XLM/USDT Secondary trend. 14 04 2025Logarithm. Time frame 3 days. After a big pump "with a stick" (so that the "waiters" who want "a little cheaper" would not have time to buy) +8.5X from the accumulation zone of 2.4 years, now a descending wedge is forming on the rollback, similar to 2017. Breaking through its resistance (breaking the downward trend) - the second wave of price growth:

1) through consolidation and sideways movement (cutting the zone, dumping "in waves").

2) aggressive pump as in 2017 "with a stick" and entry into the main distribution zone (late autumn 2025)

The previous idea of the secondary trend was published on 14 01 2024 Exactly when the position was being collected in the horizontal channel in the 4 zones shown, as well as the reversal zone and the percentage of this first strong pump (under XRP).

XLM/USDT Secondary trend. 14 01 2024

XLM/USD Main trend. Timeframe 1 week. Channel. Publication in 2022.

Local wedge breakout zone.

XLMUSD.P trade ideas

Ripple Cycle XRP-XLM"Nothing new Under the sun" from the bible

using the cycle charts wise i do belive we are at the bottom theres not price action to prove or theres not much i can do to prove.. im going off the charts even tho we are bearish i did take a loan out thinking this is the bottom.

Feedback anyone what your thought.

At the beging of the chart we consider candles not wicks.

The Case for $XLMA laggard compared to its sister, XRP.

XLM showing potential for a breakout. XRP & XLM once traded together almost systematically, XRP was able to break out of its wedge repeating its performance of 2017. Although past performance does not indicate future performance its important to reference.

XLM seems ready to sweep sell side liquidity one last time before its next leg up out of its wedge.

Ill continue to add to this thread as the days go on.

XLM - Still Moving With XRP XLM has made a strong move along with XRP and has perched itself on top of the Monthly Gaussian Channel

I have posted the comparable move that occurred in 2017 which puts price above $40, I doubt it will perform as well as previously but its cool to see.

Very bullish on this Monthly

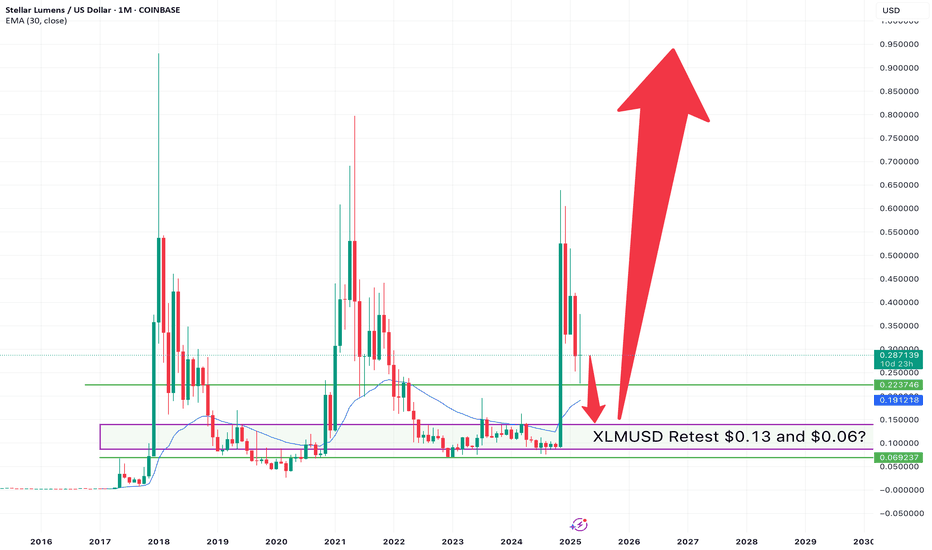

From Crypto Winter to Crypto Depression - Trouble for StellarStellar or XLM is in major trouble as it fights for its life in the crypto world.

If Bitcoin, Ethereum crashes - the alt market does tend to follow similar to major stock indices versus minor.

And there is no exception for this.

Now there are a few other reasons for Stallars downside to come including:

💥 1. Crypto Market Crash

A broader sell-off across crypto markets has dragged Stellar down with it.

📉 2. Lack of Developer Activity

Stellar is facing declining interest from developers compared to rival platforms.

💰 3. Investors Moving to Bigger Coins

Investors are shifting funds to Bitcoin and Ethereum for perceived stability.

🚫 4. Partnerships Falling Through

Several high-profile partnerships have quietly ended or stalled.

🧊 5. Low Community Engagement

Social media buzz and community activity around Stellar have hit new lows.

Here are basic technicals.

M Formation broke downn

Price below 20MA

First target to 200MA

Next to $0.135

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

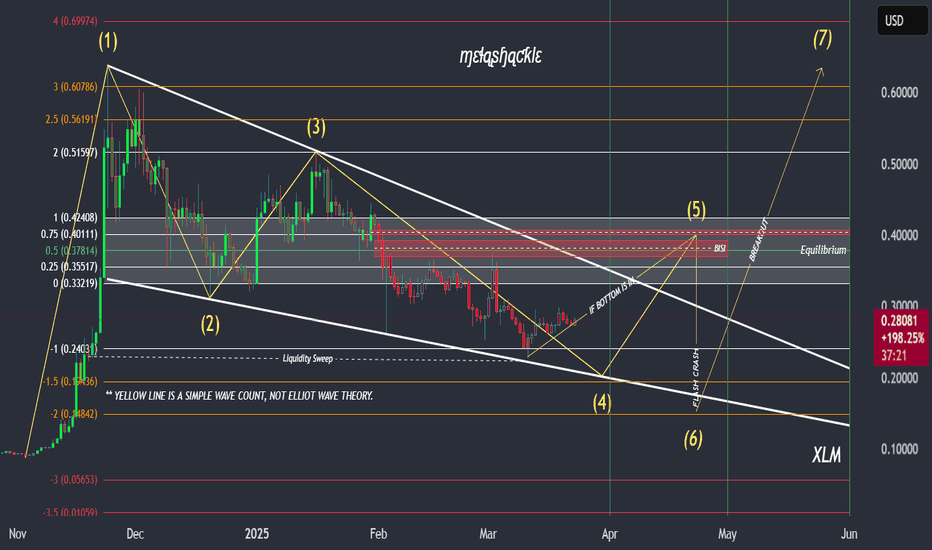

XLM charts with April 'flash crash' thesis zones.Here's my latest XLM chart, which includes potential levels that could be hit, along with an alternative path for the 5th wave, assuming the bottom is already in on the chart.

- If wave 4 is already complete, then the wave 6 "flash crash" low would likely be higher than the chart shows.

- If wave 4 isn't complete, then the wave 6 "flash crash" would likely sweep that low, prior moving into the real breakout beginning in the month of May.

- The real breakout, the 7th wave, would likely take out the previous pattern high making a run for what could potentially become a new all-time high in XLM.

Keep in mind that the "flash crash" in April is a theory and may not come to fruition or could be off in timing. However, I do believe that the breakout will begin in May, even if the "flash crash" does not occur in mid to late April as I've theorized.

Good luck, and always use a stop loss!

XRPUSD and XLMUSD side by sideThe XRPUSD and XLMUSD pairs are showing divergent trends, with XRPUSD moving sideways and XLMUSD trending downward, which is considered bullish. however we know these pairs move together. XLMUSD has formed a triangle pattern that is nearing its apex, suggesting a potential breakout by the end of March or early April. This squeeze indicates an imminent move, either to the upside or downside, for both pairs despite their current differences. While the exact direction remains uncertain, historical patterns suggest significant potential for growth. If XLM were to replicate its performance from the previous bull run, it could potentially reach at least $4. However, it's important to note that market conditions and regulatory factors may influence the outcome.

XLM/USD "Stellar vs US Dollar" Crypto Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XLM/USD "Stellar vs US Dollar" Crypto market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

Thief SL placed at the recent / swing low level Using the 4H timeframe (0.30000) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 0.23000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

XLM/USD "Stellar vs US Dollar" Crypto market is currently experiencing a Bearish Trend,., driven by several key factors. 📰🗞️Read Fundamental, Macro, COT Report, On Chain Analysis, Sentimental Outlook, Intermarket Analysis, Future Prediction:

📌Keep in mind that these Fundamental factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

HUGE BULL FLAGDo NOT fall asleep on this BULL FLAG

formation on XLM. We could have one

more touch at the bottom of the flag

formation around .19 cents.. or it's possible

that we could just keep moving up and

break out without the last touch on the

line shown above. I believe we will get

the that last touch based on what I see

on ETH. ETH has been moving down since

Nov 2024...looks UGLY to. XLM has also moved

down since Nov 2024 however, it's developing

a BEAUTIFUL BULL FLAG that will break to the

upside soon! Spot buy here is smart. If we

do get that final touch I would go ALL IN...LOL

Good luck and...

********* HAPPY XLM HUNTING ********

XLM short termHello

this time I am posting a short term idea (few days to few weeks).

After explosion in Q4 of 2024 XLM has formed a downtrending channel which can potentially turn into a bull flag.

Currently XLM price is sitting at a bottom of this channel.

Short term traders can look to purchase some XLM now and wait till it comes towards the top of the channel to sell and get some profit. If it reaches top of the channel potential is 50% price increase.

If the market turns bullish in next few days to weeks XLM might even break upwards out of this bull flag but do not count on it just yet.

This idea is somewhat risky so proceed with extreme caution and with tight stop-loss below the channel.

Good luck.

Stellar: A Prime Opportunity Amid Market CorrectionsHello,

The Stellar network is an open-sourced, public blockchain powered by the Stellar Consensus protocol (SCP), a Proof-of-Agreement (PoA) consensus mechanism. Thanks to PoA, the Stellar network is faster, cheaper, and far more energy-efficient than many other blockchains.

Stellar (XLM) is currently undergoing a corrective phase, presenting a strategic opportunity for investors ahead of a potential market rebound. While short-term price action remains subdued, the broader outlook remains strong, especially as institutional adoption gains traction.

The recent push by the U.S. government to establish official cryptocurrency reserves has triggered market-wide volatility. However, this move could be the catalyst for a global shift, with other nations expected to follow suit. As governments begin accumulating digital assets, Stellar—known for its efficient cross-border transactions—stands to benefit significantly.

Once more countries establish their crypto reserves, demand for established cryptocurrencies like Stellar will increase, positioning it for long-term growth. The current correction serves as a healthy reset, setting the stage for a major breakout in the near future. Investors should watch closely for confirmation signals to capitalize on this emerging opportunity.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

(xlm) STELLAR "LOOP"This chart looks like there is no real volume and only someone very rich controlling the price of XLM. If I missed the top to sell and the price of XLM never went higher than previous ATH the price of most cryptocurrency is what would otherwise be stuck in a loop with very little interest from real investors. How is it possible for the chart to be like this?

Technical Analysis of XLM | Short-term Bearish Signal

Based on recent observations in the crypto market, XLM is showing signs of weakness in its price structure. Given the formation of a bearish pattern and the price’s reaction to key resistance levels, a downward move exceeding 10% is anticipated in the short term.

Support levels and bearish targets have been identified, and if a breakout is confirmed, the downward momentum could accelerate. Cautious traders may consider exit strategies or risk management plans.

⚠️ This analysis is for informational purposes only and does not constitute financial advice.

XLM is going to put some smiles on people's faces very soon!The XLM chart appears to be showing some serious potential for growth. Currently trading within a descending wedge pattern and displaying a 5th wave internal wave count, XLM could outperform many people's expectations if the 5th wave plays out. Although many people tend to prefer XRP over XLM, I wouldn't count it out just yet, as—with recent price increases—it has potentially become more desirable compared to XRP due to its lower entry price range. As we know, many people don’t have a lot of extra cash just lying around nowadays.

Good luck, and always use a stop loss!

50 EMA Resistance good day team, please see how that value zone resistance crept back into the picture, we need a clean break from that resistance and possibly a retest, please be careful, please observe the falling wedge we are breaking free from, also notice how the 50 EMA is serving as a resistance