XMRUSD trade ideas

The invisible coin club (Monero $XMR)Setup

The price has pulled back to a formerly significant price pivot at 300 after hitting a 4-year high over 400 in April. The price is well above its up-sloping 30-week moving average.

Signal

The daily chart shows a potential breakout from a base formed above 300 with RSI also confirming the bullish turn with a break over the 50 level.

XMR 3 Month Heikin Ashi Trend ChartWe have here a trend outlook chart for Monero on a 3 monthly timeframe (Heikin Ashi candlestick chart). XMR is one of a handful of high market cap coins which have showed signs of strength on a variety of indicators (despite high volatility with various other high market cap coins), including the positive MACD and RSI indicators as shown in this chart.

In addition, there has been significant buy volume in the 170 - 277 price range, as can be seen in the Price-Volume indicator to the right of the chart, keeping the price up.

Monero has withstood the political and economic turmoil in recent months making it a strong contender against some of the largest market cap coins. With the current price sitting at approximately USD$315, there is potential for further upside in the long-term.

_____________

This publication and the information contained in it are for educational purposes only, and is not meant to be nor does it constitute financial, investment, trading or other types of advice or recommendations.

Monero Yeet RetracementWith the big God Candles ended be reminded the Monero KRAKEN:XMRUSD has pulled back to the 50% Retracement of the move at 292. Monero is still up 53% YTD and in the past has shown signs of great resiliency and a "safe haven asset" within crypto itself. Monero outperforms all others crypto during bear market cycles as it holds its value better.

BITFINEX:XMRBTC Monero versus Bitcoin is still up +44% YTD

His name is Monero- Despite numerous attempts by various projects to create private coins or tokens, none have succeeded meaningfully.

- Monero is the Bitcoin of the darknet. They can delist it or try to kill it, but Monero is here to stay.

- With rising concerns over privacy and the inevitable push toward CBDCs, the next bullish cycle could drive XMR to a new ATH, $1,000 is a realistic target, not a fantasy.

- Everything you need is in the chart. This is not financial advice, buy only when you believe the time is right.

Happy Tr4Ding !

Case for Monero ContinuesTL;DR:

Monero is used as a currency giving it a relatively stable value during all seasons

There has been and will continue to be large transfers of Bitcoin to Monero creating supply shocks and XMRUSD RIPs

I have been heavily focused on sharing my bull case for Monero for over two years now. That made for a very disturbing morning on February 4th, 2024 when I woke up to see KRAKEN:XMRUSD down more than -30%. My first thought was, "oh no... someone cracked its privacy!" Then I read the details; it had been delisted from Binance for "being impossible for government to track and therefor banned in many countries." So... Monero was actually "working as intended." Buy!

There are only 3-4 cryptocurrencies that matters to me: Bitcoin, Monero, and which wins between Ethereum/Solana. These cryptocurrencies represent the established use cases thus far respectively in Store of Value, Currency, and Smart Contracts. I have been writing about Monero for several years now relating my observations about its uses, price performance, and future predictions. Recent events have proven my thesis to be accurate and I am confident will continue to be.

Performance versus Bitcoin:

One criticism of observing recent or past outperformance of BITFINEX:XMRBTC is "zoom out bro" where the full decade plus price trend it noted. This is undeniable. However, one should remember the investing adage: "past performance is not indicative of future results." One should also not be ignorant of the facts leading to extended periods of outperformance and what they mean for future market conditions.

During the crypto winter of 2022 Monero outperformed Bitcoin as a product of Monero holding its value, presumably because of its continued use as a medium of exchange (currency), while Bitcoin fell precipitously.

The same outperformance happened again when Bitcoin had a less dramatic decline in value during 2024. Again, Monero maintained a relatively stable valuation.

Year to Date as a product of Monero's prior stability and the catalyst event (I will talk about later) have driven a period of outperformance yet again.

Store of Value

Bitcoin's use case as a Store of Value is well established. Prior to the last Halvening event Bitcoin was actually MORE inflationary than Monero. Now the inflation rate for Bitcoin and Monero is 0.83% and 1.7% respectively. Monero has an inflation rate known as a "tail emission." The inflation rate actually declines over time as the amount of new Monero being added (432,000 annually) is fixed. There will actually be a point where they are close again around late 2027 when the rates will be 0.83% and 0.82% respectively. As Bitcoin rewards continue to decrease there will never be a point where Monero's inflation is less than Bitcoin's.

However, being inflationary or deflationary alone does not grant or guarantee value. Bitcoin will always hold the title of "most deflationary" between the two. Having limited supply and being scarce is not enough to give something value. Intrinsic value is derived from many potential factors and one that is common between both of them is: use as a medium of exchange. Monero is actually proving to be more used as a medium of exchange.

"Monero is what people think Bitcoin is."

I have been observing over the last two years a shift on the Darknet markets that there are two primary currencies: Bitcoin and Monero. What is interesting is that some Darknet markets have ceased transacting in Bitcoin entirely and rely exclusively on Monero. This is one of the reasons that Monero has maintained its value over this time. The reason is Monero's primary use case: private money. Monero is built upon privacy by default. This is originally what Bitcoin was perceived to be. Now, the public nature of Bitcoin is seen as a value proposition for state and corporate adoption to the benefit of NGU (Number Go Up) but it provides no security for those that value privacy.

"What about Zcash?"

There are other privacy coins, sure. Often times when I talk about Monero these competing coins are brought up in the context of "interesting technology." Tech matters less to use. You can have amazing tech that is worthless if no one uses it. This is analogous to the platform war between Betamax and VHS. Betamax arguably had better technology but the consumer market chose VHS and that became the standard.

As long as Monero "has privacy" then any other cryptocurrency that "has privacy" has only equal use case. What matters then is the market; the consumer. And the market and consumers have already decided to use Monero. The network effect has already taken over. It will be incredibly unlikely that any other privacy coin can reach the same network effect and supplant Monero.

Bitcoin is worthless without state approval

In 2023 and 2024 hackers that had somehow broken into the Darknet market of Silk Road and the Cryptocurrency exchange Bitfinex were captured, prosecuted, deprived of freedom, and forced to surrender their Bitcoin many years after their crimes were committed. We are talking billions of USD worth of Bitcoin that were rendered worthless to their ill gotten owners. What should have been realized then was that all Bitcoin, despite being permissionless, is worthless to its owner without full state approval. You can hold it, send it, and trade it but if government does not approve it will find you and take your freedom. That is, of course, unless you hand it over to them and they might give you some of that freedom back.

So it became rather obvious that should a hacker acquire copious amounts of Bitcoin they would invariable seek to privatize these gains. Just such an event happened in April. Allegedly, a hacker gained access to a very old Bitcoin private key containing nearly $330 million worth of Bitcoin and then proceeded to convert it to Monero irrespective of transaction costs and liquidity. This created an acute supply shock leading to a huge RIP. Many smaller exchanges "ran out" of Monero exacerbating the supply shock and leading to further appreciation.

This is a catalyst that is founded upon rational actions albeit not ethical. We can presume that such catalysts will continue to happen into the future.

Technical Analysis

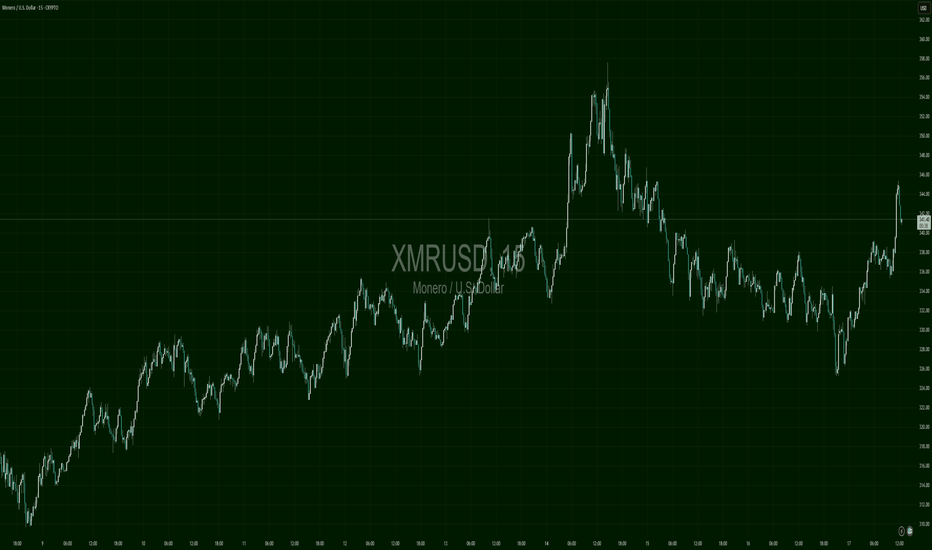

Monero has been very hard to trade using my standard methods. Because of its normal stability of value it lacks clear and robust trends to play pullbacks. However, there is a definite recent trend to look at now. I am very interested to see where and if Monero establishes a new trading range because then I can look at the lows of this range to accumulate more. The potential 50% Retracement level of the present price action is 292.

Conclusion

During all seasons both bullish and bearish Monero will continue to be used as a medium of exchange and maintain its Store of Value. Monero has already reached adoption level in the use case of privacy which establishes a moat of competitive advantage versus any other privacy coins. As long as humans use cryptocurrency they will value the privacy advantage of Monero versus Bitcoin and periodically and unexpectedly convert between the two leading to huge supply and price shocks.

Will XMR tripple top?Monero / XMRUSD has been seeing amazing gains since the April 7th Low, despite this week's natural technical correction.

There is a massive Rising Resistance originating from the December 18th 2017 High that price also the 2021 Cycle Top, which poses as the next most probable target.

We expect to test it around 580.

If it breaks, it is not impossible to see the uptrend complete a +1000% rise from the bottom as it did in 2021.

Follow us, like the idea and leave a comment below!!

Monero completes 8-YEAR Wycoff Re-accumulation Range $XMR #XMRThis 8-year range for OMXSTO:XMR has followed the Wycoff re-accumulation pattern to a tee. Insane possibility heres for the log timeframe. Monero is quite a few years behind bitcoins chart, with a 1% yearly inflation rather than halvenings anymore; however, the fixed supply of Monero will experience the exponential growth that Bitcoin has seen, and monero has gotten a taste of. 4 digits soon enough, 5 digits someday.

Privacy Coins Surge: Monero & Zcash Lead $10B Rally In the ever-dynamic and often boisterous world of cryptocurrency, where hype cycles can inflate and deflate valuations with breathtaking speed, a particular sector has been making significant strides, albeit with less fanfare than its more mainstream counterparts. Privacy coins, designed with the core tenet of offering users enhanced anonymity and transaction confidentiality, have been steadily gaining traction. Recently, this burgeoning niche has quietly crossed a significant milestone: a collective market capitalization exceeding $10 billion. Spearheading this charge are two of the most established and technologically distinct players in the privacy space: Monero (XMR) and Zcash (ZEC), both of which have recently shown notable activity on price charts, signaling growing investor interest and a potential re-evaluation of their intrinsic value.

The concept of financial privacy is hardly new, yet its application in the digital realm, particularly on inherently transparent blockchains like Bitcoin’s, presents unique challenges. While Bitcoin transactions are pseudonymous (linked to addresses, not directly to real-world identities), the public nature of the ledger means that with enough analytical effort, transactions can often be traced and linked. Privacy coins aim to solve this by employing sophisticated cryptographic techniques to obscure sender and receiver identities, transaction amounts, and other metadata that could compromise user anonymity.

Monero (XMR): The Standard-Bearer for Obligatory Privacy

Monero, launched in 2014, has long been considered one of the most robust and uncompromising privacy coins. Its core philosophy revolves around the principle that privacy should be default and mandatory for all users and transactions. This is achieved through a multi-layered approach to obfuscation:

1. Ring Signatures: This technique allows a sender to sign a transaction amongst a group of other possible signers (decoys pulled from the blockchain), making it computationally infeasible to determine which member of the group actually authorized the transaction. The size of this "ring" enhances the ambiguity.

2. Stealth Addresses: For every transaction, a unique, one-time public address is generated for the recipient. This prevents linking multiple payments to the same recipient address, a common method for deanonymizing users on transparent blockchains.

3. Ring Confidential Transactions (RingCT): Implemented in 2017, RingCT obscures the amounts being transacted. While the network can cryptographically verify that no new coins are being created out of thin air (i.e., inputs equal outputs), the actual values remain hidden from public view.

This combination ensures that Monero transactions offer a high degree of unlinkability (difficulty in proving two transactions are related) and untraceability (difficulty in determining the sender/receiver). This commitment to always-on privacy has made Monero a favorite among those who prioritize true financial anonymity, believing it essential for fungibility – the property where each unit of a currency is interchangeable with any other unit. If some coins can be "tainted" by their transaction history (as can happen on transparent ledgers), true fungibility is compromised.

The recent positive performance of Monero on the charts could be attributed to several factors. There's a persistent underlying demand from users who genuinely require its privacy features. Furthermore, in an environment of increasing discussion around Central Bank Digital Currencies (CBDCs) and heightened digital surveillance, assets that offer an alternative path to financial confidentiality may be seeing renewed interest.

Zcash (ZEC): Optional Privacy with Cutting-Edge Cryptography

Zcash, launched in 2016, takes a different approach to privacy, offering it as an option rather than a default setting. It utilizes a groundbreaking cryptographic technique known as zk-SNARKs (Zero-Knowledge Succinct Non-Interactive Arguments of Knowledge). This allows one party (the prover) to prove to another party (the verifier) that a statement is true, without revealing any information beyond the validity of the statement itself.

In Zcash, this translates to the ability to conduct fully "shielded" transactions. When a transaction moves from one shielded address (a "z-addr") to another, the sender, receiver, and amount are all encrypted on the blockchain, yet zk-SNARKs are used to prove that the transaction is valid according to the network's consensus rules (e.g., the sender had the funds, no double-spending occurred).

Zcash also supports "transparent" addresses (t-addrs), which function similarly to Bitcoin addresses, with all transaction details publicly visible. Users can choose to transact transparently, from transparent to shielded, from shielded to transparent, or fully shielded. This optionality aims to provide flexibility and potentially cater to a broader range of users and regulatory environments, allowing for auditable transparency when desired, while still offering robust privacy when needed.

The recent chart activity for Zcash might reflect growing appreciation for its sophisticated technology and its unique positioning. The development and improvement of zk-SNARKs are at the forefront of cryptographic research, and Zcash is a prime example of their real-world application. As the crypto space matures, there may be an increasing demand for solutions that can offer strong privacy while also providing pathways for selective disclosure or compliance, a balance Zcash aims to strike.

Why the Quiet Surge to $10 Billion?

The collective rise of privacy coins to a $10 billion market capitalization, while "quiet" relative to mainstream crypto narratives, is significant. Several undercurrents could be contributing to this growth:

1. Growing Awareness of Blockchain Transparency: As more individuals and institutions interact with cryptocurrencies, the implications of permanently public ledgers are becoming better understood. High-profile cases of blockchain analysis being used to track funds (for both legitimate and questionable purposes) highlight the lack of inherent privacy in many popular cryptocurrencies.

2. Desire for Financial Sovereignty: For some, the ability to transact privately is a fundamental aspect of financial freedom and sovereignty, akin to using physical cash. Privacy coins offer a digital equivalent.

3. Concerns Over Digital Surveillance: The increasing digitization of finance, coupled with discussions around government-issued digital currencies, has raised concerns about potential mass financial surveillance. This may drive some users towards privacy-preserving alternatives.

4. Maturation of Privacy Technology: The cryptographic techniques underpinning coins like Monero and Zcash have been developed, battle-tested, and refined over several years, increasing confidence in their efficacy.

5. Niche Use Cases: While sometimes controversial, privacy coins serve legitimate niche use cases, such as individuals in oppressive regimes needing to protect their financial activities, or businesses wanting to keep sensitive commercial transactions confidential from competitors.

6. Market Diversification: As the overall crypto market grows, investors may look to diversify into sub-sectors like privacy coins, especially if they perceive them as undervalued relative to their utility or technological innovation.

The "Quiet" Aspect and Lingering Challenges

Despite their technological sophistication and growing market cap, privacy coins operate in a somewhat contentious space, which contributes to their "quiet" ascent.

1. Regulatory Scrutiny: The primary challenge comes from regulators worldwide. Concerns that privacy coins can be used to facilitate illicit activities like money laundering or terrorist financing have led to increased scrutiny. Several exchanges have delisted privacy coins in certain jurisdictions to comply with KYC/AML (Know Your Customer/Anti-Money Laundering) regulations. This regulatory pressure can stifle adoption and create uncertainty.

2. Perception Issues: The association, whether fair or not, with illicit activities has created a perception challenge for the sector. While proponents argue that any financial tool can be misused and that privacy is a fundamental right, this narrative can be difficult to overcome.

3. Complexity: The advanced cryptography involved can make these coins less accessible to the average user compared to simpler cryptocurrencies. Explaining the nuances of ring signatures or zk-SNARKs is more challenging than explaining Bitcoin.

4. Development and Governance: Like all crypto projects, ongoing development, robust governance, and maintaining network security are crucial and require significant resources and community effort.

The Significance of the $10 Billion Milestone

Reaching a $10 billion collective market capitalization is a testament to the resilience and perceived value of the privacy coin sector. It indicates that despite regulatory headwinds and perception challenges, there is a substantial and growing demand for financial privacy in the digital age. While still a relatively small fraction of the total cryptocurrency market, it's a clear signal that a significant number of users and investors believe in the importance of these tools. This milestone provides a degree of validation for the developers, communities, and users who have championed the cause of digital financial privacy.

Future Outlook

The path forward for privacy coins like Monero and Zcash will likely remain complex. They will continue to navigate a challenging regulatory environment, engaging in an ongoing dialogue about the balance between privacy and law enforcement. Technological innovation will be key, not only in enhancing privacy features but also in improving user experience and potentially developing solutions that can address regulatory concerns without compromising core principles (as Zcash attempts with its optional transparency).

Education will also play a vital role – helping the public and policymakers understand the legitimate needs for financial privacy and the capabilities and limitations of these technologies. The debate over financial privacy is far from over, but as Monero and Zcash move up and the sector surpasses the $10 billion mark, it's clear that the demand for confidential transactions is a persistent and growing force in the digital economy. The quiet surge may be a prelude to a louder conversation about the future of money and the fundamental right to privacy in an increasingly interconnected world.

XMR LOOKS SUPER BULLISH (1W)Before anything else, pay attention to the timeframe of the analysis; it’s weekly.

It seems that wave C of the weekly triangle has ended, and the price has entered wave D.

Wave D could progress up to the ATH or even slightly exceed it.

For wave E, we will have a rejection, and then the main upward move will form.

On the chart, we have marked a green line as our KEY LEVEL. As long as the price stays above this line, XMR is super bullish.

A weekly candle closing below the invalidation level will invalidate the analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

[$XMRUSD] Monerochan is riding the bull KRAKEN:XMRUSD

+++ Quick update and follow-up to 'The only true crypto currency.' from Jan 13 2025 +++

🗺️Macro-mentals

What the f* is going on?

How is it effecting Crypto overall as 'an alternative to FIAT-Money'

↗️ Dollar-debt getting slowly out of control (Moody's honest down-grading from 'Aa1 to Aaa')

⬆️ Trade-Wars are de-escalating lately

↘️ ongoing geopolitical risk (ME/Israel/Iran, EU/Ukraine/Russia, ...)

🚀 Pumpa-mentals

How far can Monero pump in this cycle?

1) BTC has to top and stay there for a full-on alt-cycle

2) No black-swan this time (Israel-Iran Attack, etc.)

--

Entry : 200 USD

Profit-taking : 550 USD and above -> that is already 2,75x (175%)

Profit-taking : 600 USD and above -> for all greedy degens

Stop-Loss/Repositiong : 165 USD

So, to sum it up:

I hope you went long, and are flying with Shen-Long 🐉

Please like / share / comment /dislike!

Monero's path to 500$ As bitcoin become mainstream and institutional, people are going to learn the concept of crypto currencies. Monero has a specific and unique use case. Like or dislike, it is going to stay and live.

Technically, the chart is looking super bullish. BItcoin is very near ATH, possibility of breakout to new top is likely. We can just check what gold did on a similar pattern to tell us a the information we need.

GOLD

BTC

The orange line is a trend line similar to BTC and gold.

By connecting these we can take an approximate guess on where Monero is going.

You can also see two accumulation period. One under a major support and the other over the major supper which indicates a strong momentum.

It is also possible to look at the cups break out after those accumulations.

The only downsize here is that Monero's total volume transactions is not peaking

bitinfocharts.com

Maybe it is possible to explain this because there is a good amount that are on exchanges? Hard to say, what you think?

In the end, it is clear that Monero is bullish right now and a buy with a target of 500$

If BTC and cryptos are becoming more main stream and people gain knowledge, Monero will inevitable gets its fair of share.

Another Cup and Handle?Bullish continuation on this asset, as long as BTC can hold current support. Almost an identical pattern from its initial rise many years ago. My only concern is they were delisted from the major exchanges not too long ago. Whilst that is normally bearish for bulls, some charts appear to have their own mind. This is priming up for another major move.

XMR in a-distribution Wycoff phaseLooking for XMRs final UTAD before bear market

PSY—preliminary supply, where large interests begin to unload shares in quantity after a pronounced up-move. Volume expands and price spread widens, signaling that a change in trend may be approaching.

BC—buying climax, during which there are often marked increases in volume and price spread. The force of buying reaches a climax, with heavy or urgent buying by the public being filled by professional interests at prices near a top. A BC often coincides with a great earnings report or other good news, since the large operators require huge demand from the public to sell their shares without depressing the stock price.

AR—automatic reaction. With intense buying substantially diminished after the BC and heavy supply continuing, an AR takes place. The low of this selloff helps define the lower boundary of the distribution TR.

ST—secondary test, in which price revisits the area of the BC to test the demand/supply balance at these price levels. For a top to be confirmed, supply must outweigh demand; volume and spread should thus decrease as price approaches the resistance area of the BC. An ST may take the form of an upthrust (UT), in which price moves above the resistance represented by the BC and possibly other STs before quickly reversing to close below resistance. After a UT, price often tests the lower boundary of the TR.

SOW—sign of weakness, observable as a down-move to (or slightly past) the lower boundary of the TR, usually occurring on increased spread and volume. The AR and the initial SOW(s) indicate a change of character in the price action of the stock: supply is now dominant.

LPSY—last point of supply. After testing support on a SOW, a feeble rally on narrow spread shows that the market is having considerable difficulty advancing. This inability to rally may be due to weak demand, substantial supply or both. LPSYs represent exhaustion of demand and the last waves of large operators’ distribution before markdown begins in earnest.

UTAD—upthrust after distribution. A UTAD is the distributional counterpart to the spring and terminal shakeout in the accumulation TR. It occurs in the latter stages of the TR and provides a definitive test of new demand after a breakout above TR resistance. Analogous to springs and shakeouts, a UTAD is not a required structural element: the TR in Distribution Schematic #1 contains a UTAD, while the TR in Distribution Schematic #2 does not.

Random Monero God Candle??The "reason" KRAKEN:XMRUSD RIPPED to $339 overnight was because of a hack:

Nine hours ago a suspicious transfer was made from a potential victim for 3520 BTC ($330.7M)

Theft address

bc1qcrypchnrdx87jnal5e5m849fw460t4gk7vz55g

Shortly after the funds began to be laundered via 6+ instant exchanges and was swapped for XMR causing the XMR price to spike 50%.

Apparently it was an OG Bitcoiner that had funds on a CEX (Centralized Exchange). The hacker spent upwards of 7 figured in fees across different exchanges to convert the Bitcoin into Monero.

This event is in line with Bullish thesis:

Very public arrests of the Bitfinex and Silk Road hackers from tracing their surveillance chain (Bitcoin) makes it obvious that privacy is of highest value.

Monero has low liquidity: expect more random god candles.

The relative outperformance of Monero versus Bitcoin BITFINEX:XMRBTC continues this year:

Privacy matters, and it will cost you in the futureGood day Investor and traders,

When the criminals run show, they definitely don't want you to know it.

Privacy is a double edged sword. However, just because criminals use it doesn't mean it should shunned upon. Criminals also wear clothes and use curtains. Both are fashion statement second, but serve as privacy first. Enough of my opinion, the chart speaks for its self.

Other than my additions, this is a naked chart of XRM on the weekly. It shows a very distinct patterns of how it moves.

XMR is another coin that was in my thesis from a couple years back in the bear market of 2022 that was the "lengthening or alternating" altcoin cycles. Another cycle that looks like it want to repeat, just much more drawn out. I do believe it will repeat, it might take 10-20 years or so to do so. The next big phase of privacy might have to have people getting a taste of CBDC or UBI, before they realize how much it will, or most likely could infringe upon their privacy. The chart shows early investors already knew this. Look at that move from 2016 to 2017 25 cents to $480 dollars. WOW, that rivaled XRP's big move!!! The key pattern here is the initial move then the big correction, the retest (double top) and how it moves with the fib levels. I have highlighted this in the chart with the Monero XMR logo and and a circle then with the yellow rectangle. Its the same pattern just waaaay drawn out. So, after this double top M then correction, marks the key before price explosion. IMO, I don't think it's and "IF" it happens, but "WHEN" it happens. These types patterns are what sparked my original thesis on these coins. IMO there is a reason other than just profits, early investor recognized the eventual use case, just like in Bitcoin.

Let me know what you think in the comments.

Kind regards,

WeAreSat0shi

XMR: I was there, Gandalf. I was there 3000 years ago...In the crypto space, it's quite difficult to talk about long-term trading because very few coins actually survive for a long time and continue to show cyclical dynamics. But when such coins do appear, their setups can be published in a textbook on technical analysis.

On the weekly chart, we see a formed Wyckoff accumulation structure with almost all the features inherent to this structure on the chart.

We can see how smart money accumulated their positions from mid-2022, conducted a local rally in early 2023, thus forming a range in which we have been for almost 2 years .

This was possible due to the negative sentiment around the coin (tightening regulatory screws, delisting from a number of exchanges, including Binance on February 20, 2024 ) and the lack of speculative hype around XMR.

However, the price has now broken out of the range and confidently consolidated above it, and right now there is a good opportunity in terms of Risk/Reward to go long on XMR.

It should be noted that the trade will be positional, with a horizon of more than 6+ months. However, the wait may be justified because the volume profile on the chart does not illustrate large "walls," i.e., potential seller pressure across the entire price range up to the ATH . KRAKEN:XMRUSD

MONERO: $161 | Rule #1 a heads up for when to hop on and hop off

the crypto cyclical bull bear flat markets

we have the pre halving PUMP

the never ending dump

and the post halving insatiable madness

12 to 24 day lead time forward price action

meaning when BTC begins to PUMP

you get validation 12 to 24 days later

you miss out 15% to 35%

in the alts you will miss out 150% to 300%

--

same when BTC peaks

you get confirmation 12 to 24 days after the fact

that game over for reset back to when the banker started the cycle

good lucks and remember Rule #1

"we dont talk about MONERO"

keep safe fellas