XRP scenario 1, 2 or 3I read a lot of comments about XRP, saw all kinds of charts and predictions. Must admit that here on TradingView you can find both kinds - "short" and "long". By this time, I can only find correlation of XRP with BTC. If BTC falls down, XRP falls too but it has strong support at $0.38. I'm not sure will this support be strong enough if BTC drops to 6k level as many traders predict due to needed correction. On the other hand if BTC stays on 8k level for the next 7 days, can we expect some life in XRP?

Written triangle ends tomorrow morning around 10am UTC+2, so something will happen for sure :)

Anyway, it seems that we need more patience ...

XRPEUR trade ideas

The time is comming...XRP/EUR Daily chart.

Last 7 Days change +8,48

Today's change +5,35

Price needs to brake out of this descending triangle to the upper side if we would like to see continuation, as we see we allready had two touches of our strong support level at 0,25 which is there from December last year. Positive looking on this pair. Few more zones on the chart just for orientation.

Let me know what is your opinion on this pair, post the chart belowe in the coments.

XRP/EUR - Daily - At an interesting spotTrade Alert

Continue observing XRP/EUR carefully, as it balances slightly below its medium-term tentative downside resistance resistance line taken from the high of September 30th. At the same time, the crypto is balancing around its 200 EMA.

For now, we remain cautiously-bullish, but before we could examine higher area, we would need to see a break of that downside line first.

Please see the chart for details.

Don't forget your stop-loss.

Bullish scenario in XRPwhat i see in xrp is, that is about to finish wave 2 in a bullish trend on the ( daily-weekly).

and it has formed a BIG descending triangle, if this scenario plays out perfectly, we will get a last touch on the 7 months old support. if that plays out. i´m pretty sure we will be looking at prices around 0.35-0.50 in ending off may. (maybye april) if you pair the news about xrp there have been published in the last half off year. AND keep in mind that we are about to jump into the 2 quarter off this year. im pretty confident to say, that we will see a spike in the price, in the nearest future. BUT i will not call it a bull-run yet! i think we wil have to look at prices around 0.30-0.28 again. and THEN i will concider to call the BULL-RUN. but for now. I will be looking for longs around 1-5 april in the 0.26500-0.25900 ( maybye before) if you are using stop-losses it will be in the 0.24880 zone. it could give a great R/R 1:3 to target 1.

1 target = 0.29700-0.30700

2 target = 0.40500-0.45000

AND always remember to trade safe and make your own descisions and TA´S

good trading here from ;)

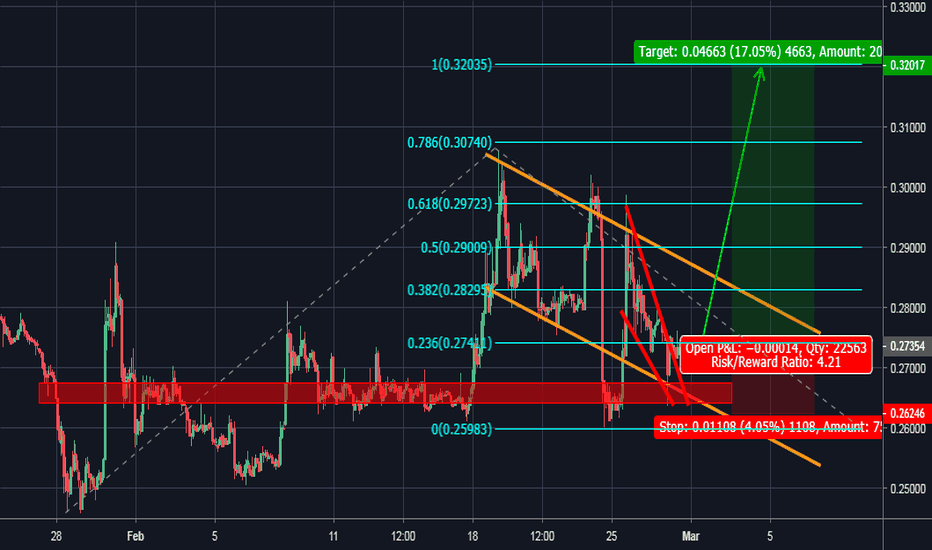

XRP/EUR buy idea H2 RR=4 We have a breakout of falling wedge and a bounce on a previous key level (shown in red) and bottom of falling parallel channel wich is a figure of continuation for upward movements , I'm expecting trend to be bullish for the next few day . Potential target : the 0.32 euro (the 100% trend based fib extension level ).For a buy at 0.27354 , TP at 0.32 and SL at 0.26246 you get a RR ratio of 4 .

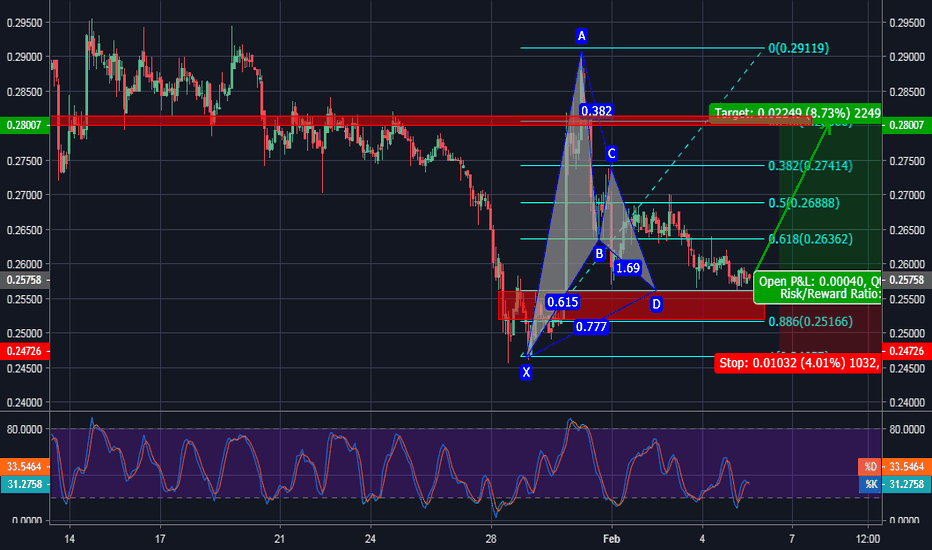

XRPEUR buy opprtunity H2Stochastic indicator shows that we are in oversold zone ,Price formed a bullish gartley pattern at previous support level it may go up test previous key zones at least the last swing high . For a buy at actual price 0.25758 , SL at 0.24726 and TP at 0.28 you get a RR ratio of 2