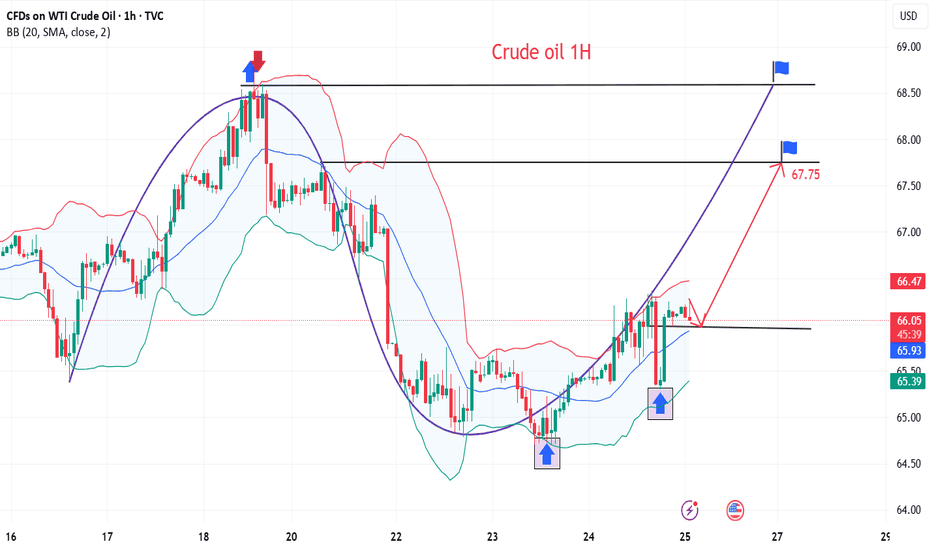

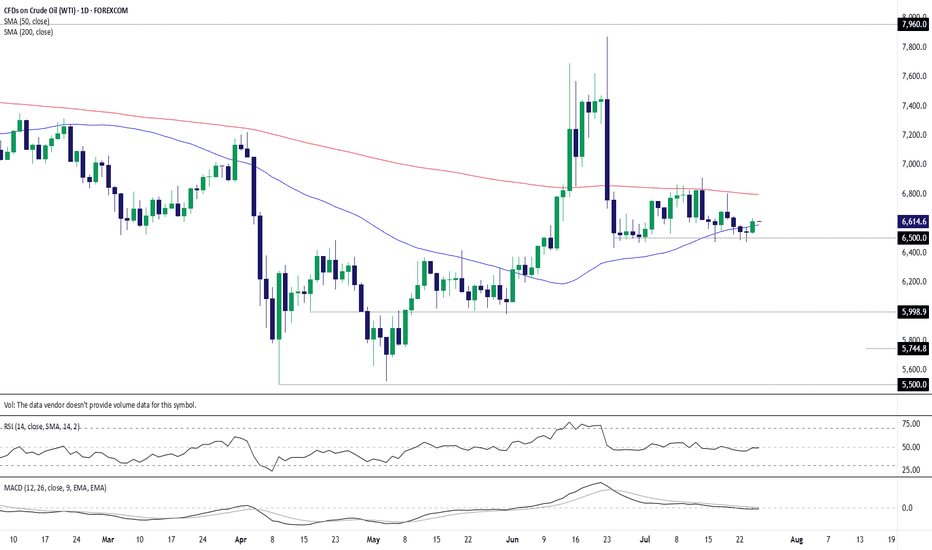

WTI remains supported on Russia sanctions threatIt is worth keeping an eye on the energy markets, given the recent bounce from a key support area around $65.00. With WTI moving back above the 200-day average at $68.00, this is an additional bullish sign from a technical standpoint. This level is now the first support to watch, followed by $67.00 and then that $65.00 key level.

Resistance comes in at $70.00 followed by $72.80.

From a macro point of view, President Trump’s decision to bring forward the deadline for Russia to agree to a ceasefire has ever so slightly heightened the prospect of secondary sanctions being imposed on foreign purchasers of Russian crude — namely China, India, and Turkey. There is a risk we could see a spike in oil prices, if fears of Russian supply being curtailed, intensifies. At the same time, fears about demand have receded with the announcement of a few trade deals by the US and recent economic data from Europe and the US both showing mild strength.

By Fawad Razaqzada, market analyst with FOREX.com.

XTIUSD trade ideas

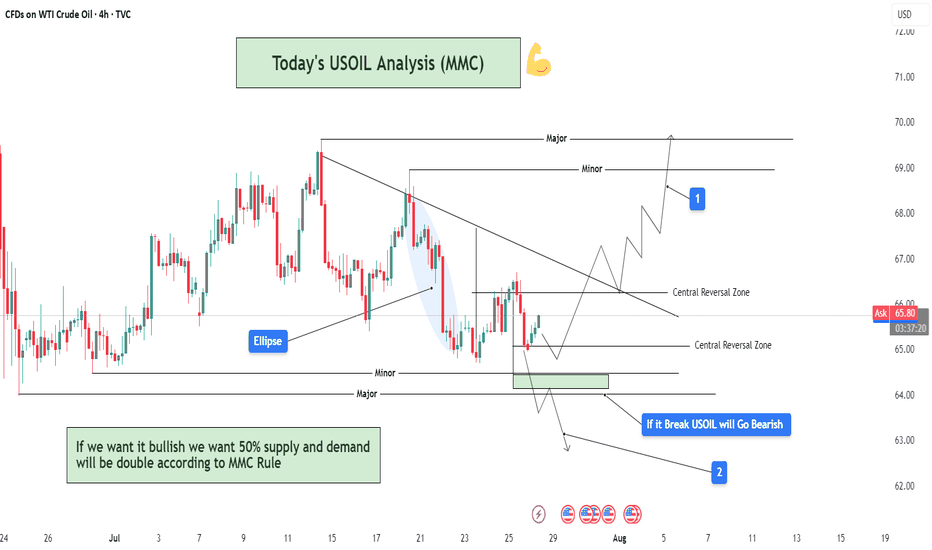

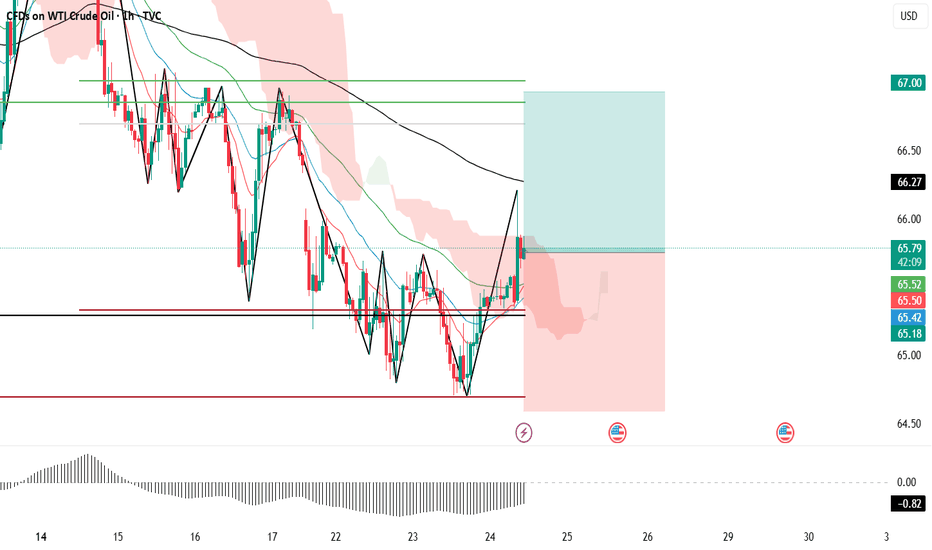

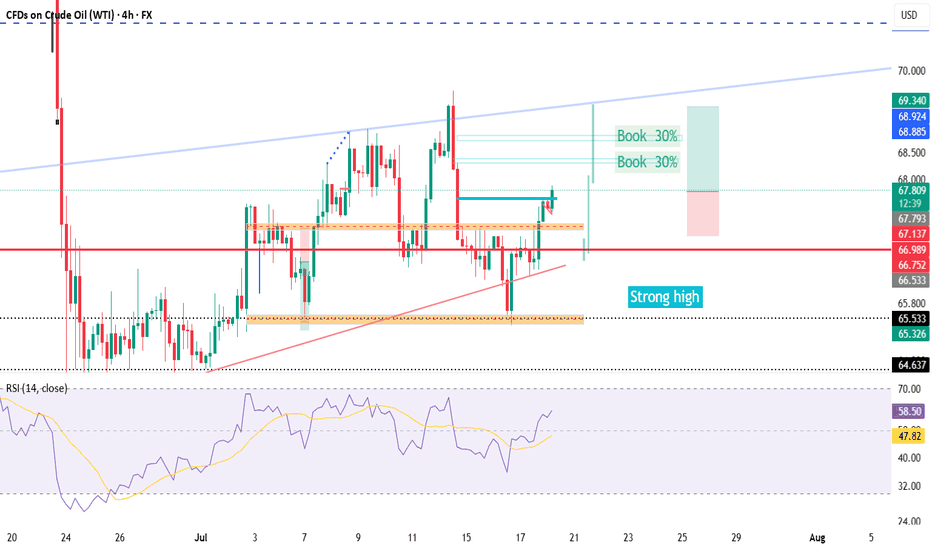

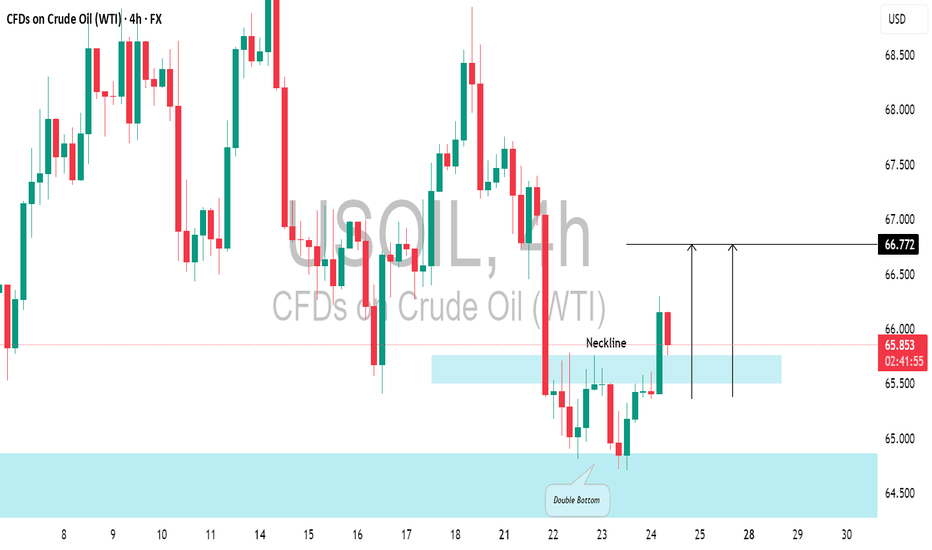

USOIL Analysis : MMC Bullish Setup Building on USOIL – Target🧠 Introduction & Trade Philosophy

In today’s 4H USOIL chart analysis, we are at a critical decision-making zone, where price action is preparing to make a major move in either direction, based on the response to a central demand zone. We are applying the MMC Rule, which emphasizes mirroring supply-demand behavior and validating market moves through structural confirmation.

The current price structure presents a classic MMC scenario, where price must either confirm a bullish double demand reaction or invalidate the setup by breaking the key zone and moving bearish.

📍 Chart Structure Explained

🔷 1. Central Reversal Zones (CRZs)

There are two CRZs highlighted:

The upper CRZ around 65.90–66.20, where price was previously rejected.

The lower CRZ, where price is currently consolidating, is around 64.80–65.50.

These zones are liquidity-rich areas where big players react—either by absorbing positions or driving directional moves.

🟢 2. Bullish Scenario – MMC Rule In Play (Path 1)

"If we want it bullish, we want 50% supply and demand will be double according to MMC Rule"

According to MMC, a bullish move must be confirmed by a strong reaction from demand, showing double the pressure of the last bearish move. Here's how that plays out:

Price respects the lower CRZ, bouncing near the 65.00 mark.

If this bounce gains momentum and breaks above the trendline resistance, the first target is the minor resistance at $69.00, followed by the major resistance zone near $70.50–$71.00.

A retest of broken structure, followed by bullish continuation, is expected. This is marked with the white zigzag projection labeled as “1” on the chart.

Watch for a clear higher high formation, which would indicate a shift in structure and validate bullish momentum.

🔻 3. Bearish Scenario – Breakdown Confirmation (Path 2)

"If it breaks, USOIL will go bearish"

If price fails to hold the current demand and closes below $64.80–64.50, it signals that demand has been absorbed, and MMC reversal has failed. In that case:

A clean breakdown below the demand zone will confirm bearish control.

The next downside target becomes $62.00, as labeled “2” on the chart.

The downward move is likely to follow a steep path as marked with the sharp downward trendline extension, especially if supported by volume and news catalysts.

🔄 Mirror Concept Highlight – Ellipse Area

The ellipse shape on the chart marks a previous compression zone followed by a breakout. This area represents an imbalance in supply that led to a sell-off. The MMC principle suggests the market tends to mirror these zones—if that was previous supply, and the current demand zone mirrors its positioning and structure, we can anticipate a similar reaction, but to the upside.

This is where the "50% double reaction" rule comes in—demand needs to show twice the strength to overcome the previous sell-side pressure.

🔧 Technical Levels Summary

Zone Type Price Range Notes

Major Resistance 70.50 – 71.00 Final target if bullish scenario plays out

Minor Resistance 68.80 – 69.20 First bullish checkpoint

Upper CRZ 65.90 – 66.20 Key structure to break for bulls

Lower CRZ (Support) 64.80 – 65.50 Demand base for bullish setup

Bearish Target Zone 62.00 – 61.80 Projected zone if support breaks

🧭 Trader’s Mindset & Risk Notes (MMC Style)

Wait for clear confirmation and price behavior near the CRZs before entering.

Use trendline breaks, candlestick confirmation, and volume to validate direction.

Avoid guessing the direction—let price tell the story.

Stick to MMC rules: No confirmation, no position.

✅ Bullish Criteria Checklist:

✔️ Price respects lower CRZ

✔️ Breakout above trendline

✔️ Closes above $66.20

✔️ Higher highs + strong bullish candles

✔️ MMC Double Demand Reaction Confirmed

❌ Bearish Breakdown Triggers:

❌ Breaks below $64.50

❌ Weak bounce + lower highs

❌ Volume increases on downside

❌ Clean breakdown structure

🚀 Trade Plan & Outlook

We’re now at a critical zone where market sentiment will soon be clear. Based on your MMC analysis, the bias remains bullish as long as price holds above $64.80. Be patient and let the setup complete with structure confirmation.

This is not just a technical play—it's a psychological zone, where institutional traders also make decisions. Follow the MMC logic and react with confirmation.

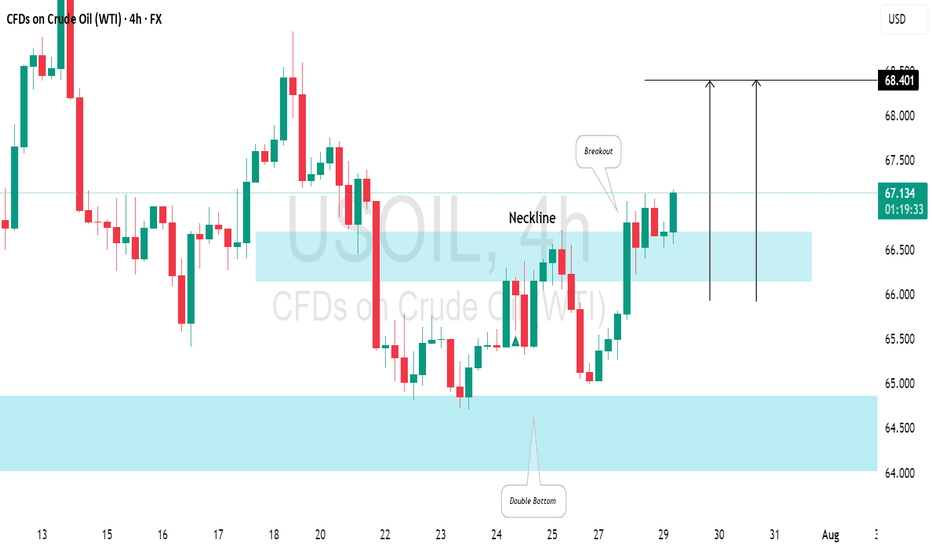

US CRUDE OIL(WTI): Very Bullish Pattern📈USOIL has reached a significant horizontal demand zone on the daily chart, leading to price consolidation and the formation of a double bottom pattern with a higher low.

Yesterday, the market rebounded, creating a new local higher high that broke above the pattern's neckline.

This suggests a typical bullish reversal, and the oil price is expected to rise towards 64.40.

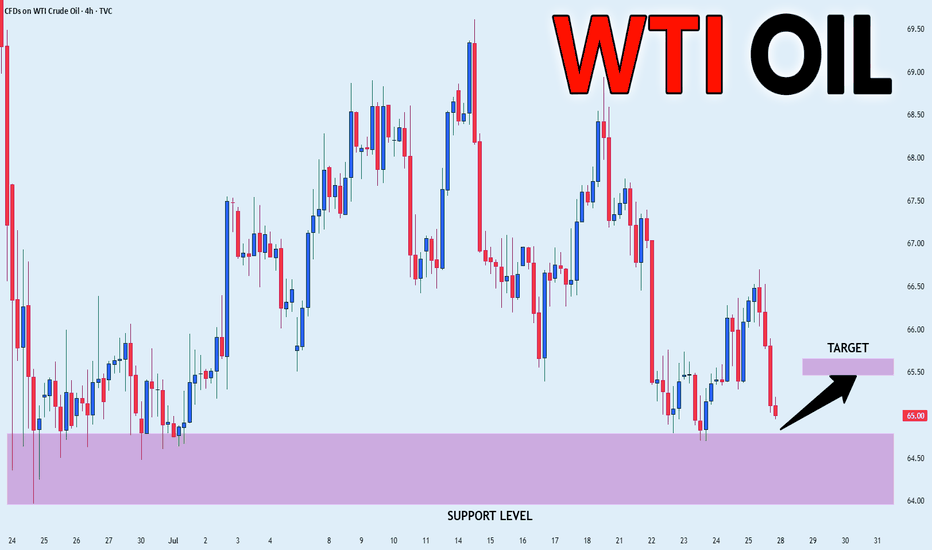

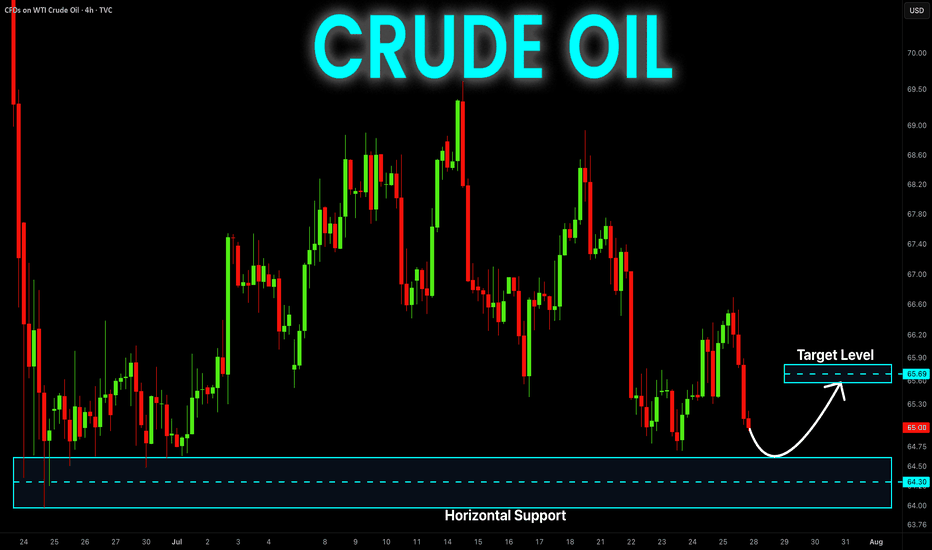

CRUDE OIL Bullish Continuation! Buy!

Hello,Traders!

CRUDE OIL made a rebound

From the support just as

I predicted and the price

Went further still and broke

The key horizontal level

Of 66.50$ and the breakout

Is confirmed so we are

Bullish biased and we will be

Expecting a further bullish

Move up!

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CRUDE OIL REBOUND AHEAD|LONG|

✅CRUDE OIL is going down now

But a strong support level is ahead at 64.69$

Thus I am expecting a rebound

And a move up towards the target of 65.50$

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

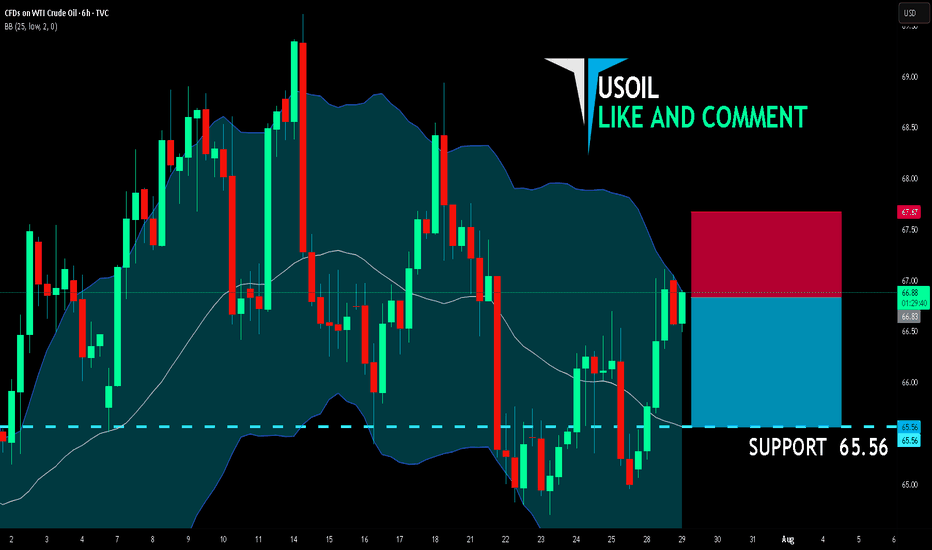

USOIL BEST PLACE TO SELL FROM|SHORT

USOIL SIGNAL

Trade Direction: short

Entry Level: 66.83

Target Level: 65.56

Stop Loss: 67.67

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 6h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

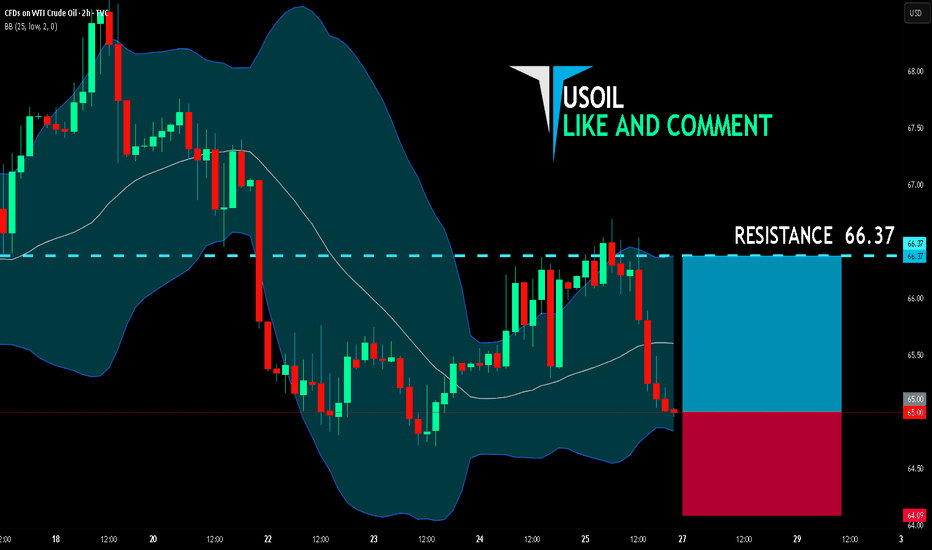

USOIL LONG FROM SUPPORT

USOIL SIGNAL

Trade Direction: long

Entry Level: 65.00

Target Level: 66.37

Stop Loss: 64.09

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 2h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

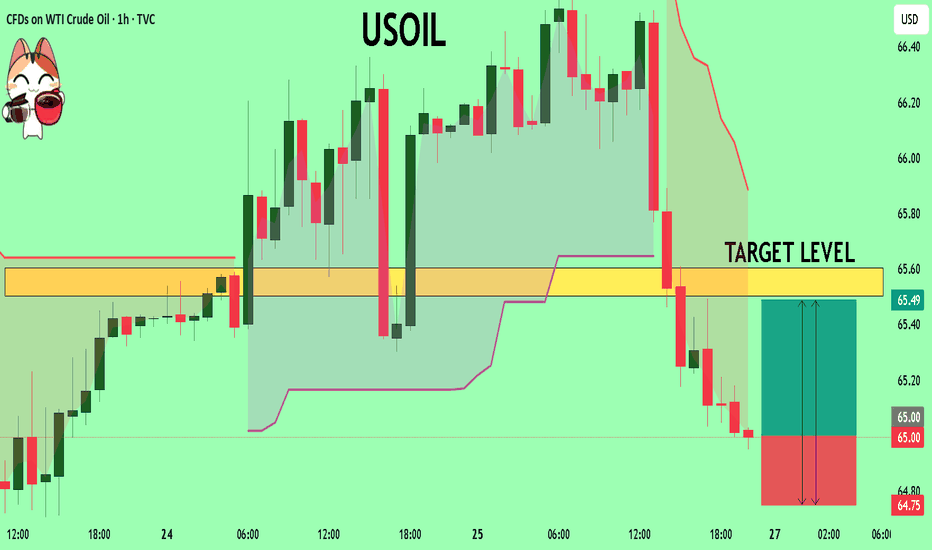

USOIL My Opinion! BUY!

My dear friends,

Please, find my technical outlook for USOIL below:

The instrument tests an important psychological level 65.00

Bias - Bullish

Technical Indicators: Supper Trend gives a precise Bullish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 65.50

Recommended Stop Loss - 64.75

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

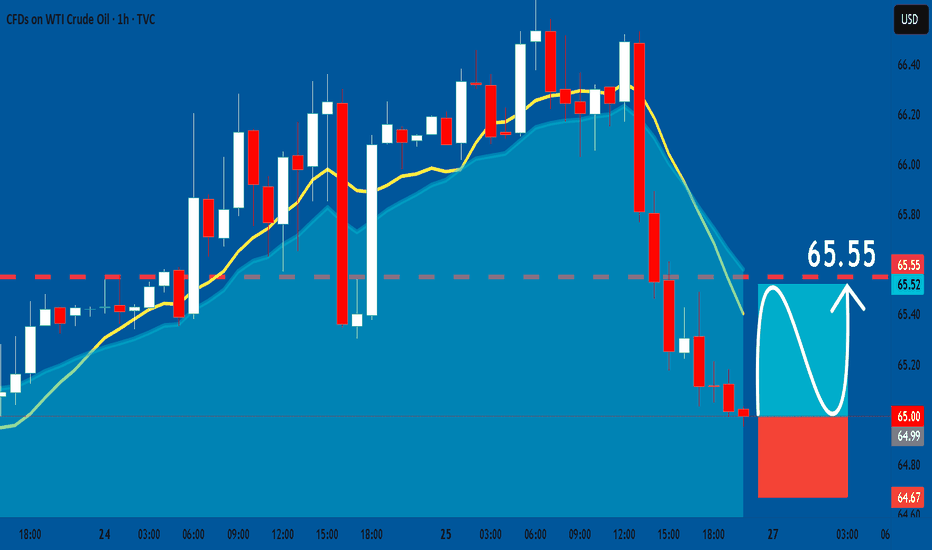

USOIL: Long Trade with Entry/SL/TP

USOIL

- Classic bullish setup

- Our team expects bullish continuation

SUGGESTED TRADE:

Swing Trade

Long USOIL

Entry Point - 65.00

Stop Loss - 64.67

Take Profit - 65.55

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

Potential Long on WTI

Crude oil is showing potential for a bullish move due to increasing speculation about a possible agreement between China and the United States.

As we approach August 1st – the date associated with Trump's proposed tariff actions – the chances of a diplomatic breakthrough are growing.

If the two economic giants reach any form of understanding, it could trigger a wave of optimism in the oil market, potentially leading to a strong upward move.

Market participants should closely watch developments related to the US-China negotiations over the coming days.

CRUDE OIL Risky Long! Buy!

Hello,Traders!

CRUDE OIL will soon hit

A horizontal support

Of 64.50$ and as it is

A strong level we will be

Expecting a local bullish

Rebound on Monday

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USOIL: Next Move Is Up! Long!

My dear friends,

Today we will analyse USOIL together☺️

The market is at an inflection zone and price has now reached an area around 65.029 where previous reversals or breakouts have occurred.And a price reaction that we are seeing on multiple timeframes here could signal the next move up so we can enter on confirmation, and target the next key level of 65.579.Stop-loss is recommended beyond the inflection zone.

❤️Sending you lots of Love and Hugs❤️

Crude oil trading reminder: triple positive support

💡Message Strategy

After three consecutive days of sluggishness, both U.S. and Brent crude oil remained above the 100-day moving average on Thursday (July 24). U.S. crude oil is currently up 0.4%, trading around 65.46; Brent crude oil is currently up 0.1%, trading around US$68.67 per barrel. The three engines of trade negotiations, unexpected decline in inventories, and geopolitical games are ignited at the same time. Oil prices showed signs of stabilizing, allowing bulls to "smell" the long-awaited rebound opportunity.

1. The trade war breaks the ice: the US, Japan and Europe have reached a series of agreements to ignite market hopes.

2. Inventories plummeted by 3.2 million barrels! The balance of supply and demand suddenly tilted.

3. Geopolitical black swan: The war between Russia and Ukraine burns the energy supply chain

📊Technical aspects

The short-term (4H) trend of crude oil fluctuated upward slightly. The moving average system gradually formed a bullish arrangement, and the short-term objective trend direction was upward. In terms of momentum, the MACD indicator opened upward above the zero axis, and the bullish momentum was sufficient.

In terms of form, the oil price broke through the neckline, and the head and shoulders bottom reversal pattern was established. It is expected that after the intraday crude oil trend retests the neckline position, the probability of forming another upward rhythm is high.

💰Strategy Package

Long Position:65.50-66.50,SL:64.00,Target:67.75-68.00

WTI crude: $65 floor holds again as bulls test 50-day MAAfter nine failures to break and close beneath $65 per barrel over the past month, you have to wonder how much longer bears will persist in attempting to take out the level. Following a nice pop higher on Thursday, completing a morning star pattern and closing above the 50-day moving average, it may be time for WTI bulls to have their day in the sun.

For those eyeing long setups, positions could be initiated above the 50-day moving average with a stop beneath for protection against reversal.

As for potential targets, the contract had little luck breaking cleanly above the 200-day moving average earlier this month, making it screen as a suitable level. It’s found just below $68 per barrel today.

Good luck!

DS

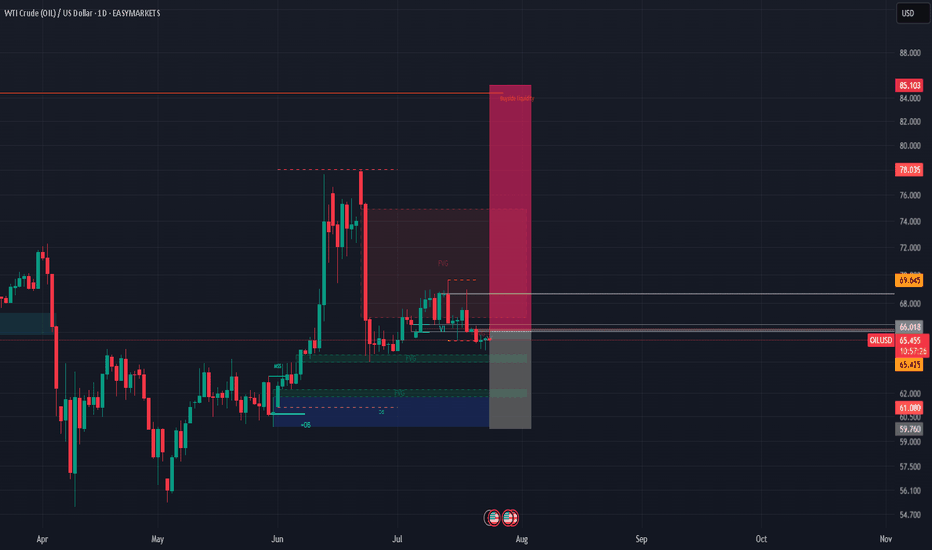

CRUDE OIL (LONG IDEA)🛢️ OILUSD (WTI Crude Oil) – LONG SETUP 🛢️

🚦 Bias: BULLISH (Long)

💰 Entry: Market @$65.408 (or buy dips)

🛑 Stop Loss:$60.00 (HTF protection)

🎯 Take Profits:

• TP1:$69.65

• TP2:$72.00

• TP3:$85.00 🚀 (HTF buy-side liquidity)

🔍 Why This Trade?

✨ Multi-Timeframe Confluence:

📈 Weekly: Bullish structure shift, liquidity sweep

🟩 Daily: Strong bounce from order block + FVG

⏰ 4H: BOS, FVG tap, higher lows = bullish flow

🔥 Fundamentals:

🏦 EIA: Big crude inventory drawdown

🌍 OPEC/IEA: Q3 demand rising

⚡ Geopolitics: Middle East/Red Sea risk premium

💵 Macro: USD weakness = oil tailwind

🧠 Sentiment:

🧑💻 Retail: Still net short

🏦 Managed money: Adding longs

🚀 Fuel for upside!

🛠️ Execution Plan:

💸 Buy now @$65.408 or scale in on dips $64.50–63.50)

🛡️ Stop Loss:$59.780 (HTF structure)

🎯 Targets:

TP1:$69.65

TP2:$72.00

TP3:$85.00 🚀

❌ Invalidation:

Weekly close <$60.00 = exit

⚡ Summary:

All signals GO! 🚦 Multi-timeframe bullish structure, strong demand, and fundamentals + sentiment all align for a high-conviction long. Risk defined at $60.00 for max protection. Targeting major buy-side liquidity at $85.00!

#OILUSD #CrudeOil #Long #SmartMoney #TradeSetup 🚀

Could Oil (WTI) Be Breaking Out of its Range?Oil (WTI) has moved back to the forefront of traders thinking this week after OPEC+’s weekend decision to raise September production by circa 550k barrels per day. They also put traders on notice that all options remain open regarding further production increases to replace another output layer, amounting to 1.66 million barrels per day that has been offline since 2023. A decision on what comes next is due to take place at a meeting scheduled for September 7th.

Perhaps unsurprisingly, this potential for extra production (supply) being unleashed into the market later in the year has led to some downside pressure for Oil this week. This is because it comes at a time of uncertainty surrounding Oil demand due to possible weaknesses in the global economy, created by President Trump’s tariff policies. Oil (WTI) prices have fallen 4.8% from opening levels on Monday to post a new 1 month low at 64.20 yesterday, a level that it currently holding (more on this in technical update below).

Looking forward, one of the challenges traders are facing for where Oil moves next is President Trump’s August 8th deadline for Russia to end the war with Ukraine or face fresh sanctions on its energy exports. President Trump has also suggested he would increase tariffs on countries buying Oil from Russia, including China, although right now India is his initial focal point in this regard and yesterday, he doubled tariffs on Indian goods (25% to 50%) due to the country’s purchases of Russian Oil. These new tariffs are due to start in 3 weeks’ time.

With so much uncertainty surrounding Oil prices, including reports of a possible meeting between President Trump and President Putin being scheduled at some stage next week, it could be useful to be prepared for a potential increase in Oil (WTI) price volatility.

Technical Update: New Correction Lows Posted

Having seen the sharp sell-off in Oil between June 23rd and 24th 2025, a period of more balanced activity developed, as a reaction to over-extended downside conditions in price.

As the chart above shows, this resulted in a phase of sideways price activity between support marked by the 65.21 June 24th low, up to 71.34, which is equal to the July 30th failure high. However, price declines on Wednesday this week, have produced closes below 65.21, in the process of posting a new correction low at 64.20.

While communications between the US and Russia regarding the war in Ukraine are on-going, this type of break lower in the Oil price is no guarantee of future declines, so it could be helpful to assess what could be the potential support and resistance levels to focus on, just in case the outcome of these events lead to an increase in Oil price volatility.

Possible Next Support Levels:

As we have said above, the August 6th price weakness has seen a new correction low posted at 64.20, and this may now be viewed as the first support focus. Closes below 64.20 might then lead to a more extended decline in price.

Such moves would indicate the potential of further price weakness, with the next support possibly marked by the May 30th session low at 60.17, perhaps further towards 55.64 (May 5th low), if this level in turn gives way.

Potential Resistance Levels:

On the topside, within a period of price weakness, it can be the declining Bollinger mid-average that reflects the first possible resistance, and for Oil this currently stands at 67.44. Closing breaks above 67.44, if seen, could prompt further attempts to develop price strength to test higher resistance levels.

The first possible level would appear to be marked by 71.34, which is the July 30th session high. If this level was broken on a closing basis, it might then lead to tests of 73.29, which is equal to the 61.8% Fibonacci retracement of the June 23rd to June 24th sell-off.

The material provided here has not been prepared accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research, we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

OUR TRADE FOR THE DAYEarly today, I posted that we'll be waiting for the market to give us an entry after grabbing the liquidity, we did have it and caught it.

I didn't share it since it was given to my students.

As you can see on the chart, the market gave us a FVG after that it did grab the liquidity which we entered based on to target again the LQ level to close with a good margin.

Follow for more!