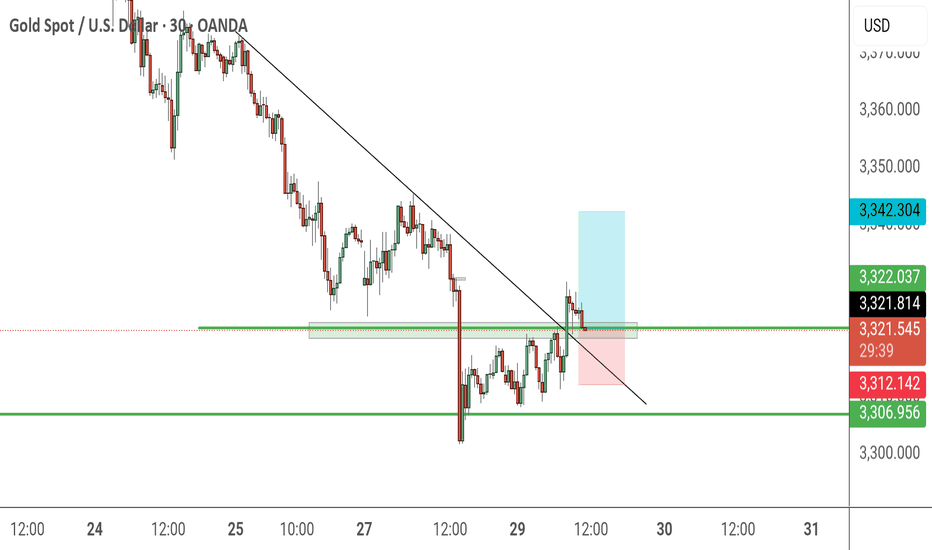

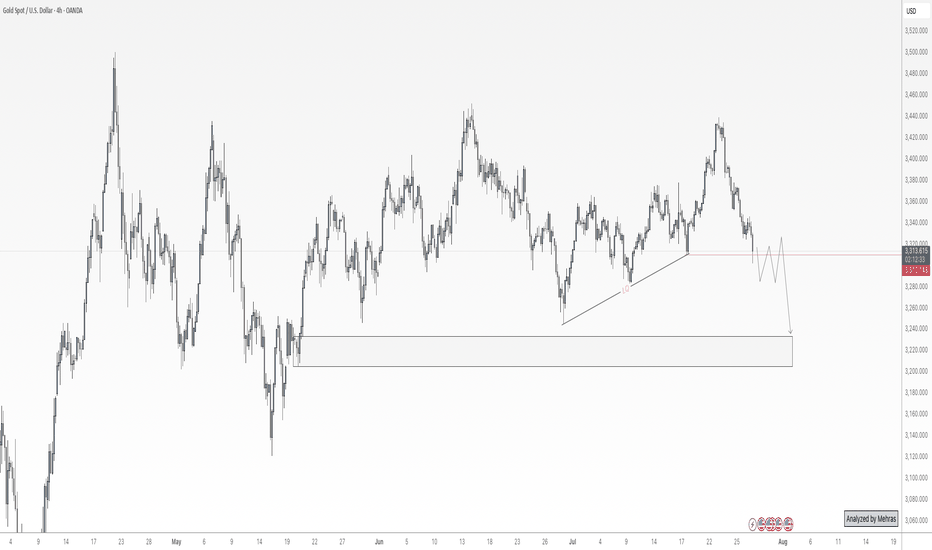

Bearish Gold Outlook — Potential Flash Crash Imminent🔻 Technical Structure – Bearish Breakdown Brewing

Lower highs and lower lows forming on the daily and 4H timeframes — classic downtrend mechanics.

Price has rejected multiple times near $3,400–3,430, forming a strong resistance ceiling.

Support at $3,280–3,300 has been tested too many times— and each bounce is weaker. When support holds with less conviction, it's often about to break.

Volume spikes on red candles show smart money is exiting on down moves — signs of institutional distribution.

The **tightening consolidation range** looks like a **descending triangle** — usually resolves downward.

If $3,280 breaks, expect a **liquidity event**. Stops get swept, leading to a **sudden acceleration — possibly a flash crash** to $3,200 or lower.

🌍 **Fundamental Drivers – Macro Picture Is Turning Hostile for Gold**

1. Real Yields Are Climbing

U.S. real yields are up as inflation fades and the Fed stays hawkish.

Gold, being yieldless, suffers when investors can get positive returns from bonds.

2.The Dollar Is Gaining Strength

DXY is pushing higher, fueled by strong U.S. data and weak peers (euro, yen).

Gold priced in USD becomes more expensive globally — this suppresses demand.

3. **Rate Cuts Are Off the Table — or Delayed**

Market is pricing fewer and later rate cuts from the Fed.

This removes one of gold’s biggest bullish catalysts from earlier in the year.

4. Geopolitical Fear Is Cooling

No major escalation in Ukraine, Middle East, or Taiwan.

Without fear, gold loses its safe-haven premium.

5. Central Bank Buying May Have Peaked

Recent data from WGC shows some slowing in central bank accumulation.

If this institutional bid softens, gold could drop hard — few natural buyers remain above $3,300.

⚠️Conclusion: Gold Is Walking a Tightrope

The chart is a staircase down.

Macro fundamentals are no longer supportive.

A clean breakdown below $3,280 could trigger a **chain reaction** of automated selling and margin calls — **a flash crash is on the table**.

This isn’t just a correction — this feels like the calm before the storm.

XAUUSDK trade ideas

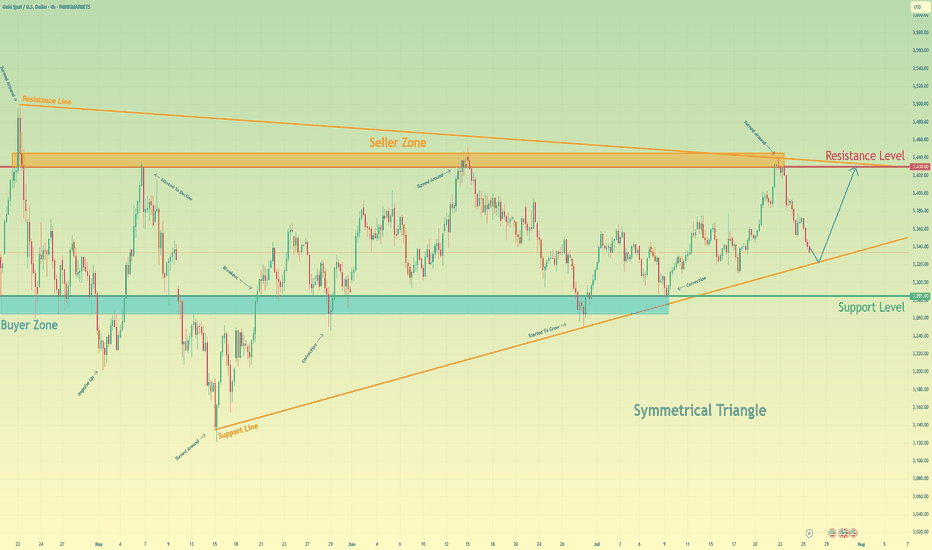

Gold will rebound from support line of triangle and rise to 3430Hello traders, I want share with you my opinion about Gold. Following a sequence of significant upward trends and the subsequent downward corrections that defined its range, gold has entered a broad market zone of consolidation. This battleground is clearly anchored by the historically significant buyer zone around 3285 and a formidable seller zone near 3430. Currently, the asset's price action is coiling and contracting within the confines of a large symmetrical triangle, a classic pattern that signifies a period of equilibrium and energy build-up before a potential high-volatility breakout. After a recent upward rebound was decisively rejected by the upper resistance line, the price is now in a corrective descent, heading towards the crucial ascending support line of the triangle. The primary working hypothesis is a long scenario, which is based on the expectation that this downward move will find strong buying interest on this key trendline, respecting the pattern's integrity. A confirmed and strong bounce from this level would signal another complete upward rotation within the triangle is underway. Therefore, the tp is logically and strategically set at the 3430 resistance level, as it not only aligns with the formation's upper boundary but also represents the major seller zone, a natural magnet for price on such a rebound. Please share this idea with your friends and click Boost 🚀

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

GOLD BUYGold maintains its daily gains around $3,300

After retreating markedly on Wednesday, Gold rebounds moderately and remains positive at about $3,300 per troy ounce on Thursday. The precious metal’s rebound comes in response to the daily retracement in US yields across the curve and the so far irresolute price action in the Greenback

The US Federal Reserve kept its benchmark interest rate unchanged for the fifth consecutive meeting, in a range of 4.25% to 4.5%, despite intense pressure from US President Donald Trump and his allies to lower borrowing costs. The decision, however, met opposition from Fed Governors Michelle Bowman and Christopher Waller. This was the first time since 1993 that two governors had dissented on a rate decision.

In the accompanying monetary policy statement, the committee had a more optimistic view and noted that the economy continued to expand at a solid pace. Adding to this, Fed Chair Jerome Powell said during the post-meeting press conference that the central bank had made no decisions about whether to cut rates in September. This comes on top of the upbeat US macro data, and lifted the US Dollar to a two-month high.

Automatic Data Processing reported that private payrolls in the US rose by 104,000 jobs in July, following a revised 23,000 fall recorded in the previous month. Adding to this, the Advance US Gross Domestic Product (GDP) report published by the US Commerce Department showed that the economy expanded at a 3.0% annualized pace during the second quarter after contracting by 0.5% in the previous quarter

SUPPORT 3,346

SUPPORT 3,328

SUPPORT 3,309

RESISTANCE 3,283

RESISTANCE 3,273

Is the market panicking over FOMC today?⭐️GOLDEN INFORMATION:

Gold (XAU/USD) fluctuates within a narrow range during the Asian session on Wednesday, showing only modest gains and losses as traders tread carefully ahead of the Federal Reserve’s policy announcement. The metal’s recent rebound from the $3,300 area faces hesitation, with investors awaiting clearer signals on the Fed’s rate-cut trajectory before committing to new positions. As such, attention remains firmly on the outcome of the two-day FOMC meeting, set to be released later today.

In the meantime, pre-Fed uncertainty is lending some support to the safe-haven appeal of gold. Additionally, a slight pullback in the U.S. Dollar—after hitting its highest level since June 23 on Tuesday—is providing a mild lift to the metal. However, expectations that the Fed will maintain elevated interest rates for an extended period are limiting the dollar’s decline and capping upside potential for the non-yielding yellow metal. Adding to the cautious mood, recent optimism on global trade also tempers bullish momentum in XAU/USD.

⭐️Personal comments NOVA:

slight recovery, not big before FOMC news. Gold price will still be under selling pressure when interest rate stays at 3300

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3373- 3375 SL 3380

TP1: $3360

TP2: $3344

TP3: $3330

🔥BUY GOLD zone: $3283-$3281 SL $3276

TP1: $3295

TP2: $3307

TP3: $3320

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Gold is Falling Sharply – Will It Keep Falling?Hello dear traders, what’s your view on XAUUSD?

Yesterday, XAUUSD continued its strong downtrend and is now trading around 3,296 USD.

The recent drop in gold is largely due to the strengthening U.S. dollar, following the Federal Reserve’s decision to hold interest rates steady as expected — despite sharp criticism from President Donald Trump.

Technically speaking, after breaking below the rising trendline, gold failed to retest successfully and plunged further, confirming that the bearish trend is now in control. Price is currently moving below key moving averages, and the structure has clearly formed a sequence of lower highs and lower lows — reinforcing the likelihood of continued downside.

If a pullback occurs before the next leg down, the Fibonacci 0.5 and 0.618 retracement zone — which aligns with the EMA 34 and 89 and a major resistance level — will be a key area to watch. This could present a prime opportunity for breakout and trend-following traders.

Looking ahead, the next key support sits near 3,220 USD. If this level breaks, gold may head toward the 3,162 USD zone.

What do you think? Will gold keep falling, or will buyers step in? Drop a comment and hit follow to catch the next big move!

XAUUSDXAUUSD trend If the price can still stand above 3249, it is expected that there is a chance that the price will rebound. Consider buying the red zone.

🔥Trading futures, forex, CFDs and stocks carries a risk of loss.

Please consider carefully whether such trading is suitable for you.

>>GooD Luck 😊

❤️ Like and subscribe to never miss a new idea!

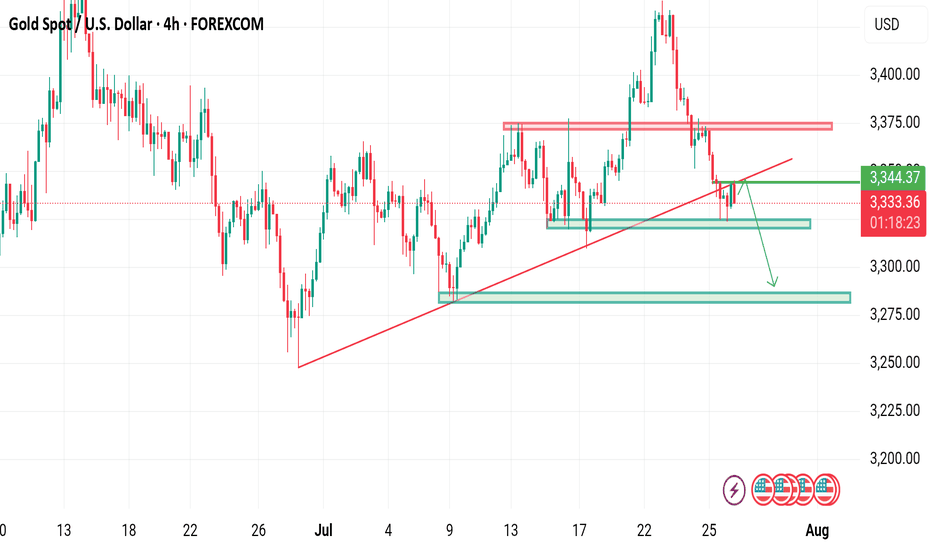

XAUUSD below trend Gold is currently below rising channel

What's possible scanarios we have?

▪️if H4 closed above 3345 ,I will be on bullish side till 3370-3380.

▪️if H4 candle closing below 3330 this Parallel moves upside will be invalid and we have targets at 3290 on mark I'm expecting selling move

#XAUUSD

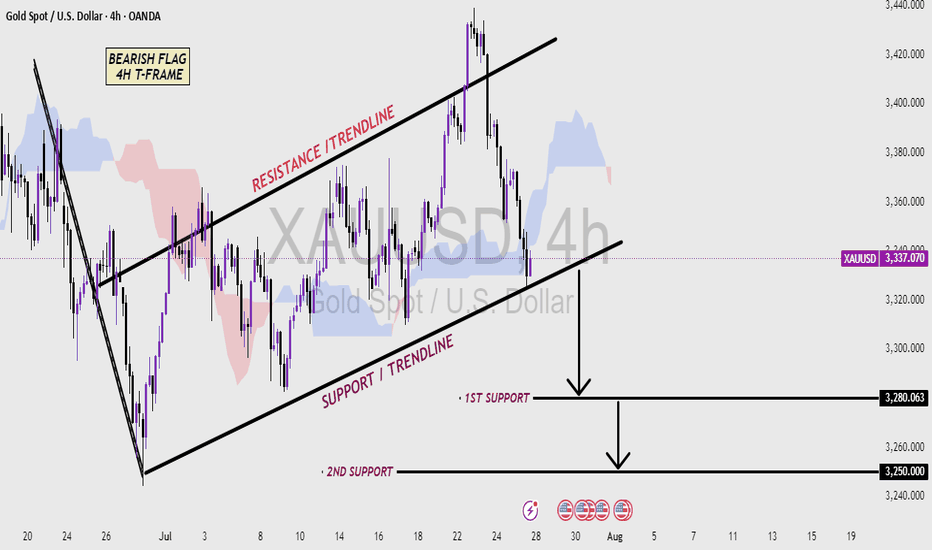

XAUUSD 4H CHART - Bearish pattern Analysis (read the caption)📉 XAUUSD 4H Chart – Bearish Flag Pattern Analysis

This 4-hour chart of Gold (XAUUSD) shows a classic Bearish Flag pattern, which is typically a continuation signal in a downtrend. After a strong bearish move, price entered a consolidation phase inside a rising channel, forming higher highs and higher lows—this creates the flag structure.

The price is currently trading within the Resistance and Support Trendlines of the flag. A break below the Support Trendline would confirm the bearish flag breakout, suggesting a continuation of the downtrend.

Key support levels to watch:

🔻 First Support: 3280.063 – Initial target after breakout

🔻 Second Support: 3250.000 – Extended target if bearish momentum continues

Traders should monitor for a confirmed breakdown with volume and bearish candlestick confirmation to validate short entries. This setup favors sellers if the support breaks decisively.

Gold may paint a false breakdown of supportGold is testing local resistance at 3325 with a touch. It is also touching the lower boundary of the channel. Thus, the price is stuck in the range between 3325 and 3320. A return of the price to the upward channel may attract buying activity. In this case, we can expect growth to 3375 or to the channel resistance.

The trend is upward. If gold does not fall but returns to the channel, we will see a false breakdown of support. According to statistics, all the strongest movements begin after false breakdown

XAU/USD GOLD NFP DIRECTIONThis chart analysis is for XAU/USD (Gold vs. U.S. Dollar) on the 4-hour timeframe. The focus is on a bearish market structure, highlighting potential Price of Interest (POI) zones for a short (sell) setup.

Key Elements:

Market Structure: Clear downtrend with lower highs and lower lows.

POIs Identified:

Optional POI: An initial supply zone where price might react.

Extreme POI: A more significant supply zone marked for a stronger potential reversal.

Labels & Notes:

The price levels are marked between 3,320 – 3,340, showing where the reversal is expected.

Interpretation:

The chart anticipates a retracement upward into the POIs before continuing the bearish move. Traders may look to enter short positions around these zones, especially the Extreme POI, which is seen as a high-probability reversal area.

Gold Breakout Failed – Bearish Reversal in Play?Last week was both interesting and revealing for Gold.

After breaking above the key $3375 resistance—which also marked the upper boundary of a large triangle—price quickly accelerated higher, reaching the $3440 resistance zone.

However, instead of a bullish continuation, we witnessed a false breakout and sharp reversal. What initially looked like a healthy pullback turned into a full bearish rejection by week’s end.

________________________________________

📉 Current Technical Picture:

• On the daily chart, we now see a clear Three Black Crows formation

• On the weekly chart, a strong bearish Pin Bar confirms rejection

• And if we add the failed breakout above 3375, the bias tilts decisively bearish

________________________________________

📌 Key Zones and Trading Plan:

• Gold is currently bouncing from the ascending trendline zone, which is natural after dropping more than 1,000 pips in just 3 days

• The $3375–3380 area has regained importance as a key resistance zone, and that’s where I’ll be looking to sell rallies

• A bullish invalidation would only come if price manages to stabilize above $3400

Until then, this remains a bear-dominated market, and a drop below $3300 is on the table.

________________________________________

🧭 Support levels to watch:

• First support: $3280

• Major support: $3250 zone

________________________________________

📉 Conclusion:

The failed breakout, bearish candle formations, and current price structure all point to a market that's shifting in favor of sellers.

I’m looking to sell spikes into resistance, with a clear invalidation above $3400.

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

NF news, can gold selling pressure drop to 3240?⭐️GOLDEN INFORMATION:

Gold (XAU/USD) is trading lower, around $3,285 in early Asian hours on Friday, as a firmer U.S. dollar weighs on the non-yielding metal following new tariff measures announced by President Donald Trump.

The White House said late Thursday that Trump will set a 10% baseline tariff, stepping back from earlier speculation about hikes to 15% or higher, according to Bloomberg. He also signed an executive order raising the tariff on Canada from 25% to 35%, effective August 1, 2025, while extending Mexico’s current tariff rates for another 90 days to allow more time for negotiations.

⭐️Personal comments NOVA:

large frame, gold price is still moving in the downtrend line. will wait for NF result to have strong selling force again 3240

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3374- 3376 SL 3381

TP1: $3365

TP2: $3350

TP3: $3333

🔥BUY GOLD zone: $3242-$3240 SL $3235

TP1: $3255

TP2: $3268

TP3: $3280

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

GOLD recovers after many days of declineOANDA:XAUUSD has recovered after several days of declines. Investors will focus on the Federal Reserve's interest rate decision on Wednesday, which is expected to cause significant market volatility.

Gold hit a three-week low of $3,301 an ounce on Monday, before recovering somewhat on Tuesday after falling for a fourth straight day as the dollar erased some of its earlier gains, boosting demand for the precious metal.

Falling US Treasury yields and a weak US jobs report also prompted investors to buy gold.

Data released by the U.S. Labor Department on Tuesday showed the number of jobs added fell in June after two straight months of gains.

The number of jobs added in June fell to 7.44 million from a revised 7.71 million in May. The median forecast of economists in a survey was 7.5 million.

Focus on the Federal Reserve's decision

The Federal Reserve will announce its interest rate decision at 01:00 IST on Thursday; Federal Reserve Chairman Powell will hold a press conference on monetary policy at 01:30 IST on the same day.

The market generally expects the Federal Reserve to keep interest rates unchanged, with the focus on whether Fed Chairman Powell's speech will provide any clues about the timing or pace of future rate cuts.

The market sees a very low chance of a rate cut in July and a roughly 40% chance of another rate cut in September, up from about 10% last month, according to the Chicago Mercantile Exchange's FedWatch tool. Investors will be closely watching the statement and Fed Chairman Powell's remarks at his post-meeting press conference for fresh clues on the timing of the next rate cut.

- If Powell opens the door to a rate cut in September, citing the recent trade deal as a reason to ease uncertainty, US Treasury yields could fall immediately, paving the way for gold prices to rise.

- On the other hand, if Powell avoids committing to a rate cut at this meeting, citing recent rising inflation data, gold prices could fall.

Gold typically performs well in low-interest-rate environments because it does not pay interest and its appeal increases when returns from other assets decline.

Technical Outlook Analysis OANDA:XAUUSD

Gold has recovered from the key $3,300 price point and is holding above $3,310, which is also the nearest support. However, the current recovery is not technically enough to create a short-term uptrend, or conditions for a sustained price increase. In terms of position, gold is under pressure with the 21-day EMA as the nearest resistance at around $3,340 – $3,350. If gold falls below the 0.382% Fibonacci retracement level, it will be eligible to open a new downtrend with a target of around $3,246 in the short term, more than the 0.50% Fibonacci retracement level.

On the other hand, RSI is below 50, and the current 50 level acts as momentum resistance in the short term. If RSI slopes down, it will signal bearish momentum with more downside ahead. For gold to qualify for bullish expectations, it needs to at least push price action above EMA21, then retrace back to the price channels and finally break above the 0.236% Fibonacci retracement level to confirm bullish conditions. The upside target could be towards $3,400 in the short term, more like $3,430 – $3,450.

For the day, the technical outlook for gold prices tends to lean more towards the downside, with the following notable points listed.

Support: 3,310 – 3,300 – 3,292 USD

Resistance: 3,340 – 3,350 – 3,371 USD

SELL XAUUSD PRICE 3376 - 3374⚡️

↠↠ Stop Loss 3380

→Take Profit 1 3368

↨

→Take Profit 2 3362

BUY XAUUSD PRICE 3280 - 3282⚡️

↠↠ Stop Loss 3276

→Take Profit 1 3288

↨

→Take Profit 2 3294

Gold 3H Bullish Reversal SetupGold (XAU/USD) 3H Chart Setup:

Price has bounced from a key support zone around 3315, triggering a potential bullish reversal. The target is set near 3360, with a stop loss below the support zone. The projected price path shows possible consolidation before an upward breakout.

GOLD: $4000 on the way! Bulls has the controlGold is on the way hitting a record high since the global tension rising we can see gold creating another record high. Please note that it is a swing trades and may take weeks and months to hit the target or it may not even reach the target itself. This is prediction only so do your own due diligence.

Gold at a Crossroads: $100 Drop Ahead or New All-Time High?Gold is now sitting at a critical decision zone near the $3300 level — a key bank-level area. If we see a daily candle close below this level, I anticipate a minimum drop of 1,000 pips, with the first major support around the $3220–$3200 range. The $3200 level is extremely significant, and I’ll discuss its importance more in future updates if necessary.

On the flip side, if buyers step in and we get a daily close above $3300, I still believe it’s too early to jump into longs. The selling pressure remains quite obvious, and we’ve already seen multiple failed attempts to push beyond this level toward the $3500 all-time high. That tells me the orders at this level might be exhausted.

Personally, I’ll only consider a long position if we get at least a clean 4-hour candle close above $3350.

It’s going to be an exciting week ahead with high-impact data releases including ADP, Core PCE, the Federal Funds Rate — and most importantly, Friday’s NFP.

📌 Stay tuned for updates throughout the week!

Disclaimer: This is not financial advice. Just my personal opinion!!!

The rebound is weak, short orders intervene#XAUUSD

After two consecutive trading days of volatility, gold finally began to fall under pressure near 3335. After breaking through the 3300 mark, the price of gold accelerated its decline, reaching a low of around 3268, and yesterday's daily line closed with a large negative line. 📊

Today's rebound is more likely to be based on the buffering performance of the impact of news. The ATR data also shows that the bullish momentum is slowly weakening in the short term. 🐻After digesting the impact of yesterday's news through rebound during the day, it may fall again in the future.📉

📎The primary focus today is 3305 above, which was also the high point of yesterday's pullback correction. If the gold price rebounds to 3305-3320 and encounters resistance and pressure,📉 you can consider shorting and look towards 3290-3270.🎯

If the short-term gold rebound momentum is strong and breaks through the 3305-3320 resistance area, it will be necessary to stop loss in time. Gold may be expected to touch yesterday's high resistance of 3330-3335, which is the second point to consider shorting during the day.💡

🚀 SELL 3305-3320

🚀 TP 3290-3270

XAUUSD Expecting Selling Movement After retesting the zone, sellers stepped in again confirming Rejection Selling

Price is now breaking out of the pattern to the downside, signaling potential continuation

Targets

First Target: 3300

Second Target 3275

As long as price stays below the rejection zone, bearish momentum remains valid. Watch for volume confirmation and follow price structure closely

GOLD REVERSALHello folks, most traders stop out on this idea right? lets get back to previous month opening price, for short idea stoploss above. 3440.

But If you can wait for LONG below. maybe in the next 2 days.

Goodluck. I prefer LONG? I will update once I see volumes on downtrend today or the next day.

I only see short today. the volume is declining/exhausted. I predict reversal atm.

ciao.. see the chart above.

this is not a financial advice.

trade it like its your own business.