\$3,370**

→ **\$3,360**

*Bullish Scenario (If Support Holds)**

* If **\$3,380** holds and price reclaims above **\$3,395**, a **bounce toward \$3,405–\$3,410** is possible.

* Look for a **break above EMA21 (currently near \$3,402)** for bullish confirmation.

#3,377.80 Resistance remains strongMy position: I have Bought Gold many times above #3,400.80 benchmark however as it got invalidated, I Bought #3,390.80 again late U.S. session and closed my set of Buying orders on #3,395.80 nearby extension. I left one runner (#3,390.80 entry point) with Stop on breakeven expecting Asian session to recover #3,400.80 benchmark, however it was closed on break-even as Gold extended Selling sequence. I will continue Selling every High's on Gold and if #3,357.80 gives away, expect #3,352.80 and #3,342.80 contact points to be met.

As expected Gold delivered excellent #3,372.80 and especially #3,365.80 - #3,352.80 Selling opportunities throughout yesterday's session which I utilized to it's maximum. I have also Bought Gold on late U.S. session with #3,372.80 as an entry point / however since Gold was ranging, I closed my order on break-even and met Gold below #3,352.80 benchmark this morning personally on my surprise (I did expected #3,377.80 to be invalidated to the upside).

Technical analysis: Gold’s Price-action is performing well below both the Hourly 4 chart’s and Daily chart’s Resistance zones for the cycle. Selling direction of today’s session is directly correlated with Fundamentals leaving the scene which found Sellers near the Intra-day #3,377.80 Resistance and most likely DX will close the Trading week in green, however struggling to make Bullish comeback and if #3,327.80 - #3,342.80 reverses the Selling motion, Gold’s Daily chart’s healthy Technicals which preserved core uptrend values. If the Price-action gets rejected at #3,352.80 - #3,357.80 Resistance zone, then further decline (under conditions where I will have more information with U.S.’s session candle) is possible and cannot be ruled out. Notice that at the same time and manner, Bond Yields are on consecutive Selling spree as well which Fundamentally has a diagonal correlation with Gold. The slightest uptrend continuation there, should add enormous Selling pressure on Gold.

My position: I am Highly satisfied with recent results and will take early weekend break (no need to Trade more). If however you decide to Trade today, Sell every High's on Gold / no Buying until Monday's session (my practical suggestion).

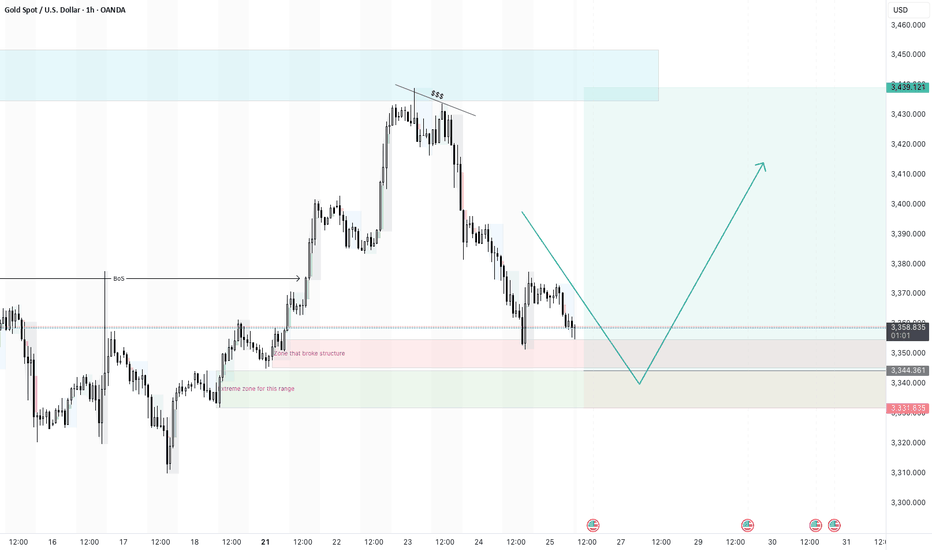

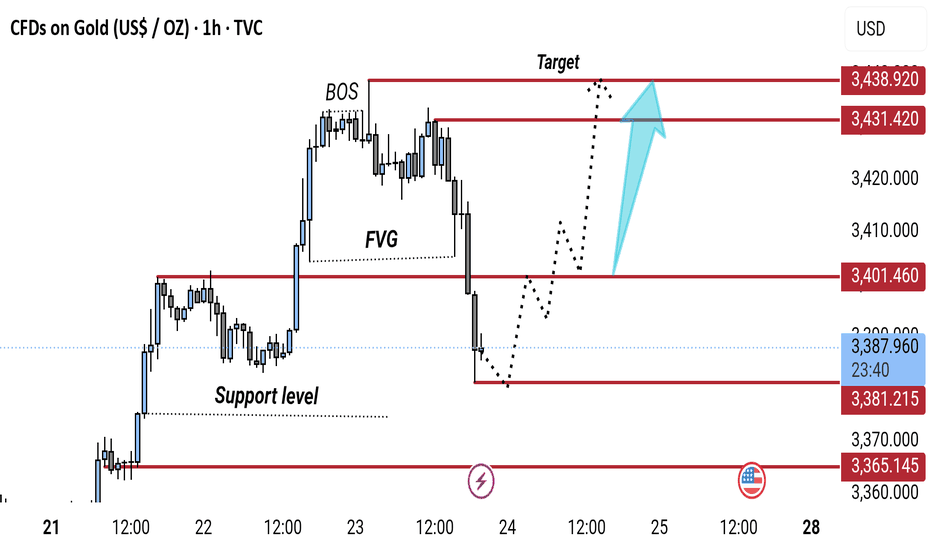

"Gold Price Reversal Setup: Targeting Bullish Recovery After BOSThis 1-hour gold (XAU/USD) chart shows a potential bullish setup. After a Break of Structure (BOS) and a drop into a support level, price may rebound through the Fair Value Gap (FVG) toward the target zone around 3,431.42–3,436.92. The dotted line outlines a projected bullish move.

The callback continuity is poor, and the bulls are still strong📰 News information:

1. Geopolitical situation

2. Tariff retaliation

📈 Technical Analysis:

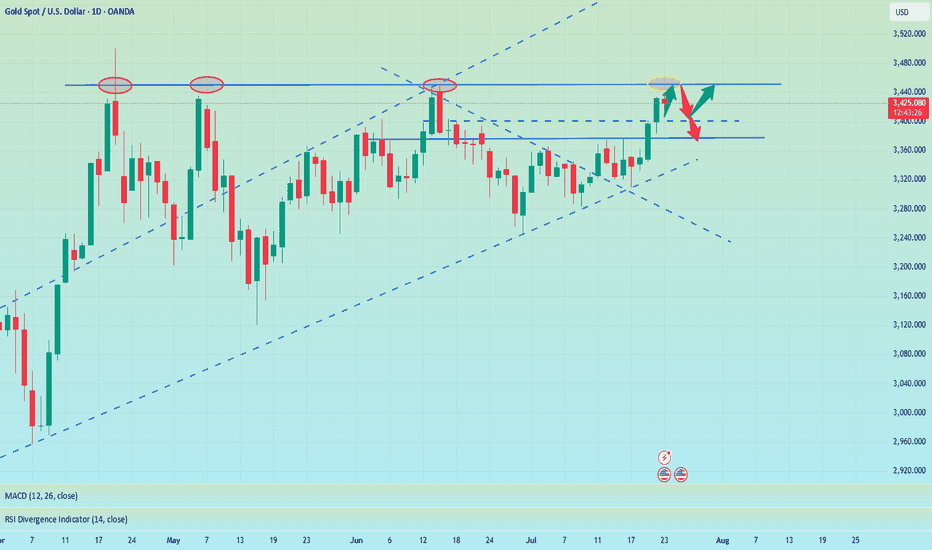

Trump continued to lash out at the Fed, but seemed to have backed off on whether to remove Fed Chairman Powell. The continuous rise of the gold index, once close to 3440, also ushered in a new high in more than a month. Next, we need to pay attention to whether gold can reach the 3450 mark.

Judging from the daily chart, there were three times when it touched around 3450 and then fell back. If it breaks through and stabilizes above 3450 this time, the historical high of 3500 may be refreshed. If it cannot effectively break through 3450, the probability of subsequent retracement is still very high.

From the hourly chart, the bottom support is almost at 3405-3400. However, the recent rhythm belongs to the consolidation of the Asian and European sessions, the US session has begun to rise, and the risk of serious overbought data indicators is still there. This is why I told everyone in the morning that we need to be vigilant about the current rise. Waiting for a pullback to go long is relatively more stable. I also explained in the morning that if it falls below 3405-3400, the decline may continue to around 3385. After all, the fundamental purpose of our trading is to make a profit, so we must minimize the foreseeable risks to the greatest extent possible.

On the whole, if there is an obvious stop-loss signal at 3405-3400, you can consider going long and looking at 3450. Once it falls below 3400, don't chase it easily, and pay attention to the possibility of a retracement below 3385.

🎯 Trading Points:

BUY 3405-3400

TP 3440-3450

In addition to investment, life also includes poetry, distant places, and Allen. Facing the market is actually facing yourself, correcting your shortcomings, facing your mistakes, and exercising strict self-discipline. I share free trading strategies and analysis ideas every day for reference by brothers. I hope my analysis can help you.

FXOPEN:XAUUSD OANDA:XAUUSD FX:XAUUSD FOREXCOM:XAUUSD PEPPERSTONE:XAUUSD TVC:GOLD

Gold dips on profit-taking, long-term outlook still bullishGold prices continued to decline this morning as investors locked in profits following the precious metal’s recent rally above $3,400.

In the short term, further downside is possible if profit-taking persists and capital flows shift toward equities, especially as U.S. stock markets hover near record highs. However, gold remains a favored safe-haven asset for the long run amid ongoing global economic and geopolitical uncertainties.

Markets are also turning their focus to the upcoming Federal Reserve policy meeting on July 29–30. While the Fed is expected to hold interest rates steady this time, many investors still anticipate a potential rate cut in September. A low interest rate environment typically supports non-yielding assets like gold.

Trend corrected, long funds reduced, sellers returned#XAUUSD

The current moving average is still spreading downward, and the 4-hour chart closed with a large negative line. The market has not yet given a clear feedback on the current trend. However, after a large amount of buying funds intervened, the gold price hit a high of around 3377 and then stagnated. The short-term bullish momentum has weakened, and there is a certain risk of a correction and decline. Sellers are beginning to return📉.

Currently, you can consider participating in short selling at 3370-3377💡. If it rebounds directly to 3400-3405, you can still short if it does not break🔍. The target is 3360 below, and 3350 or even 3330 if it breaks🎯.

🚀 SELL 3370-3377

🚀 TP 3360-3350

Gold Takes Flight, But Will Support Hold? Watch This Zone!Gold has broken its key resistance level in the New York session and, at the same time, has taken support from the trend line, which is pushing it upward. Currently, however, gold has also broken through another minor support level, and we can now observe that it is pulling back and moving downward.

It is advisable to remain patient at this stage. Wait for the market to come down to the zone where the previous resistance has now turned into support. If the price reacts positively at that level and shows signs of holding, we could potentially see a good buying opportunity from there.

As always, please conduct your own research (DYOR) before making any trading decisions. This is not financial advice.

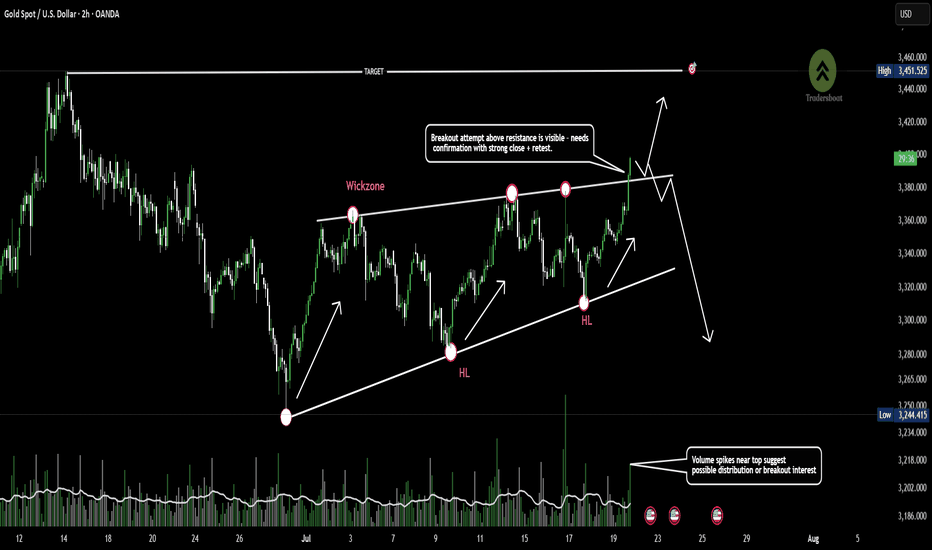

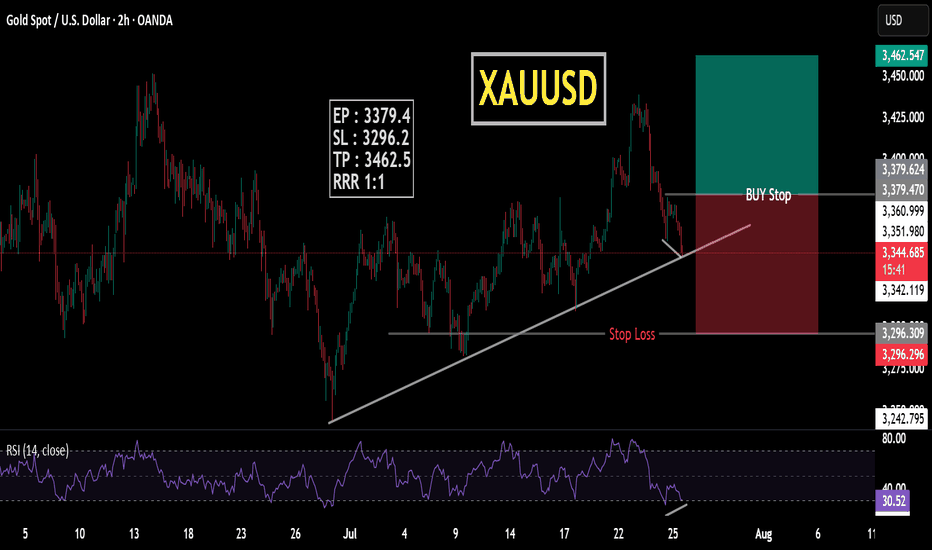

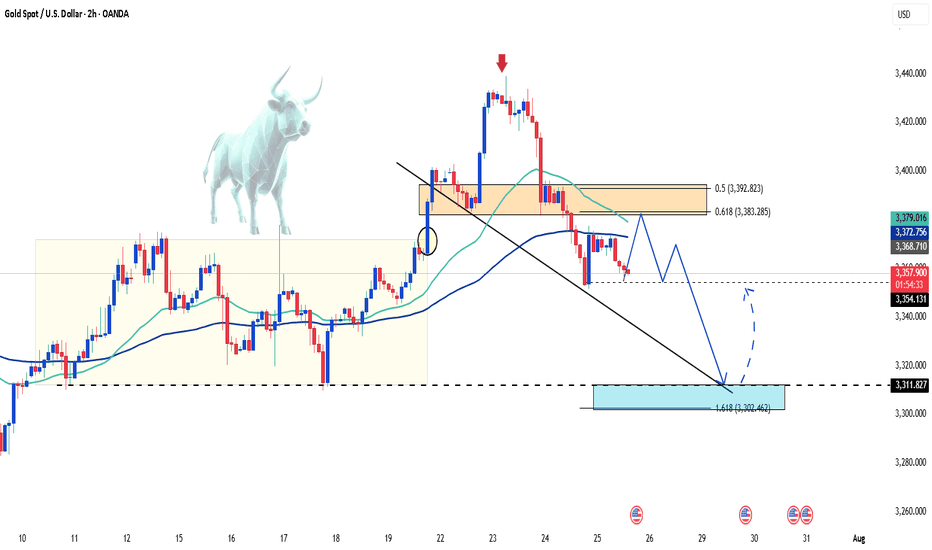

Today's GOLD Analysis (MMC) – Sell Bias Continues To Next TargetChart Overview:

This 2-hour GOLD (XAU/USD) chart showcases a clear bearish structure in line with the Mirror Market Concepts (MMC) methodology. Price action is respecting key supply zones and continues to reject significant levels, confirming the dominance of sellers in the short-term structure.

🔍 Key Technical Elements:

1️⃣ Break of Trendline (MMC QFL Entry Model)

The descending grey trendline marks consistent lower highs, showing clear bearish pressure. The breakout and rejections around this trendline zone (annotated “1”) confirm it as a strong supply area. This breakdown set the stage for a QFL (Quick Flip Liquidity) drop.

🧊 2x Supply Zone (High Confidence Rejection)

The 2x supply label highlights an area where price rapidly reversed with aggressive bearish momentum. This zone was tested and respected again, leading to further downside pressure, reinforcing the idea of institutional selling interest from that level.

📉 QFL Levels & Central Zone

Two major QFL drops are evident, where price broke previous demand structures and created new supply imbalance. The Central Zone currently acts as short-term support, but price is hovering just above it with weak bullish reaction, indicating potential for further breakdown.

🎯 Target & Reversal Zone – 3,331.90

The green zone below marks the Next Reversal Zone, with a highlighted price target at 3,331.90. This is where:

Previous liquidity was absorbed.

Demand imbalance may attract buyers again.

MMC reversal structures might be anticipated.

This zone aligns perfectly with the broader MMC concept of flipping between major zones and reversal blocks.

🧠 Trade Idea & Strategy (MMC Traders’ Minds)

Current Bias: Bearish

Entry Trigger: After rejection from trendline & 2x supply area.

Stop-Loss Suggestion: Above the trendline or recent supply wick (~3,375-3,380).

Take-Profit Zone: Primary TP at 3,331.90, with eyes on lower reversal targets if momentum persists.

Market Behavior: Controlled by sellers, liquidity sweeps seen, weak demand below Central Zone.

📌 Key Events to Watch

As marked at the bottom, major US news events are scheduled between July 30th and 31st, which could act as catalysts for price acceleration toward the reversal zone or cause sharp volatility. Plan accordingly.

🧭 Conclusion:

Gold is respecting bearish market structure under the MMC model. With clear QFL breakouts, rejection from 2x Supply, and weak bullish attempts near the Central Zone, this chart favors short setups targeting the 3,331.90 zone. MMC traders should monitor price action closely within the Reversal Zone for potential buy signals or trend continuation if sellers remain aggressive.

Gold is under pressure, shorts aim at 3310Gold is under pressure, shorts aim at 3310

Gold technical analysis and trading strategy: key support faces test, weak rebound, beware of breakout risk

Fundamental driving factors

The stabilization of the US dollar index suppresses gold prices: recent US economic data (such as retail sales, initial jobless claims) show resilience, the market's expectations for the Fed's rate cuts have been postponed, and US Treasury yields have rebounded, weakening the attractiveness of interest-free assets such as gold.

Risk aversion cools down: The situation in the Middle East has not escalated yet, and the rebound in US stocks has weakened the safe-haven demand for gold.

Fund flow: ETF holdings data show that institutional investors have continued to reduce their holdings of gold recently, reflecting that market sentiment is cautious.

Key technical signals

1. 4-hour cycle: oscillating bearish structure

Clear suppression: The overnight rebound high of 3375 (38.2% Fibonacci retracement level) constitutes a short-term strong and weak boundary, and the price has failed to stand firm here, indicating that bullish momentum is insufficient.

Support overlap: The 3340-35 area is the resonance area of the 4-hour trend line support and the Fibonacci downward target (3335-40). If it is lost, the downward space will be opened to 3320-3300.

Indicator divergence: The MACD histogram is shrinking and the fast and slow lines are close to the zero axis, and the RSI is hovering below 50, suggesting that the rebound momentum is exhausted.

2. 1-hour cycle: short-term technical structure is formed

Descending channel: Thursday's high of 3395 and the current high of 3377 form a secondary high point. Connecting the low point of the hourly chart can draw a descending channel, and the price runs along the lower track of the channel.

Key watershed: 3350 (61.8% retracement level) is a short-term long and short battle point. After breaking it, it will accelerate the test of 3340-35.

Today's trading strategy

Direction: Rebound high and empty mainly, and follow up after breaking the support.

Entry:

Aggressive short order: 3368-3373 light position short test, stop loss above 3380, target 3345-3340.

Steady short order: If the price rebounds to 3375-3380 under pressure, add short position, stop loss 3385, target unchanged.

Take profit and risk control:

Partial reduction of position near the first target 3340, the remaining position observes the support strength of 3340-35.

If it quickly breaks below 3340, short can be chased to 3325-3320 (previous low of daily line).

Alternative plan:

If the price unexpectedly breaks through 3380 and stabilizes, short position needs to be exited, wait and see the 3390-3400 pressure zone and then choose the opportunity to layout.

Key Tips

Don’t blindly buy the bottom: The current technical structure has not shown a bottom signal. Although the 3340-35 area is support, if it is accompanied by a large negative line break, it may trigger long stop-loss orders.

Data risk: Pay attention to the US PMI data in the evening. If it is stronger than expected, it may strengthen the dollar to suppress gold prices.

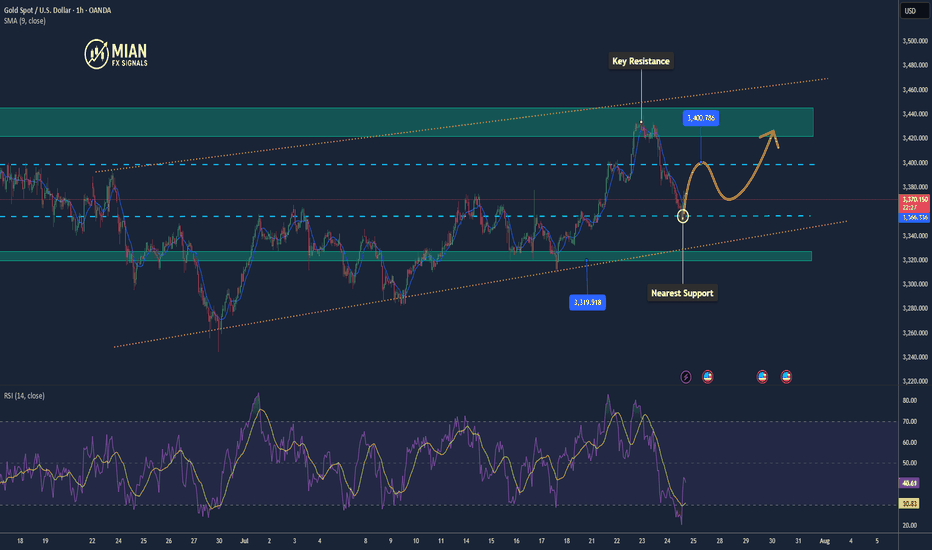

Gold Bounces Back After Testing Key Support📊 Market Drivers

• Gold dropped to around $3,352, touching a key support zone, then quickly rebounded to $3,373, gaining over +20 points.

• The rebound is supported by continued weakness in the US Dollar and slight easing in Treasury yields, keeping gold attractive as a safe haven.

• Although some optimism around US-Japan trade negotiations slightly reduced risk aversion, it wasn’t enough to push gold below support.

📉 Technical Analysis

• Key Resistance:

o $3,397 – $3,400: psychological resistance and near the next bullish breakout zone.

o If breached, next target lies around $3,420–3,445.

• Nearest Support:

o $3,356 – $3,364: recently confirmed support zone that triggered the current rebound.

o Deeper support at $3,326 – $3,320 if the rebound fails.

• EMA (EMA50):

o Price remains above the 50-period EMA, indicating bullish momentum in the short term.

• Patterns & Momentum:

o Market structure shows a "rising low" pattern — a bullish signal that buyers are stepping in at higher levels.

o RSI was briefly in oversold territory and now supports a recovery bounce.

o If $3,356 holds, the upside targets remain valid toward $3,397 → $3,439.

📌 Assessment

• Gold has confirmed strong support at $3,356–3,364, with the rebound from $3,352 as proof.

• Short-term uptrend remains intact, unless the USD strengthens sharply or unexpected macro news hits.

• If gold breaks below $3,356, it may retrace toward $3,326–3,320, but the upside potential is currently favored.

💡 Suggested Trade Setups

BUY XAU/USD: $3,356–3,364

🎯 Take Profit: 40/80/200 pips

❌ Stop Loss: $3,346

SELL XAU/USD: $3,397–3,400

🎯 Take Profit: 40/80/200 pips

❌ Stop Loss: $3,407

Elliott Wave Analysis – XAUUSD July 25, 2025📊

________________________________________

🔍 Momentum Analysis

• D1 Timeframe: Momentum is declining. Based on the current pace, it’s likely that only 1–2 more daily candles are needed before momentum enters the oversold zone → suggesting one more potential downward leg.

• H4 Timeframe: Momentum is about to turn bearish, indicating we might see a sideways movement or a slight drop in the short term.

• H1 Timeframe: Momentum is currently falling. By the end of the current H1 candle, momentum will likely enter the oversold zone → potential for a bullish reversal soon.

________________________________________

🌀 Elliott Wave Structure

• A clear 5-wave Wave A has already formed with no irregular patterns, so I’m expecting Wave B (black) to unfold as a 3-wave structure.

• Within this black Wave B, price is now developing Wave B (blue), meaning Wave A (blue) has already completed. Looking at the lower timeframe, I can identify a 5-wave structure → suggesting a zigzag correction in the form of 5-3-5 for black Wave B.

• Target for Wave B (blue): The 3360 area – this is a support level and also aligns with Fibonacci confluence, making it a strong candidate for the end of Wave B (blue) and a potential reversal zone.

• If price respects the 3360 level, then projected targets for Wave C (blue) would be around 3386 or 3402.

• However, if price breaks below 3351, the current wave count becomes invalid. In that case, we will shift to an alternate scenario and look for a buy opportunity near the lower edge of the triangle (c)-(e) and other confluence support zones.

________________________________________

🔄 Combining Momentum & Wave Structure

• D1 momentum shows weakening in this downward move, and the lower boundary of the triangle (c)-(e) is a prime area to look for the end of Wave e.

• Ideally, we want to see:

o A short-term bounce upward aligning with H1 momentum reversal to complete Wave C (blue).

o Then a confluence with H4 momentum turning bearish, indicating possible trend continuation or reversal.

________________________________________

📌 Trade Plan

• For experienced traders:

Watch closely around 3385 and 3401 for reversal signals to enter Sell positions.

• For beginners, I recommend the following limit setup:

o SELL ZONE: 3399 – 3402

o SL: 3501

o TP1: 3374

o TP2: 3351