XLM - Inverse Head and Shoulders Setup, Ready for Takeoff (~60%)XLM has a great setup here. You can see the rounded bottom it has formed since last month. It has reset the RSI from the previous pump and is forming a right shoulder of an inverse head and shoulders pattern. I think we may see big volume like we did last time and hit our target pretty quickly if this takes off. I'm entering here and buckling up!

Did my idea help you make a successful trade?

Donations are always welcome and much appreciated!

BTC : 136dZZ2XyUirYUX1nUXwrU6sGgaBNPiFnU

ETH : 0x2fda8b3ebf9f03078d2e4657ebca5c41ed020bf6

XRP : rPVMhWBsfF9iMXYj3aAzJVkPDTFNSyWdKy Tag: 395032582

XLMBTC trade ideas

XLMBTC Low Volume Breakout Imminent Hello Traders!

Today’s chart update will be on the XLM/BTC pairing which is in an interesting position, testing current local support with volume well below average, a break out move may be probable…

Points to consider,

- Trend bullish, probable of new higher low

- Price testing structural support

- .50 Fibonacci acting as resistance

- RSI neutral

- Stochastics showing upwards momentum

- VPVR showing decreasing transactions

- Volume decreasing rapidly

- EMA’s giving price resistance

XLM has had an insane bull move that corrected all the way down to the .786 Fibonacci level before retracing and trading in the now current rage. The trend is overall bullish as we do have consecutive higher lows in place; however this is in a parabolic manner.

Price is testing structural support, previous resistance; a break of this area will be quite bearish as market structure will then not be putting in a new higher high. Local resistance is at .50 Fibonacci level that needs to break upon respect of current support. If this level is broken then a test of the local highs will be more probable.

The RSI is quite neutral at current given time, it can break in any direction, really depends on the next move of XLM. The stochastics currently is projected upwards, we still have room for further upside potential.

The VPVR is interesting, showing us that the volume of transactions is decreasing on both ends, bullish and or bearish; the next move has a high degree of probability of being a flush move. Furthermore the volume itself is declining rapidly, telling us that a breakout is imminent in the near future.

The EMA’s are currently giving price resistance, is price fails to break the EMA’s then XLM will not put in a new higher high, the bullish market structure will no longer be in place…

What are your thoughts on XLM, is a breakout move imminent due to declining volume?

Please leave a like and comment

And remember,

“Hope is bogus emotion that only costs you money.” – Jim Cramer

XLM/BTC having a rest after its epic move; it will be back.After taking a pounding for months and months, XLM/BTC blew up over 50%.

XLM/BTC has taken back territory after each recent drop from BTC, and has recovered on the USD side very quickly after the drops.

If you hate XRP like I do, then XLM comes into view and its always been a profitable coin when I've traded it.

XLM is a sleeping giant.

Stellar Lumens Price Analysis: Bullish Opportunity on the HorizoConclusion for today's Stellar Lumens price analysis:A break above the long term trendline can be used as part of a conservative strategy to go long (i.e. buy) Stellar Lumens.

A log scale of Stellar Lumens price is presented on the 6 hour timeframe with coverage of market action since May 2019.

The long term bearish trendline is plotted on the chart with peak of the price spike on September 18, 2019 used as the second pivot in drawing the trendline. The 200 and 50 moving averages are also drawn to track price for possible trend change(s).

Signs of hesitation for the downtrend as shown on the chart include the formation of a double bottom (ideally bullish) chart pattern between September 6 and September 14, 2019. Confirmation of the pattern occurred on September 17, 2019 when price broke and closed above ~0.00000597.

A retracement to the aforementioned price level i.e. ~0.00000597 can be observed after the price spike, suggesting that Stellar lumens’ price could potentially find support at the price level. A second test would provide additional evidence of bullish momentum picking up and hence change in the trend from bearish to bullish.

The September 24, 2019 bullish crossover (50 moving average above the 200) also does favor a bullish scenario for Stellar Lumens as opposed to the continuation of the long term bearish trend.Confirmation of support at ~0.00000597 (second successful test) provides a great risk/reward ratio for long (buy) positions.

More conservative strategies for initiating long positions however involve waiting for price to close above the long term bearish trendline.Price closing below ~0.00000563 presents a great challenge for the continuation of price action to the upside, therefore invalidating the bullish analysis for Stellar Lumens.

LONG XLM bullish failing wedge breakout ?Price Action(PA) XLM closed above 700 sats resistance level . Closed above EMA 21,50,100,200 Uptrend.

Indicators: RSI above 50 points, MACD bullish crossover above zero line ( bullish sign)

Pattern: Failing wedge bullish breakout.

Bullish Volume respond. Confirm trend.

S/R : Strong support at 600 sats , Resistance at 850 sats .

Disclaimer: THIS IS NOT FINANCIAL ADVICE. All the information shared here is for learning and entertainment purposes only.

XLM Prepared for another wavemost likely XLM has finally formed its bottom and we could get a great trade opportunity here for potentially upto 49% of profits.

entry zone will be between fib50 to fib618 incase if this support breaks than fib786 have to hold the peices.

below fib786 we get a good level to place our stops, if prices hits our stop loss than definitely xlm is going to retest its support or even lower.

Buy XLMBTC 728, 705, 687

Position size 5-10%

T1 800

T2 890

T3 930

T4 1025

SL 620

$XLM, Retraced back to ~700sats level (1st target on the way up)$XLM

Retraced back to ~700sats level (1st target on the way up)

Bouncing from here (flipping this level into support) is key for continuation into new local highs...

Not able to hodl this level would be back to the beginning of what started around September 14th

#XLM

XLMBTC formed bullish Crab pattern | Upto 27% potential tradePriceline of Stellar Lumens / Bitcoin cryptocurrency has formed a bullish Crab and entered in potential reversal zone.

This PRZ area can be used as stop loss in case of complete candle stick closes below this area.

I have defined the targets using Fibonacci sequence:

Buy between: 0.00000717 to 0.00000667

Sell between: 0.00000755 to 0.00000849

Regards,

Atif Akbar (moon333)

XLM/BTC Bounce. XLM (Lumens), the native token of the Stellar blockchain, was one of the leaders of the Altcoin rally we saw the past few days. It rallied ~60% in approximately 3 days before starting to retrace. We have now come down more than 20% from the high of .00000944. We are approaching the .618 Fib retracement level. This is always a good zone to watch for a bounce after such staggering rallies.

The strategy would be to buy as close to the .0618 fib (.00000715 BTC) as possible. This is a short term trade just intend to catch the bounce. Look to take profit around .0000077 for ~5% profit. This zone may become resistance as the price retraces further. Give the overbought conditions on the daily chart holding onto a long position here is too risky for my taste.

Watch for the short term bounce!

Happy trading!

Like comment and subscribe!

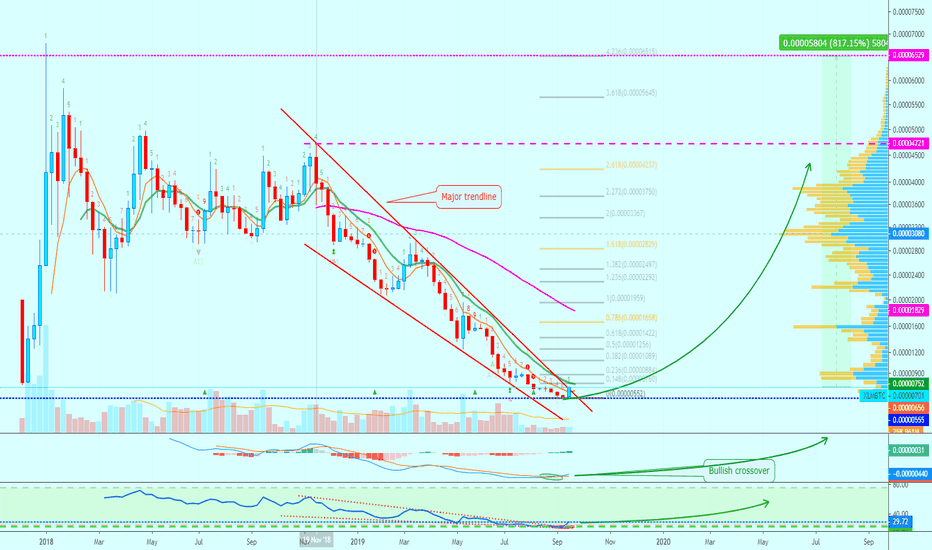

Stellar Lumens Long-term | Weekly Chart Analysis | Over 800%Let's take a look at the Stellar Lumens (XLMBTC) chart long-term, on the weekly time frame...

Let's start with the chart pattern, we can see the classic bullish falling wedge.

XLMBTC is breaking pass the "major trendline" in red. Moving above this level would put XLMBTC above resistance and a new trend can start to take form.

So the market moves in cycles... First, we have a downtrend, the uptrend comes next... How long will it last?

RSI:

The RSI printed the same bullish pattern and hit its lowest point ever, oversold... After a strong bounce, it is showing plenty of room left available for growth (green arrow).

MACD:

The MACD also reached its lowest point ever and is now displaying a bullish cross... Plenty of room available for growth (green arrow).

This is the long-term chart for Stellar Lumens (XLMBTC).

You can see the indicators oversold and sending out strong reversal signals... There are over 800% profits potential to XLM ATH on Binance... Surely, this pair will generate so much more gains/growth in the weeks, months and years to come.

What's your take?

Share your thoughts in the comments section below.

Namaste.

Stellar Lumens Full Chart Analysis | Daily Time-fameWe just looked at Stellar Lumens (XLMBTC) on the weekly time-frame, the long-term chart, now we are going to take a closer look and see what is going on...

Let's start by zooming in on the chart above:

We can see XLMBTC on a very steep decline since November 2018... Stellar never did let go and has been going down since... Only now early reversal signals are starting to show up.

Here we can see a new low being hit (bottom dashed line).

Here can see the volume breakout... We can see volume decreasing and then a sudden jump to print higher volume bars as well as break pass resistance.

The RSI is super strong, over 66.85. This is the highest it has been since March 2019.

If we compare Stellar to other altcoins, we are likely to see some huge growth in the weeks to come... All the details are shared on the chart above.

All the targets are clearly marked... Stellar Lumens is now super bullish.

Thanks a lot for your continued support.

Namaste.

_____________________________

Weekly analysis for Stellar Lumens (XLMBTC)

$XLM, Looking quite good aswell..$XLM / $BTC

Looking quite good aswell..

Currently against resistance level at ~710sats (buying now could be risky so wait for a confirmed flip!)

if flipped then aiming for ~850 sats as 1st target

Volume flowing in

UCTS Buy signal flashing on the daily (and lower TFs)

#XLM