XRPUSDT trade ideas

2.20 Support levels broken , 2.60 rejected , breakthrough to 3+?XRP Technical Analysis – March 6

In my previous analysis, I indicated that XRP was at a key resistance level and could potentially seek lower support levels. As anticipated, it broke the $2.20 support and dropped to $1.90 before gradually climbing back to $2.60, only to face an instant rejection at that level.

During the move up to $2.60, I noticed that the trading range and the higher lows were becoming progressively tighter. What I mean by this is that in my last post, I observed roughly a $0.10 price difference in support and resistance levels on lower timeframes (30M, 15M, and below). However, this time, the price seems to be moving more aggressively as it approaches $2.60 and $3.

In my opinion, XRP is likely to create a lower high as it approaches $2.60, and I expect a potential breakout from this range. If it doesn’t break upward, I’ll be watching for support in the $2.30–$2.40 range, while hoping it holds above $2.20. That level appears significant as XRP looks to be breaking the downtrend, with horizontal and vertical patterns forming lower highs and short-term support levels. The price has been bouncing off these supports, gradually creating new, higher support zones.

I hope this analysis is clear and helpful. This is my second time posting. I’ve been taking profits and re-entering at lower prices, carefully trading within these ranges. XRP often makes moves that look like it’s about to skyrocket, so it’s essential to learn and recognize these patterns.

Shiba Inu (SHIB) Shows First Major Bullish Signal Amid Market ReAfter weeks of downward pressure, Shiba Inu (SHIB) (traded on WhiteBIT) has recorded its first notable bullish retrace, hinting at a potential trend reversal. The asset is currently trading near $0.00001337 and has successfully broken above the 26-day EMA—a key technical level that often signals the start of broader upward momentum.

This breakout is significant, marking SHIB’s first major move above resistance since February’s downtrend. The token’s local support now sits at $0.0000122, and if bullish momentum continues, SHIB could target the next major resistance at the 50 EMA ($0.0000145). A further push above this level could solidify the reversal.

Additionally, the Relative Strength Index (RSI) at 50.75 suggests growing buying pressure. A move above the 55-60 zone would reinforce the bullish setup and potentially trigger further gains. With market liquidity also increasing, traders seem to be re-entering SHIB, setting the stage for possible continued upside.

XRP - Looks Bearish XRP looks really red in terms of volume, CVD etc..

Small retailors are going for Long (low TF) but Smart Money is really decreasing!

Short the sht out of it if the lower blue trend line (marked as blue) breaks downward.

Follow for more ideas/Signals. 💲

Look at my other ideas 😉

Just donate some of your profit to Animal rights and rescue or other charity :)✌️

XRP/USDT:BUY LIMITHello friends

You can see that after the price fell in the specified support area, buyers came in and supported the price and created higher ceilings and floors.

Now we can buy at the specified levels with capital and risk management and move with it to the specified targets.

*Trade safely with us*

$XRP Eyes $10 as SEC Case ClosesAnalysts predict that XRP CRYPTOCAP:XRP could reach $10 by 2030 after the SEC officially dropped its lawsuit against Ripple. Ripple CEO Brad Garlinghouse confirmed that the regulator will not appeal the court’s decision, marking the end of the legal battle that began in 2020. As of March 24, 2025, XRP CRYPTOCAP:XRP trades at $2.46, up 2.17% in the past 24 hours, with a market cap of $143.29 billion.

Despite bullish prospects, challenges remain. Market volatility and competition from Ethereum and stablecoins could slow growth. Analysts at InvestingHaven believe XRP’s success depends on Ripple’s network expansion, though crypto market instability remains a key factor.

While a 306% rise to $10 by 2030 seems feasible, today’s market is less competitive than in 2017 when XRP CRYPTOCAP:XRP surged 64,000%. Investors are closely watching regulatory changes and macroeconomic conditions that could impact the coin’s future trajectory.

$XRP Adds $100 Billion to Its Market Cap in a YearShort-term charts depict XRP CRYPTOCAP:XRP as highly volatile and, at times, disappointing. Despite favorable external factors, the token has gained only 14.96% over the past year. However, the long-term outlook tells a different story—XRP is up 277.50% year-over-year and 385.54% since Donald Trump's pivotal re-election.

XRP’s market capitalization reflects this surge, skyrocketing by approximately $107.6 billion from $34.7 billion to $142.34 billion. The impact of Trump’s November victory is even more pronounced, with XRP’s market cap jumping $113.7 billion from 28$28.6 billion since November 5.

Most of these gains occurred before January 20, when the most crypto-friendly president in history took office, and SEC hardliner Gary Gensler stepped down—marking a turning point for regulatory sentiment toward digital assets.

XRP/USDT📊 XRP/USDT Analysis – March 24, 2025 🚀

XRP is currently trading at $2.4585, showing a slight increase of +0.79%. The chart highlights a significant zone around the $2.50-$2.70 range, which could determine the next big move.

📈 Key Technical Levels:

🔹 Resistance: $2.70 - A breakout above this level could push XRP towards $2.90-$3.00.

🔹 Support: $2.30 - If XRP fails to hold, it may retest $2.20 or lower.

The price is approaching a major resistance zone, and the market will need strong volume to break higher. If rejected, a pullback toward the support zone is likely.

📊 Technical Outlook:

✅ Bullish Scenario: A break and close above $2.70 could trigger a rally toward $3.00 and beyond.

❌ Bearish Scenario: Failure to break resistance might lead to a drop back to the $2.30-$2.20 support area.

📢 Recent Fundamental Developments:

SEC Drops Case Against Ripple: The U.S. Securities and Exchange Commission (SEC) has withdrawn its lawsuit against Ripple Labs, ending a four-year legal battle. This decision has significantly boosted investor confidence in XRP.

Presidential Support for Crypto: President Donald Trump acknowledged XRP's potential inclusion in the U.S. government's crypto reserve and anticipates the approval of an XRP-tracking ETF this year. He emphasized his administration's commitment to positioning the U.S. as a leader in the crypto industry.

Analyst Predictions: Analysts are optimistic about XRP's future, with some forecasting a rise to double-digit values within the year. This bullish outlook is supported by increasing institutional interest and favorable regulatory developments.

Market Sentiment: The resolution of Ripple's legal issues and growing institutional adoption have improved market sentiment toward XRP, potentially attracting more investors.

XRP Found Buyers Near 2.35XRP Found Buyers Near 2.35

From our previous analysis, XRP reached our third target and decreased again.

After this taking profit moment, XRP decreased by nearly 9% from 2.59 to 2.35

The price reaction from 2.35 zone looks strong again and also clear, so XRP may resume the bullish trend again as shown on the chart.

XRP may rise again to 2.56, 2.63 and 2.76

You may find more details in the chart!

Thank you and Good Luck!

❤️PS: Please support with a like or comment if you find this analysis useful for your trading day❤️

Bounce from 200 EMA – Is XRP Ready to Fly?XRP is currently showing bullish momentum as it pushes toward the strong resistance zone after bouncing off the 200 EMA, which is acting as dynamic support. This move follows a consolidation phase above the strong support zone, indicating accumulation.

If the price breaks and sustains above the resistance zone, it could trigger a strong upward move.

DYOR, NFA

XRP/USDT "Ripple vs Tether" Crypto Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XRP/USDT "Ripple vs Tether" Crypto Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish thieves are getting stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (2.0500) then make your move - Bearish profits await!"

however I advise placing Sell Stop Orders below the breakout MA or Place Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest. I Highly recommended you to put alert in your chart.

Stop Loss 🛑: Thief SL placed at 2.4000 (swing Trade Basis) Using the 4H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 1.4000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental, Positioning, Overall Outlook:

╰┈➤XRP/USDT "Ripple vs Tether" Crypto Market is currently experiencing a bearish trend,., driven by several key factors.

🌟⭐🌟Fundamental Analysis

Regulatory: Ripple’s SEC lawsuit remains unresolved; potential ETF approvals (e.g., Bitwise) could lift XRP, but legal risks persist—mixed impact.

Adoption: Ripple’s payment network grows (e.g., U.S. hiring up 75%, FXStreet), but XRP utility lags vs. stablecoins—mildly bullish.

Market Trends: Altcoin interest rises (XRP inflows $38.3M vs. BTC outflow $571M)—bullish.

Tech: XRP Ledger’s speed/low fees remain competitive—bullish.

Supply: 57.45B circulating, 100B total; Ripple’s escrow releases (e.g., 500M unlocked, FXStreet) add pressure—bearish.

🌟⭐🌟Macroeconomic Factors

U.S.: Fed rates at 3-3.5%, PCE 2.6%—USD strength caps XRP gains; weak PMI (50.4) may soften USD—neutral.

Global: China at 4.5%, Eurozone 1.2%, Japan 1%—slow growth boosts safe-havens, indirectly aiding XRP—mildly bullish.

Commodities: Oil at $70.44—stable, neutral for XRP.

Trump Policies: Tariffs (25% Mexico/Canada, 10% China) drive risk-off, potentially lifting XRP vs. USD—bullish.

🌟⭐🌟Commitments of Traders (COT) Data

Speculators: Net long ~40,000 contracts (down from 50,000 post-Jan peak), cooling but still bullish.

Hedgers: Net short ~45,000, steady as firms lock in highs—neutral.

Open Interest: ~90,000 contracts, rising—sustained U.S. interest—bullish.

🌟⭐🌟On-Chain Analysis

Volume: 24h trading volume ~$7.91B (TradingView)—declining buying pressure, bearish signal.

Active Addresses: ~81,000 (CoinRepublic)—stable engagement, neutral.

Dormant Supply: Spiked to 208M XRP ($467M, FXStreet) as long-term holders sell—bearish.

Exchange Supply: 41.75M XRP—high liquidity, potential sell-off risk—bearish.

🌟⭐🌟Market Sentiment Analysis

Retail: 60% short at 2.2000

contrarian upside risk—bullish potential.

Institutional: Mixed—bullish long-term (CoinCodex to $3.26 in 2027), cautious now—neutral.

Corporate: Ripple hedges at 2.50-2.80, neutral stance—stable.

🌟⭐🌟Positioning Analysis

Speculative: Longs target 3.00-3.40, shorts aim for 2.00-1.80

Retail: Shorts at 1.40-1.20—squeeze risk if price rebounds.

Institutional: Balanced, eyeing regulatory clarity.

Corporate: Hedging caps upside pressure.

🌟⭐🌟Overall Summary Outlook

XRP/USDT at 2.2000 shows mixed signals: bullish fundamentals (adoption, tariffs) clash with bearish on-chain (selling pressure) and sentiment (retail shorts, Social media bearishness). Short-term downside to 2.00 looms unless 2.20 holds, with medium-term upside to 2.90 possible if catalysts emerge.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

XRP Breakout Alert! Time for a 40% Move?OKX:XRPUSDT.P has been trading inside a parallel channel for 66 days since January 16, 2025. Now, the price is breaking out to the upside!

💡 The key strategy here is waiting for a retest if the price successfully flips the channel into support, it could be the perfect entry for a strong upward move.

📈 Potential upside? 40%+ if the breakout holds and momentum kicks in!

🔍 Watch for:

✅ Retest & confirmation of support

✅ RSI & momentum indicators aligning

✅ Heatmap support

✅ Gold cross of MA 200-D/50-D

Are you catching this move? Share your thoughts in the comments! 🚀🔥

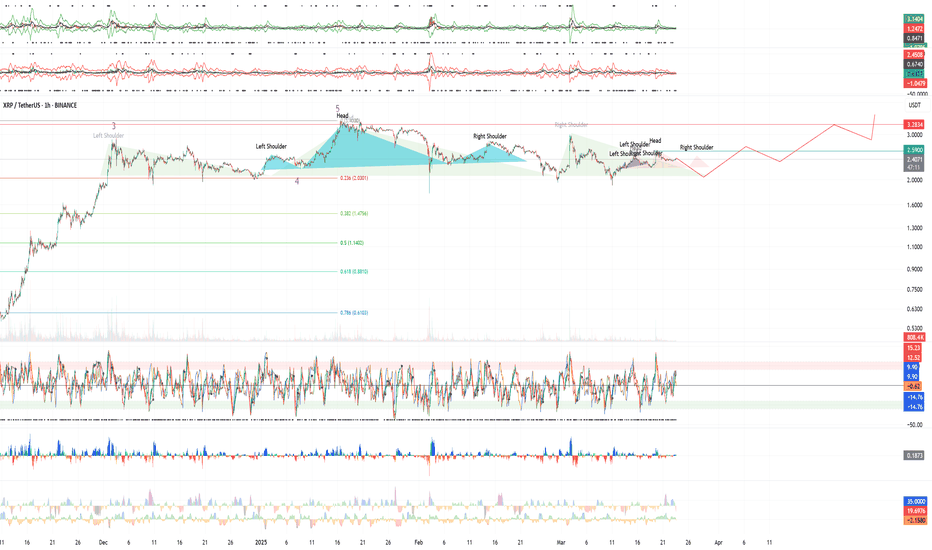

XRPUSDT Consolidating at ATHi see the consolidation as very young and it may need both : time and volume to gather serious weight in order to register new all time highs . I see a rare fractalized repetition of H&S patters on the lower timeframes which is up to end a toping pattern in the following days thus granting short term opportunities for shorting with significant R/R ratios