short term scaling opportunities on GBPUSD using multi-time frame analysis

In this video I go over how to trade with channels and multi-time frame analsys for the best entries. I also show my way of trading fake outs on channels and building a logical and rational case for entering markets with confluence.

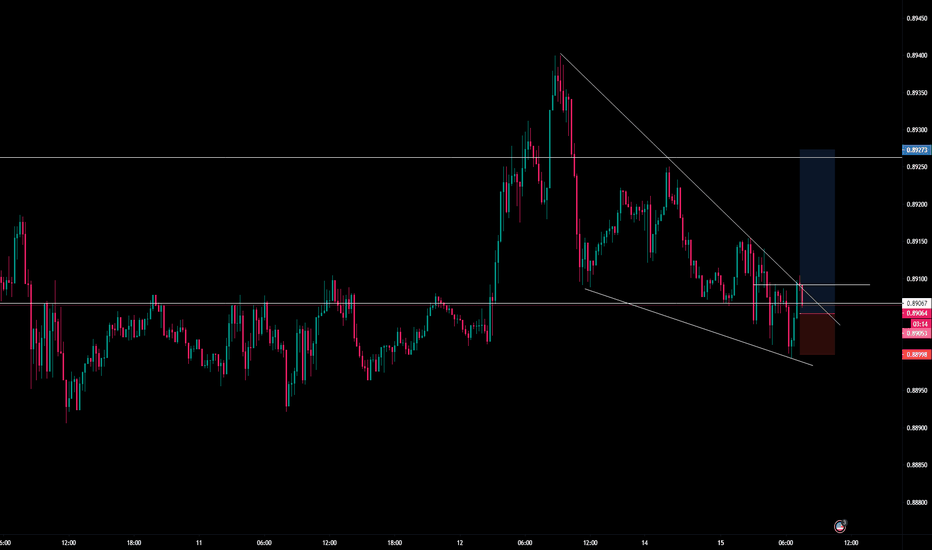

This is a trade that I foolishly took on USDHF but contains some valuable lessons! The market should continue bearish over the week as we see CHF and JPY pairs getting stronger towards the sessions end.

Here are the setups I'm looking to take along with the USD analysis from a market structure perspective using chart pattern and other forms of anlaysis.

This will show my methodology and system for getting high risk to reward trading setups using whatever analysis that you choose that doesn't involve indiaotrs. Wyckoff, Smart Money Concepts, Price Action. But primarily this calls for an understanding of market structure.

This is the weekly outlook for you guys. Hope you All enjoy!

We always want to trade against the weak hands in the market and get in at optimal entries. THis entry explains that very concept.

We may get buys today on USDJPY. This is a consolidation play that I like to use sometimes where yoou can buy or sell inside of a consolidation just before the break.

This shows how we are waiting long-term for more shorts from the H4 but we can take scalps from the lower time frames. Momentum is going to be key in the market to time things perfectly which I explained in the video.

eurjpy is in a consolidation and we may see the prie come back down for a retracement today. Prefect for scalps. So the key is going to be to pay attention to the lower time frame market structure and if momentum comes back in for shorts.

GBPUSD is still in a n overall uptrend on all time frames however, the current price action demonstrates weakness and potential Banks taking profits at these levels which may go to 1.4000. In this video I go over setups that we could possibly take going into next week.

DXY price action and multiple time frame analysis update! This video explains the current retracement phase of the market and soem potential areas of opporutinty. The USD is potentially looking for higher movements towards 92.00 before rejecting price and pushing back down in continuation of the overall bearish trend.

My analysis and setups for GBPUSD

My stups and analysis for EURJPY

My analysis for GBPJPY

MY analysis for EURUSD

My analysis for USDCHF

trade stups for today and analysis