Aait24

Nifty set to approach recent highs. I simply dont understand how people react to what happens in the US stimulus. Thats their country and this is ours. Its just going good and Nifty should not be affected much. Even if it opens gap down, it should recover back soon.

Indicated on chart is the bullish triangle and bullish divergence.

Nifty closed with bearish engulfing candle confirming the rising wedge triangle to break down in near term.

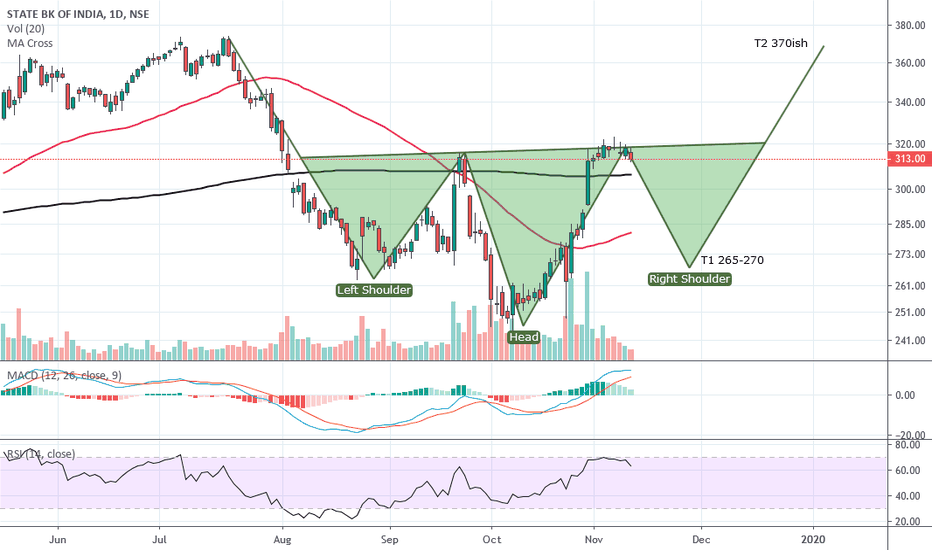

SBIN chart doesn't really seem like morphing the inverse head and shoulder pattern. Its pretty much valid as of now. Current trade should be short with target price as shown on chart before going long.

$ISEC #ISEC Chart suggesting multiple bullish views. A nice elliot 5 wave pattern seen, bounce from 0.61 FIB, the red line showing bullish divergence, positive Q2 results, the black trend line showing uptrend intact and a bullish golden cross of 50x200 dma. my T1 335ish, T2 350ish and T3 390ish. A perfect positional long setup IMO.

Classic double bottom pattern clearly visible on daily chart with a W shape. T1 should be the 200 DMA at around 92ish and T2 post breakout of 200 DMA would be around 108 to 110

IRCTC is currently trading in a bearish descending triangle. The price should break down to a measured move to 0.5 fib levels which is at 820ish. Daily RSI over brought. Also it broke below the 200 period MA on hourly chart.

SBIN is potentially forming an inverted head and shoulder pattern with current target set to neckline 313ish before forming right shoulder. Looking forward to a move up. lets see.