Key facts today

Meta Platforms reported earnings that exceeded Wall Street forecasts during a week of significant earnings announcements from major tech companies.

Meta's CFO, Susan Li, revealed plans to boost capital spending in 2026 after raising 2025 guidance, while still not providing a cloud service for external use.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

24.0 EUR

60.24 B EUR

158.90 B EUR

2.17 B

About Meta Platforms

Sector

Industry

CEO

Mark Elliot Zuckerberg

Website

Headquarters

Menlo Park

Founded

2004

FIGI

BBG002Z340H7

Meta Platforms, Inc. engages in the development of social media applications. It builds technology that helps people connect and share, find communities, and grow businesses. It operates through the Family of Apps (FoA) and Reality Labs (RL) segments. The FoA segment consists of Facebook, Instagram, Messenger, WhatsApp, and other services. The RL segment includes augmented, mixed and virtual reality related consumer hardware, software, and content. The company was founded by Mark Elliot Zuckerberg, Dustin Moskovitz, Chris R. Hughes, Andrew McCollum, and Eduardo P. Saverin on February 4, 2004, and is headquartered in Menlo Park, CA.

Related stocks

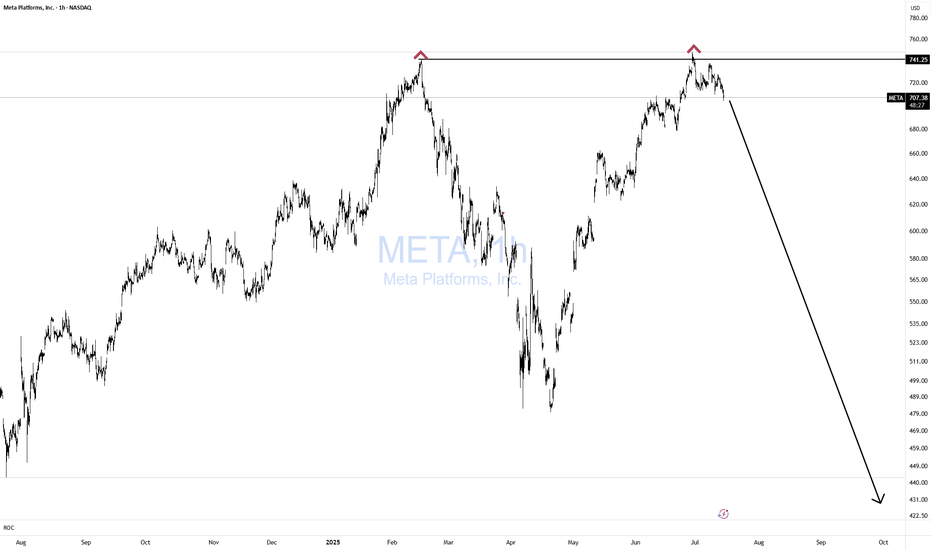

Incoming 40% correction for FacebookOn the above 10 day chart price action has rallied 500% since October 2022. It is somewhat unfortunate to see so many long ideas at the moment.

Motley Fool August 8th:

“Here's how Meta could achieve a $2 trillion valuation within three years, and if it does, investors who buy the stock today could

7/30/25 - $meta - And u think they'll miss?7/30/25 :: VROCKSTAR :: NASDAQ:META

And u think they'll miss?

- we continue to collect data pts that the consumer is spending like a drunken sailor and somehow the market still wants to bid the trash meme stocks that will burn cash until kingdom come

- amazon prime day

- dubious/ but still... go

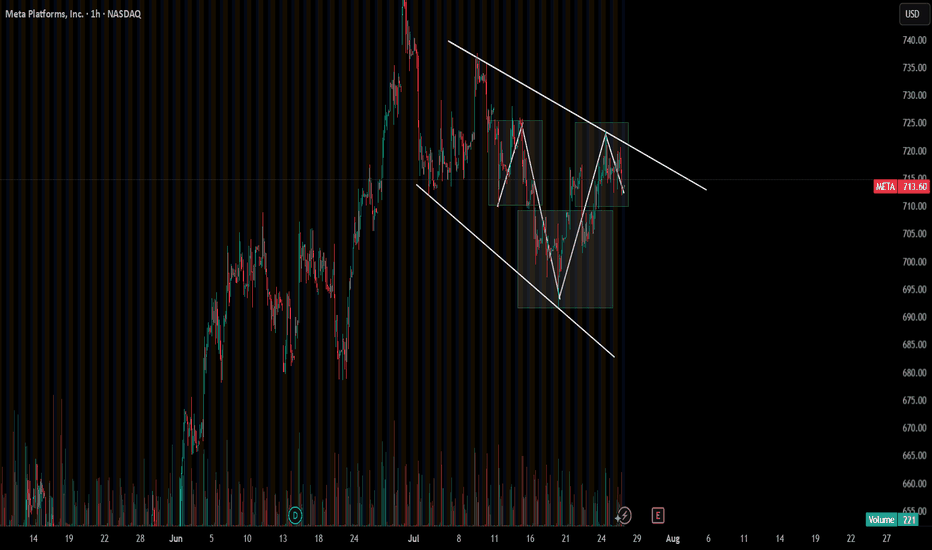

META CANT KEEP THE HULK DOWN!!!!META has been consolidating for a few weeks now, but it's still in this bull flag that looks like it might break out soon, hopefully before earnings on Wednesday, July 30. I love technical analysis on charts, and this inverse head and shoulders pattern has been effective on most semiconductor names

META Earnings Trade Setup — July 30 (AMC)

## 🧠 META Earnings Trade Setup — July 30 (AMC)

📈 **META (Meta Platforms Inc.)**

💥 **Confidence**: 85% Bullish

💡 **Play Type**: Pre-earnings call option

📊 **Fundamentals + Flow + Setup = High Conviction Swing**

---

### 📊 FUNDAMENTALS SNAPSHOT

✅ **Revenue Growth**: +16.1% YoY

✅ **Profit Margin**:

Meta - The breakout in question?🪓Meta ( NASDAQ:META ) is retesting major structure:

🔎Analysis summary:

After Meta perfectly retested a major previous support trendline in 2022, the trend shifted bullish. We have been witnessing an incredible rally of about +700% with a current retest of the previous all time highs. Time wil

META’s Monster Gap — Gamma Ceiling. 8/1META’s Monster Gap — Gamma Ceiling at $785 or Room to Run Past $800?

🔍 GEX & Options Flow Insight (1st Image Analysis)

META ripped higher on earnings momentum, gapping from the $690s into the $770s, and is now stalling just under the Gamma Wall / Highest Positive NET GEX at $784.69. Options positio

Meta surprises to the upside & strengthens its leadership in AIBy Ion Jauregui – Analyst at ActivTrades

Meta Platforms (TICKER AT: META.US) has posted strong quarterly results that significantly exceeded market expectations, driven by its solid positioning in artificial intelligence, advertising monetization, and the resilience of its digital ecosystem.

Key

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US30303M8D7

META PLATF. 22/32 144AYield to maturity

16.29%

Maturity date

Aug 15, 2032

FB5458295

Meta Platforms, Inc. 4.65% 15-AUG-2062Yield to maturity

6.31%

Maturity date

Aug 15, 2062

FB5458293

Meta Platforms, Inc. 4.45% 15-AUG-2052Yield to maturity

6.11%

Maturity date

Aug 15, 2052

FB5522241

Meta Platforms, Inc. 4.65% 15-AUG-2062Yield to maturity

6.02%

Maturity date

Aug 15, 2062

FB5522214

Meta Platforms, Inc. 4.45% 15-AUG-2052Yield to maturity

5.97%

Maturity date

Aug 15, 2052

FB5868810

Meta Platforms, Inc. 5.55% 15-AUG-2064Yield to maturity

5.74%

Maturity date

Aug 15, 2064

FB5868809

Meta Platforms, Inc. 5.4% 15-AUG-2054Yield to maturity

5.68%

Maturity date

Aug 15, 2054

FB5581331

Meta Platforms, Inc. 5.75% 15-MAY-2063Yield to maturity

5.65%

Maturity date

May 15, 2063

FB5581330

Meta Platforms, Inc. 5.6% 15-MAY-2053Yield to maturity

5.59%

Maturity date

May 15, 2053

FB5458289

Meta Platforms, Inc. 3.5% 15-AUG-2027Yield to maturity

5.28%

Maturity date

Aug 15, 2027

FB5458291

Meta Platforms, Inc. 3.85% 15-AUG-2032Yield to maturity

5.23%

Maturity date

Aug 15, 2032

See all FB2A bonds

Curated watchlists where FB2A is featured.

Big software stocks: Red pill gains

9 No. of Symbols

Political stocks: The corridors of power

15 No. of Symbols

See all sparks

Frequently Asked Questions

The current price of FB2A is 654.1 EUR — it has decreased by −4.29% in the past 24 hours. Watch META PLATFORMS INC. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on XETR exchange META PLATFORMS INC. stocks are traded under the ticker FB2A.

FB2A stock has risen by 7.39% compared to the previous week, the month change is a 6.64% rise, over the last year META PLATFORMS INC. has showed a 39.02% increase.

We've gathered analysts' opinions on META PLATFORMS INC. future price: according to them, FB2A price has a max estimate of 951.29 EUR and a min estimate of 499.29 EUR. Watch FB2A chart and read a more detailed META PLATFORMS INC. stock forecast: see what analysts think of META PLATFORMS INC. and suggest that you do with its stocks.

FB2A reached its all-time high on Feb 18, 2025 with the price of 707.7 EUR, and its all-time low was 14.0 EUR and was reached on Sep 4, 2012. View more price dynamics on FB2A chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

FB2A stock is 5.37% volatile and has beta coefficient of 1.29. Track META PLATFORMS INC. stock price on the chart and check out the list of the most volatile stocks — is META PLATFORMS INC. there?

Today META PLATFORMS INC. has the market capitalization of 1.65 T, it has decreased by −2.78% over the last week.

Yes, you can track META PLATFORMS INC. financials in yearly and quarterly reports right on TradingView.

META PLATFORMS INC. is going to release the next earnings report on Oct 22, 2025. Keep track of upcoming events with our Earnings Calendar.

FB2A earnings for the last quarter are 6.06 EUR per share, whereas the estimation was 4.99 EUR resulting in a 21.36% surprise. The estimated earnings for the next quarter are 5.73 EUR per share. See more details about META PLATFORMS INC. earnings.

META PLATFORMS INC. revenue for the last quarter amounts to 40.34 B EUR, despite the estimated figure of 38.05 B EUR. In the next quarter, revenue is expected to reach 42.66 B EUR.

FB2A net income for the last quarter is 15.57 B EUR, while the quarter before that showed 15.38 B EUR of net income which accounts for 1.18% change. Track more META PLATFORMS INC. financial stats to get the full picture.

Yes, FB2A dividends are paid quarterly. The last dividend per share was 0.45 EUR. As of today, Dividend Yield (TTM)% is 0.27%. Tracking META PLATFORMS INC. dividends might help you take more informed decisions.

META PLATFORMS INC. dividend yield was 0.34% in 2024, and payout ratio reached 8.38%. The year before the numbers were 0.00% and 0.00% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 2, 2025, the company has 74.07 K employees. See our rating of the largest employees — is META PLATFORMS INC. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. META PLATFORMS INC. EBITDA is 81.11 B EUR, and current EBITDA margin is 51.83%. See more stats in META PLATFORMS INC. financial statements.

Like other stocks, FB2A shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade META PLATFORMS INC. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So META PLATFORMS INC. technincal analysis shows the buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating META PLATFORMS INC. stock shows the buy signal. See more of META PLATFORMS INC. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.