Before GER40 Roars, It WhispersHey guys👋

Here’s the latest GER40 analysis I’ve prepared for you:

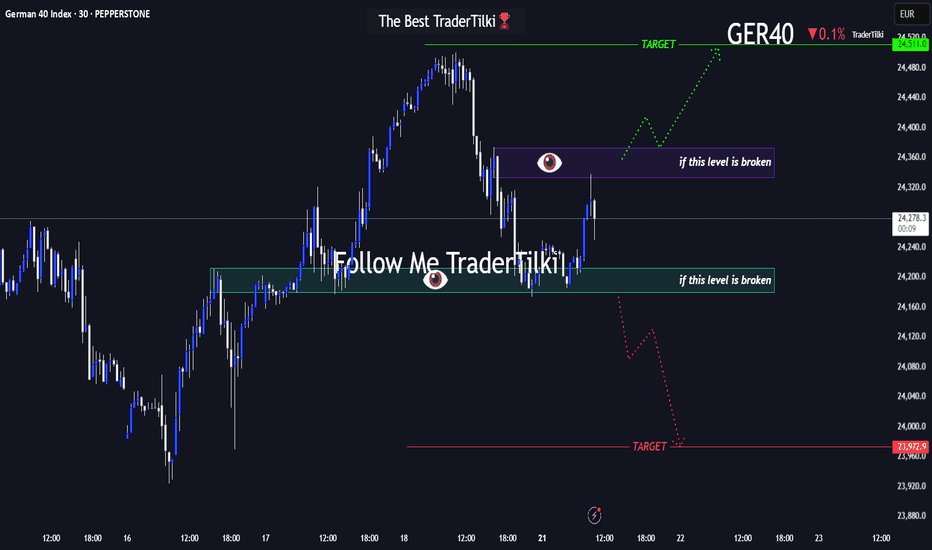

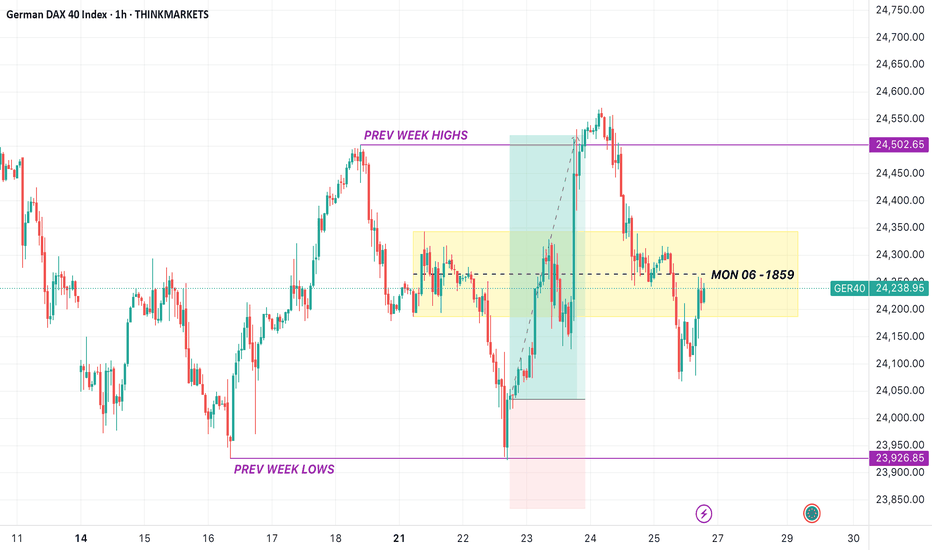

🔻 If the **24,179** support level breaks, the next target is **23,972**.

🔺 If the **24,373** resistance level breaks, the next target is **24,511**.

🎯 I’ve shared two key levels with you — please monitor them carefully.

Every

About DAX Index

The German stock index DAX 40 (GER40) was introduced under "DAX" on July, 1st in 1988 by the Frankfurt Stock Exchange. It consists of the 40 largest companies listed on the Frankfurt Stock Exchange based on the market capitalization and liquidity. The trading hours for the Frankfurt Stock Exchange take place from 9:00 a.m. to 5:30 p.m. CET. The DAX40 is usually reported as a performance index, which means that the dividends of the companies are reinvested.

Related indices

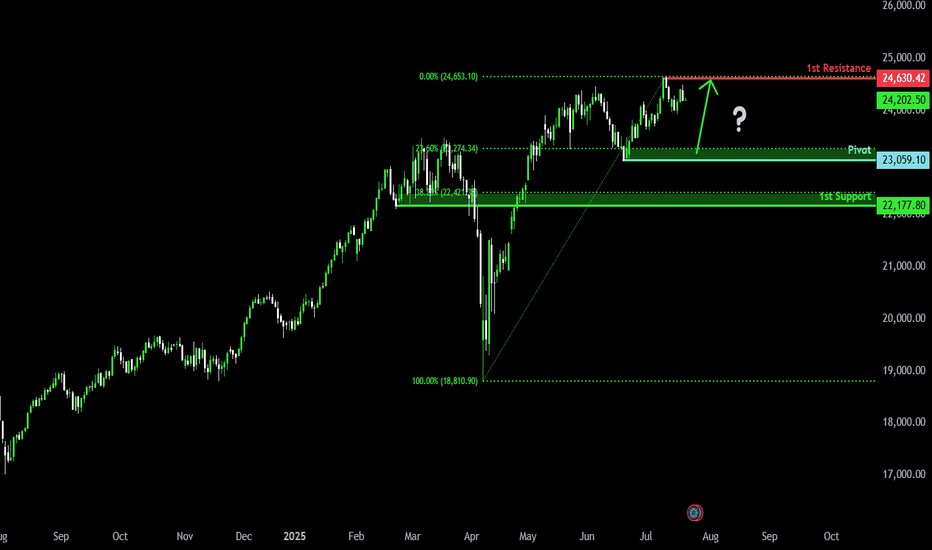

Bullish momentum to extend?DAX40 (DE40) is falling towards the pivot which has been identified as a pullback support and could bounce to the pullback resistance.

Pivot: 23,059.10

1st Support: 22,177.80

1st Resistance: 24,630.42

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you shoul

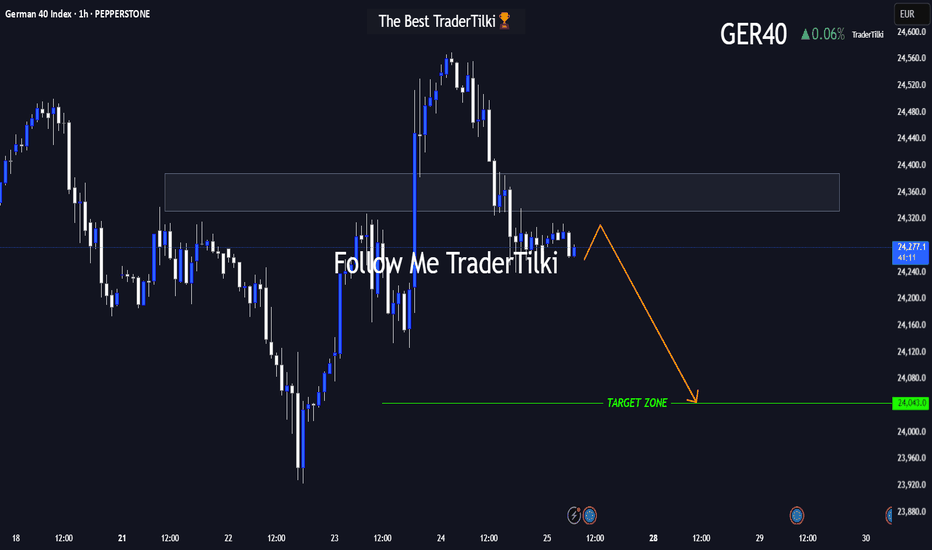

GER40 in Motion: This Setup Speaks Volumes 🌅 Good morning, my friends,

I’ve put together a fresh GER40 analysis just for you. Even if the 1-hour timeframe shows some upward momentum, I fully expect the price to reach my target level of **24,050**.

I'm holding firm until that level is hit.

Every single like from you is a massive source of

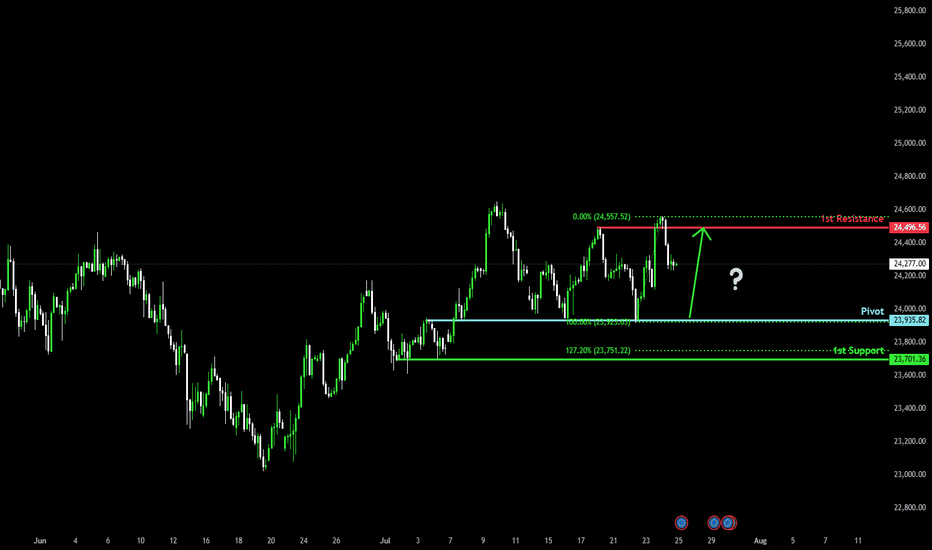

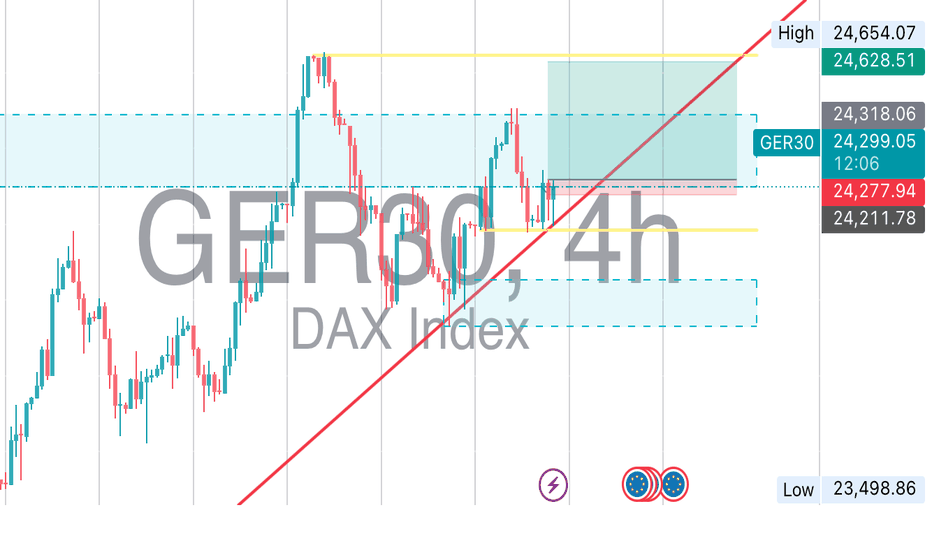

Bullish bounce off major support?DAX40 (DE40) is falling towards the pivot, which has been identified as an overlap support and could bounce to the 1st resistance.

Pivot: 23,935.82

1st Support: 23,701.36

1st Resistance: 24,496.56

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should on

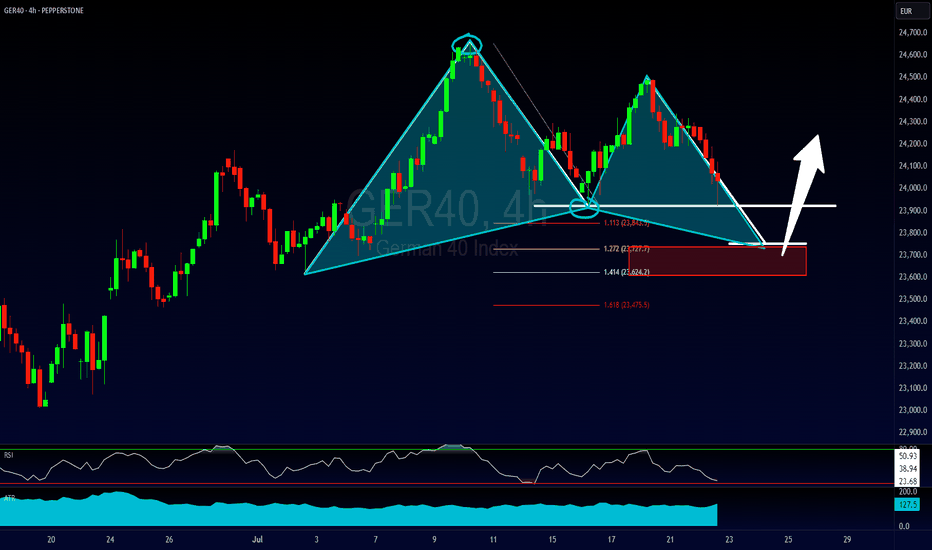

The Kiss of Death Trade & Other Reasons for EntryFollowing up on the 2618 opportunity that we looked at on the FOREXCOM:GER40 this past weekend the market has now created more potential trading opportunities to get involved.

1) A bullish bat pattern that has completed due to a result of a complex pullback into the original double bottom.

2) A

The DAX Index Is Losing Its Bullish MomentumThe DAX Index Is Losing Its Bullish Momentum

At the end of May, we noted that the German stock index DAX 40 was exhibiting significantly stronger performance compared to other global equity indices. However, we also highlighted the 24,100 level as a strong resistance zone.

Two months have passed,

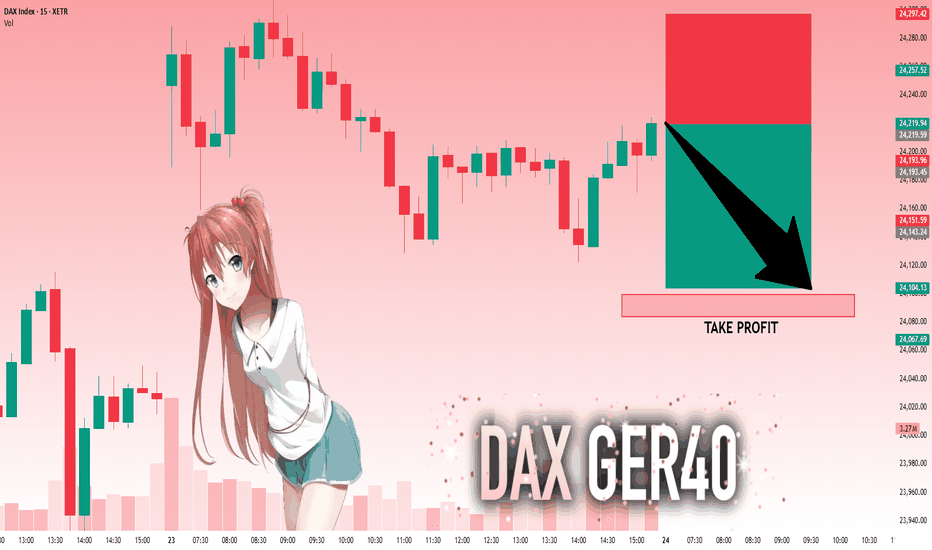

DAX: Target Is Down! Short!

My dear friends,

Today we will analyse DAX together☺️

The recent price action suggests a shift in mid-term momentum. A break below the current local range around 24,219.59 will confirm the new direction downwards with the target being the next key level of 24,099.27.and a reconvened placement

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current value of DAX Index is 24,217.50 EUR — it has fallen by −0.32% in the past 24 hours. Track the index more closely on the DAX Index chart.

DAX Index reached its highest quote on Jul 10, 2025 — 24,639.10 EUR. See more data on the DAX Index chart.

The lowest ever quote of DAX Index is 372.30 EUR. It was reached on Nov 6, 1974. See more data on the DAX Index chart.

DAX Index value has decreased by −1.09% in the past week, since last month it has shown a 2.13% increase, and over the year it's increased by 32.99%. Keep track of all changes on the DAX Index chart.

The champion of DAX Index is XETR:ENR — it's gained 282.54% over the year.

The weakest component of DAX Index is XETR:P911 — it's lost −32.13% over the year.

DAX Index is just a number that lets you track performance of the instruments comprising the index, so you can't invest in it directly. But you can buy DAX Index futures or funds or invest in its components.

The DAX Index is comprised of 40 instruments including XETR:SAP, XETR:SIE, XETR:DTE and others. See the full list of DAX Index components to find more opportunities.