PFE trade ideas

PFIZER INC. (NYSE)For all vaccine enthusiasts, Pfizer shares are currently among the best options.

At the time of publication, the price is holding steady at $24.83 . Our forecast is that the price will rise to $27.48 (minimum)! Most likely by August.

Personally, I don't trade stocks, as I have decided to change my market preference, but I can say that if I were Warren Buffett , I would recommend buying it.

✅ The price is low.

✅ The brand is well-known.

✅ Pharmaceuticals is a profitable sector of the economy, on par with IT and other new technologies.

Aggressive Trend Trade 1HAggressive Trend Trade 1H

- short trend

+ volumed T1

+ support level

+ biggest volume 2Sp+

Daily Trend

+ long impulse

+ T2 level

+ support level

+ 1/2 correction"

Monthly CounterTrend

"- short balance

+ expanding ICE

+ support level

+ unsuccessful biggest volume manipulation"

Yearly Trend

"+ long impulse

+ 1/2 correction

- below exhaustion volume?

- below SOS"

Will add more when 5M, 1H or 1D will show entry point

BUY Pfizer (PFE) growth by Viagra

Tomorrow, I’m entering a position in Pfizer Inc. (NYSE: PFE)—a globally recognized pharmaceutical giant with strong fundamentals and an attractive technical setup.

Pfizer maintains a solid revenue base, reporting $62.46 billion in total revenue in the last fiscal year. Despite recent fluctuations, its profitability remains intact, with a gross profit of $45.15 billion. The company continues to invest in drug innovation and strategic acquisitions, ensuring long-term growth.

Pfizer is a consistent dividend payer, making it an attractive choice for income-focused investors. Its dividend yield remains competitive, reinforcing its appeal as a long-term hold.

I see strong upside potential — both technically and fundamentally. Now is the perfect time to enter.

PFE - A GOOD DIVIDEND PLAY LONG TERMGood Morning,

I have been keeping an eye on PFE for awhile as I want to get it on a low to hold in my TFSA long term for dividend payments.

PFE created an initial support at level 21-21.50$. PFE continued to climb aggressively until seeing some rejection at the 24$ level. It dropped down to retest previous supports at the 21.50$ in which there was two good buying accumulation supports.

From here I will be adding PFE to my TFSA for long term. For swing trade opportunity you could look to hold for 26.50$.

ENJOY!

PFE – Long Trade Setup !📈 🟢

Ticker: Pfizer, Inc. (NYSE: PFE)

Chart: 30-Min Timeframe

Pattern: Ascending triangle breakout continuation

🔹 Entry: $24.38 (breakout from consolidation + trendline support)

🔹 Stop-Loss: $24.01 (below ascending trendline)

🔹 Take Profits:

TP1: $24.89 – Gap-fill resistance zone

TP2: $25.55 – Measured breakout target

⚖️ Risk-Reward Calculation:

– Risk/Share: $0.37

– Reward to TP2: $1.17

– R:R Ratio: ~1:3.1 ✅

🧠 Technical Highlights:

– Clean breakout from ascending triangle pattern

– Strong move with steady volume support

– Price reclaiming key resistance with bullish follow-through

Pfizer Stock Chart Fibonacci Analysis 042925Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 22.7/61.80%

Chart time frame:D

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress: C

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E) Hit the top

Stocks rise as they rise from support and fall from resistance. Our goal is to find a low support point and enter. It can be referred to as buying at the pullback point. The pullback point can be found with a Fibonacci extension of 61.80%. This is a step to find entry level. 1) Find a triangle (Fibonacci Speed Fan Line) that connects the high (resistance) and low (support) points of the stock in progress, where it is continuously expressed as a Slingshot, 2) and create a Fibonacci extension level for the first rising wave from the start point of slingshot pattern.

When the current price goes over 61.80% level , that can be a good entry point, especially if the SMA 100 and 200 curves are gathered together at 61.80%, it is a very good entry point.

As a great help, tradingview provides these Fibonacci speed fan lines and extension levels with ease. So if you use the Fibonacci fan line, the extension level, and the SMA 100/200 curve well, you can find an entry point for the stock market. At least you have to enter at this low point to avoid trading failure, and if you are skilled at entering this low point, with fibonacci6180 technique, your reading skill to chart will be greatly improved.

If you want to do day trading, please set the time frame to 5 minutes or 15 minutes, and you will see many of the low point of rising stocks.

If want to prefer long term range trading, you can set the time frame to 1 hr or 1 day.

Tensions in the Pharma Sector and Signs of U.S. StagflationBy Ion Jauregui – Analyst at ActivTrades

The U.S. biopharmaceutical industry may soon face significant regulatory changes. According to sector sources, the Trump administration is evaluating a proposal to tie U.S. drug prices to the lowest prices available in other developed countries. This initiative, viewed by companies such as Pfizer Inc. (NYSE: PFE) and Merck & Co. Inc. (NYSE: MRK) as a direct threat to innovation, could redefine the global balance of the pharmaceutical sector.

Macroeconomic Outlook: Stagflation Warning

On the macroeconomic front, Citigroup Inc. (NYSE: C) has warned that despite current signs of consumer activity, the negative effects on growth are expected to intensify in the second half of the year. Nathan Sheets, the bank’s Chief Economist, points to rising risks of stagflation, in a context marked by declining confidence and renewed criticism from Donald Trump towards Federal Reserve Chair Jerome Powell.

Defense Sector: Tariff Impact

Raytheon Technologies (NYSE: RTX) has stated that new tariffs proposed by the Trump administration could have a negative impact of up to $850 million on its 2025 earnings. Nevertheless, the company exceeded market expectations in its latest quarterly results and reaffirmed its annual guidance.

Shareholder Reshuffle at BP

Activist fund Elliott has acquired a 5.006% stake in BP plc (LON: BP), surpassing the regulatory threshold in the United Kingdom and becoming the company’s second-largest shareholder—behind BlackRock (9.2%) and ahead of Vanguard (4.95%). This strategic move reflects the increasing shareholder pressure on major oil companies.

Key Events of the Day

Notable economic indicators and corporate earnings scheduled for today include:

• S&P Global Manufacturing PMI

• S&P Global Services PMI

• Earnings reports from: Philip Morris (PM), IBM (IBM), AT&T (T), Thermo Fisher Scientific (TMO), ServiceNow Inc. (NOW), Boston Scientific (BSX), Texas Instruments (TXN), Boeing (BA), O’Reilly Automotive (ORLY), Chipotle Mexican Grill (CMG)

These releases are expected to have a significant impact on markets, particularly across the consumer, technology, and defense sectors.

*******************************************************************************************

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and such should be considered a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.

PFEAt the current price, I'm looking for a retest toward the daily target zone located on the chart. On 3/21 PFE announced news about dropping the decision to move forward with the weight loss drug. Since then, price dropped down in spike like fashion. After the big volume spike, on that date, volume cam down and slowly started to build up again for the bears but there may be some weakness here. I wonder if this is a good price range where short sellers are starting to get concerned? I don't care for news and and am mainly a volume trader. So this trade will be interesting and maybe we get some attention at some point.

If price goes lower, we will revisit if another opportunity presents itself.

OptionsMastery: Looking like more downside on PFE!🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

The Collaborative Edge: Pfizer's Innovation Secret? Pfizer's success in the biopharmaceutical industry hinges on its internal capabilities and a strategic embrace of external collaboration. This proactive approach, spanning diverse technological frontiers, fuels innovation across its operations. From partnering with QuantumBasel and D-Wave to optimize production planning using quantum annealing, to collaborating with XtalPi to revolutionize drug discovery through AI-powered crystal structure prediction, Pfizer demonstrates the tangible benefits of cross-industry partnerships. These initiatives showcase a commitment to exploring cutting-edge technologies to enhance efficiency and accelerate the identification of promising drug candidates, ultimately improving patient outcomes and strengthening Pfizer's competitive position.

The article highlights specific examples of Pfizer's collaborative endeavors. The Pfizer Healthcare Hub in Freiburg acts as a catalyst, connecting internal needs with external innovation. The successful proof of technology in production planning using quantum annealing resulted in significant time and resource savings. Furthermore, the partnership with XtalPi has dramatically reduced the timeframe for determining the 3-D structure of potential drug molecules, enabling faster and more efficient drug screening. These collaborations exemplify Pfizer's strategic focus on leveraging specialized expertise and advanced technologies from external partners to overcome complex challenges in the pharmaceutical value chain.

Beyond these specific projects, Pfizer actively engages with the broader quantum computing landscape, recognizing its transformative potential for drug design, clinical studies, and personalized medicine. Collaborations with technology giants like IBM and fellow pharmaceutical companies underscore the industry-wide interest in harnessing the power of quantum computing. While the technology is still in its early stages, Pfizer's proactive participation in this collaborative ecosystem positions it at the forefront of future healthcare breakthroughs. This commitment to synergy, from basic research to market research, underscores a fundamental belief in the power of working together to drive meaningful advancements in the pharmaceutical industry.

12/23/24 - PFE: new BUY mechanical signal.12/23/24 - PFE: new BUY signal chosen by a rules based, mechanical trading system.

PFE - BUY

Stop Loss @ 24.80

Entry BUY @ 26.71

Target Profit @ 29.54

Analysis:

1. On the Higher timeframe - Prices have stayed above the lower channel line of the ATR (Average True Range) Channel

2. Higher timeframe - Trader Vic's (Victor Sperandeos) 1-2-3/2B Buy pattern...where the lowest current bottom breakout price is greater than the preceding bottom price

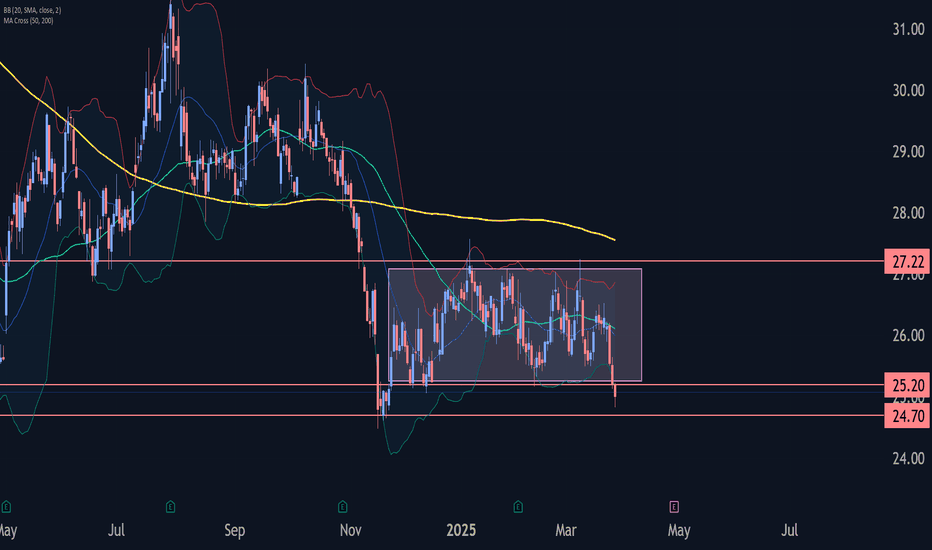

Pfizer Wave Analysis – 27 March 2025

- Pfizer broke support level 25.20

- Likely to fall to support level 24.70

Pfizer recently broke the pivotal support level 25.20 (lower border of the sideways price range inside which the price has been moving from November).

The breakout of the support level 25.20 accelerated the active impulse wave c of the higher impulse wave B from Janaury.

Given the clear daily downtrend, Pfizer can be expected to fall to the next support level 24.70 (former strong support from November and the target for the completion of the active wave B).

Pfizer: Oh Buyer Where Art Thou?Pfizer has struggled for years, and some traders may see risk of further downside.

The first pattern on today’s chart is the slide to a new 12-year low in October and November. The drugmaker barely retraced half that move at subsequent highs. It also remained mostly below its October low of $26.87. That may suggest old support has become new resistance.

Second is PFE’s price action at its 100-day simple moving average (SMA). It fell sharply after breaking that SMA in October and now seems to be stalling at the same line. (See white arrows.) That may reflect a longer-term downtrend.

Third, $25.53 was the weekly close in mid-February. It provided support earlier this month, but yesterday the stock returned to the same level. Could that trigger a breakdown?

Next, the 50-day SMA had a “death cross” under the 200-day SMA in late November. The 100-day SMA followed in December. The resulting alignment, with faster SMAs under slower ones, is potentially consistent with a downtrend.

Finally, PFE is an active underlier in the options market. (TradeStation data shows it ranking 13th in the S&P 500 in the last month, averaging about 110,000 contacts per day.) That could make it easier to position for moves with calls and puts.

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options and futures. If you're born to trade, we could be for you. See our Overview for more.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options or futures); therefore, you should not invest or risk money that you cannot afford to lose. Online trading is not suitable for all investors. View the document titled Characteristics and Risks of Standardized Options at www.TradeStation.com . Before trading any asset class, customers must read the relevant risk disclosure statements on www.TradeStation.com . System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors.

Securities and futures trading is offered to self-directed customers by TradeStation Securities, Inc., a broker-dealer registered with the Securities and Exchange Commission and a futures commission merchant licensed with the Commodity Futures Trading Commission). TradeStation Securities is a member of the Financial Industry Regulatory Authority, the National Futures Association, and a number of exchanges.

Options trading is not suitable for all investors. Your TradeStation Securities’ account application to trade options will be considered and approved or disapproved based on all relevant factors, including your trading experience. See www.TradeStation.com . Visit www.TradeStation.com for full details on the costs and fees associated with options.

Margin trading involves risks, and it is important that you fully understand those risks before trading on margin. The Margin Disclosure Statement outlines many of those risks, including that you can lose more funds than you deposit in your margin account; your brokerage firm can force the sale of securities in your account; your brokerage firm can sell your securities without contacting you; and you are not entitled to an extension of time on a margin call. Review the Margin Disclosure Statement at www.TradeStation.com .

TradeStation Securities, Inc. and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., both operating, and providing products and services, under the TradeStation brand and trademark. When applying for, or purchasing, accounts, subscriptions, products and services, it is important that you know which company you will be dealing with. Visit www.TradeStation.com for further important information explaining what this means.

FEAR PRESENTS A BUYING OPPORTUNITYThe deteriorating sentiment over the last 3 years has created a substantial buying opportunity.

The negative sentiment can be attributed to 4 main things- decreased EPS/ Net Income since 2022/2023 (end of COVID $$), increased debt levels post-Seagen acquisition and revenue challenges due to upcoming patent expirations.

While these concerns are not unwarranted, it is important to note that Pfizer has been through several patent cliffs before while simultaneously growing dividends .

The notable upcoming expirations include the pneumonia shot Prevnar in 2026 and the cancer drugs Ibrance and Xtandi, both in 2027. Pfizer has an exceptional history of capital preservation and therefore will continue to take action to address any potential revenue shortfalls including aggressive cost-cutting measures already in progress.

From a valuation perspective, PFE's shiller PE is currently 9.51 or 94% as low as it has been in the last 10 years and also 89% better than 462 companies in the drug manufacturing industry.

Seeking Alpha gives PFE a grade of F on Growth, but when looking at the individual characteristics not 1 is below a D and only two are D's, and in aggregate looks much better than SA is portraying with a grade of F. Pfizer should not usually be expected to be a grower as it is a mature company.

From a technical standpoint it looks like a double bottom is forming at the bottom of a 12 year trend line.

The Price/ FCF and EV/EBITDA ratios have decreased back to 2023 and prior levels indicating it is no longer overvalued as it was in 2024.

Reverse DCF based on EPS w/out NRI and an 11% discount rate show thaf Pfizer's fair value is $35.89, indicating a 27% margin of safety.

The recent volume shows large-scale buying, probably by institutions.

Overall I believe the negative sentiment mostly due to the upcoming patent expiration and the realization of loss of revenue from COVID era $ is currently baked into the price and presents a decent buying opportunity.

PFE Operation PlanFor this trade on Pfizer (PFE), we will implement a staggered entry strategy with three designated entry points at $26, $25, and $24.5. This approach allows for a cost-averaging method and improved risk management as the market fluctuates.

Our profit targets are set at $28, $30.5, and $31, ensuring we capture gains incrementally as the price moves upward. These targets are based on our technical analysis and current market dynamics. Additionally, strict stop-loss protocols will be in place to mitigate downside risks.

Disclaimer:

This information is provided for educational and informational purposes only and should not be considered financial advice. Trading involves substantial risk, and past performance is not indicative of future results. Always conduct your own research or consult a professional financial advisor before making any investment decisions.