AdamIdris

I refer to latest diagonal bullish Wave 1 structure. Complex corrective structure WXY which I believed may nearly completed with condition the minor Wave V completed above it bearish channel line. Currently wave V which may consists of 5 minor waves is in progress. Prefer to trade long. If Gold fall below Wave IV then Wave Y maybe not yet completed.

I prefer short if gold price not breaking resistance at wave B of Wave Y.

My guideline for GBPAUD market. Waiting completion of Wave 4 before short trade. Waiting Wave 4 to be above Kumo in H4. Target take profit at Wave 5 downtrend.

My guideline for GU next move. As wave 2 orange was simple corrective wave, then wave 4 orange maybe complex wave. Final wave 5 also possible to have a diagonal pattern.

My guideline for GBPJPY market direction. Just my imagination. Market move is a real one.

Perhaps Gold has completed her corrective wave. If new impulsive wave1 also completed and in progress of making abc corrective Wave2. Let's see if this true and take trade with calculated risk.

Gold has potential to continue bullish if immediate resistance level broken.

Possible double bottom. Invalid if support broken.

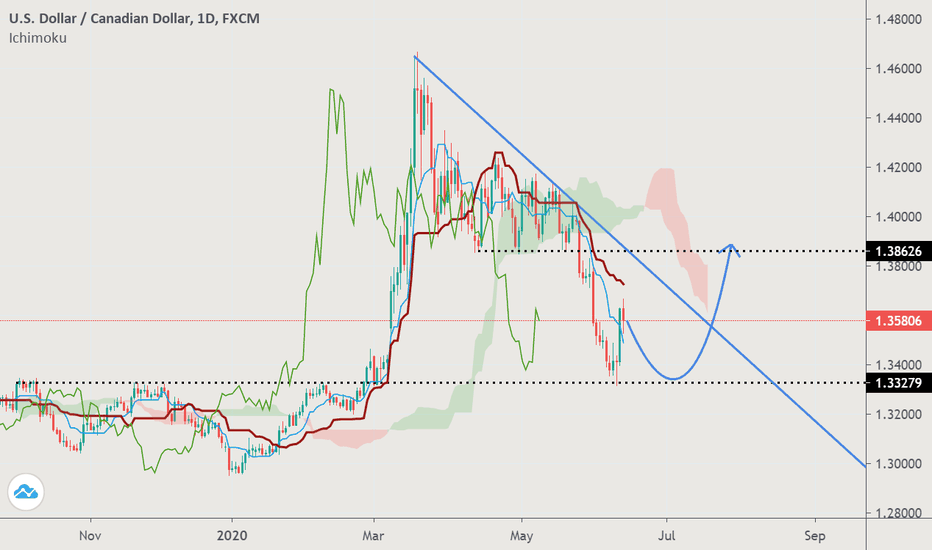

Daily trend still bearish. Look for R:R>1:3.

Daily trend is bullish. Wait for rejection of retracement prior to entry. Target R:R>1:3.

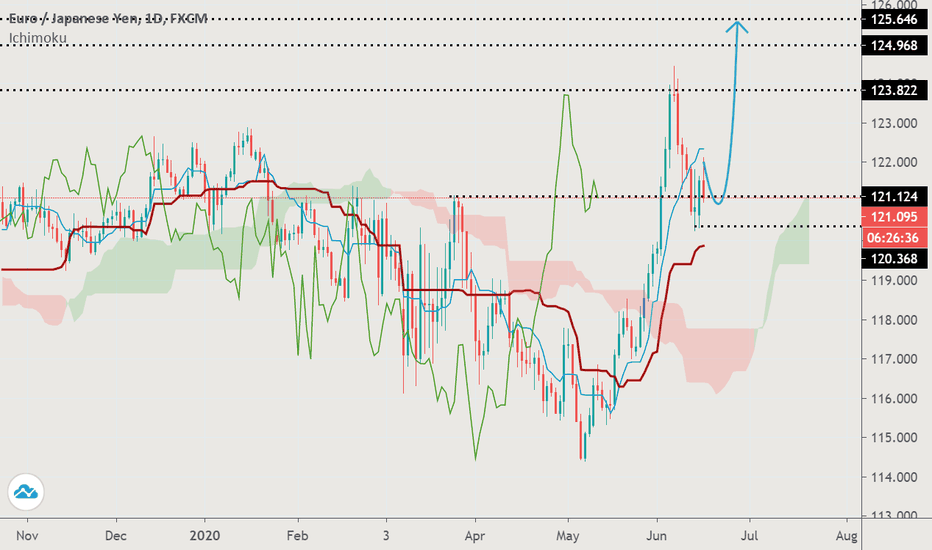

EJ is in retracement. Monitor lower tf for entry. R:R>1:2.5

Wait near immediate support level and look for latest price action before buy entry. Look also possible demand zone.

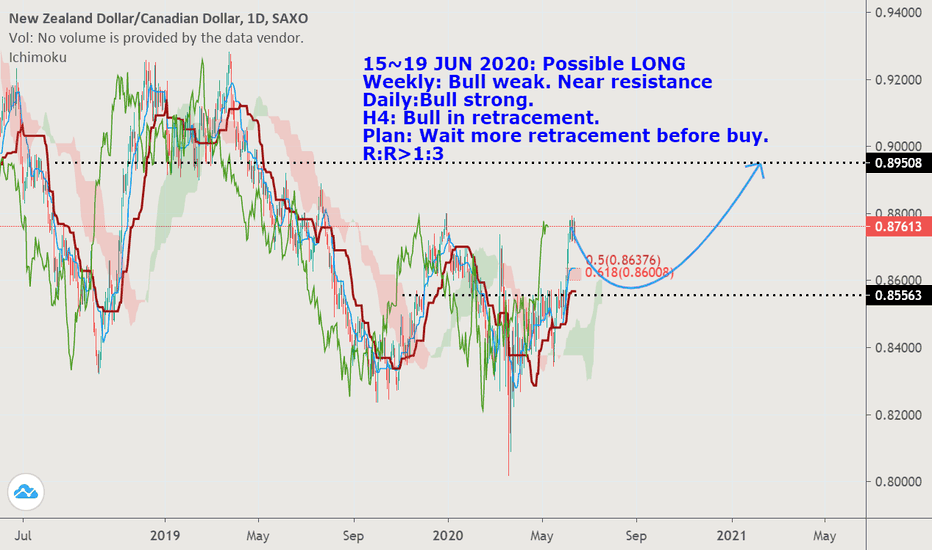

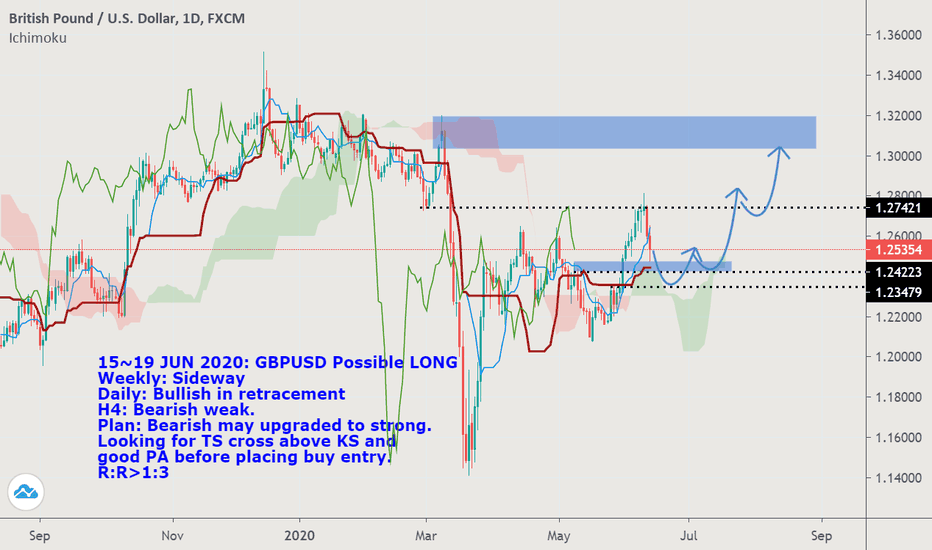

Weekly: Sideway Daily: Bullish in retracement H4: Bearish weak. Plan: Bearish may upgraded to strong. Looking for TS cross above KS and good PA before placing buy entry. R:R>1:3

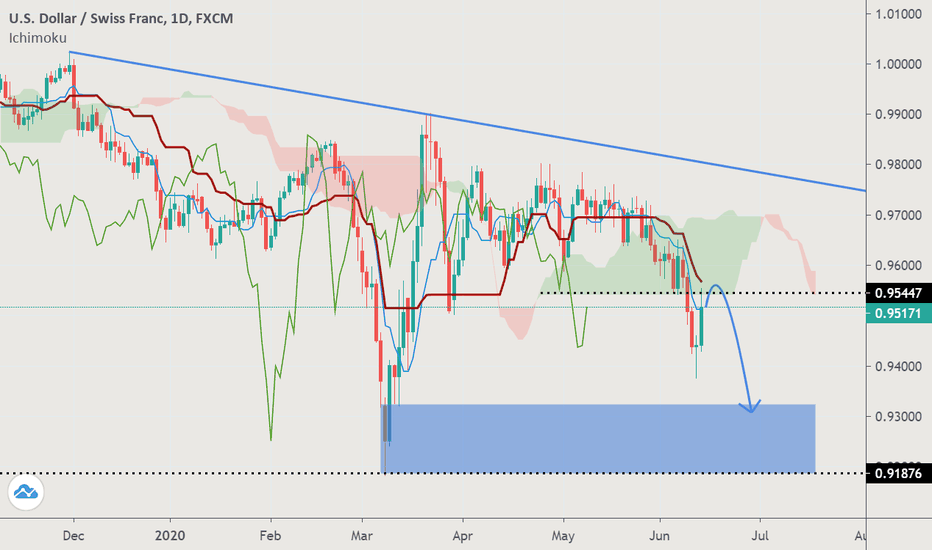

Go for short term first, then long for mid term.

Bitcoin Weekly Chart TA (22/03/2020) If Wave 3 in triangle is valid. Then look for the end of Wave 3 (within fibo number). Look for ltf for long setup with target to Wave 4 in triangle. This is only guideline for current scenario. Please refer other EW technician before placing trade.

GBPJPY (Weekly Outlook) Daily : Bearish H4 : Sideway. In Kumo Wait until price below H4 kumo for sell setup to Wave 2. Sell idea invalid if price above H4 Kumo. Only for guideline.

17/3/2020 onward. Trading within Wave 1 if Bitcoin reached it bottom. Look for ltf for reversal and setup.

If Wave V is completed, then next wave is bullish impulsive wave. Look for ltf for long setup. This is only for trend guideline. Not considering fundamental analysis.