Abz_fx1

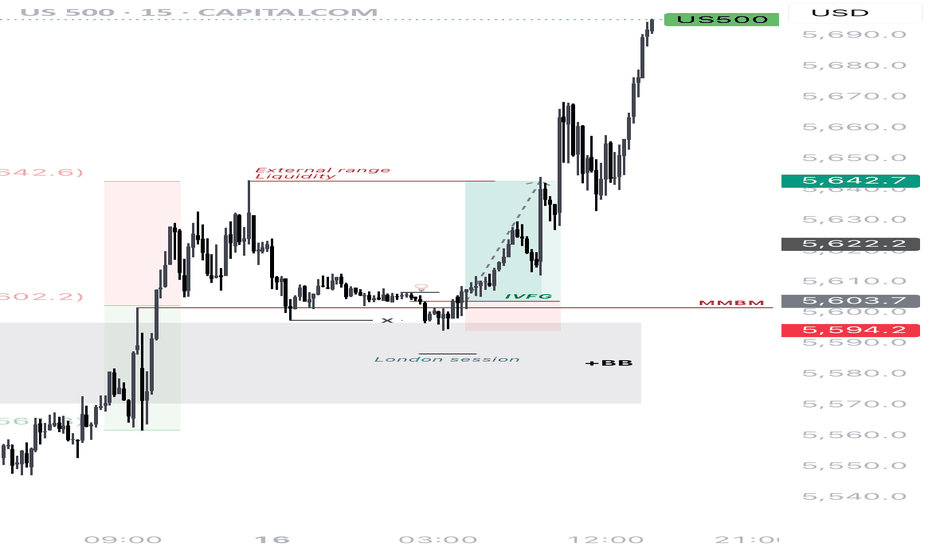

Based on the positive fundamentals for the dollar I’m expecting short term higher prices closing march

The market gives. It always did, you just have to know when to take, put that philosophy in your notebook. It was a Monday today and there was anticipation for consolidation but that’s not the case for all markets. Once you get familiar with an asset there’s no harm in looking around. Your set up will come, you just have to know when to catch it.

Trading is performative. And an aspect in trading that contributes to performance is your CONFIDENCE ,the confidence of you losing your A+ trade set up knowing you would take that same set up again if the market gave it to you. That’s what sets you apart. That’s what gives you a huge advantage

MMSM an easy sell for next week, can squeez in trades till next week to DOL

Next week: since there was an impulsive bullish move the previous week, we can expect consolidation or a reversal from a monthly PD array. Since it is post-NFP let’s where the next week takes ;expecting a reversal due to historical data the eur/usd has shown weakness on the month of march this further amplifies my confluences for next week.

Tried retail, volume, order foot prints, you name the strategy and I’ve tried it however the case, I have found success in ict trading , why? Not because of order blocks or fvgs or all that, but because of context. The single most differential factor in trading between being a good trader and a mechanical average trader is context, that’s your key, that’s your answer.

tesla has a clear falling channel expecting price to break on the upside after it hits that resistance that is now support

inverted triangle formation on ethereum waiting once price breaks out

another triangle formation, once price breaks out a high probability trade

the market looks extremely overbought price is definitely looking to go down to a resistance into a support zone

price breaks out retests and continues upwards a clear triangle formation setup a high probability tarde

price is respecting the 0.5 zone on the Fibonacci looking for entries on long position in area of value

FX:EURGBP Price is respecting the 0.5 zone of the fib retracement looking for bearish momentum to the upside