Crude oil has been trading in higher high higher low formation suggesting the trend to be bullish in the near term, currently it has corrected and is at the support zone of the 20-day SMA. Technical setup suggests that corrections are likely to find buyers on declines. It would be prudent to say that crude oil could rebound towards $48.00 and $48.75 if it sustains...

Gold has been trading in small body candlestick formations since the past few trading sessions near $1890-$1900 level and has been experiencing higher level rejection, indicating impending correction. Short term charts are supportive of the above view and signify a correction for gold in the near term. It would be prudent to say that gold could decline towards...

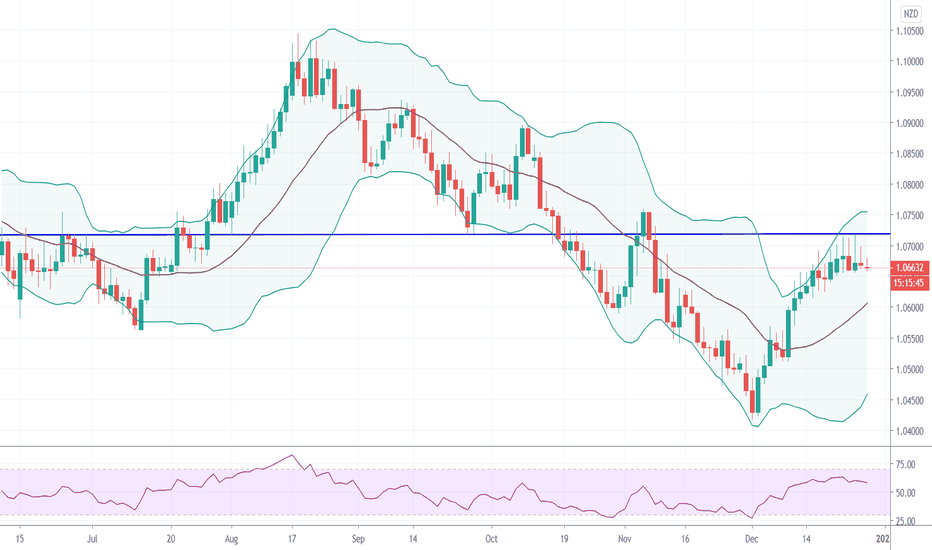

AUDNZD has been trading in small body candlestick formation since the past few trading sessions near the horizontal resistance line suggesting resistance at higher level. RSI has flattened out since mid-December and just starting the decline indicating the pair could decline in the coming sessions. It would be prudent to say that the currency pair could decline...

EURUSD has been trading in a higher top higher bottom formation suggesting the trend to be positive in the near term, further it is also trading above the 20-day SMA supporting the above observation. The pair has made a long legged hammer on 21st December, the low of which has been protected indicating that the currency has ended the organic correction and is...

GBPJPY has been trading in the 140-138 range since the past few trading sessions; it currently is near the upper end of this range. A break above the horizontal resistance line just above current level would give fresh break out and the impetus required to take the pair higher. It would be prudent to say that the currency pair could advance towards 141.00 and...

AUDUSD has been trading in a higher top higher bottom formation since the month of November, further the pair is also trading above the 20-day SMA indicating the trend to be positive. On 21st December the pair made a long legged doji and found support at the 20-day SMA suggesting support at lower levels. It would be prudent to say that the currency pair could rise...

Crude oil declined sharply on Monday and experienced follow-up selling on Tuesday, albeit the trend for crude is bullish and this short term correction is likely to find buyers. Further the low on Monday coincided with the 20-day SMA & upward sloping trend line, supporting the above observation. Crude oil could advance towards 47.60 and 48.00 while it sustains...

Natural gas has ended in four consecutive doji candlestick formations near the 20-day SMA suggesting resistance at higher levels. RSI has also flattened indicating an impending correction and a retracement of the rally experienced from 2.40 to 2.72 in the past few days. Natural gas could decline towards 2.60 and 2.55 while it sustains below 2.73. Risk...

USDCAD is trading in a lower top lower bottom formation suggesting the trend to be bearish in the near term. The currency pair is trading below the 20-day SMA supporting the above observation, RSI is also hovering in the bearish zone corroborating the above observation and indicating further downside potential. The currency pair could decline towards 1.2670 and...

Silver has risen sharply after taking support at the 20-day SMA and has breached the upper Bollinger band indicating upside breakout for the metal. RSI is rising supporting the above observation and signifying further upside potential. It would be prudent to say that silver can rise further towards 25.80 and 26.30 while it sustains above 23.75. Risk...

Gold has been trading near the $1,820-10 range since the past few trading sessions and seems to have established a base near this level, further the commodity has rebounded sharply and is trading above the 20-day SMA. RSI is also rising indicating further upside potential, short term charts are also signifying the near term trend to be positive for the safe heaven...

WTI Crude oil has been trading in a higher top higher bottom formation suggesting the trend to be positive in the near term, momentum indicators are also in buy mode corroborating the above observation. Oil is also trading above the 20-day moving average supporting the bullish view and indicating further upside potential. It would be prudent to say that crude can...

USDJPY has been trading in small body candlestick formations since the last few trading sessions after it found support near 103.70 levels, which is its strong support zone signifying a rebound in the offing. On the weekly charts as well dollar yen has been trading in small body candlestick formations suggesting the down trend to have likely ended and a support...

EURUSD is trading near the downward loping trend line and a horizontal resistance line signifying limited upside potential. Further the pair has been trading in small body candlestick formations near the mentioned resistance level since last six trading sessions, indicating a trend reversal could be witnessed. RSI has also flattened since mid-November supporting...

GBPUSD is trading near the downward sloping trend line signifying resistance at higher levels, further on Monday the currency pair ended in a doji candlestick formation signifying indecision at higher levels. It declined from 1.3313 in the previous week suggesting selling at higher levels, short term charts corroborate the above observation signifying an impending...

EURAUD touched a high of 1.6827 on 20th October from where it declined sharply to touch a low of 1.6216 on Friday; it rebounded sharply from this level after taking support at the upward sloping trend line suggesting further upside potential. Also on Friday the pair ended in a bullish engulfing candlestick formation corroborating the above observation, RSI has...

USDCAD rose sharply after making a low near 1.3081 on 21st October to make a high around 1.3389 on 29th October from where the pair has dipped sharply back towards 1.3100. The 1.3100-3080 zone is a strong support, further the pair currently stands at the upward sloping trend line support. Yesterday the USDCAD ended in a long doji candlestick formation suggesting...

EURGBP rose sharply from 3rd September to 11th September after making a low of 0.8864 to rise sharply to touch 0.9292. Post hitting this level the currency has been drifting lower, trading below the 20-day SMA. Currently the pair is rising after taking support at the 78.6% Fibonacci support of the rise seen from 3rd September to 11th September, RSI is also rising...