XRP/USDT I Reverse Short Squeeze Alert! Resistance at 2 USDTHey Traders after the success of my Previous trade this month on NASDAQ:HOOD hitting Target 1 & 2 in 2 days more than 16%+

With a Similar Trade setup But Crypto I bring you today

BINANCE:XRPUSDT

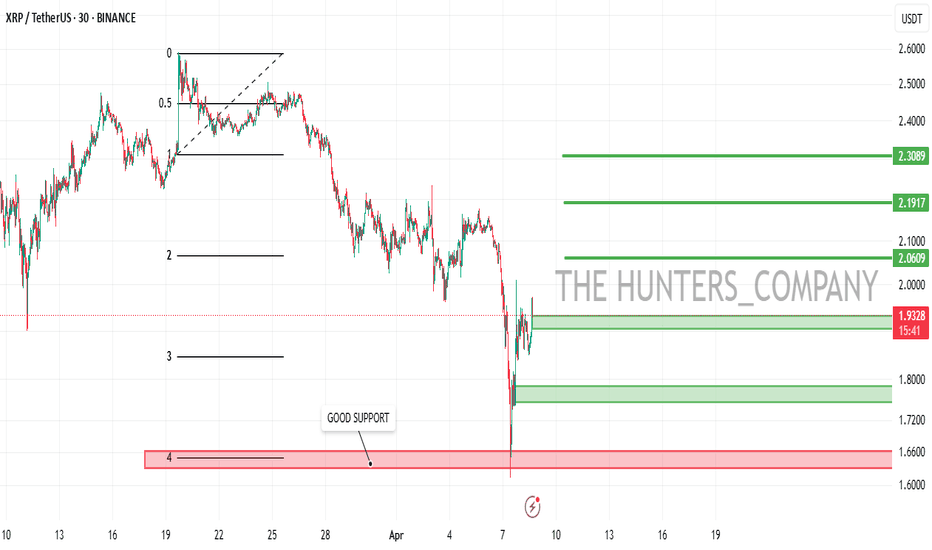

Short opportunity

- Market structure

- Head and shoulder pattern

- Currently will be trading at supply zone which was a recent support and now an ideal place for a reversal which is taking place as we speak- 4 Hour TF.

- Breakdown and retest

- Risk Aversion Dynamics in Cryptocurrency Markets

PROTIP/-

Entry on Bearish candle stick pattern on Current Levels

Stop Loss : 2.2292

Target 1 : 1.4707

Target 2 : 1.0507

Technical View

The orange circle marks a double top within the supply zone, acting as the shoulders of a larger head and shoulders pattern, suggesting strong resistance.

Bearish Trendline

breakdown + Retest

Risk Aversion Dynamics in Cryptocurrency Markets

Fundamental View - How Current Affairs can effect this pair!

The proposed imposition of significant tariffs, such as the 60% levy on Chinese imports suggested by former U.S. President Donald Trump, could trigger a chain reaction across global markets. This scenario would likely amplify risk aversion among investors, potentially catalyzing a sell-off in risk-sensitive assets like XRP (Ripple) in favor of perceived safe havens such as the U.S. dollar (and by extension, Tether/USDT). Below, we analyze the mechanics of this relationship and its implications for the XRP/USDT trading pair.

1. Tariff Escalation and Its Macroeconomic Consequences

1.1 Direct Impact on China’s Economy

A 60% tariff on Chinese exports to the U.S. would directly reduce China’s export competitiveness, potentially lowering its GDP growth by 1.5–2.5 percentage points annually, according to UBS economists. This slowdown would exacerbate existing vulnerabilities in China’s economy, including a property market crisis, weak domestic demand, and deflationary pressures (June 2024 CPI: 0.2% YoY). Reduced economic activity in China—the world’s second-largest economy—could dampen global trade volumes and commodity prices, indirectly affecting risk sentiment in financial markets.

1.2 Global Spillover Effects

The UBS analysis highlights that retaliatory measures by China or other nations could amplify trade fragmentation, further destabilizing supply chains and corporate earnings. For example, the April 2025 announcement of 25% U.S. tariffs on automotive imports triggered a 2.9% drop in the S&P 500 and a 5–7% decline in major Asian equity indices. Such volatility often precedes broader risk aversion, as investors reassess exposure to growth-dependent assets.

2. Risk Aversion Dynamics in Cryptocurrency Markets

2.1 Flight to Safety and USD Appreciation

During periods of economic uncertainty, capital typically flows into safe-haven assets like U.S. Treasuries and the dollar. Tether (USDT), a stable coin pegged 1:1 to the USD, often benefits from this dynamic as crypto traders seek stability. For instance, Bitcoin’s role as a “weak safe haven” for the USD in acute crises suggests that stable coins like USDT could see increased demand during tariff-induced turmoil, while altcoins like XRP face selling pressure.

2.2 XRP’s Sensitivity to Risk Sentiment

XRP, unlike Bitcoin, lacks established safe-haven credentials. Its price action in Q2 2025 exemplifies this vulnerability: a 7.5% decline over 30 days (peaking at 2.57 USDT on March 19 and bottoming at 1.64 USDT on April 7). This volatility aligns with broader patterns where altcoins underperform during risk-off periods. A global slowdown would likely intensify this trend, as retail and institutional investors reduce exposure to speculative crypto assets.

3. Mechanism: From Tariffs to XRP/USDT Price Decline

3.1 Investor Behavior in Risk-Off Environments

Tariff Announcements → Equity Market Sell-Off: The April 2025 auto tariffs caused a 6–7% drop in Asian equities, signaling growing risk aversion.

Liquidity Reallocation: Investors exit equities and crypto (including XRP) to hold cash or cash equivalents like USDT.

USD/USDT Demand Surge: Increased demand for USD lifts USDT’s relative value, pressuring XRP/USDT downward.

3.2 Technical and Fundamental Pressure on XRP

Supply-Demand Imbalance: As sellers dominate XRP markets, the token’s price in USDT terms declines. The 14.56% 90-day volatility in XRP/USDT suggests heightened sensitivity to macroeconomic shocks.

Liquidity Crunch: A broader crypto market downturn could reduce trading volumes, exacerbating price swings.

4. Historical Precedents and Limitations

4.1 Bitcoin’s Mixed Performance as a Hedge

While Bitcoin has shown limited safe-haven properties for the USD in short-term crises, its decoupling from altcoins like XRP during stress periods is well-documented. For example, Bitcoin’s 40% rebound post-COVID crash contrasted with XRP’s prolonged slump in 2020–2021.

4.2 Mitigating Factors

Stimulus Measures: If China implements aggressive fiscal stimulus, as UBS posits, a partial recovery in risk appetite could cushion XRP’s decline.

Crypto-Specific Catalysts: Regulatory clarity or Ripple-related developments (e.g., SEC case resolutions) could counteract macro-driven selling.

5. Conclusion: Bearish Outlook for XRP/USDT in Tariff Scenario

In a tariff-driven slowdown, the XRP/USDT pair faces downward pressure due to:

Risk Aversion: Capital rotation from crypto to stable coins.

USD Strength: USDT demand surges as a proxy for dollar safety.

Altcoin Underperformance: Historical precedent of XRP lagging during macro stress.

People interested should monitor China’s policy response and U.S. tariff implementation timelines, as these factors will determine the severity of XRP/USDT’s downside. A breach below the April 7 low of 1.64 USDT could signal prolonged bearish momentum.

This analysis synthesizes macroeconomic triggers, market psychology, and cryptocurrency-specific dynamics to outline a plausible pathway for XRP/USDT depreciation amid escalating trade tensions.

Not An Investment Advise

XRPUST trade ideas

Is a 20% Pump to $2.60 Now in Play for Ripple?Hello and greetings to all the crypto enthusiasts, ✌

All previous targets were nailed ✅! Now, let’s dive into a full analysis of the upcoming price potential for Ripple 🔍📈.

Ripple is currently approaching a highly significant trendline, signaling a potential breakout. In addition, the emergence of strong bullish volume suggests growing investor confidence and momentum building toward an upward move. From this level, I anticipate at least a 20% price increase, with the primary target set at $2.60, as the critical $2.50 resistance level appears poised for a breakout in the coming days.📚🙌

🧨 Our team's main opinion is: 🧨

Ripple is gaining momentum near a key trendline with strong buying volume, eyeing a 20% move toward $2.60 as the $2.50 resistance looks ready to break. 📚🎇

Give me some energy !!

✨We invest hours crafting valuable ideas, and your support means everything—feel free to ask questions in the comments! 😊💬

Cheers, Mad Whale. 🐋

XRP/USDT:BUY LIMITHello friends

Due to the price drop, we have reached a good support area, which you can see is supported by good buyers.

Now we can buy in stages and with capital management in the specified areas and move to the specified targets.

Always buy in fear and sell in greed.

*Trade safely with us*

The last bullish chance of RIPPLE in Mid term!The price has formed a bullish wedge on the daily time frame, and if it breaks out, it can drive the price up to around $3 . I don't know why this coin reminds me of BNB!!!

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

Why it is a good idea to start shorting XRP at $2.16 (4/12)Two clear distribution channels on the daily timeframe that have harmed a lot of retail investors FOMOing in.

Scenario 1: XRP continues its trajectory in the downward distribution channel, potentially dumping to the downside at any time

or

Scenario 2: Reversal of downwards channel with price trending upwards for an extended period on the daily (most likely in the bottom half of the upward channel)

XRP, Bloodbath is ComingBINANCE:XRPUSDT / 1D

Hello Traders, welcome back to another market breakdown.

BINANCE:XRPUSDT is showing strong bearish momentum after BINANCE:BTCUSD and BINANCE:ETHUSD broken bellow resistance. However, the price is oversold for now. Hence, instead of jumping in at current levels, I recommend waiting for a pullback into the high of the range zone for a more strategic entry.

If the pullback holds and sell off confirms, the next leg higher could target:

First Resistance: Immediate levels formed during prior consolidation.

Stay disciplined, wait for the market to come to you, and trade with confidence!

Trade safely,

Trader Leo.

XRP Update: Full Analysis & 8X LONG Entry LevelsThe 3-Feb. low has been pierced. Notice the same chart with the same numbers extracted months ago. This is important because the action keeps happening around those levels.

XRPUSDT moved below the 3-Feb. low/support but closed above it. Then it was challenged again yesterday but the session ended as a higher low compared to 7-April and green. This means that the low is in.

We have a technical double-bottom and a long-term test of support. More than four months of sideways action. The stage is set for bullish growth.

We are already ready and active here with an 8X LONG. Entry levels go from $1.75 to $1.96. Just sharing for your info and convenience.

Yesterday's session was full green and negated the two sessions preceding it. This is a shakeout or stop-loss hunt event. This is a bullish signal if we see it as a failed signal. Bears tried to push prices below support but failed. Another way to look at it; XRPUSDT is trading above support and within the bullish zone. Both are good and pointing toward higher prices.

The weekly timeframe reveals a hammer candlestick after the lowest price in months, since November 2024. See here:

The hammer is an early reversal signal. Once confirmation is in, a change of trend is confirmed. Confirmation comes when several sessions close green after the signal shows up.

Finally, we have marketwide action and related markets.

Cardano produced the same pattern but with a higher low in April rather than a lower low.

Bitcoin is bullish and strong, trading back above 80K.

Nvidia is bullish as well as the SPX. So the correction is over and this is a valid, informed, wise and logical assumption, because the market was down for more than four months.

XRPUSDT has beeen clearly sideways, it still is. But sideways means no growth.

So, a rise starts in early November 2024. It reaches maximum momentum in early December and then slows down but still grows. Going a bit higher in early January and then a minor correction phase. The correction produces a low followed by another low, double-bottom; the main move is a bullish jump starting in November. This is the move that is being corrected and consolidated. Once the action resumes, it will resume what was already happening. Up.

If the market was bearish and set to move lower and continue lower, we would be seeing a steep decline, lower highs and lower lows. Instead, we have a perfect sideaways pattern which tends to show up before additional growth.

XRPUSDT will grow strong, mark my words.

The time is now. Mange your risk but feel free to go LONG (experts only).

The rest of the participants can accumulate (buy) like it is the end of the world.

You should be buying now; buy, buy, buy... Once the action resumes, there is no going back. This is your chance.

We caught the late 2024 bullish wave, we will also catch this one; and then next and so on ad-infinitum.

Thanks a lot for your continued support.

It is my pleasure to write for you. We've been trading XRP together since December 2017.

It has been a great ride.

Feel free to follow me.

Namaste.

XRP May Collapse During This CycleXRP has a giant head and shoulders formation in daily chart.

If it breaks 2$ level support zone, XRP may lose at least -%30 of it's value.

You can use it for short.

Safe entry would be below 2$ with a closeure of daily candle.

Or.. Simply short right from here but it would be risky.

XRP: Fresh Gains Ahead? Bullish Setup Intensifies.XRP Price Poised for Potential Breakout? Bulls Eye Fresh Gains Amid Bullish Setup as Open Interest Surges

The cryptocurrency market is a relentless arena of volatility, sentiment shifts, and technical battles. Among the major digital assets, XRP, the native token of the XRP Ledger, often finds itself at the center of intense debate and speculation, largely due to its unique position, technological proposition, and the long-standing regulatory shadow cast by the Ripple vs. SEC lawsuit in the United States. Recently, however, a confluence of factors has ignited discussions about XRP's potential for a significant upward move. With the price consolidating and holding firm above the psychologically crucial $2 mark, coupled with a notable surge in derivatives' open interest, bullish traders are keenly watching for signs that XRP might be coiling up for its next major run.

The Significance of the $2 Threshold: A Psychological and Technical Battleground

Price levels ending in round numbers often act as powerful psychological magnets in financial markets, and $2 is no exception for XRP. Crossing and holding above such a level can signal a significant shift in market sentiment, transforming previous resistance into potential support. For XRP, reclaiming and maintaining ground above $2 carries several implications:

1. Psychological Boost: A sustained presence above $2 instills confidence among existing holders and can attract new buyers who perceive it as a validation of strength. It breaks a mental barrier that may have previously deterred accumulation.

2. Technical Support: Historically significant price levels often become areas where buying interest clusters. If XRP consistently finds buyers stepping in around the $2 mark, it establishes this zone as a credible technical support level. A strong support base is crucial for launching further upside attempts, as it provides a foundation from which bulls can stage rallies.

3. Confirmation of Strength: In technical analysis, breaking above a major resistance level (which $2 may have been previously) and then successfully defending it as support (a "resistance-support flip") is considered a strong bullish signal. It suggests that the underlying demand is robust enough to absorb selling pressure at that level.

The current price action, characterized by XRP holding above $2 despite broader market fluctuations, is therefore a key factor fueling bullish optimism. It suggests resilience and a potential accumulation phase where buyers are absorbing supply, potentially setting the stage for the next leg higher. However, a decisive break below this level could conversely signal weakness and potentially trigger further downside.

Decoding the Bullish Technical Setup: Chart Patterns and Indicators Aligning?

Beyond the $2 level itself, chart patterns and technical indicators are providing further clues that bulls are closely monitoring. While specific patterns evolve rapidly, several common bullish setups could be in play or forming:

1. Consolidation Patterns: Often, before a significant price move (either up or down), an asset enters a period of consolidation. This can take the form of patterns like:

o Ascending Triangles: Characterized by a horizontal resistance line and a rising trendline of support (higher lows). A breakout above the horizontal resistance is typically considered a bullish continuation signal.

o Bull Flags or Pennants: These are short-term continuation patterns that form after a sharp price increase (the "flagpole"). They represent a brief pause before the trend potentially resumes. A breakout above the flag/pennant's upper boundary signals a likely continuation of the prior uptrend.

o Range Consolidation: Price trading sideways between defined support and resistance levels. A decisive break above the range resistance, especially on high volume, can signal the start of a new uptrend.

2. Moving Averages: Key moving averages (MAs) like the 50-day and 200-day simple moving averages (SMAs) are widely watched indicators of medium and long-term trends.

o Golden Cross: A bullish signal occurs when the shorter-term MA (e.g., 50-day SMA) crosses above the longer-term MA (e.g., 200-day SMA). This indicates that short-term momentum is strengthening relative to the long-term trend.

o Price Above Key MAs: XRP trading consistently above both the 50-day and 200-day MAs is generally viewed as a sign of a healthy uptrend. These MAs can also act as dynamic support levels during pullbacks.

3. Momentum Indicators:

o Relative Strength Index (RSI): This indicator measures the speed and change of price movements. An RSI reading above 50 suggests that bullish momentum is dominant, while readings above 70 indicate potentially overbought conditions (though an asset can remain overbought during strong uptrends). A sustained RSI above 50, possibly bouncing off this level during dips, supports a bullish outlook.

o Moving Average Convergence Divergence (MACD): This trend-following momentum indicator shows the relationship between two exponential moving averages (EMAs). A bullish signal occurs when the MACD line crosses above the signal line, especially if this happens above the zero line.

o

If multiple technical indicators and patterns align – for instance, XRP holding above $2, breaking out of a consolidation pattern, trading above key MAs, and showing strong momentum on the RSI and MACD – the case for a potential run becomes significantly stronger.

Open Interest Surges: Fueling the Fire or Adding Risk?

A particularly noteworthy development often accompanying potential price breakouts is a surge in Open Interest (OI) in the derivatives market (futures and perpetual swaps). Open Interest represents the total number of outstanding derivative contracts that have not been settled. It essentially measures the total amount of capital committed to that market.

• Rising OI + Rising Price: This is generally considered a bullish sign. It suggests that new money is flowing into the market, primarily opening long positions, reflecting increasing conviction among buyers that the price will continue to rise. The new longs add buying pressure and fuel the uptrend.

• Rising OI + Falling Price: This is typically bearish, indicating new money is entering to open short positions, betting on further price declines.

• Falling OI + Rising Price: This might suggest that the rally is driven by short-covering (short sellers buying back to close their positions) rather than new buying interest, potentially making the rally less sustainable.

• Falling OI + Falling Price: This often indicates that traders are losing conviction and closing out existing long positions, potentially signaling the end of a downtrend but not necessarily the start of an uptrend.

The reported surge in XRP's Open Interest while the price holds above $2 aligns with the bullish interpretation (Rising OI + Stable/Rising Price). It implies that traders are increasingly betting on upside continuation, adding capital to back their bullish theses.

However, high Open Interest also introduces risks. A large number of leveraged long positions makes the market vulnerable to a "long squeeze." If the price unexpectedly drops (perhaps due to negative news or a broader market downturn), it can trigger cascading liquidations of these leveraged longs. This forced selling adds intense downward pressure, potentially leading to a sharp price crash. Therefore, while rising OI can confirm bullish sentiment, it also amplifies potential volatility in both directions.

Fundamental Factors: The Ever-Present Shadow of the SEC Lawsuit and XRPL Developments

No analysis of XRP is complete without considering the fundamental factors, dominated by the ongoing legal battle between Ripple Labs and the U.S. Securities and Exchange Commission (SEC). The lawsuit, initiated in December 2020, alleges that Ripple conducted an unregistered securities offering through its sales of XRP.

• The SEC Lawsuit: This remains the single most significant factor influencing XRP's price potential, particularly concerning US-based investors and exchanges.

o Positive Outcome/Settlement: A favorable ruling for Ripple, a clear settlement defining XRP as not being a security, or favorable legislation clarifying the status of digital assets could remove a massive cloud of uncertainty. This would likely lead to relistings on US exchanges and potentially trigger a substantial price rally, potentially decoupling XRP somewhat from the broader market trend.

o Negative Outcome: A ruling deeming XRP a security could have severe negative consequences, potentially limiting its utility, hindering adoption (especially in the US), and causing a significant price decline.

o Ongoing Uncertainty: As long as the case drags on, it acts as a headwind, potentially suppressing XRP's price relative to other cryptocurrencies that don't face similar regulatory challenges. Positive developments or perceived wins for Ripple during the legal proceedings often cause short-term price spikes.

• XRP Ledger (XRPL) Developments and Adoption: Beyond the lawsuit, the underlying technology and its adoption matter.

o On-Demand Liquidity (ODL): Ripple's primary use case for XRP, facilitating low-cost, instant cross-border payments, continues to see adoption, primarily outside the US. Growth in ODL volume signifies real-world utility.

o Central Bank Digital Currencies (CBDCs): Ripple is actively engaging with central banks globally, exploring how the XRPL could potentially support CBDC initiatives. Success in this area could significantly boost the ledger's profile and potentially XRP's utility.

o Other Use Cases: Developments around NFTs, decentralized finance (DeFi), and smart contracts on the XRPL, while perhaps less mature than on other blockchains, contribute to the ecosystem's overall value proposition.

Will Buyers Push XRP Further? Potential Targets and Risks

Given the confluence of factors – holding the $2 support, potentially bullish technical setups, and rising open interest – the question remains: can buyers sustain the momentum and push XRP significantly higher?

• Potential Upside Targets: If the bullish scenario plays out and XRP breaks decisively upwards, potential resistance levels and targets could include:

o Recent swing highs (e.g., $2.20, $2.50, depending on recent price action).

o Psychologically important levels ($2.50, $3.00).

o Fibonacci extension levels based on previous price swings.

o The previous all-time high (around $3.40 - $3.84 depending on the exchange data).

• Key Risks: Despite the bullish signals, significant risks persist:

o SEC Lawsuit: Any negative news or ruling remains the primary threat.

o Market-Wide Correction: A downturn in Bitcoin or the broader crypto market could easily drag XRP down, regardless of its individual setup.

o Failure at Resistance: If XRP attempts to rally but fails to break through key overhead resistance levels, it could lead to a reversal.

o Breakdown Below Support: A decisive drop below the $2 support level would invalidate the immediate bullish thesis and could open the door to lower targets (e.g., $1.80, $1.50, or key moving averages).

o OI Liquidation Cascade: As mentioned, high open interest could fuel a sharp sell-off if sentiment sours.

Conclusion: Cautious Optimism Warranted

The current situation for XRP presents a compelling, albeit complex, picture. The ability to hold the crucial $2 support level is a significant show of resilience. Combined with potentially forming bullish technical patterns and a notable surge in open interest suggesting fresh capital inflow and conviction, the ingredients for a potential price run appear to be gathering. Bulls are rightly eyeing fresh gains, encouraged by these developments.

However, caution remains paramount. The cryptocurrency market is inherently volatile, and XRP carries the unique and substantial burden of the SEC lawsuit's uncertainty. While technicals and derivatives data might point towards bullish potential in the near term, fundamental risks and the ever-present possibility of market-wide corrections cannot be ignored. A breakdown below $2 support or negative news from the legal front could quickly invalidate the bullish outlook.

Traders and investors considering XRP must weigh the potentially explosive upside against these considerable risks. Monitoring the $2 level, key resistance zones, developments in the SEC case, and overall market sentiment will be crucial in navigating XRP's next potential move. While the setup looks promising for the bulls, confirmation through decisive price action and continued positive momentum is needed before declaring that XRP is definitively "ready to run."

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Trading cryptocurrencies involves significant risk, and you could lose your entire investment. Always conduct your own thorough research and consult with a qualified financial advisor before making any investment decisions.

XRP Ripple Is Showing That Correction In Crypto Is OverHello, Skyrexians!

Let's continue to look at the different confirmations of the incoming growth on crypto. BINANCE:XRPUSDT is one the largest altsoins was in correction for 4 month. This was a global wave 4, now we have the confirmation that Ripple coin will reach new ATH.

Let's take a look at the daily time frame. Previous huge impulse consists of 5 waves. It was a global wave 3, now we are in the ABC shaped wave 4. The anticipated wave C has been finished inside the 0.61 Fibonacci Retracement. Also we can see the bullish divergence and increasing momentum at the Awesome Oscillator. Moreover, we can see the green dot on the Bullish/Bearish Reversal Bar Indicator , which is the great potential growth confirmation. The target for the next wave is approximately at $3.8, but can be recalculated further.

Best regards,

Skyrexio Team

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

Bearish Continuation or Reversal? XRP at Make-or-Break ZoneCurrent Price: around 1.956 USDT (bouncing slightly as of now).

Support Zone:

First Support: 1.821 USDT

Stronger Demand Zone (highlighted in the blue box): 1.6215 to ~1.84 USDT

Price might test this zone if the downward momentum continues.

Could serve as a potential buy zone or accumulation area.

- Watch for a breakout from the channel with strong volume for confirmation of a reversal.

- A breakdown below the support box would invalidate the bullish outlook and could signal deeper downside.

XRP/USDT DTF Chart – Technical & Fundamental AnalysisXRP/USDT DTF Chart – Technical & Fundamental Analysis

On the DTF chart, XRP is currently in a prolonged consolidation phase, largely due to uncertainty in the financial markets. As we analyze this further, we've identified several key levels that will be crucial for our next market price movement, particularly in alignment with any breakouts that occur at these levels.

We have identified two minor key resistance levels at 2.2500 and 2.5000, which are important to watch. However, the major level we’re eyeing for a potential breakout is 1.9000, our primary support level. This support has already broken clearly, triggering a large volume of sellers’ pending orders. However, market makers stepped in and pushed the price back up, hunting for liquidity. Currently, the price is within this liquidity zone.

We expect a clear liquidity buildup within this zone before the price breaks below the major support again. If that happens, we will position a sell stop order at 1.8900, with a stop-loss at 2.2320 (just above the liquidity zone in case of further liquidity buildup). The take-profit (TP) target is set at 0.9430, the next major key support level.

Technical Outlook:

Key Resistance Levels: 2.2500 and 2.5000

Key Support Level: 1.9000 (already broken, triggering selling pressure)

Liquidity Zone: Current price is within a liquidity zone, anticipating further price action.

Sell Stop Order: 1.8900

Stop-Loss: 2.2320 (above liquidity zone)

Take-Profit: 0.9430 (next major support)

However, this analysis provides a key technical outlook on the setup, while it's also important to consider the positive news surrounding XRP. Ripple's acquisition of Hidden Road and the launch of the Teucrium XRP ETF could act as significant catalysts for XRP’s price. These developments highlight Ripple's commitment to expanding its presence in the growing decentralized finance (DeFi) sector, which could drive future demand for XRP. This is why we are also monitoring the two minor key resistance levels for potential breakouts. If we see breakouts at these levels, it could signal a positive and bullish move for XRP in the future.

On the other hand, the ongoing tensions between China and the U.S. remain a critical factor to watch, as both countries hold substantial Bitcoin reserves, which could influence broader market sentiment. A resolution of these trade disputes could alleviate some market pressures and contribute to a bearish outlook for XRP, especially if the market views these developments as stabilizing factors for global trade. Additionally, it's important to note that the market could face a global recession before the current uncertainties are resolved.

📌 Disclaimer:

This analysis is for informational and educational purposes only and should not be considered financial advice. Trading involves substantial risk, and past performance is not indicative of future results. Always conduct your own research and consult with a financial professional before making any investment decisions.

XRP/USDT – LONG Setup

Price is moving within a descending channel and currently testing the bottom trendline, which has acted as a strong support historically.

A rounded bottom pattern is forming inside the channel, suggesting a possible accumulation phase before breakout.

Break above $2.00–$2.20 resistance could signal the beginning of a bullish wave toward higher levels.

This structure mirrors classic reversal patterns within downtrend channels. If the bullish reaction holds at the lower boundary and a breakout occurs, XRP may gain significant momentum toward $3+.

🔹 Direction: LONG 📈

🔹 Entry Zone: $1.70 – $1.85

🔹 Stop Loss: Below $1.60

🎯 Targets

TP1: $2.3385

TP2: $2.8160

TP3: $3.3062

Lingrid | XRPUSDT Correction Following ABC move CompletionThe price perfectly fulfilled my previous idea . It reached the target. BINANCE:XRPUSDT price has completed its ABC move, which is typically followed by the pullback we're currently witnessing. The market has broken below the psychological 2.00 level and its established range zone. I think the price may move toward the middle of the range zone, as this area historically acts as both support and resistance. However, considering the downward trendline and the key resistance at 2.00 above, I anticipate the price may rebound from that zone and continue its downward trend. My goal is support zone around 1.60

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

Ripple Nearing Strong Support: 18% Upside to $1.99 TargetHello and greetings to all the crypto enthusiasts, ✌

All previous targets were nailed ✅! Now, let’s dive into a full analysis of the upcoming price potential for Ripple 🔍📈.

Ripple is currently approaching the lower boundary of a descending channel, with a robust monthly support level in close proximity. Given this, I anticipate at least an 18% upside from this point, with a target of $1.99, a critical resistance level and a psychologically significant round number. This presents a promising opportunity for short-term growth while navigating key technical levels.📚🙌

🧨 Our team's main opinion is: 🧨

Ripple is approaching strong support in a descending channel, with a potential 18% gain and a target of $1.99, a key resistance level.📚🎇

Give me some energy !!

✨We invest hours crafting valuable ideas, and your support means everything—feel free to ask questions in the comments! 😊💬

Cheers, Mad Whale. 🐋

XRP ... silence before the storm !Hello Traders 🐺

I hope you're doing well — especially during the current market conditions.

Honestly, these days everything seems to be bearish, and staying positive and motivated through the losses is a bit hard, even for pro traders.

But as they say:

If you can't hold during the crash, you probably won't hold during the boom.

Or like the old man said:

"Those who survive the dump, deserve the pump!"

Let’s talk about XRP 👇

As you can see on the chart, price is clearly inside an ascending channel, which can also be considered a bull flag — because when we see a correction after a strong rally, it’s healthy for the market.

In such cases, price tends to form a pattern, and most of the time it's either a channel or some kind of wedge.

In this case, we have an ascending channel — or as mentioned, a bull flag.

So what can we do now?

There are two important trendlines to watch:

The blue line (monthly resistance)

The yellow line (channel support & resistance)

Right now, price is sitting below the blue trendline, so we’ll need a monthly close above it to confirm breakout — it's too early to judge just yet.

If we break in either direction, we have key Fibonacci levels to keep in mind:

0.618 and 0.718 fib levels are acting as support for now — and if we break to the upside, the upper channel resistance is the next big level to watch.

In my opinion, despite BTC.D's current position, there’s a strong chance we’ll see a reversal in the Altcoin sector and a major drop in BTC.D.

If you haven’t read my recent idea about BTC.D yet (which is going viral and was even chosen as an Editor’s Pick), I strongly suggest checking it out here 👇

It’s super important to combine macro fundamentals with technical analysis — and when it comes to Altcoins, BTC.D is a key index you should always pay attention to.

I hope you find this information valuable — and as always, remember:

🐺 Discipline is rarely enjoyable, but almost always profitable

🐺 KIU_COIN 🐺