P911 trade ideas

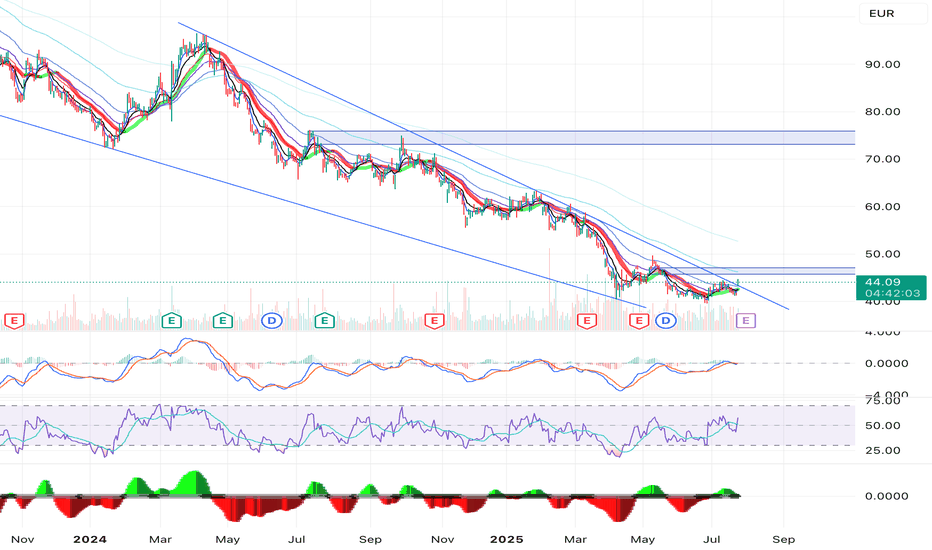

PORSCHE - One of the worst performing stocks as an opportunitySince Porsche got listed for the Stock Market it is only going a downpath. Well there is a trendchange signal, but I really hate European stocks they perform mostly like garbage unless youre a company called Rheinmetall which has an unlimited money glitch... I won´t say to much about Porsches business model and their future because it depends in German Economy a lot, and German Economy is like if youre on a ship where there is slowly starting to leak water and you know it will go down just not when. Still this stock may temporarly see a trend reverse for the moment.

Why It’s a Good Idea to Buy Porsche Stock During a Market CrashStrong Brand with Loyal Customers

Porsche is a premium brand with global recognition. Even during downturns, demand for luxury products like Porsche remains relatively resilient.

Fundamentally Solid Company

Porsche has strong revenue, high profit margins (some models generate over 15–20% margin), and a reputation for financial discipline.

Undervalued During Crashes

In a market crash, even high-quality companies are sold off irrationally. This creates a rare opportunity to buy at a discount to intrinsic value.

Healthy Balance Sheet with Low Debt

The company maintains a solid financial position, making it more capable of weathering economic storms.

Attractive Dividend Yield

Porsche pays dividends, and when the stock price drops, the dividend yield becomes more attractive to long-term investors.

Backed by Volkswagen Group

As part of the VW Group, Porsche benefits from shared technology, resources, and strategic support, adding an extra layer of stability.

📈 Why Porsche Is Likely to Recover After a Crash:

Strong Demand for Luxury Vehicles

The premium segment tends to recover faster post-crisis, as high-net-worth individuals are less impacted and quicker to resume spending.

Innovation & EV Leadership

Models like the Taycan prove that Porsche is a frontrunner in high-performance electric vehicles, well-positioned for the EV revolution.

Global Presence

Porsche operates across major markets—Europe, the U.S., and Asia—offering multiple growth channels once global recovery begins.

Limited Shares – High Demand Potential

After Porsche AG’s IPO, only a portion of shares are publicly traded, meaning limited supply. Once demand returns, this can drive the price up sharply.

Long-Term Vision & Prestige

Investors see Porsche not just as a carmaker but as a long-term luxury mobility brand with staying power and vision, which boosts confidence in its recovery.

P911 - Opportunity to Buy a cheap Porsche? Stock - not a car :( GETTEX:P911

We all know issues that VW group is currently facing so no point of writing about that. Lets look at some investment opportunities!

Since the start of 2024 Porsche saw a nice move to the upside where price found resistance and since then.... since exactly 224 Days, price dropped -42.27%!!! Only in November price dropped -17,33%.

While this may look bad, and in most cases is bad, there is money on the table for those who still havent invested in this stock.

We do not know 100% what will happen with VW group and Porsche, too big to fail? I guess.

There is no historic price action so we also dont know for how long this will keep on dropping and where is the actual bottom before reversing to the upside?

Me personally, I started buying some of Porsche stocks each month. We know for certain it cant go bellow 0 (Absolute bottom). There is still room to drop , but there is also profit potential on the upside towards historic prices.

For those who are willing to take the risk and have some connection to the car industry - Porsche in general, like me.. This may be a good investment in the long run.

Also do not forget that owning this stocks Porsche will be paying you dividends once a year!

Patience is the key! Play it smart!

PORSCHE - P911 - German Auto IndustryWith current issue on tariffs between EU & China - it will be a daring move to buy and European Car stock. It is hard to predict how those discussions will end given the current shift in the EU political landscape.

DAX broke records but P911 was on a downtrend forever. Profitable, dividend play. If to chose any EU auto stock RACE (Ferrari) STLA and Mercedes would be top of the list along with P911.

Once the trend line breaks, ideal entry would be on the retest. The last extended wick might have marked a local bottom

Porsche - Is worth it ? Porsche 26 of April 2024 reported its revenues and earnings. Will help us these reports consider whether XETR:P911 is worth at this price ?

Let´s have a brief look.

1. earnings positively surprised us, 3.94% exceeded its expectations. ✔️

2. revenue´s stayed behind expectations by 3.96% ❌

3. hikes dividend amount to 2.31 per share ✔️

4. launching four new models in 2024 (Macan, Panamera, Taycan, 911) ✔️

5. expects an operating return on sales of between 15 - 17%, down from 18% noticed in previous two years ❌

6. future - they focus on sustainable success of company ✔️

7. expectations to 2025 - strong recovery in China and full range of models which will kick their financials off ✔️

Revenue by countries:

- North America 29.53%

- China 23.56%

- Europe 21.66%

- Germany 12.03%

- Rest of the World 14.26%

Balanced distribution throughout the world puts this company on solid footing. China is still behind expectations due to decrease in demand and EV price war. China could be an ace up in its sleeve in the coming years.

Mixed financial reports could mislead us a bit. However Porsche still has a strong vision, sustainable business model and positive fundamental background.

Stock´s sold at 3.34 times by its book value. Obviously there´s a premium priced in we have to reckon with. Premium car segment needs premium price of stocks.

Let´s recap.

Is it worth it at this price ?

In my point of view, stock´s around the IPO price. The range between 82.5 - 84.0 seems to be very pleasant to place buy-orders. Definitely from a long-term point of view.

Consider your best price to entry and make your own call.

Porsche reclaims higher price tags and wants to join its peersLast year in September, we analyzed Porsche's stock following its 2022 initial public offering. At the time, we noted Porsche's shares had great prospects in the long term and viewed a potential pullback in price as a great opportunity to buy this stock at relatively reasonable prices (judging by Porsche’s performance during its short life span on the exchange). When Porsche was still trading above €100, we eyed an ideal entry 10% below its market price. However, we also emphasized the need to leave some more capital aside to execute additional purchases once the opportunity arises. After patiently waiting a few months, we signaled another opportunity in late January 2024 when Porsche was trading near its all-time lows, looking relatively cheap to its peers like BMW and Mercedes-Benz. Fast forward to today, and shares of Porsche are trading up about 30% from that level and above the level we signaled in late September 2023 as well (above the area between €90 and €92). As far as our outlook goes, we remain bullish on Porsche in the long term and believe it has a chance to reclaim all-time highs and continue higher (though it might be a rocky ride).

Illustration 1.01

Illustration 1.01 shows the daily chart of Porsche stock and simple support/resistance levels derived from peaks and troughs.

Technical analysis gauge

Daily time frame = Bullish

Weekly time frame = Bullish

*The gauge does not necessarily indicate where the market will head. Instead, it reflects the constellation of RSI, MACD, Stochastic, DM+-, ADX, and moving averages.

Please feel free to express your ideas and thoughts in the comment section.

DISCLAIMER: This analysis is not intended to encourage any buying or selling of any particular securities. Furthermore, it should not be a basis for taking any trade action by an individual investor or any other entity. Therefore, your own due diligence is highly advised before entering a trade.

Dr. Ing. h.c. F. Porsche P911 (still long)Full year 2023 earnings: Revenues in line with analyst expectations

Full year 2023 results:

Revenue: €40.5b (up 7.7% from FY 2022).

Net income: €5.16b (up 4.2% from FY 2022).

Profit margin: 13% (in line with FY 2022).

Revenue was in line with analyst estimates.

Revenue is forecast to grow 5.4% p.a. on average during the next 3 years, compared to a 1.9% growth forecast for the Auto industry in Germany.

P911 on XETR. Buy.The long-lasted Weekly downtrend and a new Weekly uptrend has started. The momentum line of this new Weekly uptrend is still intact. Price reacted from a Weekly Supply but buying is still the good decision. This is a Daily Demand level and can look for a quick trade. Because the real Weekly Demand below might attract price through this.

If you want to buy a Porsche (without wheels)P911 at the very important level. It can surely break below, but it is important to monitor this level for possible rejection. Personally I´m expecting a strong reaction at the 80 level, but please, don´t use entry line as a trigger. Trade the reaction (rejection) not the action. I will try to update this trade if-when entry conditions are met. Wish you good luck to trade this idea.

One luxury carmarker is down 20%, a buying opportunity?Although founded in 1948, Porsche became a public company in late September 2022. Initially, the company started to float on the market with an opening price of €84. However, shares rose as high as €120.80 in the coming months. Yet despite these impressive gains since the IPO, shares of the company began to decline in May 2023, losing about 20% of their value through the summer.

In its recent financial report, Porsche AG Group revealed that its operating profit rose 10.7% YoY and sales revenue 14% YoY in the first six months of 2023. Meanwhile, cash and cash equivalents decreased by 52% (by €2.466 billion to €2.244 billion), and the deliveries went up by 14.7% YoY to 167,354 vehicles, with increases in all sales regions. Based on the report, the biggest demand was for models Macan and Cayenne, with 46,842 and 46,399 cars sold, respectively.

Going forward, the company cited supply chain challenges related to auto parts and their quality while noting that risks associated with gas shortages and the Russia-Ukraine conflict decreased. On top of that, the report states: “The explanations on the liquidity risks presented in the risk reporting section of the 2022 combined management report remain unchanged… The overall conclusion that, based on the information and assessments currently available, a development jeopardizing the group’s ability to continue as a going concern is sufficiently improbable in the fiscal year 2023, remains unchanged."

Based on these and other factors, we consider Porsche shares attractive below €100 (with ideal entry around €90 to €92) for the long term (talking about years). However, at the moment, we believe it would be proper to start only with incremental purchases and leave some capital aside for better opportunities.

Technical analysis

Daily time frame = Bearish

Weekly time frame = Bearish

Please feel free to express your ideas and thoughts in the comment section.

DISCLAIMER: This analysis is not intended to encourage any buying or selling of any particular securities. Furthermore, it should not be a basis for taking any trade action by an individual investor. Therefore, your own due diligence is highly advised before entering a trade.

Porsche with one of the highest profit margins per carPorsche, one of the automotive manufacturers with one of the highest profit margins per car in the world. After RACE, Ferrari, it's Porsche, it seems to me.

This stock has returned to its IPO price...

Undervalued in my opinion.

- Price-To-Earnings ratio (12.9x) is below the German market (16.1x)

- Earnings are forecast to grow 5.77% per year

- Earnings grew by 3.3% over the past year

- Analysts in good agreement that stock price will rise by 33.9%

- No risks detected for P911

- Revenue is meaningful (€41B)

- Market cap is meaningful (€67B)

- The company’s earnings are high quality

- Debt level is low and not considered a risk

Breakout of the wedge on the support.In the figure, you can see the support marked with a purple color, which is the defense of the previous LOW.

There is also a wedge on this support.

If the trend line is broken, and the wedge is broken at the same time, there is a possibility of entering a trade and achieving a risk to reward ratio of four to one.

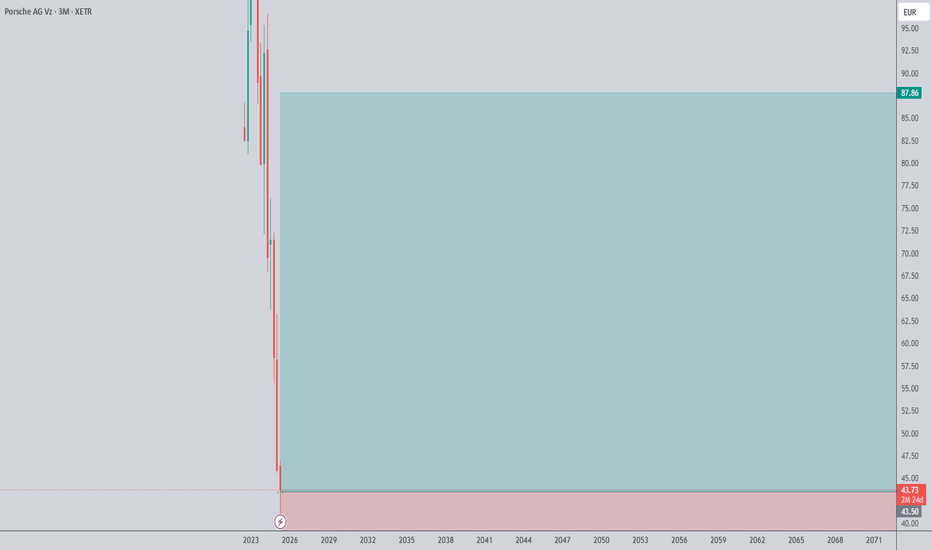

Porsche ( $P911 ) Short ideaOne of the iPOs that I've tracking, and following a standard pattern. Together with a short term (or likely more) top in EU indices, we should see this go much lower after the initial move liquidating early shorters and now FOMO buyers. Red line is stop loss, Green lines are TP1 and 2, respectively. GL