DIS was going higher within an upward channel or rising wedge formation. It seems broken down the pattern, retested the broken support and getting ready to rollover. It would be a good short, If it breaks below 50 day MA, and for trade we would consider $110 May-17 Puts * Trade Criteria * Date First Found- February 23, 2017 Pattern/Why- Upward channel or Rising...

INSY is an interesting flag setup. Moneyflow has strong positive divergence, and in strong uptrend in the positive side. Good potential to run up to Moving averages around $12.50 * Trade Criteria * Date First Found- February 19, 2017 Pattern/Why- Flag formation Entry Target Criteria- Break of $11.27 Exit Target Criteria- $12.43 Stop Loss Criteria-...

CUR formed a strong flag formation. It would be very quick in & out type of Day trade. However it has some insider buying so we can keep it running after we close half in first target. * Trade Criteria * Date first found- Pattern/Why- Entry Target Criteria- Break of $ Exit Target Criteria- $ Stop Loss Criteria- $ Please check back for Trade updates....

XYL seems breaking down underneath Resistance, and seems forming a flag formation. Downward volume is increasing & moneyflow is going down as well. We think if it can break below $46.63 it can go all the way down to $40 area. * Trade Criteria * Date first found-February 9, 2017 Pattern/Why- Resistance breakdown, Inverted flag formation Entry Target...

XYL looks very suitable short opportunity as it has lots of weakness. It has moneyflow divergence & insider selling. It also breaking down from a long upward channel. We think it will decline to 46 & lower, and we are considering $50 January puts, last traded for $2.55 You can check our detailed analysis on XYL in the trading room/ Executive summary link...

FCX came up in capture in crush scan. It seems forming a head & shoulder formation. It can easily break down to $13.43 area. * Trade Criteria * Date First Found- February 16, 2017 Pattern/Why- Head & shoulder, Capturing the crush Entry Target Criteria- Break of $14.83 Exit Target Criteria- $13.43 Stop Loss Criteria- $15.33 Please check back for Trade...

CCI is building a rising wedge formation. If this breaks down below the 50 day moving average at $87, it could be an easy drop down to $80 * Trade Criteria * Date First Found- January 13, 2017, new trade criteria- February 19, 2017 Pattern/Why- Rising wedge formation Entry Target Criteria- Break of $87.0 Exit Target Criteria- $80 Stop Loss Criteria-...

IMAX seems running within an upward channel, also forming a possible bear flag formation. On the other side we have the earnings coming in 2 days. So we would like to take advantage with option, and we would consider $31 March-17 Puts, last traded for $1.25 * Trade Criteria * Date First Found- February 19, 2017 Pattern/Why- Upward channel, Possible bear flag,...

FL seems forming a rising wedge formation. Breaking below $70.13 would be wedge break-down confirmation, and if it breaks it can decline to $66. * Trade Criteria * Date first found- February 21, 2017 Pattern/Why- Rising wedge Entry Target Criteria- Break of $70.13 Exit Target Criteria- $66 Stop Loss Criteria- N/A Please check back for Trade updates....

EDIT looks like an awesome flag formation. We sent this out during Fridays Live trading session. It looks like a great flag from $24 and upward. * Trade Criteria * Date First Found- February 17, 2017 (In Live trading session) Pattern/Why- Strong flag potential Entry Target Criteria- Break of $24 or above Exit Target Criteria- $31.57 Stop Loss Criteria-...

GMO formed a beautiful flag formation. Flag straight up, formed a pennant, and Pennant broke-out nicely to its target area. Now we are looking for a second Flag formation possibility here. It also has some insider buying. * Trade Criteria * Date First Found- February 16, 2017 Pattern/Why- Flag formation Entry Target Criteria- Pull back to $0.65 Exit Target...

AQMS is a nice Flag formation. We discussed in the valentine day trading alerts. This is a nice opportunity from $17 to $1 * Trade Criteria * Date first found- February 14, 2017 (Discussed in Valentine day Trading room) Pattern/Why- Flag formation Entry Target Criteria- Break of $17 Exit Target Criteria- $19 Stop Loss Criteria- N/A Please check back for...

ATEN seems forming a Flag formation. Moneyflow increased & showing upward potential. Looking very good as long. * Trade Criteria * Date First Found- February 16, 2017 Pattern/Why- Flag formation Entry Target Criteria- Break of $9.74 Exit Target Criteria- $10.57 Stop Loss Criteria- $9.27 Please check back for Trade updates. (Note: Trade update is little...

IPI was a successful Flag play & now seems forming another flag in weekly frame. It also running within a downward channel formation. Both pattern suggesting upward move. We think it can easily hit $3 area. * Trade Criteria * Date First Found- February 15, 2017 Pattern/Why- Flag formation Entry Target Criteria- Break of $2.33 Exit Target Criteria-...

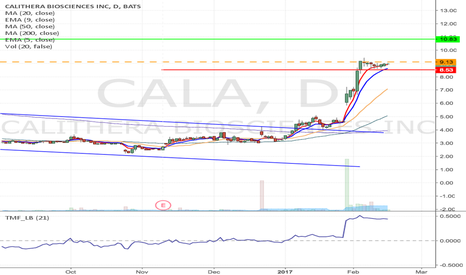

After a very successful Long trade, CALA seems getting ready for another upward move as it is forming another Flag formation. If it can break recent high, it has good upside potential to go as high as $11 area. * Trade Criteria * Date first found- February 14, 2017 Pattern/Why- Flag formation Entry Target Criteria- Break of $9.13 Exit Target Criteria-...

CIG seems breaking out a cup and handle formation, also broken out long term resistance. Moneyflow is strong, and also has support form the moving averages. We think it has good upside potential & it can go all the way to $3.67 or higher. It was send through our intraday alert. * Trade Criteria * Date first found- February 15, 2017 Pattern/Why- Entry...

INFI seems breaking out of a pennant formation. There is a potential for upward channel formation as well. However both pattern suggests upward movement & we think it has good upside potential up to $4. * Trade Criteria * Date first found- February 14, 2017 Pattern/Why- Upward Channel; Pennant formation. Entry Target Criteria- Entry around 2.5-2.58 (Hit...

IVN or IVPAF (US) has huge upside potential. Our fundamental Analyst Strath thinks that it is like buying a option without expiration data & it will be 10 - 20 times bagger over the years to come. Trade Criteria Date first found - January 17, 2017 Entry Target Criteria- current price Exit Target Criteria- Momentum Stop Loss Criteria- N/A (Note: Trade update...