XRPUSD trade ideas

XRP WHERE ARE WE HEADED ? LEVELS TO LOOKOUT FORHey trading fam

So XRP is a fun one but based on BTC correcting and what we are seeing there are a couple thesis's that we currently have for it

Thesis 1: We break south from 2.98 lows: Levels to look out for:

2.80

2.70

2.68

Thesis 2: We break the highs of 3.29: Levels to look out for:

3.65

3.79

3.99

Trade Smarter Live Better

Kris

XRPUSD Is Heading Up, The Best Case Above 3.66Possibility for xrpusd as well to go up. As we have complete h4 expanding flat.

The stop could be below the low of the latest low of bullish engilfing candle. The best case we can go all the way up above the high of July 2025, 3.66.

Dont risk more than 1 % for this trade.

Working to move to the upsideMy views on XRP still hasn't change since my last article. The price action has been quite volatile, but if you look at it in the higher time frames such as monthly/weekly/daily, I think XRP is still working to move to the upside.

Daily:

1) The price has found the temporary support at Fib 0.5 level and EMA55.

2) yesterday's daily candle closed above $3.07 area (previous major resistance area)

3) Both RSI and MACD are still in the bull zone.

4) Stochastic has reached the oversold territory the lines have crossed and now are moving to the upside.

XRP retracement levelsWhere is XRP next likely to head next?

$2.65 is the next price level down with 4 points of contact. This level was also a weekly high as well as the 0.5 fibbonachi.

Next level down is $2.34 with 6 points of contact.

There is a downtrend forming so a breakout of this trend could be bullish for XRP 📈

XRP VS AI ?Hi,

This is fun, come on XRP $4.95

Average Speed (Points/Day) 0.053

Retracement Amount (Points) 0.80

Retracement % 51.28%

Probability of Retracement % 5-10%

Projected Next Move Size (Points) 2.09

Next Projected High Price 4.95

Estimated Duration to Next Target 39.4 days

Projected End Date 2025-09-10

All the best

Not a guru

Can XRP obtain a 50% increase in the next few weeks XRP has recently been under a lot of manipulation lately! Is it time for the bulls to finally step in and move the price point on this digital asset to a 50 percent increase to another ATH at $4.45………? The world will see with the next few weeks! And why is #Bradgarlinghouse X account always following 589………..? It’s it a signal or is he just trolling

XRP - IH&SLike I said in my last post, xrp was to hit 2.80. Nailed it. Right on the money!

Now, it seems like we're printing an IH&S. No other real patters are matching up l well. We finally have some liquidity in the market to chart some rough patterns.

I'm seeing a little push up off the bottom BB - to 3.12 ish? But rejection back down to the daily pivot for the right shoulder. And acuminate there prior to any news from the SEC. And then were primed and strapped to a rocket!

But honestly, who really knows what these MM have in store. So stay light on your feet in this area.

Roll them bones for it!

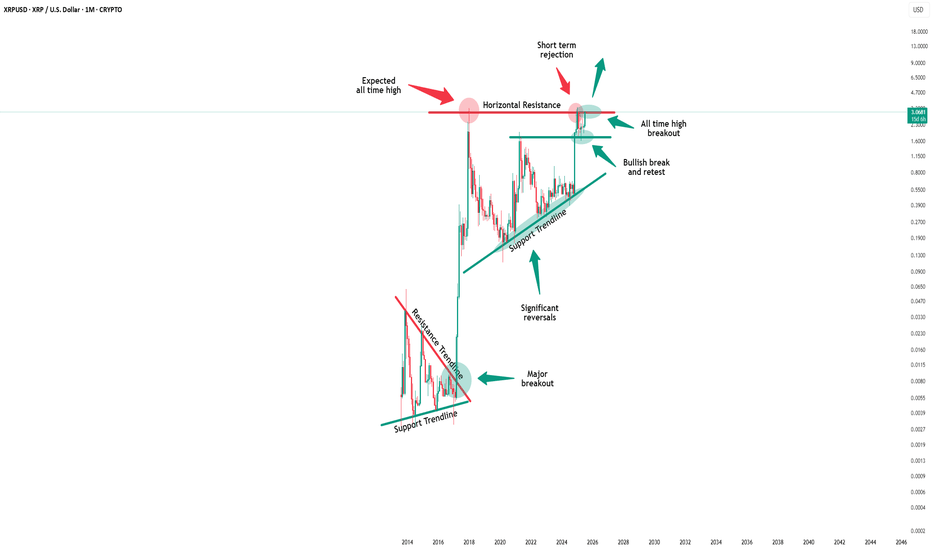

Xrp - The final bullish breakout!💰Xrp ( CRYPTO:XRPUSD ) will create new all time highs:

🔎Analysis summary:

After a consolidation of an incredible seven years, Xrp is finally about to create new all time highs. With this monthly candle of +40%, bulls are totally taking over control, which means that an altcoin season is likely to happen. And the major winner will simply be our lovely coin of Xrp.

📝Levels to watch:

$3.0

🙏🏻#LONGTERMVISION

SwingTraderPhil

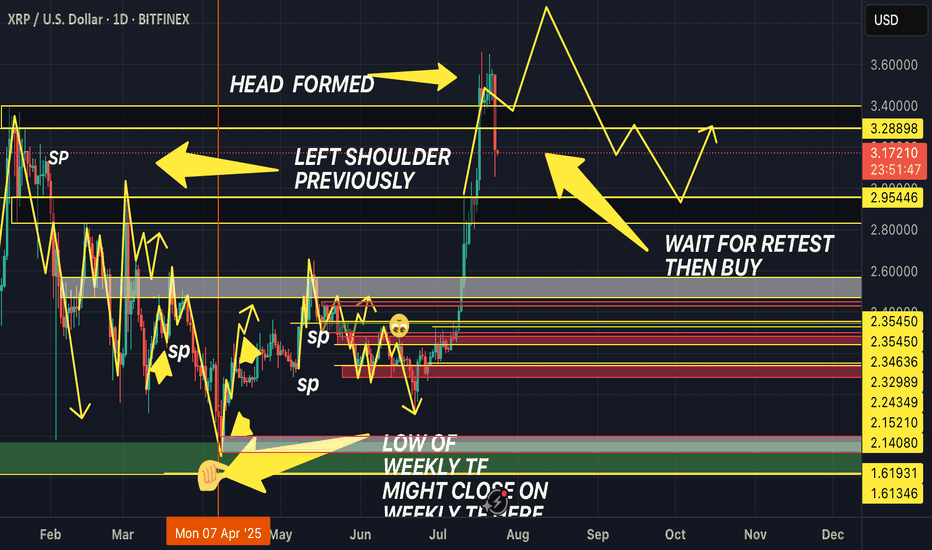

HEAD & SHOULDER DAILY TIME FRAME! (DOUBLE WHAMMY!!!!)The market has previously created a left shoulder. Now, it has broken out of the top of the Resistance and broken back into the support and resistance, about to form the right shoulder.

Wait for retest of the resistance then sell to the support, AND THEN BUY IT BACK TTHE RESISTANCE!! DOUBLE WHAMMMY!!

XRP/USD Breakout Watch: $3.22 Target in SightA key blue trendline on the XRP/USD chart that reflects market sentiment. If price breaks above it with strong volume, we could see a rally toward $3.22.

Support zone: $0.55–$0.60

Bullish case: Improved sentiment, easing tariffs, and regulatory cooling

Strategy: Wait for breakout confirmation before entering

Share your thoughts — are you preparing for a breakout?

XRP at $2.93? They Forgot What’s Coming?XRP isn’t just another coin. With clarity coming from major rulings, its return to previous highs isn’t just possible it’s probable. I like this level. Watching price and fundamentals line up.

I’m not just looking at the chart — I’m looking at the bigger picture.

Super bullish!! (I am not a XRP fan, but still) XRP is one of those cryptocurrencies that attract cult-like followers. I am not one of them.

Fundamentally I have no idea about the long term potential of XRP. HOWEVER, purely based on technicaly analysis, it looks very bullish to me.

Monthly:

1) the price finally broke above the 2018 historical ATH.

2) All momentum indicators in the bull zone.

3) Both RSI and MACD are in the overbought territory but they can remain in the OB territory for weeks and weeks when the macro bull trend begins.

4) Stochastic lines have crossed to the upside in the bull zone.

Weekly:

1) all momentum indicators are in the bull zone.

2) The price broke above the historical ATH. It is going through pull back now, but, there is a strong buying pressure around $3.15.

Daily:

1) all momentum indicators have reached the overbought territory. The lines are now rolled to the downside, however, it is likely to be a corrective move.

2) the price is hovering above EMA21 where the recent price breakout happened on Thurs 17th July. I have been monitoring price action in lower time frames such as 5 and 15 minutes, and it looks like the price does not want to go below the previous historical high at this stage.

I am not very familiar with XRP, but purely based on the current price action, it looks very bullish. For the very first time as a trader/investor, I deployed my capital to buy XRP last Wed (just under $3.00).

I have already took some profit when it hit $3.60. But I am planning to sell 90% of my XRP when it reaches $4.50 and $5.00, and let the rest run just in case it goes to the moon😅.

XRP To The Moon and Back! Opportunities Presented.Context 1:

Support: $2.50 to $2.75

Resistance: $3.50

Psychological Levels: $3.00 and $2.50 and $2.00

Context 2:

Technical Structure 1: XRP now in a Bullish Flag Pattern. Resistance tested 6 times and Support tested only once.

FVG’s:

FVG Confluence 1: We have an unmitigated 1H FVG located below price. A 4H FVG almost fully mitigated below price as well.

Golden Pocket (Bullish#1): There is a GP located at psych level $3.00. This aligns with the lower anchored VWAP 50% of the way through the Flag Formation.

Golden Pocket (Bullish#2): There is a major GP located at the bottom of the Bullish Flag Pattern. This aligns with Support at between $2.50 and $2.75.

Golden Pocket (Bearish): A mitigated bearish GP located above price may provide the momentum we need to break through multiple FVG’s to the $3.00 psych level leaving a strong confluence for a sweep of liquidity.

Context 3:

Volume Insight: OBVshows a spike in volume at $3.15. Showing strong confluence to clear lower FVG alignment and sweep liquidity at $2.85 to continue upwards.

BullishScenario #1:

We flush liquidity and mitigate all unresolved orders from $2.75 to $2.85. With the help of our lowered anchored VWAP and an EMA 200 confluence we see a sharp rise to the top of our Bullish Flag Pattern for breakout at $3.25. With a retest of the breakout leading to push price upward to sweep the $3.50 to $3.65 area.

Bearish Scenario #1:

After breaking out of the Flag Patter and sweeping the highs around $3.60, we clear a 4H Rejection Block located inside a Daily Rejection Block. We then test the breakout area creating a Head and Shoulders pattern and close out back inside the Flag Pattern

BullishScenario #2:

After we enter back into the Flag Pattern after sweeping highs, we see a move down to test support a third and final time at the $2.50 psych level. Aligning with the initial bullish move and it’s .618 level along with the bottom of our Flag pattern where we may see a sharp move upwards to create a new support level and ATH.

Update on XRPCurrent Price: ~$3.31 (Coinbase USD)

Trend: Bullish continuation after minor retracement from $3.34 high.

Structure Update:

Price is holding above the $3.28–$3.30 intraday support zone.

Strong buying interest continues on dips toward $3.25.

4H EMA trend remains bullish, with volume contracting — often a precursor to another breakout leg.

Key Levels:

Immediate Support: $3.28 → $3.25 → $3.20

Resistance / Targets:

TP1: $3.38 (break above recent high)

TP2: $3.50 (major breakout level)

TP3: $3.72 (measured move from last breakout zone)

Stretch Target: $4.00 psychological barrier

Trade Idea:

Entry Zone: $3.28–$3.30 (scaling in if price stays above $3.25)

Stop-loss: Close below $3.20 (breaks short-term structure)

Targets: TP1 $3.38 → TP2 $3.50 → TP3 $3.72 → Stretch $4.00

Bias: Bullish above $3.25; watch for increasing volume on any push above $3.34 for confirmation.

📌 A clean 4H close above $3.34 will likely trigger the next upside push toward $3.50 and above.

XRP Forecast: Bullish Breakout Incoming?BITSTAMP:XRPUSD

Bottom Line: 🚀

Expecting a moderate rise to the $3.50-$3.80 range in the next 48 hours, assuming positive momentum continues. Breaking above $3.30 will accelerate the surge, with potential for a V-shaped recovery post-SEC lawsuit resolution.

Technical Analysis and Current Metrics: 📊

Current XRP Price: ~$3.25, up 1.4% in the last 24 hours. Trading Volume: $7.92 billion, Market Cap: $192.7 billion.

Key Indicators: RSI and MACD signaling "Strong Buy" for the day and week, with support at $3.10-$3.20 and resistance at $3.30-$3.40. A "Bull Flag" pattern is forming, hinting at an upward breakout if volume increases.

Hot News from the Last 48 Hours: 🔥

SEC lawsuit against Ripple ends, removing regulatory barriers and encouraging institutional investments. Whales accumulated 900 million XRP, indicating strong accumulation and high confidence. Rumors of a potential XRP ETF add optimism, though no official confirmations yet.

Market Sentiment and Social Buzz: 😎

Very positive sentiment on X/Twitter, with predictions of $4-$5 short-term and even $7-$13 in the coming months. Futures volume up 200% post-lawsuit announcement, but risk of temporary profit-taking.

Risks and Scenarios: ⚠️

If there's a general market downturn (e.g., due to macro events), price could drop to $3.10. High leverage in futures market may amplify volatility.

Recommendation: Watch for a break above $3.30 as an entry point. This is not financial advice – DYOR! 🔍

#XRP #Crypto #TradingView #Ripple #Bullish