260 days $24XPRUSD new ath coming in 2025. Referencing the timeline from 2017 to predict the BTC outcome in 2025. If i was to assume everything will playout similar this time around in terms of relative price action we should see $24 XRP by summer of 2025. It really all depends on how far alts fall in this coming crash. We are still very much in a bull market. 260 days till the party is over.

XRPUSDC_69033B.USD trade ideas

THOUGHTS ON XRP/USDXRP/USD 1D - As you can see price has been sat within this range for some time now, I think its only a matter of time before we have our next rally to the upside. I was sceptical about seeing price take a further down move to clear the inefficiency.

However price has shown good signs of holding within this range and its actually respecting these areas of Demand as you can see above, this tells me that the balance is in fact in favour of the Demand in the market.

I have gone ahead and marked out a fractal area here, I would like to see price clear the orders within this before that hike, this gives people the opportunity to top up on XRP should they want to.

From this next hike I am predicting price to surpass previous highs that have been set within this range, and I am expecting that the lows set here would then be seen as protected following the laws of Bullish structure.

xrp format rsi and macd"The XRP/USD pair is currently exhibiting signs that may indicate a potential bullish reversal.

Technical Analysis:

Relative Strength Index (RSI): The RSI is at 49.28, suggesting neutral momentum. A move above 50 could signal strengthening bullish momentum.

Moving Average Convergence Divergence (MACD): The MACD line is at -0.00453, positioned above the signal line at -0.01699. Despite both values being negative, this crossover may indicate a weakening bearish trend and a potential shift towards bullish momentum.

Trade Setup:

Entry Point: Consider entering a long position if the RSI crosses above 50, confirming bullish momentum.

Stop Loss: Set a stop loss below recent support levels to manage risk effectively.

Take Profit: Identify key resistance levels as potential take profit targets, ensuring a favorable risk-reward ratio.

Time Frame: This analysis is based on the daily chart, suggesting a medium-term trade horizon.

March 28 Is XRP's Big Day—Or At Least Better Be

Friday, March 28, 2025, marks exactly 144 days since XRP's breakout from November 4, 2024—right on cue with Gann’s "inner year" cycle, signaling a potential trend reversal (or at least a good excuse to tweet "I told you so").

Conveniently enough, March 28 is also exactly 52 days post the "flash crash" on February 3rd (if we're even calling that hiccup a crash).

The stars (or rather, candlesticks) align for Ichimoku’s Chikou Span to finally clear both the candlestick bodies and the Cloud, creating a bullish setup that even perma-bears might glance at sideways.

If XRP pulls off a daily close at or above $2.61 on March 28, expect Gann and Ichimoku fanboys to show up with wallets wide open and confidence suspiciously high.

XRP Pounced on by the group! RIPPLE XrpUsd Ready to Go? Now if you NOTE exactly where PRICE was at the EXACT TIME that 🟢SeekingPips🟢 Shared the last XRP CHART.

You can see that was a PERFECT ALIGNMENT of both TIME & PRICE.👌

ℹ️ Many SHORT TERM & INTRADAY TRADERS paid themselves at 🟢SeekingPips🟢 pre defined 🔴RED🔴 level @ 2.4980 for a PAIN FREE TRADE with A GREAT REWARD TO RISK OUTCOME.

🌎 You can also NOTE TWO VERY IMPORTANT THINGS WITH THIS TRADE...

▪︎1) Our ORIGINAL Stop Loss has still been untouched even after the 100% retracement of our original ENTRY.

▪︎2) Now anyone who was not in the group or followed 🟢SeekingPips🟢 original chart share at the time of our entry and instead decided to jump in as price was already moving up would have made a poor choice.❗️

By waiting on the next 240m bar/candle to close you could have theoretically left a limit order at original entry area and would have been easily filled for a STRESS FREE trade so far.🚀🚀🚀

What's the lesson here❓️

Know what you want to see and do not act beforehand.

If you miss your FIRST entry have a PLAN for your SECOND ATTEMPT.

Note the word PLAN.

⚠️ As per 🟢SeekingPips🟢 BIO Without A PLAN it's NOT TRADING But GAMBLING.

🎲

XRP Market Update 3.25.2025My current bias for XRP, analyzed today 3.25.25 at 7:52am.

Let me know down below your thoughts on this asset!!

Forex, Crypto and Futures Trading Risk Disclosure:

The National Futures Association (NFA) and Commodity Futures Trading Commission (CFTC), the regulatory agencies for the forex and futures markets in the United States, require that customers be informed about potential risks in trading these markets. If you do not fully understand the risks, please seek advice from an independent financial advisor before engaging in trading.

Trading forex and futures on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade, you should carefully consider your investment objectives, level of experience, and risk appetite.

There is a possibility of losing some or all of your initial investment, and therefore, you should not invest money that you cannot afford to lose. Be aware of the risks associated with leveraged trading and seek professional advice if necessary.

BDRipTrades Market Opinions (also applies to BDelCiel and Aligned & Wealthy LLC):

Any opinions, news, research, analysis, prices, or other information contained in my content (including live streams, videos, and posts) are provided as general market commentary only and do not constitute investment advice. BDRipTrades, BDelCiel, and Aligned & Wealthy LLC will not accept liability for any loss or damage, including but not limited to, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

Accuracy of Information: The content I provide is subject to change at any time without notice and is intended solely for educational and informational purposes. While I strive for accuracy, I do not guarantee the completeness or reliability of any information. I am not responsible for any losses incurred due to reliance on any information shared through my platforms.

Government-Required Risk Disclaimer and Disclosure Statement:

CFTC RULE 4.41 - HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Performance results discussed in my content are hypothetical and subject to limitations. There are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading strategy. One of the limitations of hypothetical trading results is that they do not account for real-world financial risk.

Furthermore, past performance of any trading system or strategy does not guarantee future results.

General Trading Disclaimer:

Trading in futures, forex, and other leveraged products involves substantial risk and is not appropriate for all investors.

Do not trade with money you cannot afford to lose.

I do not provide buy/sell signals, financial advice, or investment recommendations.

Any decisions you make based on my content are solely your responsibility.

By engaging with my content, including live streams, videos, educational materials, and any communication through my platforms, you acknowledge and accept that all trading decisions you make are at your own risk. BDRipTrades, BDelCiel, and Aligned & Wealthy LLC cannot and will not be held responsible for any trading losses you may incur.

Bitcoin & Altcoin Market Showing Strength Amid Stock Market Rebo📈 Market Overview:

Bitcoin is showing signs of renewed strength and is currently trading above $88,000.

The Russell 2000 is leading the stock market rally, up over 2%, historically correlated with BTC.

Bitcoin’s recent low came with bullish indicators, including RSI and MACD curling upward.

📊 Key Technical Levels:

BTC Dominance: Watching for a rejection at the 0.702 Fibonacci retracement level, signaling capital rotation into altcoins.

Support Levels: Holding above 200-week MA confirms bullish momentum.

Resistance Levels: The psychological barrier at $100,000 remains a key target.

🚀 Altcoin Market Outlook:

XRP remains stable at ~$0.246–$0.247, with potential for a breakout.

Altcoins could see a strong rally once BTC dominance starts to decline.

🔍 Final Thoughts:

Bitcoin appears to be in a grinding phase, climbing the “wall of worry” before major FOMO kicks in.

The current price action aligns with past range-bound consolidations, often unpredictable but bullish in structure.

Momentum favors the bulls, but expect volatility—just remember, choppy action is part of the process.

📢 Stay patient & follow the trend! Are you bullish or bearish? Drop your thoughts below! 🚀📉

XRP: Possible pattern this bull runHello,

Look out for April dip and if it remains above $1.7, it is possible for XRP to reach $7 to $11.

FED should do two more cuts by June 2025, that might trigger one last pump to the top.

0.5 trillion market cap will bring XRP around $7, which is definitely possible if it stays above $1.7.

happy trading

BITSTAMP:XRPUSD

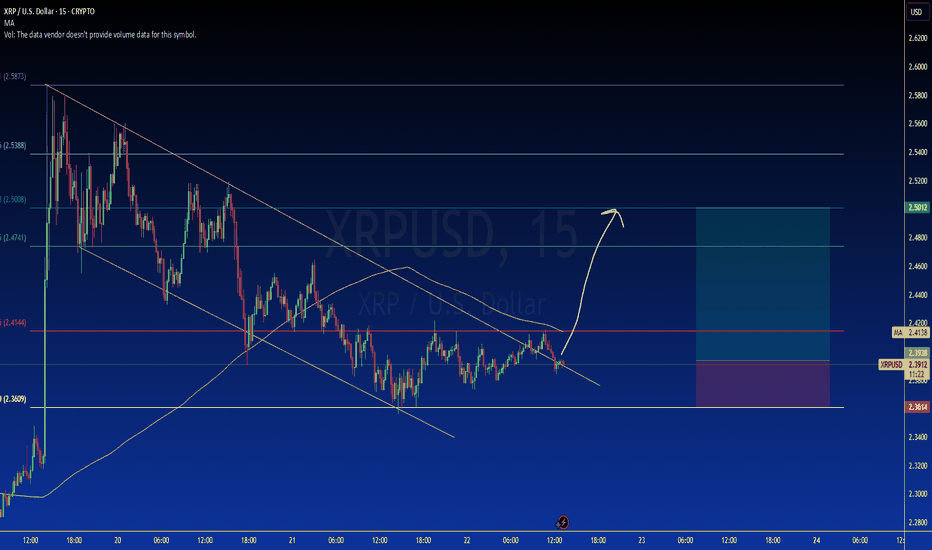

XRP/USD 15-Minute Scalping Setup – Bullish Breakout in PlayAlright, here’s my current scalp setup for XRP/USD on the 15-minute chart. Price is respecting the trendline, and we’re seeing a nice bounce off support. I’ve entered around $2.4588, with a stop set at $2.3916 to manage risk properly. Targeting $2.6436 for a solid 7.52% move, giving me a 2.76R setup—worth the shot.

The moving average at $2.4022 is acting as dynamic support, and as long as price stays above, I’m holding this position. If we break higher, momentum should push us toward the target. If it rejects, I’m out with minimal damage. Let’s see how this plays out.

XRP/USD "Ripple vs US Dollar" Crypto Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XRP/USD "Ripple vs US Dollar" Crypto market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

Thief SL placed at the recent / swing low level Using the 4H timeframe (2800) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 1500 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Read Fundamental, Macro, COT Report, On Chain Analysis, Sentimental Outlook, Intermarket Analysis, Future Prediction:

XRP/USD "Ripple vs US Dollar" Crypto market is currently experiencing a Bearish Trend (Higher chance for Bullish in Future),., driven by several key factors.

1. Fundamental Analysis⚡⭐

Fundamental analysis assesses XRP’s intrinsic value by evaluating adoption, regulatory environment, technological developments, and market demand.

Adoption: XRP, developed by Ripple, is tailored for cross-border payments and liquidity management. By March 2025, expanded partnerships with financial institutions could enhance its utility, driving demand and supporting price growth.

Regulatory Environment: The SEC lawsuit against Ripple remains a pivotal factor. A favorable resolution by 2025 could eliminate uncertainty, boosting investor confidence and XRP’s price. Conversely, ongoing legal challenges might hinder growth.

Technological Developments: Improvements to the XRP Ledger, such as faster transaction speeds or new features, could reinforce its competitive advantage over other cryptocurrencies and traditional payment systems.

Market Demand: XRP’s ability to lower costs and accelerate international transfers increases its appeal. Growing global demand for efficient payment solutions could elevate its value.

Conclusion: The fundamental outlook is cautiously optimistic, with significant upside potential linked to regulatory clarity and increased adoption.

2. Macroeconomic Factors⚡⭐

Macroeconomic conditions shape investor risk appetite and influence cryptocurrency prices.

Global Economy: A stable or growing global economy in 2025 could encourage investment in risk assets like XRP. A recession, however, might trigger a shift to safer assets, pressuring XRP’s price downward.

Interest Rates: Low or declining rates could make XRP more appealing than yield-bearing assets. Rising rates might reduce its attractiveness.

Inflation: High inflation could position XRP as an inflation hedge, attracting investors. Deflationary trends might dampen demand for speculative assets.

Geopolitical Events: Stability in major markets (e.g., U.S., Asia) could foster bullish sentiment, while geopolitical tensions might heighten volatility.

Conclusion: Assuming a stable economy with low interest rates and moderate inflation in 2025, macroeconomic conditions could support XRP’s growth.

3. Commitments of Traders (COT) Data⚡⭐

COT data provides insights into market sentiment by showing the positions of large traders and institutions.

Large Traders (Non-Commercial): A net long position (e.g., a long-to-short ratio of 1.5:1) indicates bullish sentiment among institutional players, suggesting expectations of price appreciation.

Small Traders (Commercial): If retail traders are also predominantly long, this could amplify bullish momentum. A net short position might reflect caution or hedging strategies.

Conclusion: With large traders net long, COT data leans bullish, assuming retail sentiment aligns similarly.

4. On-Chain Analysis⚡⭐

On-chain metrics reveal network activity and user behavior, key indicators of XRP’s health and adoption.

Active Addresses: An increase in active addresses suggests growing usage and adoption, supporting price stability and potential growth.

Transaction Count: Higher transaction volumes indicate greater utility, possibly driven by real-world applications like remittances.

Validator Activity: Robust validator participation and network uptime signal a secure and reliable network.

Whale Activity: Accumulation by large holders (whales) reflects bullish intent, while distribution could indicate selling pressure.

Conclusion: Rising active addresses and transaction counts point to strong network activity, supporting a positive price outlook.

5. Intermarket Analysis⚡⭐

Intermarket analysis examines XRP’s correlations with other asset classes.

Stock Market: A positive correlation with tech-heavy indices like the NASDAQ suggests XRP could rise alongside tech sector strength.

US Dollar: A negative correlation with the US Dollar Index (DXY) implies that a weaker dollar might lift XRP prices.

Other Cryptocurrencies: XRP often tracks Bitcoin and Ethereum; a broader crypto bull run could propel XRP higher.

Conclusion: Favorable conditions—such as a robust tech sector and a weaker dollar—could align with bullish intermarket signals for XRP.

6. Market Sentiment Analysis⚡⭐

Sentiment analysis evaluates the mood across different investor groups.

Retail Investors: Positive sentiment on platforms like Twitter and Reddit (e.g., 70% bullish) reflects retail optimism, often fueling momentum.

Institutional Investors: Bullish sentiment, inferred from COT data, suggests confidence among sophisticated players.

Fear and Greed Index: A reading of 70 indicates greed, signaling strong bullishness but cautioning against potential overbought conditions.

Conclusion: Broadly positive sentiment, tempered by high greed levels, supports a bullish yet cautious perspective.

7. Next Trend Move and Future Trend Prediction⚡⭐

Projected price movements for XRP/USD are based on current trends and analysis:

Bullish Outlook:

Short-Term: $2.50–$2.60

Medium-Term: $3.00–$3.50

Long-Term: $4.00–$5.00

Key Drivers: Regulatory clarity, adoption growth, and supportive macro conditions.

Bearish Outlook:

Short-Term: $2.30–$2.20

Medium-Term: $2.00–$1.80

Long-Term: $1.50–$1.20

Key Risks: Regulatory setbacks, macroeconomic headwinds, or technological challenges.

Final Prediction: The analysis leans cautiously bullish, but bearish (short) scenarios remain credible if risks like regulatory uncertainty or economic shifts emerge. Investors should watch catalysts closely to determine XRP’s next move—upward or downward.

8. Overall Summary Outlook⚡⭐

The outlook for XRP/USD is cautiously bullish, supported by:

Strong Fundamentals: Adoption and technological utility provide a solid base.

Supportive Macro Conditions: Low rates and stable growth favor risk assets.

Bullish COT Data: Institutional optimism signals confidence.

Healthy On-Chain Metrics: Network activity reflects real demand.

Favorable Intermarket Signals: Correlations with tech and a weaker dollar are positive.

Positive Sentiment: Investor optimism drives momentum.

Risks: Regulatory uncertainty, macroeconomic shocks, or profit-taking could temper gains. On balance, the evidence favors growth.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

RIPPLE What Next? XRP To Make It's Next Move! XrpUsdT GO or NO? ⚠️ The next 240 minute bar could be key in decrypting what XRP is likely to do next.

ℹ️ The way is clear for it to begin building a BULLISH base from here however, the way 🟢SeekingPips🟢 sees it there still remains a fair amount of liquidity below current price in the form of stop orders and buyers stop losses.❗️

✅️ VOLUME viewed on the LOWER TIMEFRAMES may hold the clues from here.🚀

🟢SeekingPips🟢 pips has this on his RADAR and will be updating his thoughts on this CRYPTO regularly this week.📈

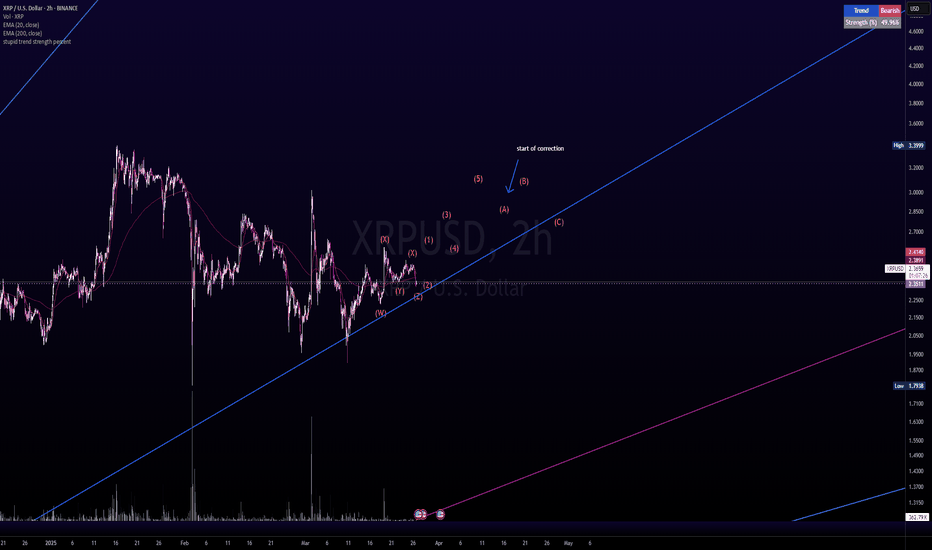

XRP: Wave 4 Corrective Structures Signaling Final Push?🔹 Overview:

We’re currently witnessing a variety of corrective structures across the crypto market, with assets like XRP showing significant strength, while Cardano (ADA) and SUI appear to be forming classic ABC corrections and wave 4 setups. These patterns align with historical market cycles, particularly resembling price action from September 2017, before a final wave 5 rally.

🔹 Technical Breakdown:

-XRP has remained resilient, consolidating instead of breaking down—indicative of a strong underlying structure.

-Cardano (ADA) is following a textbook ABC correction, similar to past pre-wave 5 setups.

-SUI is showing signs of a wave 4 consolidation, which typically precedes a final wave 5 push.

These patterns corroborate each other, suggesting a synchronized market move is approaching.

🔹 Macro Market Alignment:

-2017 Parallel: When comparing current structures to past cycles, we see striking similarities. XRP’s correction phase now mirrors its 2017 structure, aligning with the moment before its parabolic move.

-Stock Market Correlation: Broader macro trends, including mega-cap stock movements, also support the prediction of one last rally before the cycle concludes.

🔹 Key Considerations:

✅ Wave 5 Blow-Off Top: If historical patterns hold, we could see a broad market rally leading to a final euphoric push.

✅ Retrace vs. New Highs: While some altcoins may set new all-time highs, many will likely only retrace previous losses rather than break out into price discovery.

✅ Timing Expectations: Based on previous cycle durations, a final move could fully play out by mid-2025. However, market sentiment and liquidity will ultimately dictate the speed.

🔹 Trade Plan & Risk Management:

⚠️ Final phase of the cycle – time to start considering exit strategies for long-term positions.

⚠️ Watch for confirmation signals – particularly evidence of expansion across the market.

⚠️ If the rally fails to materialize, and markets continue retracing, this could signal a deeper macroeconomic shift.

🔹 Final Words:

The market structure suggests we are in the late-stage corrective phase, setting up for a final impulsive wave. While exact timing remains uncertain, this aligns with previous cycle patterns. Keeping an eye on XRP, Cardano, and SUI as key indicators will be crucial in confirming this prediction.

🔻 What do you think? Are we about to enter a final wave, or is the market sentiment shifting into an extended downturn? Drop your thoughts in the comments!

📈 Like & Follow for more in-depth market analysis! 🚀

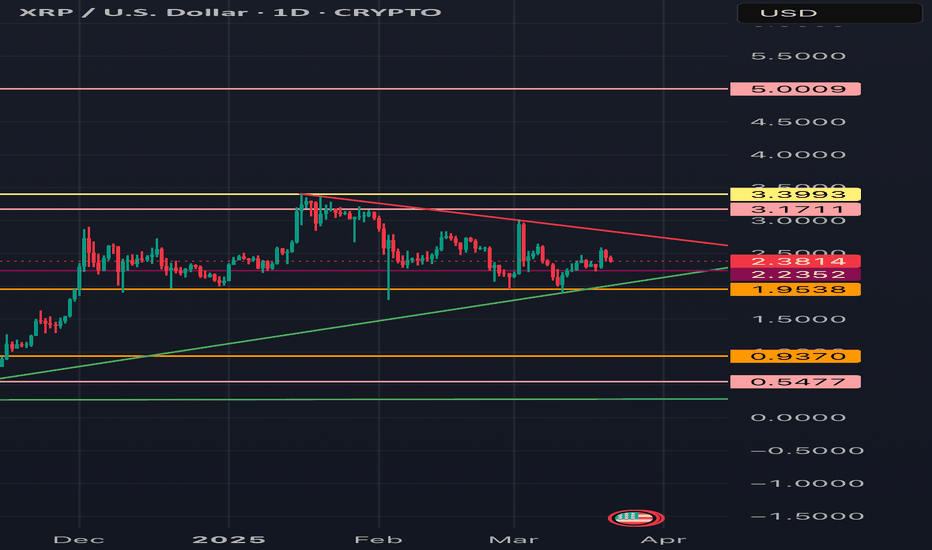

XRP with likely levels, and alternatives for April 'flash crash'Here's my latest XRP chart, which includes potential levels that could be hit, along with an alternative path for the 5th wave, assuming the bottom is already in on the chart.

- If wave 4 is already complete, then the wave 6 "flash crash" low would likely be higher than the chart shows, perhaps staying within the lower white trendline (thicker white line).

- If wave 4 isn't complete, then the wave 6 "flash crash" would likely go outside the lower white trendline (thicker white line), targeting the green fair value gap (FVG) in the chart or somewhere between that FVG and the lower white trendline, sweeping the previous lowest low of the entire pattern.

- The fair value gap that absorbed the "Trump Crypto Reserve" tweet breakout—which quickly failed after hitting the gap—would likely be filled during the 5th wave (false breakout leg), taking out that high before the April "flash crash."

- The real breakout, the 7th wave, would likely take out the previous all-time high and run to the top of the pattern, reaching the area of the upper white trendline (thicker upper white line).

I will be going over this chart again very soon for anyone who follows me.

Keep in mind that the "flash crash" in April is a theory and may not come to fruition or could be off in timing. However, I do believe that the breakout will begin in May, even if the "flash crash" does not occur in mid to late April.

Good luck, and always use a stop loss!

XRP Price Breakout? Scalping Setup for Quick Profits – TechnicalXRP is showing signs of a potential breakout on the 5-minute chart! The price is attempting to break out of a descending channel, with Fibonacci levels indicating strong resistance and support zones. If the breakout is confirmed, we could see XRP push towards the next key resistance at $2.50. Traders looking for a scalping opportunity should watch for volume confirmation and price action signals. Will XRP pump, or face another rejection? Stay tuned for live updates!

#XRP #Ripple #CryptoTrading #Scalping #DayTrading #TechnicalAnalysis #TradingView #XRPBreakout