XRPBULLUSD trade ideas

XRP: Wave 4 Corrective Structures Signaling Final Push?🔹 Overview:

We’re currently witnessing a variety of corrective structures across the crypto market, with assets like XRP showing significant strength, while Cardano (ADA) and SUI appear to be forming classic ABC corrections and wave 4 setups. These patterns align with historical market cycles, particularly resembling price action from September 2017, before a final wave 5 rally.

🔹 Technical Breakdown:

-XRP has remained resilient, consolidating instead of breaking down—indicative of a strong underlying structure.

-Cardano (ADA) is following a textbook ABC correction, similar to past pre-wave 5 setups.

-SUI is showing signs of a wave 4 consolidation, which typically precedes a final wave 5 push.

These patterns corroborate each other, suggesting a synchronized market move is approaching.

🔹 Macro Market Alignment:

-2017 Parallel: When comparing current structures to past cycles, we see striking similarities. XRP’s correction phase now mirrors its 2017 structure, aligning with the moment before its parabolic move.

-Stock Market Correlation: Broader macro trends, including mega-cap stock movements, also support the prediction of one last rally before the cycle concludes.

🔹 Key Considerations:

✅ Wave 5 Blow-Off Top: If historical patterns hold, we could see a broad market rally leading to a final euphoric push.

✅ Retrace vs. New Highs: While some altcoins may set new all-time highs, many will likely only retrace previous losses rather than break out into price discovery.

✅ Timing Expectations: Based on previous cycle durations, a final move could fully play out by mid-2025. However, market sentiment and liquidity will ultimately dictate the speed.

🔹 Trade Plan & Risk Management:

⚠️ Final phase of the cycle – time to start considering exit strategies for long-term positions.

⚠️ Watch for confirmation signals – particularly evidence of expansion across the market.

⚠️ If the rally fails to materialize, and markets continue retracing, this could signal a deeper macroeconomic shift.

🔹 Final Words:

The market structure suggests we are in the late-stage corrective phase, setting up for a final impulsive wave. While exact timing remains uncertain, this aligns with previous cycle patterns. Keeping an eye on XRP, Cardano, and SUI as key indicators will be crucial in confirming this prediction.

🔻 What do you think? Are we about to enter a final wave, or is the market sentiment shifting into an extended downturn? Drop your thoughts in the comments!

📈 Like & Follow for more in-depth market analysis! 🚀

XRP with likely levels, and alternatives for April 'flash crash'Here's my latest XRP chart, which includes potential levels that could be hit, along with an alternative path for the 5th wave, assuming the bottom is already in on the chart.

- If wave 4 is already complete, then the wave 6 "flash crash" low would likely be higher than the chart shows, perhaps staying within the lower white trendline (thicker white line).

- If wave 4 isn't complete, then the wave 6 "flash crash" would likely go outside the lower white trendline (thicker white line), targeting the green fair value gap (FVG) in the chart or somewhere between that FVG and the lower white trendline, sweeping the previous lowest low of the entire pattern.

- The fair value gap that absorbed the "Trump Crypto Reserve" tweet breakout—which quickly failed after hitting the gap—would likely be filled during the 5th wave (false breakout leg), taking out that high before the April "flash crash."

- The real breakout, the 7th wave, would likely take out the previous all-time high and run to the top of the pattern, reaching the area of the upper white trendline (thicker upper white line).

I will be going over this chart again very soon for anyone who follows me.

Keep in mind that the "flash crash" in April is a theory and may not come to fruition or could be off in timing. However, I do believe that the breakout will begin in May, even if the "flash crash" does not occur in mid to late April.

Good luck, and always use a stop loss!

XRP Price Breakout? Scalping Setup for Quick Profits – TechnicalXRP is showing signs of a potential breakout on the 5-minute chart! The price is attempting to break out of a descending channel, with Fibonacci levels indicating strong resistance and support zones. If the breakout is confirmed, we could see XRP push towards the next key resistance at $2.50. Traders looking for a scalping opportunity should watch for volume confirmation and price action signals. Will XRP pump, or face another rejection? Stay tuned for live updates!

#XRP #Ripple #CryptoTrading #Scalping #DayTrading #TechnicalAnalysis #TradingView #XRPBreakout

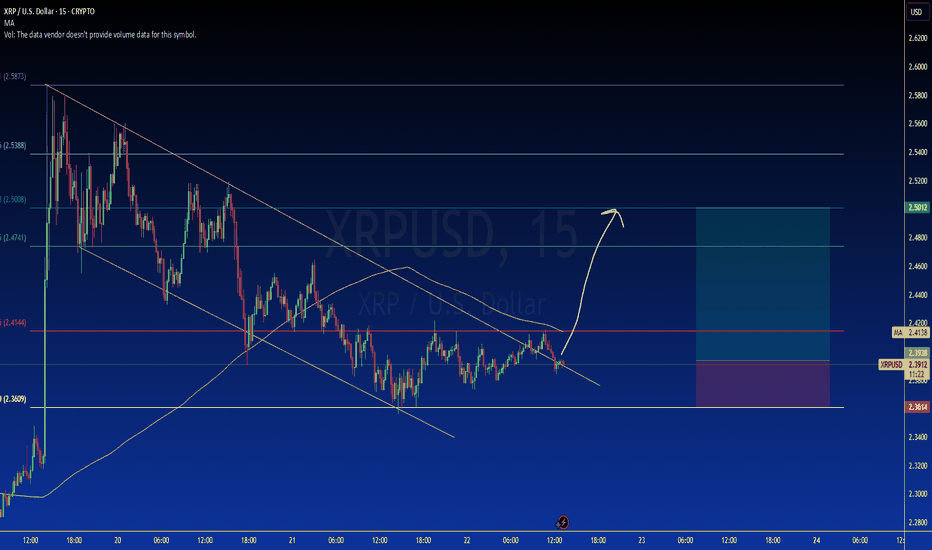

"XRP Facing Downtrend – Key Support Levels to Watch"XRP is trading within a descending channel, struggling to break above key resistance levels. The price has rejected the moving average and is showing potential downside movement. Fibonacci retracement levels highlight key support at $2.31 (0.786 Fib) and $2.02.

If the bearish momentum continues, a retest of the lower trendline may be likely. Can XRP find support and bounce back, or will the downtrend persist? Let us know your thoughts.

#XRP #Ripple #CryptoAnalysis #TechnicalAnalysis #Trading

For those of you who bought XRP...I've known about COINBASE:XRPUSD for over a decade now. Time has brought tons of rumors, tons of hype, and tons of mistakes still being made by those new and experienced alike. For those of you holding strong pre $1.00, I commend you. For those of you who are bought high and are now riding the emotional roller coaster, consider these 3 things before you make a decision.

1. We are DIRECTLY in the middle of the range

Over 3 months of consolidation has taken place. With a high of 3.40 and a low of 1.70, this is a range for advanced traders. If you bought around 2.00 or under, Congrats! even though you didn't get in pre $1.00, there are alot of Big buyers that have been scooping up XRP at the 2.00 level.

For those of you that Bought 2.50 and above.

Ask yourself why you purchased XRP?

I ask you; Did you buy XRP to trade? or to invest? No they are not the same thing. Investing is long term, 3-5 years+. Trading is dealing with much shorter time windows, even if you are swing trading, Trading is Trading, and this takes a different skill set and mindset. so if you are investing, be happy that XRP is lower in price. if big money is Buying at 2.00, there is nothing stopping you from doing the same. If you are a beginner trader, consider our last point.

Buy with Buyers, Sell with Sellers

Sounds simple right? Here is something you may not know. Liquidity is what moves markets. If you have 100million that you have to invest for your clients in XRP, do you slap the market button? Absolutely not, in fact, you want to make yourself as small looking as possible. Why? YOU NEED PEOPLE TO SELL INTO YOU. Big firms (unless through dark pools) have algorithms make themselves look as small as possible, whilst accumulating and distributing shares efficiently. At the end of the day, These are the big players that move the markets big.

Do you need to know this? Not necessarily for the technical side, but for your emotions, your psychology? Yes this is important.

Find the buyers and sellers (I have them marked in my chart), and learn to play alongside them. You will get better pricing, feel great about your positions, and know if it goes against you, you can cut the trade off early and reposition.

Hope you enjoyed, and happy Trading!

* A GAME OF PACIENCE *Yurrr XRPeers,

If you have been following my analysis, you was also prepared yesterday to a possible sellout from all the news we got.

That sellout happen today. If you were watching the market, you saw volume peaking as retail dumped all their XRP at the peak and sellers got in aggressively bringing the price down to the $2.4 range.

As you can see in the chart, I have two possible price targets for this little correction happening so check it out below for explanation.

T1:

- This first target is assuming that yesterday's pump is part of the first impulsive wave of the W3(green).

- If this scenario is correct, I'd expect buyers hold that $2.3 level and prepare for another impulsive wave.

- The price action that XRP is going through right now is favorable to it. There is a clear ABC pattern with wave A having 3 moves, wave B having 3 moves, and the starting of wave C that is expected to have 5 moves to be completed.

T2:

- For the second target, I'm assuming that yesterday's pump broke the consolidation that was happening before and formed a new top for W1.

- If that is the case, price could have a retracement beginning on T1 but a downtrend continuation that will aim at T2.

I would also like to bring your attention to the RSI, where we can see our Higher Lows trendline being tested and could either be broken or held strong depending on what's happening next.

It is still too early to know and I still haven't figured out how to predict the future, but all we really need to do is observe and prepare accordingly.

Let me know what you think!

Xrp - Destroying All Hopes For Bears!Xrp ( CRYPTO:XRPUSD ) is heading for new all time highs:

Click chart above to see the detailed analysis👆🏻

Literally all cryptocurrencies are currently creating pump and dump like price action with swings of two digits within a couple of minutes. But if we look at the higher timeframe - specifically also on Xrp - markets are still 100% bullish and heading for new all time highs.

Levels to watch: $2.0, $5.0

Keep your long term vision,

Philip (BasicTrading)

The trend that is trendyAs you can see since November 24th, 2024 pump, this thing has not stopped trending to the upside. It is majorly super bullish. Don't listen to the naysayers. The chart is the news.

Xrp hasn't just been performing sideways action. It's already telling us exactly the directions It's headed before we go there. Patience 😏

Bearer of Bad News - Short $XRPI originally posted this idea several days ago, but it was flagged b/c I linked one of my social media accounts. Apologies for any typos - the format of my post got jacked up after copying/pasting. Crypto's going to break one way or another from current levels. Bitcoin has a wide supply zone (not super strong) 86267.86-92920.42, so watch how it reacts...

Strictly technical setup here. Near-term demand/buy zones were good for bounces across the crypto space. However, buying has been fairly tepid. Given the technical structure for many crypto underlyings, this is unsurprising (addressed in CRYPTOCAP:DOGE ( COINBASE:DOGEUSD ), CRYPTOCAP:BTC , CRYPTOCAP:TOTAL ideas). Barring a catalyst, it seems more likely that crypto (and risk assets generally) will trade lower before higher.

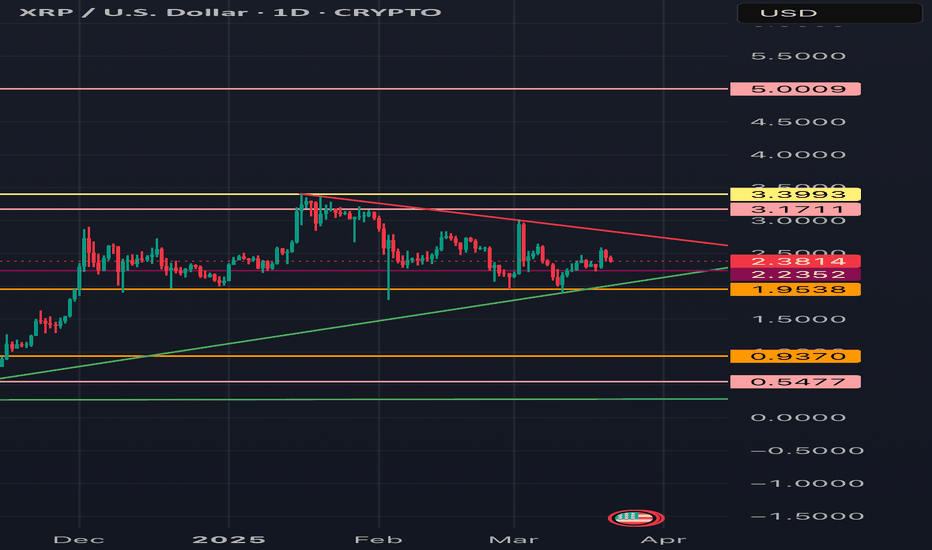

Unfortunately for bulls, BITSTAMP:XRPUSD has levels of daily supply near current price. Per the 1D chart, sell zone = 2.3265-3.4106, 2.5032-2.6487. Additional sellers are likely lurking between 2.6487 and 3.0153, though LTFs need to be analyzed for identification. If the RSI is printing < 60/65 if/when price reaches the abovementioned ranges, CRYPTOCAP:XRP could roll over and commence another bearish impulse wave. Use micro-timeframes to watch for signs of uptrend violation/termination + to confirm any short entries/long exits.

To bolster positional confidence, observe other cryptos, especially larger market caps. Correlative behavior can be a very helpful trading "odds enhancer". If other majors rally w/ significant volume/momentum, XRP will likely follow. Conversely, if BITSTAMP:BTCUSD , BITSTAMP:ETHUSD ( CRYPTOCAP:ETH ), etc. fizzle out, expect XRP to do the same.

If this idea materializes and shorts regain control, daily demand = 1.5414-1.2843, 1.1222-1.0033. Fib retracements reinforce the aforementioned buy zones. Because of the explosive nature of XRP's 2024 rally, the monthly/weekly charts have "tradeable voids" (expanded-range candlesticks). While traditional technicals tout large candles, they're a double-edged sword. Their elongated nature is often reflective of limited trading and gaps in order flow, which can have a vacuum-like effect if/when prices correct. It's great when you're on the right side of the trade creating the candles, but there's also not a lot of unfilled orders to stop price from moving rapidly in the opposite direction. So, if XRP sells off, don't be surprised if price moves quickly.

I'm a fan of confirmation entries vs. "catching a falling knife". Referencing RSI momentum + using micro-TFs to ID trend reversal signals can help prospective buyers reduce risk (and/or increase position size). When volatility strikes, preservation is paramount.

Thanks for reading! Feedback/engagement welcome.

Jon

XRP/USD Technical Analysis: Trend Reversal and Key Levels to WatThe overall price direction shows a transition from a downtrend to an uptrend, which can be broken down into 3 phases:

Strong Downtrend: At the beginning of the chart, the price declined sharply, dropping from levels above 2.50 to 1.89708 (lowest point).

Consolidation and Correction Phase: After reaching the low, the price started to consolidate and attempt to form a bottom. Several buy signals (green triangles) appeared at the bottom, indicating a potential reversal.

Clear Uptrend: Starting from the middle of the chart, the price began forming higher highs and higher lows, with moving averages crossing upwards, signaling a positive trend continuation.

The main reason for identifying the trend as currently bullish is:

Price recovery to 2.50 after forming a bottom at 1.89.

Moving averages crossing upward.

Increased buying momentum, as seen in technical indicators.

Bullish Indicators

Breakout above previous resistance at 2.30, allowing price to rally towards 2.50.

Moving Averages (MAs) show a positive trend, with price trading above the blue and red lines, indicating continued upward momentum.

Buy signals (green triangles) at lows, suggesting strong buying pressure.

Relative Strength Index (RSI) surpassing 60, indicating bullish momentum.

Increased trading volume during upward moves, confirming buying strength.

Bearish Indicators

Sell signals (red triangles) at resistance levels, which may indicate a price rejection or strong resistance around 2.50 - 2.52.

Price approaching a key resistance at 2.52, where it might struggle to break through without additional momentum.

RSI approaching overbought territory (near 80), which could signal a potential pullback.

High price volatility with a sudden spike, which may lead to short-term profit-taking.

Conclusion

Overall Trend: Bullish after breaking out of the consolidation phase.

Potential Upside Targets: If the price breaks 2.52, it could target 2.60 - 2.70.

Support Levels: 2.30, followed by 2.10 (in case of a pullback).

Resistance Levels: 2.52, then 2.60.

Expected Scenario: As long as price holds above 2.30, the bullish trend remains intact. However, if 2.52 is rejected, a slight pullback may occur before resuming the uptrend.

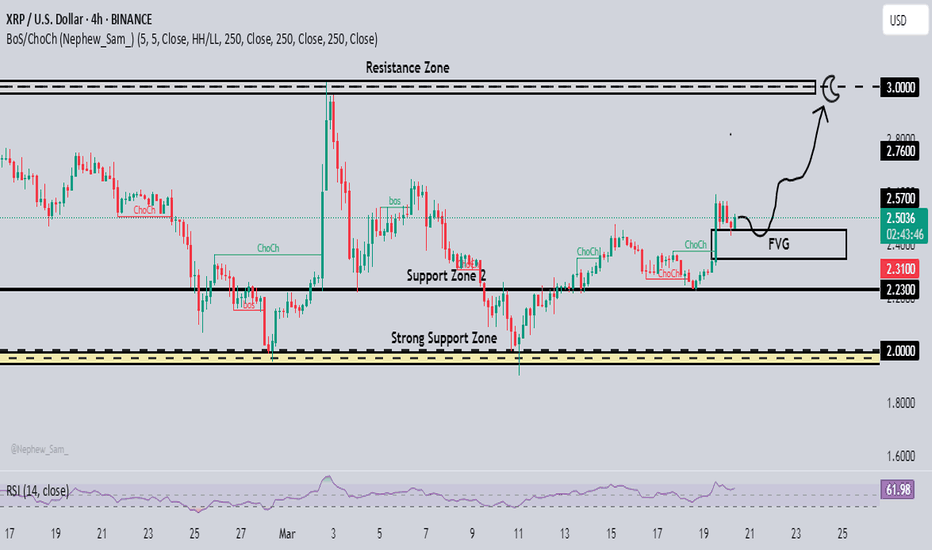

XRPUSD H1 Timeframe MARKET analysis to BullishBINANCE:XRPUSDT My Analysis XRP vs US Dollar shows a candlestick chart for XRP, a common tool in financial trading. It highlights support and resistance zones, which are key concepts in technical analysis. Key Points: First we look at the RSI which is hovering around 62.70 indicating an uptrend. On the other hand we look at Support and Resistance.

Strong Support Zone: 2.0000 Price has previously bounced off this level, suggesting buying interest.

Support Zone 2: 2.300 A recent support level, indicating a potential area for price recovery. Strong Resistance Zone: 3.3000 This is a weak strong resistance zone that could see a good chance of breaking above.

We would consider buying

XRPUSD Buy Entry Level:2.5020

TP: 2.5700

TP: 2.7600

TP: 3.0000

SL: 2.3100

XRP Wave 5 Starting Part 2Hello There,

There is the bullish case in which we bottomed and we are heading higher with a completed sideways combo in the wave 2. Currently we could be starting Wave 3 with a Leading Diagonal in the wave 1.

Probabilities? currently looking at both cases I think the bearish case may have a slight higher probability at the moment to dip in the $1.4 - $1.9 range first before hitting that $10 range.

Either way we have at least one more bullish wave left, so plan according with your holding and risk

GOD BLESS AND TRADE ON

Stay Humble and Hungry

XRP Wave 2 or Wave B incoming Part 1Hello there,

I am presenting a bearish (short term; current post) count and a bullish count (in my next post). This is showing that we hit a truncated top (see previous posts; attached) and we are coming down in the $1.9 - $1.4 ish range to compete Wave 2 (or could be Wave B) of cycle. I see us pushing to the $2.9 - $3.2 ish range to finish the C wave of the Major wave B of the wave 2 before finishing. it seems to me that we are making a Flat in this sideways chop.

please review and ask me any questions

GOD BLESS AND TRADE ON

Stay Humble and Hungry