AbdulKamawi

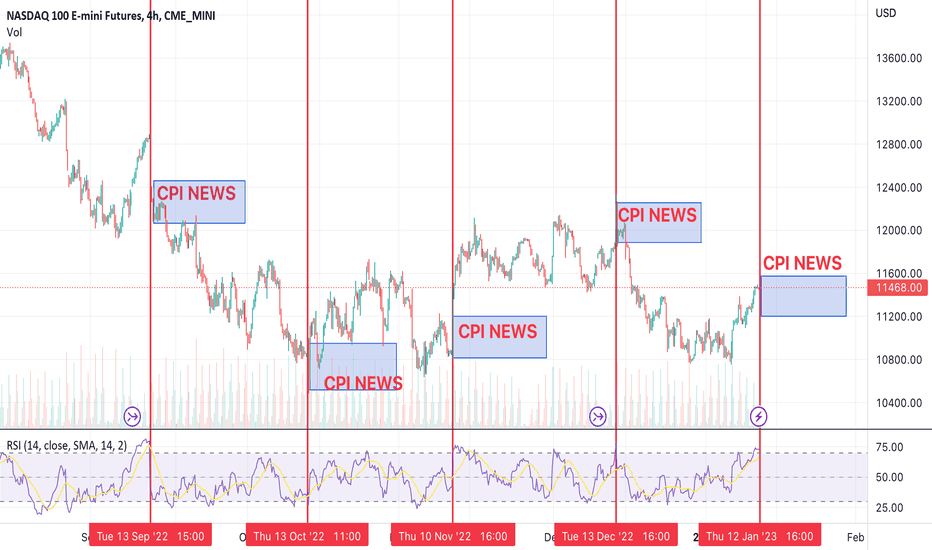

CPI news is coming, the idea is the news will have a negative impact on NASDAQ, but biased is for both positive and negative.

Gold Weekly Analysis is expected to be bullish with DXY comparison...

The idea is to wait for the Povit point and wait which direction will it take......

The Time Cycle of NFP news is usually when data is positive then gold drops sharply around 300-400 pips, after this big fluctuation then we wait for a breakout in today's case if breaks below 1700 then bearish if breaks above 1729 then slightly bullish. Please note before NFP there is always consolidation as we saw yesterday.

BTCUSD sideways double bottom, that target might be hit with risk reward ration

The weekly forecast of the Gold shows that the upcoming week will be bearish.

15 min charts with limited Risk with only 0.03 pips, the patterns indicate that it will go bullish

15 MInts Chart to check the ration calculations and indicators and pattern suggests it is bullish on limit time

The aim is to short and check if Target is hit first or Stop loss

Bullish Channels on one hourly time frame, also strong signal of Divergences.

The overall hourly and daily trend is bearish, plus it didn't break the channel on hourly.

Various indicators to check if Plan A is successful or should wait for plan B.

To find out if Plan A will be successful or should wait to implement plan B.

Bearish and Bullish Indicators tools. Analyzing Harmonic, AB=CD Patterns along with FIB AND Candlesticks.

To find out if the indicators can help to achieve the Target area or if it will hit stop loss.