KHNZ trade ideas

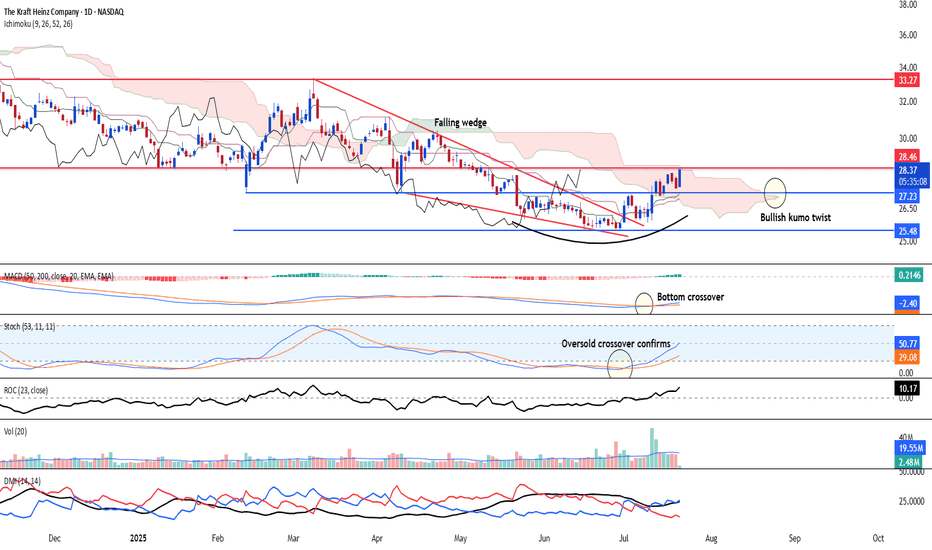

Bottoming out - Likely to see strong reversion up NASDAQ:KHC is looking at a bottoming out after the stock breaks above the falling wedge formation. We could also observe that there is a steady climb up of bullish bars after the breakout. Based on the momentum, the stock is ripe to break 28.46 potentially. Long-term target is at 33.27 and 38.00.

Long-term MACD is positive after bottom crossover.

Stochastic Oscillator oversold confirmed after it rose above the 20-oversold line.

23-period ROC is strong and positive.

KHC – Momentum Reversal with Volume Surge & Tactical Exit Plan📈 Ticker: NASDAQ:KHC (The Kraft Heinz Company – NASDAQ)

📆 Timeframe: 1D (Daily)

💵 Current Price: $27.80

📊 Pattern: Falling Wedge Breakout + Volume & RSI Divergence

📌 Trade Setup:

✅ Our Entry: $26.60

⛔ Stop-Loss: Below $24.80

🔰 Confirmation Signals:

Bullish volume divergence: Selling pressure diminished while price made lower lows

Explosive green volume bar on breakout — strongest in 12+ months

RSI breakout above 60, confirming strong momentum and trend shift

💰 Profit-Taking Strategy:

📍Sell Zone Price Level % of Position Rationale

🥇 Sell 1 $28.48 50% Pre-earnings resistance – lock early profit

🥈 Sell 2 $30.71 30% Next strong resistance area

🥉 Sell 3 $31.62 10% Long-term descending trendline — potential reversal point

🔄 Remaining 10%: Optional trail with stop-loss raised, if momentum continues

📊 Technical Confidence & Probabilities:

🧠 Pattern: Falling Wedge

Bulkowski probability of breakout upward: ~68%

Average gain post-breakout: ~38%, though current targets are more conservative (15–19%)

📈 Volume breakout + prior divergence = strong institutional signal

📉 Risk clearly defined with stop at $24.80

📈 Target Gains vs Entry ($26.60):

🎯 Target Price Gain from Entry

Target 1 $28.48 +7.06%

Target 2 $30.71 +15.47%

Target 3 $31.62 +18.89%

🧾 Summary:

This is a high-probability breakout play, combining:

✅ Bulkowski-validated falling wedge

✅ Volume-based confirmation

✅ Clear stop and tiered exit strategy

✅ Strong risk/reward profile

“Our Entry Price: $26.60 – Breakout Backed by Big Money”

#KHC #TargetTraders #VolumeSpike #BreakoutTrade #TechnicalAnalysis #Bulkowski #StockMarket #Investing

KHC | Reversal Breakout in Motion – Triggered with Target $31📍 Ticker: NASDAQ:KHC (The Kraft Heinz Company)

📆 Timeframe: 1D (Daily)

📉 Price: $26.61

📈 Pattern: Falling wedge breakout + horizontal support reclaim

📊 Breakout Probability: ~68% upward

🔍 Technical Setup:

KHC has just broken above a descending wedge, paired with a clear reclaim of horizontal structure (~$26.00). Volume surged on the breakout candle, confirming participation.

✅ Falling wedge → bullish breakout confirmed

📈 RSI crossed 50 with strong upside momentum

📉 Prior resistance at $28.45 and $30.70 now set as key swing targets

🧠 Trade Plan:

📥 Entry Zone: $26.40–$26.70 (confirmed breakout)

⛔ Stop-Loss: Below $24.80 (beneath last major support & wedge base)

📐 Pattern Breakout Probability: ~68% bullish

🎯 Upside Targets & ROIC (from $26.61):

Target Price Return

🎯 Target 1 $28.48 +7.04%

🎯 Target 2 $30.70 +15.4%

⚠️ Key Observations:

Classic falling wedge structure → statistically strong setup

High-volume breakout = institutional confirmation

RSI breakout supports momentum

Risk is tightly defined, reward is clearly measurable

💬 KHC is triggering a textbook breakout from a falling wedge pattern with strong volume confirmation.

Backed by historical performance metrics, this setup carries a 68% probability of success.

#KHC #BreakoutSetup #FallingWedge #TechnicalAnalysis #BulkowskiPatterns #TargetTraders

KHC Monthly Support and Resistance Lines for June 2025KHC Monthly Support and Resistance Lines for June 2025, only valid till end of June.

Overview:

These purple lines act as Support and resistance lines when the price moves into these lines from the bottom or the top direction. Based on the direction of the price movement, one can take long or short entries.

Trading Timeframes

I usually use 30min candlesticks to swing trade options by holding 2-3 days max. Anyone can also use 3hr or 4hrs to do 2 weeks max swing trades for massive up or down movements.

I post these 1st week of every month and are valid till the end of the month.

$KHC (FIXED) I believe in the next 6 months we will see significant price action in favor of the bulls. I could be wrong because technically NASDAQ:KHC did invalidate what I had drawn for the run up using Elliott wave. I still think it is due for a bounce to the upside earnings were better than expected and I anticipate on investors picking this stock up for their portfolios.

$KHC: Kraft Heinz – Sizzling Growth or Cooling Off?(1/9)

Good Morning, snackers! 🌞 NASDAQ:KHC : Kraft Heinz – Sizzling Growth or Cooling Off?

Kraft Heinz dished out $6.58B in Q4 2024 but missed the mark—price hikes are biting back! Can this food giant spice things up again? Let’s dig in! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Q4 2024: Revenue at $6.58B, down 4.1% year-over-year, missed estimates 📉

• Full Year 2024: Free cash flow up 6% to $3.2B, per Yahoo Finance 💰

• Sector Trend: Consumer staples steady but facing thriftier shoppers 🌟

A bit of a sour taste, yet cash keeps flowin’! ⚙️

(3/9) – MARKET POSITION 📈

• Standing: 3rd largest food & bev in North America, per earnings 🏆

• Brands: Heinz, Oscar Mayer, Lunchables—household legends ⏰

• Trend: Pushing “Accelerate” platforms for growth 🎯

Still a pantry king, but gotta woo new eaters! 🚀

(4/9) – KEY DEVELOPMENTS 🔑

• Q4 Results: EPS beat at $0.84, but sales lagged, per Feb 12 Yahoo 🔄

• Strategy: Plans to adjust pricing on key brands, per Reuters 🌍

• Market Reaction: Shares slipped post-earnings, analysts cautious 📋

Cookin’ up fixes, but the stove’s tricky! 💡

(5/9) – RISKS IN FOCUS ⚡

• Demand: High prices deter budget shoppers, per Reuters 🔍

• Volume: Organic sales dropped 3.1%, volume down 4.1% 📉

• Competition: Smaller brands nip at their heels ❄️

Tough bites to chew, but not outta the game! 🛑

(6/9) – SWOT: STRENGTHS 💪

• Cash Flow: $3.2B free cash flow in 2024, up 6% 🥇

• Brand Power: Global reach, iconic products 📊

• Dividends: Steady $0.40/share payout 🔧

Got a solid recipe in the pot! 🏦

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: Sales miss, volume dips, per Q4 earnings 📉

• Opportunities: New products, emerging markets expansion 📈

Can they whip up a tastier comeback? 🤔

(8/9) – 📢Kraft Heinz’s cash flow’s up, but sales took a hit—your take? 🗳️

• Bullish: $40+ soon, staples rebound 🐂

• Neutral: Steady, tweaks needed ⚖️

• Bearish: $25 looms, demand stalls 🐻

Serve your thoughts below! 👇

(9/9) – FINAL TAKEAWAY 🎯

Kraft Heinz’s $3.2B cash flow tastes sweet 📈, but demand dips add a sour note 🌿. Volatility’s our sous-chef—dips are DCA gold 💰. Grab ‘em low, savor the rise! Gem or bust?

$KHCKraft Heinz Co. (KHC) is scheduled to report its fourth-quarter and full-year 2024 earnings on February 12, 2025.

Analysts anticipate earnings per share (EPS) of $0.78 for this quarter, consistent with the same quarter last year.

Recent options activity indicates heightened interest, with significant volume in both call and put options. This suggests that investors are actively positioning themselves ahead of the earnings announcement.

As of the latest trading session, KHC's stock price is $29.28, reflecting a 1.84% decrease from the previous close. The day's trading range was between $28.99 and $29.79.

Kraft Heinz Co (KHC)

$29.28

-$0.55

(-1.84%)

Today

$29.24

-$0.04

(-0.14%)

After Hours

Investors are closely monitoring the upcoming earnings report, given the active options market and the company's performance trends.

I like NASDAQ:KHC here A LOT.

Kraft Heinz: hooray for boring stocks...The Kraft Heinz Company (NASDAQ:KHC) is a global leader in the food and beverage industry that was formed in 2015 through the merger of Kraft Foods and Heinz. The firm produces a wide range of products, including dairy, meat, sauces, beverages, and other commodities.

Trend Analysis:

Downtrend Reversal: The stock was in a downtrend but has shown signs of bullish reversal, indicated by the bullish divergence (highlighted on the chart).

Ichimoku Cloud: The price is attempting to break above the Ichimoku Cloud, which is a key resistance level. A confirmed breakout could indicate a further uptrend.

Moving Averages:

Short-term moving averages are crossing above longer-term moving averages, suggesting momentum shift.

The SMA 240 is above the price, meaning a strong long-term resistance remains.

Indicators Analysis:

MACD (Moving Average Convergence Divergence):

The MACD line has crossed above the signal line, a classic bullish signal.

The histogram is increasing, confirming positive momentum.

RSI (Relative Strength Index):

RSI is at 60.37, which is above 50, indicating bullish strength but not yet overbought.

The RSI Divergence Indicator also shows a bullish signal, further strengthening the uptrend case.

Volume:

Recent trading volume has increased, indicating strong buyer interest.

A sustained rise in volume could validate the uptrend.

Key Levels:

Resistance: Around $31.93 - $32.00 (where the price previously stalled).

Support: Around $29.60 - $30.00 (recent swing lows).

Conclusion:

Bullish Bias: The stock is showing a bullish reversal with a breakout attempt.

Confirmation Needed: A strong close above the Ichimoku Cloud and $32.00 resistance would confirm an uptrend.

Potential Entry: If price holds above $31.30, with stop-loss near $30.00 and target $34.00 - $35.00.

KHC is BullishPrice was in a downtrend, however a bullish divergence with a double bottom reversal pattern hints that bulls are trying to assume control of the price action. If lower high is broken successfully then we can expect a bullish reversal as per Dow theory. Targets are mentioned on the chart.

The Kraft Heinz Co.: A Leading Food and Beverage ManufacturerThe Kraft Heinz Co. Stock Update

Some key points about The Kraft Heinz Co. stock:

Current Price: $29.64 USD

Change: +0.37 (+1.26%)

Market Capitalization:$35.83B

Volume: 57.42K (average volume: 9.86M)

Next Earnings Report: In 22 days (February 12, 2025)

Additionally, the stock has seen significant changes in recent months:

* **1W:** -1.39%

* **1M:** -16.28%

* **3M:** -10.97%

* **6M:** -4.32%

* **YTD:** -20.19%

This is a #BuyWholesaleSellRetail buy wholesale...

Looking bullish on KHC immediately. Check the video out!🔉Sound on!🔉

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

Kraft Heinz | KHC | Long at $32.00Kraft Heinz NASDAQ:KHC currently has a 4.88% dividend and anticipated earnings growth (though modest) through 2027. Inflation benefits the food industry and Kraft Heinz may do well moving forward. From a technical analysis standpoint, the chart is in the accumulation zone around my selected simple moving average and may be preparing for a larger move up. Currently in a personal buy zone at $32.00.

Target #1 = $42

Target #2 = $47

KHC is BullishPrice was in a strong down trend, however a bullish RSI divergence on daily time frame, indicates that bulls are trying to assume control of the price action, and they have successfully managed to break previous lower high. If the bulls continue to assert pressure, we can expect a bullish reversal as per Dow theory. Targets are mentioned on the chart.