Dear Fellow Traders, How I see it: If OIL structure holds - "Inverse H&S" Buyers will fill Imbalance area indicated or Target = Trend Resistance Feel free to ask if anything is unclear. Thank you for taking the time to study my analysis.

Dear Fellow Traders, How I see it: This Major pair has the potential for a correction/small bounce. My "BULLISH" targets in case Daily "Trend Support" holds- * TP1 & TP2 as indicated. My "BEARISH" targets in case Daily "Trend Support" are breached- * TP1 & TP 2 as indicated. Feel free to ask if anything is unclear. Thank you for taking the time to study my analysis.

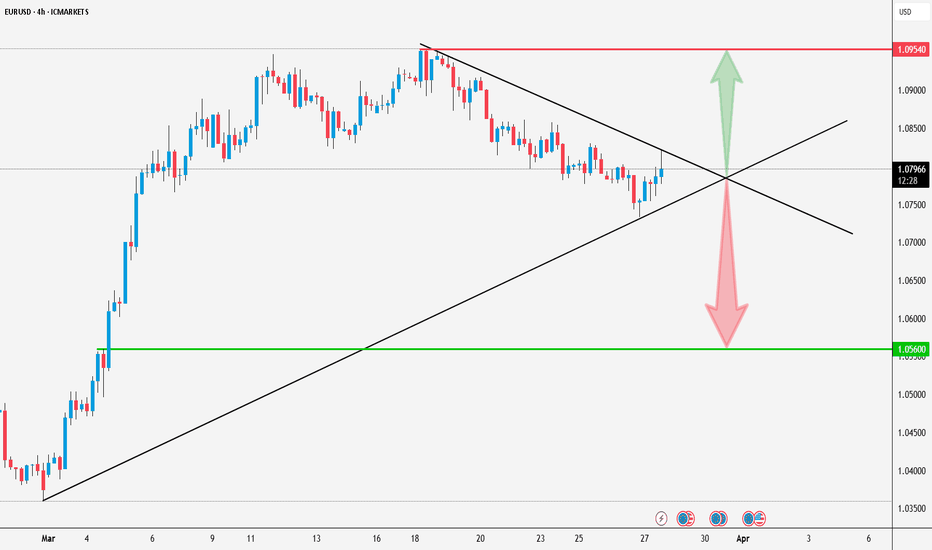

Dear Fellow Traders, How I see it: This Major pair has the potential for a correction. My "BEARISH" targets in case Daily "Trend Resistance" holds - * TP1 & TP 2 as indicated. My "BULLISH" targets in case Daily "Trend Resistance" are breached - * TP1 & TP2 as indicated. Feel free to ask if anything is unclear. Thank you for taking the time to study my analysis.

Dear Fellow Traders, How I see it: First "SHORT" then "LONG" My "BEARISH" targets in case Daily "Trend Resistance" holds - * TP1 & TP 2 as indicated. My "BULLISH" targets in case Daily "Trend Resistance" are breached - * TP1 & TP2 as indicated. Feel free to ask if anything is unclear. Thank you for taking the time to study my analysis.

Dear Fellow Traders, How I see it: Gold has the potential for a small correction My "BULLISH" targets in case "Confluence of Support" holds - * TP1; TP2 & TP3 as indicated. My "BEARISH" target in case "Confluence of Support" are breached - * TP1 as indicated. Feel free to ask if anything is unclear. Thank you for taking the time to study my analysis.

Dear Fellow Traders, How I see it: NASDAQ Stocks will remain in a sell off phase this quarter. My "BEARISH" targets in case "DAILY TREND RESISTANCE" holds - * TP1 & TP2 as indicated. My "BULLISH" targets in case "DAILY TREND RESISTANCE" is breached - * TP1 & TP2 as indicated. KEYNOTE: Bullish TP 2 = 78.60% FIB retracement from ATH Feel free to ask if...

Dear Fellow Traders, 4HR Calibration - Post CPI 1) Potential return - "SHORT" to breakout area if bullish trend is breached. 2) Potential continuation of rally - in case of breached trend resistance: * Imbalance to be filled Feel free to ask if anything is unclear. Thank you for taking the time to study my analysis.

Dear Fellow Traders, IF 1HR Trend is breached and confirmed on at least 1HR TF - "SHORT": Potential Targets Indicated: TP1 - TP3 Gold is extremely bullish - If 3220 resistance is breached: * 3250 Is the next psychological resistance. (Also next FIB extension target) Feel free to ask if anything is unclear. Thank you for taking the time to study my analysis.

Dear Fellow Traders, CPI - Inflation Data Today, be safe. 1) Potential return - "SHORT" to breakout area if trend resistance holds. 2) Strong bullish breakout yesterday, price can also just attempt a minor correction and continue to rally - "LONG". Feel free to ask if anything is unclear. Thank you for taking the time to study my analysis.

Dear Fellow Traders, 4HR Analysis - Gold in heavy demand - BULLISH 1) Monitor PA when testing zone: 3055 -3038 2) A potential deeper correction is possible -As indicated with green zone If red resistance trend is breached: "LONG" - Potential targets indicated Feel free to ask if anything is unclear. Thank you for taking the time to study my analysis.

Dear Fellow Traders, Gold is testing a key resistance area, already indicating rejections. A potential correction - "SHORT" then "LONG". ## For the correction: The green 30min bull trend must be breached first. If resistance (red confluence) is breached, rally will just continue. Feel free to ask if anything is unclear. Thank you for taking the time to...

Dear Fellow Traders, NASDAQ is in a sell-off phase - Extreme bearish behavior! I have indicated a "Potential Reversal" Zone. I am personally not looking for any potential entry at this stage. (If I was scalping, I won't even consider buying - although they do look very inviting) PLEASE HAVE A LOOK AT MY HIGH TIME FRAME ANALYSIS: Posted on March the...

Dear Fellow Traders, This pair is testing a key confluence of support. A Falling Channel - Exhaustion Pattern is unfolding. A strong breakout required above dashed resistance for bullish reversal - Institutional "LONG" Inventory accumulation is evident. Feel free to ask if anything is unclear. Thank you for taking the time to study my analysis.

Dear Fellow Traders, This major pair is testing a key confluence of support. Quality bullish behavior, if support holds: Rally will continue. A deeper 4HR correction is always possible with a potential pullback at the end: 1) Monitor price @ 1.09945 closely if above mentioned scenario unfolds. 2) Monitor price @ 1.09721 closely if above mentioned scenario...

Dear Fellow Traders, This major pair has the potential for a "SHORT" - RSI Divergence. Upside is limited in the short term. A strong quality breakout is necessary, either way. Feel free to ask if anything is unclear. Thank you for taking the time to study my analysis.

Dear Fellow Traders, This major pair have the potential for a deep correction. A strong quality breakout is necessary, either way. Feel free to ask if anything is unclear. Thank you for taking the time to study my analysis.

I calibrated the analysis a little: It seems like stocks have some bullish strength. We'll have to wait and see if the imbalance will be filled in the short term. Feel free to ask if anything is unclear. Thank you for taking the time to study my analysis

I calibrated the analysis a little: It seems like stocks have some bullish strength. We'll have to wait and see if the imbalance will be filled in the short term. Feel free to ask if anything is unclear. Thank you for taking the time to study my analysis