XMRUST trade ideas

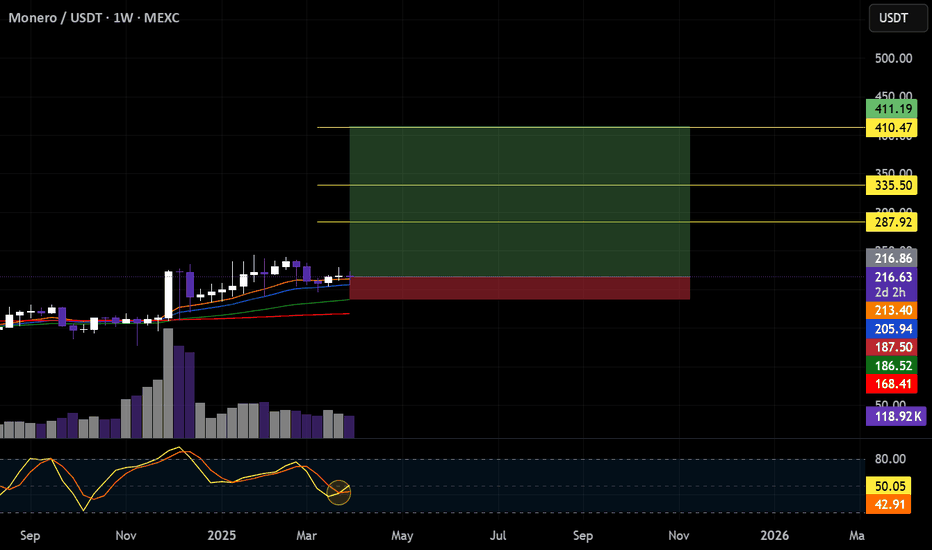

XMRUSDT broke resistance, waiting for consolidation XMRUSDT is consolidating against the background of an upward (bullish) trend. The coin reacted weakly to yesterday's bitcoin pullback and is testing consolidation resistance with the aim of continuing growth

Scenario: at the moment the price makes a breakout of 401.65. Consolidation of the price above the level will confirm the intentions of buyers to go to the intermediate target of 440.0. Price consolidation above the consolidation will strengthen buying, which may trigger growth

Reasons for Monero's Price Increase

High demand for privacy: With increasing regulation and privacy concerns, Monero's anonymity features are highly sought after.

Protection against quantum hacking: The upcoming FCMP++ upgrade will significantly enhance the network's resistance to potential attacks from quantum computers.

Use in covert operations: Monero's utilization for laundering large sums (e.g., after the $330M Bitcoin theft) highlights its effectiveness in ensuring anonymity.

Increased miner activity: Monero mining has reached an all-time high, signaling heightened interest and activity within the network.

Technical Analysis

However, it's highly likely that Monero's price surge has ended. Technical indicators point to the asset being severely overbought. On the weekly timeframe, the RSI was already above 86%. A bearish divergence has appeared on the daily timeframe.

Idea

The emergence of bearish patterns could be a strong signal for opening a short position.

Monero (XMR): Possible Long Squeeze ComingMonero coin has been having a lot of long squeezes (on smaller timeframes we can see more of them), which is giving us the option of another upcoming long squeeze happening.

We are basing our theory on the current market state and the price movement of XMR, where we are overexpanded currently, which would be the ideal place for a quick reset.

Swallow Academy

Monero Wave Analysis – 29 April 2025

- Monero broke resistance area

- Likely to rise to resistance level 300.00

Monero cryptocurrency recently broke the resistance area between the resistance level 240.40 (former multi month high from the start of this year) and the resistance trendline of the weekly up channel from the middle of 2024.

The breakout of this resistance area accelerated the active short-term impulse wave 5, which belongs to wave (3) from the start of 2024.

Given the clear weekly uptrend, Monero can be expected to rise toward the next round resistance level 300.00.

Perfectly wyckoffed XMRUSD produce beautifull set of higher higsPOLONIEX:XMRUSD

A textbook Wyckoff bottom accumulation just happened.

Easy 200% gains are on the table—right now. Check it out on the sc profile.

Think about it: What are the whales who were buying between 2022 and 2024 planning to do with the price?

Sure, Monero is being delisted from more exchanges lately. Some might see that as bearish, but it gives whales more control over the price since liquidity is lower.

I'm in for quite some time. But it is not too late for you. ;)

Strategy?

Either sell 50% of the position at 180% profit and hold the other half for 1.5 years.

Or hold all for 2 years.

Monero(XMRUSDT) SL-$212,29 TP-$240Technical Analysis:

False lows indicate bullish strength

Compression at the upper limit of the range announces an explosion of volatility

Tenkan-Kijun crossover on the daily chart

20-50 EMAs crossover on H4

MACD aligned on the daily chart

Additional Note:

The behavior of Monero is always unusual, but it tends to respect price ranges and compressions. Another detail is that it's the only altcoin to have independence from BTC movements, and it continues to grow despite governmental persecution.

LONG on XMR/USDTI'm opening a long position on XMR/USDT based on a broader market narrative. As regulatory frameworks around cryptocurrency are expanding globally, privacy coins like Monero (XMR) stand to benefit significantly.

With privacy-focused features becoming increasingly valuable in a regulated landscape, Monero could experience substantial growth. From a technical standpoint, the chart shows , aligning with this fundamental view.

Targeting with a stop-loss at to manage risk.

Let's see how this idea plays out! 🚀

What do you think of this analysis? Feedback is welcome!

XMR/USDTKey Level Zone : 203.50 - 204.50

HMT v4.1 detected. The setup looks promising, supported by a previous upward/downward trend with increasing volume and momentum, presenting an excellent reward-to-risk opportunity.

HMT (High Momentum Trending):

HMT is based on trend, momentum, volume, and market structure across multiple timeframes. It highlights setups with strong potential for upward movement and higher rewards.

Whenever I spot a signal for my own trading, I’ll share it. Please note that conducting a comprehensive analysis on a single timeframe chart can be quite challenging and sometimes confusing. I appreciate your understanding of the effort involved.

Important Note :

Role of Key Levels:

- These zones are critical for analyzing price trends. If the key level zone holds, the price may continue trending in the expected direction. However, momentum may increase or decrease based on subsequent patterns.

- Breakouts: If the key level zone breaks, it signals a stop-out. For reversal traders, this presents an opportunity to consider switching direction, as the price often retests these zones, which may act as strong support-turned-resistance (or vice versa).

My Trading Rules

Risk Management

- Maximum risk per trade: 2.5%.

- Leverage: 5x.

Exit Strategy

Profit-Taking:

- Sell at least 70% on the 3rd wave up (LTF Wave 5).

- Typically, sell 50% during a high-volume spike.

- Adjust stop-loss to breakeven once the trade achieves a 1.5:1 reward-to-risk ratio.

- If the market shows signs of losing momentum or divergence, ill will exit at breakeven.

The market is highly dynamic and constantly changing. HMT signals and target profit (TP) levels are based on the current price and movement, but market conditions can shift instantly, so it is crucial to remain adaptable and follow the market's movement.

If you find this signal/analysis meaningful, kindly like and share it.

Thank you for your support~

Sharing this with love!

HMT v2.0:

- Major update to the Momentum indicator

- Reduced false signals from inaccurate momentum detection

- New screener with improved accuracy and fewer signals

HMT v3.0:

- Added liquidity factor to enhance trend continuation

- Improved potential for momentum-based plays

- Increased winning probability by reducing entries during peaks

HMT v3.1:

- Enhanced entry confirmation for improved reward-to-risk ratios

HMT v4.0:

- Incorporated buying and selling pressure in lower timeframes to enhance the probability of trending moves while optimizing entry timing and scaling

HMT v4.1:

- Enhanced take-profit (TP) target by incorporating market structure analysis

XMR/USDTKey Level Zone : 200 - 201

HMT v3.1 detected. The setup looks promising, supported by a previous upward/downward trend with increasing volume and momentum, presenting an excellent reward-to-risk opportunity.

HMT (High Momentum Trending):

HMT is based on trend, momentum, volume, and market structure across multiple timeframes. It highlights setups with strong potential for upward movement and higher rewards.

Whenever I spot a signal for my own trading, I’ll share it. Please note that conducting a comprehensive analysis on a single timeframe chart can be quite challenging and sometimes confusing. I appreciate your understanding of the effort involved.

Important Note :

Role of Key Levels:

- These zones are critical for analyzing price trends. If the key level zone holds, the price may continue trending in the expected direction. However, momentum may increase or decrease based on subsequent patterns.

- Breakouts: If the key level zone breaks, it signals a stop-out. For reversal traders, this presents an opportunity to consider switching direction, as the price often retests these zones, which may act as strong support-turned-resistance (or vice versa).

My Trading Rules

Risk Management

- Maximum risk per trade: 2.5%.

- Leverage: 5x.

Exit Strategy

Profit-Taking:

- Sell at least 70% on the 3rd wave up (LTF Wave 5).

- Typically, sell 50% during a high-volume spike.

- Adjust stop-loss to breakeven once the trade achieves a 1.5:1 reward-to-risk ratio.

- If the market shows signs of losing momentum or divergence, ill will exit at breakeven.

The market is highly dynamic and constantly changing. HMT signals and target profit (TP) levels are based on the current price and movement, but market conditions can shift instantly, so it is crucial to remain adaptable and follow the market's movement.

If you find this signal/analysis meaningful, kindly like and share it.

Thank you for your support~

Sharing this with love!

HMT v2.0:

- Major update to the Momentum indicator

- Reduced false signals from inaccurate momentum detection

- New screener with improved accuracy and fewer signals

HMT v3.0:

- Added liquidity factor to enhance trend continuation

- Improved potential for momentum-based plays

- Increased winning probability by reducing entries during peaks

HMT v3.1:

- Enhanced entry confirmation for improved reward-to-risk ratios

XMR 200% after retest is completedXMR broke out from long consolidation and currently retesting and trying to find support on previous resistance.

RSI also touched 70 level as testing ground.

Possible move from 200% to 250%