Adhamcurrency

💡XAGUSD chart analysis (daily timeframe). After a positive reaction from the $29 area, the price rose strongly to surpass the $31 level, which had previously been broken. Retest – $31 level. After a strong rebound, the price returned to test the $31 area. This behavior is very positive, as it proves that buyers are defending this level once again. If this test is...

💡Chart analysis of the EUR/NZD currency pair (daily timeframe). Retest: After the breakout, the price returned to test the broken area (structure + trend) — this is considered a classic scenario for resuming movement in the direction of the breakout. However, in this analysis, the bullish scenario is favored, provided a confirmation pattern is established. The...

💡Chart analysis of the GBP/CAD currency pair (daily time frame). The price is currently retesting the broken structure - a demand zone. If it fails to break above it, it may return to the downside towards the support area (S.1). The MACD indicator shows decreasing upward momentum, supporting the possibility of an upcoming decline. ⛔️Not investment advice for...

💡Chart analysis of the USD/CAD currency pair (daily time frame). The price broke the support structure and shifted to a downtrend. Wait for a retest of the red zone and enter a short position from it if bearish price action (such as a reversal candle) appears. MACD indicator: There are no signs of weakening negative momentum so far, which reinforces the downside...

💡Chart analysis of the NZD/CHF currency pair (4-hour timeframe). The price is in a strong demand zone. The trader is waiting for a bullish candle to close to confirm the entry. The target is to reach previous resistance areas (swing highs). MACD indicator: The selling momentum on the indicator is beginning to weaken, supporting the bullish trend. ⛔️Not...

💡XAUUSD Gold Chart Analysis (Daily Timeframe) The price is moving within an ascending price channel. Possible Scenarios: Bull Scenario (Currently Likely): 1. The price rebounds from the lower boundary of the channel. 2. This rebound is consistent with the price behavior within the ascending channel. 3. The price may rise to test the resistance zone (R.1) again. 4....

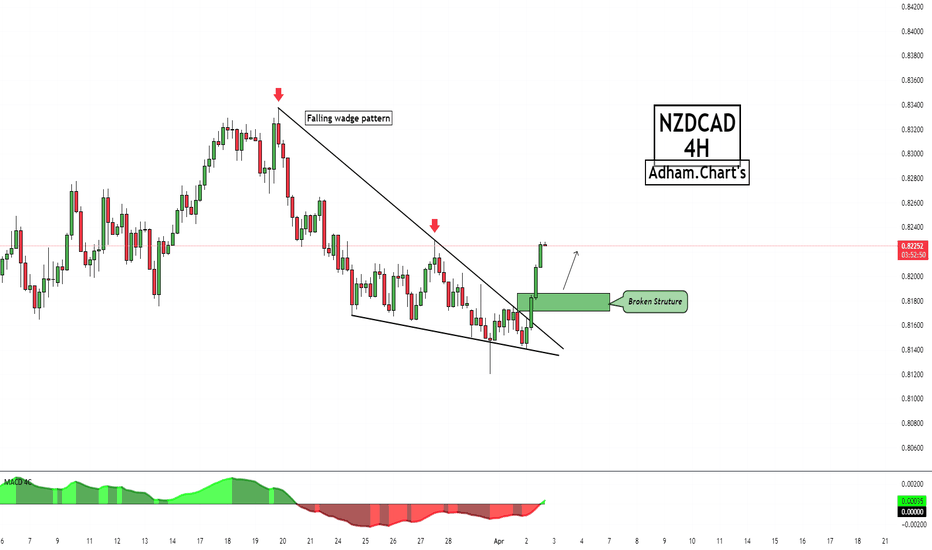

💡Chart analysis of the NZD/CAD currency pair (4-hour timeframe). A falling wedge pattern appears, a reversal pattern that indicates a potential price rally after a breakout. The MACD indicator supports the bullish scenario, showing improved buying momentum after the breakout. ⛔️Not investment advice. For educational purposes only.

💡Chart Analysis of the NZD/JPY currency pair (daily time frame). The pair is moving in a downward trend, as evidenced by the downtrend line that has been tested several times. Break of Structure (BOS): A previous low has been broken, confirming the continuation of the downtrend. The broken area is now a potential resistance zone, and the price may retest it before...

💡Gold Chart Analysis (4-hour timeframe). Falling Wedge Pattern: The technical chart shows a falling wedge pattern, a bullish reversal pattern. It has been broken to the upside, indicating a potential continuation of the uptrend. Key Support Area (S.1): After the breakout, the price retested the shaded support area (S.1), which was previously resistance and has...

💡Chart Analysis of the GBP/AUD currency pair (4-hour timeframe). Liquidity Sweep: The price broke a previous high, indicating that pending sell orders above it are being targeted. Broken Structure: After the liquidity sweep, the price broke an important support level, confirming the beginning of a downtrend. MACD indicator shows divergence and weak buying...

💡The chart shows a technical analysis of the EURUSD currency pair on the 4-hour timeframe. The price gathered liquidity from a previous swing high and then reversed downward, indicating a liquidity trap where buy orders were liquidated before moving in the opposite direction. The structure—the support area—was broken. The MACD indicator is showing bearish...

💡The chart shows a technical analysis of the GBP/USD pair on the 4-hour timeframe. Rising Wedge Pattern: There is a clear shape of a rising wedge pattern, a reversal pattern where the price is within a narrow, upward-sloping channel. Typically, a break of this pattern downward indicates a reversal from bullish to bearish. The MACD indicator shows that momentum is...

💡The chart shows a technical analysis of the NZDUSD currency pair on the four-hour timeframe. Liquidity and Trend Change: The chart shows a Liquidity Sweep at the bottom, indicating liquidity was accumulated before the price reversed upwards. There is a symmetrical triangle pattern, and the price managed to break through it to the upside. The MACD indicator is...

💡The chart shows a technical analysis of the GBPJPY currency pair on the 4-hour timeframe. The price is moving within an ascending channel. There are repeated bounces from the upper channel line, as shown, indicating strong resistance at these levels. The price reached the upper channel line and rebounded, indicating strong selling pressure at this level. There is...

💡The chart shows a technical analysis of the AUDJPY currency pair on the 4H frame. The price broke the previous swing low and gathered liquidity, a common behavior before a reversal. Emerging Bullish Momentum: After gathering liquidity, the price rose and broke through a previous resistance area, indicating the market's intention to move upward. The green shaded...

💡The chart shows technical analysis of the USDCHF currency pair On the daily time frame D1. Rising channel:⬆️ The price was moving within an ascending channel ✨Channel break: The price broke the bottom line of the channel, which may indicate a trend change to down. If the price continues below the channel, it may head to one of the identified support areas. If the...

💡The chart shows a technical analysis of GOLD on the daily time frame D1. General trend: The drawing shows an upward trend after the price rebounds from support levels (S1, S2, S3). Support and resistance levels: Support (S1, S2, S3): Strong areas to buy. Resistance (Swing High and R.1): Levels to monitor the possibility of a price reversal. Buying strategy:⬆️...

💡The chart shows a technical analysis of the AUD/CAD currency pair On the daily time frame D1. The price appears to be moving within a descending price channel The price reached the upper border of the descending channel and started to decline, which may indicate a continuation of the downtrend unless the channel breaks higher. The MACD indicator is showing the...