ALRASHYD_

PremiumThe dollar looks like it’s done bein’ weak and is gearin’ up to reclaim its throne. It hit a bearish target real quick, formed a double bottom pattern at the golden Fibonacci ratio, and on Friday, it completed the pattern. That’s showin’ it’s ready to kick off a new upward wave.

I wrote before about the S&P 500 when it was at its peak, showing that "head and shoulders" pattern, and it hit its target. Now, the index has been tradin’ below the 200-day moving average for 10 sessions and is strugglin’ to get back above it. There’s also a "double top" pattern formin’, targetin’ around the 5400 level. Next week’s gonna be big—needs to climb...

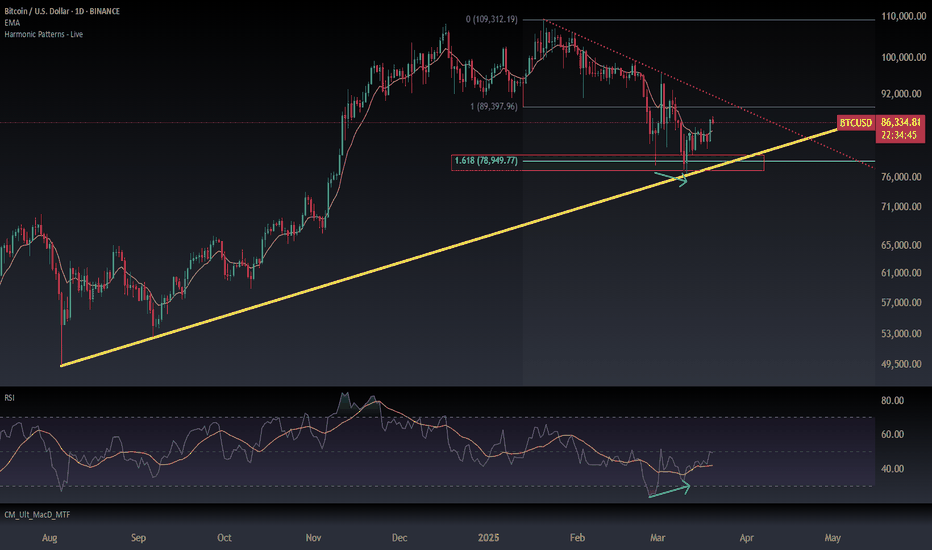

Let’s talk Bitcoin (BTCUSD) on this daily chart—it’s putting on a show! We’ve got a sweet bounce off that trendline, The bounce happened right at the golden Fibonacci extension level, which is spot for a reversal. And check this—the RSI is showing some nice divergence, giving us a solid signal that the bulls might be waking up. This is a strong setup for a...

Alright, I know the week ain’t over yet, but I’m seeing something pretty hype on Google’s chart (GOOG) that’s got me pumped! The stock’s pulling back to that 0.786 Fibonacci level, and guess what—it’s chilling right at the 100-day moving average. What a wild coincidence, right? On top of that, the weekly candle so far is looking like a reversal—unless...

Yo, let’s break down D-Wave Quantum (QBTS) on this daily chart—this quantum computing player’s got some juice! The stock closed at $10.15, and it just wrapped up a continuation pattern that’s got its sights set on $22.50 target. That’s a big leap, and the vibes are strong with this one! The chart’s showing a breakout from that triangle pattern, and it’s been...

Alright, let’s zoom into Broadcom (AVGO) on this hourly chart! The stock’s been cruising in a solid uptrend since last August, making some nice gains along the way. But lately, it’s hit a bit of a speed bump, slipping into a corrective wave and forming a clean descending channel. Here’s where it gets juicy—AVGO just carved out a head and shoulders pattern right at...

Yo, let’s dive into Tesla (TSLA) on this daily chart—things are heating up big time! The stock just smashed its “head and shoulders” reversal target, dropping to around $240.68 as of March 13, 2025, with a solid 2.99% dip for the day. And check this—it nailed that golden Fibonacci retracement level like a pro, while also filling a previous gap like it was no big...

Alright, let’s talk Starbucks (SBUX) on this daily chart—things are getting spicy! The stock just pulled back to that trusty uptrend line it’s been riding since mid-2024, and it’s hanging out right at a sweet Fibonacci retracement zone around $96.25 as of March 13, 2025. To top it off, check the RSI—it’s flashing oversold vibes hard, dipping to 29.1, which is...

Alright, let’s dive into Lululemon (LULU) on this daily chart! The stock just hit a reversal target from that triple top pattern we’ve been watching, which lined up perfectly with a Fibonacci correction at the golden ratio—pretty slick move! Check the RSI down below—it’s screaming oversold with that dip into the 30 zone, which could signal a breather for the...

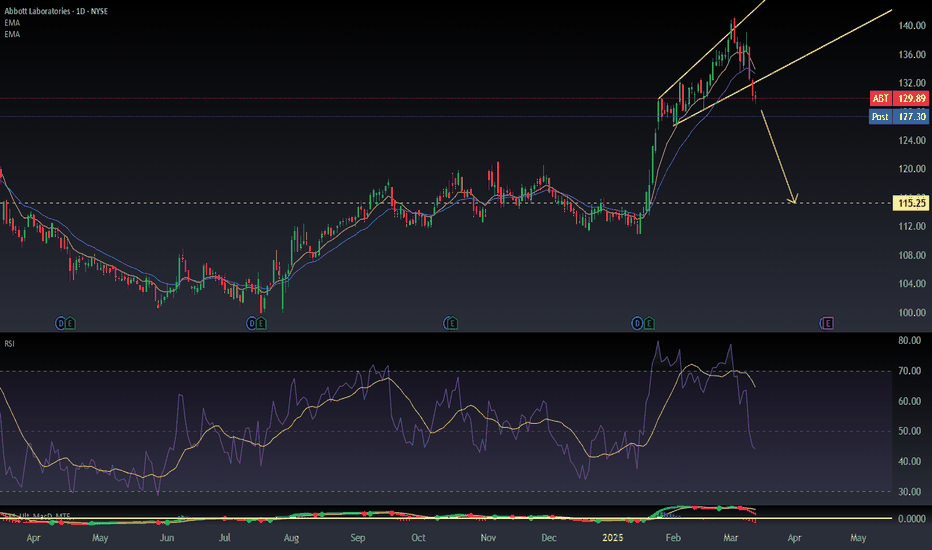

Alright, let’s check out ABT on the daily chart. The stock enjoyed a steady climb since Jan 2025, riding a clear uptrend line, and now just nailed a technical reversal pattern, and it seems like it’s aiming for a target around $115 per share in the short term (1-3 months).

The Nasdaq 100 index achieved a rally that nearly began in October 2022, reaching a peak gain of 111%. It appears that the rally is nearing its end with the formation of a "cup and handle" pattern and a divergence between the Nasdaq index and the RSI (Relative Strength Index) on the monthly chart. At the target level, the closing was marked by a Doji candle.

The S&P 500 index approached the "cup and handle" target at 6152 points, but recently it has formed a "head and shoulders" reversal pattern at the neckline. The index has retraced to 5783, filling a previous gap. If it trades below this gap, it may head towards 5583 points to achieve the head and shoulders pattern target.

Alright, folks, it looks like Apple stock has just nailed one of those harmonic patterns, and on top of that, the RSI is screaming oversold, hitting a rock-bottom 26—the lowest it’s been in a year! With the stock chilling and holding steady at these current price levels, it’s boosting the odds of a sweet upward price reversal coming our way.

Amazon's stock reached a historic high of $241.77 per share, aligning with a previous pattern's target that specifically aimed at this level. It then entered a corrective wave and failed on Friday to reclaim its historic levels, seemingly forming a harmonic pattern with a target of $231.2 per share.

AMZN hits the target of double top. After reaching the target area, it will form a V-shaped bottom, and if it is maintained, it will form two double bottoms, which makes the stock set for an upward trend.

SP500 has reached the target of V-shaped pattern. The Fed is expected to start tightening monetary policy next month. Will November be the time for the bears to rise?