XRP/USDT 1H: Bullish Breakout Holding – Can $2.80 Be Reached?XRP/USDT 1H: Bullish Breakout Holding – Can $2.80 Be Reached?

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!

Current Market Conditions (Confidence: 8/10):

Price at $2.51, confirming strong bullish breakout.

RSI at 68.91, approaching overbought territory but still has room for continuation.

Clear order block formation at $2.35, reinforcing demand.

No significant bearish divergences present, supporting further upside.

LONG Trade Setup:

Entry: $2.48 - $2.52 zone.

Targets:

T1: $2.65 (initial resistance).

T2: $2.80 (extended target).

Stop Loss: $2.35 (below recent support).

Risk Score:

7/10 – Favorable risk-to-reward, but watch for profit-taking near resistance zones.

Market Maker Activity:

Accumulation is evident at higher levels, with minimal selling pressure.

Strong break above $2.40 suggests continued bullish momentum.

Key resistance ahead at $2.60, with previous resistance at $2.35 now acting as support.

Recommendation:

Long positions remain favorable within the $2.48 - $2.52 entry range.

Monitor price action near $2.60, as this level may provide temporary resistance.

Volume confirmation needed for a potential move beyond $2.80.

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!

XRPUSDT.P trade ideas

XRP/USDT (1H Chart) - Trade Strategy & Market InsightsBased on the analysis of the chart and considering the market patterns and liquidity behaviors I previously mentioned, here’s how I would approach this situation.

1. Observing Key Market Movements

✅ Liquidity Grab Before Expansion:

Price swept the downside liquidity (below 2.2677 USDT) before making a sharp move up.

Break of Structure (BOS) confirmed a bullish trend shift.

✅ Fair Value Gap (FVG) Retest in Progress:

A large FVG has formed between 2.3788 and 2.4512 USDT, which price is now testing.

If price fills this FVG and shows a bullish reaction, the next move is likely upwards.

✅ Order Block (OB) Near 2.2225 USDT Acting as Strong Support:

If price drops further, the next major liquidity zone sits around 2.2225 USDT.

This zone is critical for bounce confirmation.

✅ RSI Showing Overbought Conditions & Possible Cooldown:

RSI at 68.49, indicating it was previously overbought and may need a correction.

If RSI drops to 50–55 range while price stays stable, it confirms bullish momentum is still intact.

2. Trade Setup & Recommendations

✅ Ideal Buy Entry (Long Position)

First Entry Zone: Around 2.38 - 2.41 USDT (Inside FVG) → Conservative buy.

Second Entry Zone: Around 2.27 - 2.30 USDT (Deeper retracement to liquidity grab) → High-risk buy.

Confirmation Needed: Look for a bullish engulfing candle or pin bar before entering.

❌ Stop Loss (SL)

Below 2.22 USDT, since breaking this would invalidate the bullish structure.

🎯 Take Profit (TP) Targets

TP1: 2.48 USDT (Previous Resistance)

TP2: 2.64 USDT (Major Resistance Level)

TP3: 2.75+ USDT (Potential breakout level)

XRP/USDT:BEST CHANCEhello friends

Due to the price correction, now is a good opportunity to buy in steps.

Note that the best way to buy a ladder is to not suffer a loss if the price changes.

We have specified price targets for you.

We have also specified an important resistance range for you, when the price reaches it, we will give you an update.

*Trade safely with us*

SEC Officially Drops Ripple $XRP Lawsuit XRP Up 13%In a shocking news today the US SEC officially drops Ripple CRYPTOCAP:XRP lawsuit a move that saw CRYPTOCAP:XRP surged nearly 15% today amidst the market dip to $2.54 pivot. in a similar events, CRYPTOCAP:ETH likewise reclaims the $2k pivot albeit CRYPTOCAP:BTC trading at FWB:83K point.

Garlinghouse called the move “a resounding victory for Ripple, for crypto, every way you look at it.” Moreover, the move was one in a string of similar actions taken by the revamped agency this year. The arrival of 2025 has come with a completely overhauled cryptocurrency policy embraced by the returning Trump administration.

The lawsuit was originally filed four years ago, under the previous Gary Gensler-led SEC. Ripple CEO Brad Garlinghouse called the lawsuit “doomed from the start” in a statement following the dropped appeal.

“In many ways, it was the first major shot fired in the war on crypto,” Garlinghouse added. “I truly felt that I knew then that Ripple was not only on the right side of the law, but I felt that we were also going to be proven to be on the right side of history.”

The landmark decision has proven Garlinghouse and the company right in the end.

Technical Outlook

As of the time of writing, CRYPTOCAP:XRP is up 11% trading within over bought territory with the RSI of 73. For the altcoin, the 65% Fibonacci retracement point is serving as a support point should CRYPTOCAP:XRP cool off. Similarly, a break above the $2.64 price pivot that connotes with the 38.2% Fibonacci level could spark a move to $5 as more buyers will feel convicted and step in.

XRP's Bullish Triangle: A Promising PatternXRP's Bullish Triangle: A Promising Pattern

XRP has recently completed a bullish triangle pattern, which appears to be a strong and reliable formation. The growing trading volume further supports this bullish outlook.

While Bitcoin's trajectory remains uncertain, many cryptocurrencies are showing signs of growth, potentially paving the way for Bitcoin to follow suit.

For XRP, I am targeting conservative price levels at 2.37, 2.45, and 2.56, based on the current market dynamics and technical indicators.

You may find more details in the chart!

Thank you and Good Luck!

❤️PS: Please support with a like or comment if you find this analysis useful for your trading day❤️

XRP: Current SituationYou asked, and we delivered:

XRP is trading at $2.23, down from recent highs and caught in a choppy phase amid a broader crypto market dip (total market cap down 4.4% in the last 24 hours). Some traders point to a breakout from a descending channel, hinting at bullish potential, while others flag whale selling and weak volume, suggesting bearish risks. The breakout lacks strong volume, raising doubts about its staying power. External factors, like the ongoing SEC lawsuit and ETF rumors, add volatility but remain speculative. For now, XRP is testing immediate support at $2.20-$2.23, with the market awaiting a decisive move.

Technical Indicators and Key Levels

Short-Term (1-Hour Chart):

Support: $2.20-$2.23 (current test), $2.00

Resistance: $2.33, $2.50

Indicators: RSI at 49 (neutral), MACD bearish. The breakout needs volume to confirm; otherwise, a retest could push XRP back to $2.00.

Long-Term (Weekly Chart):

Support: $1.90 (critical), $1.50

Resistance: $2.50, $3.00

The 200-day MA is falling, reflecting long-term pressure, but holding $1.90 is key for bulls.

Potential Scenarios

Bullish Case: Hold $2.20, break $2.33 with volume → target $2.50. Long-term, clear $2.50 → aim for $3.00.

Bearish Case: Drop below $2.20 → test $2.00; below $1.90 risks $1.50.

Volume is critical—watch for spikes to validate moves.

Broader Context and Tips

XRP’s utility in cross-border payments and ETF whispers keep long-term optimism alive, but regulatory uncertainty looms. Traders should focus on $2.20, a hold keeps bulls in play, a break signals caution. Use tight stops (e.g., below $2.20 for longs) and stay alert for news on the SEC case or ETF developments. Long-term, $1.90 is the line to watch for bullish continuation.

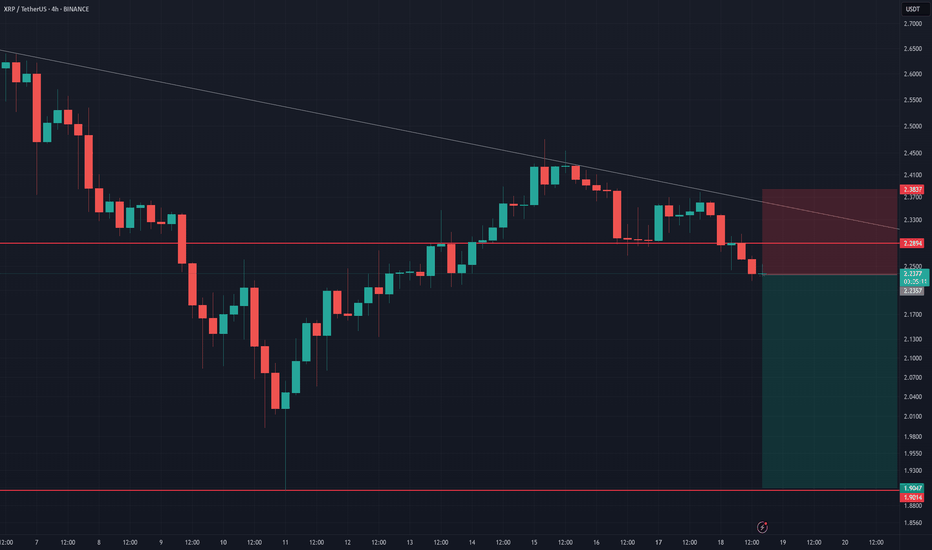

XRP/USDT 4h chart review Hello everyone, let's look at the 4H XRP chart to USDT, in this situation we can see how the price moves over the upward trend line, or rather on the upward trend line and fights to stay above the line.

However, let's start by defining goals for the near future the price must face:

T1 = $ 2.41

T2 = $ 2.49

Т3 = 2.56 $.

T4 = $ 2.63

Let's go to Stop-Loss now in case of further declines on the market:

SL1 = 2.30 $

SL2 = $ 2.25

SL3 = $ 2.22

SL4 = $ 2.17

Looking at the RSI indicator, you can see how it stays in the upper part of the range, however, you can see how there was a place for potentially re -growth.

TradeCityPro | Deep Search: In-Depth Of XRP👋 Welcome to TradeCity Pro!

Today, we're diving deep into the Uniswap project with Deepresearch. First, we'll review the project information, and then I'll provide a technical analysis of the UNI coin.

🤑Overview of XRP & XRP Ledger (XRPL)

XRP Ledger (XRPL) is a decentralized blockchain launched in 2012 that functions as a currency exchange network, payment settlement system, and remittance platform. It is designed as an alternative to the SWIFT system for international money transfers, enabling instant and low-cost transactions. Of course, these services have not been officially launched yet.

🔹Key Features

Transaction Speed: 3-5 seconds

Scalability: 1,500 transactions per second

Low Fees: $0.0002 per transaction

Energy Efficiency: Carbon neutral and low energy consumption

🔹How XRP Works

XRP operates on an open-source, peer-to-peer, decentralized platform. Unlike Bitcoin and Ethereum, which use Proof-of-Work (PoW) and Proof-of-Stake (PoS), XRP uses the Ripple Protocol Consensus Algorithm (RPCA).

🔹Key Components of XRP Ledger

Consensus Mechanism:

-Transactions are verified by a group of bank-owned servers (validators).

-Users select trusted nodes (Unique Node List - UNL) for transaction validation.

-A transaction is validated if 80% of validators approve it.

-Instead of blocks, ledgers are used to store transactions.

🔹Gateways:

-Acts as a middleman for currency exchange between fiat and cryptocurrencies.

-Anyone can create a gateway to provide liquidity in XRP transactions.

🔹Transaction Fees:

Minimum transaction cost is 0.00001 XRP, significantly lower than bank fees for cross-border payments.

🔹XRP Tokenomics & Vesting Schedule

Total Supply: 100 Billion XRP (Pre-mined)

Current Circulating Supply: ~45 Billion XRP

Escrow System:

-80 Billion XRP was given to Ripple Labs at launch.

-55 Billion XRP was locked in escrow, with monthly releases of up to 1 Billion XRP.

-Unused XRP is returned to escrow to control supply inflation.

Inflation and Deflation Mechanism:

Every transaction burns a small amount of XRP, reducing total supply over time.

Unlike Bitcoin, which is capped at 21 million coins, XRP’s supply management prevents extreme price volatility.

🔹Ripple’s Funding & Investors

Total Raised: $294.5 Million

Current Valuation: $9.8 Billion

🔹Major Funding Rounds

🔹Key Investors & Partnerships

1- SBI Holdings – Major financial institution in Japan, strong supporter of XRP.

2- Santander & Accenture – Integrated XRP for remittance solutions.

3- Bank of America & American Express – Tested XRP for cross-border payments.

4- BlackRock – Exploring tokenization of U.S. Treasury bonds on XRP Ledger.

🔹Ripple and SEC Lawsuit

Background of the Legal Case

-The SEC filed a lawsuit against Ripple in December 2020, alleging that XRP is an unregistered security.

-Ripple argues that XRP is a digital asset, not a security, and operates similarly to Bitcoin and Ethereum.

Latest Developments

-July 2023 Court Ruling: U.S. District Judge Analisa Torres ruled that XRP is not inherently a security, particularly when traded on secondary markets. However, the court found that Ripple's direct sales of XRP to institutional investors constituted unregistered securities offerings.

-Ongoing Settlement Discussions: Recent reports indicate that the SEC is considering classifying XRP as a commodity in its ongoing settlement talks with Ripple Labs.

Potential Impact on Market

-If Ripple wins – Strengthens XRP’s legal standing, boosts institutional investment, and may set a precedent for other cryptocurrencies.

-If SEC wins – Increases regulatory scrutiny, could affect other blockchain projects, and may impact market liquidity.

🔹Future Roadmap & Developments (2025)

Regulatory Expansion and Compliance:

-Expanding into Dubai with regulatory approval, reducing dependency on the U.S.

-Seeking partnerships with Central Banks for CBDCs (Central Bank Digital Currencies).

Tokenization and Institutional Finance:

-BlackRock partnership to tokenize U.S. -Treasury Bonds on the XRP Ledger.

-Increased use of XRPL for real-world asset (RWA) tokenization.

Enhanced XRP Ledger Capabilities:

-Improvements in transaction speed and cost-efficiency.

-New developer tools for smart contracts and DeFi applications.

🔹TVL overview:

An analysis of the Total Value Locked (TVL) in XRPL reveals that after a significant drop in early November 2024, it has recently shown a modest upward trend. Since early February 2025, TVL has increased from approximately $31.5 million to $34.5 million. Despite this recovery, it remains about 380% below its peak recorded in November.

—

🔹Certik: 94.25

—

🔹Ripple Team and Key Figures Behind XRP

Founders (2012):

-David Schwartz (CTO): Architect of XRP Ledger, leads technical development.

-Jed McCaleb: Co-founder, later founded Stellar (XLM).

-Arthur Britto: Key cryptographic contributor, works on decentralization.

-Chris Larsen: Co-founder, now Executive Chairman.

🔹Current Leadership:

-Brad Garlinghouse (CEO): Drives global expansion, leads SEC legal battle.

-Monica Long (President): Manages Ripple’s growth strategy.

-Kristina Campbell (CFO): Oversees Ripple’s financial operations.

-Stuart Alderoty (Chief Legal Officer): Leads Ripple’s defense in the SEC lawsuit.

-Global Presence: Offices in San Francisco (HQ), London, Singapore, and Duba

🔹On-Chain Analysis of Ripple (XRP)

Following XRP’s all-time high (ATH) in January 2025, network activity has declined sharply, with the number of active addresses returning to levels seen four months ago.

In March, exchange inventories show an increase in inflows, possibly indicating selling pressure from individual holders.

Regarding supply distribution, wallets holding over 1 million XRP (primarily institutions and organizations) have reduced their holdings since the ATH. Meanwhile, the number of addresses holding over 1,000 XRP has increased, but this growth appears to be partly due to transfers from larger holders rather than new demand.

🔹Platforms for creating XRP liquidity pools

Uniswap

KLAYswap

Claimswap

Sologenic

Squadswap

—

🔹Some of the wallets that support XRP:

Atomic Wallet

Trust Wallet

Exodus

Guarda

Xaman

Safepal

MetaMask

Tangem Wallet

BitPay Wallet

Math wallet

Trezor

Now that we have reviewed the project, let’s move on to the chart to analyze it from a technical perspective.

📅 Weekly timeframe

As observed in the weekly timeframe, after breaking 0.6568, an upward leg started, and the price even broke through 1.5728, reaching 3.0590.

📊 Market volume was decreasing before the start of the upward movement but surged with the upward trend, although it is currently on the decline again.

✨ The SMA25 has reached the candles, and the price has pulled back to this area. This indicator might introduce new momentum into the market. If it breaks above 3.0590, we could witness the next upward leg.

💫 If this SMA is broken, the price could correct further down to 1.5728. SMA99 could also act as dynamic support.

🛒 For spot purchases, you can enter upon breaking 3.0590. However, if the price corrects further, new triggers will be formed.

📅 Daily Timeframe

In the daily timeframe, as you can see, the price has formed a range box between 2.0032 and 3.3117 and has managed to maintain itself well within this area.

✔️ The 2.0032 area overlaps with the 0.236 Fibonacci level, and if this area breaks, the price could move down to lower Fibonacci levels.

🎲 Market volume in the box is decreasing, which could bring the next price move closer as decreased volume reduces price volatility and allows more whales to influence the price significantly.

⚡️ If the RSI oscillator can stabilize above 50, it might introduce some upward momentum into the market, potentially driving the price up to the box's ceiling. The main trigger for a bullish market is breaking 3.3117.

🔽 For short positions, you can confirm a downward movement with the break of 2.0032, but be aware that this movement is a bearish correction against the main market trend.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

XRP: The Calm Before the ExplosionXRP has been in strong 100-day accumulation, with a few deviations along the way. Many altcoins have formed reversal patterns, and XRP is setting up for a sharp move upwards. Expecting a breakout from this consolidation phase, potentially propelling XRP to #2 in market cap. The stage is set for a major run!

Entry: NOW

TP: 4

$XRP - Range Bound ConsolidationRanging:

Support: $1.9 to $2

Pivot: $2.45 to $2.5

Resistance: $3

Price is at PoC of Volume Profile

........

Bulls aiming for Breakout and Retest above $3 to lead towards Target Price $5

Bears aiming to Breakdown and Retest Failure of $2 support Band. Bears logical target are the Weekly MA50 at $1.20 and MA200 at $0.75

.......

Neutral stance. Expect further range bound Price Action between the Support-Pivot-Resistance Zones.

Operating with Tight Stop Loss at both extremes of the range seems logical.

Or maybe deploy counter hedges as well for studden upside or downside protection.

XRPUSDT after more range here more fall is ahead XRPUSDT is long-term still super bullish and we are looking for targets like 5$ and 10$ too but if the major resistance zone which is 3.1$ break to the upside else we are looking for more range here and even breakout of 2$ support zone to the downside and targets like 1.5$ and less and then we will update with long positions near that support zones mentioned on the chart too.

DISCLAIMER: ((trade based on your own decision))

<<press like👍 if you enjoy💚

XRP Update: Legal Battle Nearing End & Bullish DivergenceHey traders! 👋

Let’s talk about XRP, a coin that’s been fighting a legal battle with the SEC for years, but it looks like we might be approaching the end of this long-standing case. The lawsuit has been a major overhang, but the fight to get a favorable ruling could set the stage for big things ahead! Ripple is challenging the SEC's stance and aiming for a full win on all fronts, which would be massive for the future of the project. ⚖️

And it's not just about the lawsuit – XRP is making moves in the broader financial world with multiple ETF applications and strategic partnerships with banks. With all these developments, I’m starting to see a bright future for Ripple. Do you agree? 🌟

Looking at the chart, we’ve got a bullish divergence forming, which could signal a potential trend reversal. If XRP manages to break the current downtrend, we may target the supply zone next. However, if we break through that supply, we could be looking at new all-time highs. 🚀

What do you think? Are we about to see a breakout, or will XRP face more resistance? Let’s hear your thoughts in the comments below!

Happy trading, everyone! 💰📈

Ripple is Nearing Important SupportHey Traders, in today's trading session we are monitoring XRPUSDT for a buying opportunity around 2.35 zone, XRP is trading in an uptrend and currently is in a correction phase in which it is approaching the trend at 2.35 support and resistance area.

Trade safe, Joe.