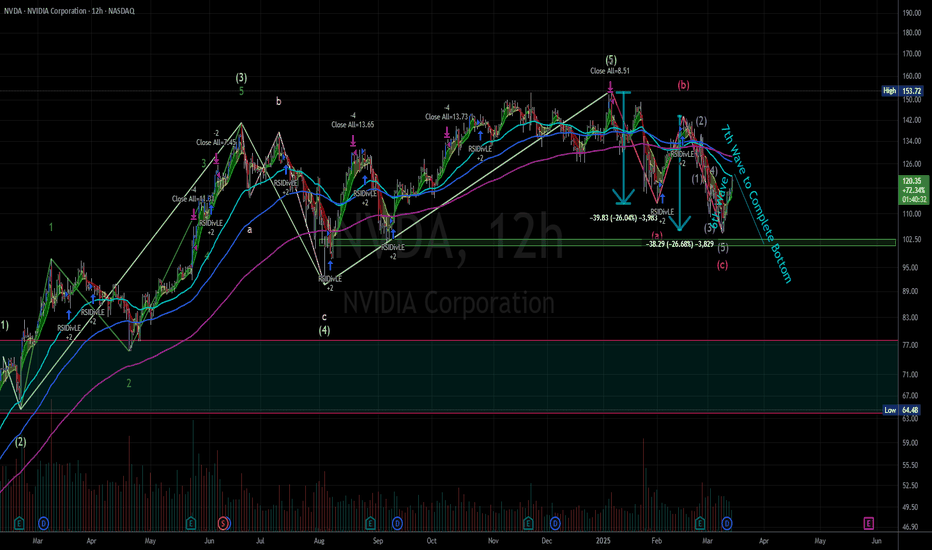

Another Leg down for NVDAHello Traders,

If we do not see NVDA rise about the $121-$124 level for a large amount of volume... we should see another leg down from this area... I am expecting NVDA to drop below $100 in the next 2 weeks. I personally believe by April this stock will see its bottom around $75. It may happen faster. Good luck.

NVD trade ideas

NVDA - what to expecthi traders,

In this analysis we will have a look at NVDA on 1D time frame.

As we can see, the price found support at 105$ and we got a rejection to the upside.

However, we should be realistic with our expectations.

2 scenarios that I expect to play out:

1. The price gets rejected at the downsloping resistance line and the price will revisit the area of 110-105$ which will be an entry zone for longs.

Stop loss should be placed below 105$.

2. If the price closes below 105$, it should go to the buy zone 2 presented on the chart.

In both scenarios, I expect a new all-time high for NVDA.

Buying at buy zone 2 would be a great entry for a swing traders and long-term investors.

$140 - $150 are imminent for NVDANVIDIA Stock Analysis & Forecast

Price Outlook: $140 - $150 in Sight

NVIDIA (NVDA) has consistently been one of the most rewarding stocks for investors, delivering substantial returns over the past few years. However, following its all-time high (ATH) of approximately $153 on January 7, 2025, the stock experienced a notable pullback, declining to around $105.

Since that dip, NVDA has shown signs of recovery, with the current price stabilizing at $121.67. This upward momentum suggests a potential rally toward the $140 - $150 range in the near term.

Investment Strategy

Long-Term Perspective: Given NVIDIA’s strong fundamentals and market dominance, accumulating shares for long-term investment remains a solid strategy.

Short-Term Trading: For traders, technical indicators suggest potential entry and exit points. Refer to my chart for the accompanying chart for detailed technical analysis (TA) insights.

While the stock has shown resilience, monitoring key support and resistance levels will be crucial in determining the next phase of its movement.

Nvidia Rises Over 4.5% and Reclaims $120 ZoneBy the end of the week, Nvidia's stock has surged to $120 , with the strong bullish movement likely driven by positive results from its largest supplier. Taiwanese company Hon Hai Precision Industry (Foxconn) reported revenues exceeding $30 billion and announced plans to establish the world's largest chip manufacturing plant in Mexico, aimed at improving supply efficiency for its main client, Nvidia. This news has restored investor confidence in the short term, and if this positive momentum persists, the bullish pressure surrounding the stock could intensify further.

Large Bearish Channel:

Despite the recent confidence in Nvidia, it is important to note that since early January, the stock has been forming a large bearish channel, and its current price remains midway within that channel. This suggests that the short-term buying momentum still has room to grow, but it has not yet been strong enough to break the dominant bearish formation.

RSI Indicator:

The RSI indicator has started showing an upward slope, and the RSI line is preparing to cross the neutral 50 level. This could indicate that buying momentum may begin to take control, especially if the RSI line continues to move consistently above this neutral level in the upcoming sessions.

MACD Indicator:

The MACD histogram is showing a similar pattern, as it is currently testing the neutral 0 line. If a crossover occurs, it would suggest that the moving average trends are turning bullish, potentially reinforcing buying confidence in the following sessions.

Key Levels:

$130 – Significant Resistance: This level coincides with the bearish trendline and the 38.2% Fibonacci retracement level. A breakout above this level could challenge the current bearish channel and pave the way for stronger buying momentum.

$115 – Near-term Support: This level aligns with the 61.8% Fibonacci retracement barrier. If bearish oscillations push the price below this level, it could completely negate the current buying sentiment and extend the long-term bearish trend that has persisted for weeks.

By Julian Pineda, CFA – Market Analyst

NVDA - Forming a local bottom? Looking at potential local bottom being formed, new to this but this is my thesis.

To me it looks like the 6th wave is starting to complete, then it going to roll over to form the 7th wave before I would consider it being the bottom. It might pass or meet its recent low(bottom of 6th wave 106-102 range). If it holds there, then I would watch for an accumulation to form. Before it tries to go back up and retest the ATH.

Let me know what you think. Time will educate us on what its going to do.

NVDA Bearish Channel Structure TradeNVDA has been respecting this bearish channel since Nov '24 with 5 touches on the lower trendline and 4 touches on the upper.

NVDA most recently bounced off the lower support, making the 5th touch, and gapped up with the indicies to reclaim the midpoint of the channel. With the midline acting as support, movement towards the upside of $127-$130 is much more likely.

Significant resistance might be met at the $125-$126 level but past that the runway is relatively clear for full retracement of the structure.

Structure trade can be easily invalidated by broader macro factors, tariff revisions, & tweets.

$NVDA double-bottom bull flag long...This is the daily of NVDA with a 150 EMA. In my opinion, we are seeing the formation of a double-bottom bull flag. Since most trends continue, I view this as a high-probability to enter or add to a long position on NVDA. With GTC happening next week as a potential bullish catalyst, this adds to my long conviction. Great trading, everyone.

-MrJosephTrades

NVDA Short Term BuyPrice is currently consolidating within a tight range, and a breakout appears imminent. I am looking for a clean break above resistance, followed by a retest of the breakout level, which could provide a strong buy opportunity. If this setup plays out, the next key target would be the $135 level.

However, this move is likely to be a short-term retracement within a larger downtrend. If price struggles to sustain momentum above $135 and shows signs of weakness, it could indicate a continuation of the broader bearish trend. Confirmation will come from price action signals and volume dynamics on the retest.

Nvidia (NVDA) Share Price Rises Over 6%Nvidia (NVDA) Share Price Rises Over 6%

The NVDA stock chart shows that following yesterday’s trading session, the share price climbed over 6%, outperforming the Nasdaq 100 index (US Tech 100 mini on FXOpen), which gained just over 1%.

Despite this recovery from a six-month low, NVDA shares remain down 15% year-to-date.

Why Did Nvidia (NVDA) Shares Rise Yesterday?

Positive sentiment swept through the stock market after U.S. inflation data came in lower than expected. The Consumer Price Index (CPI) for the month stood at 0.2%, below analyst forecasts of 0.3% and the previous reading of 0.4%.

Investors may now be looking for opportunities following the March sell-off, triggered by Trump’s tariff policies and recession fears—and NVDA shares appear attractive in this context.

Barron’s suggests that NVDA stock may currently be undervalued, while MarketWatch cites BofA analyst Vivek Arya, who advises investors to focus on Nvidia’s gross profit margins as a key driver of significant share price growth.

Technical Analysis of NVDA Stock

Earlier this month, we identified a descending channel (marked in red) and suggested that its lower boundary could act as support—which was confirmed (highlighted by the circle).

Bullish perspective:

- The stock opened with a bullish gap and gained throughout the session, failing to hold below the psychological $110 level.

Bearish perspective:

- The price remains within the descending channel, with the median line potentially acting as resistance.

- The $117.50 level, previously a support, has turned into resistance (as indicated by the arrows) and may pose a challenge to further recovery.

NVDA Share Price Forecast

According to TipRanks:

- 39 out of 42 analysts recommend buying NVDA stock.

- The average 12-month price target for NVDA shares is $177.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

NVDA - Bearish IdeaA Three downward move situation with the last dip being the largest pushing price down to a lower trend line in red (dotted line)

Bars pattern tool in red shows my thoughts of the bearish movement

I think price will continue down below the green line that has previously been seen as support

Daily chart

NVIDIA Stock Chart Fibonacci Analysis 031225Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 108/61.80%

Chart time frame: B

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress: A

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E) Hit the top

Stocks rise as they rise from support and fall from resistance. Our goal is to find a low support point and enter. It can be referred to as buying at the pullback point. The pullback point can be found with a Fibonacci extension of 61.80%. This is a step to find entry level. 1) Find a triangle (Fibonacci Speed Fan Line) that connects the high (resistance) and low (support) points of the stock in progress, where it is continuously expressed as a Slingshot, 2) and create a Fibonacci extension level for the first rising wave from the start point of slingshot pattern.

When the current price goes over 61.80% level , that can be a good entry point, especially if the SMA 100 and 200 curves are gathered together at 61.80%, it is a very good entry point.

As a great help, tradingview provides these Fibonacci speed fan lines and extension levels with ease. So if you use the Fibonacci fan line, the extension level, and the SMA 100/200 curve well, you can find an entry point for the stock market. At least you have to enter at this low point to avoid trading failure, and if you are skilled at entering this low point, with fibonacci6180 technique, your reading skill to chart will be greatly improved.

If you want to do day trading, please set the time frame to 5 minutes or 15 minutes, and you will see many of the low point of rising stocks.

If want to prefer long term range trading, you can set the time frame to 1 hr or 1 day.

Should wait for the Breakout..Bearish Divergence on Weekly & Monthly TF.

However, Hidden Bullish Divergence is appearing

on Weekly TF which is actually a Positive sign.

Immediate Support seems to be around 126 - 130.

But if 140 is Sustained on Weekly basis, we may witness

further Upside around 150ish.

Best Approach would be to wait for the Rectangular Channel

Breakout.

NVDA Chart Analysis and Predictions According to my technical analysis, NVDA is on its way of retesting 100D EMA, 200D EMA and complete the head-and-shoulder pattern. This retracement is possibly stop at 127-130. Once the retest is complete, further correction will follow. I marked the possible gaps that needs to be filled, the nearest gap first. However, depending on the macro market environment and NVDA's performance, not all the gaps have to be filled.

NVDA Breakdown: Is a Trend Reversal Unfolding?NVDA is showing signs of weakness, with an A-B-C correction potentially unfolding, hinting at a trend reversal. The near-term peak in AI compute demand, proven by DeepSeek , and NVDA’s reliance on Taiwan-based TSMC amid geopolitical risks add fundamental pressure. Broader market sentiment hasn’t turned fully bearish yet either, with CPCE unchanged for March — suggesting market participants haven't fully priced in further downside.

Chart Study #2 Mixed IndicatorsMy focus is on the mix of Indicators on this these charts: IBM and SMCI because I need to have the ability to see how much resistance is overhead, which warns me if the trade will be easier, or more of a struggle. I like easy.

The Indicators here are:

VRVP

4 EMAs

EM VRVP

FVG

FVG Instantaneous Mitigation

Gann Square of 9

Previous N Days/Weeks/Months High Low

TwV MTF Dynamic VRVP

Future Trend Channel [ChartPrime}

I like this setup a lot, it seems sensible for many reasons, but I don't see yet how I can figure out if the overhead is clearer or more stuffed-up.

NVDA Lost it's key support level. Are we headed to 50$ ?The critical support level has been breached, and the price action suggests we could be headed toward the $50 zone 📉. Adding fuel to the bearish case, we see a major bearish divergence on the MFI indicator, signaling weakening momentum.

Is this the beginning of a deeper correction? Stay sharp! ⚠️