XUSDT Reversal Point - Buying OpportunityIn the upcoming week, starting from June 2nd, I anticipate a price drop to 0.00006388. This level could serve as a potential reversal point, but only if the price reaches it within the current week. Please note that this price level is valid only for one week; after that, the chart conditions and traders' behavior must be re-evaluated

XUSDT trade ideas

XUSDT ( new Update )It appears that we will witness a price decline to the range specified in the image. It is expected that an upward movement will emerge from the identified zone, which will not result in a new peak. (This is because the previous upward movement did not create a new peak, and based on this analysis, the price decline will not create a new bottom. Consequently, a new peak cannot be anticipated.) In my opinion, the final upward movement, which will lead to a new price peak, will start around the price of 0.00003956. It is necessary to monitor price movements in this price range closely.

#X #XUSDT #XEMPIRE #LONG #Scalp #Scalping #Eddy#X #XUSDT #XEMPIRE #LONG #Scalp #Scalping #Eddy

XUSDT.P Scalping Long Setup

Important areas of the upper time frame for scalping are identified and named.

This setup is based on a combination of different styles, including the volume style with the ict style. (( AMD SETUP ))

Based on your strategy and style, get the necessary confirmations for this scalping setup to enter the trade.

Don't forget risk and capital management.

The entry point, take profit point, and stop loss point are indicated on the chart along with their amounts.

The responsibility for the transaction is yours and I have no responsibility for not observing your risk and capital management.

Note: The price can go much higher than the second target, and there is a possibility of a 70% pump on this currency. By observing risk and capital management, obtaining the necessary approvals, and saving profits in the targets, you can keep it for the pump.

Be successful and profitable.

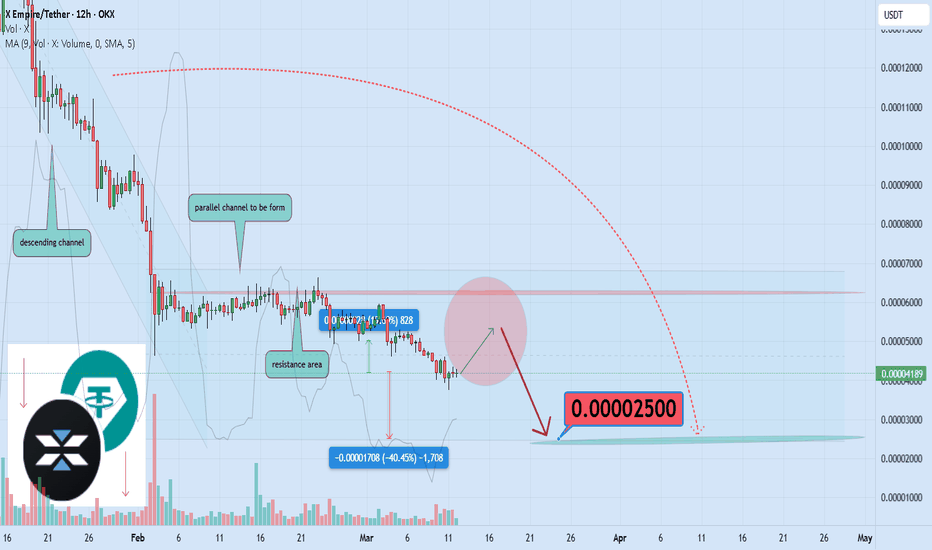

X Empire Breakdown: 40% Drop Targeting 0.000025Hello and greetings to all the crypto enthusiasts, ✌

All previous targets were nailed ✅! Now, let’s dive into a full analysis of the upcoming price potential for X Empire 🔍📈.

The X Empire has exhausted all its key support levels, and I project an additional decline of at least 40% moving forward. The primary target for this downturn is 0.000025. Following this, I anticipate a phase of consolidation, characterized by range-bound price action and the potential establishment of a parallel channel.📚🙌

🧨 Our team's main opinion is: 🧨

X Empire has lost all support, with a 40% decline expected to 0.000025, followed by consolidation and a possible parallel channel.📚🎇

Give me some energy !!

✨We invest hours crafting valuable ideas, and your support means everything—feel free to ask questions in the comments! 😊💬

Cheers, Mad Whale. 🐋

$OKX:XUSDT OKX:XUSDT

If the green box is lost, it can drop to the price range of 0.0000145. This currency is a playground for gamblers. Friends who want to buy this currency for investment purposes should never do so. If you observe the trading volume of this currency in a single day, you will see that it is traded at least as much as the total volume of this market, indicating the activity of trading bots as well as gamblers who make trades in the short term. There are no fundamentals behind this currency, and the only reason it can rise and fall is the news coming from Elon Musk. This analysis is an update from the last analysis conducted on this currency.